In 2026, usage-based insurance gets smarter and faster. AI and sensors raise or lower what you pay as risk changes, with new rules and big privacy stakes.

A simple promise that feels revolutionary

Insurance has always asked you to pay for the unknown. You pay, even on quiet days. You pay, even when nothing happens. That old model made sense when insurers had limited data.

Now the promise sounds almost unbelievable. Pay only when you are actually at risk. Pay less when you drive safely. Pay more when danger rises. Pause coverage when you are not using something. Turn it on when you do. This is the emotional hook of “usage-based everything.”

However, it is not just a catchy idea. It is a market direction. It is also a power shift. Risk used to be measured in broad groups. Risk is now measured in moments.

Additionally, this shift is accelerating because three forces have lined up at once. First, modern phones and cars can collect behavior signals. Second, cloud systems can price those signals quickly. Third, AI can spot patterns that humans miss.

Consequently, personalization is becoming the competitive battlefield. Many insurers no longer want to be “fair on average.” They want to be “fair for you.” That framing feels rewarding. It also raises hard questions about privacy and discrimination.

Meanwhile, 2026 is likely to be the year where usage-based insurance expands beyond “early adopter” status. It will spread into more products. It will also collide with tighter AI rules. That collision will shape what you can trust.

What “only pay when you’re at risk” really means

The phrase sounds absolute. Real insurance is not that clean. Insurers still need predictable premiums. They still must hold capital. They still must cover claims.

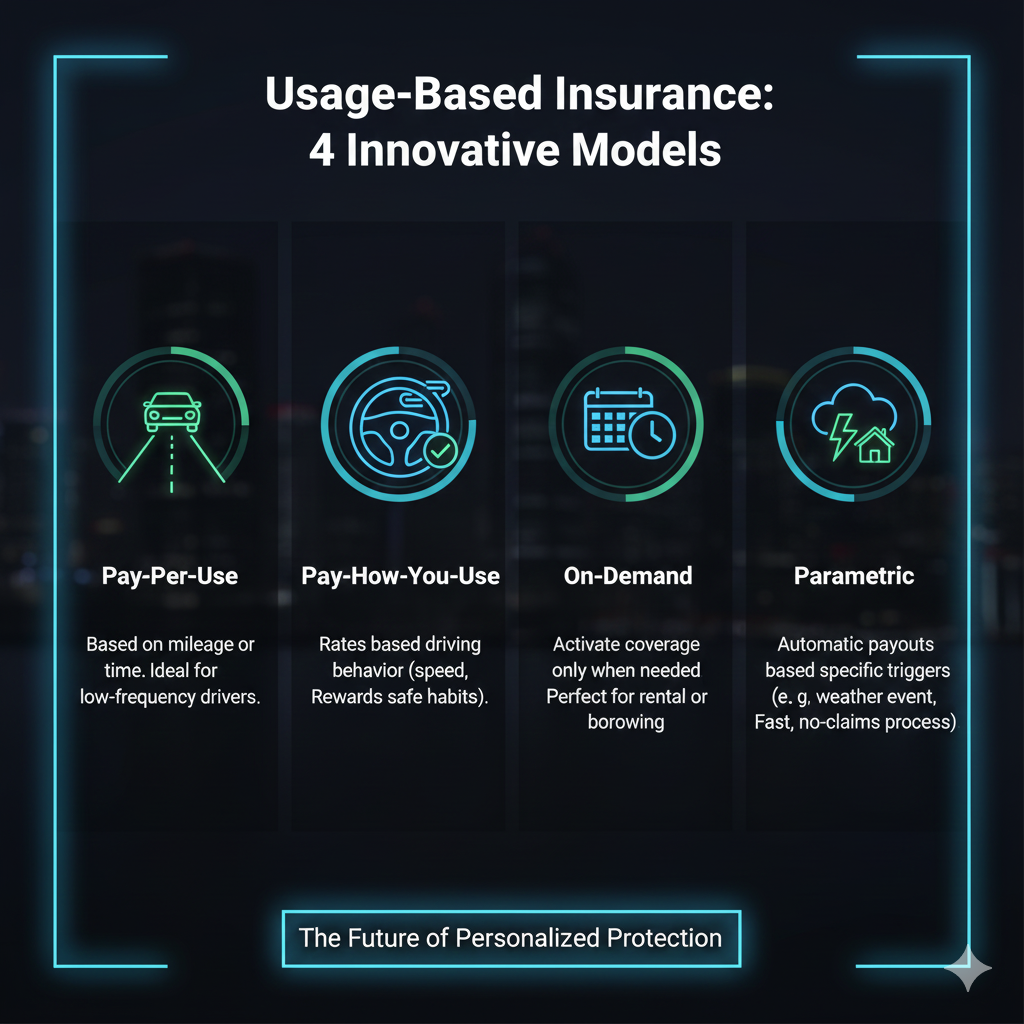

So in practice, “pay-per-risk” usually means one of four designs.

First, pay-per-use. You pay when you use the thing. Think pay-per-mile car insurance. Second, pay-how-you-use. You pay based on behavior quality. Think safe driving discounts. Third, on-demand. You toggle coverage for time windows. Think gadget or travel micro cover. Fourth, parametric triggers. You get paid when a defined event happens. Think storm index cover.

Furthermore, 2026 will blur these lines. A single product can mix them. A car policy can be pay-per-mile plus behavior scoring. A home policy can add water leak sensors and price adjustments. A health add-on can tie to activity and sleep.

Why 2024 and 2025 set the stage for 2026

The “usage-based” story did not start yesterday. Auto telematics programs have existed for years. Still, 2024 and 2025 made two changes feel urgent.

First, consumers became more cost-sensitive. Prices rose in many categories. People started hunting for flexible subscriptions. Insurance is a natural target. If you drive less, you want to pay less. If you rent out a room only sometimes, you want coverage only sometimes.

Second, AI moved from hype to real operations. Insurers began using AI for customer service, claims triage, fraud signals, and underwriting support. That helped leaders imagine something bigger. They started imagining continuous underwriting. They started imagining continuous pricing.

However, there is another driver that matters. Data access rules are moving. Consumer data rights and AI governance are becoming stricter. That regulatory pressure is pushing insurers to document what they do. It is also pushing them to explain what they do.

Consequently, 2026 becomes a pivot year. The technology is mature enough to scale. The rules are strict enough to force discipline. The market is anxious enough to demand lower-cost options.

Auto insurance became the laboratory

Auto insurance is where usage-based insurance learned to walk. Cars generate data. Phones generate data. Driving behavior has clear signals like speed, braking, and time of day.

Additionally, the consumer value proposition is easy to explain. Drive less, pay less. Drive safer, pay less. That clarity helped programs spread.

Yet the auto lab also exposed the pain points. People fear constant tracking. People worry about being punished for night shifts. People worry about data being sold. People also worry about mistakes.

These concerns matter because 2026 will expand usage-based models into more personal areas. Health and home are more intimate than driving. The trust barrier becomes higher.

[YouTube Video]: CNBC looks at usage-based auto insurance and why insurers track driving through smartphone data. It is a sharp window into the “pay-per-risk” logic.

The emotional tension inside personalization

Personalization feels empowering. It can feel fair. It can feel like a breakthrough.

However, personalization can also feel invasive. It can feel like you are always being judged. It can feel like you are losing the safety of the crowd.

Classic insurance spreads risk. It treats you as part of a pool. Usage-based insurance shrinks the pool. It treats you as a micro-pool. That is the hidden trade.

Additionally, insurers have incentives that are not always aligned with yours. They want profit stability. They want predictable loss ratios. They want to avoid adverse selection. That means they may design personalization to protect them first.

So the big 2026 question is not “Will usage-based insurance grow?” It likely will. The real question is “Will it grow in a way that stays trusted and accountable?”

The technology stack that makes pay-per-risk possible

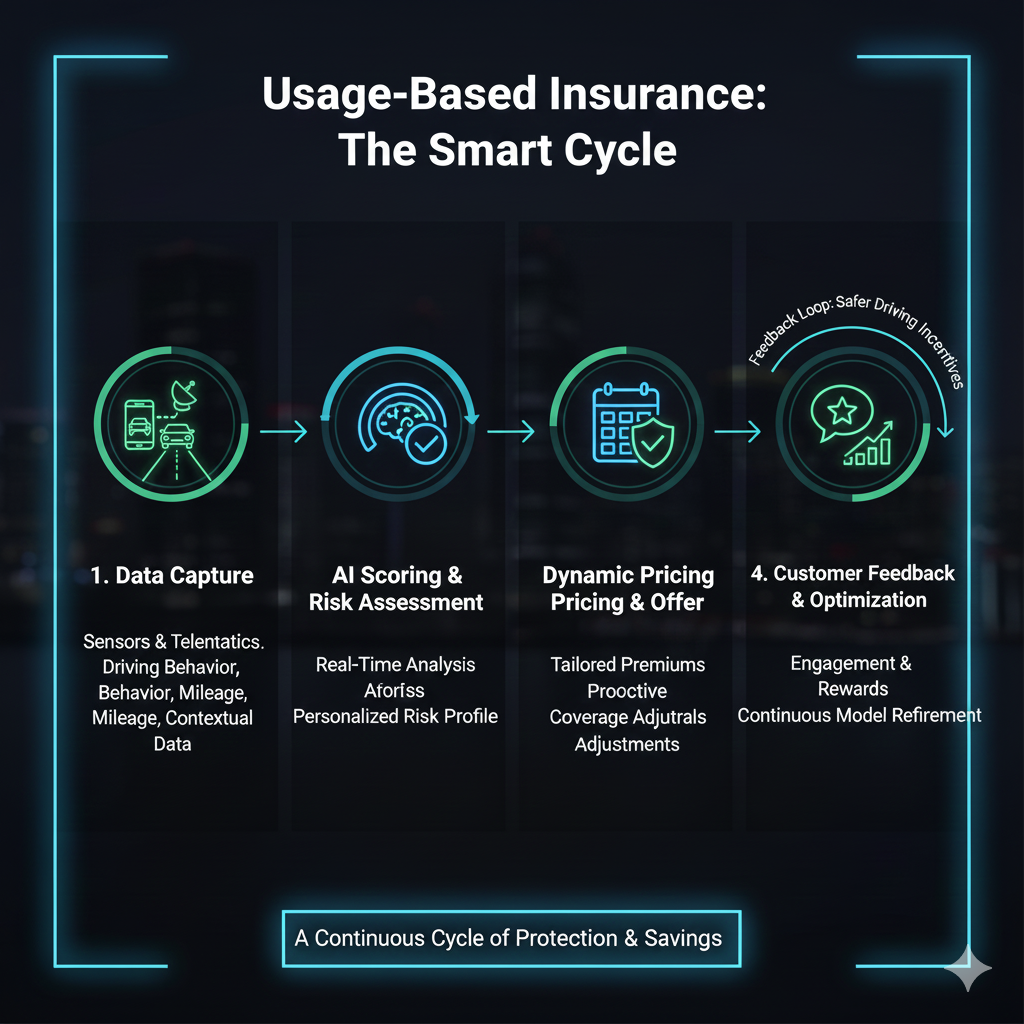

The modern usage-based model is not one gadget. It is a pipeline. Data is collected, cleaned, scored, priced, and audited. That pipeline is where risk can be reduced. It is also where privacy can be lost.

Sensors are becoming cheap and invisible

Phones can detect motion patterns. Cars can share mileage. Homes can report water leaks. Watches can track sleep. Even shopping behavior can hint at lifestyle risk.

Consequently, insurers no longer need specialized hardware for every customer. Smartphone telematics can do a lot. Connected car platforms can do more. Smart home sensors can do home risk monitoring.

Meanwhile, many of these sensors were not built for insurance. They were built for convenience. That creates a gap. Convenience sensors were designed to collect and share. Insurance needs careful limits.

Additionally, the shift toward “embedded insurance” amplifies this. Embedded insurance means coverage is sold inside another product. It could be inside a ride-sharing app. It could be inside a travel checkout. It could be inside a phone purchase.

In that world, data flows faster. Consent can become blurry. That will be a critical theme for 2026.

AI turns messy signals into a risk score

Data is noisy. Phones drop signals. GPS glitches. Sensors fail. Human behavior is complicated.

This is where AI plays a real role. AI can spot patterns in irregular data. It can separate normal behavior from risky behavior. It can estimate missing values. It can also predict the chance of a claim.

However, AI can also amplify bias. If a model correlates night driving with risk, it might punish night workers. If a model correlates certain neighborhoods with risk, it can raise fairness concerns. If a model correlates income signals with risk, it can become discriminatory.

Consequently, 2026 will bring sharper debate about what models are allowed to use. The future is not only technical. It is moral and legal.

Real-time pricing is the next leap

Most usage-based insurance today is not fully real-time. It often adjusts monthly. It may adjust at renewal. It may adjust after a driving period.

In 2026, expect more “near real-time” behavior. Some products will adjust pricing faster. Some will adjust discounts weekly. Some will offer instant “risk sessions.” Think one weekend road trip priced differently than the rest of the month.

Additionally, insurers will push more real-time nudges. They will try to change behavior, not only price it. You might get alerts like “This route is safer.” You might get a reward for avoiding high-risk hours.

That feels helpful. It can also feel like surveillance. So trust design will matter.

What’s coming in 2026: the usage-based expansion

Usage-based insurance will not stay inside auto. That is the most important 2026 prediction. The next year will broaden the concept into everyday life.

Micro-duration insurance becomes mainstream

The idea is simple. Coverage should match your exposure window. If your exposure is two hours, why pay for a month?

In 2026, expect growth in micro-duration cover for travel, rentals, events, gadgets, and gig work. It fits the way people live now. People switch contexts fast. People rent and share more. People work in flexible ways.

Additionally, platforms love micro-duration insurance. They can sell it at checkout. They can wrap it into a membership. They can even include it inside fees.

However, micro-duration products can be confusing. They can have narrow triggers. They can exclude obvious scenarios. They can be hard to claim. So education becomes vital.

Home insurance shifts to “prevent and price”

Home losses can be devastating. Water damage is common. Fire is catastrophic. Theft is emotional.

Insurers have learned a harsh lesson from recent years. Catastrophe losses and severe weather have stressed profitability. So the industry is hungry for prevention.

Consequently, 2026 will push more “smart home” partnerships. Leak detection can reduce claims. Fire monitoring can reduce severity. Security systems can deter theft. Insurers can price the difference.

Meanwhile, this changes the relationship. The insurer becomes part risk partner, part coach, part monitor. That can feel reassuring. It can also feel intrusive if the boundary is unclear.

Additionally, privacy stakes rise. A water sensor seems harmless. A camera is more sensitive. Data rules will decide what is acceptable.

Health personalization accelerates, but with backlash

Wearable devices made health tracking normal. Activity, heart rate, sleep, and stress signals are now common. Some insurers already offer wellness discounts.

In 2026, expect more sophisticated personalization offers. They will likely be framed as rewards. They will be framed as benefits. They will feel exclusive and motivating.

However, health is deeply personal. Many people will reject constant health pricing. Some will fear discrimination. Some will fear losing coverage. So the market may split.

Consequently, insurers may push “optional layers” rather than fully usage-based health premiums. They may offer add-ons with rewards. They may avoid direct premium changes at first. This is a strategic compromise.

Cyber and identity cover become continuous

Cyber risk changes daily. Your password practices change. Your exposure to scams changes. Your device security changes.

So cyber insurance is naturally aligned with usage-based logic. In 2026, expect more continuous cyber coverage models. They may price based on security posture. They may bundle monitoring with insurance. They may trigger support automatically after suspicious activity.

Additionally, this is where AI agents can play a huge role. An AI can detect a scam pattern. It can warn you. It can help you lock accounts. It can create a “risk moment” where coverage is activated and support begins.

However, cyber cover also depends on data access. The insurer may want to see your device health. That can feel invasive. Again, trust design matters.

The regulations and policies expected to shape 2026

Insurance is regulated heavily. AI is being regulated more each year. 2026 is where those two worlds collide in practical ways.

Colorado’s AI law becomes a 2026 compliance date

Colorado passed a major AI consumer protection law. It has a clear effective date in 2026. That matters because insurers and insurtech firms often operate across states.

On and after February 1, 2026, the law requires deployers of “high-risk” AI systems to use reasonable care to protect consumers from known or foreseeable risks of algorithmic discrimination. That includes disclosure requirements in consumer interactions.

Consequently, insurers using AI for pricing, underwriting, or claims triage will face pressure to document safeguards. They will need governance. They will need monitoring. They will need escalation paths.

Additionally, even outside Colorado, the cultural effect can spread. Compliance teams tend to generalize. They hate running two standards.

NAIC guidance raises the bar on insurer AI governance

Insurance regulators in the United States have been working on AI governance expectations. The NAIC’s model bulletin on AI systems by insurers pushes for stronger oversight, documentation, and attention to unfair discrimination.

In 2026, this will matter more because usage-based programs lean on AI scoring. They use big data. They often use external vendors. Regulators will ask who is responsible. They will ask how decisions are tested. They will ask how models are validated.

Furthermore, consumer complaints will increase as usage-based models spread. Complaints often trigger regulatory attention. That pressure tends to accelerate clear rules.

Europe’s AI Act timeline is becoming politically dynamic

The EU AI Act has a phased implementation. It has already started early measures. It also has deadlines for different categories of systems.

However, late 2025 brought real political movement. There have been public debates about whether to delay certain “high-risk” obligations. That debate is still evolving.

Consequently, the 2026 outlook is two-sided. On one side, the compliance mindset keeps tightening. On the other side, businesses are pushing for more time. For insurers, this means uncertainty. Yet the direction is still clear: more transparency and more accountability.

Meanwhile, global insurers will not wait for perfect clarity. They will build for the strictest likely future. That is how large risk industries survive.

Privacy rules become the hidden battleground

Usage-based insurance relies on personal data. That makes privacy a core risk. In 2026, privacy compliance will not be “legal hygiene.” It will be product strategy.

Expect more products to offer clear data controls. Expect dashboards that show what data is used. Expect easier opt-out mechanisms. Expect more “data minimization” claims.

However, watch the fine print. Some programs may offer discounts only if you share more. That is not always coercion. Still, it creates unequal access. It can also create social pressure.

Consequently, consumer advocacy will focus on fairness. Regulators will focus on discrimination. Trust will decide who wins.

Industry predictions for 2026: what changes first

Predictions can be noisy. Still, a few patterns look stable.

The strongest growth will come from embedded distribution

Embedded insurance is a distribution revolution. It moves insurance from a separate purchase to a feature inside another purchase.

In 2026, expect more embedded usage-based offers. The logic is simple. Platforms already see behavior. They already see usage. They can price insurance around it.

A mobility platform sees trip frequency. A travel platform sees travel windows. A rental platform sees rental duration. A device retailer sees device value and loss risk. Those signals can become pricing inputs.

Additionally, embedded insurance reduces friction. People dislike paperwork. Embedded flows remove it. That makes adoption easier.

However, embedded flows can also hide important details. So regulators may demand stronger disclosures. Platforms may be forced to slow down checkout. That tension will shape product design.

More insurers will move from discounts to full program design

Some telematics programs today are “discount-only.” They reward good behavior but do not punish. That was a trust strategy.

In 2026, more insurers will experiment with two-sided pricing. They will offer both rewards and penalties. They will justify it as “fairness.” They will frame it as “accurate risk.”

Consequently, consumer reaction will split. Some will love it. Some will refuse. That will create segmentation. It will also create new marketing claims like “privacy-first usage-based.”

Risk prevention will become a bigger selling point than price

Price matters. Yet prevention is becoming a stronger narrative. Severe weather and catastrophe trends have made insurers focus on avoiding losses, not only pricing them.

In 2026, expect more programs that include devices. Leak sensors, smoke detectors, and monitoring services will be bundled. These bundles can feel protective and comforting.

Additionally, prevention aligns with AI. AI can detect anomalies. AI can predict failures. AI can trigger alerts. When prevention works, everyone wins.

However, prevention programs also create data. That data can be misused. So the “prevention bundle” must have tight privacy boundaries.

Expert projections: why insurers want this future

Insurers do not chase change for fun. They chase stable profitability. They chase predictable risk.

Usage-based pricing helps insurers in three ways.

First, it reduces adverse selection. If pricing is accurate, high-risk customers pay more. Second, it can reduce claims by nudging behavior. Third, it can improve retention by making low-risk customers feel rewarded.

Additionally, reinsurers and global market outlook reports in late 2025 have highlighted how technology and AI use cases are spreading across the insurance value chain. That supports the idea that 2026 will see more operational AI. It also supports the idea that customer-facing personalization will grow.

Meanwhile, regulators and global supervisors have also noted capital and solvency stability expectations across 2025 and 2026. That matters because stable capital encourages innovation. When capital is stressed, insurers become cautious.

Consequently, 2026 looks like a year of controlled experimentation. Expect pilots to graduate into products. Expect products to become more standardized. Expect “best practices” to spread quickly.

[YouTube Video]: Stanford Graduate School of Business explains vehicle telematics and usage-based insurance at a high level. It helps you understand how the pricing logic is built.

The risks you must watch in 2026

A smarter insurance world is exciting. It can also be unfair. It can also be unsafe. This is where an analyst mindset protects you.

Algorithmic discrimination becomes the biggest reputational risk

If a model penalizes certain groups, headlines follow. Lawsuits follow. Regulators follow.

In usage-based insurance, discrimination can happen indirectly. A model might use proxies. It might learn patterns tied to geography. It might punish shift workers. It might punish people with older phones that collect noisy data.

Consequently, 2026 will push more fairness testing. Insurers will need to prove their programs are not creating unfair outcomes. That will change which variables are used. It will also change how models are tuned.

Additionally, consumers will demand appeals. If your score drops, you will want to know why. If you cannot contest it, trust breaks.

Surveillance fatigue can slow adoption

People accept tracking when value is obvious. People reject tracking when it feels creepy.

In 2026, usage-based models may expand into areas where tracking feels too personal. Health and home can trigger that reaction. Even auto telematics can feel excessive for some.

Consequently, “privacy-first” offerings will be a growth niche. Some insurers will offer coarse personalization with minimal data. Others will offer deep personalization for bigger discounts. The market will split.

Data breaches become more damaging

Usage-based programs store behavior data. That data can reveal patterns of life. When you drive. Where you park. When you travel. Whether you are home.

A breach of this type is not like a credit card breach. It can feel personal. It can feel threatening. It can create real safety risks.

Therefore, 2026 products must prove security maturity. Expect more encryption claims. Expect more vendor audits. Expect more restrictions on data sharing.

However, you still need skepticism. Security promises are easy to say. Real security is expensive to maintain.

How to prepare for 2026 changes

You do not need to become an expert. You need a practical strategy. You also need a calm approach.

Learn the questions that reveal the truth

When you evaluate a usage-based program, the best questions are simple.

Ask what data is collected. Ask how long it is stored. Ask whether it is sold or shared. Ask whether you can delete it. Ask whether you can pause tracking. Ask whether pricing can go up, not only down.

Additionally, ask how disputes work. If the app misreads your driving, can you correct it? If your phone battery dies, do you get punished? If you switch phones, do you lose history?

These questions reveal whether the program is designed for you or for the insurer.

Decide your personal trade: savings vs privacy

There is no universal answer. Some people want maximum savings. Some want maximum privacy.

In 2026, you will be offered a spectrum. On one end is deep tracking with bigger discounts. On the other end is minimal tracking with smaller discounts.

Consequently, decide your boundary early. That prevents regret. It also prevents pressure. If you know you refuse location tracking, you can ignore offers that require it.

Prepare for the new normal: continuous insurance decisions

The old world had a yearly renewal decision. The new world adds ongoing choices.

You may be asked to opt into new sensors. You may be asked to accept new AI terms. You may be asked to share data with partners. These choices can creep in slowly.

Therefore, set a calendar reminder to review your insurance data permissions every few months. Keep it quick. Keep it consistent.

A realistic 2026 forecast by product category

The smartest way to understand the future is to see where the economics make sense.

Auto: the most advanced and most contested

Auto will keep leading. Pay-per-mile programs will expand where low-mileage driving is common. Behavior scoring will become more common. Price volatility may increase for risky patterns.

However, public debate will also increase. Privacy concerns will rise. Some states may push for stronger disclosures. Some insurers will offer non-tracking alternatives to avoid backlash.

Consequently, 2026 will be a year of choice and tension in auto.

Home: strong growth, driven by prevention

Home usage-based will grow fastest through prevention bundles. Water leak detection is a clear win. Fire monitoring can be powerful. Weather risk analytics will refine pricing.

Additionally, insurers will push “resilience credits.” Upgrade your roof, get a discount. Install sensors, get a discount. This feels rewarding. It also shifts some risk management burden onto homeowners.

However, affordability issues can rise in high-risk areas. That is a policy concern. It will not disappear in 2026.

Health: growth through rewards, not punishment

Health personalization will expand mainly through wellness rewards, not premium penalties. That is the most likely consumer-acceptable path.

Expect more partnerships with wearable platforms. Expect more optional programs. Expect more “earn points” style incentives.

However, regulators and advocates will watch closely. Health data is sensitive. Discrimination fears are intense. That keeps insurers cautious.

Life: slow movement, but real experiments

Life insurance is long-term. It is harder to make “real-time pricing” feel fair. Still, 2026 will bring more experiments.

Expect more “dynamic underwriting” at signup. Expect more optional wellness riders. Expect more simplified products that use fewer questions but more data signals.

However, full pay-per-risk life pricing is less likely to become mainstream in 2026. The backlash risk is high.

Cyber: rapid growth, because risk is already dynamic

Cyber will become more usage-based because it already behaves like that. Scam risk changes daily. Fraud patterns change fast. Identity threats rise and fall.

In 2026, expect more cyber products that bundle monitoring and response. They may feel like subscriptions. They may price based on security posture. They may include AI-driven support.

However, always check what data they access. Device access can be sensitive. Account access can be risky.

Conclusion: 2026 is the year trust becomes the product

Usage-based insurance is not a niche anymore. It is a direction. It is also a test of ethics.

The pitch is seductive. Pay only when risk rises. Get rewarded when you act safely. Feel seen as an individual. That can be empowering and freeing.

However, the hidden costs can be serious. Surveillance fatigue is real. Algorithmic discrimination is a real threat. Data breaches are more painful when data is behavioral.

Consequently, the winners in 2026 will not be the companies with the flashiest AI. The winners will be the companies that earn trust. They will explain their models. They will limit data. They will protect consumers. They will offer real control.

If you prepare now, the next year can feel like a smart upgrade. It can also feel like a safer deal. The key is simple: let personalization serve you, not judge you.

Sources and References

- Deloitte 2026 insurance industry outlook

- Swiss Re Institute sigma: Global economic and insurance outlook 2026-27

- IAIS Global Insurance Market Report 2025 (2025-2026 outlook)

- NAIC explainer on telematics and usage-based insurance

- NAIC Model Bulletin: Use of AI Systems by Insurers (PDF)

- Colorado SB24-205: Consumer Protections for Artificial Intelligence (effective Feb 1, 2026)

- Maryland Insurance Administration: Telematics Survey Report 2025 (PDF)

- McKinsey Global Insurance Report 2025 (embedded and tech trends)

- Reuters: EU proposal to delay some high-risk AI rules (Nov 19, 2025)