In 2026, AI data centers make water priceless. Learn water rights, reuse tech, and the urgent investment risks and winners in a thirsty world.

Why water becomes the 2026 investment battlefield

December 2025 has a strange mood. AI feels limitless. Cloud capacity feels like magic. Yet the next year is shaped by a very old constraint: water.

This is not a soft, distant theme. It is a sharp, local, emotional story. It is about permits. It is about drought. It is about public anger. It is about sudden costs that look small in a spreadsheet, then explode in real life.

Meanwhile, investors are hunting for the next critical bottleneck. In 2026, “water rights” and water treatment infrastructure are moving from niche to urgent. That shift is not driven by ideology. It is driven by physics and politics.

AI data centers turn water into a constraint

AI compute runs hot. Dense racks mean intense heat. Cooling must be reliable. When cooling fails, everything fails.

Many facilities use evaporative cooling or water-intensive approaches because they can be efficient and cost-effective. However, that choice looks different in a drought corridor. It also looks different when communities see “millions of gallons” tied to a building that creates fewer jobs than expected. Large facilities can use water at a scale that shocks local residents. (Environmental and Energy Study Institute)

Consequently, water becomes a gating factor for new projects. Not power alone. Not land alone. Water too.

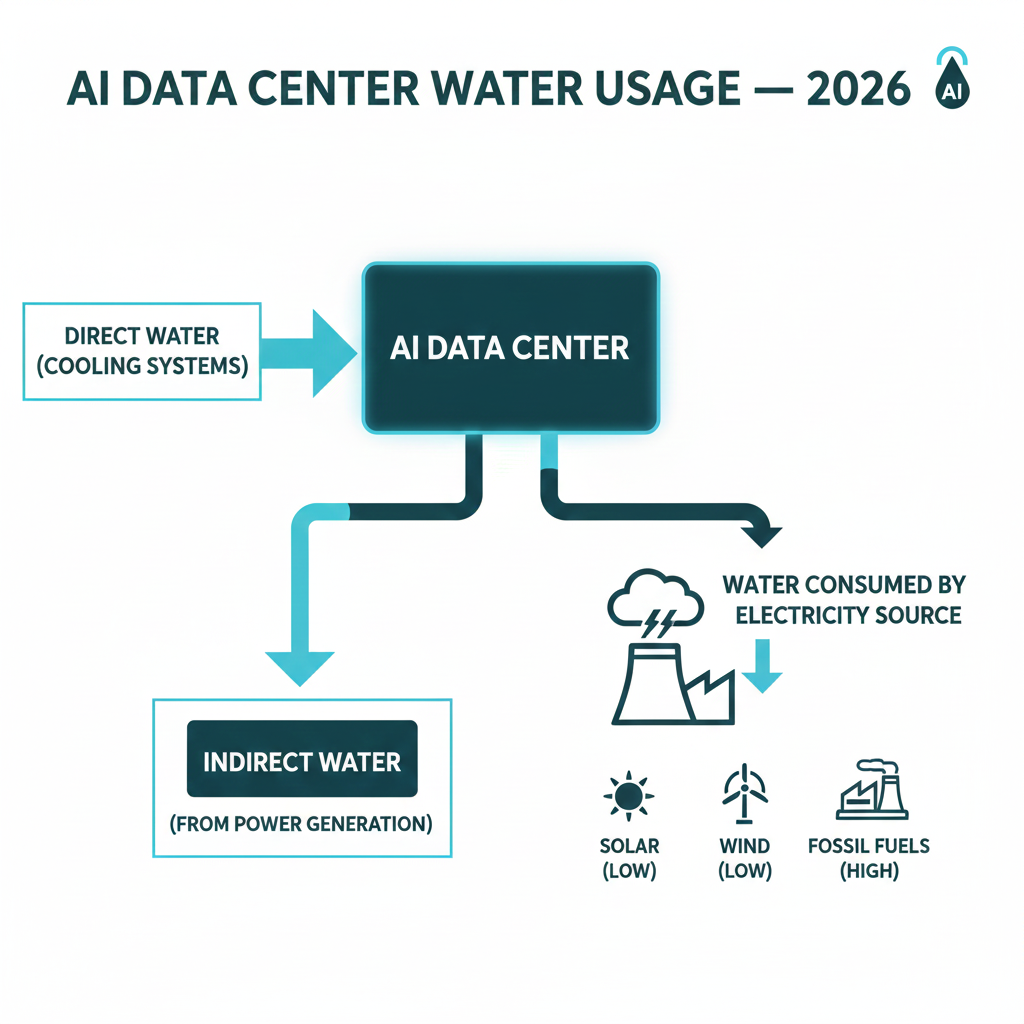

The hidden water footprint of electricity

There is a second layer that gets missed in public debates. Even “zero water on-site” does not mean “zero water total.” Electricity has a water footprint, depending on the grid mix and generation methods. A major U.S. data center energy report ties data center electricity use to indirect water consumption intensity figures. (LBL ETA Publications)

Additionally, this creates a trade-off. Some cooling approaches use more water to save electricity. Others use more electricity to save water. That tension is now a boardroom issue, not a sustainability footnote. (Undark Magazine)

The new narrative: “blue economy” meets water stress

The phrase “blue economy” often evokes oceans, ports, fisheries, shipping, tourism, and coastal resilience. The OECD frames it as a growth engine, but also one exposed to climate impacts and ecosystem pressure. (OECD)

Yet the 2026 investing theme is broader than coastlines. It is about water as infrastructure. It is about treatment, reuse, monitoring, and rights. It is about a “water security economy” that touches every sector, including AI.

From values talk to resilience talk

In 2026, the emotional center shifts toward resilience. Investors want assets that survive chaos. Governments want systems that do not break under stress. Communities want proof, not promises.

Furthermore, data centers are now political. They are framed as strategic assets. They are also framed as resource threats. The result is a fierce, visible fight over who gets water, who pays, and who benefits.

Water is local, political, and priced

Unlike oil, water is not one global commodity. It is local. It is controlled by laws, districts, compacts, and courts. In the American West, for example, the “Law of the River” governs Colorado River allocations through a complex web of authorities and agreements. (Congress.gov)

Meanwhile, 2026 is already written into the headlines. Federal officials have announced 2026 allocation cuts for Arizona, Nevada, and Mexico due to ongoing drought conditions, while California’s senior rights shape a very different outcome. (AP News)

That is the core investing truth for 2026: water is not just a resource. It is a legal system.

What 2024 and 2025 already revealed

The smartest 2026 predictions start with what 2024–2025 exposed. Those two years made three realities impossible to ignore: AI infrastructure is accelerating, water stress is intensifying, and transparency demands are rising.

The scale of data center growth, and the water signal

In late 2025, Pew Research summarized a striking projection: hyperscale data centers alone are expected to consume between 16 and 33 billion gallons of water annually by 2028, excluding indirect water use. (Pew Research Center)

That is not a distant number. It is close enough to shape 2026 permitting and 2026 capital flows.

Additionally, reporting and measurement are becoming mainstream. Metrics like WUE, Water Usage Effectiveness, are moving from engineering circles into investor questions, community hearings, and regulation debates.

The backlash is no longer hypothetical

Community conflict is becoming a decisive factor. A December 2025 investigation described water stress concerns as data centers move into Great Lakes communities, with residents worried about infrastructure strain and long-term ecological cost. (The Guardian)

Similarly, coverage of Nevada’s AI data center expansion highlighted tension around water and energy demand in a region already vulnerable to drought. (The Guardian)

However, backlash does not always mean “no.” It often means “show the plan.” In 2026, the winning projects will be the ones with credible water strategies, not vague sustainability slogans.

[YouTube Video]: BBC World Service explains why AI uses water, how cooling works, and why the pressure is growing.

2026: the three shifts that matter most

If you want a clean, powerful lens for 2026, look for three shifts. Each one changes what gets funded, what gets delayed, and what becomes surprisingly profitable.

Shift 1: Water accounting goes mainstream

Regulators are moving toward stronger disclosure. In the EU, the Energy Efficiency Directive introduces monitoring and reporting obligations, supported by a European database that includes data relevant to the water footprint of data centres. (Energy)

Meanwhile, legal and policy analysis points to a fast-evolving EU regulatory landscape, with a Data Centre Energy Efficiency Package expected in Q1 2026. (White & Case)

Additionally, national rules are tightening. Germany’s Energy Efficiency Act includes escalating waste heat reuse obligations with timelines that start in 2026 for certain facilities. (Orbital Industries)

Even when these rules are not “water laws,” they reshape water outcomes. Heat reuse changes cooling designs. Reporting changes reputational risk. Both influence water decisions.

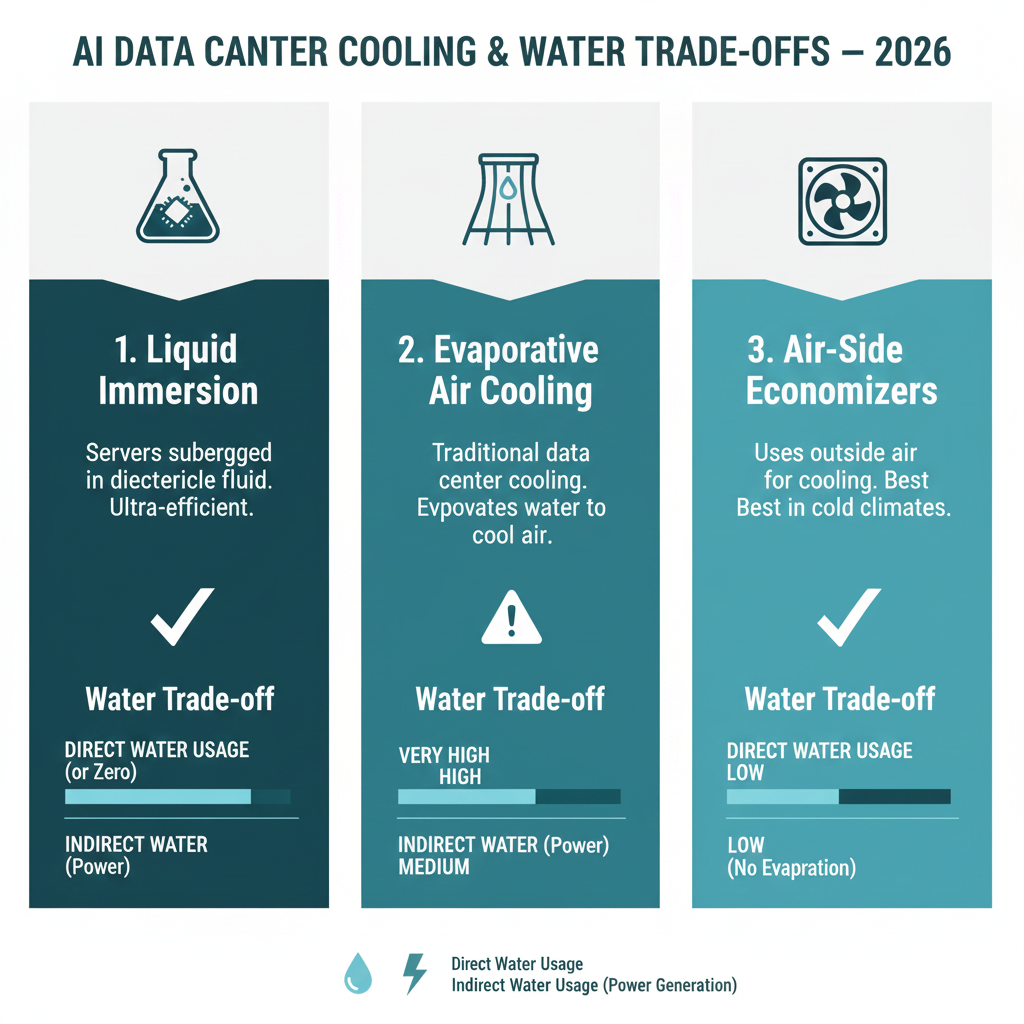

Shift 2: The race for low-water cooling becomes a brand war

The next-generation cooling story is now a competitive weapon. Microsoft, for example, has described a next-generation datacenter design that consumes zero water for cooling by avoiding evaporation, with deployment beginning in 2024 for new designs. (Microsoft)

In 2026, expect more of this: direct-to-chip cooling, closed-loop systems, reuse of non-potable water, and designs optimized around local water constraints.

However, there is a hard truth. “Zero water” can shift costs to electricity. That can be acceptable in some grids and painful in others. The winner is not one technology. The winner is the best fit for a specific place.

Shift 3: Water reuse infrastructure becomes the quiet winner

The most rewarding theme in 2026 may be the least glamorous. It is pipes, treatment, sensors, and reuse.

This is where “blue economy” becomes practical. Reuse is not just a climate story. It is a cost story. It is a permitting story. It is a “license to operate” story.

Major institutions are framing reuse as a tipping point. The World Bank has produced work focused on scaling municipal and industrial water reuse. (World Bank)

Additionally, investor-facing frameworks are getting sharper. The World Economic Forum has published work on aligning investment strategies with water innovation. (World Economic Forum Reports)

In 2026, reuse is a strategic bridge. It reduces pressure on freshwater. It can reduce community conflict. It also creates reliable demand for treatment technology.

Water rights: the misunderstood “Human IPO” of water

The phrase “water rights” sounds simple. It is not. It is a legal promise, not a physical bottle. It is also the part of the water story that attracts the most hype, and the most controversy.

Michael Burry is often linked to “water” in popular finance talk. The deeper point is not celebrity. The deeper point is scarcity plus rights. Productive land with secure water access becomes more valuable when water is uncertain. That logic is brutally simple.

Rights are not the same as water

A right depends on jurisdiction. It depends on priority. It depends on enforcement. It depends on infrastructure. It also depends on politics.

Consequently, “water rights investing” is not like buying a stock. It is closer to buying a permit, a contract, or a slice of a regulated system.

That is why sophisticated players focus on due diligence: basin rules, historical flows, seniority, transfer constraints, and litigation risk.

Trading, futures, and the controversy effect

California’s water futures market is a perfect symbol of 2026’s tension. There is a contract tied to the Nasdaq Veles California Water Index. It has rules about settlement timing and index pricing. (CME Group)

Supporters frame it as risk management. Critics fear it invites speculation. Either way, it signals something crucial: pricing water is becoming more explicit, and that changes behavior.

[YouTube Video]: A news explainer on California water futures and why scarcity drives pricing debates.

Where the money flows in 2026

The most exciting investment stories in 2026 will feel “inevitable.” They will also feel uncomfortable. Scarcity creates opportunity, but it also creates anger. That mix is exactly why this theme is powerful.

The unglamorous winners: treatment, reuse, leakage control

Municipal and industrial treatment is a huge, durable need. In 2026, the emotional driver is reliability. People want systems that work through heat waves, population surges, and industrial expansion.

Additionally, leakage reduction becomes a quiet goldmine. Saving water is often cheaper than finding new water. This is where smart monitoring, pressure management, and next-generation pipe rehab win.

The result is a wave of projects that look boring and then become essential. That is the kind of trend that can be both stable and profitable.

Desalination and advanced purification: powerful but expensive

Desalination is a dramatic solution. It is also energy-heavy. It can be politically divisive. Still, in some regions, it is a lifeline.

In 2026, expect two moves. First, more incremental expansions where plants already exist. Second, more attention to reuse and purification as lower-cost alternatives when they are feasible.

Meanwhile, the private sector is leaning into “water-as-a-service” models in some markets, offering faster deployment and predictable costs. That approach can feel revolutionary when traditional projects take a decade.

Data center adjacent: cooling hardware, heat reuse, and water-smart design

There is a 2026 theme hiding in plain sight: the suppliers around the data center.

Cooling vendors, heat exchangers, control software, sensor networks, and water treatment partners are the picks-and-shovels for the AI boom. Some will have a thrilling year. Some will have a brutal year if they cannot prove performance.

Consequently, procurement standards will tighten. Public scrutiny will sharpen. Claims will be tested.

One reason is that the trade-off story is now public. Reporting around cooling choices, energy cost, and water saving is entering mainstream coverage. (The Verge)

New regulations and policy moves to watch in 2026

It is dangerous to pretend we know every rule that will appear. Still, the direction is clear, and 2026 is already loaded with catalysts.

Reporting and transparency rules accelerate

The EU’s approach is not only about carbon goals. It is also about visibility. Reporting systems that include water footprint data change corporate behavior. (Energy)

Additionally, local U.S. permitting is likely to become more demanding where water is tight. This is not one federal law. It is a patchwork of county hearings, utility agreements, and state-level pressure.

Western U.S. water negotiations shape risk

Colorado River negotiations and allocation cuts keep water politics at the front of the economic story. (AP News)

That matters for investors because water rights values can move on policy shifts, not just weather. It also matters because data center site selection increasingly intersects with water realities.

“Water-positive” pledges face hard audits

Corporate pledges can be inspiring. They can also be vague. In 2026, expect sharper questions from communities and regulators about what “water-positive” means in practice.

Microsoft’s public statements about eliminating water evaporation for cooling in new designs show how the competition is shifting. (Microsoft)

However, scrutiny will focus on full-system impact, including indirect water use from electricity. That is where the next debate will live.

The risks most people ignore, and why they will hurt in 2026

The water theme can feel like a guaranteed win. That is exactly why it can be dangerous. Scarcity creates opportunity, but it also creates explosive risk.

Regulatory risk and sudden backlash

When communities feel ignored, projects stall. When a utility feels overrun, contracts change. When a state feels cornered, it can tighten rules quickly.

In 2026, the brand risk is real. Data centers can become symbols of unfairness. That can trigger political action, even when the engineering plan is sound. (The Guardian)

Climate volatility and “false certainty”

Water models can be wrong. Snowpack shifts. Heat waves intensify. Rivers swing between extremes.

A policy group focused on the U.S. West has highlighted large, long-term declines and stresses tied to drought and climate impacts. (CSG West)

Consequently, asset values tied to water can be more volatile than investors expect. A “safe” right can become constrained. A “secure” basin can become litigated.

Ethics and social license

Water is emotional. People do not forgive perceived abuse. That is not moralizing. It is practical reality.

In 2026, the strongest operators will treat social license as a core asset. They will use reclaimed water where possible. They will invest in local infrastructure. They will publish credible reporting.

Additionally, they will avoid the most fragile narrative: “We can pay more, so we get more.” That story triggers resistance fast.

How to prepare for 2026 changes without chasing hype

This section is not personal financial advice. It is a practical framework for thinking clearly.

Ask better questions than “Is water the next oil?”

That headline is tempting. It is also misleading. The better question is: where are the bottlenecks, and who controls them?

In 2026, four questions separate disciplined analysis from wishful thinking.

First, ask where the water comes from, and what happens in drought years. Second, ask what the legal priority is, not the marketing claim. Third, ask what the community thinks, because backlash is a cost. Fourth, ask what the fallback plan is, because resilience is everything.

Watch the indicators that will move fastest in 2026

Look for the signals that change decision-making quickly.

One signal is new reporting rules and databases that make water performance visible. (Energy)

Another signal is the spread of low-water cooling designs and chip-level approaches that shift the water-energy balance. (Microsoft)

A third signal is the acceleration of reuse projects and “treatment as infrastructure,” especially where growth is colliding with scarcity. (World Bank)

Build a “barbell” mindset for the theme

A practical approach is to separate stable needs from speculative pricing.

The stable side is infrastructure: treatment, reuse, leak control, monitoring, and engineering services. The speculative side is rights pricing, litigation outcomes, and policy-driven shocks.

However, the smartest stance in 2026 is humility. Water is a legal story as much as a physical story. It punishes sloppy assumptions.

The 2026 forecast in one sentence

2026 will reward water realism.

AI infrastructure will keep expanding. Water stress will keep rising. Transparency will tighten. The winners will be the projects and providers that deliver verified, resilient water strategies, not just ambitious promises. (Pew Research Center)

Conclusion: Water is the new permission slip

Water is not just an input. In 2026, it is a permission slip.

It decides whether a data center gets built on schedule. It decides whether a community supports expansion. It decides whether a project faces lawsuits, protests, or smooth approvals.

Meanwhile, the “blue economy” label is evolving. It is no longer only about oceans. It is about water systems that keep economies alive.

That makes this theme emotionally charged, fiercely debated, and potentially rewarding. It also makes it unforgiving. In 2026, the market will not reward vague optimism. It will reward verified resilience.

Sources and References

- US data centers’ energy use amid the AI boom (Pew)

- Data Centers and Water Consumption (EESI)

- 2024 United States Data Center Energy Usage Report (LBNL PDF)

- Energy Efficiency Directive, data centre reporting (EU)

- EU data centre regulatory outlook and Q1 2026 package (White & Case)

- Understanding the Water Futures market (CME PDF)

- California’s water futures market explained (Pacific Institute)

- Colorado River allocations overview (Congressional Research Service)

- UN World Water Development Report 2025 (UN-Water)

- Microsoft: Next-generation datacenters consume zero water

- How Much Water Do AI Data Centers Really Use? (Undark)