Diversify with confidence in 2025. Learn proven ways to cut risk, smooth returns, and build a thriving portfolio, from beginner to intermediate.

As of December 2025, diversification is not a fancy finance word. It is a practical, proven defense. It helps you stay calm when headlines get loud. It also helps you avoid a painful single point of failure.

The December 2025 backdrop

Markets in 2024 and 2025 rewarded some investors fast. They also punished others fast. That emotional whiplash is real. Consequently, many beginners feel stuck. Intermediate investors often feel overexposed.

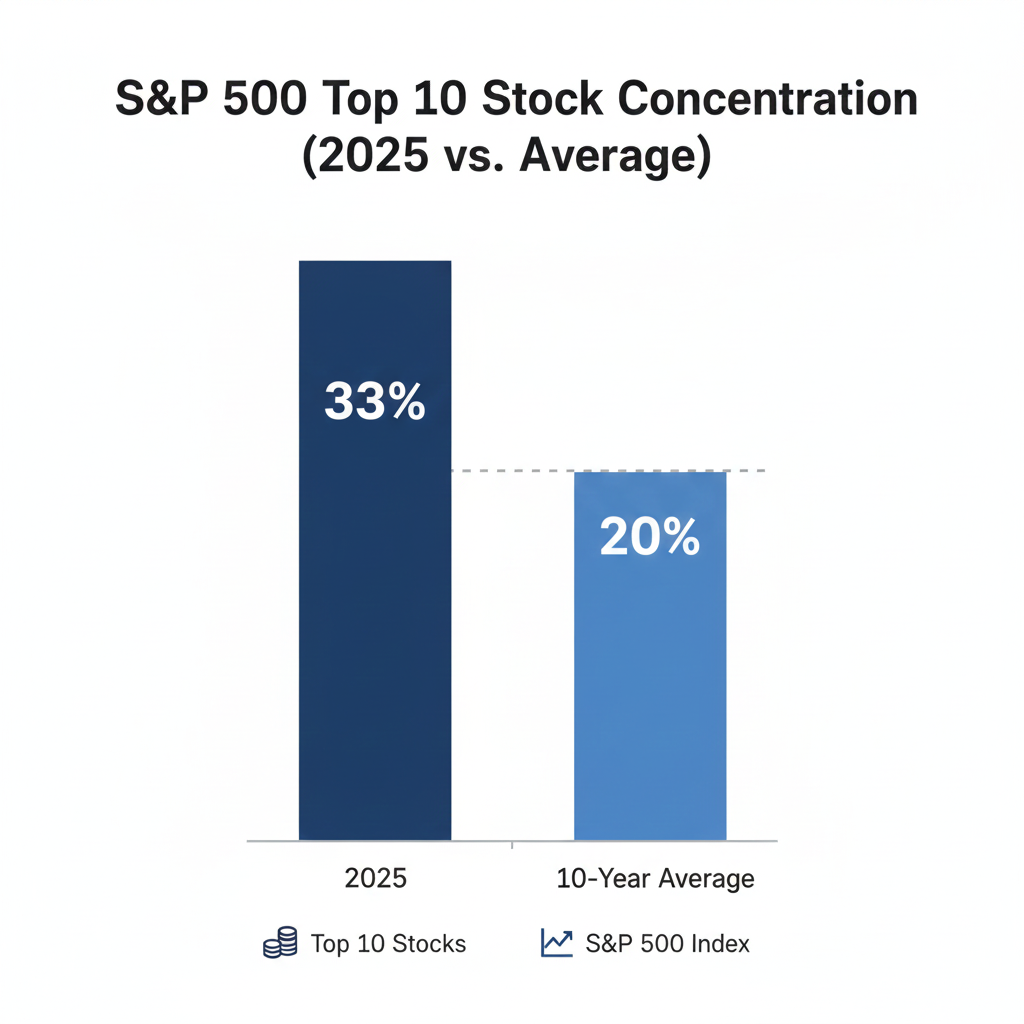

Concentration is the silent stress test

A key story in late 2025 is concentration risk. A small set of mega cap names drove a huge part of index returns. That can feel thrilling. It can also be fragile.

In 2025, several credible market commentaries highlighted how top heavy major indexes have become. For example, TD wrote that 10 stocks made up roughly 36% of the S&P 500’s total weight in September 2025. (TD Bank). Reuters also reported that the top 10 U.S. stocks were 33.8% of total U.S. market cap at the end of September 2025. (Reuters). Those numbers are not a reason to panic. Still, they are a clear reason to diversify on purpose.

Rates, bonds, and “surprise” risk

Another late 2025 theme is rate uncertainty. Bonds can stabilize a portfolio. However, bonds can also fall when yields jump. That shocks new investors. It can also scare experienced investors who expected bonds to be a guaranteed cushion.

BlackRock’s Fall 2025 outlook discussed how regimes can shift. It also described why traditional mixes may behave differently when inflation and policy dynamics change. (BlackRock). The lesson is simple. Diversification must be multi layer. It cannot be one idea.

What diversification really means

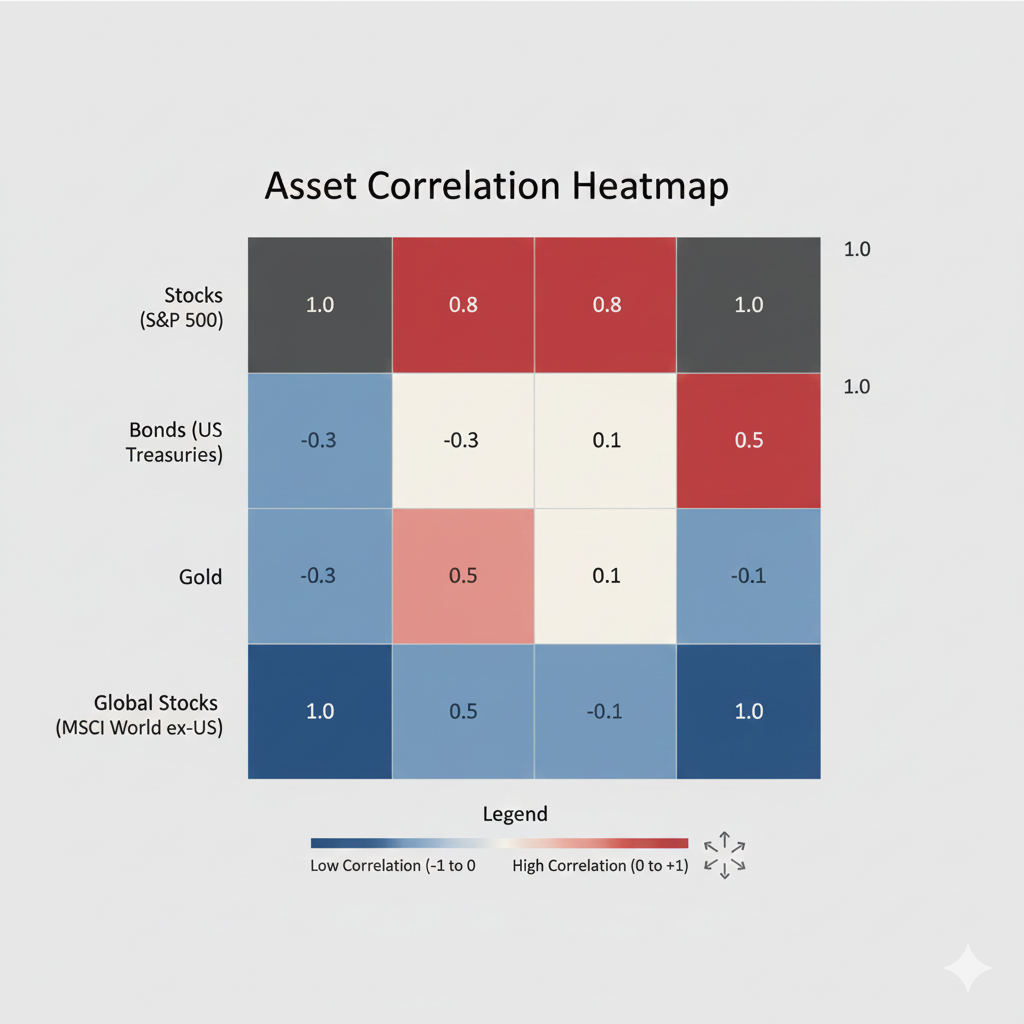

Diversification is not about owning “a lot of stuff.” It is about owning assets that do not all move the same way. That difference is the breakthrough.

FINRA describes diversification as spreading investments among and within asset classes. It also links diversification with asset allocation and rebalancing. (FINRA). Investor.gov teaches the same core idea, with plain language that fits beginners. (investor.gov).

What diversification is

Diversification is a design choice. You pick a mix. You accept that some parts will lag. You gain a more resilient whole.

A diversified portfolio often aims for these outcomes:

- more stable performance across market cycles

- reduced damage from any single company, sector, or country

- a clearer plan you can follow when emotions spike

That is rewarding. It is also realistic.

What diversification is not

Diversification is not a magic shield. It does not eliminate risk. It does not guarantee profit. In fact, some years feel annoying. Your best performer will often be a smaller slice. That can feel frustrating. Yet that frustration is often the price of safety.

Additionally, diversification is not the same as “adding random assets.” If you add five funds that all own the same mega caps, you did not diversify. You multiplied overlap.

The core engine: correlation, not quantity

Most investors do not need 40 holdings. They need low correlation between key parts of the portfolio. Correlation is a simple idea. It asks, “Do these move together?”

If everything rises and falls together, your risk is concentrated. If parts move differently, your total ride can be smoother. That smoother ride is vital. It can keep you invested. It can keep you from selling at the worst moment.

A practical way to think about it

Instead of chasing perfection, use a simple question.

If stocks fall sharply, what in my portfolio is likely to hold up?

If rates rise quickly, what in my portfolio is less sensitive?

If one country struggles, what in my portfolio is not tied to it?

Those questions are powerful. They turn diversification into a real plan.

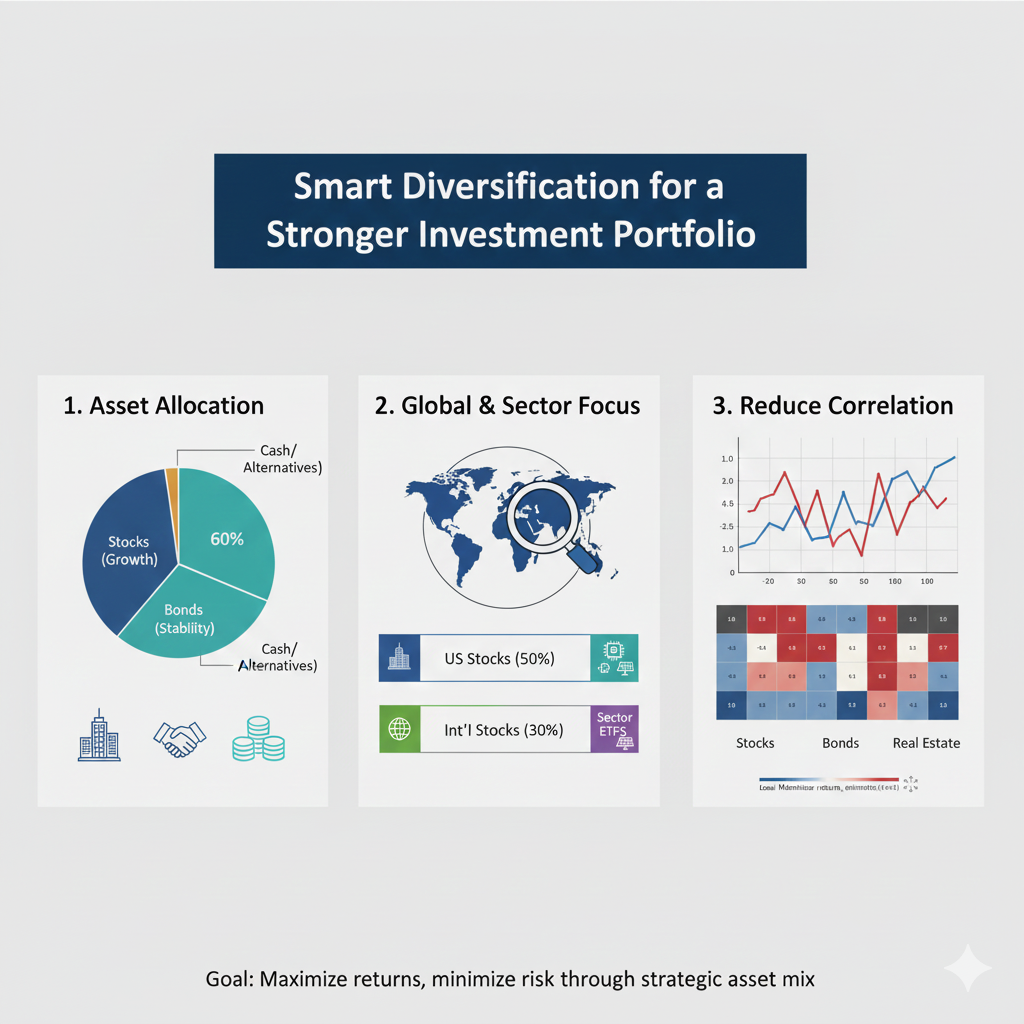

The three levels of diversification

A strong portfolio usually diversifies on three levels. Moreover, each level protects against a different type of shock.

Level 1: Diversify across asset classes

Asset classes behave differently. Stocks are growth engines. Bonds can be stabilizers and income tools. Cash is a short term shock absorber. Real assets can help in inflationary periods.

Investor.gov explains asset allocation as dividing your portfolio among asset categories like stocks, bonds, and cash. (investor.gov). Vanguard also frames diversification as owning stocks across industries and countries, plus other asset classes whose performance is not usually in sync with stocks. (Vanguard).

A beginner friendly starting point is to pick a “core” mix first. Then build inside that mix.

Level 2: Diversify within each asset class

A stock allocation is not automatically diversified. One stock is a single bet. Five stocks can still be a single bet. Investor.gov notes that a portfolio is not truly diversified if it holds only a handful of individual stocks. (investor.gov).

Within stocks, you can diversify by:

- sector and industry

- company size (large, mid, small)

- style (growth, value, quality)

- geography (U.S., developed ex U.S., emerging markets)

Within bonds, you can diversify by:

- maturity (short, intermediate, long)

- credit quality (Treasury, investment grade, high yield)

- issuer type (government, corporate, municipal, global)

- inflation protection (TIPS in the U.S.)

Level 3: Diversify your behavior over time

Your behavior is an asset. It is also a risk. Buying all at once can be fine. Yet many people cannot handle the emotional stress.

Regular contributions reduce timing regret. They also create a steady discipline. That discipline is a verified advantage for many real people.

Why diversification boosts “staying power”

A diversified plan can help you stay invested. That is the hidden superpower. It is not flashy. Still, it is essential.

When a portfolio is concentrated, drawdowns feel personal. They feel like failure. When a portfolio is diversified, drawdowns feel like a market season. That psychological shift is critical.

The real enemy is the panic decision

Many investors do not fail because they picked the wrong ETF. They fail because they abandon the plan. A diversified portfolio can reduce the urge to react.

Vanguard’s rebalancing guidance highlights staying on track and keeping your allocation aligned. (Vanguard). Investor.gov also provides a clear explanation of rebalancing and why it matters. (investor.gov).

Beginner friendly diversification that actually works

You do not need exotic products. You need a simple structure. Additionally, you need consistency.

Start with a simple “core”

For many beginners, the most effective core is:

- a broad stock index fund or ETF

- a broad bond fund or ETF

- a small cash buffer for near term needs

This is not exciting. It is proven. It is also easy to maintain.

If you want one product, a target date fund can handle allocation and rebalancing for you. Investor.gov describes target date funds as diversified funds that shift more conservative over time. (investor.gov).

Build “breadth” before you chase “alpha”

Many beginners want the next big winner. That urge is normal. However, breadth is safer than bravado.

If your stock exposure is only one country, consider adding global stocks. If your bond exposure is only long duration bonds, consider adding shorter maturity or a mix. If your entire plan depends on one tech trend, add other sectors.

The goal is not to avoid growth. The goal is to avoid a fragile portfolio.

Intermediate diversification: make it intentional

Intermediate investors often own “more things.” Yet they still feel concentrated. That is common. It usually comes from overlap and hidden bets.

Find your hidden bets

Your portfolio may be concentrated even if you own:

- several U.S. index funds

- a tech ETF plus a broad market ETF

- multiple growth funds with the same top holdings

In 2025, the mega cap effect made this overlap even more important. Several sources flagged how a small set of stocks can dominate broad indexes. (TD Bank).

A practical fix is to check:

- top holdings overlap

- sector exposure

- country exposure

- duration exposure in bonds

If you cannot check it easily, use simpler building blocks.

Consider “complements,” not clutter

A clean structure can look like:

- Core global stocks

- Core high quality bonds

- A small satellite sleeve for personal convictions

That sleeve could be small caps, value, REITs, or a modest commodity slice. The key is modesty. The satellite should not hijack the plan.

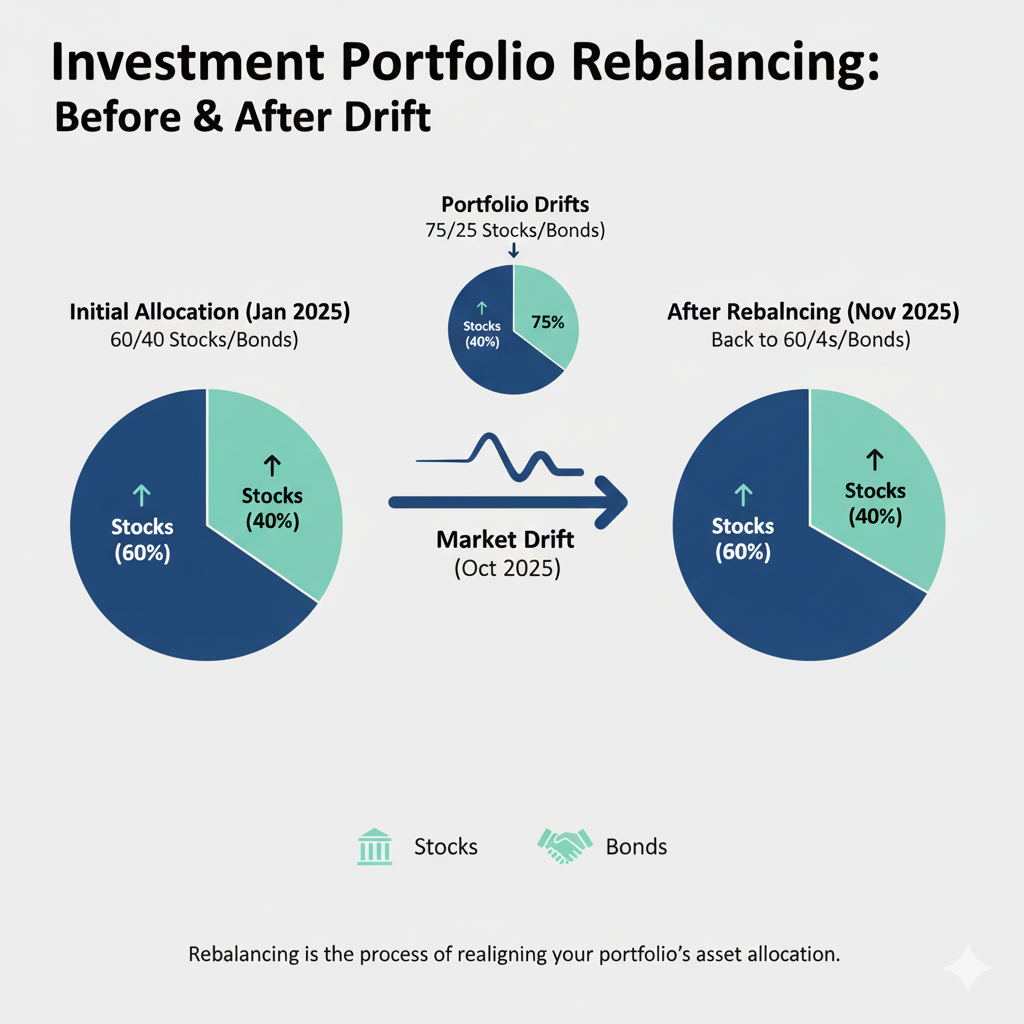

Rebalancing: the diversification defense

Diversification is a structure. Rebalancing is the maintenance. Moreover, rebalancing is where discipline becomes real.

FINRA describes rebalancing as making regular adjustments to ensure you are still hitting your target allocation. (FINRA). Investor.gov gives a concrete example of rebalancing back to a target mix. (investor.gov).

Why rebalancing feels hard

Rebalancing makes you trim winners and add to laggards. That feels counterintuitive. It can even feel painful. Yet it is often the most authentic form of “buy low, sell high.”

A Vanguard paper even frames rebalancing as a defense mechanism that can reduce emotional stress. (Vanguard Mexico).

Simple rebalancing rules that stay practical

Keep it simple. Pick one of these approaches:

- calendar based: review once or twice a year

- threshold based: rebalance when you drift by a set amount

The best rule is the one you will follow. That follow through is vital.

Diversification tradeoffs you must accept

Diversification is powerful. However, it has tradeoffs. Knowing them keeps you confident.

You will always own something disappointing

A diversified portfolio always has a “boring” piece. Sometimes bonds look boring. Sometimes international stocks look boring. Sometimes cash looks boring.

That boredom can be a feature. It can reduce regret. It can prevent impulsive moves.

Over diversification is a real risk

More holdings do not always mean more safety. Too many funds can:

- increase fees and complexity

- hide your true exposure

- make rebalancing harder

Fidelity notes diversification is designed to reduce volatility over time by limiting exposure to any one type of asset. (Fidelity). Limiting exposure is the goal. It is not collecting tickers.

Risks diversification cannot fully remove

It is critical to stay honest. Diversification is not invincible.

Market wide crashes can still hurt

In a global crisis, many risky assets can fall together. That is real. Diversification may reduce damage. It may not prevent losses.

Inflation can be the sneaky thief

Inflation risk can hit both stocks and bonds in certain regimes. That is why some investors add inflation linked bonds or real assets.

BlackRock’s Fall 2025 materials discuss shifting regimes and the need to rethink how diversification is achieved. (BlackRock).

Liquidity and time horizon matter

If you need money soon, long term assets can be dangerous. That is not about diversification. That is about matching time horizon to risk.

Cash and short term instruments can be a calm buffer. That buffer can be essential for peace of mind.

Common mistakes that sabotage diversification

Most investors do not need more information. They need fewer mistakes. Consequently, this section can save real money.

Mistake 1: Confusing “more funds” with “more diversification”

If your funds own the same top stocks, you are not diversified. You are duplicated.

A practical fix is to look at:

- top 10 holdings

- sector weights

- country weights

If it feels complex, simplify the lineup.

Mistake 2: Home bias that becomes a blind spot

Many investors overweight their home country. It feels safe. Yet it can be risky if your job, property, and currency are also tied to that country.

Vanguard emphasizes diversification across industries, countries, and risk profiles. (Vanguard).

Mistake 3: Chasing last year’s winner

Performance chasing is emotional. It feels urgent. It also often arrives late.

A better approach is to set your allocation first. Then rebalance calmly. That calm is a powerful edge.

Mistake 4: Ignoring bond risk

Bonds have risks. Duration risk matters. Credit risk matters. Liquidity matters.

If you buy long duration bonds for safety, you may be surprised. A mix that includes shorter maturity bonds can reduce sensitivity to rate moves. That can feel like relief.

A practical, no drama diversification blueprint

You can build a strong plan without complexity. Additionally, you can scale it as you learn.

Step 1: Define the purpose of each bucket

Give each part a job:

- Growth bucket: long term wealth building

- Stability bucket: reduce volatility and fund near term needs

- Optional bucket: small sleeve for personal themes

When every bucket has a job, you stop guessing.

Step 2: Choose the simplest tools that meet the job

Broad, low cost funds can do a lot. Target date funds can do even more for hands off investors. (investor.gov).

If you do use individual stocks, keep them as a small satellite. Also keep them diversified across sectors. Investor.gov warns that only a few individual stocks is not truly diversified. (investor.gov).

Step 3: Commit to one rebalancing routine

Pick a day. Put it on your calendar. Review calmly. Rebalance if needed. Then move on.

Investor.gov offers a straightforward rebalancing example that is easy to follow. (investor.gov).

Step 4: Protect your plan from you

Automation is your friend. Auto contributions reduce stress. They also reduce timing regret.

This is not weakness. It is smart design.

Conclusion: diversification is confidence you can earn

Diversification is not about predicting the future. It is about preparing for many futures. That mindset is empowering. It is also practical.

In late 2025, concentration risk, shifting rates, and fast narratives made many investors feel anxious. A diversified portfolio cannot remove uncertainty. Still, it can reduce fragile exposure. It can smooth the emotional ride. It can help you stay invested through noise.

The most successful investors often look boring. They are disciplined. They are consistent. They are diversified. That is the quiet, proven path to a stronger investing life.

Sources and References

- Asset Allocation and Diversification (FINRA)

- Asset Allocation, Diversification, and Rebalancing 101 (investor.gov)

- Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing (investor.gov)

- Portfolio diversification: What it is and how it works (Vanguard)

- Rebalancing your portfolio: How to rebalance (Vanguard)

- What Is Portfolio Diversification? (Fidelity)

- US stock market concentration is less extreme than you think (Reuters)

- The Growing Risk Behind Market Concentration (TD Bank)

- 2025 Fall Investment Directions: Rethinking diversification (BlackRock)

- Diversify Your Investments (investor.gov)