In 2026, insurance turns proactive. Expect concierge wildfire defense, tougher rules, and smarter pricing that rewards real mitigation before the next mega-fire season.

The moment insurance stopped being “after the fire”

A few years ago, homeowners insurance still sounded simple. You paid premiums. If disaster hit, the carrier wrote a check. That story is now cracking in public.

In California, the state backed FAIR Plan has become a pressure valve for a market that keeps tightening. After destructive Los Angeles area fires in early 2025, regulators asked insurers for a major cash infusion to shore up the FAIR Plan, because claims were already draining resources fast. (Reuters) The political fight that followed was loud, because it touched the third rail of insurance: who pays when the losses are huge and rising. (AP News)

Meanwhile, premium jumps started to look less like normal inflation and more like an emergency brake. State Farm was allowed an emergency homeowners rate increase in California in 2025, after wildfire driven stress and a broader capital squeeze. (Barron’s) This is not just a California storyline either. Texas has seen dramatic homeowners rate increases across recent years, driven by a complex mix of catastrophe risks. (Capstone DC)

However, the most startling shift is not the price. It is the promise.

High end insurance is experimenting with a bold, emotionally charged idea: do not just reimburse the homeowner after flames pass. Instead, send help before the fire arrives.

Why “concierge wildfire defense” is suddenly credible

Insurers have always tried mitigation. They inspect roofs. They ask about brush. They nudge smoke alarms. Yet the math of modern wildfires has changed the tone.

Today’s extreme events can torch thousands of structures in days. When that happens, claims are not only large. They are clustered. They hit at once. Reinsurance gets expensive. The next renewal cycle becomes a brutal negotiation.

Consequently, carriers are trying a more direct approach: pay for prevention services that reduce severity right now, in the same season, before the loss explodes.

One of the clearest signals is the growing use of private wildfire response resources contracted by insurers. Some private companies describe themselves as wildfire risk intervention partners for the insurance industry, combining monitoring with on the ground response options when conditions allow. (Wildfire Defense Systems)

Additionally, mainstream attention has made the concept feel real. It is no longer a rumor told in luxury real estate circles. It is being discussed openly as a benefit attached to premium policies.

[YouTube Video]: A major insurer explains why it sends private firefighters and what “loss mitigation” looks like during active wildfire conditions.

What concierge wildfire defense actually looks like on the ground

“Concierge” can sound like marketing gloss. In practice, it usually means a bundled set of services that sit between pure insurance and emergency management. The key is that these services aim to reduce the probability or severity of loss, rather than only documenting damage afterward.

That said, it is critical to be clear about limits. Private crews cannot replace public fire agencies. They operate under local rules. They must coordinate, or stay out. Public authorities have warned that private firefighting activity can pose safety risks in some situations, especially when it complicates incident management. (News From The States)

So the best programs focus on targeted, permitted actions that reduce structure ignition risk, rather than aggressive frontline firefighting.

The three layers of the new model

The first layer is intelligence. It is constant monitoring of weather, fuels, and incident movement, paired with rapid alerts to policyholders and insurer teams. Wildfire Defense Systems, for example, markets year round monitoring for wildfire conditions and incidents as part of its services to the insurance industry. (Wildfire Defense Systems)

The second layer is pre loss preparation. This is where the “concierge” feeling becomes tangible. Some programs push home hardening support, vendor referrals, and documentation that can help underwriting decisions. Others integrate remote assessments using aerial imagery or property data.

The third layer is response when conditions allow. This is the controversial piece that grabs headlines: a private crew may be dispatched to help protect specific insured properties, using approved defensive measures and access coordination.

Who provides the crews and why insurers like the arrangement

Private wildfire response is not brand new. Yet it has scaled with the severity of fire seasons, and with the growth of the high net worth insurance segment.

Trade and fire service coverage describes private firefighting firms as “qualified insurance resources” in some contexts, paid by insurance companies to protect policyholder homes, often with a focus on prevention and structure defense. (FireRescue1)

Meanwhile, carriers benefit because the service can reduce claims severity. It can also support a premium narrative: you are not only buying money. You are buying capability, speed, and a measured form of protection.

Additionally, some insurers openly describe the model as a response program that authorizes wildland firefighters to respond to a wildfire threat on a member’s property, while emphasizing there is no guarantee of a successful defense. (USAA) This honesty matters. It resets expectations. It also signals that insurers are trying to reduce losses, not promise miracles.

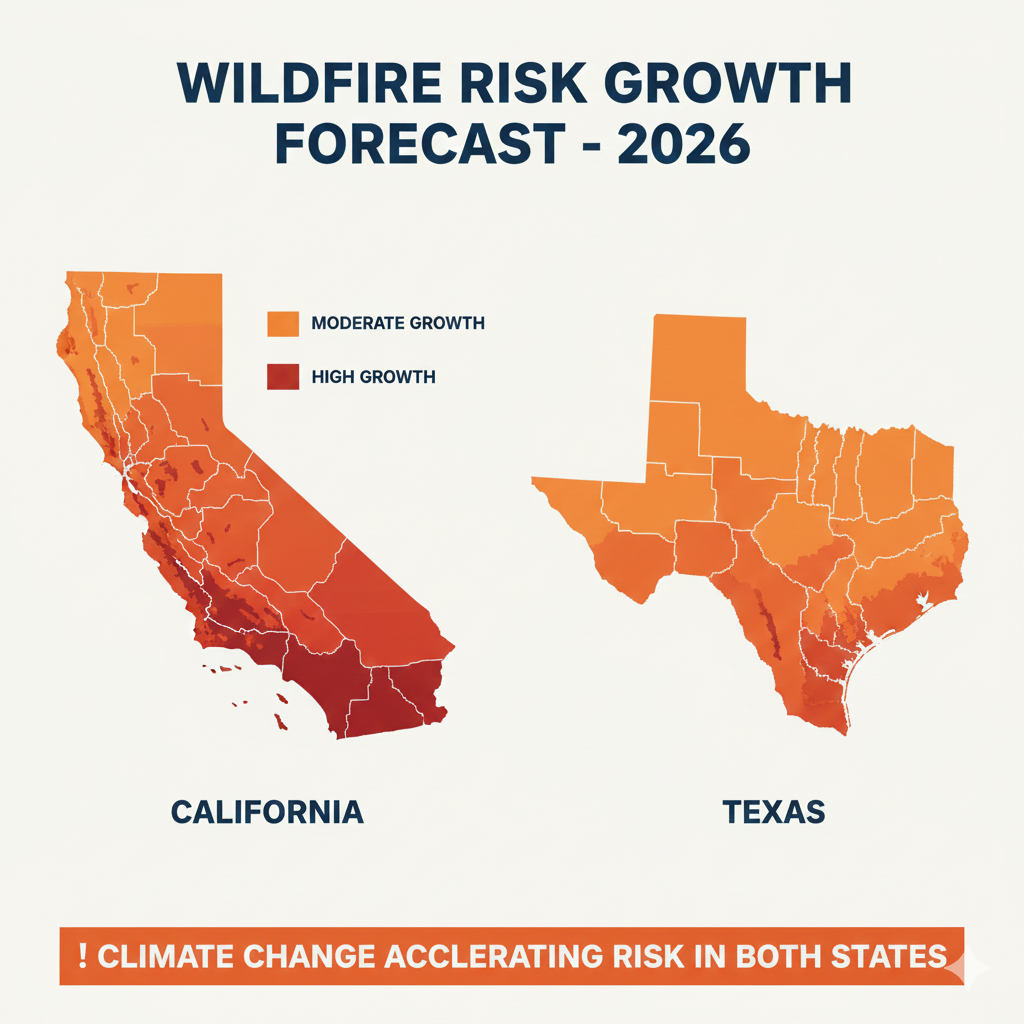

Why California and Texas are the proving grounds

The concierge defense concept is spreading. Yet California and Texas sit at the center for different reasons.

California is a regulatory and market stress laboratory. Texas is a scale and volatility laboratory. Together, they shape the next playbook.

California: reform, backlash, and a fragile backstop

California’s homeowners insurance crisis is now tied to policy architecture. The FAIR Plan is growing as private options shrink in certain zones. After the 2025 Los Angeles area fires, the FAIR Plan faced severe strain and required extraordinary funding steps involving private insurers. (Reuters)

Additionally, political and legal disputes emerged over whether insurers could pass part of those costs to policyholders. (AP News)

However, the most important forward looking shift is regulatory modernization. California launched a “Sustainable Insurance Strategy” that, among other changes, allows the use of forward looking wildfire risk models and lets insurers reflect certain reinsurance costs in rate filings, provided they continue writing policies in wildfire prone areas. (McKinsey & Company) This is a pivotal 2026 storyline, because implementation takes time. It will influence how quickly carriers return, and how quickly premiums reset upward.

Evan Greenberg, CEO of Chubb, has also criticized California’s incentives, arguing that underpriced coverage signals can distort behavior and push exposure into unsustainable structures. (Investing.com) His point is blunt: when pricing is politically constrained, risk does not disappear. It moves.

Consequently, 2026 is likely to bring a new equilibrium that looks emotionally unsatisfying for many homeowners: broader availability in some areas, but at higher, more risk aligned prices, paired with stricter mitigation expectations.

Texas: rising costs, underinsurance, and wildfire reality

Texas is often framed through hurricanes and hail. Yet wildfire risk is real, and it is rising in visibility.

The Insurance Information Institute has pointed to the number of Texas homes at extreme wildfire risk, ranking Texas among the top states for exposure. (III) Meanwhile, the 2024 Texas Panhandle fires highlighted how wildfire can become a humanitarian and financial shock, including for households without adequate insurance. (The Texas Tribune)

Additionally, market conditions are tense. Public policy analysis of filings has described sharp homeowners rate increases in recent years in Texas. (Capstone DC) The combined effect is dangerous: more households become price sensitive, drop coverage, or accept higher deductibles, then discover after a loss that “insured” does not mean “made whole.”

So why does this matter for concierge wildfire defense? Because Texas has affluent, fast growing communities in the wildland urban interface too. The demand for premium protection services exists. The willingness to pay exists. Therefore, 2026 could see broader adoption of premium wildfire response add ons in Texas, even if the public conversation is quieter than California’s.

The business logic that makes concierge defense explode in 2026

A normal person might ask: why would an insurer pay for crews and tech instead of just charging more?

The answer is both financial and psychological.

Financially, insurers hate correlated losses. Wildfire creates correlation. Concierge defense is an attempt to de correlate at the margins, property by property. If a targeted intervention saves even a small fraction of high value homes, the claims savings can justify the program.

Psychologically, premium customers are not only buying risk transfer. They are buying certainty. They want rapid response. They want status. They want control in a world that feels unstable. Concierge defense sells a powerful feeling: you are not helpless.

Additionally, the data flywheel makes the model stronger each year. Monitoring tools, imagery, and post incident outcomes feed underwriting. The insurer learns what mitigations work. That learning can become a pricing advantage.

The quiet shift from “actuarial” to “operational” insurance

Traditional insurance is a paper machine. It prices risk. It writes contracts. It pays claims.

Concierge wildfire defense is closer to an operations company. It runs networks. It dispatches resources. It partners with vendors. It uses near real time intelligence.

Consequently, in 2026 the winners may look less like classic carriers and more like hybrid platforms. They will blend underwriting with service delivery. They will treat mitigation like a subscription benefit. They will treat data as a product.

However, this also raises ethical and regulatory questions. If only wealthy homeowners get pre fire help, does that deepen inequality? Public reporting and commentary have highlighted the discomfort: private crews protecting select properties can feel like a two tier system, and fire officials worry about safety and coordination. (The Wall Street Journal)

So 2026 is not only a market year. It is a legitimacy year.

[YouTube Video]: A clear explanation of the FAIR Plan crisis and why “insurance of last resort” is becoming mainstream in wildfire states, setting the stage for 2026 reforms.

Technology innovations that will shape 2026 wildfire insurance

Tech is not a magic shield. Yet it is changing what insurers can measure, verify, and reward.

The next year should bring more aggressive use of three innovation clusters: detection, verification, and response support.

Detection becomes cheaper, faster, and more automatic

Satellites, camera networks, and AI alerting are making early detection a commodity. That matters because minutes can decide whether a small ignition becomes a neighborhood scale disaster.

Additionally, insurers can use detection tools to trigger customer alerts, mobilize vendor networks, and document timelines for claims handling. It is both safety and operations.

In 2026, expect more partnerships between insurers and sensor platforms. Expect more “wildfire monitoring included” language in premium policies. This is already a core marketing claim for specialized wildfire risk firms serving insurers. (Wildfire Defense Systems)

Verification turns mitigation into something underwriters can trust

For decades, underwriters struggled with a simple problem: homeowners say they cleared brush, but did they? Photos can be staged. Inspections are expensive.

Now, remote verification is improving. High resolution imagery, property data, and structured mitigation checklists can produce a defensible “home hardening score.”

Consequently, 2026 pricing may become more personalized, with discounts tied to verified upgrades and defensible space conditions. This fits perfectly with California’s push toward forward looking models and stronger risk pricing, even if the politics are painful. (McKinsey & Company)

Response support gets smarter, but regulation gets tighter

Insurers will keep funding response capacity. Yet they will also face more scrutiny.

Public reporting has raised concerns that private firefighters can create safety conflicts or divert attention, even when the intent is loss prevention. (News From The States) So in 2026, expect clearer rules around access, credentialing, and coordination. The phrase “qualified insurance resources” will matter more, because it signals structured relationships with insurers and expectations about professionalism. (FireRescue1)

Additionally, environmental concerns may grow around chemical use and runoff, pushing programs toward less intrusive defensive methods and more pre season mitigation instead of last minute spraying.

New regulations and policy moves to watch in 2026

The coming year is loaded with policy tension. The core question is simple: should insurance be allowed to price catastrophe risk more freely, if the alternative is insurer retreat?

California’s “Sustainable Insurance Strategy” enters its proving phase

California’s strategy allows insurers to use modern catastrophe models and reflect certain reinsurance costs, if they commit to writing in wildfire prone areas. (McKinsey & Company) That trade is the heart of 2026.

Additionally, California’s FAIR Plan funding actions in 2025 created political aftershocks that will shape how reforms are perceived. (Reuters) If homeowners see higher bills without improved availability, backlash grows. If they see more coverage options and faster rebuilding, legitimacy rises.

So expect 2026 to feature more rate filings using forward looking models, more debate about transparency, and more pressure on insurers to prove they are truly expanding coverage, not just charging more.

A broader US trend: separating wildfire coverage

Here is the frightening part: other states may experiment with allowing insurers to exclude wildfire coverage from standard homeowners policies.

A new Nevada law starting January 1, 2026 allows home insurers to exclude wildfire coverage from standard policies, potentially pushing buyers toward separate wildfire policies. (San Francisco Chronicle) Even if California does not copy this approach, it signals how fast the Overton window is shifting.

Consequently, 2026 may bring more “split coverage” products across the West: one policy for basic homeowners perils, another for wildfire, and another for flood. This can make coverage feel fragmented, confusing, and emotionally exhausting for families.

However, it can also be a market re entry tactic. Insurers may return if they can cap wildfire exposure cleanly. That is the trade.

Texas: scrutiny without California style constraints

Texas regulation differs from California. Yet cost pressure is building, and consumer frustration rises when claims close without payment due to deductibles or narrow coverage. (Houston Chronicle)

So 2026 could bring more political focus on deductibles, claim handling, and transparency, even if the policy tools differ.

What to expect in 2026: five clear predictions

This is the core forecast, written from late 2025 reality, not fantasy.

Prediction 1: “Pay after” insurance keeps shrinking in high risk zones

In the highest wildfire risk corridors, classic broad coverage will remain scarce or expensive. The FAIR Plan will stay central in California, because the private market cannot absorb all exposure at politically acceptable prices. (San Francisco Chronicle)

Additionally, expect more households to layer policies, pairing FAIR Plan with supplemental coverage to fill gaps, because base options feel thin.

Prediction 2: Concierge defense becomes a selling point, not a curiosity

Premium carriers will keep bundling wildfire response and monitoring into policies for affluent clients, because it is a differentiator and a loss control tool. The model is already visible in public discussion and in insurer contracted private firefighting arrangements. (FireRescue1)

However, the marketing will shift. In 2026 it will sound less like “we protect you” and more like “we verify you mitigated, and then we support you.”

Prediction 3: “Verified mitigation” becomes the new credit score of home insurance

Insurers want proof. Regulators want fairness. Homeowners want discounts. Technology now makes verification more realistic.

Consequently, 2026 will reward households that document roof type, vents, defensible space, and community level resilience measures. Carriers will use this data to justify pricing, and to defend rate filings in contentious markets, especially under California’s updated strategy. (McKinsey & Company)

Prediction 4: Public backlash rises unless service feels broadly accessible

The concierge model has an inequality problem. If it becomes “private crews for the rich,” the legitimacy cost can be severe.

Public coverage has already raised ethical and safety questions about private firefighting. (News From The States) In 2026, insurers will try to soften the image by emphasizing community safe mitigation, partnerships, and pre season hardening support.

Prediction 5: New products grow: parametric, micro coverage, and split peril

As insurers try to manage capital, they will push new structures. Some will be parametric, paying out when measurable thresholds are hit. Some will split wildfire coverage into separate policies, as Nevada’s 2026 law illustrates. (San Francisco Chronicle)

Additionally, more households will accept higher deductibles and narrower terms, because they feel forced. That makes education and clarity vital.

How to prepare for 2026 changes without panic

You cannot negotiate with a wildfire. You can negotiate with your own preparedness and your insurance structure.

This section stays practical, but it avoids dangerous “do it yourself firefighting” advice. The goal is resilience, not heroics.

Start with the uncomfortable truth: your policy may not match rebuild reality

Many homeowners learn too late that their limits are outdated, or that their deductible is effectively a self insurance layer. This problem is intensified when catastrophes drive up labor and materials.

Additionally, in places like Texas, analyses have highlighted how claims can close without payment when damages fall below deductibles, leaving homeowners shocked. (Houston Chronicle)

So for 2026, the most valuable move is not emotional reassurance. It is a clear policy review with realistic rebuild costs, and a plan for gaps.

Treat mitigation as your “premium discount strategy”

Insurers increasingly care about verified actions. Programs built around wildfire response also tend to require enrollment, access permission, and clear understanding that response is not guaranteed. (USAA)

Consequently, the homeowners who win in 2026 will be the ones who can prove mitigation, not only claim it.

Prepare for price volatility and availability shocks

Even with reform, California’s market will remain fragile. FAIR Plan financing fights and rate debates will keep creating uncertainty. (Reuters)

Additionally, other states may adopt more flexible approaches that fragment coverage, which can create sudden coverage gaps for homeowners who assume “standard policy” still means what it used to. (San Francisco Chronicle)

So build slack into your budget. Plan renewals early. Avoid last minute shopping.

Choose insurance partners like you choose critical infrastructure

In 2026, the carrier matters more than ever. You are not only buying a contract. You are buying claims handling capability, catastrophe experience, and possibly a mitigation network.

However, do not be seduced by glossy promises. Ask direct questions: What services are included? What triggers dispatch? Who coordinates with local authorities? What are the exclusions? What proof of mitigation is required?

If the answers are vague, the protection is fragile.

The 2026 bottom line: insurance becomes a service arms race

Wildfire is rewriting the social contract of homeowners coverage. The old model was reactive. The new model is operational, predictive, and intensely selective.

California’s reforms aim to keep private insurers in the game by letting pricing reflect forward looking risk and reinsurance costs, but only if insurers keep writing in distressed areas. (McKinsey & Company) That is a high stakes experiment, and 2026 will reveal whether it stabilizes availability or simply ratchets premiums.

Meanwhile, Texas shows how fast catastrophe exposure and affordability pressures can collide, especially when households are underinsured or uninsured. (The Texas Tribune)

So the “concierge wildfire defense” trend is not a gimmick. It is the market admitting a hard truth: writing checks after megafires is not enough. The future belongs to insurers that prevent, verify, and respond, while staying legitimate in the eyes of the public.

If you are preparing for 2026, focus on one powerful idea: resilience is becoming part of underwriting. The winners will treat mitigation as essential, not optional.

Sources and References

- California seeks $1B from insurers to shore up FAIR Plan (Reuters)

- Consumer group lawsuit over FAIR Plan surcharge (AP News)

- State Farm emergency rate hike in California (Barron’s)

- Resetting California’s homeowners insurance market (McKinsey)

- New reinsurance regulation tied to CA wildfire access (Reinsurance News)

- Private firefighters and insurer strategy, with safety concerns (News From The States)

- USAA Wildfire Response Program description

- Wildfire Defense Systems overview

- Many Texas homes burned in wildfires weren’t insured (Texas Tribune)

- Texas homes at extreme wildfire risk and catastrophe mix (Insurance Information Institute)

- Nevada law allowing wildfire exclusion starting Jan 1, 2026 (SF Chronicle)

- Private wildfire crews described as insurer paid resources (FireRescue1)