Investing feels scary on a small budget. This December 2025 guide shows proven, low-cost ways to start, avoid traps, and build confidence fast.

You do not need a big paycheck to begin investing. You need a clear plan, a calm mindset, and a simple system. That combination is powerful. It turns tiny deposits into real ownership. It also turns anxiety into steady confidence.

As of December 2025, investing is more accessible than it was a decade ago. Fractional shares, micro-investing, low-cost index funds, and easy automation removed many old barriers. However, easier access can also amplify mistakes. Consequently, the goal is not just to start. The goal is to start well, with a verified process you can repeat.

What investing really is, in plain language

Investing is choosing to own assets that can grow over time. In practice, that means you buy small pieces of businesses, loans, or real estate structures. You take risk today to seek a rewarding result tomorrow. That tradeoff is the core.

Saving is different. Saving protects you from surprises. Investing helps you build future options. Additionally, both matter. A secure base makes investing feel safer. A thriving investment plan makes saving feel purposeful.

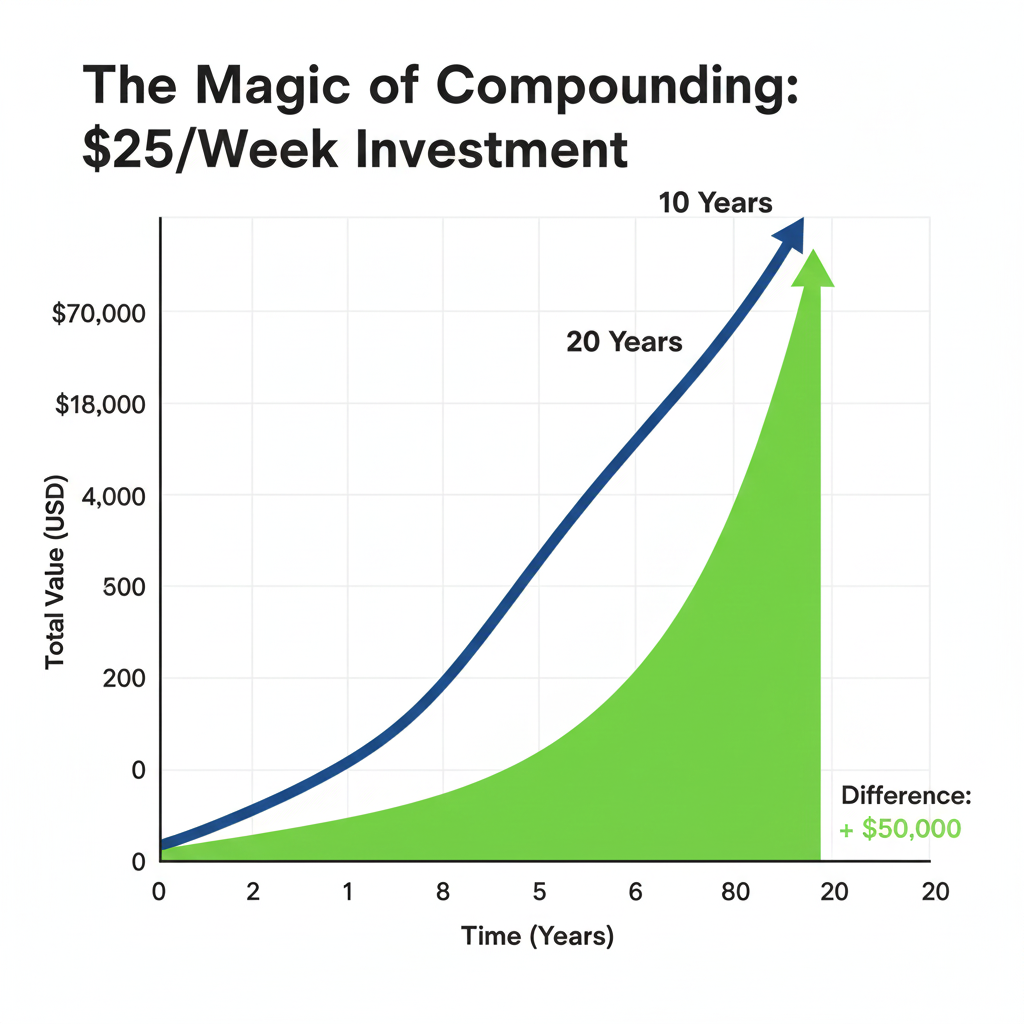

If you only remember one idea, make it this. Your biggest advantage is time, not money. Time creates compounding. Compounding is not magic. It is simple math repeated for years.

Why small contributions are not “too small”

Small deposits do two critical jobs. First, they buy real assets, even if the amounts look modest. Second, they build a habit that survives market noise. That habit is priceless.

In many households, the first month is the hardest. You feel exposed. You fear “wasting” money. Meanwhile, the market headlines feel loud. A tiny starting amount reduces that pressure. It gives you a safe test drive.

Start with an amount that feels almost silly. Five dollars. Ten dollars. Twenty-five dollars. Make it automatic. Then increase it when your confidence grows. This is a proven way to stay consistent.

The mindset that keeps beginners calm and successful

Starting small is not a weakness. It is a strategic, proven advantage. That approach feels safer. Better still, progress feels immediate, even on a tight budget.

A beginner’s biggest enemy is not the market. It is panic, perfectionism, and shame. Those emotions can push you into risky moves. They can also make you quit right before the breakthrough moment.

Replace “perfect” with “consistent”

Consistency is essential. It is also surprisingly powerful. A small, verified habit beats a dramatic plan you cannot sustain.

Choose a tiny amount you can keep investing during a messy month. That choice is vital. It protects your confidence. Additionally, it keeps your identity intact: you are building a successful system.

If you want a simple mantra, use this. “Small, steady, and authentic.” Repeat it when you feel tempted to chase a hot tip.

Use trust filters before you take advice

The internet is full of loud claims. Some are helpful. Many are not. Therefore, apply trust filters.

Look for clear disclosures. Prefer education from regulated institutions. If you hire help, consider a certified professional, such as a CFP in the U.S. or an equivalent credential where you live. Also ask how they are paid. Avoid anyone who guarantees market returns. That kind of promise is a red flag.

Additionally, celebrate boring wins. A proven deposit is a breakthrough. A verified budget cut is a powerful upgrade. Each step builds confidence. That feeling is rewarding. It is also vital when markets feel scary and urgent.

Finally, remember what “success” looks like at the start. Success is not winning a trade. Success is staying invested, keeping fees low, and adding money consistently. That path is rewarding. It can also create a thriving future.

Before you invest, fix the one thing that breaks beginners

Most beginners do not fail because they pick the “wrong” fund. They fail because their cash flow collapses under stress. A surprise bill arrives. The investment gets sold. You feel defeated. That cycle is painful.

So, build a buffer first. Keep a small emergency fund in a safe place. Use a high-quality savings account or a money market sweep at a reputable institution. The purpose is emotional stability. It is also practical protection.

However, do not wait for a perfect emergency fund before you start. If you wait for perfect, you delay for years. Instead, do both in parallel. Build the buffer and invest a tiny amount.

Handle high-interest debt with honesty

If you carry credit card debt at very high rates, that is a critical priority. Paying it down is often a guaranteed win. It is also psychologically freeing.

Still, many people need investing to stay motivated. Consequently, a hybrid plan works well. Put most extra cash toward high-interest debt. Keep a small automatic investment running. Even $10 per week can keep the habit alive.

Pick the best “starter account” for your goal

The right account depends on your purpose and your timeline. Additionally, the right choice reduces taxes and fees. It also reduces your temptation to trade.

If you have a workplace retirement plan

If your employer offers a retirement plan with a match, it can be an exceptional deal. A match is immediate value. It is also a rare, powerful boost.

Start by contributing enough to capture the full match, if you can. Then choose a diversified, low-cost fund option inside the plan. Target date funds are often a simple starting point.

If you are in the United States: IRA basics for 2025

For U.S. readers, IRA contribution limits in 2025 allow meaningful progress even with modest income. That matters if you want long-term retirement growth. Additionally, a Roth IRA can be especially rewarding if you expect higher income later.

If you are outside the U.S., the same idea still applies. Use your local tax-advantaged retirement account, if available. The details change. The strategy stays authentic.

If you want flexibility: a taxable brokerage account

A brokerage account is flexible. You can invest for a home down payment, a business goal, or long-term wealth. However, flexibility can tempt you to trade. A clear rule is essential.

Use the brokerage account for long-term goals. Do not use it as a casino. Choose broad, low-cost funds. Then automate deposits.

If you want simplicity: a robo-advisor

Robo-advisors can be a relieving option. They build diversified portfolios and rebalance automatically. They often let you start with small deposits. Additionally, they can reduce decision fatigue.

The key is to understand the fee. Robo-advisors charge a management fee on top of fund fees. That can be worth it if it keeps you invested. It can also be too expensive if you could stay disciplined alone.

What to invest in when you only have $10 to $100

When money is tight, every decision must be efficient. You want maximum diversification per dollar. You also want low friction. That is why index funds and ETFs are such a breakthrough tool for beginners.

Index funds and ETFs: the beginner’s workhorse

An index fund aims to track a market index. It does not try to “beat” the market by constant trading. That approach tends to keep costs lower. It also removes many emotional mistakes.

A broad stock index fund can hold hundreds or thousands of companies. That is instant diversification. Consequently, you reduce the impact of one company failing. You also stop obsessing over daily news.

ETFs trade like a stock. Mutual funds trade once per day. Both can be excellent. The practical differences depend on platform features and your preferences.

Target date funds: the “set it and stay calm” option

Target date funds package stocks and bonds in one fund. They automatically become more conservative over time. This can feel incredibly comforting. It is a proven choice for many retirement savers.

The tradeoff is control. You accept the fund’s glide path. However, that can be a benefit for beginners. It reduces tinkering. It also helps you stay consistent.

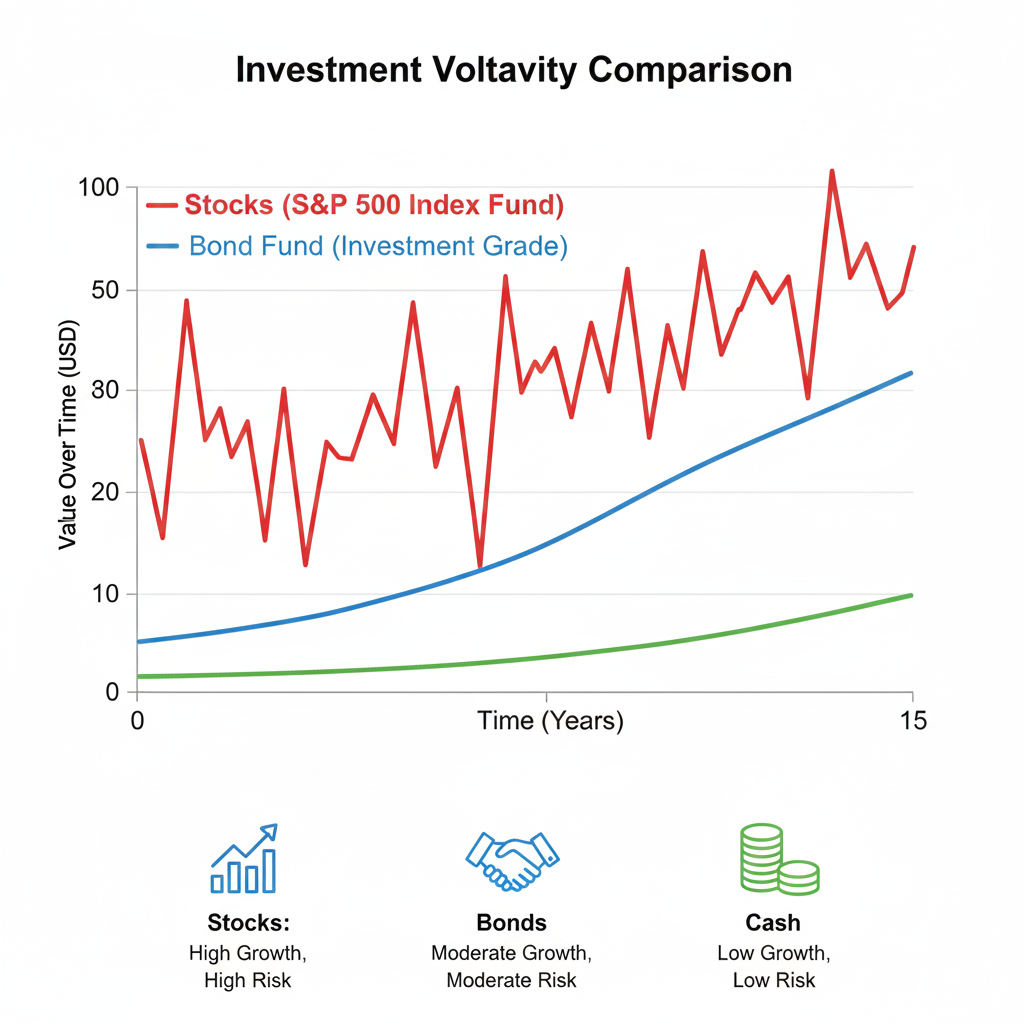

Bonds, cash, and the role of “stability”

If you invest only in stocks, your portfolio can swing hard. That volatility can feel brutal. Bonds and cash-like assets can soften the ride. Additionally, they can support short-term goals.

In late 2024 and through 2025, many investors paid more attention to cash alternatives because yields were meaningfully higher than in the 2010s. That changed the psychology of “waiting” versus “investing.” Still, long-term growth often requires owning productive assets like stocks.

Fees are quiet, but they are not small

Fees are the invisible leak in your investing bucket. They look tiny. They compound into a painful drag. Consequently, learning fees is an essential beginner skill.

Expense ratios, in one sentence

An expense ratio is the yearly cost of running a fund, shown as a percentage. You do not pay it as a separate bill. It is taken out inside the fund. That makes it easy to ignore.

In 2024 data, low-cost index ETF expense ratios were far lower on an asset-weighted basis than simple averages. That means investors tend to concentrate in cheaper funds. Additionally, it is a reminder to compare costs before you buy.

Other costs that surprise beginners

Bid-ask spreads matter for thinly traded ETFs. Trading too often creates taxes in taxable accounts. Some platforms also charge account service fees. Meanwhile, currency conversion fees can quietly hurt international investors.

The antidote is simple. Use diversified, liquid funds. Trade rarely. Prefer automatic investing.

How to pick a platform without regret

Choosing a platform can feel intimidating. Marketing is loud. Promises sound exclusive. However, you only need a few practical checks.

Look for low minimums and fractional investing

A beginner-friendly platform allows small purchases. Fractional shares can be a game changer. They let you buy by dollar amount. Consequently, you can invest $10 into a high-priced stock or ETF without waiting months.

Still, do not confuse access with strategy. Fractional trading is a tool. Your plan is what matters. Use the tool to buy diversified funds, not random hype.

Prioritize regulation and basic safety

Choose a reputable, regulated broker or fund provider in your country. Read how client assets are held. Look for clear disclosure, not vague claims. Additionally, enable two-factor authentication on day one.

If you live in the U.S., know the difference between protections. SIPC helps if a brokerage fails and assets are missing, up to stated limits. FDIC insurance is for bank deposits, not market investments. That distinction is vital.

Understand taxes and currency before you click “buy”

Taxes can feel boring. They are also critical. In taxable accounts, dividends and capital gains may create a bill. If you trade often, you can create more taxes. Consequently, long-term holding is usually more efficient.

If you invest across borders, currency adds another layer. Exchange fees can be real. Currency swings can also change results. Therefore, check your platform’s foreign exchange pricing and fund domicile rules.

How to read a fund page in 60 seconds

A fund page is not just marketing. It is a map of what you are buying. Additionally, reading it quickly can save you from an expensive mistake.

Step 1: confirm the goal and the benchmark

Look for the fund’s objective. Make sure it matches what you want. Then check the benchmark or index it tracks, if it is an index fund. A broad-market benchmark usually signals broad diversification.

If the benchmark is unclear, that is a red flag. If the strategy sounds complicated, pause. Complexity can hide risk and cost.

Step 2: check costs like a professional

Find the expense ratio. Compare it to similar funds. Small differences matter over decades. Also look for trading fees, loads, and account service fees. Many modern options are no-load. That can feel refreshing.

Step 3: scan diversification in one minute

Look at the number of holdings. Check the top positions. You do not need perfection here. You need obvious diversification. If one stock dominates, your risk rises.

Finally, glance at the fund’s history and volatility. Past returns are not guaranteed. However, volatility tells you how wild the ride can be. That awareness helps you stay calm.

A simple, realistic portfolio for small money

Many beginners think they need dozens of investments. That is false. A tiny portfolio can be strong. It can also be easier to manage.

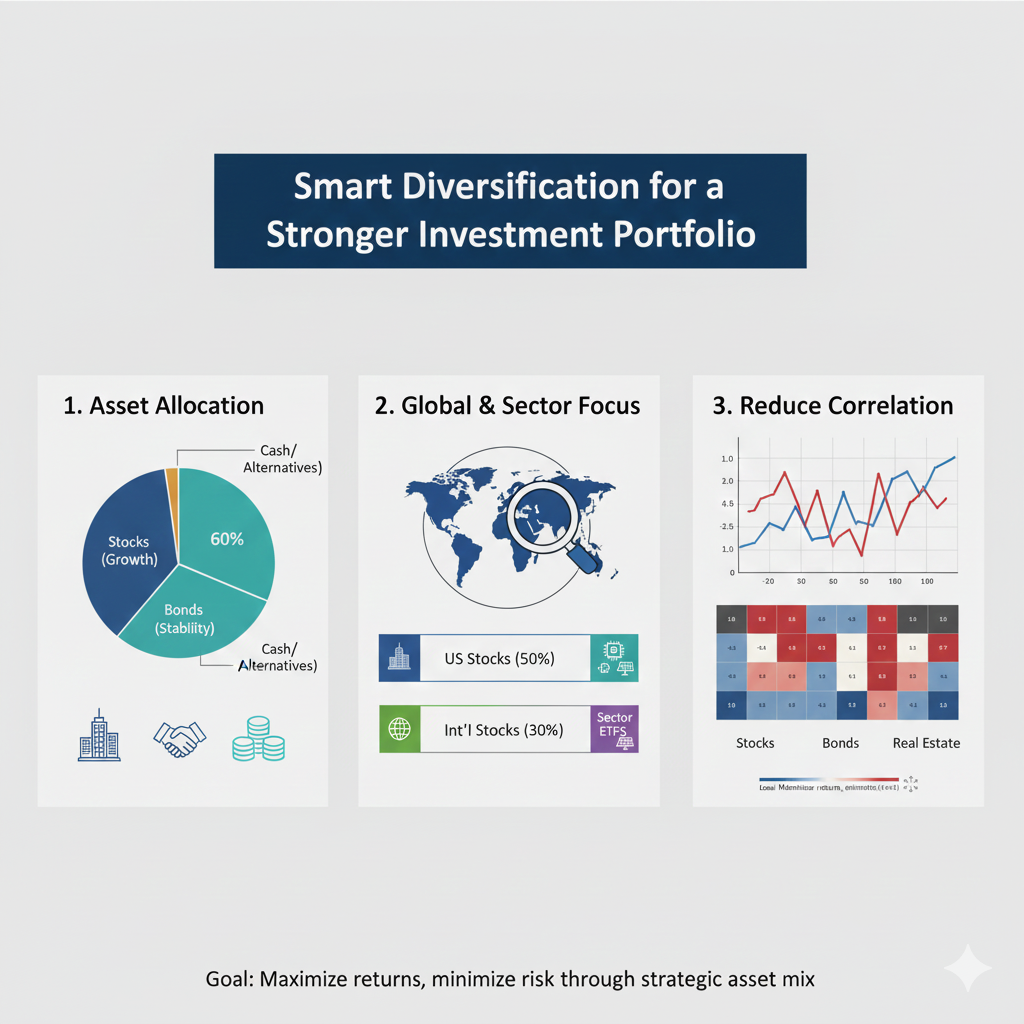

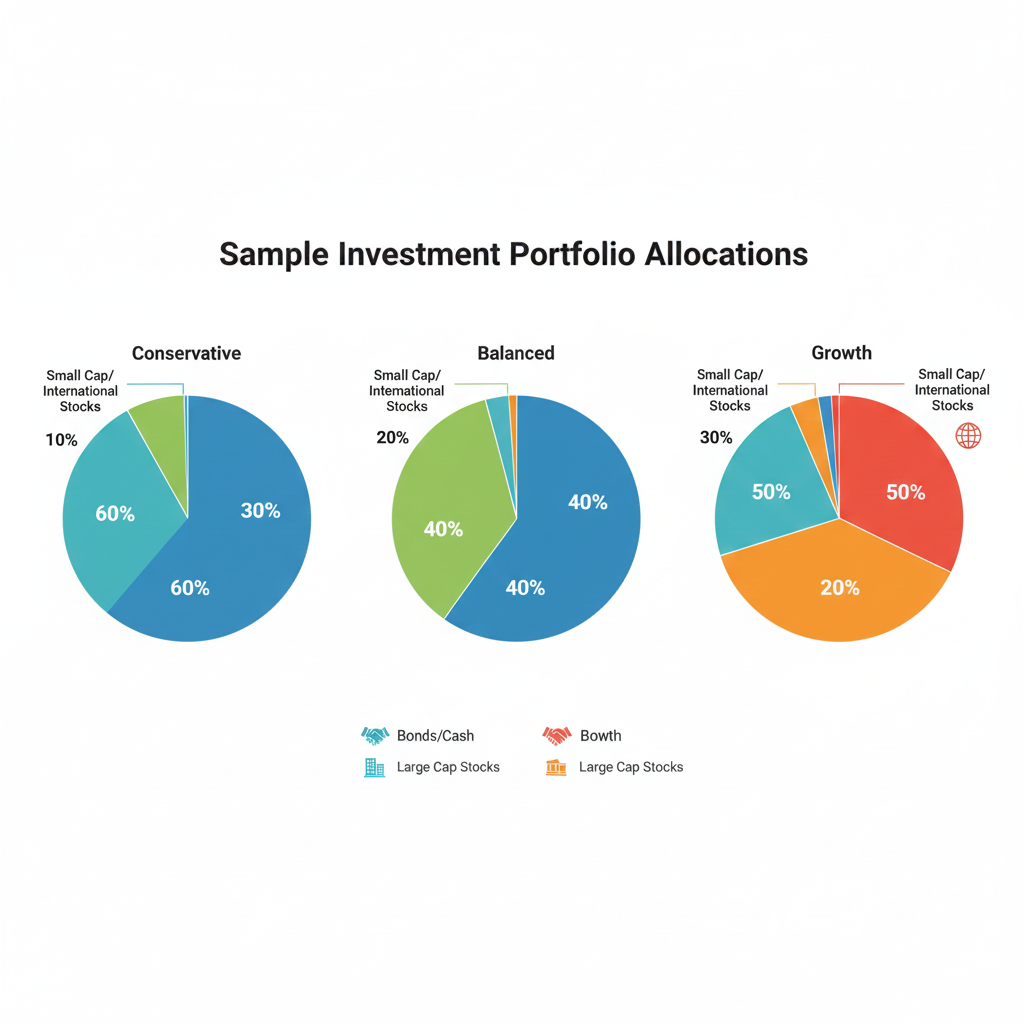

A classic approach is a broad stock fund plus a broad bond fund. Some people add an international stock fund. Others use one all-in-one target date fund. All of these can be valid.

Start with your time horizon, not your favorite stock

Time horizon is your deadline. If you need the money in one to three years, heavy stock exposure can be risky. If your horizon is ten years or more, stocks can be more appropriate. However, risk tolerance still matters.

Ask one honest question. Could you handle a sharp market drop without selling? If the answer is no, you need more stability. That is not weakness. It is wisdom.

A practical example you can adapt

Imagine you can invest $50 per month. You want long-term growth. You also want to sleep at night. A balanced fund or target date fund can be a safe, simple start.

If you want to build your own mix, you could start with mostly a broad stock index fund, and a smaller slice in a broad bond fund. As your goal gets closer, you can shift more toward bonds and cash. Additionally, you can rebalance once or twice per year. That is enough.

Automation is the difference between dreaming and doing

A plan that depends on willpower breaks under stress. A plan that runs automatically is resilient. Consequently, automation is a critical advantage when you are starting small.

Dollar-cost averaging keeps you consistent

Dollar-cost averaging means investing a fixed amount on a regular schedule. You buy more shares when prices are lower. You buy fewer when prices are higher. Over time, it can smooth your average cost.

More importantly, it protects your emotions. You stop trying to time the market. You stop waiting for “perfect” moments. Additionally, you build a calm rhythm.

Make the system painfully easy

Choose a payday rule. For example, invest every Friday, or every time your salary arrives. Start with the smallest amount that still feels serious. Then lock it in.

If you are paid weekly, weekly investing can feel natural. If you are paid monthly, monthly investing can feel clean. The best schedule is the one you will keep.

The biggest beginner mistakes, and how to avoid them

Investing is emotional. That is why mistakes repeat. However, you can avoid the most common traps with a few simple rules.

Mistake 1: chasing hot tips and viral stocks

A viral stock story feels exciting. It also creates pressure. You fear missing out. That feeling is dangerous.

Instead, build your core in broad funds. If you want “fun money,” keep it tiny. Treat it like entertainment. Do not confuse it with your future.

Mistake 2: panicking during a drop

Market drops feel personal. They are not. They are part of the experience.

Create a written rule now, before stress hits. For example: “I will not sell my long-term fund holdings because of headlines.” Additionally, commit to reviewing your plan only on a set schedule.

Mistake 3: ignoring basic protection and falling for scams

Scams target beginners because emotions run high. Promises sound exclusive. Pressure feels urgent. That is the trap.

Use regulated platforms. Verify the firm’s registration status where you live. Avoid anyone who guarantees huge returns. Be suspicious of “limited-time” offers. Meanwhile, protect your accounts with strong passwords and two-factor authentication.

It also helps to understand what protections exist. In the U.S., SIPC protects customers if a broker fails and assets are missing, up to stated limits. That is not the same as protection against market losses. Consequently, you still need diversification and discipline.

What is changing right now, as of December 2025

The investing world in 2025 is not the same as it was in 2015. Access is broader. Tools are smarter. Risks are also more complex.

Retail investors are a bigger force

Across major markets, retail participation became more visible in 2024 and 2025. That shift matters for prices, volatility, and product design. Additionally, more platforms emphasize fractional shares and easy recurring investing.

This can be empowering. It can also be distracting. The crowd can push risky behavior. That is why a simple, verified plan is vital.

AI tools are helpful, but they can be misleading

Many apps now offer AI summaries, alerts, and “insights.” Some are genuinely useful. Others create fake certainty. However, investing rewards humility.

Use AI tools for education and organization. Do not treat them as a guaranteed signal. Keep your core strategy boring. Boring can be profitable.

24/7 culture versus long-term reality

Extended access and constant news can create a restless feeling. You can feel like you must act every day. That is exhausting. Consequently, the smartest beginner move is often doing less.

If your goal is long-term wealth, your edge is patience. Your edge is consistency. Your edge is low cost.

A 30-day action plan that starts with $10

You can start this month. You can start without stress. Additionally, you can start without pretending you know everything.

Week 1: build clarity and pick one simple account

Write down your goal in one sentence. Choose a time horizon. Then pick a starter account that matches that horizon. If you already have access to a workplace plan, begin there.

Open the account with a reputable institution. Turn on two-factor authentication. Set up a small automatic transfer. Make it immediate.

Week 2: choose one diversified, low-cost option

Pick one broad index fund, one target date fund, or a simple balanced fund. Read the fund’s objective and costs. Avoid anything confusing. Confusion is a warning sign.

Place your first purchase. Keep it small. The goal is momentum, not perfection.

Week 3: automate and add a calm rulebook

Set recurring contributions. Align them with payday. Then write three rules on paper. First, make a rule about selling. Next, make a rule about adding money. Finally, make a rule about “fun” investing, if you do it at all.

Meanwhile, stop checking the account daily. That habit creates stress. Weekly or monthly is enough.

Week 4: review, adjust, and raise the bar slightly

Check your budget. Identify one spending leak you can cut. Move that amount into investing. Even a small increase is a breakthrough moment.

Finally, schedule a quarterly check-in. Rebalance if needed. Then return to your life. A thriving plan should feel quiet.

Conclusion

Starting with little money can feel vulnerable. It can also feel revolutionary. The first deposits prove you are building something real. Additionally, they build a calm identity: you are an investor.

Stay simple. Aim for low costs. Automate contributions. Focus on habits over headlines. That is how small money becomes serious money, one verified step at a time.

Sources and References

- Investor.gov: Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing (PDF). (Bankrate)

- Investor.gov: Mutual Funds. (Investor)

- Investor.gov Glossary: Total Annual Fund Operating Expense. (Investor)

- Investor.gov Glossary: Dollar Cost Averaging. (Investor)

- Fidelity: Fractional shares (Dollar-based investing). (Fidelity)

- FINRA: The Pros and Cons of Dollar-Cost Averaging. (IRS)

- IRS: IRA contribution limits (2025). (IRS)

- SIPC: What SIPC Protects. (SIPC)

- ICI: 2025 Fact Book Quick Facts Guide (2024 fee and fund data). (International Council of Independents)

- World Economic Forum: Global Retail Investor Outlook (2025 edition). (weforum.org)