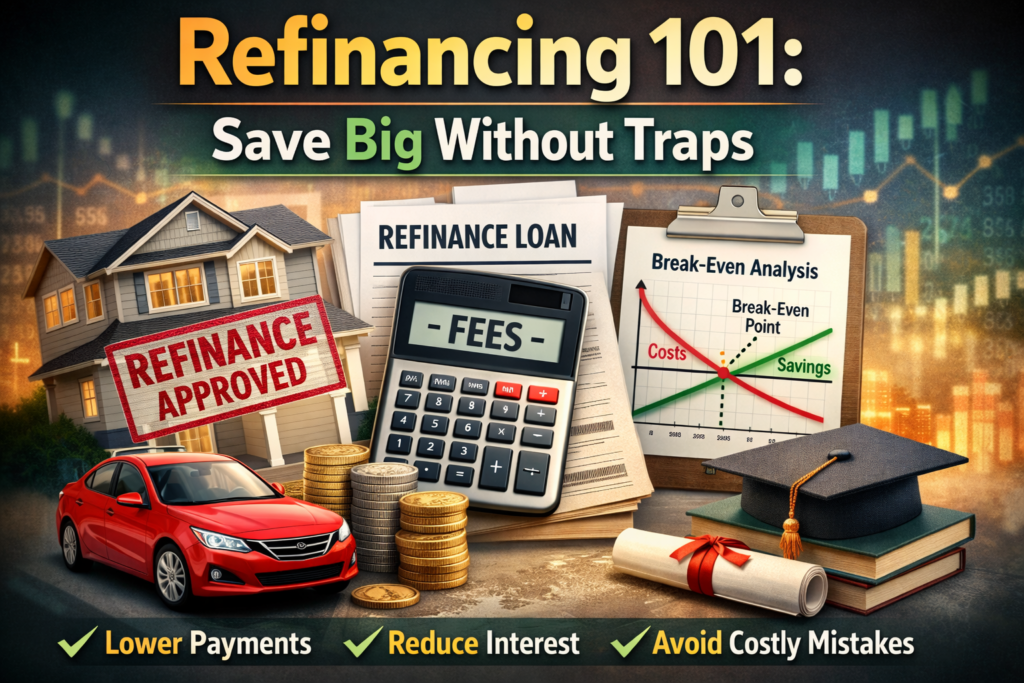

Refinancing can feel like a breakthrough button. Press it, and your payment drops. However, the wrong refinance can quietly drain your money for years. This guide shows you how to compare mortgage, auto, and student refinancing with clear math, strong documentation, and a future-ready mindset.

The core idea: you are “buying” a new loan

Refinancing is not a magic discount. It is a trade. You replace an old contract with a new one. That trade can be rewarding and powerful. It can also be dangerous if fees, timing, or terms are wrong.

Additionally, lenders can structure a refinance to look cheap today while costing more later. Your job is to see the full picture.

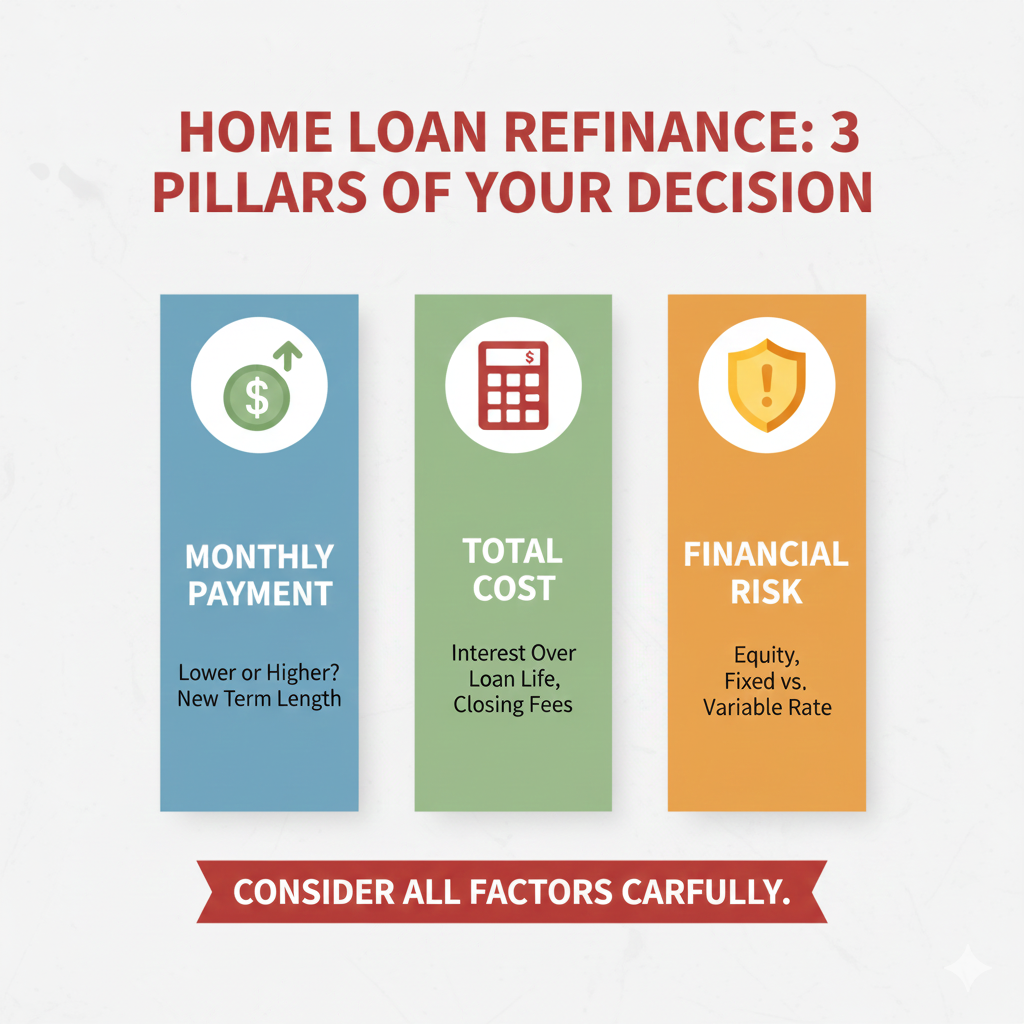

Your three decision lenses

A refinance is smart when it wins on at least one of these lenses, without destroying the others.

First, monthly cash flow. This is the immediate relief lens. It matters if your budget is tight.

Second, total cost. This is the crucial lens. It looks at interest plus fees over time.

Third, risk control. This is the protective lens. It covers stability, flexibility, and worst-case outcomes.

Moreover, the best refinance wins on all three.

Step 1: Define the exact goal before you shop

People refinance for many reasons. The safest way is to choose one main goal. Then design the loan around it.

Goal A: Lower your rate and total interest

This is the classic reason. It is usually a rate-and-term refinance. The loan amount stays close to the current balance.

However, rate savings can be erased by high fees or a longer term.

Goal B: Lower the payment fast

This goal can be vital in a high-cost season. You might extend the term to reduce the payment.

Consequently, you must measure the long-run cost. A lower payment is not always a win.

Goal C: Convert risk, like adjustable to fixed

This goal is about safety. A fixed rate can feel like a reliable shield when rates swing.

Additionally, this goal can be worth it even if the rate is slightly higher.

Goal D: Pull cash out, carefully

Cash-out refinancing can fund renovations, debt payoff, or other plans.

Meanwhile, it can also turn your home or vehicle into a debt engine. Treat it as a high-stakes move.

Step 2: Learn the break-even point, then stress-test it

Break-even is the time it takes for monthly savings to cover refinance costs.

It is simple in concept. It is also easy to fake with bad assumptions.

How to calculate break-even

Start with two numbers.

First, total refinance costs you pay. Include lender fees, third-party fees, and points. Also include any financed fees, because they still cost you.

Second, your monthly savings. That is old payment minus new payment, adjusted for insurance or taxes if they change.

Break-even months = total costs divided by monthly savings.

Additionally, do a second version using interest savings, not payment savings. Payment can fall because the term got longer. That can be a trap.

Stress-test questions that expose hidden risk

Ask these questions with brutal honesty.

Will you move or sell before break-even.

Could your income drop for three months.

Are you using the refinance to avoid a deeper spending problem.

Furthermore, if the answer feels shaky, the refinance must be extra clean to be worth it.

[YouTube Video]: Mortgage refinancing explained with clear decision logic and break-even thinking.

Step 3: Spot “no-closing-cost” claims before they bite

“No-closing-cost refinance” sounds like a guaranteed win. Often, it is a pricing shift, not a gift.

Typically, you pay costs through a higher rate, or through fees folded into the balance. The cost still exists. It just hides.

The CFPB warns that “no-cost” offers may mean you pay elsewhere. That is a critical reality check. (consumerfinance.gov)

How to test a no-cost offer

Request two quotes from the same lender.

One with closing costs paid upfront and a lower rate.

One with “no closing costs” and the higher rate.

Then calculate which wins at 24 months, 60 months, and 120 months.

Additionally, choose the scenario that matches your likely timeline, not your fantasy timeline.

Step 4: Use the documents that protect you

For mortgages, two forms are your best defense: the Loan Estimate and the Closing Disclosure.

They are designed to make surprises harder. They are not perfect, but they are powerful.

CFPB’s “Know Before You Owe” tools help you compare these documents line by line. (consumerfinance.gov)

What to check on the Loan Estimate

Focus on a few high-impact areas.

Rate and whether it is locked.

Loan term and whether it changed.

Projected payments and if they include escrow.

Closing costs summary and lender credits.

Moreover, watch discount points. Points can be smart. They can also be overpriced.

CFPB has highlighted how points and closing costs can reshape affordability. (Coast Central Credit Union)

What to confirm on the Closing Disclosure

Compare it to the Loan Estimate. Differences should be explained.

If fees moved up, ask why.

If the cash needed at closing jumped, stop and re-check.

Additionally, do not sign while confused. Confusion is expensive.

Mortgage refinancing: the clean path vs the costly path

Mortgage refinancing is the most complex. It is also where the biggest savings can live.

However, complexity creates roomisks. So you need a structured process.

Step 1: Decide the refinance type

Rate-and-term refinance: You aim to lower the rate, or change term, or both.

Cash-out refinance: You increase the loan amount and take cash.

Additionally, some borrowers use streamlined options, depending on the loan type. Rules vary, so verify details with official program guidance.

Step 2: Choose the term strategically

A shorter term can build wealth faster. It can be thrilling to watch interest shrink.

Yet, a shorter term raises the payment. That can become dangerous if income is unstable.

Meanwhile, a longer term lowers payment but can raise total interest.

A strong compromise is to refinance into a similar term remaining, not a full reset to 30 years. That keeps the math honest.

Step 3: Compare offers the right way

Do not compare only rate.

Compare APR, closing costs, points, and the lender’s reputation.

Additionally, compare “cash to close” and how long the quote is valid.

Moreover, ask if there is a prepayment penalty. Many mortgages do not have one. Still, ask.

Step 4: Watch for the subtle traps

These traps are common.

Rolling too many fees into the balance.

Resetting to a long term without realizing it.

Paying points when you will move soon.

Taking cash out for lifestyle spending.

Consequently, your refinance can look like a win while quietly weakening your future.

What is emerging in mortgage refinancing

The refinance market changes fast when rates change. CFPB data has shown how rate shifts can make refinancing surge or collapse. (Federal Trade Commission)

Meanwhile, technology is pushing faster underwriting. Digital income verification, instant bank data, and automated valuation models are becoming more common. This can be efficient and convenient.

However, speed can reduce reflection. So your process must stay disciplined.

Auto refinancing: where small differences matter a lot

Auto refinancing is often simpler than a mortgage refinance. It can still be full of sharp edges.

Additionally, the auto market has seen strong debate about dealer practices, fees, and add-ons. Regulatory moves have also been active. (Federal Trade Commission)

Step 1: Know what you can refinance

You can refinance an auto loan if you have a clear title lien situation, stable income, and decent credit.

However, if your car is very old, or has high mileage, options can shrink.

Step 2: Pull the payoff and the current terms

Get your payoff quote from the current lender.

Confirm the interest rate, remaining balance, remaining months, and whether there are penalties.

Additionally, check if your loan is simple interest. Many are. It changes payoff timing.

Step 3: Shop beyond the dealership

Dealers can offer financing. They can also mark up rates and sell expensive add-ons.

The FTC has warned consumers to watch for unwanted add-ons like service contracts, GAP, paint protection, and similar products. (Consumer Advice)

Consequently, a smart move is to get pre-approved from a bank or credit union first. Then you negotiate from strength.

Step 4: Compare the real cost, not only the payment

A longer term can lower payment. It can also trap you in negative equity longer.

Additionally, if you refinance and extend the term, you may pay more overall, even with a lower rate.

Step 5: Protect yourself from add-on pressure

If you refinance after a dealer purchase, review the original contract.

Check what add-ons you paid for.

If you did not want them, ask about cancellation rules. Some products can be canceled for a refund. Rules vary.

Meanwhile, keep documentation. Paper wins disputes.

What is emerging in auto refinancing and dealer financing

Regulatory actions around auto retail practices have been high-profile, including the FTC’s CARS Rule efforts. (Federal Trade Commission)

However, the legal status of rules can change. So it is crucial to check current enforcement and state-level protections before you rely on a headline.

Additionally, more lenders are using alternative data and instant verifications. This can approve more people. It can also raise privacy concerns.

Student loan refinancing: the most dangerous place to “save money”

Student loan refinancing can be life-changing. It can also destroy benefits you cannot get back.

This is the area where “lower rate” can hide a brutal trade.

The key distinction: federal vs private

Federal student loans come with protections and programs. These can include income-driven repayment and potential forgiveness paths.

Private loans generally do not offer the same safety net.

Therefore, refinancing federal loans into a private loan can permanently remove federal benefits.

This is not a small detail. It is a critical, one-way door.

Step 1: Identify what you have

List every student loan.

Mark each as federal or private.

Write the balance, rate, and repayment plan.

Additionally, note whether any loan is in a forgiveness track. If it is, refinancing can be disastrous.

Step 2: Decide if you mean “refinance” or “consolidate”

Federal consolidation combines federal loans into a Direct Consolidation Loan. It can simplify payments. It can also change interest and timeline details.

The U.S. Department of Education explains the Direct Consolidation Loan process and trade-offs. (econ.wisc.edu)

Private refinancing is different. It replaces your loan with a private lender’s loan.

Moreover, these are not interchangeable. Confusing them is expensive.

[YouTube Video]: Clear explanation of student loan refinancing basics and how to compare offers.

Step 3: Use a “protection checklist” before refinancing federal loans

Ask yourself a few high-stakes questions.

Do you need income-driven payments to stay stable.

Do you rely on federal hardship options.

Are you pursuing public service forgiveness.

Additionally, if any answer is yes, refinancing federal loans may be too risky.

The CFPB has discussed how people sometimes tap home equity to refinance student loans, which adds serious risk. (cfsreview.com)

Step 4: Compare student loan refinance offers like a pro

Focus on these deal terms.

Fixed vs variable rate.

Term length and total cost.

Cosigner release policy.

Hardship and unemployment protections.

Additionally, check whether the lender offers flexible repayment during downturns. Some do. Many do not.

What is emerging in student loan refinancing

In 2024 and 2025, borrowers faced shifting repayment rules, court decisions, and policy debates. The environment has been tense and fast-moving.

Consequently, flexibility is more valuable than ever. A refinance that removes flexibility can be dangerously brittle.

Meanwhile, fintech lenders are offering faster approvals and more personalized pricing. That can feel innovative.

However, faster is not always safer. Always read the full contract.

Step 5: A step-by-step refinance workflow you can reuse

This workflow is designed to be practical and repeatable.

Step A: Gather your baseline facts

Get your current loan documents.

Confirm balances, rates, term remaining, and payoff.

Additionally, capture screenshots or PDFs. Keep a folder. Organization is powerful.

Step B: Collect three competing offers

For mortgages, get at least three Loan Estimates.

For auto and student loans, get pre-approvals or formal quotes.

Moreover, use the same assumptions across offers. Same term. Same amount. Same points strategy.

Step C: Run three comparisons

Monthly payment difference.

Total cost over your expected timeline.

Worst-case scenario test.

Additionally, do not skip worst-case testing. It is the safety net.

Step D: Negotiate

Yes, you can negotiate.

Ask for lower fees.

Ask for lender credits.

Ask to remove junk fees.

Additionally, if a lender refuses to explain fees clearly, that is a warning sign.

Step E: Lock, verify, and re-verify

If you lock a rate, confirm lock duration and conditions.

Then verify the final numbers before signing.

CFPB emphasizes using the Loan Estimate and Closing Disclosure to avoid surprises. (consumerfinance.gov)

When refinancing usually saves money

Refinancing tends to be a strong move when at least one of these is true.

Your rate drop is meaningful and fees are reasonable.

You will keep the loan long enough to pass break-even.

You are reducing risk, like variable to fixed, in a volatile rate world.

Additionally, you are consolidating complexity into something you can manage.

Moreover, the refinance supports your broader plan, not a temporary emotion.

When refinancing often fails

Refinancing often backfires in predictable situations.

You refinance repeatedly and keep paying fees.

You extend the term just to feel relief, then never prepay.

You take cash out for short-term spending.

You refinance federal student loans and lose protections you later need.

Consequently, the refinance becomes a slow leak.

Practical preparation for the next two years

Refinancing is becoming more data-driven. That trend will continue.

Therefore, you can prepare in advance.

Improve your “borrower profile”

Pay on time. That is essential.

Lower revolving utilization.

Avoid new credit right before shopping.

Additionally, keep stable income documentation ready.

Build a refinance-ready file

Keep pay stubs, tax returns, and bank statements organized.

For auto loans, keep registration and insurance ready.

For student loans, keep your loan list and servicer details current.

Moreover, speed and clarity can help you get better offers.

Watch policy and tech trends

Mortgage disclosures and fee transparency remain a major focus area in consumer protection. (consumerfinance.gov)

Auto retail rules and enforcement can shift with court rulings and agency priorities. (Federal Trade Commission)

Student loan policy debates can change repayment landscapes quickly. So flexibility remains precious.

A simple decision framework you can trust

If you want one reliable rule, use this.

Refinance only when the savings are clear, the risks are controlled, and the paperwork is fully understood.

Additionally, if you feel rushed, pause. Pressure is not proof.

Conclusion: make refinancing a strategy, not a reaction

Refinancing can be a proven wealth tool. It can also be a quiet trap.

The difference is your process. Strong comparisons. Clean documents. Honest timelines. Clear goals.

Moreover, the future will keep changing. Rates will swing. Rules will shift. Technology will speed up offers.

A calm, disciplined refinance approach will stay powerful in every market.

Sources and References

- CFPB: Is there a no-cost refinance? (consumerfinance.gov)

- CFPB: Know Before You Owe, Closing Disclosure (consumerfinance.gov)

- CFPB: Understanding the Loan Estimate (Fannie Mae Multifamily Guide)

- CFPB: Data Spotlight on mortgage rate changes and refis (Federal Trade Commission)

- Federal Student Aid: Direct Consolidation Loans (econ.wisc.edu)

- CFPB: Student loan refinance using home equity risks (cfsreview.com)

- FTC Consumer Alert: Spot unwanted dealer add-ons (Consumer Advice)

- FTC: CARS Rule press release (Federal Trade Commission)

- FTC: CARS Rule extension order (PDF) (Federal Trade Commission)

If you want, paste one real offer you received (rate, term, fees, and your current loan details). I will run the break-even and risk test on it.

good helping