Litigation finance in 2026 could be a powerful, uncorrelated diversifier. Learn the risks, rules, and smart due diligence before you allocate.

The quiet boom behind volatile markets

As 2025 closes, investors feel whiplash. Rates stayed higher than many expected. Equity multiples swung fast. Private markets looked calmer, yet exits stayed uneven. Consequently, sophisticated allocators started asking a bold question: what else can earn attractive returns when stocks and bonds disagree?

Litigation finance has become one of the most provocative answers. It is emotional, controversial, and surprisingly technical. It can feel like a secret door into “alternative investments” that do not trade daily. It also comes with real landmines. Those landmines will matter even more in 2026.

In simple terms, litigation finance means funding legal claims. A funder pays some or all legal costs. If the case wins, the funder receives an agreed share of the recovery. If the case loses, the funder often gets nothing. That non-recourse structure is the core thrill and the core danger. (ILR)

Meanwhile, the story that made litigation finance famous in pop culture still echoes. Peter Thiel’s backing of Hulk Hogan’s case against Gawker became a symbol of how legal funding can amplify power. It also became a warning about optics and influence. (The Guardian)

However, the modern market is not mainly about celebrity drama. It is about commercial disputes, arbitration, and complex claims where the bill is huge and the timeline is long. In that world, litigation finance is positioned as a serious asset class, not a stunt.

Why 2026 is a turning point

2026 looks pivotal for three reasons. First, capital markets pressure has already reshaped how much money funders deploy. Second, regulators and judges are actively debating transparency rules. Third, technology is accelerating underwriting and portfolio construction.

Additionally, the investor base is changing. Some institutions pulled back when yields rose elsewhere. Yet family offices and private wealth groups kept exploring. That mix creates a tense, fascinating setup for 2026.

What litigation finance actually buys

Litigation finance is not a bet on “more lawsuits.” It is a bet on a specific legal claim’s expected value. That expected value depends on merits, damages, collectability, procedure, venue, and time.

The basic deal mechanics

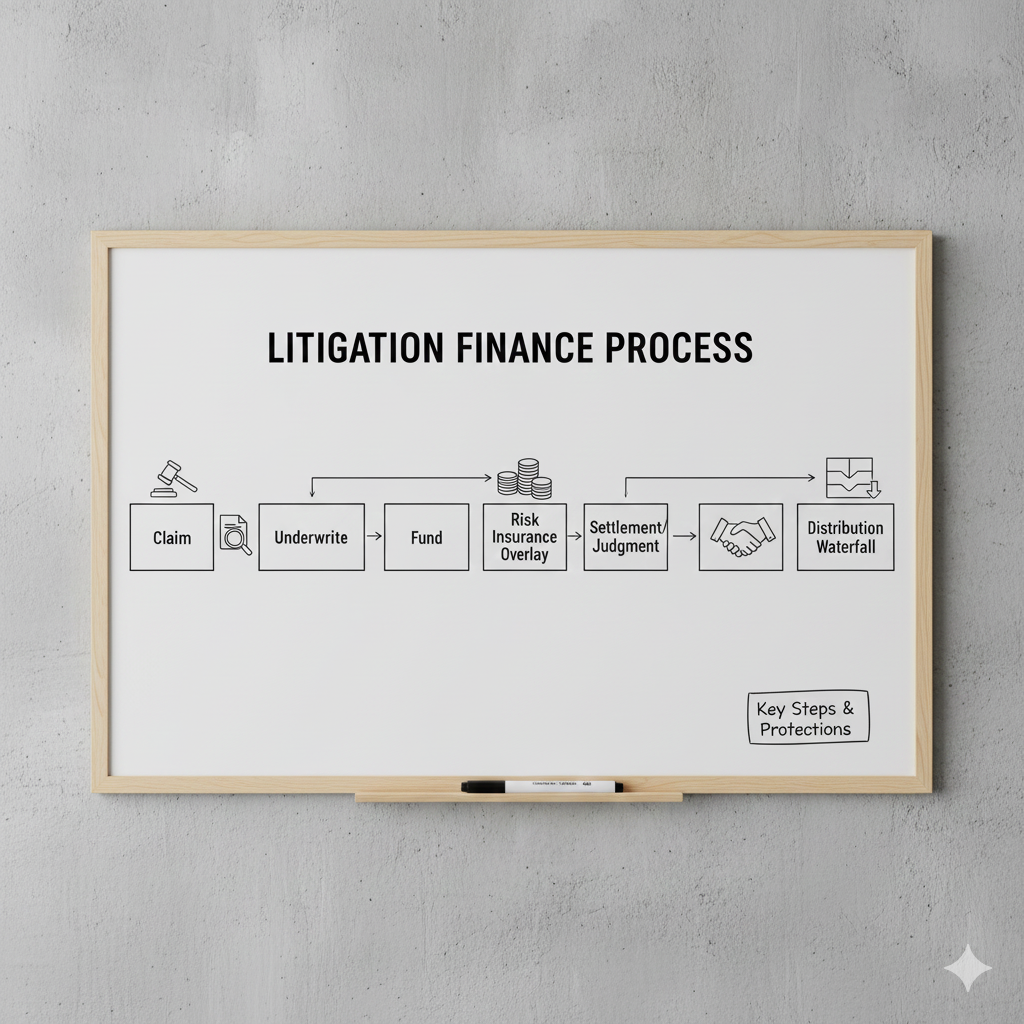

Most commercial litigation funding is structured around three moving parts.

First, the budget. Lawyers estimate fees, experts, discovery, and appeals. Second, the recovery waterfall. The contract defines who gets paid first and how the proceeds split. Third, control limits. Many agreements state the claimant keeps control, yet funders still negotiate protections. (United States Courts)

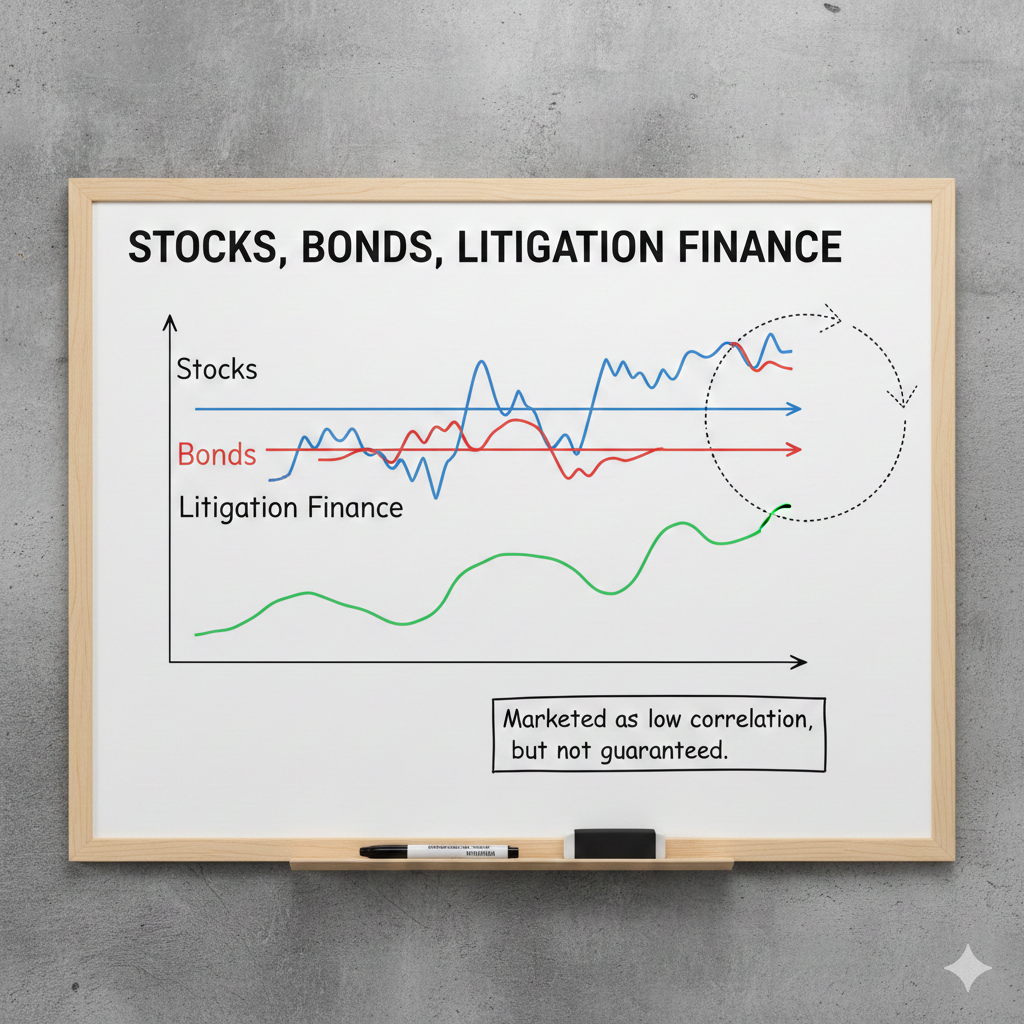

However, a critical misunderstanding persists. The “uncorrelated” pitch is often oversimplified. Case outcomes do not track the S&P 500 day to day. Yet funding returns can still be indirectly affected by recessions, court delays, settlement behavior, and enforcement risk. Academic work often frames the correlation as likely low, not magically zero. (Michigan Law Scholarship Repository)

A product family, not one product

Additionally, the market now includes more than single-case funding.

There is portfolio funding for law firms, where a funder backs a pool of cases. There are also risk-transfer tools that look like insurance. Westfleet’s research has tracked contingent risk insurance as a growing adjacent piece of the ecosystem. (Westfleet Advisors)

That ecosystem feel is essential for 2026. The “asset class” is evolving into a wider toolbox.

Why family offices are paying attention

Family offices typically crave three things. They want resilient returns. They want diversification that feels authentic. They want governance they can trust.

Litigation finance markets itself as a compelling match. The pitch is emotionally powerful: “These returns come from case outcomes, not market beta.” The pitch is also seductive: “Complexity creates premium.” Still, the best allocators do not buy slogans. They ask how the return engine truly works.

The return engine in plain language

Litigation finance tries to turn legal uncertainty into priced risk.

A funder underwrites like a specialist insurer. It reviews facts, law, venue, and counsel quality. It models probability and timing. Then it sets terms that aim to generate a target return if the case succeeds.

Consequently, underwriting discipline is everything. A single mispriced risk can erase several wins. That is why manager selection can be decisive. It is also why 2026 may widen gaps between top-tier and weak operators.

The “low correlation” claim, properly framed

Additionally, low correlation is not a guarantee. It is a hypothesis.

Courts do not move with earnings cycles. Yet settlement values can be influenced by corporate stress. Enforcement can be harder in downturns. Law firm capacity can tighten. Even insurer behavior can shift. Therefore, the intelligent framing is “potentially low correlation” plus “unique risks.”

That honest framing builds trust. It also keeps investors from making reckless assumptions.

The 2025 backdrop that shapes 2026

To understand 2026, you have to understand the cooling that already occurred.

Westfleet’s market data, reported publicly, showed U.S. commercial litigation funders committed about $2.7 billion to new deals in 2023, down from 2022. Industry assets under management were reported around $15.2 billion. (Reuters)

However, the most revealing detail was qualitative. The industry was described as being in “flux,” with closures, job moves, and a shift toward related products like contingent risk insurance. (Reuters)

What that cooling means for 2026

A cooler market can be excellent for disciplined investors. Prices can become more rational. Underwriting can get stricter. Term sheets can improve.

Meanwhile, it can be brutal for weaker funds. They may face liquidity stress. They may chase riskier cases. They may accept bad covenants. That divergence is a major 2026 theme.

Consolidation pressure is real

Additionally, the market has seen a smaller number of active funders than in prior years, per reported research coverage. (Reuters)

In 2026, consolidation could accelerate. Fewer, better-capitalized players may dominate. That can raise confidence, yet it can also raise concerns about market power and transparency.

How returns are measured and why people get confused

Litigation finance returns can look dazzling on paper. They can also be deeply misleading if you do not understand timing.

The difference between realized and unrealized outcomes

A case may take years. During that period, a fund might mark positions. Those marks rely on judgment. Those marks can be optimistic.

Consequently, sophisticated allocators focus on cash realizations and track record quality. They also ask about loss rates and duration.

Burford Capital’s public reporting gives one window into how a large platform discusses performance measures like ROIC and IRR. (SEC)

The “J-curve” problem

Additionally, litigation finance can have a J-curve. Early years show negative cash flow. Later years may show large realizations.

That pattern can be rewarding. It can also be psychologically brutal. Family offices that need short liquidity can get trapped. Therefore, 2026 allocation decisions must match liquidity reality, not optimism.

Case concentration is the silent killer

One large case can dominate a portfolio. That can be thrilling. It can also be catastrophic.

Meanwhile, portfolio funding can reduce concentration. It can also introduce correlation within a law firm’s strategy. So the right structure depends on the manager’s discipline and the investor’s risk tolerance.

The risk map that matters most in 2026

Litigation finance risks are not theoretical. They are concrete.

Legal structure risk

If a contract is drafted poorly, enforceability can break. UK markets felt this sharply after the PACCAR decision raised questions about litigation funding agreements, and the subsequent legal and policy response has remained active. (Herbert Smith Freehills)

Additionally, even in the U.S., disputes can arise over whether a funding arrangement is more like a secured loan, or whether it creates priority rights. Reuters coverage of a bankruptcy court ruling involving Burford highlights how structure and priority arguments can fail in court. (Reuters)

Regulatory and disclosure risk

In the U.S., momentum for disclosure and oversight has grown at both state and federal levels.

Louisiana enacted a law in 2024 requiring disclosures tied to foreign funding and restricting funder control, with effect in 2024. (Reuters)

At the federal level, a bill titled the “Litigation Transparency Act of 2025” was introduced in February 2025. (Congress.gov)

Meanwhile, the U.S. Judicial Conference’s Advisory Committee on Civil Rules has been studying whether a federal disclosure rule is appropriate, with stakeholder submissions and continued review. (Dechert)

Ethics and optics risk

Even if an investment is legal, headlines can be ugly. Critics argue funding can encourage aggressive litigation. Supporters argue it expands access to justice.

That debate is emotionally charged. It will not cool down in 2026. Reuters coverage has shown how sharply the arguments clash, especially around class actions and consumer proceedings. (Reuters)

Timeline and court-delay risk

Additionally, courts can slow. Appeals can extend. Enforcement can stall.

That timeline risk is not a side note. It is the heart of the asset class. A “great” case can still become a weak investment if it takes too long.

The regulation horizon for 2026

2026 will likely be a year of louder transparency fights.

The U.S. path: disclosure by rule, law, or local practice

The federal rules currently do not require blanket disclosure of funding in every civil case. Yet debate has been intensifying.

The Advisory Committee’s study process is real, and formal suggestions submitted to the committee show how actively stakeholders are pushing for clarity. (United States Courts)

Additionally, the litigation transparency bill text shows one legislative vision: broad disclosure and oversight of third-party beneficiaries. (Congress.gov)

Consequently, 2026 could bring one of two outcomes. Either a formal federal rulemaking path becomes clearer, or the patchwork of local rules and case-by-case discovery fights keeps expanding. A survey of disclosure rules and case law shows how fragmented the landscape already is. (IADC)

The UK path: stabilize funding, then regulate lightly

In the UK, policy debate has been intense after PACCAR. Reporting on the Civil Justice Council’s recommendations highlights calls for reversing disruption and creating “light-touch regulation,” rather than heavy caps. (Reuters)

Additionally, voluntary standards exist through the Association of Litigation Funders’ Code of Conduct. (Association of Litigation Funders)

In 2026, the UK theme is likely stabilization plus governance. Investors should watch how enforceability clarity affects pricing and deal flow.

The EU path: mapping, pressure, and uneven momentum

Europe has been assessing third-party litigation funding with more coordination.

The European Parliament’s 2022 resolution called for responsible regulation. Institutions and legal bodies have discussed mapping work and possible future approaches. (BIICL)

However, momentum is not linear. In late 2025, some commentary suggested the Commission’s direction could shift, pause, or narrow. (Lexology)

Consequently, 2026 in the EU could be less about a single sweeping law and more about national divergence plus ongoing pressure for minimum standards.

Technology and product innovation in 2026

Litigation finance is becoming more data-driven. That trend is not hype. It is structural.

Analytics that change underwriting

Legal analytics tools track judges, courts, counsel, outcomes, and timing. They help teams avoid pure intuition. (LexisNexis)

Additionally, predictive analytics is becoming more common in litigation strategy, blending data, modeling, and human review. (Solomonic)

In 2026, the edge may belong to managers who combine analytics with deep legal judgment. “Spreadsheet only” underwriting can fail. “Gut only” underwriting can also fail.

Insurance-like risk transfer is expanding

Risk insurance products around litigation are getting more sophisticated.

Judgment preservation insurance is one example discussed in professional guidance. (Global Practice Guides)

Additionally, litigation risk insurance concepts, including adverse judgment insurance, have been described as emerging tools to transfer downside exposure. (Clyde & Co.)

Westfleet’s 2024 report also highlighted contingent risk insurance’s role and tracked it as a meaningful slice of the ecosystem. (Westfleet Advisors)

Consequently, 2026 may see a more blended world where “funding” and “insurance” interact. That could make returns more stable. It could also make structures more complex.

How to prepare for 2026 as an investor

This is not a plug-and-play allocation. It is a governance-heavy decision.

Start with the right question

Instead of asking, “Will this beat stocks?” ask, “What role should this play?”

If the role is diversification, you focus on correlation, duration, and loss behavior. If the role is return-seeking, you focus on underwriting edge and scale. If the role is opportunistic, you focus on special situations.

Additionally, you should decide if you are buying a manager or a structure. In this space, the manager often matters more than the label.

Due diligence that actually protects you

Look for a verified process. Ask how the manager sources deals. Ask how it rejects deals. Ask how it avoids conflicts with law firms. Ask how it handles settlement decisions.

Meanwhile, insist on clarity about control. Funding agreements can say “passive,” yet the economic leverage can create subtle influence. Regulatory submissions have emphasized this debate about control features and disclosure. (United States Courts)

Also examine concentration. Ask what percent of NAV sits in the top five matters. Ask how often cases go to appeal. Ask how long capital is tied up. These answers reveal real risk.

Liquidity planning is vital

Many investors underestimate timeline risk. That mistake is costly.

A family office that might need cash for a business acquisition or real estate opportunity should not lock too much capital into slow, uncertain realizations. Consequently, 2026 planning must assume delays.

A realistic view of “uncorrelated”

Treat low correlation as a potential benefit, not a guaranteed shield. Academic writing frames correlation as likely low, but still connected to broader conditions through indirect channels. (Michigan Law Scholarship Repository)

That mindset is safer. It is also more professional.

What could go wrong in 2026

A forward-looking guide must be honest about failure modes.

A regulatory shock

If disclosure rules expand suddenly, some strategies could become less attractive. Claimants might avoid funding if confidentiality weakens. Defendants might seek discovery fights. Courts might impose new scrutiny.

State-level rules already show a direction of travel, especially around foreign funding concerns. (Reuters)

A court decision that re-prices structure

UK history with PACCAR demonstrates how one decision can disrupt enforceability narratives. (Reuters)

Similarly, U.S. bankruptcy disputes show how funders can lose priority arguments, affecting expected recoveries. (Reuters)

A liquidity squeeze inside a fund

If a manager overpromises liquidity, trouble follows. Redemptions can force secondary sales. Secondary sales can be discounted. Discounts can destroy reported performance.

Consequently, 2026 manager selection should include balance-sheet strength and realistic liquidity gates.

Reputational blowback

Some forms of litigation funding attract political heat. Investor-state dispute funding has drawn sharp criticism in public debate, especially when cases challenge regulations. (The Guardian)

Even if an investor avoids those strategies, headlines can splash across the whole category. That is a real career risk for allocators.

Predictions for 2026: the most likely shifts

Predictions are not guarantees. Still, patterns are visible as 2025 closes.

Disclosure pressure will intensify

Legislative and rulemaking activity signals continued momentum. Bills like the Litigation Transparency Act of 2025, plus ongoing Advisory Committee study, suggest disclosure debates will remain urgent in 2026. (Congress.gov)

However, the final outcome may still be incremental. The U.S. often moves via patchwork first. That patchwork already exists in state laws and local practices. (Reuters)

Risk-transfer products will grow faster

Insurance overlays, including contingent risk insurance and judgment protection structures, will likely expand. Westfleet’s tracking of contingent risk insurance underscores the trend’s seriousness. (Westfleet Advisors)

Additionally, these products may appeal to allocators who want smoother outcomes.

Consolidation will accelerate

The industry’s “state of flux” description suggests continued pressure. Some managers will merge or exit. (Reuters)

That can be stabilizing. It can also reduce competition. Investors should watch pricing power.

Data-driven underwriting will become table stakes

Legal analytics platforms are expanding coverage and sophistication. (LexisNexis)

Consequently, 2026 will punish managers who cannot quantify venue risk and timing.

More attention will go to governance and conflicts

Codes of conduct and “light-touch regulation” frameworks will remain central in the UK conversation. (Association of Litigation Funders)

Meanwhile, U.S. disclosure fights will keep focusing on who controls what.

Investors will become more selective about strategy types

Commercial single-case funding will remain core. Portfolio funding will stay important. Funding tied to politically sensitive claims will be more controversial.

That selectivity will likely be a defining 2026 investor behavior.

The bottom line

Litigation finance can be thrilling. It can also be punishing.

In 2026, the category’s biggest promise remains the same: a potentially low-correlation return stream driven by legal outcomes, not daily market moves. (Michigan Law Scholarship Repository)

However, the category’s biggest reality will also remain the same: complex risk that requires elite diligence, patient capital, and strong governance.

If you treat it as a headline trend, you can get hurt. If you treat it as a disciplined, carefully sized allocation, it can become a powerful diversifier inside a modern family office portfolio.

Sources and References

- The Westfleet Insider 2024 Litigation Finance Report (PDF)

- Reuters: U.S. litigation funding “state of flux” (Westfleet data)

- Congress.gov: Litigation Transparency Act of 2025 (H.R. 1109)

- U.S. Courts PDF: Rule suggestion on TPLF disclosure (25-CV-R)

- Dechert: Advisory Committee advances litigation funding review (2025)

- Reuters: UK urged to reverse PACCAR disruption, light-touch regulation

- Association of Litigation Funders: Code of Conduct

- Burford Capital: 2024 Annual Report (PDF)

- European Parliament resolution context and mapping study references (BIICL)

- LexisNexis: Lex Machina legal analytics overview