QSBS stacking is a vital 2026 tax shield for angel exits. Learn the proven Section 1202 rules, policy risks, and timing traps before you sell.

Why QSBS “stacking” feels like the last safe shelter in 2026

As we head into 2026, startup investors feel a sharp, emotional squeeze. Exits are back on the calendar. M&A pipelines look active again. Secondary sales are no longer taboo. At the same time, tax uncertainty still hangs over every big liquidity moment.

That is why QSBS, the Qualified Small Business Stock rules in Section 1202, suddenly feel priceless. They are not new. Yet they look newly powerful after 2025’s major tax changes, and they look even more essential when investors worry about future attempts to raise capital gains taxes for high earners. (The Tax Adviser)

However, QSBS is not a simple “tax-free” sticker you slap on a deal. It is a strict legal path. It rewards careful planning. It punishes casual planning. In 2026, the difference between a thrilling, tax-efficient exit and a painful, avoidable tax bill will often come down to one thing: whether the investor understood QSBS stacking early enough.

QSBS stacking is the strategy of multiplying the QSBS exclusion across multiple taxpayers, usually by spreading QSBS ownership across family members or properly designed trusts. (Faegre Drinker) In the best cases, the result feels almost unbelievable. It can be a breakthrough outcome. It can be a verified, high-impact shield on the exact gains that matter most.

Additionally, the “only shelter left” line is not literal. Other tools exist, like Section 1045 rollovers in certain situations. Yet QSBS is one of the rare, proven shelters that can permanently exclude a meaningful chunk of gain from federal tax if the rules are met. (FBT Gibbons)

The Peter Thiel effect, and why it shapes 2026 behavior

Peter Thiel is not the point. The point is the mythology that elite founders and early investors can exit with extreme tax efficiency if they structured ownership correctly. That story is powerful. It is also dangerous, because it tempts people to assume QSBS is automatic.

Consequently, serious advisors are reframing the story in late 2025. The real edge is not celebrity lore. The real edge is compliance discipline. It is timing discipline. It is documentation discipline.

In 2026, angel exits will reward the investors who treated QSBS like an engineering project, not like a rumor.

QSBS in plain English, with the 2026 updates that matter

QSBS is a federal tax benefit that can let eligible non-corporate taxpayers exclude some or all gain on the sale of qualified C corporation stock, if the stock and the company meet specific tests and the holding period rules are satisfied. (Angel Capital Association)

The rules have always been strict. Still, 2025 legislation widened the runway in several ways that will directly affect 2026 exits. (The Tax Adviser)

The core promise, and why it is so emotionally compelling

The promise is simple. If you qualify, you may exclude up to a per-issuer cap of gain, and you may also have an alternative cap tied to your basis. Historically, many summaries use the “$10 million or 10 times basis” framing. (Plante Moran)

However, recent law changes expanded key thresholds for newer QSBS, which makes 2026 planning feel next-generation. Multiple professional summaries highlight an increase in the per-issuer cap to $15 million for certain post-2025 QSBS, plus future inflation indexing after 2026. (The Tax Adviser)

That jump is not cosmetic. It changes how stacking works. It changes how many “buckets” of exclusion a family may want to create.

The 2025 law shift that reshapes 2026 exits

Several sources describe major expansions to Section 1202 under the One Big Beautiful Bill Act in mid-2025. Those expansions include a higher per-issuer exclusion cap and a higher gross-asset threshold for qualified small business status, with inflation indexing after 2026. (The Tax Adviser)

Additionally, multiple write-ups describe a tiered benefit for shorter holding periods for certain post-2025 QSBS, with partial exclusions at 3 and 4 years and a full exclusion at 5 years. (Baker Tilly)

This is a big deal for 2026. It changes behavior in two ways.

First, it turns “waiting five years” from a hard wall into a more flexible timeline for some investors. Second, it raises the stakes on recordkeeping, because you now have more “tiers” and more ways to make mistakes.

The big misunderstanding that ruins QSBS outcomes

The most common trap is assuming “startup stock equals QSBS.”

Many startups do not qualify. Some are in excluded business categories. Some fail the asset test at issuance. Some issue stock in ways that fail the “original issuance” rules. Some do too much non-qualified activity.

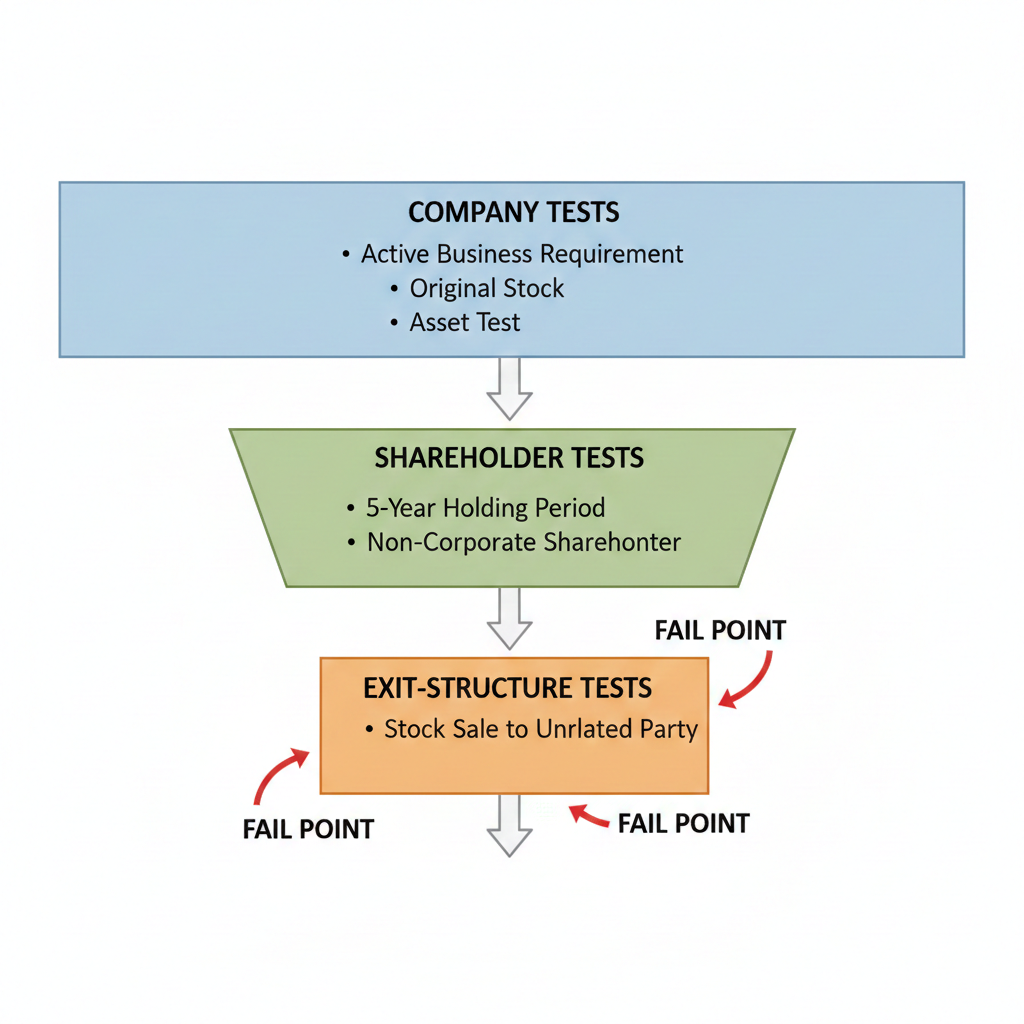

Furthermore, even when the company qualifies, a specific shareholder might not. How the shares were acquired matters. How the shares were held matters. How the exit is structured matters. (FBT Gibbons)

That is why stacking is not just an “estate planning trick.” It is a disciplined tax strategy.

What “QSBS stacking” actually means, without the hype

QSBS stacking is about multiplying the exclusion by creating multiple eligible taxpayers who each hold QSBS. It is often done through gifts of QSBS to non-grantor trusts or family members so that each taxpayer may claim a separate per-issuer cap when they sell. (FBT Gibbons)

The concept sounds simple. The execution is not.

Why stacking became mainstream for angels and founders

Angels and founders often hold the biggest upside at the earliest stages. That upside can become life-changing. Yet it also becomes a tax magnet.

In 2026, capital gains rates for most long-term gains remain in the familiar 0 percent, 15 percent, and 20 percent federal brackets, plus the Net Investment Income Tax in many high-income cases. (Bankrate) Even with “no change” at the federal rate level, the absolute tax dollars on a large startup win can feel brutal.

Meanwhile, policy risk still exists. Past federal proposals have called for sharply higher capital gains taxation for high-income taxpayers, and similar ideas can reappear. (Forbes)

Consequently, QSBS becomes emotionally attractive as a stable, proven, legal path. Stacking becomes attractive because one person’s cap may not be enough.

The key legal hinge: gifting and “step into the shoes”

One reason stacking can work is that the QSBS rules include provisions that, in certain transfers like gifts, allow the recipient to take the stock with its QSBS characteristics and holding period history, rather than “resetting” everything. (Faegre Drinker)

However, the gift must be real. It must be complete where required. It must happen at the right time. And it must be paired with an exit structure that preserves eligibility.

The timing trap that can destroy stacking

Late 2025 commentary emphasizes a critical point: gifts for stacking generally need to occur before a binding sale agreement exists. If you transfer after the deal is effectively locked, the IRS may argue the gain belongs to the original holder anyway. (The Tax Adviser)

This is the brutal, immediate rule of 2026 QSBS planning. You cannot wait until the term sheet feels “basically done.” If you do, stacking can become a costly illusion.

[YouTube Video]: A focused explainer on QSBS stacking timing and why late-stage gifting can backfire during an exit.

The 2026 landscape: why QSBS feels bigger than ever

If 2026 is a return of exits, it is also a return of tax engineering. The environment is shaping behavior.

Capital gains rates may be stable, but the anxiety is not

Multiple mainstream references emphasize that the federal long-term capital gains rate structure remains 0 percent, 15 percent, and 20 percent, with inflation-adjusted thresholds. (Bankrate)

However, investors do not just price “today’s law.” They price political possibility. They remember recent proposals to tax capital gains at much higher rates for certain high-income taxpayers. (Forbes)

Additionally, state policy is becoming more aggressive and more diverse. Some states move to tax capital gains more heavily. Others move the opposite way. For example, Missouri eliminated its state capital gains tax for individuals starting in 2025, which highlights how fast the state map can change. (Kiplinger)

Consequently, 2026 planning is multi-layered. QSBS is federal. Stacking may include trust situs strategy. The total outcome often depends on both.

The 2025 QSBS expansion creates a “stacking arms race”

The post-2025 expansion has three effects that matter for 2026 exits.

First, the per-issuer cap increase increases the value of each “stack.” (The Tax Adviser)

Second, the higher gross-asset threshold may allow more companies to qualify, which expands the universe of exits where QSBS is even on the table. (Greenberg Traurig)

Third, the tiered holding period creates a new planning lever for investors exiting before five years, although the details must be handled with precision. (Baker Tilly)

In 2026, that combination will push more angels to ask one urgent question: “Can we stack this before we sell?”

The uncomfortable truth: stacking is not for everyone

Stacking can be powerful. It can also be messy.

Trust costs matter. Trustee discipline matters. Family dynamics matter. If the structure creates conflict, the tax savings might not be worth it.

Therefore, the professional approach in 2026 is selective. Advisors will push stacking where the upside is massive and the family can handle governance. They will avoid it where the family reality is fragile.

The mechanics of stacking, explained through real-world exits

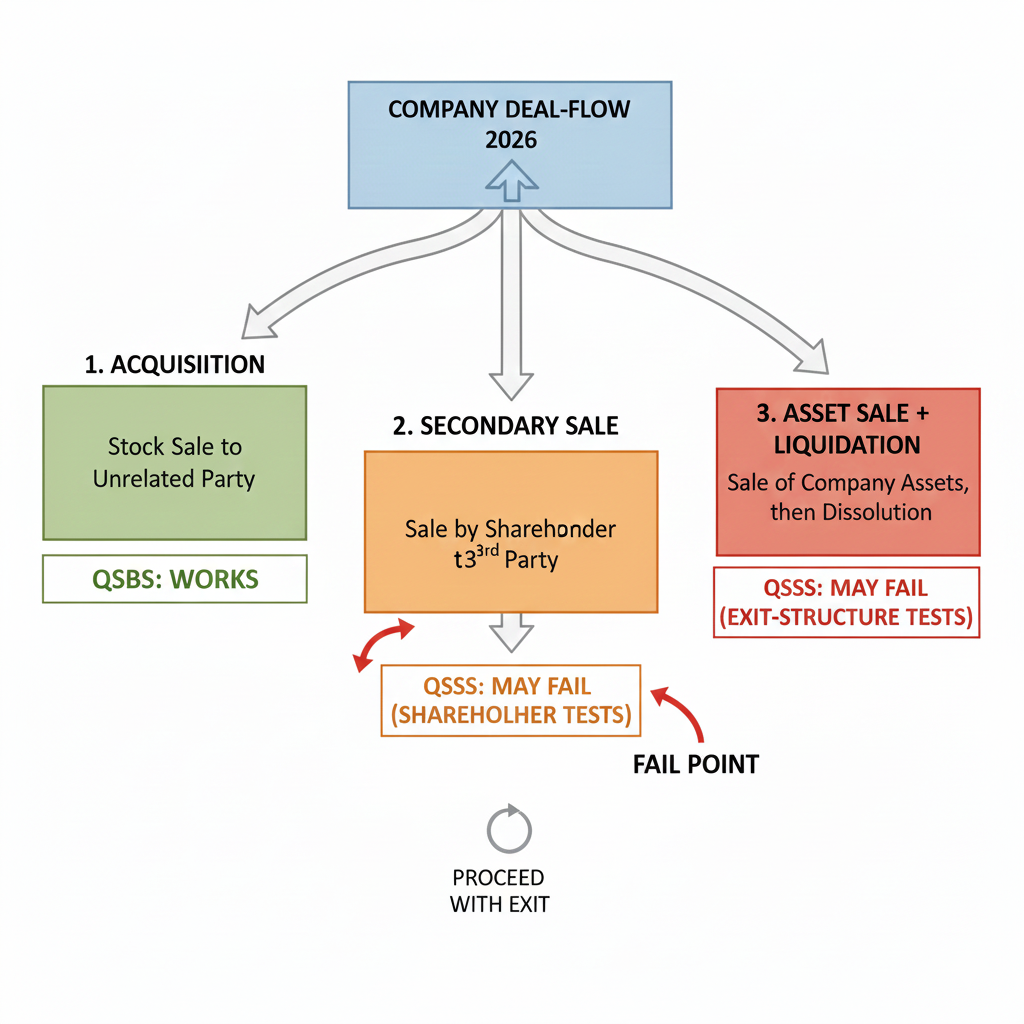

A journalist’s way to see stacking is through typical deal paths.

Scenario 1: The angel with one blockbuster winner

An angel invested early in a C corporation startup. The shares were issued directly by the company. The company stayed under the relevant asset thresholds at issuance. The business activity stayed inside eligible categories. The angel now expects a major acquisition in 2026.

If the expected gain is well beyond one taxpayer’s cap, stacking becomes attractive. Gifts to properly designed non-grantor trusts for adult children can create separate taxpayers. (FBT Gibbons)

However, the gift must be done early enough. It must be documented. It must avoid “assignment of income” arguments that can re-attribute gain. (The Tax Adviser)

Additionally, advisors will test whether the “10 times basis” cap dominates instead of the fixed-dollar cap, because that can change whether stacking provides extra benefit. (Holland & Knight)

Scenario 2: The founder facing the rollover trap

Founders often accept “rollover equity” into an LLC or partnership during a sale. That is common in private equity deals.

Yet some technical analyses warn that transferring QSBS into a partnership can cause the partnership to lose the ability to claim the QSBS exclusion on a later sale, depending on how the transfer occurs. (FBT Gibbons)

Consequently, 2026 founders are becoming more alert. They are asking for deal structures that keep QSBS alive. They are considering taxable exits instead of nonrecognition deals when the QSBS benefit is huge.

This is not about being stubborn. It is about math.

Scenario 3: The investor with multiple exits in one year

QSBS limits can apply in ways that depend on the issuer and the taxpayer.

In 2026, as exits cluster, investors will think about sequencing. They will think about which sale uses which cap. They will think about which shares sit in which trust.

Furthermore, documentation will become essential. You cannot “reconstruct” QSBS eligibility from memory after the sale. A clean file is a proven advantage.

The strict rules that decide QSBS, and how stacking intersects

QSBS is a technical regime. Still, you can understand it through a few high-stakes tests.

Original issuance is the gatekeeper

Many summaries emphasize that QSBS generally must be acquired at original issuance, meaning you received the stock from the company, not by buying it from another shareholder. (Grant Thornton)

Gifts can be an exception path that preserves QSBS status in the hands of the recipient, but you do not want to assume. You want your counsel to verify how the transfer interacts with the statute and guidance. (Faegre Drinker)

The company’s gross assets at issuance matter more than people think

Multiple post-2025 summaries describe an increased gross asset threshold for QSBS qualification for certain post-2025 stock, moving from $50 million to $75 million and indexing after 2026. (Greenberg Traurig)

This is a breakthrough expansion because it can keep more scaling startups inside QSBS territory.

However, it also creates a new compliance need. Companies and investors must document asset levels at issuance. Late-stage cap table chaos can destroy a future QSBS argument.

The holding period story changed, but it still bites

For many readers, QSBS equals “hold five years.” That remains a core benchmark. (Angel Capital Association)

Yet multiple professional sources describe newer rules with partial exclusions starting at three years for certain post-2025 QSBS, with 50 percent at three years, 75 percent at four years, and 100 percent at five years. (Baker Tilly)

Consequently, 2026 exits may see more “early-but-not-too-early” planning. Investors who miss five years might still chase partial exclusion. Still, partial exclusion is not the same as full exclusion. It can also create more tax complexity.

The per-issuer cap, and why stacking targets it

The classic QSBS limit is often described as the greater of a fixed dollar cap per issuer or 10 times basis. (RSM US)

Recent commentary highlights increases in the per-issuer limitation for certain post-2025 QSBS to $15 million, with inflation indexing after 2026. (The Tax Adviser)

Stacking is most exciting when the fixed-dollar cap is the limiting factor. That is why sophisticated advisors model both caps before recommending trust transfers. (Holland & Knight)

2026 predictions: how QSBS stacking will evolve next year

The most useful predictions are not about one law change. They are about behavior and enforcement.

Prediction 1: QSBS “opinion letters” and documentation packs become standard

As QSBS becomes more valuable, more advisors will push for formal QSBS documentation.

This includes tracking the company’s eligibility facts, stock issuance details, and business-activity evidence. It includes memos to support qualification. It includes clean cap table history.

Additionally, some investors will demand QSBS diligence as part of exit readiness, almost like financial due diligence.

In 2026, the best founders will treat QSBS readiness as part of their “IPO-grade” discipline.

Prediction 2: Stacking shifts earlier in the startup life cycle

The timing trap around binding sale agreements is forcing earlier action. (The Tax Adviser)

That means 2026 will see more stacking discussions at Series B, Series C, or even earlier, rather than at the doorstep of an acquisition.

However, earlier stacking is not always better. If you gift too early, you may lose flexibility. You may also create governance issues.

Consequently, professionals will refine a balanced approach: early enough to be safe, late enough to be informed.

Prediction 3: “Incomplete gift” trust structures stay controversial but tempting

Some summaries discuss incomplete gift non-grantor trusts, sometimes referenced as INGs, as a tool that can create an additional taxpayer for stacking while not being a completed gift in certain designs, and possibly offering state tax angles. (Wealthspire)

In 2026, these structures will remain tempting. They will also remain a space where careful legal design is essential.

The emotional pull is obvious: more stacks, less loss of control. The technical risk is also obvious: complexity creates audit exposure.

Prediction 4: Private equity and venture funds pursue QSBS more aggressively

Professional commentary notes that enhanced Section 1202 rules may impact private equity and funds, not just classic startup angels. (Plante Moran)

In 2026, expect more fund managers and deal lawyers to ask whether portfolio companies can structure issuance to preserve QSBS for key holders, where feasible.

This is not a small trend. It can reshape how companies choose entity type and how they structure growth.

Prediction 5: More state divergence changes “where” stacking is built

State tax policy is fragmenting. Some states move to reduce capital gains taxes. Others add or raise them.

Missouri’s elimination of state capital gains tax is a striking example of fast divergence. (Kiplinger)

Consequently, 2026 will bring more attention to trust situs, residency, and state sourcing. Stacking will increasingly be paired with state planning, not treated as separate.

Technology innovations arriving in 2026 that strengthen QSBS outcomes

QSBS is law. Yet execution is operational. Technology is becoming the operational edge.

Cap table platforms and QSBS tracking become “exit infrastructure”

Platforms that manage cap tables and equity records have expanded QSBS education and tracking features, and they increasingly describe the phased holding period and the gain caps in accessible ways. (Carta)

In 2026, investors will lean harder on these systems because they reduce human error.

However, software does not replace legal analysis. It supports it. It creates a clean record trail. It makes it easier to prove dates and issuance facts.

More automation for 409A valuation and issuance documentation

Many QSBS fights start with “what was true at issuance.”

Better valuation workflows and better issuance records will become a competitive advantage. Companies that can produce clean records will make investors more confident. That confidence can even improve deal terms.

Secure digital vaults for QSBS evidence

The most practical innovation is also the most underrated. A digital vault that stores key documents in one place.

In 2026, sophisticated investors will maintain a QSBS vault. It will hold stock purchase agreements, cap table snapshots, board approvals, business descriptions, and eligibility memos. That vault becomes the verified backbone of an audit defense story.

How to prepare for 2026 exits without falling into QSBS traps

This is not legal advice. It is a professional guide to the pressure points that show up in real deals.

Start with the harsh question: “Do we truly qualify?”

Ask it early. Ask it with evidence.

Many companies assume they qualify because they are “tech.” Yet excluded trades and business tests can be nuanced, and eligibility depends on facts and timelines.

Additionally, investors must confirm they are eligible holders. C corporations are generally not the intended beneficiaries of the exclusion in the same way individuals and many trusts are. Professional summaries often emphasize that the exclusion is aimed at noncorporate taxpayers. (Grant Thornton)

Consequently, eligibility is both a company story and a shareholder story.

Model both caps before stacking

In many cases, the fixed-dollar cap is the limiter. That makes stacking dramatic.

In other cases, the 10 times basis cap dominates. In those cases, stacking may add less, or it may change the math in more subtle ways. (Holland & Knight)

Therefore, 2026 planning often starts with modeling. It is not glamorous. It is essential.

Treat timing as a critical exit asset

The Tax Adviser has stressed the importance of avoiding gifting after a binding sale is in place. (The Tax Adviser)

In practical terms, this means you should discuss stacking when exits become “possible,” not when they become “certain.”

Additionally, it means you should coordinate with deal counsel. Tax planning cannot be isolated from transaction planning.

Build trust governance like you would build a company

Trusts used for stacking are not passive boxes. They are living structures.

Trustee selection matters. Distribution standards matter. Beneficiary expectations matter. If the trust is sloppy, the plan feels fragile.

In 2026, the highest-performing families treat trust governance as a system. They do annual reviews. They keep clean minutes. They follow payment and reporting discipline.

That discipline is the quiet difference between “this looked amazing” and “this held up.”

Do not let the deal structure kill the QSBS benefit

Certain deal moves can quietly ruin QSBS value. Some rollover structures can create issues. Some nonrecognition exchanges can change the tax character of what you hold. (FBT Gibbons)

Consequently, 2026 investors will push deal teams to explicitly address QSBS in the structure memo. They will ask for clarity on stock sale versus asset sale impacts. They will ask whether liquidation plans preserve the intended tax result.

That is not being difficult. That is being competent.

[YouTube Video]: A practical overview of QSBS planning, common pitfalls, and how advisors structure tax-efficient founder and angel exits.

🔗 https://www.youtube.com/watch?v=wN2m7iAfYls

New regulations and policy watchpoints for 2026

Even if 2026 begins with stable federal capital gains brackets, policy risk still matters.

Federal watchpoint: capital gains proposals can return fast

Past official budget materials and analyses have described proposals to raise capital gains taxes for high-income taxpayers and related reforms. (U.S. Department of the Treasury)

Whether or not any such proposal advances in 2026, the possibility changes behavior. Investors accelerate exits. Founders consider earlier liquidity. Advisors prioritize shelters that already exist.

QSBS fits that psychological need because it is embedded in the tax code and has remained a powerful incentive for investment in small businesses. (Angel Capital Association)

Federal watchpoint: Section 1202 reform chatter never fully disappears

Older proposals have aimed to restrict QSBS for high earners or limit its scope. Some did not pass. (RSM US)

Yet 2025’s expansion may create a new political spotlight, because larger benefits tend to attract scrutiny.

Consequently, 2026 planning should assume that QSBS is valuable, but not untouchable. That assumption pushes earlier qualification checks, earlier documentation, and earlier stacking decisions where appropriate.

State watchpoint: divergence accelerates

State changes can reshape the net benefit of QSBS.

Missouri’s elimination of state capital gains taxes underscores how fast state policy can move, and how it can change residency and trust planning incentives. (Kiplinger)

In 2026, expect more investors to evaluate state outcomes alongside federal QSBS outcomes, especially when exits are large.

The emotional reality: why QSBS stacking is a “confidence strategy”

QSBS stacking is not only tax math. It is emotional math.

It turns uncertainty into a plan. It turns fear into structure. It turns a stressful exit into a more controlled outcome.

However, it also demands maturity. It demands patience. It demands professional coordination.

In 2026, the most successful angels will be the ones who did three things early.

They verified the company qualified. They verified their shares qualified. They built an execution trail that looks clean, credible, and disciplined.

That is the real stacking advantage. It is not a trick. It is a proven process.

Conclusion: the 2026 QSBS playbook for angels who want a clean win

As we enter 2026, QSBS is positioned as one of the most powerful, legitimate tax shields for startup exits, especially after the 2025 expansion that raised caps and widened eligibility thresholds for newer issuances. (The Tax Adviser)

Stacking is the next-level move. It can multiply the benefit. It can also multiply the risk if executed late or sloppily.

Therefore, the professional strategy for 2026 is simple in spirit and rigorous in execution.

Start early. Document everything. Coordinate tax and deal counsel. Use trusts only when the family can govern them well. Treat timing like a deal term.

Do that, and QSBS stacking can turn an already exciting exit into a truly rewarding, confidence-building outcome.

Sources and References

- 26 U.S. Code § 1202, Qualified Small Business Stock

- The Tax Adviser: QSBS gets a makeover (Nov 2025)

- The Tax Adviser: Revisiting Sec. 1202 after OBBBA (Dec 2025)

- Dentons: Turbocharged QSBS benefits signed into law (Jul 2025)

- RSM: How OBBBA expands QSBS exclusions (Jul 2025)

- Baker Tilly: Evaluating Section 1202 after OBBBA (Nov 2025)

- Faegre Drinker: QSBS stacking structures (Aug 2025)

- JD Supra: Stacking QSBS using trusts (Aug 2025)

- Grant Thornton: Enhanced Section 1202 benefits (Jul 2025)

- Angel Capital Association: Section 1202 overview (Mar 2024)

- KPMG: OBBBA changes and capital gains rates unchanged (Aug 2025)

- Forbes: Biden capital gains proposal details (Apr 2024)