Decode impulse spending triggers and dopamine loops, then follow a practical reset plan to spend with calm control in a high-tech shopping world.

The new impulse spending era

Impulse spending is not a character flaw. It is a predictable human response. It meets a new kind of marketplace. That marketplace is faster, smarter, and more persuasive than ever.

In late 2024 and 2025, social commerce kept expanding. Platforms turned entertainment into checkout. Short videos became storefronts. Live shopping became normal. Meanwhile, friction kept dropping. One tap. Face ID. Done. Consequently, the gap between “I want it” and “I bought it” is now tiny.

At the same time, a fresh wave of technology made shopping feel effortless. Generative AI started guiding product discovery. Retailers leaned into AI assistants and chat-based shopping. This pushes temptation closer to your everyday scrolling. It also makes “just browsing” feel like a guided tour.

However, the story is not hopeless. The same brain that learns a spending habit can learn a new pattern. Moreover, the goal is not to stop enjoying money. The goal is to stop being steered by triggers you did not choose.

This article breaks impulse spending into clear forces. Then it gives a practical reset plan. The plan is designed for 2026 and beyond. It assumes social commerce, BNPL prompts, and algorithmic persuasion remain powerful.

Why your brain says “buy” before you think

Dopamine is not “pleasure” only

Many people talk about dopamine like it is a “happiness chemical.” Reality is more nuanced. Dopamine is strongly tied to reward, motivation, learning, and pursuit. It helps your brain tag something as worth chasing. Shopping can trigger that system. So can novelty, deals, and social approval.

This matters because impulse spending often happens in the chase. The hunt feels exciting. The delivery feels rewarding. Then the glow fades. After that, the brain looks for the next hit of novelty.

Additionally, dopamine does not act alone. Stress systems matter. Sleep matters. Social cues matter. When you are tired, hungry, anxious, or lonely, your brain seeks quick relief. A purchase can look like relief. The brain loves fast relief.

The loop is simple and dangerous

The loop is usually: trigger, urge, action, reward, story. The “story” is the justification. It is the inner lawyer. It argues you deserve it. It says it is “an investment.” It calls it “self-care.”

Meanwhile, platforms and sellers design around that loop. They add countdown timers. They add scarcity labels. They add “only 3 left.” They add free shipping thresholds. They add “people also bought.” These features are not neutral. They are optimized to convert your urge into action.

[YouTube Video]: A clear breakdown of why we buy things we do not need, and how emotions and environment shape spending decisions.

Triggers that quietly hijack your wallet

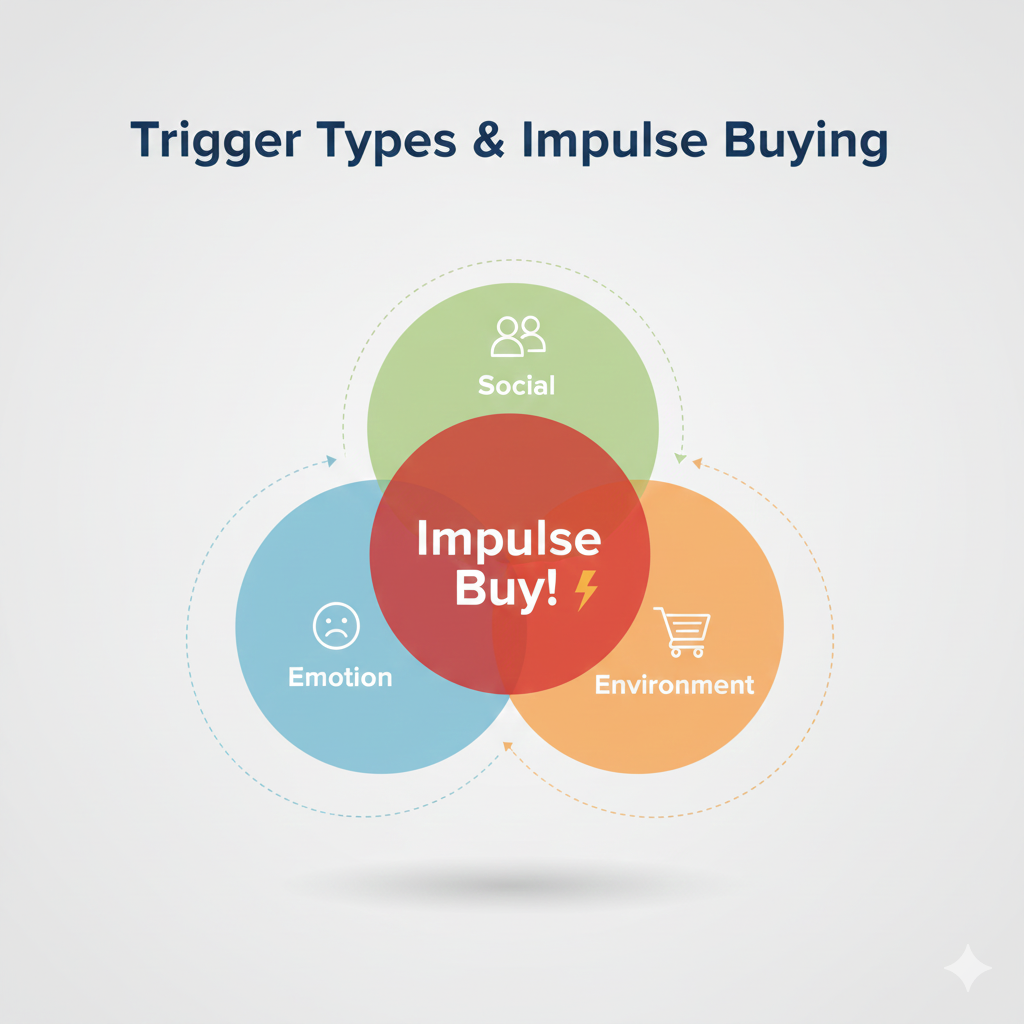

Emotional triggers

Impulse spending is often an emotion-management tool. That can be surprising. Many people assume it is about greed. Often it is about mood. A stressful day. A boring afternoon. A sense of falling behind. A need for comfort. A need for control.

However, the emotion is not always negative. Excitement also triggers spending. Celebrations trigger spending. Paydays trigger spending. Even a “fresh start” feeling can trigger spending. New week. New month. New year. The brain loves symbolic resets. Marketers know it.

Social triggers

Social comparison is a powerful trigger. In a feed, you see curated wins. You see outfits. You see travel. You see gadgets. Even if you know it is curated, it still hits. The brain reads it as social data. Consequently, buying becomes a way to “keep up” or to feel included.

Additionally, social commerce blends friends, creators, and shopping. That makes purchases feel normal. It also makes spending feel like identity. This is why “aesthetic” trends can be so persuasive.

Environmental triggers

Your environment shapes your spending more than your intentions. Notifications pull attention. Saved cards remove friction. Auto-filled addresses reduce effort. One-click checkout removes the pause you used to have.

Moreover, the phone is now a portable mall. That mall is open 24/7. It follows you into bed. It follows you into the bathroom. It follows you into moments when your self-control is weakest.

The marketplace is evolving fast

Social commerce is becoming a default

By late 2024 and into 2025, social platforms pushed harder into shopping. TikTok Shop growth became a major story. Live demos and influencer reviews moved product discovery into entertainment. This creates a potent mix: high emotion plus low friction.

Furthermore, mobile shopping continued to dominate. When buying happens on a small screen, decisions often become quicker. Quick decisions create more regret.

AI is turning shopping into a guided path

In 2025, AI-driven shopping assistance accelerated. Retailers used AI chat and discovery tools to shape buying. As AI improves, it can predict your taste. It can time offers. It can personalize urgency.

Consequently, resisting impulse spending becomes less about willpower. It becomes more about building systems that create healthy friction.

BNPL prompts raise the stakes

Buy Now Pay Later options can reduce the pain of paying. They split costs. They make expensive items feel smaller. That can be useful when used carefully. However, it can also increase impulse spending by lowering the moment of “financial reality.”

Regulators are paying attention. In the UK, BNPL and related deferred payment credit are moving deeper into formal regulation, with major changes scheduled to begin in July 2026. That signals how serious this space has become.

The hidden psychology of “I deserve it”

The self-reward trap

Many people use spending as a reward for suffering. Worked hard. Felt stressed. Dealt with conflict. The brain demands a prize. This is understandable. Yet it creates a risky link: stress equals purchase.

Moreover, if your life feels uncertain, small purchases can feel like control. You choose the item. You choose the color. You choose the delivery. It is a comforting illusion of control. That illusion can be powerful.

The identity purchase

Some purchases are not about function. They are about identity. “I am the kind of person who…” runs under the surface. “I am disciplined.” “I am stylish.” “I am successful.” When identity is involved, logic becomes weaker.

Additionally, platforms amplify identity buying. They sell lifestyles. They sell belonging. They sell “main character energy.” This is why impulse spending often spikes after big life moments. A breakup. A new job. A move. A glow-up phase.

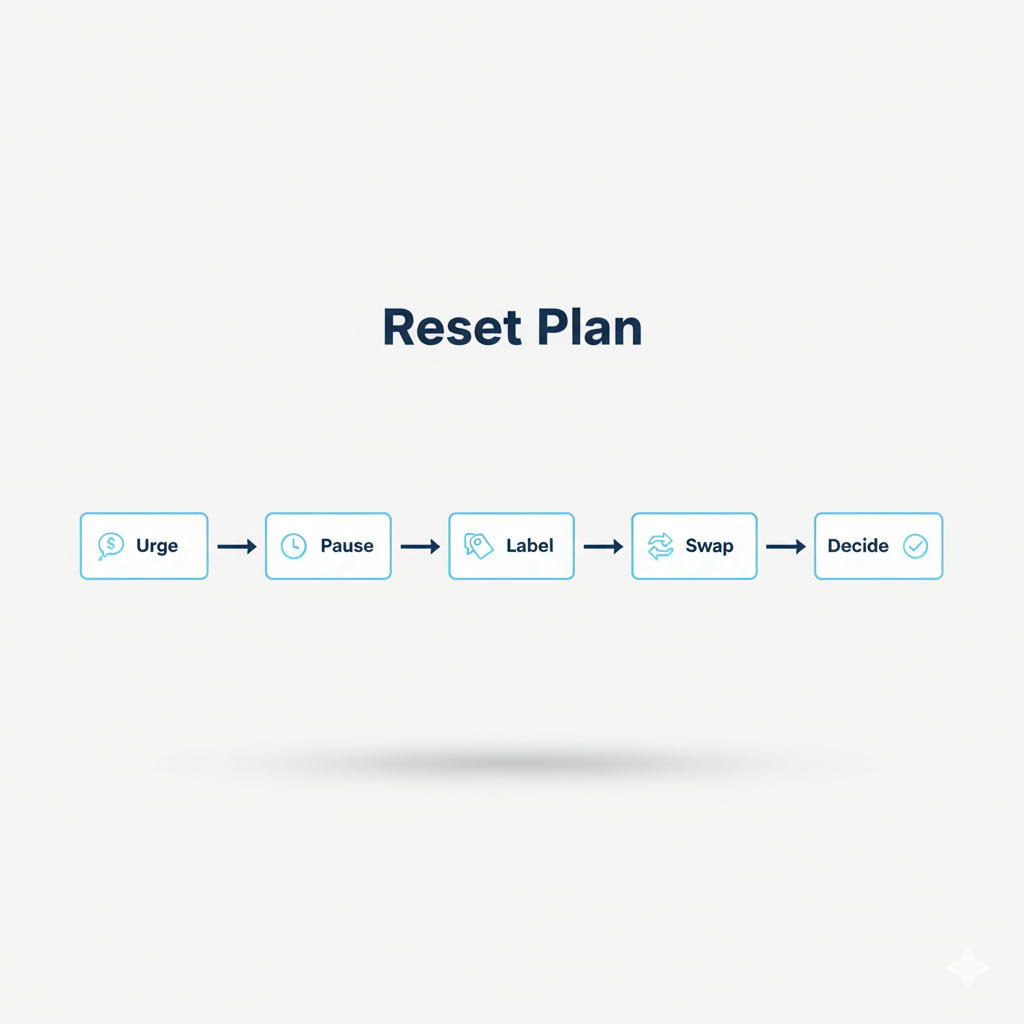

A practical reset plan that works in real life

This reset plan is not a purity challenge. It is not a harsh “never buy anything” vow. It is a reliable blueprint. It aims for calm control. It also respects that life includes joy.

Step one: build a 24-hour buffer

The buffer is a simple rule: no non-essential purchase the same day you see it. This creates the pause platforms try to remove. It also forces the urge to survive time.

However, the buffer must be frictionless to use. Create a “Buy Later” list. Use notes or a wish list. Put the item there. Then leave.

Additionally, if you fear missing out on a deal, write the deal terms. Most deals repeat. Your brain forgets that. Writing it down is a powerful reality check.

Step two: name the trigger out loud

Labeling is surprisingly effective. “I am stressed.” “I am bored.” “I am avoiding something.” This moves you from autopilot to awareness.

Moreover, it stops the story. When you name the trigger, the inner lawyer loses power. The purchase becomes a choice again.

Step three: swap the reward, not the need

If spending is meeting a need, meet the need directly. If you want comfort, use comfort tools. If you want novelty, use novelty without shopping. If you want connection, seek connection.

Consequently, create a small “urge menu.” Keep it short. Keep it realistic. A walk. A shower. A playlist. A call. A 10-minute tidy. A snack. A stretch. This is not about perfection. It is about a fast alternative that works.

Step four: add payment friction on purpose

Friction is your friend. Remove saved cards from shopping apps. Use a separate browser profile for purchases. Turn off one-click checkout when possible. Keep shopping apps off your home screen.

Additionally, consider one dedicated spending card with a weekly cap for non-essentials. When it is empty, you stop. This makes limits automatic. It also reduces daily decision fatigue.

Mid-reset reality: why “dopamine detox” can mislead you

Many people hear “dopamine detox” and assume they must remove all pleasure. That is usually not helpful. It can also backfire. Severe restriction often triggers rebound spending.

Harvard experts have pointed out that “dopamine fasting” is often misunderstood. You cannot fast from a brain chemical. You can reduce overstimulation and compulsive loops. That is useful. Still, the goal is balance, not punishment.

Therefore, choose a calmer approach. Reduce triggers. Increase sleep. Increase offline time. Increase planning. This is more sustainable. It is also more compassionate.

The 7-day reset sprint

A full reset is a lifestyle. Yet a short sprint can kickstart change. Think of this as a powerful reboot. It is designed to be doable.

Day 1: audit your triggers

Look back at your last 30 days of spending. Find the top patterns. Time of day matters. Mood matters. Location matters. Apps matter.

Moreover, do not shame yourself. Treat it like research. You are building an evidence-based profile of your impulse spending.

Day 2: clean your feed

Unfollow accounts that trigger “buy energy.” Mute shopping-heavy creators. Block certain ad categories if the platform allows it. Clear cookies on shopping browsers. Reduce the algorithm’s ability to target you.

Additionally, turn off non-essential push notifications. Notifications are a trigger delivery system.

Day 3: rebuild the checkout path

Remove saved cards. Remove PayPal one-tap. Delete shopping apps you do not need. Log out of stores. Add a password manager so logging in feels like effort.

Consequently, each purchase becomes a conscious action. That is the point.

Day 4: protect sleep and food

Impulse control drops when your body is drained. Sleep loss increases cravings for fast rewards. Skipping meals increases urges. Fixing basics sounds boring. It is also vital.

Day 5: set a “joy budget”

Restriction without joy breaks. Set a small, honest amount for fun spending. Spend it without guilt. This is crucial. It prevents “all or nothing” cycles.

Day 6: practice one uncomfortable pause

When an urge hits, pause for two minutes. Breathe slowly. Let the urge rise. Let it fall. Urges often peak and fade.

Moreover, you are training a skill: staying present with discomfort. That skill is powerful.

Day 7: do a review that feels rewarding

Review what changed. Count the urges you survived. Celebrate the wins. Not with shopping. With a meaningful treat that fits your values.

[YouTube Video]: A practical “no buy” style reset that explains what to change, what to avoid, and how to stay consistent without panic.

Preparing for 2026 and beyond

Expect more “agentic commerce”

Shopping is shifting toward AI agents that suggest, compare, and buy. That can save time. It can also blur consent. If an agent can purchase in a few steps, impulse spending risks increase.

Therefore, set rules now. Require manual approval for any purchase. Use spending limits. Keep separate accounts. Build a policy for yourself like a company would.

Expect deeper personalization

Ads will keep getting more personal. Product timing will improve. Offers will feel “made for you.” That is not magic. It is data plus prediction.

Consequently, your best defense is a strong system. Systems beat moods. Systems beat late-night scrolling. Systems beat stress.

Expect stronger consumer protections in some markets

Regulation is catching up in areas like BNPL. That can increase transparency. It can also add affordability checks. Still, protections do not remove temptation. They just reduce harm for some users.

So your plan should not rely on regulation. Your plan should rely on your own guardrails.

When impulse spending becomes compulsive

Impulse buying is common. Compulsive buying is different. Compulsive patterns can damage relationships, health, and stability. If you feel out of control, support is a strength, not a weakness.

A trusted therapist can help. A certified financial counselor can help. You can also talk to your bank about safeguards. The most important step is honesty. It is also the most freeing step.

Moreover, remember this: shame keeps loops alive. Compassion breaks loops. A calm, strategic approach is more effective than punishment.

A final, realistic promise

You do not need perfect discipline. You need a reliable plan. You need a few powerful friction points. You need a clear way to reset after a slip.

Additionally, you need a vision for what money is for. When money has a vivid purpose, random spending feels less attractive. The brain shifts from short-term relief to long-term meaning.

That shift is not instant. It is still real. It is also achievable.

Sources and References

- Dopamine: The pathway to pleasure (Harvard Health)

- Dopamine fasting: Misunderstanding science (Harvard Health)

- NIDA: Drugs, Brains, and Behavior (National Institute on Drug Abuse)

- Stanford: Addictive potential of social media (Stanford Medicine)

- Online antecedents for young consumers’ impulse buying (ScienceDirect)

- Impulsive and compulsive buying in social commerce (SAGE Journals)

- AI-influenced shopping boosted holiday sales (Reuters)

- TikTok Shop growth and shopping discovery (The Washington Post)

- FCA: Regulating Buy Now Pay Later (FCA)

- FCA consultation paper on deferred payment credit (FCA)