A thrilling 2026 playbook for converting discounted office into in-demand home, with critical risks, proven screens, and next-year policy tailwinds.

The 2026 setup: why this trade feels “inevitable”

Commercial real estate has had a brutal few years. Yet markets rarely stay frozen forever. As we move into 2026, a powerful, emotional shift is taking hold. Investors are no longer debating whether older offices are “challenged.” They are asking what comes next.

Meanwhile, the housing shortage keeps biting. Rents stay sticky in many cities. New construction is constrained by expensive capital and stubborn input costs. Consequently, the idea of buying yesterday’s empty office footprint and selling tomorrow’s housing product feels both daring and strangely logical.

However, this is not a simple bargain hunt. Office-to-residential conversion is an engineering problem, a legal problem, and a financing problem. It is also a narrative problem. The winners in 2026 will be the teams who can turn a messy, distressed story into a verified, financeable, permitted, livable outcome.

Why “Office-to-Resi” is not a trend, but a re-pricing

Office markets have become split. Trophy buildings with great amenities often hold demand. Class B stock, especially with deep floor plates and outdated systems, can get punished. That divergence is a pivotal 2026 signal. Capital is not abandoning cities. It is abandoning obsolete layouts.

Additionally, policy is catching up. Cities want activated downtowns, safer sidewalks, and full tax bases. They also want more units. That political alignment creates a rare window. In the right markets, 2026 may reward adaptive reuse more than passive office exposure.

The emotional driver: scarcity of “buildable” housing

Housing feels personal. It is urgent. It is vital. Office occupancy is corporate. It is negotiable. When policymakers must choose, housing often wins. Therefore, the conversion thesis leans on a simple truth: a decent home in a good location is always valuable.

[YouTube Video]: CBRE’s quick breakdown on office space being removed via conversions and demolitions, and why that matters for the 2025 to 2026 transition.

The “conversion arbitrage” explained in plain English

Arbitrage here means buying one kind of square footage at a distressed price and selling a different kind of square footage at a stronger price. The magic is not the purchase. The magic is the permitted change of use.

However, the spread is not guaranteed. Many buildings fail the test. Some fail fast on design. Others fail slowly in financing. A few fail late, after painful carrying costs. That is why 2026 will reward disciplined screening over optimistic spreadsheets.

Where the spread comes from

Older office assets can trade at heavy discounts after vacancies rise and refinancing becomes harsh. Residential values, by contrast, can be supported by demand, limited supply, and local incentives. Consequently, the same address can have two very different price tags depending on the use.

Additionally, conversion can compress timelines compared to ground-up development in some cases. That speed can feel like a breakthrough advantage, especially when construction pipelines are thin.

What “40 cents on the dollar” really means

When people say “40 cents on the dollar,” they usually mean the asset is priced far below a prior peak value or replacement cost. It is an emotional headline, not a universal rule. In practice, the discount must be deep enough to pay for a long list of hidden costs: demolition, re-planning, new MEP systems, code upgrades, interest carry, and tenant relocation if any remains.

Therefore, the “cheap” deal only becomes a proven deal when the basis is low enough to survive reality.

2026’s biggest tailwind: policy support and zoning momentum

Cities have started to compete for conversions. That shift is critical. It changes underwriting. It changes lender confidence. It also changes how fast projects can move.

New York City has been a high-profile example, with specific incentive frameworks and a growing pipeline of conversions and proposals. Reports also show conversion activity accelerating after policy changes and incentives. (NYC Comptroller’s Office)

The new “permission economy”

In 2026, permitting speed may be as valuable as cheap debt. Many markets still run on slow approvals. Yet some jurisdictions are building dedicated programs, clearer rules, and more predictable reviews.

Additionally, “yes” is not binary. Projects often need a chain of approvals: zoning, building code interpretation, historic review, fire and life safety, accessibility, and sometimes public benefits. The conversion winner is the team that can manage that chain with calm precision.

Why incentives matter more than people admit

A tax abatement or conversion credit can turn a marginal project into a bankable project. It can also reduce the shock of the construction period when cash flow is negative. That relief is not cosmetic. It is vital.

However, incentives can come with strict affordability requirements, timelines, and compliance risk. Therefore, the smartest 2026 operators price compliance like a real cost, not a footnote.

The building physics: the “floor plate trap” that kills deals

You can’t negotiate with geometry. Many office towers were designed for large, deep work floors with interior areas far from windows. Apartments need light, air, and a sane layout. Consequently, the floor plate is often the first brutal filter.

Developers and researchers repeatedly point to depth, window lines, and core placement as core feasibility constraints. (Brookings)

The three physical questions that decide fate

First, can you get enough natural light to bedrooms and living areas without bizarre layouts? Second, can you route plumbing stacks efficiently for kitchens and bathrooms? Third, can stairs, elevators, and life-safety paths meet residential code without a full rebuild?

If any of these break, the “cheap” office becomes an expensive mistake. Therefore, 2026 feasibility will be won by early technical diligence.

Why “Class B” is not automatically “convertible”

Class B is a market label. Convertibility is a design reality. Some Class B buildings have great bones and shallow plates. Others are wide slabs that fight residential layouts. Additionally, some buildings have mechanical systems that are too old to reuse, which pushes costs up fast.

Consequently, the winning mindset is not “buy Class B.” The winning mindset is “buy the right geometry.”

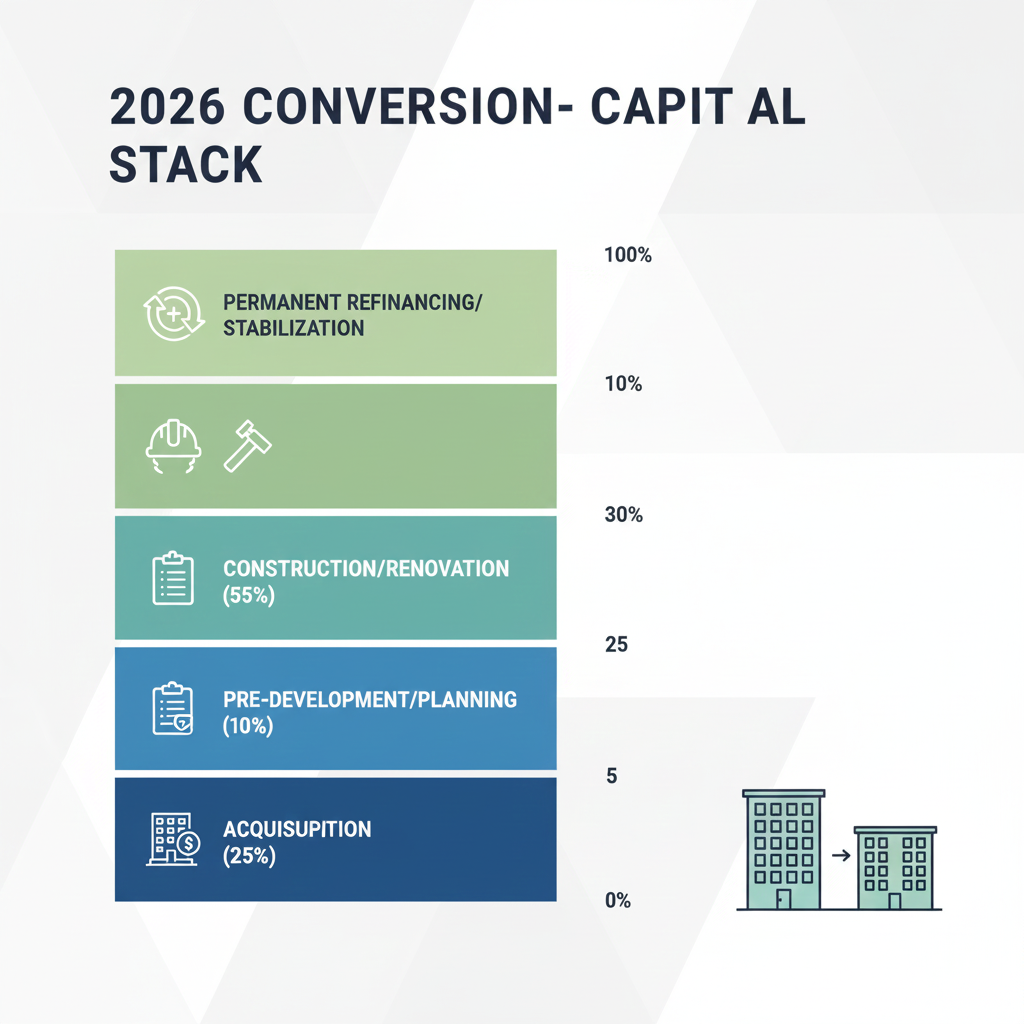

The capital stack in 2026: financing gets smarter, but stricter

Financing conditions have been evolving. Lenders and private credit have become more selective. They are also more technical. That is not bad. It is clarifying.

In 2026, expect more underwriting focus on real exit comps, realistic lease-up, and sponsor execution. Also expect more stress on interest carry, contingencies, and timing risk.

Debt is back, but patience is not

Some outlooks suggest capital markets are stabilizing and investment activity could strengthen into 2026, even as the market remains selective. (Savills Impacts)

However, “more liquidity” does not mean “easy money.” Lenders hate surprises. Conversions are full of surprises unless you manage them early. Therefore, bankability in 2026 will come from credible scope, conservative budgets, and verified municipal alignment.

Why conversions attract family office style capital

Conversions can feel uncorrelated to office leasing cycles because they aim to exit into residential demand. Yet they are still tied to rates, labor, policy, and local absorption. The better framing is this: conversions shift your exposure from office tenancy risk to construction and entitlement risk.

That is a powerful trade if you can control execution.

The 2026 playbook: how experts are screening opportunities

This section is where the “arbitrage” becomes a professional process. A serious buyer does not fall in love with the discount. They fall in love with the path to stabilization.

Additionally, a strong 2026 screen is fast. It kills weak deals in days, not months.

Start with a “No” list, not a “Yes” list

A disciplined team begins by eliminating buildings with fatal flaws. Deep floor plates, unworkable cores, toxic legacy issues, and impossible zoning are common deal killers.

Consequently, the first goal is speed. The second goal is certainty. The third goal is upside.

The quick feasibility triad

Design feasibility answers: “Can it become housing?” Legal feasibility answers: “Are we allowed to do it?” Financial feasibility answers: “Does it pencil with conservative assumptions?”

If you can’t get strong preliminary answers on all three, you pause. That pause is a profitable habit in 2026.

[YouTube Video]: A practical panel-style discussion on what office-to-residential conversion looks like, including constraints and real-world decision points.

Underwriting for 2026: what changes next year

A forward-looking model for 2026 should expect both opportunity and friction. Rates may ease or stay choppy. Construction costs may stabilize, yet labor constraints can remain. Policy support may expand, yet politics can shift quickly.

Therefore, the most rewarding underwriting stance is “optimistic on demand, conservative on execution.”

2026 trend: conversion volume becomes a signal

In several markets, conversions and demolitions have become a meaningful way to reduce office supply. That reduction can stabilize remaining office stock, while also feeding housing supply in targeted locations. Reports citing conversion pipelines highlight that this is no longer niche activity. (Facilities Management Advisor)

Additionally, expect 2026 headlines to focus on which downtowns are “winning” the reuse race. That narrative will matter for capital inflows.

2026 trend: incentives get more targeted

Early incentive waves can be broad. Later waves often get more demanding. Expect more “strings” in 2026: affordability requirements, sustainability benchmarks, faster deadlines, and tighter geography.

Consequently, the strategy becomes sharper. You pick the micro-locations where incentives and rent demand overlap in a proven way.

The hidden risks that can crush returns

This is where serious analysis beats hype. Conversions can be thrilling. They can also be punishing.

However, risk is not a reason to avoid the strategy. It is a reason to price it correctly.

Construction shock and “unknown unknowns”

Older buildings hide problems: asbestos, weak slabs, outdated electrical capacity, and brittle plumbing. Additionally, changes in code interpretation can force redesigns. Each surprise adds time and cost, which compounds interest carry.

Therefore, 2026 winners will budget generous contingencies and demand thorough due diligence.

Leasing risk is not zero

Residential demand may be strong, yet lease-up can disappoint if unit layouts are awkward or amenities feel thin. Moreover, product-market fit matters: luxury rents require luxury experience. Workforce units require cost discipline and a stable operating plan.

Consequently, unit mix and finishes are strategic decisions, not design flair.

Exit liquidity risk

Even if the building converts successfully, selling or refinancing depends on capital markets at that time. If 2026 brings volatility, exit timing becomes critical. A forced sale can destroy an otherwise successful conversion.

Therefore, a resilient plan includes multiple exits: condo sale, rental hold, or recapitalization.

The sustainability edge: why carbon math matters in 2026

Sustainability has moved from marketing to underwriting. Many institutions now treat embodied carbon, operational performance, and regulatory alignment as financially relevant.

Adaptive reuse can save embodied carbon versus demolition and rebuild. That benefit is increasingly measurable and, in some markets, increasingly rewarded. (Arup)

2026 trend: “green premiums” meet “brown discounts”

Obsolete buildings can face stronger discounts if they are energy-inefficient and costly to retrofit. Conversely, a well-executed reuse with strong performance can command a premium. Additionally, some cities and investors are pushing harder on disclosure, performance standards, and retrofit planning.

Consequently, the 2026 conversion thesis can gain an extra tailwind: sustainability alignment that boosts financing appeal and tenant perception.

Technology that will shape conversions next year

Design teams are increasingly using AI-assisted workflows, faster feasibility scans, and more integrated energy modeling. Forecasts for 2026 in the design world emphasize adaptation, reuse, and intelligent planning. (Gensler)

However, tech does not replace judgment. It accelerates iteration. The decisive factor remains the building.

Case-study lens: why New York became the conversion laboratory

New York offers a vivid template because the ingredients are intense: high housing demand, older office inventory, and active policy movement. Reports describe rising conversion activity and a pipeline that has drawn national attention. (Cushman & Wakefield)

What investors can learn from NYC without copying it

First, incentives can unlock feasibility, but they also shape unit mix and compliance. Second, older building stock can be a conversion advantage if geometry works. Third, local politics can move faster when the housing problem feels urgent.

Additionally, NYC shows that not all office buildings are viable. Even in a prime market, the feasible pool can be limited. That scarcity is a sobering, useful 2026 lesson.

The “downtown reset” narrative

Cities want mixed-use cores. They want residents who create foot traffic at night. They want retail that survives. Conversions can support that story, which is why political support can be surprisingly strong.

Consequently, conversions are not just a real estate play. They are a civic play.

How to prepare for 2026: a professional readiness checklist in prose

If you are evaluating this strategy for 2026, preparation is less about courage and more about infrastructure. You need the right team, the right process, and the right patience.

First, build a repeatable screening pipeline. Second, secure technical partners who have done conversions, not just new builds. Third, understand local incentive programs and compliance burdens. Fourth, line up financing partners who accept complexity but demand clarity.

Additionally, define your “walk away” triggers early. That discipline is protective. It is also liberating.

The talent stack that wins

A conversion project needs a strong architect, an MEP engineer who loves constraints, a code consultant, a permitting strategist, and a GC with renovation scars. It also needs legal support for zoning, tax, and contracting.

Consequently, 2026 winners will look less like tourists and more like operators.

The emotional discipline that protects capital

This strategy tempts people into overconfidence because the discount looks dramatic. Yet the market is not giving you free money. It is selling you a problem.

Therefore, the core mindset is calm skepticism. Verify everything. Price the pain. Then pursue the upside.

The 2026 outlook: predictions that feel realistic

Looking ahead, several forces point toward continued momentum in adaptive reuse, even if it remains selective. Global research outlooks highlight themes like constrained supply, focus on prime quality, and adaptation as value drivers into 2026. (JLL)

Here is the likely shape of next year, in journalist terms.

Prediction 1: More conversions, but fewer “easy” ones

The first wave harvested the most obvious candidates. As the space matures, more projects will be technically tricky. That raises the bar for sponsors, diligence, and execution.

Consequently, 2026 could reward fewer players with more concentrated gains.

Prediction 2: Incentives spread beyond the usual coastal names

Expect more mid-sized cities to refine conversion programs, especially where downtown vacancies hurt tax revenue. This trend is already visible in policy discussions and incentive design across markets. (Steven Winter Associates, Inc.)

Additionally, more places will push “office-to-anything,” not just housing, to fit local needs.

Prediction 3: Financing becomes more standardized

As lenders see more completed conversions, underwriting playbooks will solidify. That creates a verified path for repeat sponsors. However, first-timers will still face skepticism.

Therefore, 2026 may become a year where track record becomes a premium asset.

Prediction 4: The best returns come from micro-location selection

Not every downtown will rebound equally. Some will thrive on safety improvements, transit, and mixed-use planning. Others will struggle with weak job growth and poor amenities.

Consequently, the conversion thesis will become more local and less generic.

Conclusion: the “Office-to-Resi” trade is real, but it is earned

The 2026 conversion opportunity is emotionally compelling because it turns a visible problem into a livable solution. It can feel pioneering. It can also be profitable. Yet it is not a passive bet.

In 2026, the winning edge is not a catchy thesis. It is a disciplined machine: fast screening, brutal feasibility honesty, conservative underwriting, and verified policy alignment. Do that well, and the distressed office discount can become a powerful, rewarding housing asset.

Finally, remember one essential principle: this is educational content, not personal investment advice. Real estate investing involves serious risk, and professional guidance is critical.

Sources and References

- Savills: 2026 investment outlook

- JLL: Global Real Estate Outlook 2026 hub

- Brookings: Understanding office-to-residential conversion

- Brookings: Community guide, conversion economics

- NYC Comptroller: Office-to-residential conversions, economics

- Cushman & Wakefield: NYC conversion momentum

- NAIOP: Adaptive Reuse 2025 brief

- Arup: Office-to-residential conversions, carbon story

- Gensler: Design Forecast 2026

- Financial Times: NYC office conversions at highest rate since 2008