Compare pet insurance with confidence. Learn waiting periods, claim limits, and the fine print that can save you real money when your pet needs care.

Why pet insurance feels urgent right now

Veterinary care has become more advanced. That is amazing news for pets. However, advanced care can be shockingly expensive. One emergency visit can turn into scans, surgery, and follow up meds. Consequently, many owners feel trapped between love and budget.

Pet insurance exists to reduce that pressure. Still, it is not magic. It is a contract. It can help fast, or disappoint fast, depending on how you choose.

Meanwhile, the industry is growing quickly. More pets are insured than ever. Premium volume has also surged in recent years, which signals rising demand and new competition. (NAPHIA)

This guide is built for beginners. It is practical. It is also forward looking. You will learn how plans work today, and what is changing next.

Start with the core question: what problem are you solving?

Many people shop pet insurance like they shop phone plans. That is a mistake. Instead, start with the risk you fear most.

Decide what you want insurance to protect

Some owners want help with a sudden accident. Others fear cancer treatment or chronic illness. A few want routine care support. Each goal points to a different plan design.

Accident only coverage can be cheaper. Yet it will not help with most illnesses. Accident and illness coverage is broader and far more common.

Wellness add-ons can be appealing. However, they often behave like a budget tool, not true insurance. That can still be useful, but you should price it like a subscription.

Decide what you can pay out of pocket

Insurance is strongest when it protects you from a bill that would wreck your finances. If you can comfortably pay $200 or $500, then a higher deductible might be fine. If $500 would hurt, choose differently.

Additionally, think in two time frames. Ask what you can pay today. Ask what you could pay during a stressful emergency.

Pet insurance basics you must understand before comparing plans

If you skip this section, the rest will feel confusing. So, take a breath. These are the moving parts.

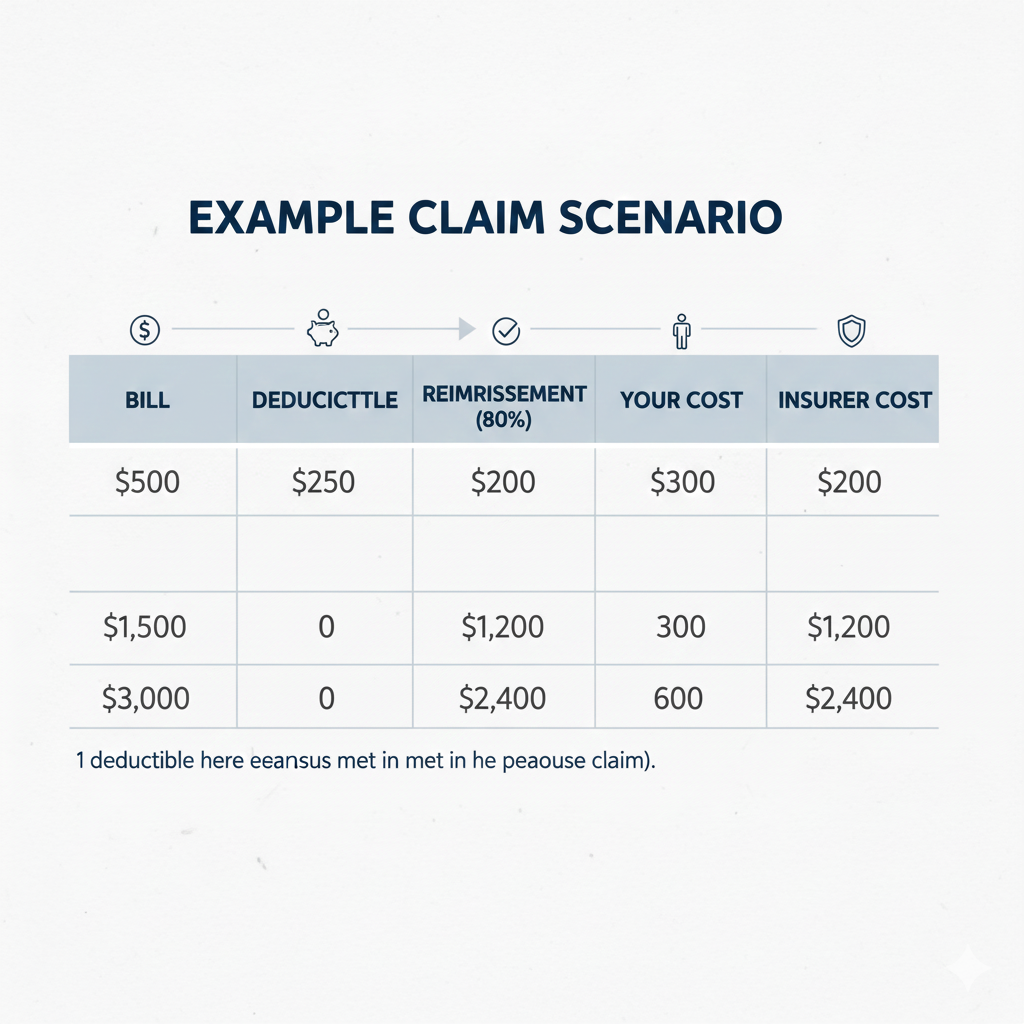

Deductible: the amount you pay first

A deductible is what you pay before the insurer reimburses. It can be annual. It can be per incident. Annual deductibles are common.

A lower deductible feels comforting. Yet it usually raises your premium.

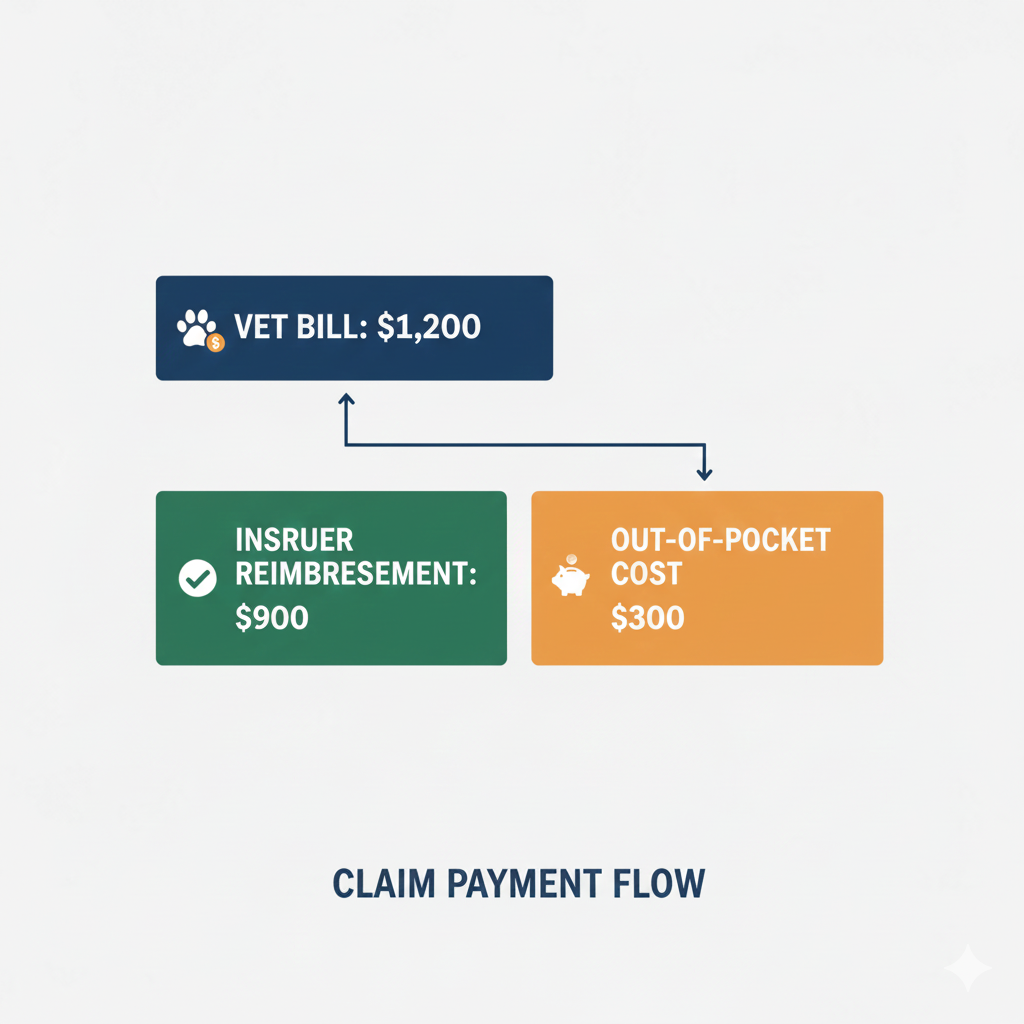

Reimbursement rate: the percentage you get back

After the deductible, the plan reimburses a percentage of covered costs. Common options are 70%, 80%, or 90%.

Higher reimbursement sounds powerful. However, it often costs more per month. Also, reimbursement applies only to eligible charges.

Payout limit: the ceiling that can quietly break a plan

This is where many people get hurt. Limits come in several forms:

An annual limit caps what the insurer pays each year. A per incident limit caps each condition or event. A lifetime limit caps the pet’s entire policy life.

If the limit is too low, one serious illness can hit the ceiling fast. Then you pay the rest.

Waiting period: the time when coverage is not active

Waiting periods are the hidden trap. They are usually different for accidents versus illnesses. Some plans also apply special waiting periods to orthopedic issues.

Waiting periods exist to prevent people from buying insurance only after a problem appears. That is understandable. Still, you must know the exact timing.

Pre-existing conditions: the most common denial reason

Most plans exclude pre-existing conditions. That can include symptoms that appeared before the policy started, even if you did not know the diagnosis yet.

Consequently, timing matters. Insuring a young, healthy pet is often easier than insuring later.

A reality check: is pet insurance worth it for you?

Pet insurance can be a smart hedge. It can also be a costly regret. The difference is clarity.

If you have strong savings and high risk tolerance, you may self-insure. If a $5,000 bill would force debt or panic, insurance can be a stabilizer.

Moreover, breed and age matter. Some breeds face higher risks for certain conditions. Older pets also face higher premiums and more exclusions.

[YouTube Video]: A clear, beginner friendly breakdown of whether pet insurance is worth it, plus common misconceptions that lead to disappointing claims.

Step 1: Compare plans using a simple scoring framework

Shopping can get chaotic fast. So use a framework. It keeps emotions from hijacking the choice.

Build a “minimum viable protection” checklist

Your baseline should answer three questions.

First, does it cover accidents and illnesses. Second, is the annual limit high enough for worst-case care. Third, is the reimbursement rate acceptable after deductible.

You are not chasing perfection. You are buying stability.

Use three scenarios to stress-test every plan

Scenario A: A broken leg with surgery. Scenario B: A chronic illness with ongoing meds. Scenario C: A sudden diagnosis that requires expensive treatment.

Now test the plan. Ask what you would pay under each scenario. You will be surprised how different policies behave.

Step 2: Decode waiting periods like a pro

Waiting periods sound boring. They are not. They can decide whether the first claim gets paid.

Typical waiting period patterns

Many plans set a short waiting period for accidents. Illness waiting periods are often longer. Orthopedic waiting periods can be longer still.

However, details vary. Some insurers reduce waiting periods with a vet exam. Others apply strict rules for ligament injuries.

Why orthopedic waiting periods matter so much

Knee injuries and hip issues can be common in active dogs. If your plan has a long orthopedic waiting period, you may be uncovered when it matters most.

Consequently, if you own a high-energy breed, you should read that clause twice.

How to protect yourself from waiting period surprises

Buy coverage before you think you need it. That sounds obvious. Yet many people delay until after the first scare.

Additionally, book a baseline vet visit right away. Keep the records. Clean records can reduce dispute risk later.

[YouTube Video]: A focused explainer on pet insurance waiting periods, why they exist, and how to avoid buying a policy that leaves you exposed early.

Step 3: Understand claim limits before you fall in love with a low premium

Claim limits are where “cheap” plans can become brutal.

Annual limits: the most important number for catastrophic risk

If a plan has a $5,000 annual limit, one serious event can wipe it out. After that, your protection is gone until renewal.

Meanwhile, veterinary costs can stack quickly. Emergency stabilization, imaging, surgery, and hospitalization can escalate fast.

So, if your main fear is a large bill, prioritize a higher annual limit.

Per incident limits: the sneaky cap

Per incident limits can look fine in marketing. In practice, a long condition can span multiple incidents. Or one “incident” definition can be narrow.

Consequently, you may hit the cap sooner than you expect. Ask how the insurer defines an incident.

Sub-limits and exclusions: read the fine print calmly

Some plans limit dental coverage. Some limit exam fees. Some limit rehab or alternative treatments.

Those limits are not always bad. Still, you must know them.

Step 4: Learn how reimbursement is calculated, because it changes everything

Two plans can both promise “90% reimbursement” and still pay very different amounts.

The pricing method can change your payout

Some insurers reimburse based on the actual vet bill. Others use a benefit schedule. Others use a “usual and customary” approach.

This is crucial. A schedule can cap reimbursement for a procedure, even if your vet charges more.

Therefore, ask which method is used. Then request examples.

Exam fees, taxes, and meds may be treated differently

Some policies reimburse exam fees. Some exclude them. Taxes might be excluded. Prescription food might be excluded.

These details can feel annoying. Yet they decide your real outcome.

Step 5: Use real examples to choose the right structure

Now we make it concrete. Imagine two owners, same dog, same emergency bill.

Example 1: High deductible, high annual limit

Owner A picks a $1,000 deductible and a very high annual limit. The premium is lower. The protection is strong for disasters.

This works best when you can absorb the deductible. It is also strong if you want catastrophic protection.

Example 2: Low deductible, moderate annual limit

Owner B picks a $250 deductible and a moderate annual limit. The premium is higher. Claims feel easier.

This works when cash flow is tight and you want help sooner. However, the moderate limit can be the breaking point in a major year.

Example 3: The “trap” plan

Owner C picks a very low premium plan with a low annual limit and a benefit schedule.

It looks safe. Yet the first serious claim is capped. The owner pays a painful remainder.

Consequently, always test the plan against a worst-case scenario.

Step 6: Choose the best plan for your pet’s profile

You are not insuring “a pet.” You are insuring your pet.

Puppies and kittens: your golden window

Young pets usually have fewer pre-existing issues. Waiting periods are easier to survive. Underwriting is smoother.

Also, early enrollment can reduce future disputes about “what existed before.” That is a powerful advantage.

Adult pets: balance premium and protection

Premiums rise with age. Yet you still want meaningful limits.

So, focus on the big levers. Annual limit, reimbursement method, and exclusions matter most.

Senior pets: protect against denial risk

Some plans restrict enrollment for older pets. Others enroll but exclude more. Some price steeply.

Therefore, compare not only price, but also what is realistically covered for that age.

Step 7: Claims process, because friction matters

A plan can be generous on paper and painful in practice. Smooth claims matter when you are stressed.

What a great claims experience looks like

Fast upload tools. Clear status updates. Predictable documentation needs. Transparent explanations for denials.

Additionally, look for clear appeal options. Mistakes happen. A good insurer fixes them.

Documents you should keep from day one

Keep vet records. Keep invoices. Keep the medical notes when possible.

This habit feels small. Yet it can be a lifesaver in a dispute.

Step 8: Common mistakes that cause expensive disappointment

Mistakes are normal. Still, these are avoidable.

Waiting too long to enroll

Delaying raises the odds that symptoms appear first. Then the condition may be excluded as pre-existing.

Assuming “wellness” equals “everything”

Wellness usually covers routine care up to set amounts. It is not a blank check.

Ignoring sub-limits

A plan might cover rehab, but cap it at a low amount. A plan might cover dental, but only extractions, not cleanings.

Not understanding the reimbursement method

This is the biggest hidden lever. Ask directly. Request a payout example.

What is changing next in pet insurance, and how to prepare

The future is not just higher premiums. It is also smarter products and tighter rules.

Regulation is pushing for clearer disclosures

In the United States, model and state efforts have focused on clearer definitions and consumer disclosures for pet insurance. For example, California has adopted disclosure oriented rules in its insurance code, reflecting a broader trend toward transparency. (NAPHIA)

Meanwhile, model frameworks like the NAIC Pet Insurance Model Act aim to standardize key disclosures and definitions across states, which can reduce confusion over terms like pre-existing conditions and waiting periods. (NAPHIA)

As a result, consumers should expect clearer documents. You should also expect more standardized language over time.

Technology is reshaping pricing and claims

Digital claims are already common. Next, insurers will likely use more automation for document reading and claim triage.

Additionally, tele-vet services may bundle with policies more often. That can improve access to advice. It can also reduce unnecessary ER visits.

Wearables and health tracking may also grow. Think activity trackers, smart collars, and weight monitoring. These tools can support preventive care.

However, there is a privacy angle. Data sharing will raise questions. Regulation may tighten around consent and use.

Industry growth is attracting new competition

NAPHIA data shows strong growth in premiums and pets insured over recent years. (NAPHIA) That growth attracts new brands.

More competition can be great. It can push innovation and improve service. Still, it can also mean more marketing noise.

So, the skill of comparison will matter even more.

Vet cost inflation is the pressure behind everything

Even when your premium rises, the underlying driver can be higher care costs. Advanced diagnostics, specialist care, and improved treatments all matter.

Consequently, the best way to prepare is to lock in a plan that fits your risk and budget, then maintain it.

A practical buying process you can follow this week

You can do this without becoming an insurance expert.

Day 1: Define your target protection

Pick accident and illness coverage unless you have a special reason not to. Choose a high enough annual limit for your worst fear.

Day 2: Choose your deductible and reimbursement

Pick the highest deductible you can truly afford in an emergency. Then choose the reimbursement rate that keeps premiums manageable.

Day 3: Audit waiting periods and exclusions

Read the waiting periods. Read orthopedic clauses. Read dental clauses. Check how pre-existing conditions are defined.

Day 4: Verify the reimbursement method with an example

Ask how reimbursement is calculated. Request an example payout for a common surgery. Compare plans using that same scenario.

Day 5: Buy, then document

Enroll. Save policy documents. Book a baseline vet exam if needed. Keep the records.

This process is simple. Yet it is powerful.

Conclusion: the “right” pet insurance plan is the one that behaves well under stress

Pet insurance should feel like relief, not a riddle. The best plan is not always the cheapest. It is the one that protects your finances when your pet needs you most.

Choose clear limits. Respect waiting periods. Understand reimbursement. Keep records. Then you can focus on what matters, which is care.

Sources and References

- NAPHIA: 2025 State of the Industry Report news release

- NAPHIA: 2024 State of the Industry news release

- NAIC Pet Insurance Model Act PDF (Vermont DOI)

- NAIC Pet Insurance Model Act PDF (NCOIL)

- California Insurance Code: Pet insurance disclosures

- California Department of Insurance: Consumer alert on pet insurance (SB 1217)

- NAPHIA: Pet insurance buying guide

- Consumer Reports: Pet insurance overview