A revolutionary lending shift is here: cash flow, rent, and digital signals are rewriting credit in 2025. See what changes in 2026 and how to win.

The headline is dramatic, but the shift is real

FICO is not “dead” in 2025. It is still powerful. It is still widely used. Yet the lending world is changing fast. What is dying is the idea that one number should rule every credit decision.

Lenders are under pressure. Consumers are under stress. Data is exploding. Meanwhile, new scoring models are moving into huge markets. New rules are arriving. New competitors are attacking old pricing.

Consequently, the FICO era is entering a new phase. It is less like a monopoly. It is more like a crowded arena.

Why FICO became the default language of credit

FICO rose because it solved a painful problem. It turned messy risk into a simple score. It gave lenders a shared standard. It allowed faster decisions. It became trusted, almost sacred.

That standardization felt safe. It felt proven. It felt certified by time.

However, the same strength created a weakness. A single score can hide nuance. It can miss context. It can punish people with thin credit history. It can also echo old inequalities baked into the system.

2024 and 2025 exposed the limits of “one-number” lending

Economic stress has made credit behavior more volatile. In the U.S., FICO reported the average credit score fell to 715 as of April 2025, down from 717 a year earlier, and that the drop was the biggest one-year decline since the post-2008 period. That is a warning sign. It tells lenders the old signals may be shifting.

Additionally, delinquencies matter more when rates are high. When payments get tighter, lenders want earlier warning. They do not want to wait for a score to fall after the damage is done.

As a result, lenders are hungry for richer signals. They want to see real cash movement. They want to see real payment habits. They want to predict risk earlier and more accurately.

What “alternative data” really means in lending

Alternative data sounds mysterious. It is not. It simply means credit signals beyond the traditional credit bureau file.

Traditional bureau data focuses on credit products like cards, loans, and mortgages. Alternative data can include bank transactions, rent payments, utility payments, telecom payments, payroll data, and verified platform activity.

Furthermore, “alternative” does not always mean “new.” Rent and utilities have existed forever. What is new is the ability to capture them reliably, verify them quickly, and use them at scale.

Cash flow data: the strongest challenger to the old model

Cash flow data is the most explosive category. It looks at money coming in and money going out. It can show income patterns. It can show bill timing. It can show overdrafts. It can show savings behavior.

This is powerful because it is close to reality. It is not a proxy. It is your financial pulse.

However, it must be used carefully. Transaction data is sensitive. It can be misread. It can also be noisy.

Still, when used with discipline, it can be a breakthrough tool for smarter lending.

Rent, utilities, and telecom: the “quiet gold” of responsible behavior

Many people pay rent faithfully for years. Many people pay electricity and phone bills on time. Yet these behaviors often do not show up in classic scoring the same way a credit card does.

That gap is critical. It is also unfair for many borrowers.

Consequently, modern models and market reforms are pushing to include this data. Some scoring approaches now claim to incorporate rent, utility, and telecom elements in ways that can expand access, especially for renters and thin-file borrowers.

Digital platform signals: helpful, risky, and easy to abuse

Some lenders also use platform data. Think of verified sales history for merchants. Think of gig income records. Think of invoice payment performance for small businesses.

This can be rewarding for borrowers who look “risky” on paper but are stable in reality.

Yet this category is also the most dangerous. It can create surveillance. It can create unfair profiling. It can be manipulated. It demands strict governance.

Therefore, the future is not “use every data source.” The future is “use the right data with verified value and clear consent.”

Why lenders are chasing alternative data in 2025

This is not a trend for novelty. It is a survival move.

Lenders want growth, but they fear losses. They want inclusion, but they fear fraud. They want speed, but they fear mistakes. Alternative data promises a thrilling solution: better decisions with more context.

Additionally, private credit capital has been moving aggressively into consumer lending in 2025. When capital flows into credit, competition rises. When competition rises, underwriting innovation accelerates.

The thin-file problem is still massive

Many adults and many small businesses do not fit the classic bureau model. They may be new to formal credit. They may avoid credit cards. They may operate in cash. They may be migrants. They may be young.

Classic scoring can label them as “unknown.” Unknown often means “denied.”

Consequently, alternative data becomes a bridge. It offers a second way to prove trustworthiness. It can be a vital path to inclusion.

Traditional scores struggle with context and timing

A score is a summary. It is not a story.

Scores often react after events occur. Cash flow can detect stress earlier. Trended credit data can show direction, not just a snapshot. Lenders want to see whether a borrower is improving or deteriorating.

Additionally, lenders want to reduce “false negatives.” That is when a good borrower gets rejected because the score missed something important.

Therefore, the most competitive lenders are moving toward blended decisioning. They still use bureau scores. They add cash flow. They add verified alternative signals. They use models that weigh context.

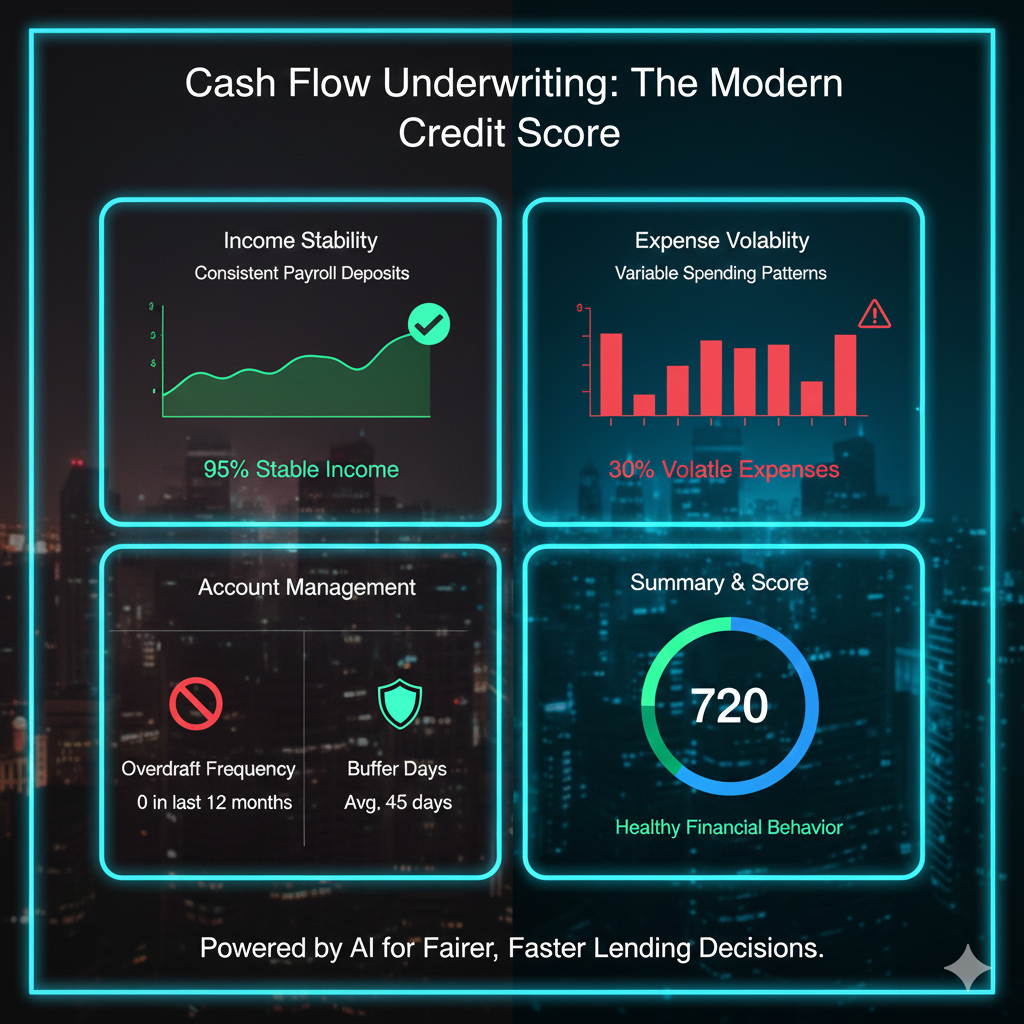

The new gold standard: cash flow underwriting

Cash flow underwriting is the center of gravity in 2025. It is the loudest promise. It is also the most misunderstood.

It does not mean “ignore credit history.” It means “upgrade the picture.” It means the lender looks at actual transaction patterns, usually with borrower permission, to evaluate affordability and risk.

Furthermore, many institutions are exploring this to approve more borrowers without raising losses, at least in theory.

Why cash flow can outperform a score in key moments

Cash flow can reveal stability in a way a score cannot.

It can show consistent income deposits. It can show whether the borrower keeps a buffer. It can show whether bills are paid before or after payday. It can show patterns of stress like repeated overdrafts or last-minute shortfalls.

Additionally, cash flow can detect “good risk” hidden behind a mediocre score. Someone might have a low score due to a past mistake. Yet their current cash behavior could be strong and stable.

That is a powerful, hopeful, and authentic idea. It can be life-changing for borrowers who were locked out.

Cash flow is not magic, and lenders must stay humble

Transaction data can mislead.

A borrower might have irregular income that looks unstable but is normal for their work. A borrower might have hidden liabilities outside the observed account. A borrower might move money between accounts, creating confusing loops.

Consequently, the best systems focus on robust variables, not raw streams. They use clear affordability logic. They use explainable features. They monitor for model drift.

The mortgage market shock: competition is widening

One of the most important signals in 2025 is happening in mortgages. The U.S. mortgage market is enormous. For decades, classic FICO dominated conforming mortgage underwriting.

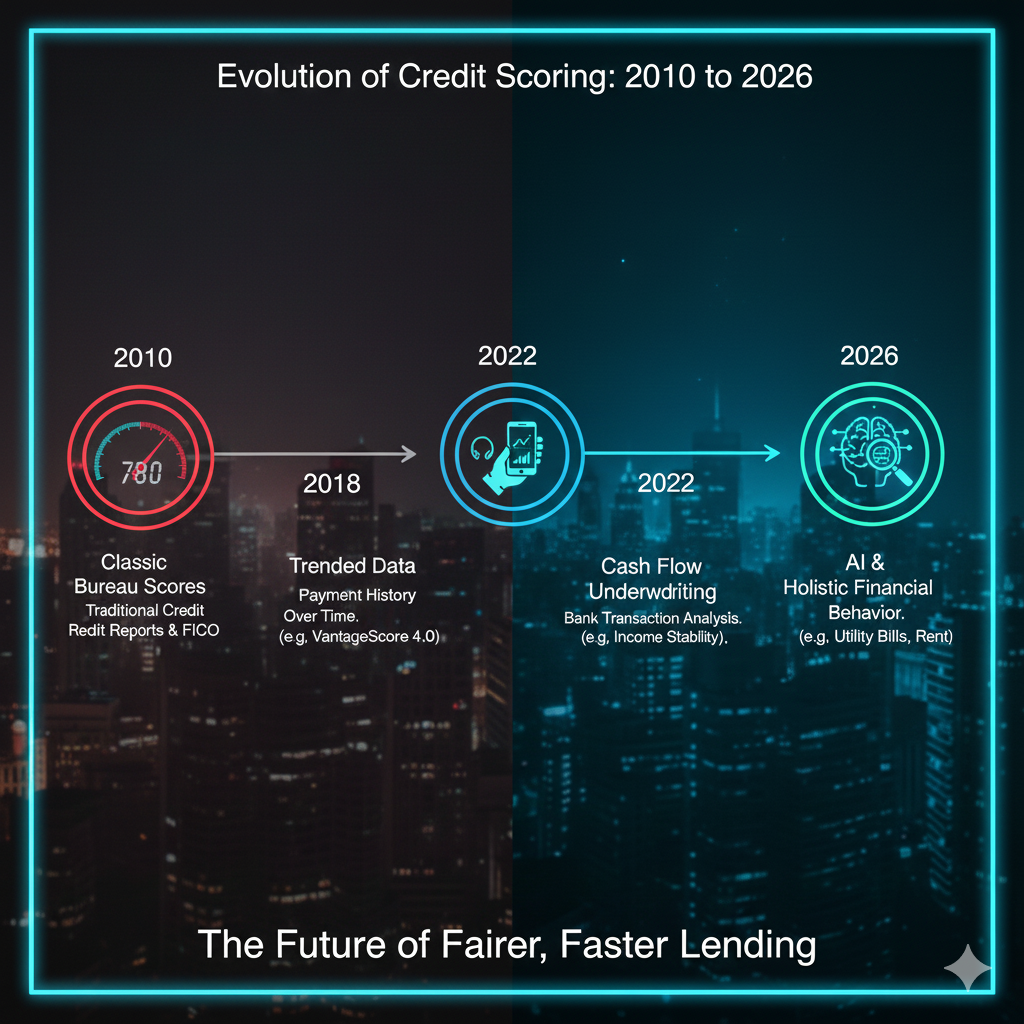

Now, the Federal Housing Finance Agency has approved the use of VantageScore 4.0 alongside FICO 10T for loans sold to the Enterprises. That is a structural shift. It signals that “one-score rule” is weakening in high-stakes markets.

Additionally, FICO 10T itself represents a change. It uses trended data. It reflects behavior over time, not just a single moment. This is still “FICO,” but it is also an admission that older models needed an upgrade.

Consequently, the “death of FICO” narrative is too simple. The real story is sharper: scoring is evolving, and the market is demanding richer models.

Trended data: a halfway bridge between old and new

Trended credit data looks at how balances and payments move over time. It can show whether utilization is rising. It can show whether a borrower is paying down debt or sliding deeper.

This is not alternative data in the broad sense. Yet it is a major step toward more dynamic risk models.

Additionally, it helps lenders detect momentum. Momentum matters in 2025. It will matter even more in 2026.

Alternative data enters the “approved” world

When large regulators approve new models, it has a ripple effect. It legitimizes innovation. It pushes vendors and lenders to invest. It encourages data partnerships.

However, it also triggers a new fight: transparency. If models are more complex, consumers will demand clearer explanations. Regulators will demand stronger evidence. This pressure is essential, not optional.

The dangers of alternative data are real and urgent

Alternative data can be empowering. It can also be harmful. The same tools that expand access can deepen inequality if used badly.

Therefore, any serious analyst must discuss the risks with brutal clarity.

Privacy and consent are the first battlefield

Cash flow data can reveal intimate life details. It can show health spending. It can show family support. It can show religion-related donations. It can show patterns of movement.

This is sensitive. It is critical. It is personal.

Consequently, consent must be meaningful. It must not be hidden in tiny text. It must be specific. It must be revocable. Lenders and platforms must minimize data collection and retention.

Bias and fairness can get worse, not better

Some people assume more data means more fairness. That is not guaranteed.

More data can encode bias in new ways. It can correlate with protected traits even if you never collect those traits directly. It can penalize people for being poor in ways that look “objective” but are simply cruel.

Additionally, machine learning models can become opaque. If a borrower is denied, they deserve a clear reason. They deserve a path to improve. They deserve dignity.

Therefore, explainability is not a luxury. It is a vital safeguard.

Model risk and “drift” become serious in 2026

Models can degrade when conditions change.

If a model was trained in a stable period, it may fail in a downturn. If fraud tactics change, approvals may become reckless. If regulation shifts, inputs may become unavailable.

Consequently, the next era of lending is not only about scoring. It is about monitoring. It is about governance. It is about constant validation. This becomes even more important in 2026 as alternative data use expands.

Regulation in 2025 is catching up fast

Regulators are not asleep. They are watching. They are collecting evidence. They are debating boundaries.

In the U.S., Congress has published research primers on alternative data in financial services. The CFPB has also discussed how credit scores only tell part of the story and how cash flow data can add valuable insight.

Additionally, global institutions like the World Bank and the BIS have published work on how non-traditional data and machine learning can affect access to credit, risk, and financial inclusion.

Consequently, the policy direction is clear: more use of alternative data is likely, but with tighter expectations around fairness, privacy, and accountability.

The new rulebook will focus on four hard questions

First, does the data have a valid link to creditworthiness?

Second, is the data collected and used with clear consent?

Third, can the lender explain decisions in plain language?

Fourth, does the approach create unfair outcomes at scale?

These questions are not soft. They are essential. They will shape 2026 product design.

Mortgages are setting the tone for broader markets

When mortgage regulators accept multiple models and allow modern scoring, the rest of the market pays attention.

Additionally, pricing wars and competitive pressure can push adoption faster than expected. That can be exciting for innovation. It can also be risky if lenders rush without guardrails.

Therefore, 2025 is a transition year. 2026 may be the acceleration year.

What borrowers can do to benefit from the shift

This story is not only about lenders. Borrowers have power too. The new system can reward responsible habits that were invisible before.

However, borrowers must be strategic.

Make your “invisible discipline” visible

If rent reporting is available through a trusted pathway, it can help some borrowers. If utility payment history can be verified and used safely, it can support thin-file profiles.

Additionally, stable cash flow patterns can become a strength. Consistent deposits matter. Avoiding overdrafts matters. Keeping a buffer matters. Paying bills predictably matters.

These habits are not glamorous. They are proven. They are powerful. They are the authentic foundation of trust.

Protect your data like you protect your money

Do not grant account access lightly. Read what is being accessed. Prefer “read-only” access when possible. Avoid services that demand excessive scope for a small benefit.

Additionally, watch for scams that pretend to offer “instant score boosts.” Fraud thrives duringvei. Real tools are transparent. Real offers are verified. Real lenders are accountable.

Consequently, the best borrower strategy is balanced: leverage the new system, but stay vigilant.

What lenders and fintech builders must get right

The winners in 2026 will not be the loudest. They will be the most trustworthy.

Alternative data can create a thrilling growth engine. Yet trust is the real moat.

Build a “nexus” discipline: only use data that truly matters

Every data source must pass a strict test. Does it predict default in a stable, explainable way? Does it add value beyond the bureau file? Does it reduce unfair rejection?

Additionally, do not collect data just because it exists. Data hoarding is a liability. It increases breach risk. It increases compliance risk. It increases reputational risk.

Therefore, the gold standard is not “more data.” The gold standard is “better data with verified purpose.”

Make decisions explainable and contestable

If a borrower is denied, explain why in plain language. Offer a path to improve. Provide a way to dispute incorrect inputs.

Additionally, monitor models continuously. Test for bias. Test for drift. Stress test under downturn conditions. Keep humans involved for edge cases.

Consequently, responsible alternative-data lending can be both profitable and fair. Reckless alternative-data lending can be disastrous.

Conclusion: the score is evolving, not vanishing

The FICO Score is not disappearing overnight. It still matters. It still influences approvals, pricing, and access.

However, the monopoly mindset is fading. In 2025, lenders are moving toward richer decisioning. Cash flow underwriting is rising. Trended data is spreading. Rent and utility signals are entering mainstream scoring debates. Regulators are setting expectations that will reshape 2026.

Consequently, the real “death” is the death of simplistic lending. The new era is context-based credit.

This can be a breakthrough era for inclusion. It can also be a dangerous era for privacy and fairness if done wrong. The gold standard is not a magic model. The gold standard is trustworthy lending: verified data, clear consent, explainable decisions, and strong protections.

In 2026, borrowers who understand this shift will have an advantage. Lenders who earn trust will win for the long term.

Sources and References

- Federal Reserve: Alternative Data Expanding Access to Credit (Oct 2025 PDF)

- World Bank: The Use of Alternative Data in Credit Risk Assessment (2025 PDF)

- FinRegLab: Using Cash-Flow Data to Underwrite Small Businesses (Jun 2025 PDF)

- U.S. Congress CRS: Alternative Data in Financial Services (Nov 2024)

- FHFA: Credit Scores policy page (Jul 2025)

- FICO Blog: Status of FICO Score 10T in conforming mortgages (Dec 2025)

- BIS Bulletin: Digital innovation, machine learning, and credit to small firms (2025 PDF)

- OECD: FinTech lending in Sub-Saharan Africa (Jun 2024 PDF)

- Investopedia: Credit scores down, biggest one-year drop since crisis (2025)

- Datos Insights: A New Age of Underwriting Ushered in by Cash Flow Data (2024)

- CFPB Blog: Credit scores only tell part of the story, cash flow data (Jul 2023)

- YouTube: Plaid Effects 2025, Smarter lending with cash flow insights

- YouTube: Experian on AI and data shaping credit assessment