Naked payments go mainstream in 2026: palm and iris scans promise instant, device-free checkout and tougher anti-fraud, but privacy rules tighten fast.

A new kind of payment is forming in plain sight

In late 2025, the payment ritual still looks familiar. You tap a phone. You insert a card. You type a PIN. You confirm with Face ID. It feels modern, yet it still relies on an object you can lose, steal, swap, or fake.

However, a sharper idea is spreading through finance and retail. What if the “thing” you carry is not a phone or card. What if the key is simply you.

That is the core of the so-called naked payment revolution. It is not about being reckless. It is about being device-less. You pay by presenting a biometric signal, often a palm scan, an iris scan, or a face template. The device becomes the terminal only. The credential becomes your body, matched to a secure identity record.

This shift is not happening in a vacuum. It is colliding with two powerful forces. First, AI-fueled fraud is exploding in sophistication. Second, regulators are treating biometrics as high-stakes data, not a casual feature.

Meanwhile, two names hover over this story like bright headlines. Sam Altman has been tied to biometric identity projects that aim to prove personhood in an AI era. Jamie Dimon represents the bank-grade anxiety of fraud, trust, and systemic risk. You do not need them to “invent” the trend. Still, they symbolize its pressure points: identity, security, and scale.

The most important question for 2026 is simple. Will biometric-first banking feel like a breakthrough, or a backlash.

Why 2026 is the inflection year

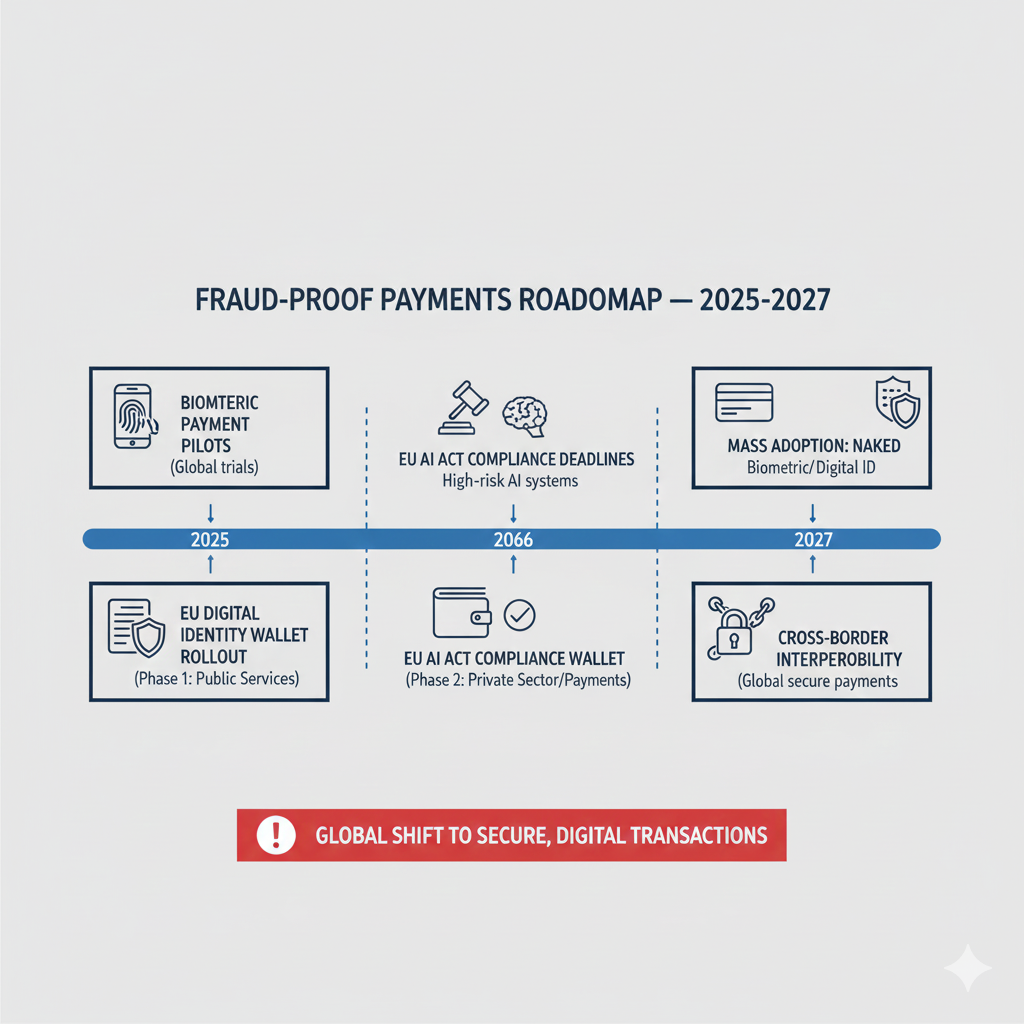

Several timelines converge in 2026. Payments innovation is accelerating. Fraud is becoming more automated. Privacy enforcement is getting sharper. In Europe, major AI compliance deadlines cluster around August 2026 for broad parts of the EU AI Act’s rollout. In parallel, digital identity infrastructure under eIDAS 2.0 is moving toward late-2026 wallet availability in EU member states.

Consequently, 2026 looks like the year biometric payments stop being a curiosity and start becoming a strategic battleground. Retailers want faster lines. Banks want fewer chargebacks. Consumers want convenience. Regulators want restraint. All sides want to avoid the next scandal.

What “biometric-first banking” actually means

Biometric-first banking is not a single product. It is a design philosophy. Your primary authentication factor is biometric, not a password or a device.

In practice, it can mean a few different flows.

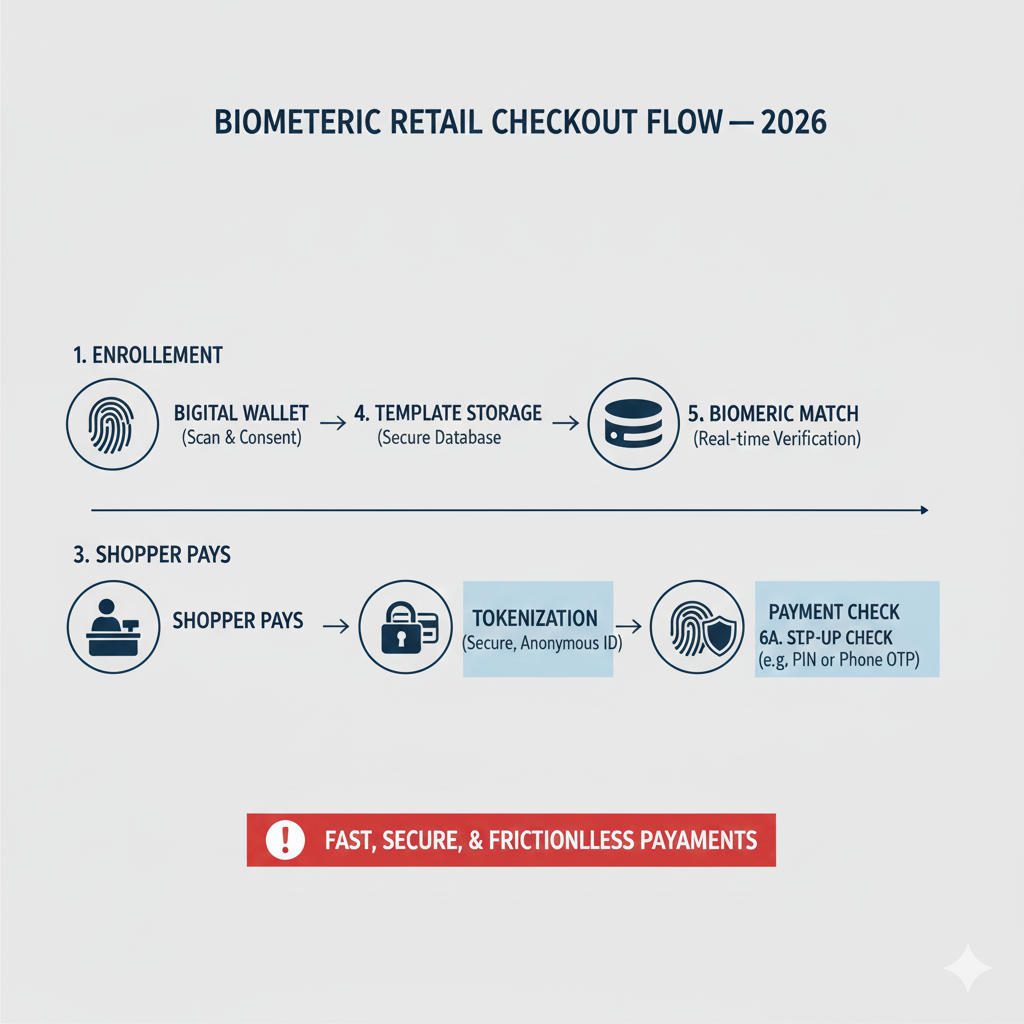

A customer enrolls once. Their biometric template is captured. The template is stored in a secure form, ideally on-device or in hardened infrastructure. When the customer pays, the terminal captures a new scan and compares it to the enrolled template. If it matches, the payment is approved.

Additionally, many systems add a second layer. They combine biometrics with tokenization, risk scoring, and behavioral signals. That extra layer is crucial. Biometrics alone should not be treated as magic.

Palm payments and iris scans are not the same risk

Palm recognition often uses vein patterns plus surface features. It is usually presented as contactless. It can be fast and comfortable. Retail pilots have tried it for checkout.

Iris scanning aims at high uniqueness. It is often framed as “proof you are a real person.” That matters in a world of bots. It also triggers deeper privacy debates, because the cultural reaction to eye-based identity can be intense.

However, both systems share a hard truth. If biometric data leaks, you cannot reset your palm like a password. That makes governance essential.

The emotional driver is fear, not convenience

Convenience is the marketing line. Fear is the real fuel.

Fraud now uses AI voice cloning, synthetic identities, and phishing that looks painfully authentic. The average consumer senses the shift, even if they cannot name it. Banks also feel it. When fraud rises, trust falls. When trust falls, adoption stalls.

So biometric-first banking is being pitched as a verified, decisive shield. It aims to make payments feel safer, cleaner, and more controlled.

Still, the promise is only as strong as the system design.

The fraud arms race that makes “being the key” attractive

Fraud is no longer just stolen card numbers. It is becoming industrial.

AI helps criminals generate believable texts, fake support calls, and deepfake video prompts. It also helps create synthetic identities that pass basic checks. That changes the economics of crime. Attackers can run more scams, faster, with less effort.

Meanwhile, classic payment security has a weakness. The credential is often separable from the person. Cards can be stolen. Phones can be hijacked. SIM swaps can bypass SMS codes. Even passcodes can be coerced.

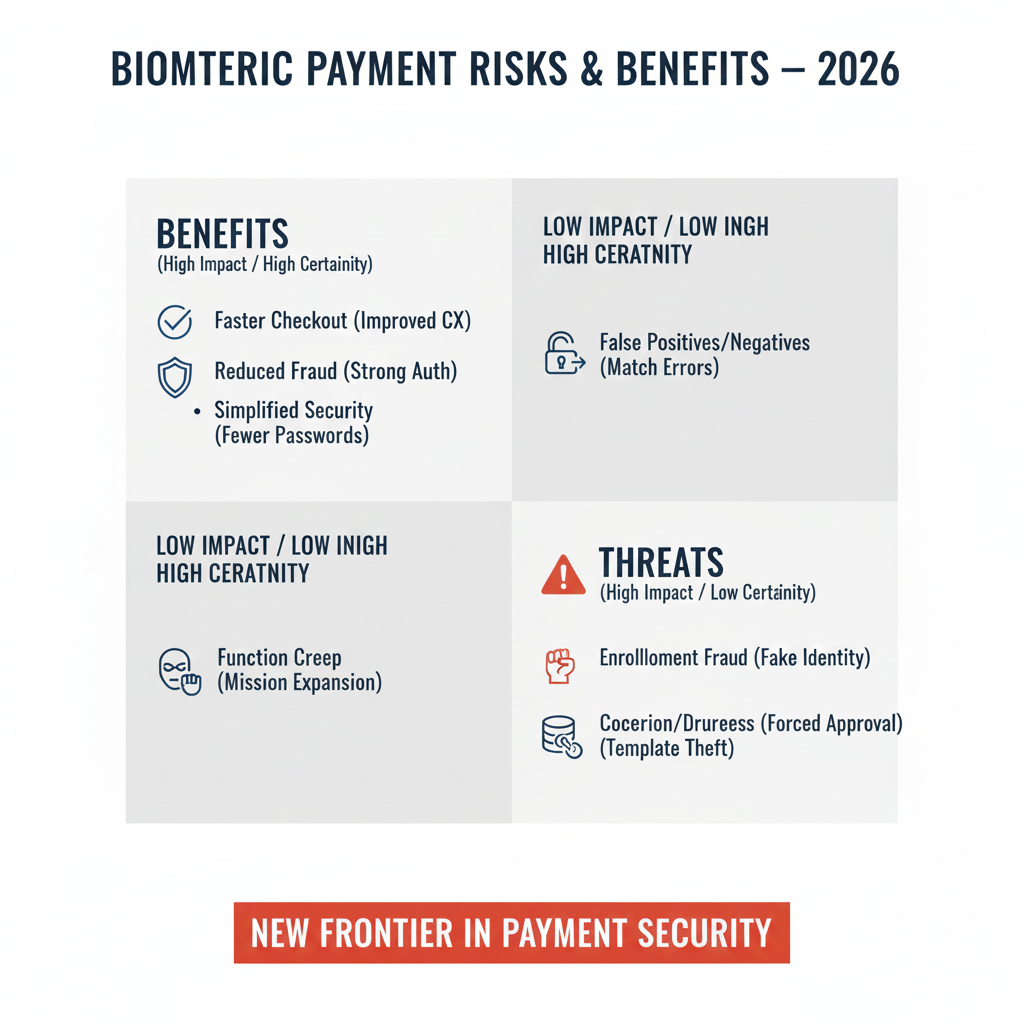

Consequently, biometric payments are marketed as “non-transferable.” If a thief cannot present your palm or iris, the transaction fails.

However, that story can be oversold.

Biometrics reduce some fraud types. They do not erase fraud. Criminals adapt. Attackers may shift toward enrollment fraud, coercion, insider abuse, or database compromise. So the real security battle moves upstream, into onboarding and governance.

The “enrollment moment” becomes the new front line

In 2026, expect enrollment to become more demanding. More liveness detection. More anti-spoof checks. More cross-checking with other signals. More friction, at least once, to earn the right to be frictionless later.

Additionally, banks and fintechs will treat enrollment like a vault door. If they get it wrong, every future payment becomes vulnerable.

That is why biometric-first banking is tied to identity infrastructure, not just payment rails.

Tokenization and risk scoring do the quiet work

Even when biometrics authenticate the person, modern payments still rely on tokenization. A token replaces the real card number. That reduces exposure.

Risk engines also score transactions. They watch location, device patterns, spending behavior, and merchant signals. They can step-up authentication if something looks off.

So the best 2026 systems will feel simple. Under the hood, they will be complex, layered, and relentlessly defensive.

The retail lab: where palm payments learn to scale

Retailers love speed. Lines are expensive. Every second at checkout matters.

That is why device-less payment pilots often start in retail. A palm scan can be faster than tapping a phone, especially if the phone triggers extra prompts. It can also help identify a loyalty account instantly.

Amazon’s palm-based system has been one of the most visible examples in recent years. It shows what large-scale enrollment and deployment can look like, even as privacy concerns remain active.

Furthermore, retail environments reveal a harsh truth. Payment tech must work under pressure. It must handle lighting changes, dirty sensors, rushed customers, and high throughput. A demo in a clean lab proves nothing. A busy store proves everything.

[YouTube Video]: A clear look at palm payments moving into grocery checkout, and why retailers think it cuts friction while raising privacy questions.

What changes when a store can “recognize” you

Recognition can feel thrilling. It can also feel invasive.

From a business view, recognition enables “one-to-one commerce.” Your offers can be personalized. Your identity can link to payments, loyalty, and customer service.

However, that is exactly what triggers regulatory and ethical scrutiny. Biometrics turn a normal transaction into a sensitive data event. In 2026, the winning brands will be the ones that make consent feel real, not buried.

The most likely 2026 retail pattern

Expect a hybrid approach next year.

Some customers will stay with cards and phones. Others will opt into palm or face-based checkout for speed. Retailers will push opt-in benefits, like faster checkout lanes or instant loyalty.

Meanwhile, more retailers will demand “privacy by design” contracts from vendors. Expect clearer retention policies. Expect better controls for deletion. Expect stronger audit requirements.

This is not idealism. It is survival.

The identity layer: why payments are merging with “proof of person”

Payments are ultimately identity claims. The system is asking: is this person allowed to move money.

In a world flooded with bots, identity becomes more valuable. That is why biometric projects increasingly talk about “proof of personhood.” They aim to show that a human, not a script, is initiating an action.

Sam Altman has been associated with identity initiatives that use biometric capture as a way to differentiate humans from AI agents. Whether you love that idea or hate it, it points to a 2026 reality: digital trust is being renegotiated.

However, identity and payments merging raises new risks. If a single identity becomes a universal key, it becomes a universal target.

So the 2026 debate will not just be about convenience. It will be about power concentration, surveillance anxiety, and governance credibility.

“Device-less” does not mean “system-less”

Some people hear “pay with your palm” and imagine no infrastructure. The opposite is true.

Device-less payments need heavy infrastructure. They need secure template handling. They need strong authentication logic. They need dispute and error handling. They need privacy controls.

Additionally, they need public legitimacy. If people suspect exploitation, adoption can freeze overnight.

That is why transparency will be a competitive advantage in 2026.

The trust test: can users exit cleanly

One key prediction for 2026 is that “exit” becomes a product feature.

Users will demand the ability to delete biometric templates. They will demand clarity on retention. They will demand portability or at least clean closure.

The brands that make exit easy will look confident. The brands that make exit hard will look suspicious.

That difference will matter.

The 2026 regulatory squeeze: AI rules, identity wallets, and biometric privacy

Innovation loves speed. Regulation loves evidence. In 2026, those forces collide.

Europe’s AI regulation timeline is a major signal. The EU AI Act rolls out in phases, with key compliance moments centered on August 2026 for broad obligations, while debates about timing and scope continue. Separately, eIDAS 2.0 drives a push for European Digital Identity Wallet availability by late 2026 across member states, shaping how identity verification can be standardized.

Meanwhile, biometric privacy laws in the United States remain fragmented. Illinois has long been famous for biometric litigation. Other states have their own rules. Enforcement trends suggest more scrutiny, not less.

Consequently, biometric-first banking in 2026 will not be a pure tech race. It will be a compliance race.

What regulators want in 2026

Regulators tend to focus on a few themes.

They want explicit consent. They want purpose limitation. They want minimal retention. They want security safeguards. They want accountability when things go wrong.

Additionally, they want to prevent “function creep,” where data collected for payments gets reused for unrelated purposes.

Expect more guidance, more enforcement, and more public debate next year.

The quiet but decisive rule: biometric data is not ordinary

The central regulatory message is emotional and practical. Biometric data is intimate.

It can identify you across contexts. It can be hard to change. It can be misused in ways that feel violating.

So in 2026, companies will need to treat biometrics as a certified high-sensitivity asset. They will need stronger governance than they used for emails or phone numbers.

That means higher costs. It also means higher trust when done well.

The technology stack that will define biometric payments in 2026

The future is not just “scan a palm.” It is a stack.

First, there is capture hardware. Second, there is matching logic. Third, there is secure storage. Fourth, there is payment tokenization. Fifth, there is fraud scoring. Sixth, there are privacy controls.

In 2026, the winners will build systems that are resilient, not just clever.

Liveness detection becomes a must-have

Spoofing is a constant threat. Attackers try photos, masks, molds, or replay attacks.

So liveness detection grows more advanced. It checks micro-movements, blood flow cues, depth signals, and timing patterns. It also uses AI to detect synthetic attacks.

However, liveness itself can create bias and accessibility issues. Some systems fail more often for certain groups. Others struggle with disabilities. So the 2026 product challenge is two-sided: stronger security, fairer outcomes.

On-device matching will be a premium design

When possible, on-device matching reduces exposure. A template stays local. The server sees only a result.

That model is not always possible for retail terminals. Still, expect more architectures that minimize central biometric databases.

Additionally, expect more encrypted computation approaches, where matching happens without exposing raw templates.

This is not science fiction. It is a practical response to public fear.

Passkeys and biometrics will coexist

Some people assume biometrics replace everything. More likely, biometrics blend with passkeys.

Passkeys aim to remove passwords, using cryptographic keys tied to devices. Biometrics often unlock the passkey locally.

So in 2026, the user experience may still involve a device in many cases. Yet the “naked” trend pushes beyond that, especially in retail and identity-linked ecosystems.

In other words, 2026 will be mixed. Not everyone goes device-less. Enough people do to reshape expectations.

Where Jamie Dimon fits: the bank-grade reality check

Jamie Dimon is not a biometric vendor. He is a symbol of bank-scale caution.

Big banks care about fraud, reputation, and regulatory exposure. They also care about operational risk. A shiny new payment method can become a crisis if it fails publicly.

Consequently, the Dimon-era posture is likely to be: innovate, but do not gamble.

In 2026, expect large banks to support biometric-first experiences where they can control risk. They may prefer biometrics as part of authentication, not as a universal identifier. They may favor step-up flows and layered defenses.

Additionally, banks will demand contractual protections from tech partners. They will want audit rights. They will want breach liability clarity. They will want certified security standards.

That conservative pressure will shape the market. It may slow some rollouts. It may also prevent catastrophic mistakes.

The bank prediction for 2026: less hype, more governance

By next year, the conversation shifts.

Instead of “look how fast this is,” the pitch becomes “look how responsibly this is built.” Expect more emphasis on privacy engineering. Expect more third-party audits. Expect clearer consent screens. Expect stronger deletion workflows.

Those are not glamorous features. They are essential features.

The privacy backlash risk: why this could implode

Biometric payments can feel futuristic. They can also feel creepy.

Backlash usually erupts for a few reasons. People feel tricked. They feel watched. They feel powerless to exit. They fear misuse. They fear a breach.

In late 2025, there is already public debate about face recognition, home cameras, and AI surveillance. That climate matters. If biometric payments are framed as “surveillance disguised as convenience,” adoption can stall.

Furthermore, regulators can react quickly when public outrage spikes.

So the biggest risk in 2026 is not technical failure. It is legitimacy failure.

The consent trap: “opt-in” that feels like pressure

If a store offers “biometric-only fast lanes,” is that still free choice. If a bank nudges users with constant prompts, is that still voluntary. If the default is on, is that still consent.

In 2026, expect watchdogs to examine these patterns. Expect journalists to highlight dark patterns. Expect lawsuits to target sloppy practices.

Consequently, the most successful biometric programs will be the ones that feel calm and respectful.

The breach nightmare: what happens if templates leak

A template is not always a raw biometric image. It is often a mathematical representation.

Still, leaks can be devastating. They can enable cross-matching. They can enable targeted scams. They can destroy trust.

So the security posture must be extreme. Encryption is baseline. Access controls must be tight. Monitoring must be relentless. Vendor risk must be managed.

This is where “revolutionary” becomes “responsible.”

The middle of the article: what instant biometric payments look like day to day

Imagine a 2026 morning.

You enter a grocery store. You pick items. At checkout, you hover your palm above a reader. The system confirms in under two seconds. Your receipt appears. Loyalty points apply. You walk out.

That feels like magic. It also feels like a new kind of contract. You traded a sensitive identifier for speed.

Now imagine an airport kiosk. Iris scan confirms your identity. A payment for lounge access is approved instantly. No phone needed.

These scenes are not guaranteed everywhere. Still, they are plausible in specific environments where terminals can be controlled and enrollment can be managed.

[YouTube Video]: A useful explainer on biometric identity projects and why “proof of person” is being pushed as AI accelerates.

The emotional truth: people will try it if it feels safe

Most users do not analyze architectures. They feel.

If biometric payments feel verified and respectful, adoption grows. If they feel sneaky or pushy, adoption stalls.

So 2026 will be a year of design psychology. The best experiences will be simple. The best policies will be visible. The best brands will sound confident, not defensive.

The inclusion question: who gets left behind

Biometric systems can fail for practical reasons. Injuries. Gloves. Lighting. Aging. Disabilities. Cultural objections.

So any 2026 rollout needs a graceful fallback. Cards. Phones. PINs. Human assistance.

If a company makes biometrics the only path, it risks discrimination and reputational damage.

Consequently, the winning strategy is choice, not force.

Predictions for 2026: what changes fast, what changes slowly

The biometric-first shift will not be uniform. It will be uneven, sector by sector, region by region.

Still, a few changes look likely next year.

Prediction 1: “Pay with palm” expands in controlled retail

More controlled retailers will test palm-based checkout. Expect expansions in environments where terminals are standardized and staff can support enrollment.

Additionally, loyalty programs will be paired with biometrics. The business case is powerful. Faster checkout plus deeper customer linkage is a tempting combo.

However, privacy messaging will determine success. Retailers will compete on how clean their consent looks.

Prediction 2: Identity tech and payment tech keep merging

Digital identity wallets, national ID modernization, and private identity projects will keep pushing the idea that identity can be portable.

Meanwhile, payment companies will want stronger authentication to fight fraud. That encourages integration.

In 2026, expect more partnerships between identity platforms and payment processors. Expect more pilots that connect verified identity to payment approval logic.

Prediction 3: Regulation becomes a product roadmap driver

Compliance deadlines in Europe and enforcement pressure in the United States will force changes.

Expect more data minimization. Expect shorter retention. Expect clearer opt-out. Expect tighter vendor contracts.

Consequently, compliance teams will shape product decisions earlier. They will not just review at the end.

Prediction 4: The market splits into “biometric-light” and “biometric-core”

Some banks and fintechs will use biometrics mostly as an unlock method. Think face or fingerprint unlocking a passkey.

Other systems will go deeper, using biometric identity as the core credential, especially in specific retail or identity ecosystems.

In 2026, both models will coexist. The second model will be louder. The first model will be more common.

Prediction 5: A backlash event forces better standards

History suggests a public incident is likely. A breach. A misuse scandal. A lawsuit. A viral story.

If that happens, standards harden. Vendors improve. Regulators clarify. Adoption slows briefly, then resumes in a safer form.

That cycle is painful. It is also normal for disruptive tech.

How to prepare for 2026, as a consumer

Preparation is not about fear. It is about control.

First, learn what you are opting into. Ask where the biometric template is stored. Ask how deletion works. Ask what happens if you stop using the service.

Additionally, keep a fallback payment method ready. That keeps you resilient.

Finally, watch for pressure tactics. If enrollment feels forced, pause. Convenience should not require surrender.

In 2026, the smartest consumers will treat biometrics like a powerful tool. They will not treat it like a toy.

How to prepare for 2026, as a business

For businesses, preparation is strategic.

Start with a clear purpose. If biometrics are used, define the exact benefit. Speed. Fraud reduction. Identity assurance.

Then design for trust. Make consent explicit. Make deletion easy. Make retention short. Make the fallback path smooth.

Additionally, stress-test your vendor. Demand audits. Demand breach response commitments. Demand data-handling clarity.

Finally, plan for scrutiny. Assume a journalist will read your policy. Assume a regulator will ask hard questions. Assume a customer will post complaints online.

If you prepare for that reality, you build a durable system.

The bottom line: 2026 is not just about paying faster

The naked payment revolution is a bold bet. It aims to make fraud harder and life simpler.

However, it also expands the surface area of privacy risk. It concentrates identity power. It raises questions about consent and control.

So 2026 will not crown a single winner. It will test designs, policies, and public trust.

If biometric-first banking becomes certified, transparent, and user-controlled, it can feel like a breakthrough. If it becomes pushy, vague, or exploitative, it can trigger a backlash that slows the entire category.

The future will not be decided by scanners alone. It will be decided by legitimacy.

Sources and References

- Amazon One overview and updates (Illinois General Assembly)

- Investopedia: What Is Amazon One? (YouTube)

- Reuters: Sam Altman-linked “World” launches in the U.S. (Reuters)

- Reuters: Spain orders Worldcoin to stop data collection (Freevacy)

- JPMorgan Payments: Biometrics and payments (JPMorgan Chase)

- EU AI Act responsibilities and key dates (Artificial Intelligence Act)

- Reuters: EU guidelines and AI Act path to Aug 2, 2026 (Reuters)

- Stibbe: eIDAS 2.0 implementation required by Dec 2026 (Stibbe)

- The Paypers: PSD3 and PSR timeline and considerations (The Paypers)

- Husch Blackwell: 2025 state biometric privacy law tracker (Husch Blackwell)

- Politico: Texas biometric privacy settlement context (Politico)

- MoFo: Data, cyber, and privacy predictions for 2026 (mofo.com)