Parametric insurance is set for a 2026 breakout. Instant payouts, smarter triggers, and tighter rules will reshape claims, pricing, and trust in a faster era.

The claim that arrives before the shock fades

The most frustrating part of insurance is not always the loss. It is the wait. It is the paperwork. It is the uncertainty. It is the silent feeling that help is far away.

Parametric insurance flips that story with a daring promise. When a predefined event happens, money moves fast. No long investigation first. No weeks of back-and-forth. No argument over every receipt.

In December 2025, this sounds like the kind of breakthrough the market has been craving. In 2026, it is likely to become a visible disruption across travel, weather risk, business interruption, agriculture, and even niche personal cover.

However, the real disruption is deeper than speed. Parametric products push insurers to act like data companies. They also push customers to think about risk in a new way. Instead of proving damage, you prove the trigger.

Additionally, this is where “usage-based everything” quietly enters the picture. Parametric insurance is not always about usage. Still, it behaves like the same mindset. Coverage becomes tied to measurable exposure and measurable events. Pricing becomes more personalized. Payouts become more automated. Trust becomes the core product.

Consequently, 2026 will test a simple question: can instant money feel fair, reliable, and transparent at scale?

What parametric insurance is, in plain terms

Parametric insurance pays a set amount when a measurable threshold is met. The trigger can be wind speed. It can be rainfall levels. It can be earthquake magnitude. It can be flight delay duration. It can be power outage time.

Unlike traditional insurance, the payout is not based on your exact loss. It is based on the parameter, meaning the trigger.

This is both the magic and the tension. The magic is speed and clarity. The tension is something called basis risk. Basis risk is the painful gap between the trigger payout and your real damage.

Still, parametric insurance can be a powerful tool when it is designed honestly. It can also complement classic coverage, acting like a rapid cash bridge.

Regulators have described this “faster payout” value clearly, especially in disaster contexts. (NAIC)

Why 2026 is the moment parametric finally feels mainstream

Parametric insurance has existed for years. So why does 2026 feel like a turning point?

A world that demands speed

People now expect instant service in almost everything. Payments are faster. Delivery is faster. Customer support is faster. The claims process, by contrast, often feels painfully slow.

Meanwhile, climate-driven disruptions are rising in visibility. Storms, floods, droughts, and heat events keep pushing communities and businesses into urgent cash needs. Fast liquidity becomes essential, not optional.

Additionally, the financial pressure on households and small businesses makes delays more damaging. When money is tight, waiting weeks for claims can be brutal.

Consequently, parametric is gaining attention because it meets an emotional need. It offers immediate relief. It offers a clear rule. It offers a strong sense of control.

Better data, better triggers

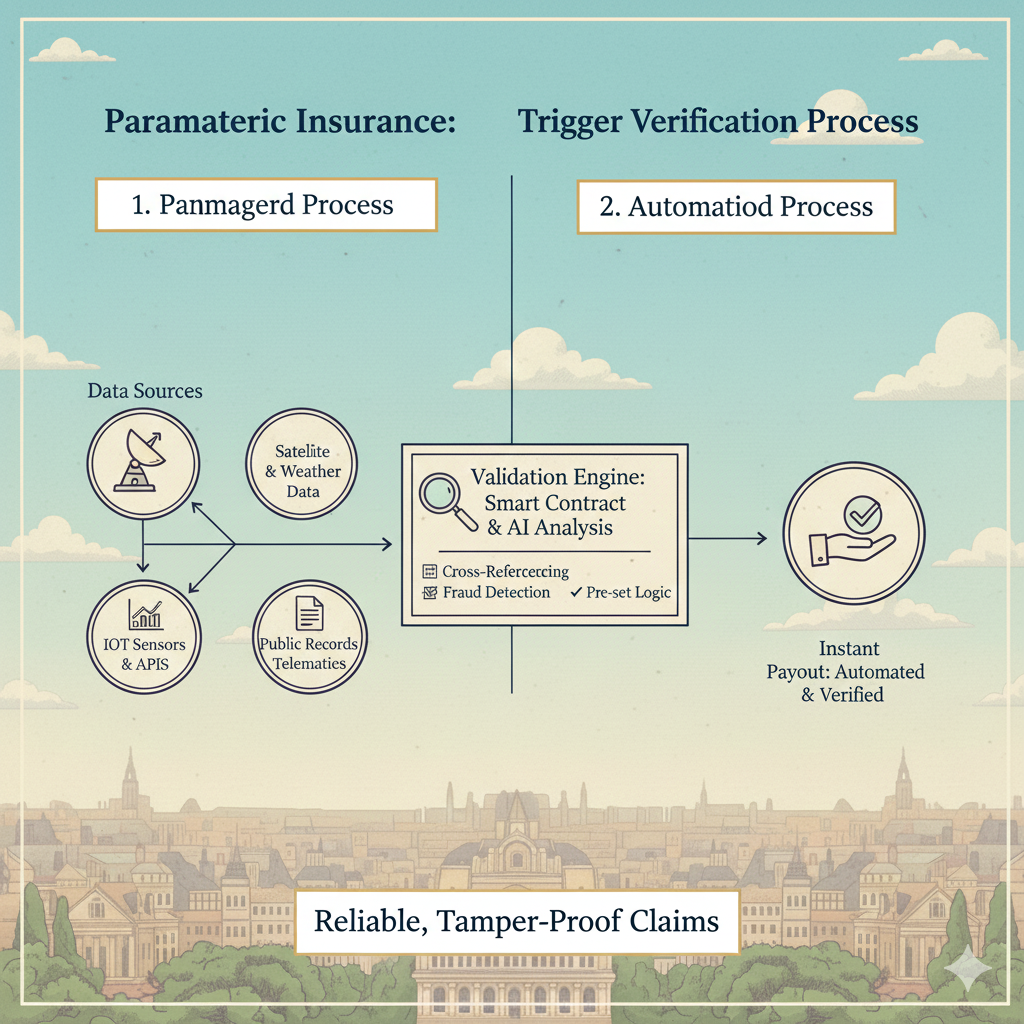

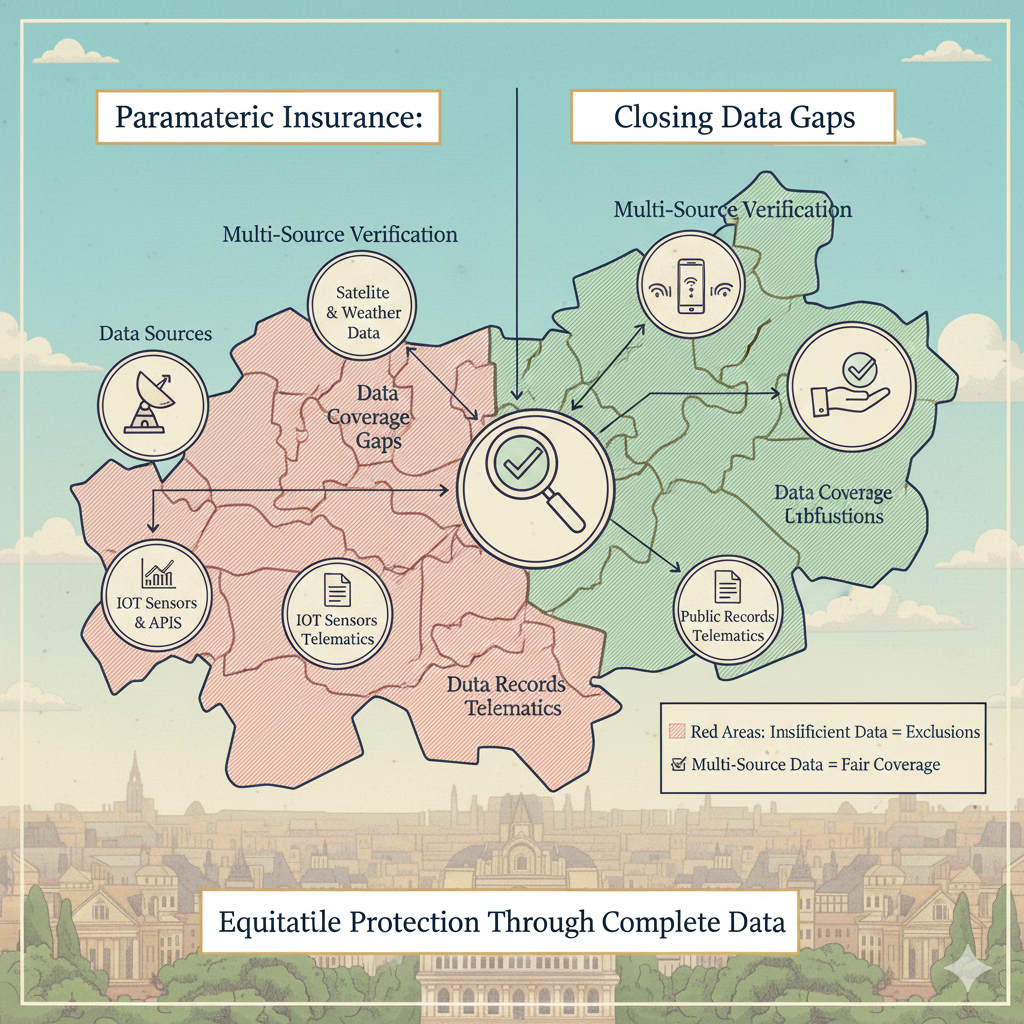

Parametric insurance depends on trustworthy data. In the past, data coverage was uneven. Reporting was slow. Verification was messy.

Now the world has more sensors, more satellites, more APIs, and more real-time feeds. That expands what can be triggered. It also improves confidence.

Furthermore, AI is helping insurers validate signals faster. AI can spot anomalies. It can detect data manipulation patterns. It can reconcile multiple sources.

However, better data does not automatically mean better fairness. The choice of trigger still matters. If the trigger is too strict, customers feel cheated. If it is too loose, insurers lose money.

So the 2026 story is not only “more data.” It is “better product design.”

Distribution is changing, fast

Parametric products are often easier to embed into digital flows. A travel site can offer flight delay cover instantly. A mobile wallet can bundle weather protection. An employer can add micro cover for a specific region.

Additionally, insurers like parametric because it can reduce claims friction. Customers like parametric because it feels fast.

Consequently, 2026 is likely to see parametric become a visible add-on in more everyday purchases.

[YouTube Video]: A concise explainer on parametric insurance and why quick, transparent payouts matter. Use it as a fast foundation before the deeper 2026 trends.

Instant payouts are rewriting the claims relationship

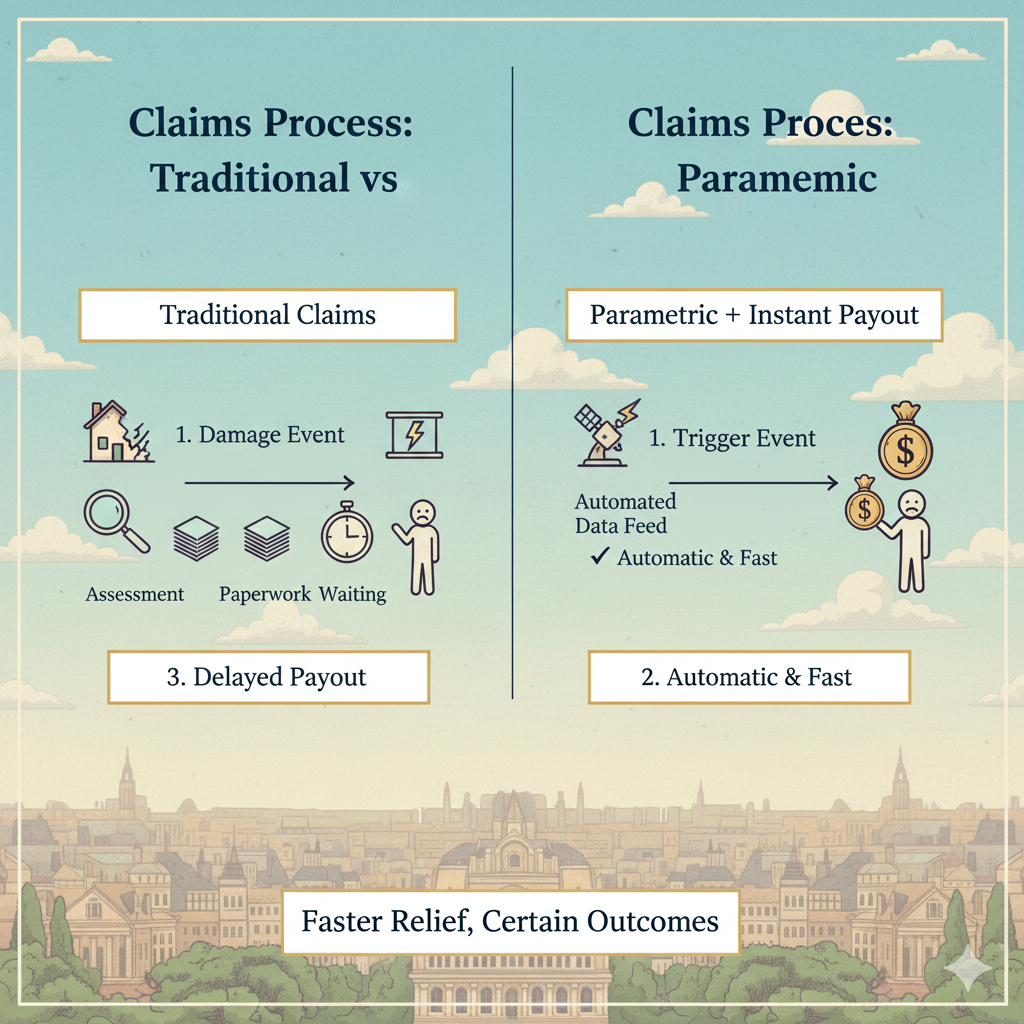

Traditional claims are built for proof. Parametric claims are built for triggers.

That difference changes everything.

From “prove your loss” to “confirm the event”

In classic insurance, the customer must often prove damage. That can mean photos. That can mean invoices. That can mean adjuster visits. That can mean debate.

Parametric products reduce that process. If the trigger is verified, the payout happens.

This is emotionally powerful. People want fewer fights during stressful moments. People want certainty. People want speed.

However, this can also feel cold if the payout arrives and the real loss is bigger. That is the basis risk problem again.

So the 2026 winners will be products that set expectations with honesty. They will not oversell. They will explain exactly what the trigger does and does not do.

The “liquidity bridge” becomes the main use case

A smart way to think about parametric payouts is as liquidity, not full replacement.

When disaster hits, cash matters immediately. People need repairs. People need shelter. Businesses need temporary operations. Communities need response resources.

Consequently, parametric payouts can function like a bridge. They can cover deductibles. They can cover immediate expenses. They can reduce financial panic.

Regulators have even discussed parametric policies as a complement to indemnity coverage, including the idea of paying an amount like the deductible to speed up recovery. (NAIC)

In 2026, expect more hybrid designs that blend parametric speed with traditional loss adjustment. That blend can reduce basis risk while keeping the instant relief advantage.

Trust becomes the battleground

When claims are instant, trust must be instant too.

Customers will ask: who verifies the trigger? Which data source is used? What happens if data is missing? What if the trigger is disputed?

Additionally, insurers will worry about moral hazard and manipulation. If someone can influence the trigger, the product collapses.

Therefore, 2026 will push more verified data standards. It will push more multi-source validation. It will also push more transparent disclosures.

What’s coming in 2026: the parametric expansion map

Parametric is often associated with disasters. That will remain true. Yet 2026 is likely to expand the category in four big directions.

Everyday parametric: travel, events, and mobility

Flight delay parametric coverage is a classic example. If your delay crosses a set threshold, you get paid.

In 2026, expect more everyday variants. Event cancellation triggers. Lost baggage timing triggers. Ride-hailing disruption triggers. Even micro cover for temporary exposure windows.

Additionally, these products will become more personalized. If your travel pattern signals higher risk, pricing can shift. If your loyalty profile shows lower risk, pricing can improve.

Consequently, parametric becomes not just a product type. It becomes a pricing style that fits modern commerce.

Climate and agriculture parametric goes bigger

Climate-linked parametric insurance is gaining political and humanitarian attention because it can move money fast after extreme weather.

For example, parametric programs have paid out to support response and resilience in vulnerable regions, including drought and cyclone impacts in Africa. (ARC Group)

Additionally, global interest is rising in national or statewide parametric schemes to reduce disaster relief burdens and speed assistance. (Reuters)

Consequently, 2026 may see more public-private expansion. Governments want predictable disaster financing. Insurers want scalable risk transfer structures. Communities want immediate support.

Business interruption and supply chain triggers

Traditional business interruption claims can be complex. They require proof. They require accounting. They can take time.

Parametric models can simplify a slice of this. A port closure trigger. A power outage duration trigger. A weather trigger tied to a defined region.

However, this is where basis risk can bite hard. Business losses vary widely. A generic trigger may not match the real hit.

Therefore, the 2026 trend will be targeted parametric layers. They will not replace full business interruption insurance. They will provide fast cash for critical moments.

Personal cyber and home resilience triggers

Parametric is also creeping into “digital life” areas. This is still early. Still, the logic is attractive.

Imagine a defined trigger related to a verified cyber event that locks you out of accounts. Imagine a home policy layer that pays instantly after a verified prolonged power outage. Imagine a water sensor trigger that releases funds immediately when a leak event is detected.

These are not guaranteed to become mainstream in 2026. Yet pilots and niche products are likely to grow, especially where data is reliable and events are clearly defined.

Emerging technologies in 2026 that make instant payouts safer

Fast payouts can be thrilling. They also create risk. That is why the tech stack matters.

Multi-source data verification becomes standard

A single data source can fail. It can also be manipulated. 2026 products will increasingly combine sources.

For weather, that could mean satellite plus ground stations. For power outages, that could mean grid frequency plus outage maps plus local sensors. For flight delays, that could mean airline data plus airport data plus independent trackers.

Consequently, trigger disputes can drop. Customer confidence can rise. Insurer confidence can rise too.

Smart contracts are maturing, but quietly

Some parametric products use blockchain-based smart contracts. Many do not. The real point is automation with auditable rules.

In 2026, the market will be pragmatic. It will use whatever automation stack works with compliance and scale. For some products, smart contract logic can help with transparency. For others, classic cloud systems will dominate.

However, the “auditable payout logic” trend will be strong. Customers want to know that rules were applied consistently. Regulators want proof.

So even when blockchain is not used, the spirit of auditable automation will spread.

AI is moving from pricing to operations

AI will do more than price risk. It will monitor data quality. It will detect anomalies. It will flag suspicious patterns. It will help customer support explain triggers.

Additionally, AI can help tailor parametric products to local reality. It can analyze historical event patterns. It can help pick thresholds that feel fair.

Yet AI also brings governance challenges. Insurers must avoid discriminatory outcomes. They must document model behavior. They must monitor drift.

As AI governance rules become stricter, insurers will be pushed to show responsible practices. One state-level AI law with a 2026 effective date will raise compliance expectations, especially for high-risk systems. (YouTube)

New regulations and policy pressure expected in 2026

Parametric insurance itself is regulated within insurance frameworks. Still, 2026 adds a new layer. AI and data rules will shape how parametric products are designed and marketed.

AI transparency and discrimination risk become real compliance work

When pricing is personalized, regulators worry about unfair discrimination. When AI is involved, scrutiny rises.

In 2026, insurers will need stronger documentation for model inputs, testing, and monitoring. They will also need clearer consumer disclosures about automated decision-making in many contexts.

This does not kill innovation. It forces discipline. It also creates a competitive advantage for companies with mature governance.

Consumer disclosure is no longer optional

Parametric products can feel simple. Still, they can hide complexity. Basis risk is the biggest example.

Consequently, expect 2026 to bring more disclosure pressure. Clear trigger definitions. Clear payout tables. Clear data source explanations. Clear dispute processes.

This is not only a legal move. It is a trust move. A product that feels honest can scale faster.

Regulators push resilience financing conversations

As climate losses remain visible, policymakers are exploring new financing tools. Parametric is often presented as one tool for rapid relief.

That means 2026 may see more public programs, more pilots, and more attention at global climate events and national resilience discussions. (Reuters)

Industry predictions for 2026: what will actually happen

Predictions should be grounded. Here is what looks most likely from today.

More parametric in the mainstream insurance conversation

Market commentary on 2026 outlooks increasingly mentions parametric solutions as a growing tool, especially for triggers like temperature and outage duration. (Amwins)

This matters because it signals normalisation. Parametric is moving from “specialty innovation” into standard planning. That is a major shift.

Hybrid products will outgrow pure parametric designs

Pure parametric is clean. It is also risky due to basis risk.

Hybrid designs reduce that pain. They can pay a fast fixed amount first, then handle the rest through traditional adjustment. This can feel both instant and fair.

Consequently, 2026 will likely be the year hybrid becomes the default design pattern in more categories.

Personalization becomes sharper, but customer control becomes essential

Usage-based thinking will shape parametric distribution. People with strong resilience behaviors, like preparedness steps or verified sensors, may receive better terms.

However, if customers feel trapped by surveillance or confusing opt-ins, adoption will slow. So the market will have to offer real control.

Expect clearer dashboards. Expect opt-out options. Expect “data minimization” positioning as a competitive weapon.

[YouTube Video]: A deeper discussion of parametric insurance and data-driven triggers, with a strong focus on climate risk and transparent payout design. It fits the mid-article moment where 2026 scaling questions get serious.

The hard truth: basis risk will decide reputations in 2026

Instant payouts are exciting. Still, basis risk can create anger.

Why basis risk feels so personal

If your roof is damaged and the trigger does not fire, you feel ignored. If the trigger fires but your loss is minor, you may feel awkward. If you get paid but your loss is bigger, you may feel shortchanged.

These feelings are intense because parametric is marketed as fast relief. Relief that disappoints can become a trust disaster.

Therefore, product design must be humble. It must be precise. It must be matched to real needs.

How 2026 products will reduce the pain

The best designs will use layered triggers. They will choose thresholds tied to meaningful disruption, not tiny measurements. They will also create tiers, so bigger events create bigger payouts.

Additionally, more products will offer “top-up” paths. The parametric payout happens fast. Then traditional coverage handles verified damage beyond the parametric layer.

Consequently, basis risk becomes manageable rather than fatal.

The fairness test: who benefits, who gets left out

If parametric products are easiest to access for people with good data coverage, that creates inequality. Rural areas may have weaker station coverage. Lower-income households may lack smart sensors.

So 2026 will require intentional inclusion design. Better regional data. Affordable sensors. Public-private programs that subsidize access.

This is not only ethical. It is commercially smart. A bigger market needs broader trust.

How to prepare for 2026 parametric changes

You do not need to be an insurance expert. You need a simple evaluation approach.

Choose clarity over hype

When you see a parametric offer, read the trigger. Read the payout. Read the data source. Read the exclusions.

If the product cannot explain the trigger in simple terms, walk away. If it hides basis risk, be cautious. If it uses vague language like “may pay,” demand specifics.

Clarity is a strong trust signal.

Use parametric as a strategy, not a replacement

In 2026, the smartest approach for many people and businesses will be layered protection.

Parametric can cover immediate cash needs. Traditional coverage can cover larger verified damage. Together, they can feel powerful and resilient.

However, buying only parametric and expecting full replacement can create disappointment. A realistic strategy prevents regret.

Demand dispute pathways

Even with verified data, disputes happen. Data feeds fail. Local conditions differ. Edge cases appear.

So ask how disputes are handled. Ask what happens when data is missing. Ask whether there is a secondary verification method. Ask how long review takes.

A proven program will have answers.

Conclusion: 2026 belongs to the fastest, fairest payout

Parametric insurance is not a gimmick. It is a serious shift in how risk is financed.

Instant payouts can reduce panic. They can speed recovery. They can feel empowering. They can also deliver a truly modern experience when everything else still feels slow.

However, the market will not forgive sloppy design. Basis risk will expose weak products. Confusing triggers will create backlash. Poor data governance will create regulatory heat.

Consequently, 2026 will reward products that combine speed with honesty. It will reward designs that protect trust as fiercely as they protect cash flow. It will also reward insurers that treat parametric as a resilience tool, not just a trendy feature.

If that happens, the claims process will not just be disrupted. It will be reinvented, in a way that feels immediate, verified, and genuinely human.

Sources and References

- NAIC: Parametric Disaster Insurance

- Amwins: State of the Market 2026 Outlook

- Milliman: Parametric insurance for public entities (2025)

- African Risk Capacity: Mozambique parametric payout (Oct 2025)

- Reuters: India explores climate-linked parametric insurance (Oct 2025)

- Deloitte: 2026 global insurance outlook

- Swiss Re Institute: Global economic and insurance outlook 2026/27 (Nov 2025 PDF)

- IAIS: Global Insurance Market Report 2025 (2026 outlook PDF)

- Colorado SB24-205: Consumer Protections for AI (effective 2026)