Master your policy with this essential guide to car insurance deductibles. Learn proven strategies to balance risk and savings for total financial peace of mind.

The world of auto insurance often feels like a maze of confusing terms and hidden costs. However, understanding your deductible is the most critical step you can take to secure your financial future. It is the heartbeat of your policy. It dictates exactly how much money leaves your pocket when disaster strikes. In December 2025, with repair costs soaring due to advanced vehicle technology, this knowledge is more vital than ever. You cannot afford to be ignorant. A wrong choice here could devastate your savings in an instant.

Many drivers treat their deductible as a mere afterthought. This is a dangerous mistake. Your deductible is a powerful lever that controls your monthly premiums. It represents your share of the risk. By mastering this concept, you unlock the potential for massive savings. You gain the confidence to navigate claims without fear. This guide will dismantle the confusion. We will provide you with the essential tools to make a smart, profitable decision for your family.

What Exactly Is a Car Insurance Deductible?

A deductible is the specific amount of money you must pay out of pocket before your insurance company covers the rest of a claim. It is your financial responsibility in the event of an accident. Think of it as a barrier to entry for your insurance benefits. You agree to pay the first portion of the damages. The insurer agrees to pay the remaining balance, up to your coverage limits.

For example, imagine you have a $1,000 deductible. You get into an accident that causes $5,000 worth of damage to your vehicle. You are responsible for the first $1,000. Your insurance provider will then issue a check for the remaining $4,000. This partnership ensures that both parties have “skin in the game.” It prevents drivers from filing trivial claims for minor scratches.

The Vital Role of Risk Sharing

Insurance companies use deductibles to share the financial risk with you. This system keeps insurance affordable for everyone. If insurers paid for every single dollar of damage, premiums would be astronomically high. By accepting a portion of the risk, you lower the insurer’s potential payout. Consequently, they reward you with lower monthly premiums. This trade-off is the core of insurance logic.

Furthermore, carrying a deductible encourages safer driving habits. When you know that an accident will cost you immediate cash, you are naturally more cautious. It acts as a financial deterrent against reckless behavior. Understanding this dynamic is crucial for every driver. It transforms a grudge purchase into a strategic financial tool.

Deductibles vs. Premiums: The Golden Rule

There is an inverse relationship between your deductible and your premium. This is a fundamental rule of insurance math.

- Higher Deductible = Lower Premium. You take on more risk, so the insurer charges you less each month.

- Lower Deductible = Higher Premium. The insurer takes on more risk, so they charge you more each month.

Finding the sweet spot between these two is essential. It requires an honest assessment of your financial health. You must balance your desire for low monthly payments with your ability to pay a lump sum during an emergency.

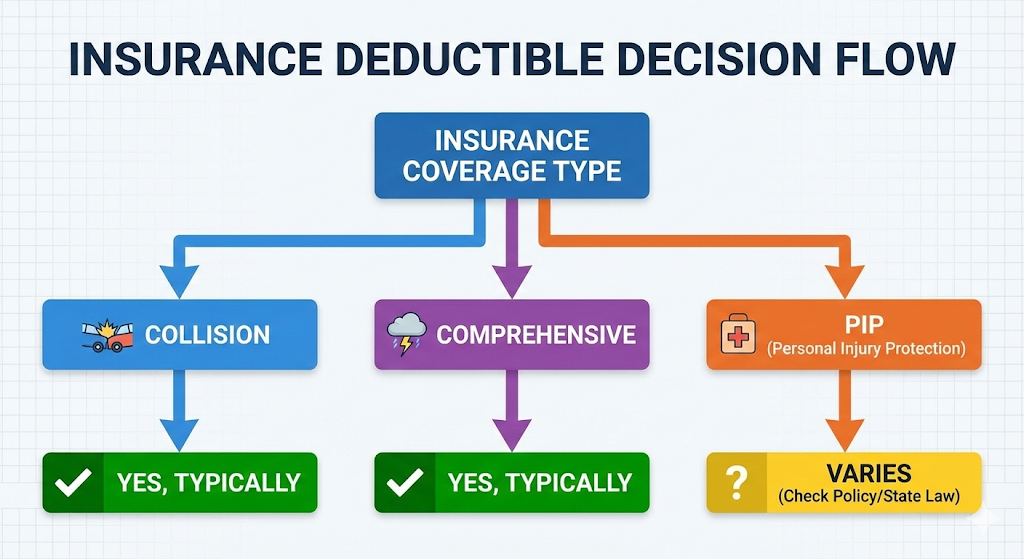

Types of Car Insurance Coverage with Deductibles

Not every part of your car insurance policy has a deductible. Understanding which coverages require one is critical for avoiding surprise expenses. Liability coverage, which pays for damage you cause to others, typically does not have a deductible. However, coverage for your own vehicle almost always does.

Collision Coverage Deductible

Collision coverage pays for damage to your car resulting from a crash with another vehicle or object. This includes hitting a tree, a fence, or a guardrail. It is vital protection for your asset. The deductible here applies every time you file a collision claim.

If you are at fault in an accident, you will pay this deductible to get your car fixed. Even if you are not at fault, you might still pay it initially. If the other driver is uninsured or underinsured, your policy kicks in. Your insurer may recover your deductible later through subrogation, but that is not guaranteed.

Comprehensive Coverage Deductible

Comprehensive coverage protects you against non-collision events. This includes theft, vandalism, fire, hail, and falling objects. It also covers hitting an animal, such as a deer. These events are often unpredictable and devastating.

The deductible for comprehensive coverage is usually separate from your collision deductible. Many experts recommend keeping this deductible lower. Comprehensive claims are often out of your control. Being penalized heavily for a hailstorm feels unfair to many drivers. Therefore, carrying a lower deductible here can provide significant emotional relief.

Uninsured/Underinsured Motorist Property Damage

In some states, this coverage carries a deductible. It protects your car if you are hit by a driver who has no insurance. It also applies if the other driver has insufficient coverage. Given the number of uninsured drivers on the road in 2025, this protection is essential. The deductible is often lower than your collision deductible, but you must check your specific policy terms.

Personal Injury Protection (PIP) Deductible

PIP covers medical expenses for you and your passengers, regardless of fault. Some states allow you to choose a deductible for PIP. Choosing a higher PIP deductible can lower your premium. However, it means you pay more for your own medical care after a crash. Weigh this carefully against your health insurance coverage.

High vs. Low Deductibles: The Ultimate Debate

This is the most common question drivers face. Should you go high or low? The answer depends entirely on your financial situation and risk tolerance. There is no one-size-fits-all answer. However, analyzing the pros and cons is vital for making an informed choice.

The Case for a High Deductible ($1,000+)

Choosing a high deductible is a powerful strategy for saving money month-to-month. By raising your deductible from $500 to $1,000, you could save 15% to 30% on your premiums. For safe drivers, this is a profitable move.

Pros:

- Immediate Monthly Savings: You keep more cash in your bank account every month.

- Discourages Small Claims: You are less likely to file claims for minor damage, keeping your claims history clean.

- Ideal for Emergency Funds: If you have substantial savings, you can easily cover the cost if an accident happens.

Cons:

- High Upfront Cost: You must come up with $1,000 or more instantly after an accident.

- Financial Stress: If you live paycheck to paycheck, a high deductible can be a disaster.

The Case for a Low Deductible ($250 – $500)

A low deductible offers peace of mind. It minimizes the financial shock of an accident. If you are risk-averse, this is the comforting choice. You pay more monthly, but you sleep better knowing a fender bender won’t bankrupt you.

Pros:

- Lower Out-of-Pocket Cost: Paying $250 is much easier than paying $1,000.

- Less Financial Anxiety: You know you are covered for almost everything.

- Good for High-Risk Areas: If you drive in a city with high accident rates, you might use your insurance more often.

Cons:

- Higher Monthly Premiums: You pay significantly more over the course of a year.

- Risk of Over-Claiming: You might be tempted to file small claims, which can raise your rates in the long run.

Calculating Your Breakeven Point

To make the best decision, you need to do the math. You must calculate the “breakeven period.” This is the time it takes for your monthly savings to equal the difference in deductibles.

Imagine your current premium is $1,500 a year with a $500 deductible. You get a quote for a $1,000 deductible, and the premium drops to $1,300.

- Savings: $200 per year.

- Increased Risk: $500 (The difference between $1,000 and $500).

- Calculation: $500 (Risk) divided by $200 (Savings) = 2.5 years.

In this scenario, you must go 2.5 years without a claim to break even. If you have an accident in year one, you lose money. If you go five years accident-free, you profit significantly. This simple calculation is essential for maximizing your financial efficiency.

Additionally, consider your driving history. Are you prone to accidents? Do you drive in heavy traffic daily? If you are a high-mileage driver, your exposure to risk is higher. In that case, a longer breakeven period might be risky. Conversely, if you work from home and rarely drive, a high deductible is a safer bet.

When Do You NOT Pay a Deductible?

There are specific scenarios where your deductible does not apply. Knowing these exceptions is empowering. It helps you advocate for yourself during the claims process.

Liability Claims

You never pay a deductible for liability claims. If you hit another car and damage it, your insurance pays for their repairs starting from the first dollar. The deductible only applies to repairing your vehicle.

Zero-Deductible Glass Coverage

Many insurers offer a “full glass” rider. Windshields are easily damaged by rocks and debris. Safety features in modern cars often require windshield calibration. This can be expensive. With full glass coverage, repairs or replacements are often free. This is a fantastic benefit to add for a minimal cost.

Not-At-Fault Accidents (Sometimes)

If another driver hits you and they are 100% at fault, their insurance should pay for your repairs. In this case, you pay nothing. However, if you file a claim with your own insurer to speed up the process, you will pay your deductible first. Your insurer will then try to recover it from the at-fault driver’s company. If they succeed, they reimburse you.

Diminishing Deductibles

Some modern policies feature a “vanishing” or “diminishing” deductible. This is a revolutionary reward for safe driving. For every year you go without a claim, your deductible drops by a certain amount, usually $50 or $100. Eventually, it could reach zero. This is a powerful incentive to drive safely and stay loyal to one carrier.

The Hidden Costs of Modern Car Repairs in 2025

The automotive landscape has changed dramatically. Cars in December 2025 are computers on wheels. They are equipped with LiDAR, cameras, and advanced sensors. While these features save lives, they make repairs incredibly expensive.

A minor bumper tap is no longer just a plastic repair. It often involves replacing sensors and recalibrating software. A simple repair that cost $500 a decade ago might cost $2,500 today. This inflation of repair costs makes your deductible choice even more critical.

Electric Vehicle (EV) Considerations

If you drive an electric vehicle, pay close attention. EVs often have higher repair costs than gas vehicles due to specialized parts and labor. Battery packs are vulnerable and expensive. Consequently, insurance premiums for EVs are often higher. Choosing the right deductible is essential to keep these costs manageable.

Moreover, parts shortages can delay repairs. You might be without your car for weeks. Ensure your policy includes rental car reimbursement. While this doesn’t directly affect your deductible, it protects your wallet during the extended repair timeline.

Emergency Funds: Your Deductible’s Best Friend

Your deductible strategy is inextricably linked to your emergency fund. You should never choose a deductible that exceeds your available cash. This is a golden rule of personal finance.

If you have $500 in savings, do not choose a $1,000 deductible. If you have an accident, you will be stranded. You won’t be able to pick up your car from the shop. This leads to a spiral of debt and stress.

Building Your Safety Net

Start by saving specifically for your deductible. Put this money in a high-yield savings account. Label it “Car Emergency.” Once this fund is fully stocked, you can safely raise your deductible. This unlocks lower premiums. You can then funnel those monthly savings back into your emergency fund or other investments. This cycle creates wealth and stability.

However, if you are currently building your savings, stick to a lower deductible. It is a small price to pay for security. As your financial strength grows, adjust your policy. Call your agent annually to review your status. Your insurance should evolve with your net worth.

Navigating Deductibles for Leased and Financed Cars

If you do not own your car outright, you might not have full freedom to choose. Lenders and leasing companies have a vested interest in the vehicle. They want to ensure it is fully protected.

Lender Requirements

Most banks and leasing companies mandate a maximum deductible. This is usually $500 or $1,000. They forbid you from carrying a $2,000 deductible because they fear you might default on repairs. Always check your loan or lease agreement before changing your policy. violating these terms can lead to penalties or “force-placed” insurance, which is incredibly expensive.

Gap Insurance Integration

If your car is totaled, your insurance pays the current market value. This might be less than what you owe on the loan. The deductible is subtracted from this payout, widening the gap. Gap insurance covers the difference. It is a vital shield for financed vehicles. It prevents you from paying for a car that no longer exists.

Strategies to Lower Your Premium Without Raising Your Deductible

You might want a low deductible but hate the high premium. Fortunately, there are other ways to slash costs. You can have the best of both worlds if you are strategic.

Bundle Your Policies

Combining your auto and home (or renters) insurance is the easiest win. Most carriers offer a significant “multi-line” discount. This can save you up to 20%. The savings often offset the cost of a lower deductible.

Improve Your Credit Score

In many states, insurers use credit-based insurance scores. Statistics show that drivers with good credit file fewer claims. Improving your credit score can drastically lower your rate. It is a long-term play with massive rewards.

Take Defensive Driving Courses

A certified defensive driving course proves you are serious about safety. Many insurers offer a discount for three years after completion. It is a small investment of time for a guaranteed return on investment.

Telematics and Usage-Based Insurance

Allow your insurer to track your driving. If you drive safely—no hard braking, no speeding—you earn huge discounts. Programs like these are becoming standard in 2025. If you are a safe driver, prove it and pay less.

What Happens If You Can’t Pay Your Deductible?

This is a nightmare scenario. You need your car to get to work, but you can’t afford the $500 to get it out of the shop. Panic sets in. However, you have options. Do not despair.

Discuss with the Repair Shop

Some body shops might offer a payment plan. They might allow you to pay the deductible in installments. It never hurts to ask. Honesty is key here. Explain your situation upfront.

Ask Your Insurer

In rare cases, the insurer might subtract the deductible from the settlement check sent to you, rather than the shop. This usually happens if you own the car outright. You can then use the payout to negotiate cheaper repairs or do some work yourself.

Credit Options

Using a credit card is a last resort, but it keeps you mobile. Ensure you have a plan to pay it off quickly to avoid interest. Personal loans are another option. The goal is to get back on the road so you can continue earning income.

Common Myths About Car Insurance Deductibles

Misinformation spreads fast. Let us debunk some persistent myths that could cost you money.

Myth 1: “I don’t pay a deductible if I’m not at fault.”

Fact: You often do. You pay it upfront to use your own collision coverage. You only get it back if your insurer successfully collects from the other party.

Myth 2: “My deductible resets every year like health insurance.”

Fact: False. Car insurance deductibles apply per incident. If you have two accidents in one week, you pay two deductibles. It is a harsh reality.

Myth 3: “A higher deductible always saves money.”

Fact: Not always. For some drivers, the premium difference is negligible. Saving $5 a month is not worth taking on $500 more risk. You must run the quotes to be sure.

Action Plan: How to Choose Your Perfect Deductible

You are now armed with knowledge. It is time to act. Follow this step-by-step plan to secure the optimal policy for your life.

- Audit Your Savings: Check your emergency fund balance today. This is your hard limit.

- Request Multiple Quotes: Ask your agent for quotes with $500, $1,000, and $2,000 deductibles.

- Calculate the Breakeven: Use the math we discussed. determining if the monthly savings justify the risk.

- Assess Your Driving Habits: Be honest about your risk level. City driving and high mileage suggest a lower deductible might be safer.

- Check for Riders: Ask about “diminishing deductibles” and “glass coverage.”

- Review Annually: Set a calendar reminder. As your savings grow, raise your deductible to save more money.

Conclusion: Empower Your Financial Future

Understanding your car insurance deductible is more than just learning a definition. It is about taking control of your financial destiny. You are no longer a passive customer; you are an informed strategist. You understand the trade-offs. You see the hidden opportunities.

By choosing the right deductible, you protect your bank account from sudden shocks. You ensure that a bad day on the road doesn’t become a bad year for your finances. This decision is a cornerstone of a solid financial foundation.

Do not wait for an accident to force you to learn. Take action today. Review your policy. Adjust your limits. Build your emergency fund. Drive with the confidence that comes from being truly prepared. You have the power to turn a potential crisis into a manageable inconvenience. Secure your car, secure your wallet, and drive forward with certainty.

Sources and References

- Insurance Information Institute: Understanding Auto Insurance Deductibles

- Consumer Reports: How to Choose the Right Car Insurance Deductible

- National Association of Insurance Commissioners: Auto Insurance Guide

- Investopedia: Comprehensive vs. Collision Insurance

- NerdWallet: Best Car Insurance Companies of 2025

- Kelley Blue Book: Average Car Repair Costs 2025

- State Farm: Deductibles Explained

- Allstate: How Deductibles Work