Longevity 2026 will reshape life insurance into daily health management. Learn the breakthrough models, instant incentives, and key trust rules to prepare now.

The quiet shift behind the loud promise

Life insurance has always been sold as a safety net. You pay premiums. Your family gets money if you die. It is simple, and it is emotionally heavy.

However, that old story is losing power. It feels distant to many buyers. It feels gloomy. It also feels mismatched with modern life, where apps coach our sleep, watches count our steps, and digital tools track everything.

Consequently, the industry is searching for a new story that feels urgent and useful. It is trying to turn life insurance into something you benefit from while you are alive.

This is not just a branding tweak. It is a product redesign. It is also a data redesign. And it is a trust redesign.

As we head into 2026, a clear pattern is forming. Life insurance is pivoting toward health management, with rewards, coaching, and prevention as core features. In some markets, this approach has already moved from experimental to mainstream. In others, it is the next competitive battleground.

This shift is exciting. It is also controversial. It can feel empowering, like a personal upgrade you get paid to maintain. It can also feel invasive, like your body becomes a spreadsheet.

The key question for 2026 is not whether the pivot continues. The question is who benefits most, who gets left out, and which rules will shape fairness.

Why “insurance for living” is suddenly believable

A few forces are pushing the change at the same time. First, consumers expect constant value. Subscription fatigue is real. People want proof that the cost is worth it.

Additionally, insurers face stubborn growth challenges in some mature markets. Many carriers are looking for new ways to engage customers and reduce lapse rates. Customer engagement is no longer a marketing nice-to-have. It is a survival lever.

Meanwhile, health technology has matured. Wearables are no longer niche gadgets. Digital coaching has improved. Remote care is more normal. Behavior science has also become more practical, with real nudges that work in real lives.

Finally, there is a strategic logic that insurers love. If a policyholder becomes healthier, the insurer’s risk can improve. That can mean fewer early claims. It can also mean a more stable pool.

That logic is sometimes called “shared value.” You improve your health. The insurer improves outcomes. Rewards become the bridge between the two.

Programs like John Hancock Vitality and similar “Vitality” style models across markets helped make the concept concrete, not theoretical. They show that life insurance can be paired with rewards for healthy activity, and that data can be used for engagement without necessarily rewriting underwriting after issue. The model is not perfect, but it is compelling. (JohnHancock)

A new definition of “longevity”

In the old world, longevity was a statistic. It was a life expectancy curve.

In the new world, longevity is a product feature. It is measured in habits. It is trained through coaching. It is encouraged through incentives. It is reinforced through community.

That is why “longevity” is turning into a sales theme. It feels hopeful. It feels modern. It feels actionable.

Yet the most important part is hidden. Longevity-first life insurance requires continuous systems. It needs data flows. It needs consent and privacy controls. It needs safeguards against bias. It also needs restraint, or it becomes creepy fast.

The 2026 Longevity Stack

To understand 2026, it helps to picture a stack. Not a tech stack only. A life stack.

At the bottom is protection. That is still the base. A death benefit still matters. Underwriting still exists. Claims still happen.

On top of protection sits engagement. That is where insurers push rewards, challenges, and habits. This layer is designed to make the policy feel alive.

Next comes prevention. That is where coaching, screenings, and care navigation appear. Some insurers will partner with telehealth. Others will partner with wellness platforms. Some will push into mental health support, since stress and sleep affect everything.

At the top sits personalization. This is where pricing, benefits, and services adapt to you. In many products, personalization shows up as discounts, gift cards, or better perks rather than direct premium changes. That distinction matters, because it affects fairness and regulation.

The wearable layer is only the beginning

Wearables are the obvious symbol. A watch counts steps. A ring tracks sleep. A device monitors heart signals.

However, the bigger trend is not the device. The bigger trend is the normalization of continuous health signals.

In 2026, more life insurers will treat wearable data as one input among many. Grocery data, preventive screenings, medical adherence, and even employer wellness participation can all become signals. The strongest products will not feel like surveillance. They will feel like support.

At the same time, the risk is clear. More signals can mean more exclusion. More signals can also mean more bias. That is why the next layer, governance, will matter as much as the tech.

[YouTube Video]: A practical look at a real life insurance rewards model, and how the incentives are designed to shape daily behavior.

Why life insurance wants to manage your health

Insurers do not become wellness brands out of kindness. They do it because the math is persuasive.

A life insurer’s profit depends on pricing risk accurately, keeping customers, and managing claims outcomes. In a competitive market, pricing alone is not enough. Experience becomes the differentiator.

Consequently, health management becomes a business strategy. It can reduce mortality risk. It can strengthen retention. It can create cross-sell paths into health, disability, or even financial wellness tools.

There is also a cultural reason. People increasingly see health as a project. They track it. They optimize it. They talk about it. Life insurance is trying to attach itself to that momentum.

From “claims process” to “life process”

Old insurance is reactive. Something bad happens. You file a claim. You wait. You argue. You receive money or you get denied.

The new model tries to win before the claim. It aims to reduce the chance that the worst event happens early. That is a bold promise. It is also emotionally powerful.

Yet we should be honest. No program can guarantee longevity. Life is messy. Genetics matter. Randomness exists. Inequality is real.

So the most credible pitch in 2026 will not be “we will make you live longer.” It will be “we will help you manage risk with tools that feel worth it.”

Incentives are becoming more sophisticated

The first generation of wellness-linked insurance leaned heavily on steps and gym visits. That was easy to measure. It was also limited.

In 2026, incentives will expand into broader outcomes. Sleep improvement. Stress reduction. Preventive screenings. Vaccination reminders. Nutrition changes. Consistent coaching attendance.

Meanwhile, some insurers are experimenting with pathways that blend health management with emerging medical tools. Weight management, for example, is becoming a major focus in wellness ecosystems, and insurers are exploring how to integrate structured support. (The Guardian)

This is where life insurance starts to resemble a health membership. It is not fully there yet. But the direction is clear.

What is new in 2026, specifically

The most important 2026 change is scale. The “longevity play” is moving from boutique to broader. More carriers will launch versions of this model. More reinsurers will support it. More brokers will learn how to sell it.

Additionally, product design will become more modular. Instead of one policy with one story, insurers will offer bundles. A base policy. A wellness layer. A coaching layer. A digital care layer. Sometimes even a device subsidy layer.

This is not just convenience. It is strategy. Modularity makes it easier to price, regulate, and swap partners.

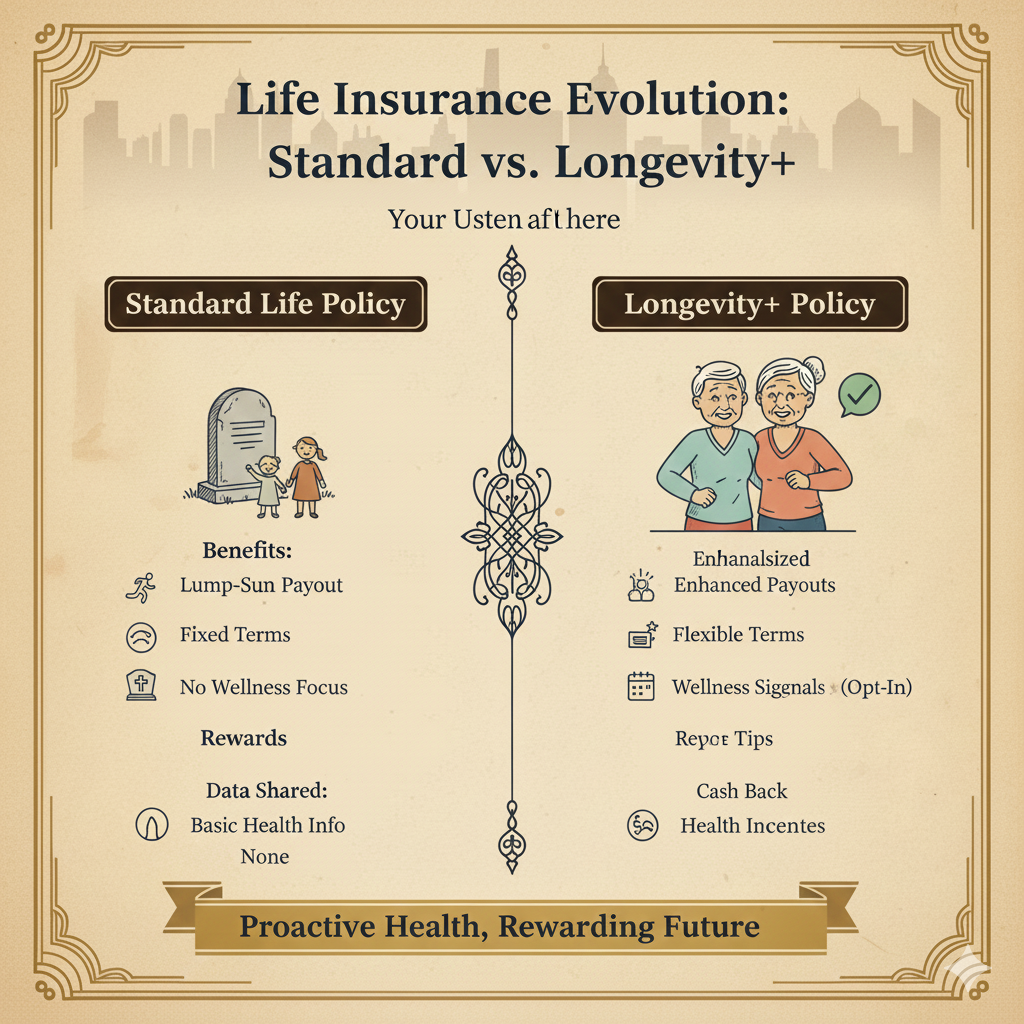

Prediction: More “rewards-first” positioning

By late 2026, many consumers will recognize two archetypes.

One archetype will be classic life insurance, priced and sold mostly the traditional way.

The other archetype will be “life insurance with benefits now.” Rewards, discounts, tools, and programs will be central, not optional extras.

In practice, both archetypes still protect families. The difference is how emotionally engaging they feel and how they use data.

Prediction: A stronger push into prevention services

Expect more life insurers to partner with services that feel medical-adjacent but not fully medical. That includes screening kits, nurse lines, care navigation, and digital coaching.

This is where the pivot becomes credible. A gift card is nice. A program that helps you catch risk early is vital.

Furthermore, prevention services can be positioned as empowerment rather than surveillance. That framing will matter in a privacy-sensitive world.

Prediction: AI becomes the invisible engine

AI will not just power chatbots. It will power underwriting triage, document summarization, and customer support workflows. Swiss Re and other industry voices have been explicit about AI’s role in claims and underwriting operations, especially for handling growing volumes of evidence and repetitive tasks. (Swiss Re)

Yet 2026 is where AI governance becomes unavoidable. As insurers use AI for decisions, regulators and customers will demand explanations.

The regulation and trust cliff in 2026

The pivot to health management runs into a hard wall: regulation. Two categories matter most. AI rules and data rules.

In Europe, the AI Act timeline is a major anchor date. The AI Act entered into force on August 1, 2024, and the EU describes broad applicability by August 2, 2026, with staged obligations and some extended timelines for certain high-risk systems. (Digital Strategy)

However, the politics are fluid. Reuters has reported debate and proposals around timing and implementation pressure, including discussions of delays for some “high risk” parts. (Reuters)

Why does this matter for life insurance? Because insurance increasingly uses AI for risk scoring, underwriting, and customer segmentation. Even when the model is framed as “rewards,” the underlying analytics can influence offers and access.

The fairness question gets sharper

When you tie insurance to health management, you risk penalizing people for factors they cannot control. Time. Money. Disability. Chronic conditions. Unsafe neighborhoods. Stressful jobs.

A brilliant longevity product can accidentally become an inequality amplifier.

That is why 2026 products will put more emphasis on positive incentives rather than penalties. It is also why insurers will talk more about optional participation, data minimization, and clear consent.

Programs like Vitality often highlight that rewards are tied to activities and engagement, and that the program structure is designed as an add-on to policies. That model gives insurers a way to position wellness as support rather than punishment. (JohnHancock)

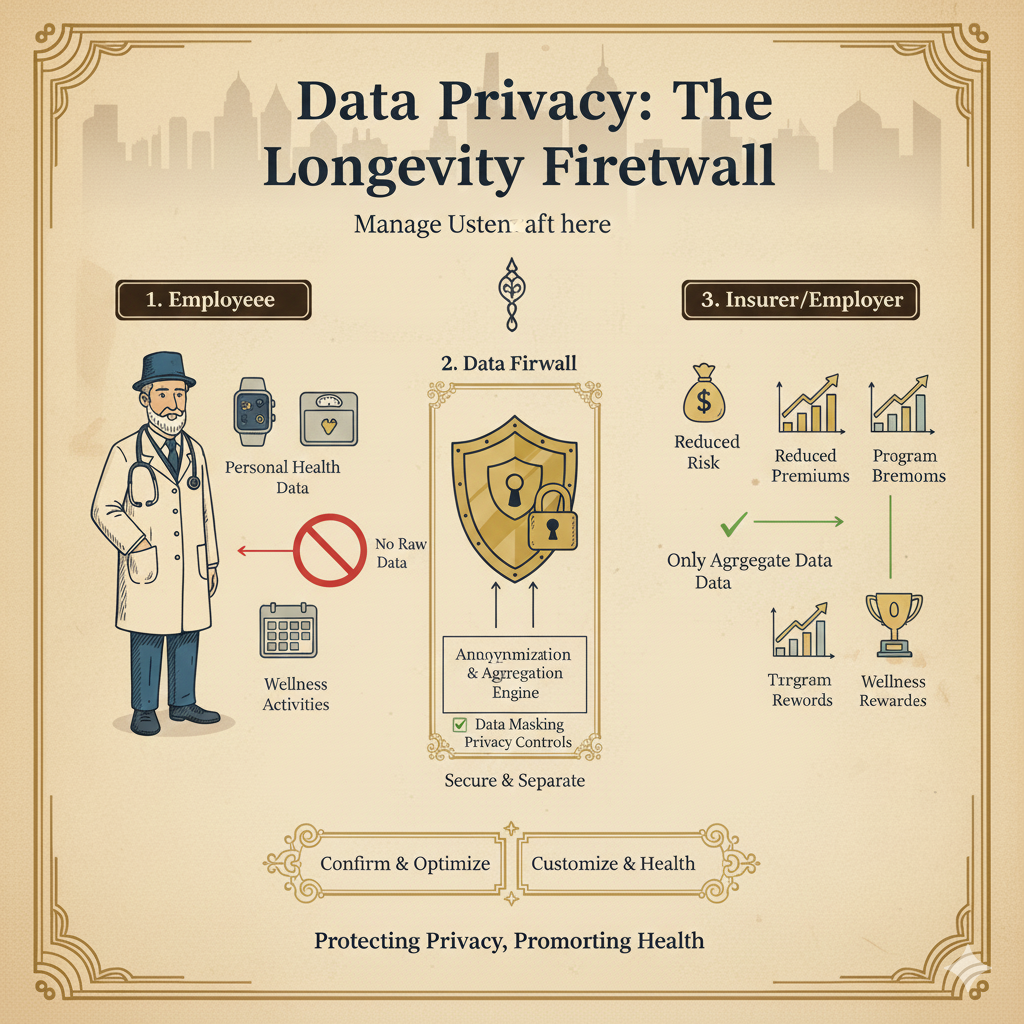

Privacy becomes a competitive feature

In 2026, privacy will not be a legal footnote. It will be part of the value proposition.

The winning insurers will do three things well. They will explain what data they collect. They will explain why they collect it. They will make it easy to control.

If the controls are confusing, people will assume the worst. If the controls are clear, trust can grow.

The technology innovations that will define 2026 launches

The next wave of innovation is not one shiny gadget. It is integration.

In 2026, expect more insurers to launch products that connect to common health ecosystems. Think Apple Health, Google Fit, and popular wearables. The goal is not just to collect data, but to reduce friction. If setup is hard, adoption fails.

Additionally, insurers will invest in better personalization engines. Not just “you walked 10,000 steps.” More like “your sleep is trending down, here is a practical plan, and here is a reward for sticking with it.”

This is where AI can be thrilling. Done well, it feels like a supportive coach. Done poorly, it feels like an annoying nag.

Underwriting gets faster, but also more debated

“Accelerated underwriting” has been growing for years. It uses data sources and algorithms to make decisions faster, often with fewer medical exams for some applicants.

In 2026, accelerated underwriting will expand, especially for simpler products. Yet the debate will intensify. Faster can mean more errors. Data-driven can mean more bias if historical patterns were unfair.

That is why insurers will invest more in explainability and model monitoring. Regulators will also expect evidence that models are controlled.

[YouTube Video]: A high-level explanation of how AI and automation are changing life and health underwriting, with discussion of the risks and the human role.

Prediction: More “life-stage” pricing and services

In 2026, insurers will lean harder into life-stage triggers. New job. New baby. New mortgage. Major health milestone.

Instead of selling a static product, they will sell a flexible journey. This aligns with the broader “insurance for living” framing that research groups and consulting reports have highlighted as a key direction. (Capgemini)

The hidden risks that will shape public backlash

Every big shift carries backlash risk. Longevity-linked life insurance is no exception.

The first risk is data breach. More data means more exposure. If an insurer holds sensitive health signals, a breach can be devastating. It can also destroy trust for years.

The second risk is “incentive fatigue.” People start excited, then drop off. If a product relies on constant engagement, it must be designed for real life, not perfect life.

The third risk is unfair outcomes. If rewards are easy for wealthy customers but hard for everyone else, regulators will notice. Customers will notice faster.

Finally, there is reputational risk. If an insurer appears to punish people for illness, it will face outrage. Even if the contract is legal, the public reaction can be brutal.

Consequently, 2026 products will try to feel supportive, not judgmental. They will highlight choice and flexibility. They will also promote “small wins” rather than extreme targets.

The “soft coercion” problem

Even when participation is optional, it can feel required. If the best pricing or perks require data sharing, people may feel pressured.

That is why transparency is essential. Insurers will need to show what you get without data, and what you get with data. Clear separation reduces the feeling of manipulation.

How consumers should prepare for 2026

If you are shopping for life insurance in 2026, the smartest move is to treat longevity features as part of the contract, not just marketing.

First, ask what data is collected. Ask how often. Ask where it is stored. Ask who can access it.

Next, ask whether the program can change your premiums. Some models focus on rewards and discounts rather than premium increases. Others may evolve toward dynamic pricing.

Then, ask what happens if you stop participating. Life happens. Devices break. People travel. Motivation dips. A fair product should not punish normal life.

Additionally, ask how the insurer protects you from unfair decisions. If AI is used, ask how it is monitored. Ask how you can appeal.

Finally, think about your own comfort. If tracking feels stressful, a classic policy may be healthier for you emotionally. Peace matters too.

The most practical decision rule

A longevity-linked policy is worth considering when the value is obvious even if you share limited data.

If the product only works when you share everything, it is riskier. If the product still feels rewarding with minimal sharing, it is more trustworthy.

This is also a good proxy for maturity. Mature programs design for consent and flexibility. Immature programs design for extraction.

How insurers will position the longevity pivot in 2026

In 2026, insurers will not talk like tech companies. They will talk like guardians.

Expect messaging around “protection plus progress.” Expect claims of “next-generation support.” Expect language about “living your best life.” Those phrases can be cheesy, but they signal a real shift.

Moreover, insurers will likely highlight partnerships. A respected wellness partner adds credibility. A recognized device ecosystem reduces friction. A strong care network makes the offering feel real.

Reports and outlooks are already framing 2026 as a year where modernization, alliances, and changing customer expectations reshape the insurance landscape. (Deloitte)

Prediction: Employers become a bigger distribution channel

Employer benefits remain a powerful pipeline. If longevity-linked life insurance can be bundled into benefits with wellness support, adoption can scale.

This is also where health trends and workforce wellness themes intersect with insurance innovation. (Forbes)

However, the employer channel adds another trust layer. Employees may worry about data flowing to employers. Insurers will need hard guarantees and technical controls to prevent misuse.

The 2026 outlook, in one sentence

Life insurance is becoming a daily health product, powered by data and incentives, constrained by trust and regulation.

That is the tension. That is the opportunity. That is the risk.

If 2026 products respect consent, reward progress, and protect privacy, they could feel revolutionary in the best way. If they overreach, the backlash will be immediate and brutal.

The “longevity play” will succeed where it feels human. It will fail where it feels like surveillance.

Conclusion: A shield that works only if you trust it

The promise of longevity-linked life insurance is emotionally bright. It reframes protection as progress. It turns a fearful purchase into a hopeful journey.

Yet the promise depends on trust. It depends on clear rules. It depends on fairness. It depends on restraint.

In 2026, the smartest consumers will read beyond the rewards. They will ask about data. They will ask about AI. They will ask about control.

At the same time, the smartest insurers will stop treating privacy and fairness as compliance chores. They will treat them as premium features. They will build products that people proudly join, not reluctantly accept.

That is the real longevity revolution. Not longer life at any cost. Better life with honest choices.

Sources and References

- 2026 insurance industry outlook (Deloitte) (Deloitte)

- 2026 global insurance outlook (Deloitte) (Deloitte)

- World Life Insurance Report 2026 (Capgemini PDF) (Capgemini)

- EU AI Act: timeline and applicability (European Union) (Digital Strategy)

- EU AI Act “High-Risk AI” guide (Orrick) (AI Law Center)

- John Hancock Vitality Program overview (JohnHancock)

- John Hancock Vitality Apple Watch Program (JohnHancock)

- Vitality 2025 Health Claims and Insights Report (Vitality UK) (Vitality Insurance Plans)

- Swiss Re: AI innovation in life and health claims and underwriting (Swiss Re)

- Accenture on wearables adoption expectations in insurance (Investment Executive)

- Reuters: EU confirms AI Act timeline (July 2025) (Reuters)

- Reuters: proposal to delay some “high risk” AI rules (Nov 2025) (Reuters)