Loans now appear right where you shop and work. Discover the powerful, risky, and fast rise of embedded finance shaping credit in 2025 and 2026.

The moment credit becomes invisible

Credit used to be a destination. You went to a bank. You filled forms. You waited. The whole process felt serious, slow, and slightly intimidating.

Now, credit shows up like a button.

You pick a phone, a flight, a course, or even a grocery basket. Then you see it: “Pay in 4,” “Pay monthly,” “Instant credit,” “Split it,” “Try now, pay later.” There is no branch. There is no long application. There is barely a pause. The offer lives inside the app you already trust.

This shift is not a small feature update. It is a quiet redesign of borrowing itself. In 2025, many people borrow without thinking of it as “borrowing.” That is why “invisible credit” is the right phrase. Credit is becoming embedded, contextual, and frictionless. It feels effortless. That feeling is the point.

However, effortless credit can be both thrilling and dangerous. When borrowing becomes frictionless, the biggest risk is not the interest rate. The biggest risk is that you stop noticing the decision.

A checkout that sells credit

Modern checkout screens are not just payment pages. They are decision pages.

Platforms test wording, colors, and timing. They show monthly amounts instead of total cost. They highlight “0%” while burying late fees. They turn a loan into a comfort story: “You deserve this.” That is persuasive. It is also powerful.

Consequently, credit becomes part of product design. It is no longer only a financial product. It is a conversion tool. It raises sales. It reduces cart abandonment. It locks in repeat usage.

This is why retailers, marketplaces, travel apps, and software platforms keep adding financing options. They are not trying to become banks. They are trying to remove hesitation.

From bank loan to product feature

The old model made credit feel separate. That separation had a strange benefit. It forced reflection.

The new model makes credit feel like a setting. You toggle it on. You slide a plan. You proceed.

Additionally, many embedded offers are personalized. The app already knows your behavior. It knows your basket size, your return history, your income signals, and your payment patterns. That data helps price risk fast. It also makes the offer feel “made for you.”

That personalization can feel exclusive and flattering. It can also feel like pressure.

What embedded finance really is

Embedded finance means financial services placed inside non-financial products. You can pay, save, insure, invest, or borrow without leaving the platform you are using.

Embedded credit is the most emotionally loaded form, because it changes what people can buy today. It also changes what people owe tomorrow.

Meanwhile, the industry uses many labels: embedded lending, lending-as-a-service, BNPL, point-of-sale loans, revenue-based finance, card issuing, and more. The names differ, but the goal is consistent: move credit closer to the moment of desire.

Embedded payments vs embedded credit

Embedded payments are about moving money. Embedded credit is about borrowing money.

Payments are already close to invisible. Tap, face scan, done. Credit is following the same path, but with bigger consequences.

Furthermore, embedded credit often “rides on top” of payments. The same checkout flow can offer a card payment, a wallet payment, or a loan. From a user’s view, these options look similar. From a risk view, they are not similar at all.

The pipes: APIs, BaaS, and underwriting partners

Embedded credit works because of infrastructure.

APIs connect platforms to lenders. Banking-as-a-service providers supply regulated rails. Risk engines and data partners speed up identity checks, fraud detection, and affordability models. The platform controls the experience. A bank or lender often holds the balance sheet. Sometimes a private credit fund finances the loans indirectly.

As a result, a non-bank can “feel” like a bank to the customer. The customer sees one brand. Behind the screen, several companies share the work.

This partnership structure is why embedded credit can scale fast. It is also why accountability can feel blurry when things go wrong.

Why 2025 feels different

Embedded credit existed before 2025. What changed is intensity.

In 2025, consumer habits, platform competition, and capital markets all push in the same direction. Faster credit now meets higher demand. That combination creates momentum.

Consumers expect instant, contextual offers

People have trained themselves to expect speed. Delivery is faster. Support is faster. Content is instant. Payments are one tap.

So lending is pressured to match that tempo.

The Federal Reserve’s survey data shows BNPL usage becoming mainstream, with 15% of people using BNPL in the prior 12 months in a 2024 survey year, up from 14% in 2023 and 10% in 2021. (Federal Reserve) That rise signals normalization. Once something feels normal, people stop treating it as special.

Data and AI make underwriting faster

Traditional underwriting can be slow. Embedded lending is built to be fast.

Platforms use more signals than classic credit applications. They look at payment history, cash flow, device risk, account behavior, and more. AI models help rank risk quickly. Automation reduces manual reviews.

Additionally, fraud defenses are getting sharper. Identity checks, behavioral biometrics, and risk scoring can run in seconds. That makes approval feel smooth.

Still, speed has a cost. When decisions are automated, errors scale too. A bad model can deny credit unfairly. A weak model can approve fragile borrowers aggressively.

Private credit and balance-sheet shifts

Banks are not the only money source anymore.

A Financial Times report describes private credit firms piling into consumer debt in 2025, with figures compiled by analysts showing about $136 billion in consumer loan purchases or agreements in 2025 versus $10 billion in 2024. (Financial Times) This matters because it changes incentives. New capital wants growth. Growth can tempt looser underwriting.

Consequently, invisible credit is not just a tech story. It is a capital story.

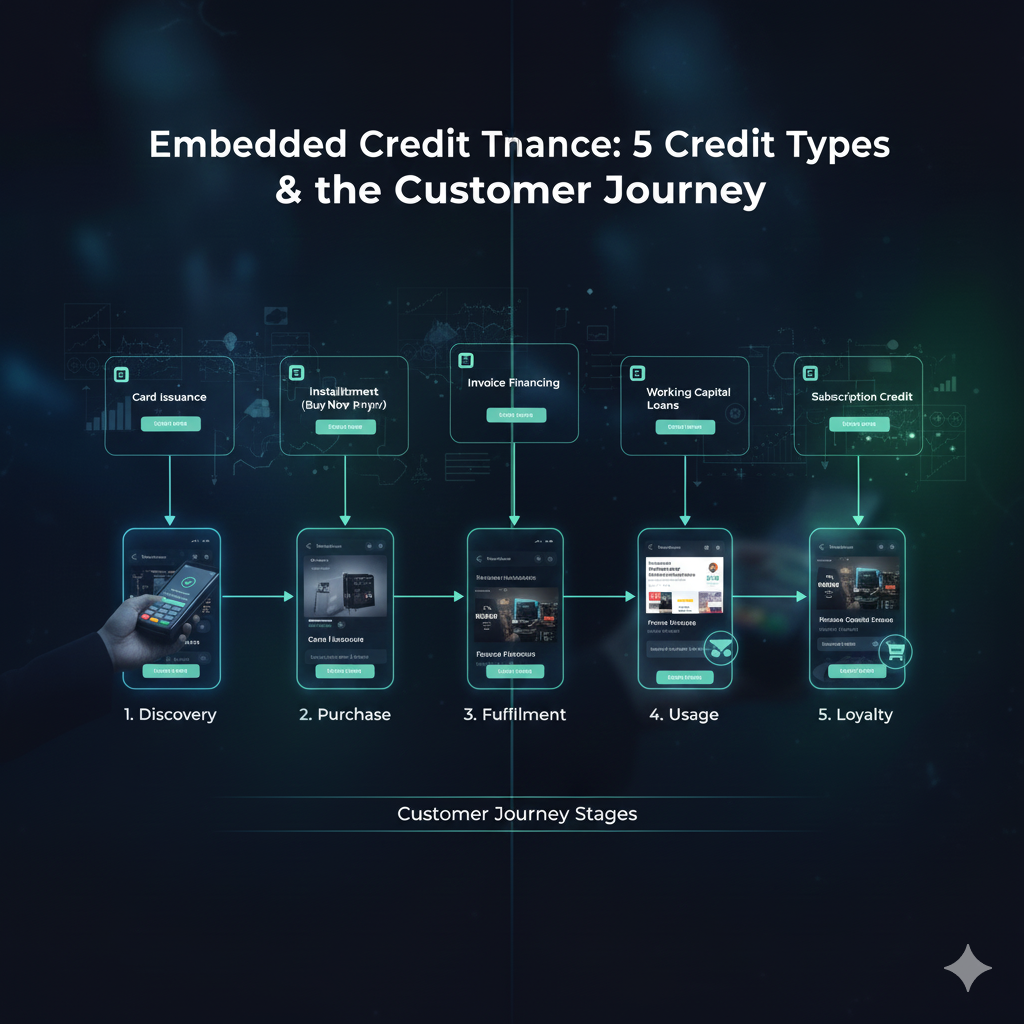

The new borrowing journey

Embedded credit redesigns the borrower’s journey. The steps still exist, but they are compressed.

Trigger, offer, decision, repayment

First comes the trigger. A purchase, a subscription, a booking, or a cash flow gap appears.

Next comes the offer. The platform presents a plan that feels simple. It often uses monthly language. It often emphasizes low friction.

Then comes the decision. This is the critical moment. The borrower chooses, often in seconds.

Finally comes repayment. This stage is where reality arrives. Autopay happens. Reminders fire. Late fees may appear. Credit reporting may begin, depending on the product and the market.

However, the emotional curve is uneven. The pleasure happens at purchase time. The pain happens later. That time gap is what makes embedded credit so seductive.

Credit scores still matter, but in new ways

Many embedded loans do not look like traditional credit cards. Yet credit bureaus still matter.

Some products report. Some do not. Some report only after delinquency. That inconsistency can confuse borrowers. It can also create “phantom debt,” where obligations exist across apps but do not feel centralized.

Meanwhile, regulators are pushing for clearer disclosure and more consistent protections. That pressure grows into 2026.

Invisible credit products you use without noticing

Embedded credit is not one product. It is a family of products. Each has a different risk shape.

Pay-in-4 BNPL and “one-click” installments

This is the gateway product for many consumers. It feels light. It feels harmless. It often looks interest-free.

Yet the emotional risk is stacking. One plan becomes two. Then five. The monthly burden grows quietly.

Additionally, BNPL often shifts attention from total price to small payments. That is psychologically powerful.

Point-of-sale loans for big purchases

For higher prices, platforms offer longer-term financing. This can look like a classic installment loan, but it is packaged inside checkout.

Sometimes the pricing is competitive. Sometimes it is expensive. The danger is that the slick flow hides the true cost.

Consequently, borrowers should treat point-of-sale loans like any other loan. Read APR. Read fees. Read total repayment.

Merchant cash advance and revenue-based finance

For small businesses, embedded credit often appears as “capital” inside the dashboard of a marketplace or payment processor.

The offer may be based on sales volume. Repayment may be a cut of daily revenue. The speed is the selling point. The cost can be the trap.

Furthermore, the language can be confusing. Some products avoid the word “loan.” That can reduce clarity for business owners.

Embedded cards and virtual cards

Some platforms issue cards inside apps. These can be debit, prepaid, or credit. Virtual cards can power B2B payments and expense flows. They can also connect to credit lines behind the scenes.

This can be efficient and rewarding. It can also make overspending easier, because the act of borrowing is hidden behind a card number.

Benefits that feel magical

Embedded credit exists because it works for many people. The benefits can be real, meaningful, and empowering.

Speed and convenience

The obvious win is speed. Approval can be instant. Checkout stays smooth. You avoid paperwork.

That speed can be a breakthrough for urgent needs. It can help with emergencies. It can reduce stress.

Additionally, convenience reduces “application fatigue.” Borrowers do not have to repeat forms across lenders.

Inclusion for thin-file borrowers

In some cases, embedded lenders can serve people with limited credit history by using alternative signals and cash flow patterns.

This can be rewarding for new workers, young adults, and people returning to the formal system. It can also help small merchants who lack classic collateral.

Still, inclusion must be authentic. If pricing is punitive, inclusion becomes exploitation.

Better pricing, sometimes

Competition can benefit borrowers. Platforms want conversion, so they negotiate better terms. Some merchants subsidize financing to raise sales.

Moreover, installment structures can be safer than revolving debt for some people. A fixed plan can be easier to manage than a never-ending balance.

However, that depends on transparency and discipline.

Risks that are easy to miss

Invisible credit has a dark twin: invisible harm. The harm is not always dramatic. Often it is gradual.

Stacking debt across apps

The biggest modern risk is fragmentation.

A borrower can have BNPL plans in multiple apps, a subscription financing plan, and a marketplace cash advance, all at once. Each one looks small alone. Together, they can become crushing.

Consequently, budgeting fails when debt is scattered. You cannot manage what you cannot see clearly.

Weak transparency and confusing responsibility

When a platform offers credit, users often assume the platform is the lender.

Sometimes it is. Often it is not.

That difference matters for complaints, dispute resolution, and hardship support. Regulators are pushing for clearer accountability, but confusion still happens.

Fees, late charges, and rising delinquencies

Many “0%” offers still carry late fees. Some carry high effective costs once you miss payments.

As BNPL scales, scrutiny grows. Public agencies have published more data on usage and outcomes, and the policy debate is heating up. (Consumer Financial Protection Bureau)

Meanwhile, lenders also face cycles. If the economy softens, consumer stress rises. Late payments increase. Lenders tighten. That can create a sudden shock for borrowers who got used to easy approvals.

Data privacy and unfair outcomes

Embedded credit depends on data. More data can reduce fraud. It can also create privacy risk.

Borrowers may not realize which data is used. They may not know how long it is stored. They may not understand which partners receive it.

Additionally, automated models can produce unfair outcomes if training data reflects past inequality. That is why transparency, auditing, and explainability are becoming vital in 2025 and 2026.

When the platform is not a bank

Banks face strict rules. Platforms often do not, even if they “feel” like banks.

This is why regulators are focusing on consumer protection, disclosure, affordability checks, and complaint pathways. That shift is most visible in BNPL regulation plans for 2026 in the UK. (FCA)

Regulation and guardrails in 2025, and what shifts in 2026

The regulatory story is catching up to the product story.

In 2025, the key question is simple: should embedded credit be treated like traditional credit when it walks and talks like traditional credit?

The UK: BNPL moves toward FCA regulation in 2026

In July 2025, the UK Financial Conduct Authority published proposals that include affordability checks and stronger support for borrowers in difficulty. The FCA also pointed to the regime coming into effect when BNPL comes under its remit in 2026. (FCA)

Additionally, UK government documents in 2025 discuss consultation responses and the move to bring BNPL products into regulation. (GOV.UK)

This is a big deal. Affordability checks can slow approvals. They can reduce harm. They can also reshape business models that depended on frictionless growth.

The US: data, scrutiny, and clearer expectations

In the US, regulators have focused on understanding BNPL usage, credit record connections, and consumer impacts. CFPB research reports in 2025 provide descriptive statistics and matched credit record analysis for major BNPL firms. (Consumer Financial Protection Bureau)

This signals a serious direction. Data leads to rules. Rules lead to compliance. Compliance changes product design.

Open finance and the next layer of borrowing

Payments moved from cash to cards to wallets. Credit is now moving from banks to platforms. The next layer is “open finance,” where more financial data can be shared securely to improve lending decisions.

In theory, that can produce better pricing and less exclusion. In practice, it can also expand surveillance and create new power imbalances.

Therefore, 2026 is likely to bring louder debates about consent, data scope, and fairness.

How to borrow safely in an embedded world

Borrowing is not evil. Bad borrowing is.

Here is a practical way to keep embedded credit beneficial instead of harmful.

A simple pause before you tap “confirm”

First, force a tiny pause. Ten seconds can save months of stress.

Ask three questions:

- What is the total cost, not the monthly cost?

- What happens if I miss one payment?

- Would I still buy this if credit was not offered?

Additionally, check whether you are stacking plans elsewhere. One small plan is manageable. Five plans are exhausting.

How to spot high-quality offers

High-quality offers share a pattern.

They disclose total repayment clearly. They show fees plainly. They provide support options. They offer easy payment scheduling. They explain who the lender is.

On the other hand, risky offers hide details behind tiny links. They use vague phrases like “as low as.” They make cancellation hard. They push urgency too hard.

Consequently, trust your discomfort. If an offer feels pushy, slow down.

Protect your identity and your data

Embedded credit is a fraud target.

Use strong passwords. Turn on device locks. Avoid borrowing on public Wi-Fi. Watch for fake checkout pages.

Also, read privacy summaries when you can. If a platform is harvesting extreme data for a small loan, that is a red flag.

What businesses and lenders are changing

Embedded finance is reshaping strategy for everyone involved.

Platforms want revenue and loyalty

Platforms love embedded credit because it increases conversion and retention. It also creates fee revenue. Some also earn interchange through embedded cards.

This can be profitable and scalable. It can also become addictive for the platform itself. When growth depends on credit, leaders may push credit harder than they should.

Lenders want distribution

Banks and lenders want customers. Platforms own attention. That creates a strong marriage.

However, distribution without discipline is risky. If underwriting quality slips, losses rise fast. That is why partnerships increasingly focus on risk controls, monitoring, and shared accountability.

Trust becomes the real differentiator

In 2025, many platforms can embed credit. In 2026, the winners may be the ones that embed trust.

Trust means clear pricing. It means fair treatment. It means fast support in hardship. It means strong fraud defenses. It means simple dashboards that show total obligations.

That kind of trust is not just ethical. It is strategic.

2026 outlook: where invisible credit goes next

Embedded credit is still early. The next stage looks both exciting and intense.

AI agents and proactive credit

AI is moving from “approval engine” to “assistant.”

In 2026, more apps will predict when you might need credit and offer it proactively. Some offers will feel helpful. Others will feel intrusive.

Additionally, AI may bundle actions: “Pay these bills, restructure this plan, and move your repayment date.” That can reduce stress. It can also reduce your awareness of the trade-offs.

Real-time payments plus credit

Real-time payments infrastructure keeps expanding. Payments that settle instantly can pair with credit that activates instantly.

That can be a breakthrough for small businesses managing cash flow. It can also amplify impulsive spending for consumers.

Therefore, guardrails matter more when speed increases.

Deeper personalization and higher pressure

Personalization will get sharper. Pricing and limits will adjust more often. Offers will be timed better. That can be efficient.

Yet it can also increase psychological pressure. The offer will show up at your most vulnerable moment: when you feel urgency, fear, or desire.

As a result, financial self-control becomes a core skill in 2026.

Winners and losers

Winners will likely include platforms that treat credit as a long-term relationship, not a short-term conversion hack.

Losers may include products that rely on confusion, weak affordability checks, and aggressive stacking. Regulation is moving. Consumers are learning. Capital is becoming more selective.

Conclusion

Invisible credit is changing borrowing in a profound way.

Embedded finance makes credit feel simple, fast, and natural. That can be empowering. It can also be risky, because it moves the hardest decision into the easiest moment.

In 2025, the most important shift is psychological. Borrowing is becoming a background action. In 2026, regulation and better design may restore some balance. Affordability checks, clearer disclosures, and stronger complaint paths can reduce harm. Better dashboards can make obligations visible again.

The future is not “no credit.” The future is honest credit.

If credit is going to be invisible, your awareness must be visible.

Sources and References

- BCG: Moving Embedded Finance from Promise to Practice

- World Economic Forum: Embedded finance’s worldwide impact

- Federal Reserve: Economic well-being (BNPL usage in 2024)

- CFPB: Consumer Use of BNPL and Other Unsecured Debt (Jan 2025)

- CFPB PDF: Consumer Use of BNPL and Other Unsecured Debt (Jan 2025)

- FCA: BNPL protections and affordability checks proposal (Jul 2025)

- UK Government PDF: BNPL consultation response (May 2025)

- Financial Times: Private credit piles into consumer debt (Dec 2025)

- Worldpay: Global Payments Report 2025

- McKinsey: Global Payments Report (Sep 2025)

- Deloitte: BNPL encourages banks to transform

- YouTube: Stripe on embedded finance

- YouTube: CNBC on BNPL boom for 2024