Learn when gold and commodities protect you, when they backfire, and how to use simple ETFs with clear rules for a stronger, future-ready portfolio.

Gold and commodities have a special power over investor emotions. They feel ancient and modern at once. A gold bar looks like certainty. A commodities chart looks like the real economy in motion. However, the same assets that can feel like a breakthrough hedge in one year can feel brutally disappointing in the next.

This is a guide, not a hype piece. You will learn what gold and commodities really do, why they sometimes shine, why they sometimes hurt, and how to use them without overthinking. The goal is calm, confident decisions that stay reliable in late 2025 and beyond.

Why gold and commodities feel “safe” and “scary”

Gold and commodities tend to show up in portfolios for two reasons. The first reason is protection. People want an insurance-like asset when inflation spikes, when wars start, or when stocks drop fast. The second reason is conviction. Some investors believe we are entering a powerful new era of supply shortages, energy transition demand, and geopolitical reshoring that could make real assets a rewarding long-term theme.

Both reasons can be valid. Yet both reasons can also become traps.

The emotional trap: “It must work now”

Gold and commodities can be frustrating because they do not always pay you quickly for being “right.” You can be right about inflation risk and still buy at a terrible time. You can be right about energy transition metals and still pick a weak vehicle that bleeds returns through costs or futures mechanics.

Consequently, the winning approach is not prediction. The winning approach is a simple framework: what job does this asset do, what vehicle matches that job, and what conditions make it help or hurt.

The practical promise: small moves, big stability

A modest, disciplined position can add stability. It can also reduce regret because you stop feeling like you must time the world perfectly. Moreover, once you understand the true drivers, the noise becomes less scary and more readable.

Gold vs commodities: what you are actually buying

“Gold” and “commodities” are not the same bet. They often behave differently, even in the same macro environment.

Gold is a monetary metal with unique drivers

Gold is not mainly an industrial input like copper or oil. Gold behaves more like a monetary asset. It tends to react to:

- Real interest rates and expected inflation

- The US dollar and global liquidity conditions

- Crisis psychology and risk-off flows

- Central bank buying and reserves narratives

World Gold Council research frequently frames gold as a strategic diversifier and a potential store of value across regimes. (IEA)

That said, gold is not a guaranteed inflation hedge month to month. It is better understood as a long-run hedge against monetary disorder and deep uncertainty, not as a perfect CPI mirror.

Commodities are a bundle of very different markets

A broad “commodities” exposure often includes energy, industrial metals, precious metals, agriculture, and sometimes livestock. Each has its own supply shocks, demand cycles, and politics. Additionally, the way you access commodities matters more than many beginners realize.

If you invest through a commodity futures index, returns can be shaped by futures market structure, not just spot prices. This is where many investors get surprised.

The hidden engine: futures carry, contango, backwardation, roll yield

Many commodity funds do not store barrels of oil or piles of wheat. They hold futures contracts and roll them forward as they expire. That rolling process can add returns or destroy them.

- Contango means longer-dated futures cost more than near-term contracts. Rolling can become a steady drag.

- Backwardation means longer-dated futures cost less than near-term contracts. Rolling can become a tailwind.

This is not theory. It is a core reason commodity funds can diverge from what people expect when they only watch spot prices. Investopedia’s discussion of oil fund behavior during contango is a clear real-world example of this risk. (IEA)

The beginner-friendly vehicles: choose the right tool

The same “idea” can be executed in very different ways. Your results depend on the tool you pick.

Gold vehicles: physical, ETFs, and miners are not equal

Physical gold can feel ultimate and tangible. However, it adds storage, insurance, and liquidity friction.

Gold ETFs can be efficient and accessible. They are often used for clean exposure without operational headache.

Gold miners are not gold. They are businesses with costs, political risk, execution risk, and equity-market sensitivity. Miners can be thrilling in bull runs and painful in downturns. Consequently, miners are closer to a leveraged equity proxy than a pure hedge.

[YouTube Video]: A clear overview of how a major gold ETF came to exist, and why ETF structure matters for practical access.

Commodities vehicles: futures-based funds vs producer stocks

With commodities, you usually choose between:

- Futures-based commodity funds (broad basket or single commodity exposure)

- Commodity producer stocks (energy companies, miners, agribusiness)

Producer stocks can generate cash flow and sometimes dividends. Yet they also carry equity market risk. Meanwhile, futures-based funds track commodity price exposure more directly, but can suffer from contango drag and roll costs.

BlackRock’s materials for a broad commodity trust explain important mechanics and risks that beginners should take seriously before buying. (SEC)

When gold and commodities help

This is the heart of the guide. You want a clear, reliable map of the conditions where these assets do their job.

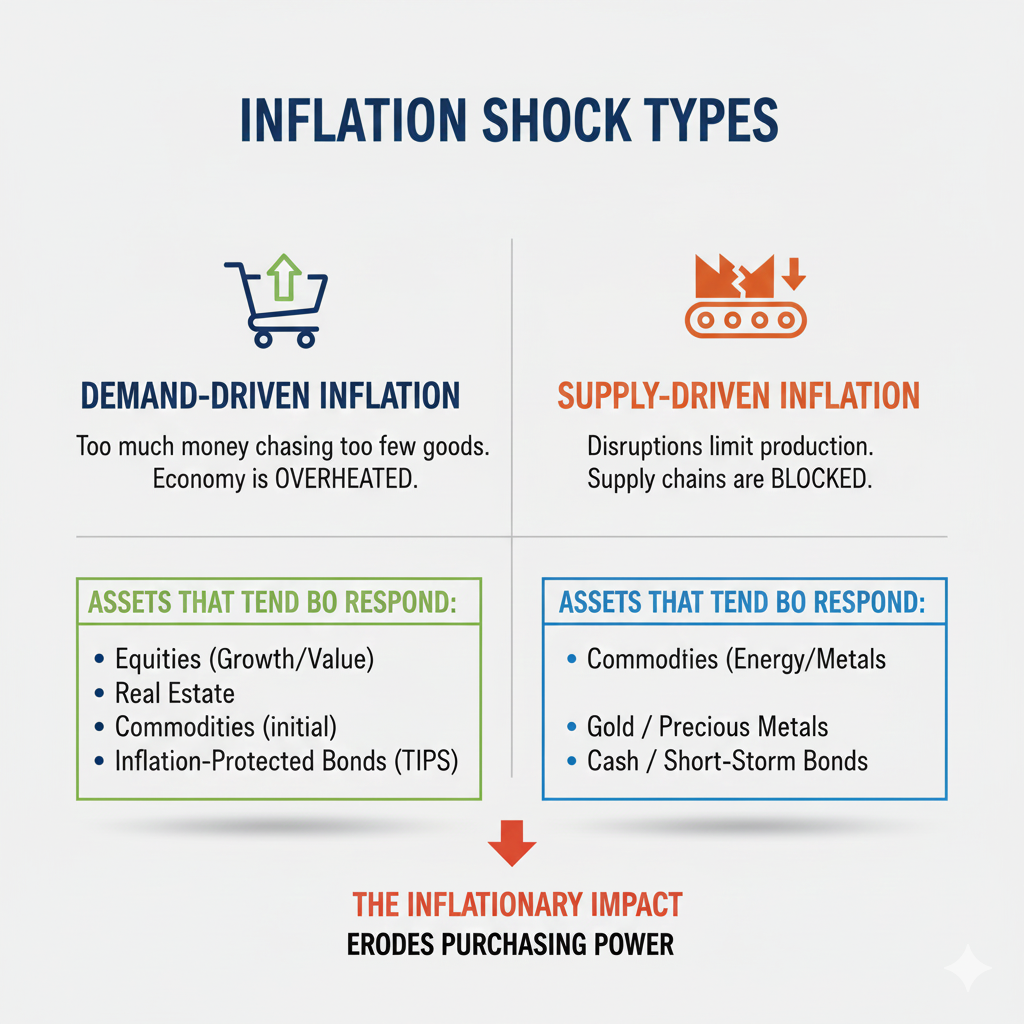

They can help during inflation surprises and supply shocks

Gold and certain commodities can shine when inflation shocks are driven by supply constraints, geopolitical disruptions, or energy spikes. In those regimes, “real assets” can feel crucial because they connect to physical scarcity.

However, results vary by category. Energy behaves differently from agriculture. Industrial metals behave differently from gold. Consequently, broad commodity exposure can smooth the bet, while single-commodity exposure can become dangerously concentrated.

They can help when diversification actually matters

Diversification is only valuable when your diversifiers do not all crash together. In a severe equity drawdown, gold has often been treated as a potential stabilizer and a liquid crisis asset, though outcomes can differ by episode. (IEA)

Commodities can also diversify, but their effectiveness depends on what is driving the downturn. If the downturn is a demand collapse, industrial commodities can drop hard. Therefore, you should not assume “commodities always protect in a crash.”

They can help in a world of energy transition and resource politics

Late 2025 is full of signals that critical minerals and supply chain control are becoming more strategic. The International Energy Agency’s work on critical minerals highlights how the energy transition can reshape demand and supply dynamics across key materials. (Investopedia)

That does not guarantee a straight-line boom. Yet it does suggest a future where commodity volatility and policy risk can remain elevated. Moreover, elevated volatility is exactly why disciplined sizing and rebalancing become powerful.

When gold and commodities hurt

To invest well, you need a brutally honest view of the downside regimes. This is where most beginner mistakes are born.

Gold can struggle when real yields rise

Gold has no cash flow. When inflation expectations cool and real yields rise, gold can become less attractive relative to bonds and cash. In that environment, gold can feel disappointing even if headlines still sound scary.

Additionally, a strong US dollar can pressure dollar-priced commodities and gold. The point is not to predict currencies. The point is to accept that gold’s “insurance” has seasons where it is not rewarded.

Broad commodities can bleed in contango

This is the most underrated pain point for beginners. In extended contango, rolling futures can create a steady negative carry. You can be emotionally “right” about commodity scarcity and still be financially wrong through the vehicle.

Investopedia’s oil fund coverage is an easy way to see how this plays out in practice. (IEA)

Commodity stocks can fall with the stock market

Producer stocks often fall during equity risk-off events, even if the commodity story looks intact. A miner is still an equity. An energy major is still exposed to broader market risk. Consequently, producer stocks are not a pure hedge.

Leverage makes everything worse

Commodities can move fast. Leverage can turn a normal drawdown into a catastrophic one. For a beginner-friendly plan, leverage is rarely necessary. Simplicity is a proven advantage.

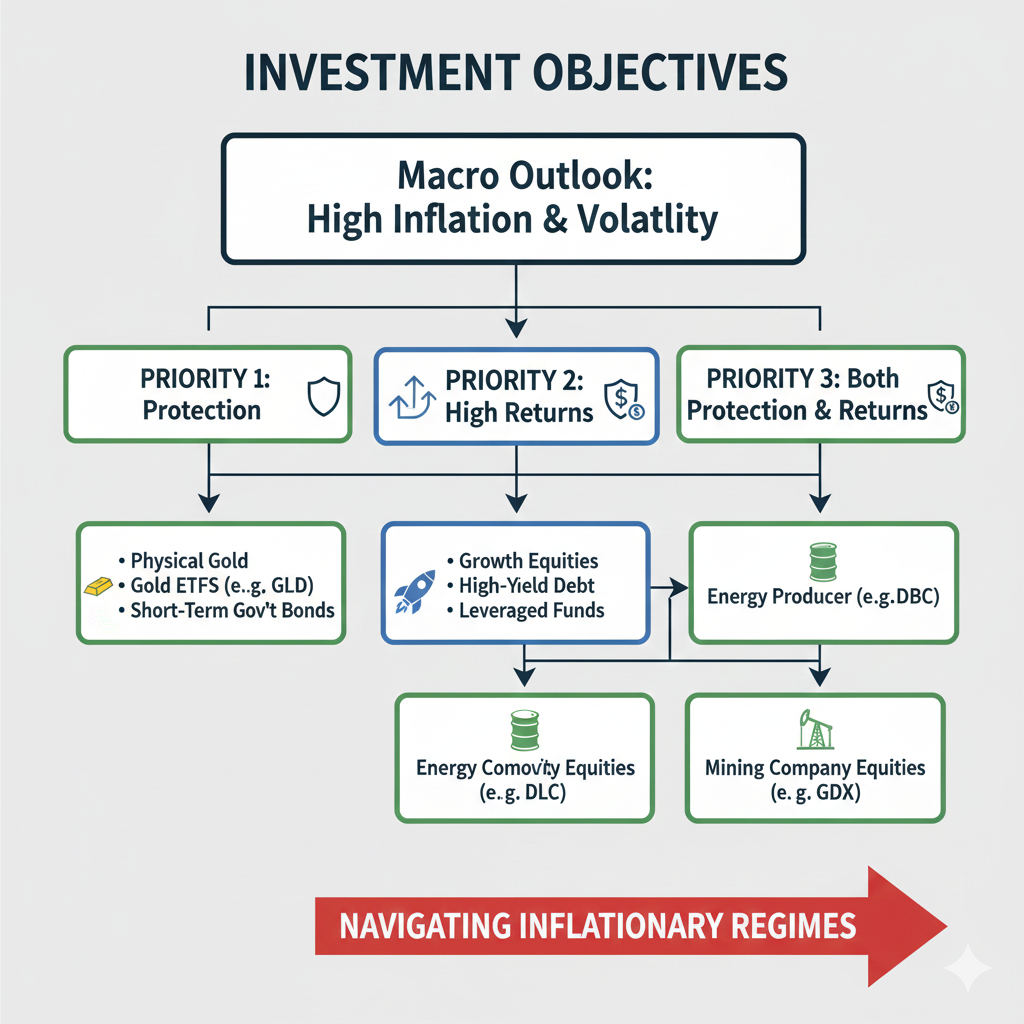

The simplest decision framework: what job do you want done?

You can reduce confusion with one vital question: are you buying gold or commodities for protection, for return, or for a balanced mix?

If the job is protection, keep it modest and liquid

For protection, you want vehicles that are liquid, transparent, and easy to rebalance. You also want a position size that feels emotionally manageable in a drawdown, because panic-selling destroys the whole point.

If the job is return, accept cycles and demand patience

If you want return, you must accept that commodities are cyclical. You must also accept that themes like electrification, defense spending, and reshoring can create opportunity, but timing remains uncertain.

Therefore, a return-seeking position should be paired with clear rebalancing rules, not daily emotions.

How to size and manage positions without overthinking

You do not need a perfect number. You need a safe process.

Start with a “stress test” mindset

Imagine gold drops 15% while stocks rally. Would you feel embarrassed and sell? If yes, your size is too large.

Imagine commodities fall sharply during a demand slowdown. Would you panic because you expected “inflation protection”? If yes, your expectations need tuning, and your size may need trimming.

Use rebalancing as your silent advantage

Rebalancing turns volatility into a disciplined routine. When a sleeve runs up, you trim. When it gets crushed, you add back to target if your thesis still holds.

This is a powerful, calming mechanism. Additionally, it keeps you from chasing performance, which is one of the most painful investor behaviors.

Prefer boring consistency over heroic timing

A small, consistent allocation that you can hold through regimes is often more rewarding than a big tactical bet you abandon at the worst time.

The crucial mechanics video: why commodity returns confuse people

If commodities have ever felt “rigged” or confusing, it is often because investors do not separate spot returns from futures roll returns.

[YouTube Video]: A focused explanation of roll return and why futures structure can create hidden gains or hidden drags in commodity strategies.

After you understand this, commodity investing becomes calmer and far more rational. Moreover, you stop blaming yourself for outcomes that were driven by structure, not by your intelligence.

What’s emerging: the next era for gold and commodities

Forward-looking investors care about what changes the game. Several forces look especially relevant heading into 2026 and beyond.

Critical minerals strategy is becoming mainstream

Governments are treating minerals as strategic inputs, not just “materials.” This can shape permitting, trade policy, stockpiles, and corporate alliances. The IEA’s critical minerals coverage is a strong starting point for understanding this landscape. (Investopedia)

That said, policy can cut both ways. Subsidies can boost supply. Export controls can shock prices. Consequently, diversification matters even more.

Climate volatility can amplify supply shocks

Weather extremes can disrupt agriculture and energy infrastructure. That can raise the probability of short, sharp price spikes. It is not guaranteed, but it is a real risk factor in the next-generation commodity landscape.

Market data and inflation measurement noise matters

Inflation data can face disruption risk in unusual circumstances. Reuters reported a case where a CPI release was canceled amid government shutdown conditions, which is a reminder that even “official” signals can be delayed or distorted at times. (Reuters)

Additionally, Vanguard research highlights that inflation is not experienced equally by everyone. Your personal inflation can diverge from headline CPI based on spending patterns. (Vanguard)

The practical takeaway is simple: do not build a fragile strategy that depends on one perfect data print.

Product innovation: more choices, more temptation

Expect more “smart beta” commodities, dynamic roll products, and thematic baskets tied to electrification. This innovation can be exciting. Yet it can also be dangerous because complexity can hide costs.

Therefore, your edge as a beginner is selective simplicity: understand what you own, why you own it, and how it behaves.

Common mistakes that quietly destroy results

Beginners usually do not fail because they lack intelligence. They fail because the product and the narrative seduce them.

Confusing “high conviction” with “high concentration”

A single commodity bet can be thrilling. It can also be brutal. If you want resilience, broad exposure is usually a safer starting point.

Buying commodities for income

Commodities do not naturally produce income. Some producer stocks do, but then you are owning equities. If you chase yield, you can end up in the wrong asset for the wrong reason.

Ignoring structure and reading only headlines

Headlines are loud. Structure is decisive. Futures roll mechanics, fees, taxes, and liquidity often matter more than your macro opinion.

Forgetting the basic investor protections mindset

Regulators routinely warn that even popular fund types can carry specific risks. SEC investor bulletins are a good reminder to read the plain-language risk sections before you commit serious money.

A simple, future-ready blueprint you can actually follow

You can keep this painfully simple.

First, decide whether you want gold, commodities, or both. Second, pick the cleanest vehicle you understand. Third, choose a modest target size you can hold proudly through disappointment. Fourth, rebalance on a schedule so emotions do not drive decisions.

Finally, remember the point: gold and commodities are not magic. They are tools. Used well, they can make your portfolio feel stronger, calmer, and more prepared for a volatile decade.

Sources and References

- World Gold Council – Gold as a strategic asset

- International Energy Agency – Critical minerals

- BlackRock – iShares S&P GSCI Commodity-Indexed Trust (GSG) prospectus

- Investopedia – Why USO may not track oil prices (contango)

- Vanguard – Personalized inflation hedging (PDF)

- SEC Investor Bulletin – Investing in target date funds

- Reuters – US CPI release canceled amid shutdown (data disruption example)

- BLS – Consumer Price Index overview