Learn how to pick a powerful, safe credit card that fits your lifestyle, protects your credit score and turns everyday spending into real value.

In 2025, choosing a credit card is no longer a casual decision. It is a critical financial choice that can either support your goals or quietly drain your money and energy. Interest rates on many cards are at record or near record levels, with average APRs for new offers in the United States recently close to 24 percent. (LendingTree) At the same time, rewards programs are more aggressive and more complex. Most general purpose cards now offer some form of rewards, and a majority of cardholders say cash back is their favourite feature. (Reuters)

This mix of high cost and tempting benefits can feel confusing. Yet it also creates an opportunity. With a clear, analytical process, you can select a card that is genuinely aligned with your life, your risk tolerance and your long term plans. The right choice can be rewarding, protective and even quietly life changing. The wrong choice can feel punishing, especially if a balance grows at a high rate.

All the data and trends in this guide are current as of December 2025. The goal is not to sell a particular product. The aim is to give you a calm, practical framework so that your final decision feels authentic, verified and confidently yours.

Why the right credit card choice is vital in 2025

The average person in the United States now has about 3.7 credit cards in regular use. (Experian) Around 75 percent of adults hold at least one card, and most of those cards come with some kind of rewards program. (Expensify – Expense Management) That combination means that almost every large purchase and many daily transactions are routed through a small piece of plastic or metal.

At the same time, the cost of carrying a balance has climbed sharply. According to the Consumer Financial Protection Bureau, average APRs on accounts that actually incur interest nearly doubled over the last decade, reaching about 22.8 percent in 2023. (Consumer Financial Protection Bureau) More recent industry data shows new card offers with average APRs just under 25 percent during late 2024, while broader averages in 2025 still sit in the low to mid twenties. (LendingTree)

Those numbers are not just abstract. A card with a 24 percent APR can turn a modest revolving balance into a heavy burden. At the same time, powerful rewards cards can deliver valuable travel perks, cash back or purchase protections when managed precisely. (bankrate.com) Choosing the right product has become essential, not optional.

Beyond the math, there is a strong emotional component. A card that fits your life can feel like a trusted tool. It can make you feel organised, confident and even proud. A poor fit, with the wrong fee structure or misleading perks, can leave you feeling trapped or misled. That emotional difference is one reason this choice deserves careful, patient attention.

Step 1: Start with your goals and habits

Before comparing offers, it is essential to understand what you actually want the card to do. Many people start with marketing details such as a headline bonus or a shiny metal design. A more powerful approach starts with your own life.

Map your spending patterns

Look back over the last three to six months of transactions. Group your spending into categories such as groceries, dining, fuel, online shopping, streaming subscriptions, travel and bills. Even a rough breakdown reveals patterns.

If a large share of your budget goes to groceries and fuel, a specialised cash back credit card that rewards those categories may be more profitable for you than a pure travel card. If you travel frequently for work or family and often pay for flights or hotels, a flexible travel rewards credit card can unlock airport lounge access, insurance benefits and redeemable points. (bankrate.com)

This analysis does not need to be perfect. The goal is to identify the three or four categories where you spend the most. That information becomes your first filter when comparing potential cards. It turns the decision from random to targeted, which is both effective and emotionally reassuring.

Decide the card’s primary job

Next, choose the card’s main role. In practice, a card can play one of several primary roles:

- A daily driver that maximises rewards on normal spending

- A specialist travel card for flights, hotels and travel protections

- A balance transfer tool with a 0 percent intro APR to manage existing debt

- A secured credit card designed mainly to build or rebuild credit

Trying to make a single card excel at every job often leads to disappointment. When you decide that the card’s primary mission is, for example, cash back on everyday spending, you accept that the best option for that mission may not offer premium airport lounge access or luxury hotel perks. That clarity reduces regret later, because you know what you optimised for. (indus-ind)

This step may seem simple, yet it is powerful and even a little revolutionary for many people. Instead of asking “What is the best card on the market,” you ask “What card is the best authentic match for my life.”

Step 2: Decode the true cost of a card

Once your goals are clear, you need to understand how each card can cost you money. Rewards and glossy benefits can be impressive, but they sit on top of a structure of interest rates and fees.

Understanding APR in a high rate environment

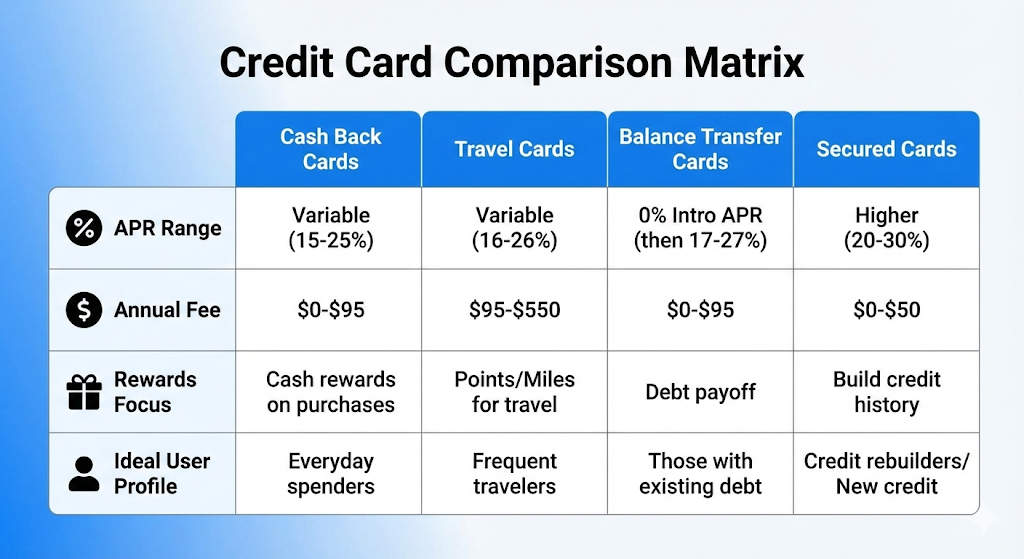

The APR, or annual percentage rate, is the headline interest rate that applies when you carry a balance from month to month. In today’s environment, typical APRs on many general purpose credit cards are above 20 percent, with averages around 22 to 24 percent in recent data. (LendingTree)

If you always pay your statement balance in full, the APR may rarely matter. If you ever carry a balance, it becomes critical. A high interest rate can quietly absorb the value of rewards and promotional offers. Regulators have repeatedly warned that rising margins on credit cards have added billions in extra interest charges for consumers. (Consumer Financial Protection Bureau)

Because rates are so elevated, a card with a slightly lower APR can make a meaningful difference if you sometimes revolve a balance. That does not mean you must choose a low rate card over a high rewards card every time. It does mean that ignoring the APR completely is risky.

Fees that shape the real price

In addition to APR, cards carry various fees. The most visible ones are annual fees, which can range from zero to several hundred dollars per year. Premium travel cards often charge higher annual fees but offer lounge access, travel credits and insurance cover that can be extremely valuable for the right user. (Moneywise Doctor)

Less visible fees include foreign transaction fees, balance transfer fees, late payment fees and sometimes fees for paper statements or returned payments. For someone who travels internationally even a few times per year, a card with no foreign transaction fees can be significantly more rewarding and less stressful than a card that charges a few percent on every overseas purchase. (IEFA Blog)

When comparing offers, list these potential fees next to each card. Ask yourself which ones are likely in your specific situation. That way, you are not just comparing headline bonuses but the authentic long term price of each option. It is a calm, rational step that can prevent unpleasant surprises later.

Step 3: Match card types to your real life

With your goals and the cost structure in mind, you can now explore the main card types. Each has its own strengths, weaknesses and emotional appeal.

Cash back credit cards

Cash back cards are popular because they are simple, practical and immediately rewarding. Many people say that straightforward cash back is their favourite credit card feature, ahead of more complex perks. (bankrate.com)

These cards typically offer a flat rate on all spending, such as 1.5 or 2 percent, or a higher rate on specific categories like groceries, dining or fuel. Some products allow you to choose a custom category for higher rewards, which can be especially powerful if your spending is concentrated. (Bank of America)

A strong cash back card is often the ideal everyday workhorse. It is particularly attractive for people who prefer immediate, guaranteed value over points that need complex redemption. For someone who is just starting to organise their finances, the simplicity feels calming and authentic.

Travel rewards and premium cards

Travel cards focus on points or miles that can be redeemed for flights, hotels or upgrades. They often partner with specific airlines or hotel chains, or they offer flexible points that transfer to many partners. These cards may include exclusive benefits such as airport lounge access, trip delay insurance, lost luggage cover and no foreign transaction fees. (Moneywise Doctor)

The emotional appeal here is strong. For frequent travellers, these cards can feel glamorous, powerful and even transformative. A single welcome bonus and a year of focused spending can sometimes unlock a long haul flight in a premium cabin or a luxury hotel stay.

However, the structure can be complex. If you rarely travel or dislike managing points, a premium travel card may leave value unused while you still pay the annual fee. In that case, a solid cash back or low fee product may be more suitable and less stressful.

0 percent intro APR and balance transfer cards

Balance transfer and 0 percent intro APR cards are specialised tools. Their primary job is to help you manage or eliminate existing debt more efficiently. Many offers provide a 0 percent introductory APR on balance transfers for periods that can extend up to 18, 21 or even 35 months in some markets, in exchange for a one time transfer fee. (bankrate.com)

Used wisely, these cards can be powerful and genuinely life improving. During the promotional period your payments go primarily toward principal rather than interest, which can accelerate your exit from debt. Guides from banks and comparison sites emphasise that you should calculate the fee, avoid new spending on the card and have a clear payoff plan before the promotional rate ends. (Compare the Market)

If you are currently carrying a balance, a dedicated balance transfer card can be a vital part of your strategy. It may not be the right long term everyday card, but it can be an essential short term rescue tool.

Secured cards and starter products

Secured credit cards require a refundable deposit that typically becomes your credit limit. They exist primarily to help people build or rebuild credit. For example, many international students, recent graduates or people recovering from past credit difficulties choose secured cards as a safe training ground. (IEFA Blog)

Although they may feel less glamorous than premium products, secured cards play a critical role in long term financial health. A reliable history of on time payments, even with a modest limit, sends a strong positive signal to future lenders. Over time, you can often upgrade to an unsecured card and have your deposit returned. That journey from secured starter to trusted mainstream card can feel incredibly rewarding and empowering.

Step 4: A simple framework to compare specific offers

Once you know which card type fits your life, the next challenge is choosing among several similar offers. Instead of drowning in small print, you can use a three filter framework: cost, fit and flexibility.

Filter one: Cost

First, compare the total cost. Look at:

- APR range for purchases

- Length and rate of any intro APR offers

- Annual fee

- Key fees you are likely to encounter

Remember that if you always pay in full, the APR may be less important than the annual fee and the value of rewards. If you sometimes carry a balance, the APR and any 0 percent intro offers become extremely important. In a world where average rates are around the mid twenties, even a slightly lower rate can save significant money over time. (LendingTree)

Filter two: Fit

Next, examine how well the card matches your real spending. Does it reward your top categories at a high rate, or does it mainly reward categories you rarely use. Are the redemption options flexible and clear. Are the benefits reliable and easy to use.

Independent guides stress that the “best” card on paper is not necessarily the best for you. A travel card that shines for frequent flyers can be an awkward mismatch for someone who rarely leaves their home city. (indus-ind)

Filter three: Flexibility and risk

Finally, consider how forgiving the card is when something goes wrong. Does it charge high penalty rates after a single late payment. Does it offer tools such as payment reminders, mobile controls and clear access to customer support. Some issuers also provide flexible features like instalment plans for large purchases or free credit score monitoring. (Bank of America)

Thinking about flexibility may not feel exciting, yet it is a vital protection. It is about resilience. A card that supports you when life is messy can be far more valuable than one that is only generous when everything goes perfectly.

Step 5: Special situations and tailored choices

Not everyone approaches credit cards from the same starting point. Here are several common situations where a more customised approach is helpful.

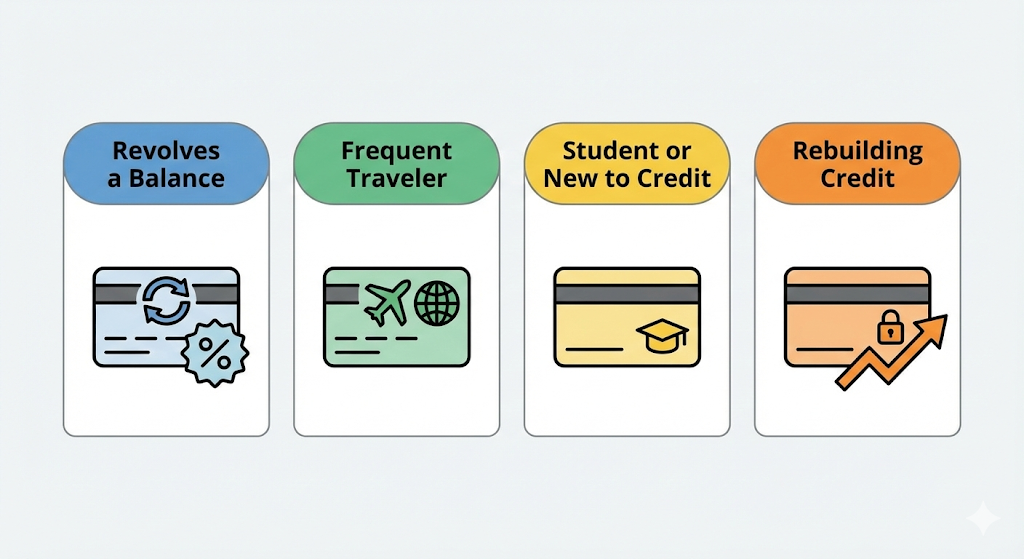

If you regularly carry a balance

If you know that you sometimes carry a balance, cost must sit at the centre of your decision. In this case, low APR cards or 0 percent intro APR offers are often more important than premium rewards structures.

Recent data suggests that households with revolving credit card debt carry an average balance above ten thousand dollars. (NerdWallet) For those households, a high APR can generate hundreds or thousands of dollars in interest each year. A slightly lower rate or an effective balance transfer plan can therefore have a dramatic, immediate effect.

Additionally, it may be wise to avoid very high annual fee travel cards until your debt is under control. Once you are in a more stable position, you can reconsider those premium products from a place of strength rather than urgency.

If you are a frequent traveler

For frequent travellers, a strong travel rewards card can feel almost essential. Benefits such as airport lounge access, no foreign transaction fees, travel insurance and accelerated points on flights and hotels can create huge value for the right person. (Moneywise Doctor)

However, it is important to check whether the partners and alliances match your usual routes. A premium card that partners with airlines or hotel brands you rarely use may deliver less value than a more flexible competitor. Also pay attention to seat selection rules, baggage protections and how easy it is to redeem points at a fair rate.

In this scenario, the right card can transform stressful journeys into smoother, more comfortable experiences. The wrong one can add complexity without enough benefit. That is why a calm review of your actual travel patterns is so critical.

If you are a student or new to credit

Students and people with limited credit history face a particular challenge. They often want a card for online payments, travel or emergencies, but their credit score and income may not qualify them for high tier products.

In this case, a student credit card, a beginner friendly cash back card or a secured card is usually safer than chasing a premium travel card immediately. Guides for international students, for example, highlight the importance of starting with a manageable limit, paying on time and choosing a card with fair fees and clear terms. (IEFA Blog)

The emotional win here is not glamorous perks. It is the powerful, verified feeling that you are building a trustworthy credit profile that will open bigger doors in the future.

If you are rebuilding after past problems

For people recovering from missed payments, collections or bankruptcy, credit cards can feel intimidating. Yet an appropriate card can also be a vital tool in rebuilding trust.

In this situation, secured cards, low limit products and cards explicitly designed for rebuilding credit are usually the safest starting point. The key metrics to consider are reporting behaviour, fees and the possibility of upgrading later. Many issuers promise that if you use the card responsibly for a certain period, you may qualify for an unsecured product and have your deposit refunded. (Consumer Voice – Consumer Voice)

This journey requires patience, but the emotional payoff is huge. Each on time payment is a small, authentic victory that moves you closer to financial stability.

Step 6: Apply strategically and protect your score

Once you have picked a strong candidate card, it is time to apply. Here, strategy matters.

Check your credit before you apply

Before submitting an application, review your credit reports and scores. Major credit reporting agencies and many banks now provide free access to your score and sometimes to your full report. This review helps you understand whether the card you want is realistic and whether there are errors you should correct first. (NerdWallet)

Additionally, many comparison sites offer eligibility checkers that estimate your chances of approval for specific cards with only a soft inquiry. These tools can help you avoid unnecessary hard inquiries on your file. (MoneySavingExpert.com)

Limit the number of applications

Applying for several cards in a short period can make you look risky to lenders. Each hard inquiry may have a small temporary impact on your score, and a cluster of them can suggest financial stress.

A more careful approach is to short list two or three realistic options, use pre qualification tools where available, and then apply for a single card that matches your profile closely. If you are declined, pause, reassess and consider whether a more accessible product, such as a secured card, would be a better immediate step. (NerdWallet)

After approval: set yourself up for success

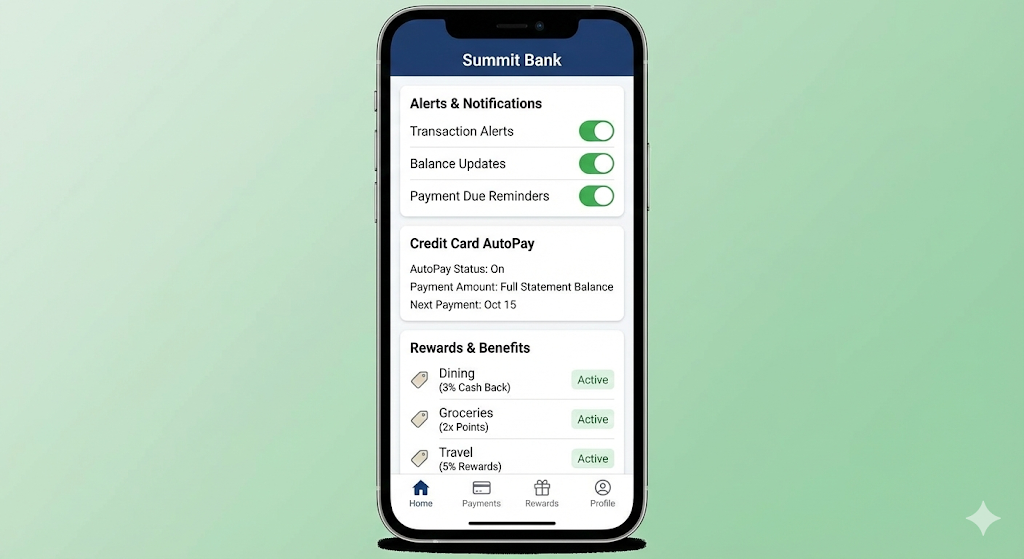

If your application is approved, take a few deliberate steps before you start spending.

Set up online access, enable alerts for due dates, and, if possible, schedule automatic payments at least for the minimum each month. Consider setting a separate reminder to review your statement for fraudulent charges and to pay any amount above the minimum that you can afford. (Consumer Voice – Consumer Voice)

Also decide how you will use the card strategically. For example, you might decide that this card is only for groceries and fuel, or only for travel and major online purchases. This intentional rule helps you avoid unconscious spending and keeps tracking simple.

Step 7: Review and adjust your card mix over time

Choosing the right card is not a one time event. Your life and the market both change.

Annual checkup for your card

At least once a year, perform a quick review. Ask:

- Are you still using the card in the way you expected

- Are you paying in full, or have balances started to accumulate

- Are the rewards and benefits still valuable for your current lifestyle

Industry surveys show that many issuers adjust interest rates, rewards structures and perks over time. Watchdogs have even warned companies not to quietly devalue rewards without clear communication. (Reuters)

If you notice that a card is no longer competitive, you have options. You might request a product change within the same issuer to a more suitable card, or you might reduce your use of the card and rely more heavily on a better alternative.

Avoiding common mistakes

There are a few recurring errors that can undermine even a strong initial choice:

- Chasing every bonus offer and ending up with too many cards to manage

- Ignoring the effect of high APRs when carrying a balance

- Paying annual fees for features you rarely use

- Letting small irregular charges or subscriptions quietly increase spending

Awareness is your best defence. A smart, authentic card strategy focuses not only on exciting perks but also on stability, control and long term freedom. The aim is a thriving financial life where your cards work for you, not the other way around.

Helpful video explainers

Conclusion: A confident, authentic card choice

In a world where credit card interest rates are high, rewards programs are heavily promoted and choice feels overwhelming, a calm, structured approach becomes a powerful advantage. By starting with your goals, mapping your habits, decoding costs and matching card types to your real life, you transform a confusing decision into a strategic move.

The right card can feel genuinely empowering. It can protect you during travel, smooth your cash flow, reward your everyday spending and help you build a strong, verified credit record. The wrong card can quietly amplify stress and drain your finances.

As of December 2025, the environment is demanding, but the tools are better than ever. Comparison sites, eligibility checkers, educational videos and detailed issuer disclosures give you more information than previous generations ever had. With that information and a thoughtful mindset, you can make a choice that feels both emotionally satisfying and financially sound.

Most importantly, remember that the card serves you, not the other way around. When you treat this choice as one crucial part of a broader, thriving financial plan, you move closer to a future where your borrowing is intentional, your rewards are truly rewarding and your money supports the life you want to build.

Sources and References

- LendingTree – Average Credit Card Interest Rate in America (LendingTree)

- CFPB – Credit Card Interest Rate Margins at All Time High (Consumer Financial Protection Bureau)

- Experian – What Is the Average Number of Credit Cards? (Experian)

- Expensify – Credit Card Statistics 2025 (Expensify – Expense Management)

- Bankrate – Retail Credit Card Interest Rates Remain Sky High (bankrate.com)

- MoneySavingExpert – Balance Transfer Credit Cards Guide (MoneySavingExpert.com)

- Discover – What Is a 0 Percent Interest Balance Transfer Credit Card? (Discover)

- IndusInd Bank – How to Pick the Right Credit Card According to Your Financial Goals (indus-ind)

- MoneyWiseDoctor – Mastering Your Personal Finances: Choosing the Best Credit Card (Moneywise Doctor)

- NerdWallet – Credit Card Data, Statistics and Research (NerdWallet)

- Bank of America – Cash Back Credit Cards (Bank of America)

- Compare the Market – Balance Transfer Credit Cards (Compare the Market)