Sports teams are turning into hard assets in 2026. Learn what fuels soaring valuations, new ownership rules, and smarter ways investors can get exposure.

The shock shift: from trophy to “utility stock”

For decades, owning a sports team looked like a glamorous flex. It was social power first, profit second. That story is fading fast as we head into 2026. Today, pro teams are being treated like scarce infrastructure. They are closer to a toll road than a toy.

The reason is simple and explosive. Elite teams sit on a rare bundle of assets that is hard to copy. They hold league memberships that are limited by design. They control local attention in a way most media brands lost years ago. They also sit at the intersection of live entertainment, streaming, betting, real estate, and global culture.

Meanwhile, traditional safe assets have been loud and stressful. Bonds can swing. Growth stocks can collapse. Commercial real estate has felt fragile in many cities. In that environment, sports has started to look surprisingly sturdy and rewarding.

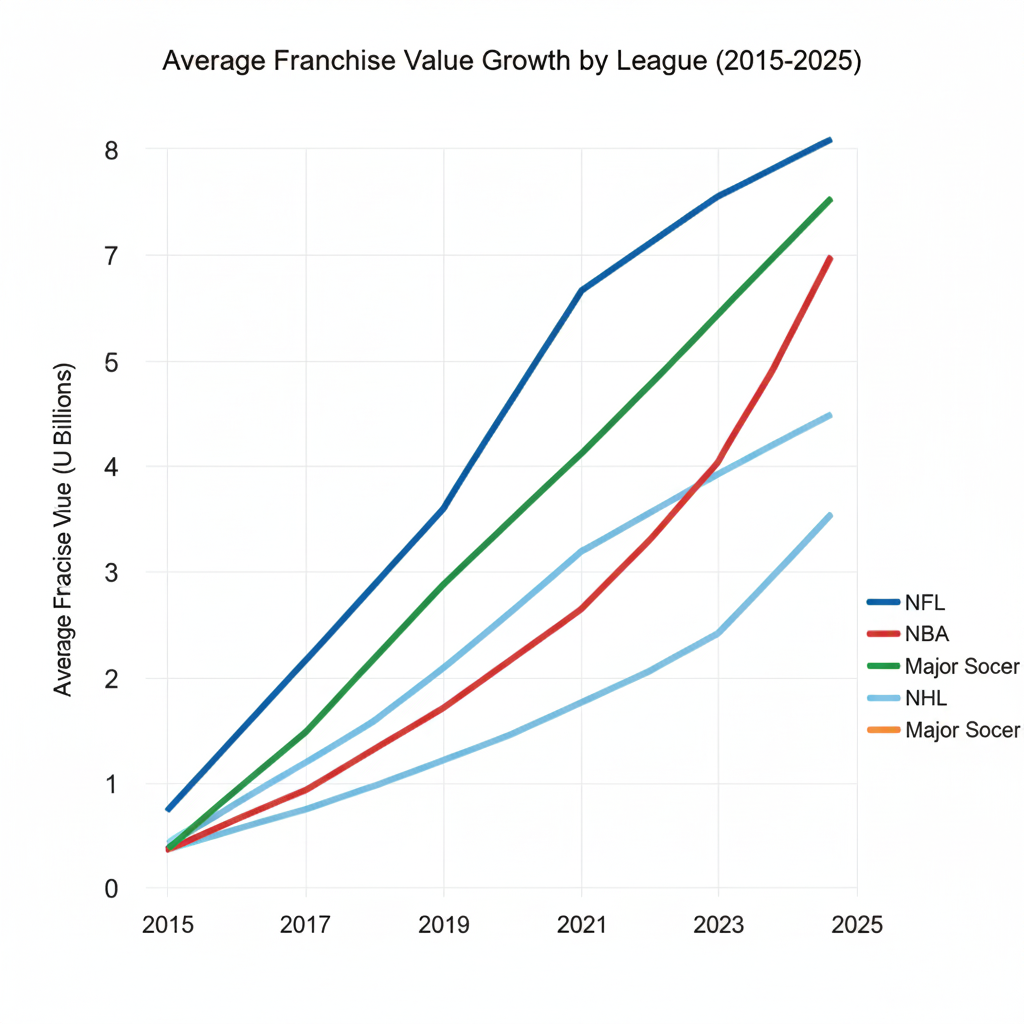

Valuation data has reinforced the mood. Forbes’ 2025 ranking of the world’s 50 most valuable sports teams put the combined value above $353 billion, up sharply from 2024. (Forbes) That is not a niche move. It is a powerful signal that the asset class is being repriced.

Additionally, the buyer pool has widened. It is no longer only old families and local moguls. Private equity platforms, sovereign capital, and celebrity led groups are all in the room. The competition pushes prices up. It also professionalizes the business.

Why “hard asset” fits better than “entertainment”

A hard asset is not just physical. It is also about scarce rights and predictable demand. In sports, scarcity is built in. Leagues protect membership. Media partners fight for rights. Sponsors chase authenticity. Fans stick through recessions and roster chaos.

However, the hard-asset label is not magic. Teams can be mismanaged. Debt can bite. On-field failure can hurt. Still, the long trend is that the whole system has become more diversified in its cash flows, which makes it feel more resilient.

The cash engine behind the boom

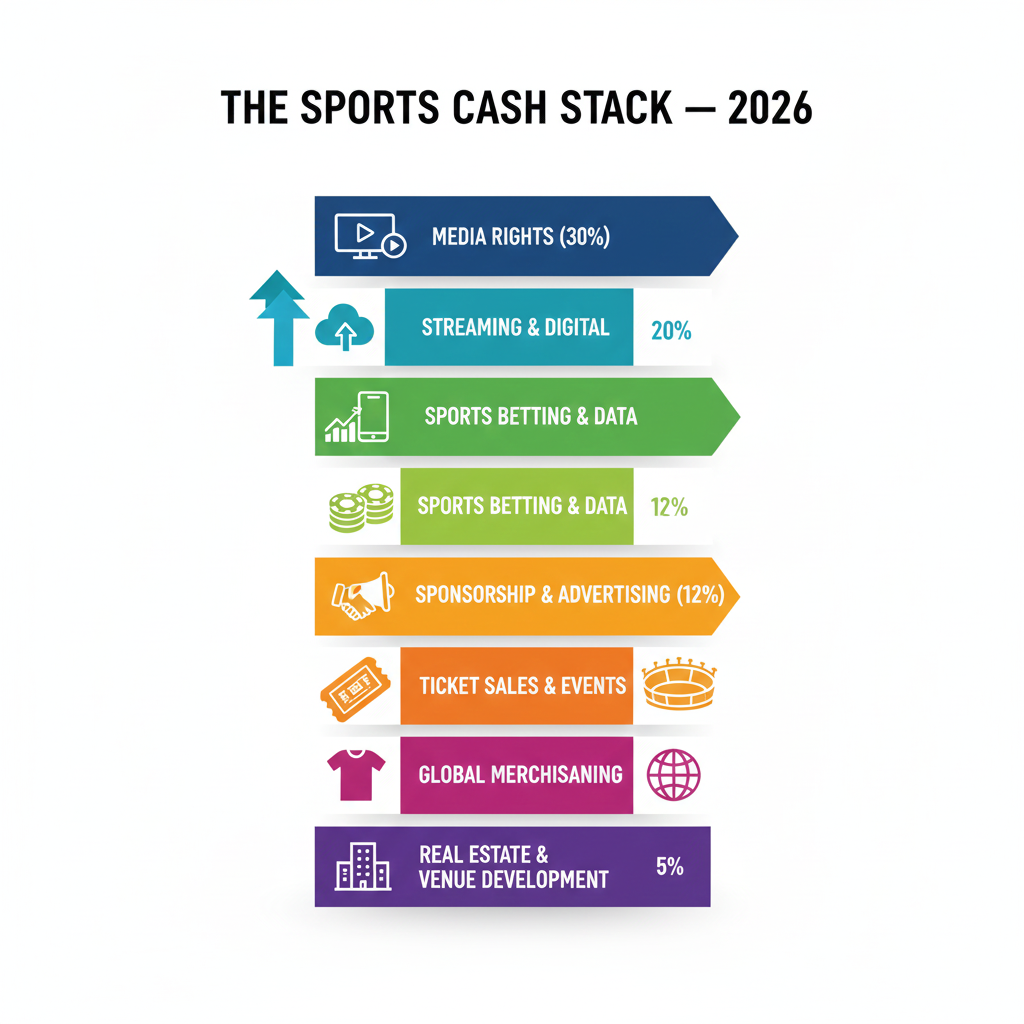

Media rights are the new backbone

Sports still sells the most valuable thing modern media can sell: live attention. Live events keep ads premium. Live games reduce churn for streamers. Live moments create social gravity.

Consequently, media rights have become the backbone of franchise economics. Even when ticket demand softens, rights money can hold the floor. That is one reason teams can behave like “utility stocks” in tough cycles.

In 2025, the NFL’s average team value was reported by Forbes at roughly $7.1 billion, with sharp growth versus 2024. (Forbes) At the same time, Sportico’s NFL valuations reported the Cowboys at $12.8B, with several teams above $10B. (Reuters) Those numbers are not just ego metrics. They reflect the market’s belief that media driven cash flows are durable.

Real estate and districts: the quiet multiplier

The most valuable teams increasingly own more than seats. They own districts. They control arenas, parking, mixed-use developments, and adjacent entertainment. That matters because real estate can turn a “seasonal” business into a year-round machine.

Sportico’s NBA valuations for 2025 put the Warriors at the top, supported in part by ownership of their arena and surrounding development. (Reuters) This is a clear pattern. Teams that own the building often get a valuation premium.

Additionally, real estate supports financing. It can be collateral. It can also be an independent profit center. That is critical as stadium costs climb and public funding debates intensify.

Betting, data, and micro-rights

Sports betting has changed the economics of engagement. It makes games “must watch” for more people, more often. It also creates new data products. Data feeds, integrity services, and official league data have become meaningful revenue lines.

Moreover, teams and leagues are learning to slice rights into smaller pieces. Highlights, alternate broadcasts, creator streams, and localized content deals are all growing. This creates a more complex but also more diversified revenue stack.

Why 2026 looks like a breakout year

The biggest 2026 story is not one new TV contract. It is the structure of ownership and access.

The “institutionalization” wave accelerates

For years, the last major US league resisting institutional capital was the NFL. That barrier fell. In August 2024, the NFL approved rules allowing private equity funds to buy minority stakes in teams, under specific limits and conditions. (NFL.com) This decision matters because the NFL is the crown jewel of US sports economics.

Once the NFL opened the door, the “sports as an asset class” thesis got a huge credibility boost. It also pulled forward conversations that will likely intensify in 2026: liquidity, governance, and price discovery for minority stakes.

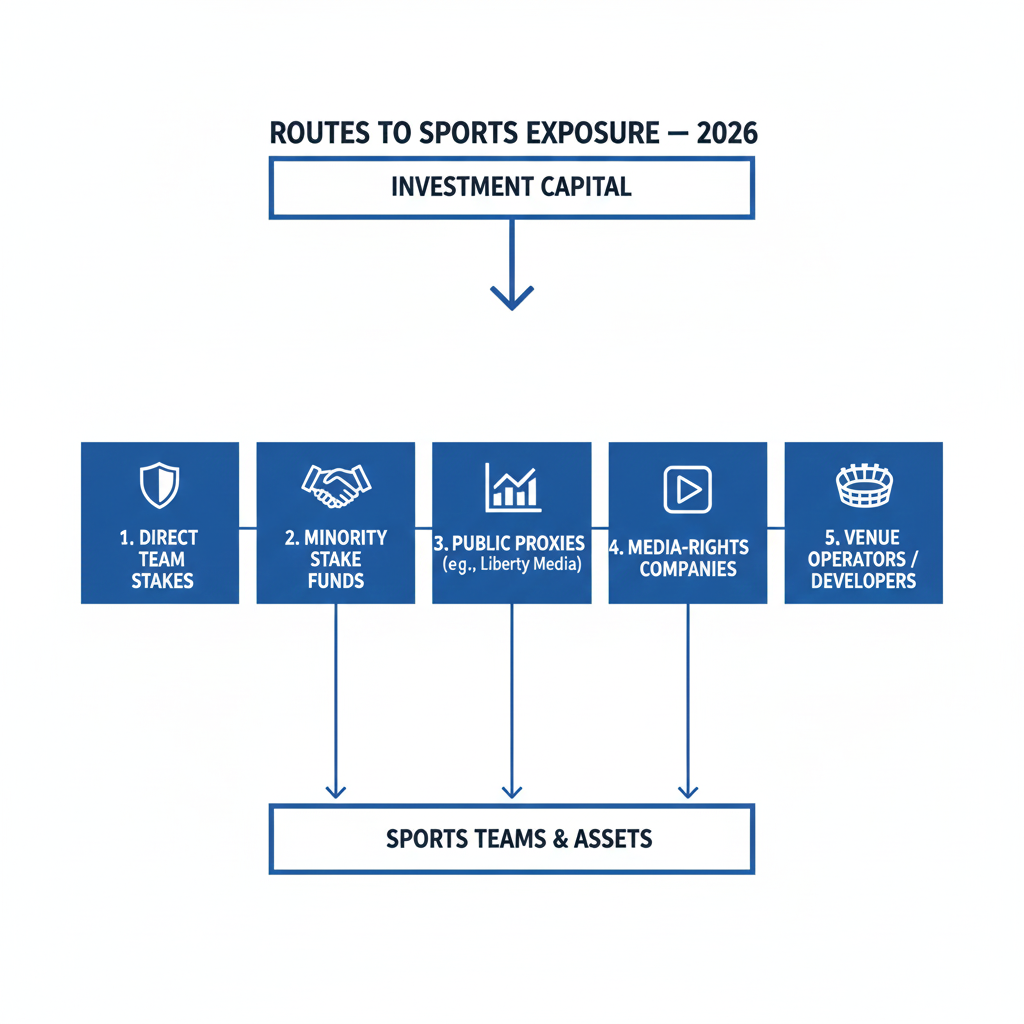

A stronger pipeline of “fund-like” vehicles

Sports investing used to be lumpy. One buyer. One club. One giant check. Now, platforms pool capital and buy minority positions across multiple teams and leagues. That diversification is psychologically powerful for investors. It is also operationally efficient.

Arctos, for example, has built a model around minority stakes across teams, aiming to give owners liquidity while giving investors a portfolio of exposure. (SportsPro)

Meanwhile, Blue Owl’s Dyal HomeCourt strategy has been positioned around minority investments in NBA franchises. (SEC) Even when only a slice is available, the signal is bold: pro sports is being packaged more like private credit or infrastructure.

[YouTube Video]: A clear breakdown of how sports became a serious asset class, featuring finance and sports business leaders.

The celebrity effect is not a joke anymore

Celebrity ownership used to be marketing. In 2026, it is strategy. It helps globalize a club’s brand. It helps unlock sponsors. It helps sell merchandise worldwide. It also helps attract documentary deals and streaming interest.

Ryan Reynolds’ Wrexham story is the cleanest example of celebrity plus operational ambition. The club’s rise, and the attention around it, has also attracted institutional capital. The Financial Times reported Apollo Global Management took a minority stake in Wrexham, with the proceeds supporting stadium redevelopment and growth plans. (Financial Times)

LeBron James is a different archetype. He is not only a celebrity investor. He is building a long-term business portfolio tied to culture and sports. Reports have linked him to an ownership stake in Fenway Sports Group, expanding his exposure to sports assets like Liverpool and the Red Sox. (Los Angeles Times)

Additionally, 2026 is likely to bring more deals where celebrity capital is paired with institutional capital. That pairing is potent and highly scalable.

What “fractional ownership” really means in 2026

Many headlines make it sound like anyone can buy a tiny piece of a team tomorrow. The real picture is more nuanced.

The accredited investor gate is still real

A lot of sports focused private funds are still private funds. That often means access is limited to institutions and high-net-worth individuals who qualify under US rules.

The SEC explains that accredited investors typically meet certain income or net worth thresholds, or specific financial sophistication criteria. (SEC) That definition shapes who can participate in many private offerings tied to sports stakes.

However, pressure is rising. Policy debates about who should qualify, and how the definition should evolve, are active. A Congressional Budget Office analysis in 2025 discussed legislation that would push the SEC to review and establish accepted credentials lists on a set schedule. (Congressional Budget Office) That does not guarantee a 2026 change. Still, it shows that “access rules” are politically alive.

Public market “team proxies” are the near-term path for most people

For most non-accredited investors, the practical route is exposure through public companies tied to sports rights, leagues, or specific teams.

Some examples include publicly traded entities connected to sports properties or rights ecosystems, such as Atlanta Braves Holdings or Formula One’s tracking stock structure inside Liberty Media. (Nasdaq) These are not the same as owning a team stake directly. Yet they can provide real exposure to sports economics in a regulated, liquid format.

Additionally, sports entertainment companies can offer “league-like” exposure. For example, TKO Group Holdings was formed as a public company combining UFC and WWE under one umbrella. (Wikipedia) Again, it is not a franchise stake. Still, it is a way to participate in sports media economics without private-market restrictions.

Tokenization will be talked about, but not fully “solved”

In 2026, you will hear more bold talk about tokenized ownership, blockchain settlement, and retail fractional stakes. The idea is emotionally exciting and feels revolutionary.

However, real ownership of teams is deeply regulated by leagues, not only by securities law. Leagues care about control, conflicts, and integrity. Consequently, tokenization may show up first in narrower areas: revenue sharing products, fan engagement assets, or structured instruments tied to future media cash flows, rather than direct equity in a team.

The big risk: governance, control, and conflict

If sports becomes an institutional asset class, the governance model must mature.

Minority stakes are not the same as control

Many sports deals are minority investments. That can look safer. It can also be frustrating. Minority holders may have limited rights. They may not control strategy. Liquidity can be uncertain.

The NFL’s private equity rules highlight how tightly leagues want to manage this. Limits on stake size, holding periods, and multi-team ownership reflect fear of conflicts and information leakage. (NFL.com)

Additionally, multi-club ownership is a constant governance flashpoint in global soccer. It can trigger conflicts in competitions. It can also distort talent pipelines. Expect 2026 to bring more scrutiny, especially as US capital pushes deeper into European football.

The “utility stock” narrative can hide cyclicality

Sports can feel recession-proof. Fans keep watching. Yet some revenue lines are cyclical. Luxury suites can soften. Sponsorship budgets can tighten. Local media deals can be challenged.

Moreover, interest rates matter. Stadium financing is sensitive to debt costs. A club that leans too hard on leverage can feel fragile. The hard-asset story works best when cash flows are diversified and debt is disciplined.

The 2026 trend map: what investors will chase

Women’s sports: the fastest narrative upgrade

Women’s sports is gaining momentum in rights deals, sponsorship, and fandom. In 2026, the biggest change may be perception. Investors increasingly see it as an emerging growth segment inside the broader “sports as infrastructure” thesis.

Additionally, women’s sports benefits from cultural tailwinds. Brands want authenticity and community. Women’s leagues often offer both.

Football globalization: US money, global audience

US investors continue to buy into European clubs and multi-club groups. Celebrity backed ownership adds marketing heat. Meanwhile, institutional capital adds financing depth.

Apollo’s expansion in sports is a strong signal. Apollo announced a dedicated Apollo Sports Capital platform in late 2025. (Apollo) The Financial Times also reported Apollo’s move to acquire a majority stake in Atlético Madrid, with the deal expected to close in early 2026. (Financial Times) That is a major marker for what 2026 could look like: bigger checks, bigger clubs, more structured capital.

Stadium redevelopment as the “infrastructure play”

Stadium projects can be catalytic. They can unlock year-round revenue. They can also drive valuation narratives.

Wrexham’s story points here too, with new investment linked to redeveloping its stadium. (Financial Times) Expect 2026 to feature more deals where the equity story is really an infrastructure story.

The celebrity case studies that matter

LeBron James: ownership as portfolio architecture

LeBron’s sports ownership exposure fits a broader portfolio approach. It is not only about fandom. It is about durable cultural assets with global reach.

Reports have linked him to increased equity involvement with Fenway Sports Group, tying him into an ecosystem of teams and related sports businesses. (SportsPro) This is a powerful template for 2026: own the platform, not only a single team.

Additionally, platform ownership can create synergy. It can help with cross-sponsorship. It can also help with shared analytics, shared ticketing strategy, and shared commercial partnerships.

Ryan Reynolds: storytelling as a financial lever

Reynolds and Wrexham demonstrate that narrative can be a measurable asset. Documentary exposure can expand a club’s global fan base. That can lift merch sales. It can also attract new sponsors.

The Financial Times reported Apollo’s minority stake in Wrexham, highlighting the club’s revenue growth and stadium plans. (Financial Times) That is not just a fun story. It shows how capital follows attention, and how attention can be engineered.

[YouTube Video]: A mainstream, high-visibility interview that explains how Wrexham ownership became a serious business project.

The 2026 policy and regulation watchlist

The key question is not whether money wants in. It does. The real question is how leagues and regulators respond.

League rule changes will likely continue

The NFL’s private equity framework is still new. In 2026, expect pressure to evolve it. Some owners will want more liquidity. Some funds will want larger caps. Some league officials will push back to protect integrity.

Consequently, 2026 may bring tweaks rather than a full rewrite. Watch for adjustments around stake caps, eligible fund structures, and reporting requirements. The direction of travel is clear: more institutional capital, but under tight guardrails. (NFL.com)

SEC and “who gets access” will stay a hot topic

Accredited investor rules shape who can buy private fund interests. That matters for sports funds, because many are private vehicles.

The SEC’s public guidance lays out how individuals qualify today. (SEC) Meanwhile, policy discussion about reviewing and updating the accredited framework has continued in Washington. (Congressional Budget Office) In 2026, that debate can influence how broadly sports investing is marketed to wealthy individuals.

Additionally, regulators may watch how private funds describe risks. Sports can feel “safe” because it is familiar. That familiarity can be dangerous if it leads investors to underestimate illiquidity.

How to prepare for 2026 changes without getting reckless

This is not financial advice. It is a practical framework for thinking clearly.

Start by learning the product, not the hype

A team stake is not a stock. A private fund interest is not an ETF. Liquidity, fees, and rights vary widely. Consequently, the smartest move is to learn what you are actually buying exposure to: media rights growth, real estate cash flows, or pure valuation appreciation.

Additionally, understand the difference between a league wide portfolio and a single club bet. A diversified platform can reduce headline risk. A single club can deliver a thrilling upside, but also painful volatility.

Ask the hard questions about liquidity

Many sports stakes are held for long periods. Even the NFL’s rules for private equity contemplate multi-year holding. (Thompson Hine LLP) That can be fine. It can also be a trap if you expect quick exits.

Moreover, minority stakes can be hard to sell. Exit often depends on another big buyer showing up, or the controlling owner choosing to transact.

Treat “hard asset” as a discipline, not a slogan

Hard assets are supposed to protect you. That only works when the price is reasonable relative to cash flows. If the narrative gets too euphoric, returns can compress.

Therefore, preparation for 2026 is about discipline. It means respecting valuation, respecting debt, and respecting governance risk. It also means being honest about what drives the upside. In many cases, it is media rights optimism plus scarcity. That is powerful. Yet it is not invincible.

The 2026 forecast: three scenarios

Scenario one: the steady boom

In this path, media rights remain strong, streaming competition stays intense, and private capital expands carefully. Valuations keep rising, but not in a bubble. Ownership rules evolve gradually. This is the most probable base case.

Scenario two: the governance shock

In this path, conflicts over multi-team ownership, data rights, or integrity trigger backlash. Leagues tighten rules. Some planned deals get blocked. Prices wobble short term. Still, long-term demand survives because the scarcity remains.

Scenario three: the access breakthrough

In this path, new regulated vehicles make it easier for wealthy individuals and eventually broader investors to gain diversified sports exposure. Public market proxies expand. New structures emerge. Private capital continues to dominate direct stakes, but the “access story” becomes more credible.

Additionally, a breakthrough scenario would likely be driven by platforms that can satisfy both league governance requirements and securities regulation. That is hard, but it is not impossible.

The bottom line for 2026

Sports teams are being reframed. They are becoming strategic hard assets in the eyes of capital markets. The drivers are powerful: scarcity, live attention, diversified cash flows, and global culture. The institutional wave, especially after the NFL’s shift toward private equity ownership, has made the trend feel official. (NFL.com)

However, the most important word for 2026 is not “boom.” It is “structure.” Structure decides who gets access. Structure decides how conflicts are handled. Structure decides whether sports investing stays a privileged game or becomes a broader, regulated opportunity.

If you prepare with discipline, the theme can be exciting and rewarding. If you chase hype, the same theme can become painfully expensive. The smart play for 2026 is to separate the emotional thrill of sports from the cold mechanics of ownership.

Sources and References

- The World’s 50 Most Valuable Sports Teams 2025

- The NFL’s Most Valuable Teams 2025

- Cowboys remain NFL’s most valuable as 3 teams top $10B (Reuters)

- Warriors lead Sportico’s NBA valuations at $11.33B (Reuters)

- NFL owners vote to allow private equity funds to buy stakes

- The NFL opens its door to private equity (Clifford Chance PDF)

- Apollo acquires minority stake in Wrexham (Financial Times)

- 5 MLS franchises top $1B in Sportico’s valuations (Reuters)

- Accredited Investors guidance (SEC)

- Apollo announces launch of Apollo Sports Capital