Dividend investing sounds simple: buy a stock, collect cash, repeat. It feels safe. It feels reliable. It feels like you found a proven shortcut.

However, the real story is sharper. Dividends can be powerful. They can also be a costly illusion. The biggest danger is not “dividends are bad.” The danger is believing yield is the goal.

In late 2025, this matters more than it did in the low-rate era. Cash yields compete with dividends. Corporate payout strategies keep evolving. Meanwhile, buybacks remain a dominant force in market cash returns.

So this article separates myth from reality. It shows why “high yield” can be a trap. It also explains what long-term dividend investors should watch next.

The Myth That Dividends Are “Free Money”

A dividend is not a bonus that appears from nowhere. It is a distribution from a company’s cash flow and balance sheet. On the ex-dividend date, the share price typically adjusts downward by the dividend amount, all else equal. That adjustment is not a moral judgment. It is basic accounting meeting market pricing.

Still, the “free money” myth survives because dividends feel tangible. They hit your account. You can spend them. That emotional punch is real. It feels rewarding. It feels immediate.

Additionally, dividends can create discipline. Many investors reinvest automatically. That habit is simple and powerful.

Yet the myth becomes dangerous when it makes investors ignore risk. It encourages yield chasing. It pushes people into fragile businesses. It also makes them underestimate the role of total return.

Total Return Is the Real Scoreboard

Total return is price change plus dividends, after taxes and costs. That is the only scoreboard that counts over decades.

Consequently, you can “win” with low yield if the business grows. You can also “lose” with high yield if the price collapses or the dividend gets cut.

That is why the most serious dividend question is not “What is the yield?” It is “How safe is the payout, and what is my full return path?”

Dividend Reality Check: Why High Yield Can Be a Trap

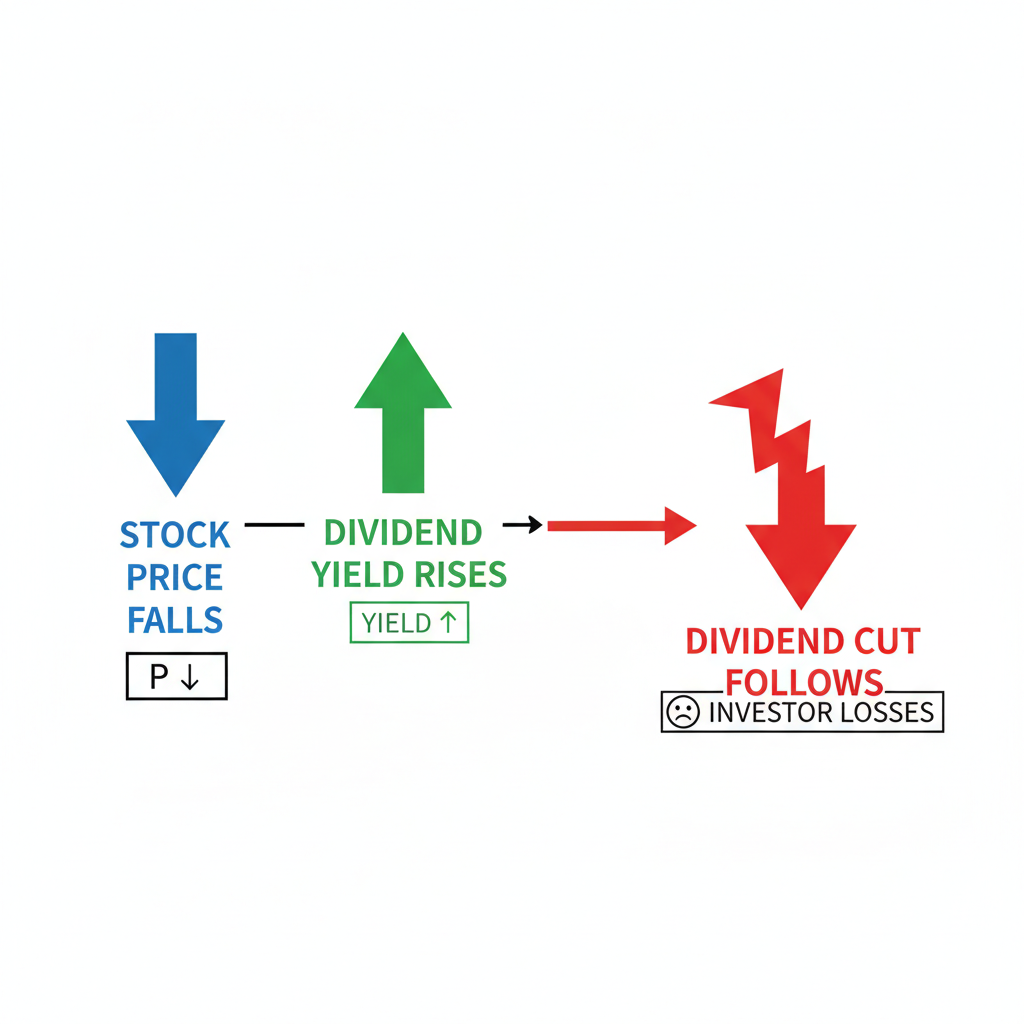

High yield often signals one of three things. First, the market expects trouble. Second, the stock price has dropped hard. Third, the payout may be unsustainable.

In other words, the yield can be high for a bad reason.

A quick example explains the trap. Imagine a stock at $100 paying a $4 annual dividend. That is a 4% yield. Then the business weakens. The stock falls to $50. The dividend has not been cut yet. Now the yield looks like 8%. That “income” looks irresistible.

However, the market may be warning you. If earnings keep falling, a dividend cut becomes likely. If the cut happens, you may face a double hit: lower income and more price pain.

Investopedia’s recent warning signs include “unsustainable dividend yields” as a clear red flag, tied to stress or instability. (Investopedia)

The Yield Trap Has a Pattern

Yield traps often share common features. The company shows shrinking margins, rising debt, weak free cash flow, or an industry in slow decline. Sometimes you also see aggressive accounting or sudden “one-time” explanations.

Moreover, yield traps are common in sectors where investors expect “steady income.” That includes certain REITs, certain telecoms, and some high-payout cyclicals.

Still, you can find excellent dividend businesses in every sector. The point is screening. The point is skepticism. The point is quality.

Myth: “A High Dividend Means a Great Company”

This is emotionally appealing. A big payout feels generous. It feels shareholder-friendly. It feels authentic.

Yet dividends do not automatically mean quality. Some great companies pay no dividend at all because they reinvest for growth. Investopedia highlights that many high-quality firms return value through reinvestment and, often, buybacks rather than dividends. (Investopedia)

Additionally, a high payout can hide weakness. If management is paying out cash while the business needs investment, that payout may be a short-term signal, not a long-term promise.

Reality: Quality Shows Up in Cash Flow, Not Yield

A healthy dividend is usually supported by reliable free cash flow. It is supported by a resilient business model. It is supported by pricing power and smart capital allocation.

Meanwhile, the most durable dividend stories often involve dividend growth, not extreme yield. Dividend growth tends to signal a business that is expanding earnings and cash flow. It can be a powerful indicator of corporate health.

That is why many long-term investors focus on “dividend growth investing,” “quality factor,” and “free cash flow yield,” rather than raw dividend yield.

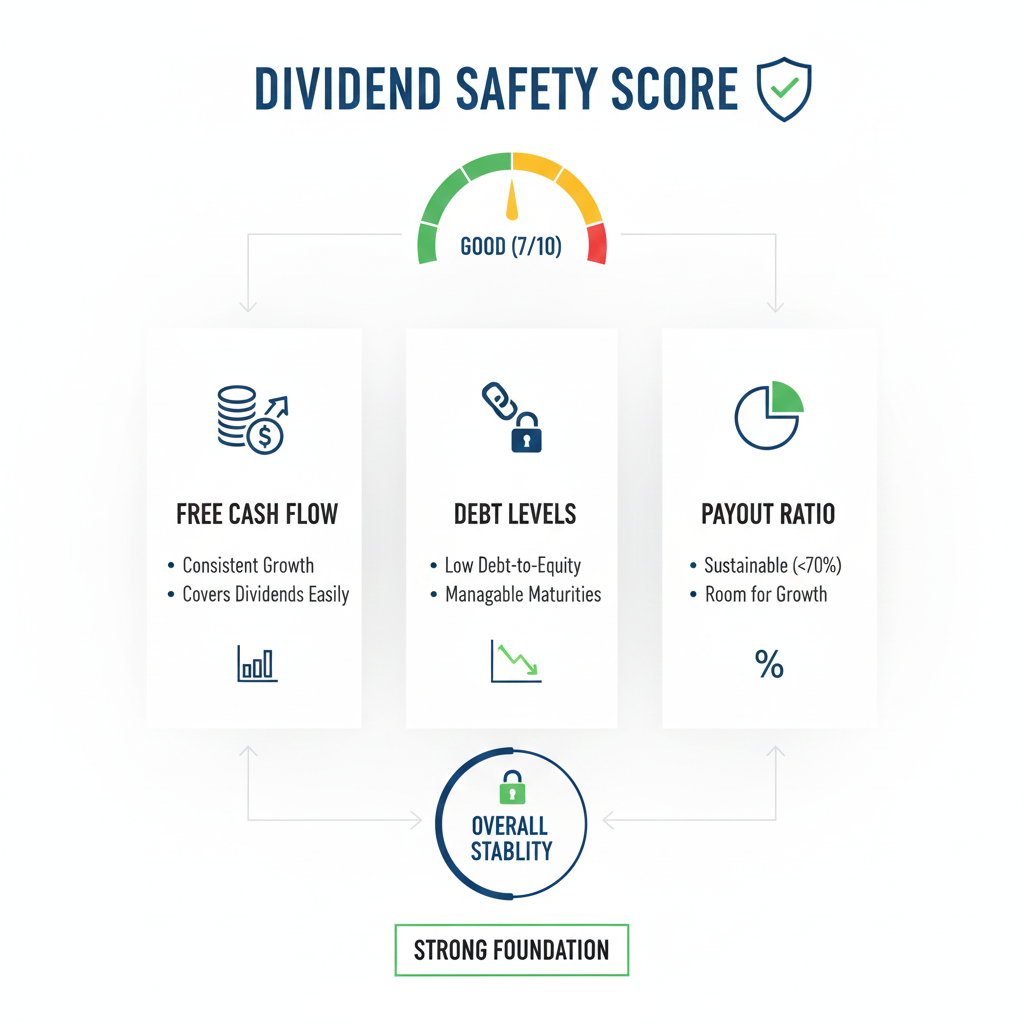

How to Stress-Test a Dividend Like a Pro

A serious dividend investor acts like a credit analyst first. You are underwriting a promise.

So you want simple, hard checks.

Payout Ratio: Useful, But Not Enough

The payout ratio compares dividends to earnings. A low payout ratio can be comforting. A very high payout ratio can be alarming.

However, earnings can be noisy. Accounting can distort them. One-time gains can inflate them. That is why payout ratio is a first pass, not a final answer.

Free Cash Flow Coverage: The Real Oxygen

Free cash flow is what remains after operating costs and capital spending. It is often the cleanest “dividend fuel.” If a company repeatedly pays dividends while free cash flow is negative, the dividend is living on borrowed time, or borrowed money.

Additionally, look at the trend. One bad year can happen. Two or three is a pattern.

Balance Sheet Pressure: Debt Is a Silent Dividend Killer

Debt is not always bad. Debt can be strategic. Yet high debt plus rising rates can crush dividend safety. Refinancing becomes more expensive. Interest expense grows. Cash that could fund dividends gets diverted.

Consequently, in the 2024–2025 higher-rate environment, dividend screening has become more critical than during the easy-money era.

The 2024–2025 Shift: Dividends vs Buybacks in a New Era

A modern dividend investor must understand one uncomfortable truth. Dividends are only one way companies return cash. Buybacks are the other giant.

In fact, buybacks have been projected at massive levels. Reporting has pointed to buybacks potentially topping $1 trillion in 2025, driven by strong cash generation and corporate priorities.

Additionally, broader coverage has described huge levels of cash returned to shareholders through a mix of dividends and repurchases.

Why does this matter?

Because many “dividend myths” assume dividends are the main return channel. That is no longer true across large parts of the market. Tech, for example, often prefers buybacks. Many high-growth firms may start dividends later, after maturity. (Investopedia)

Meanwhile, dividend-heavy sectors can behave like “rate-sensitive assets.” Utilities, REITs, and other income sectors can get hit when bond yields rise. That makes 2024–2025 and beyond a different game.

Regulation Watch: Buyback Disclosure Is Moving, But Not Smoothly

Regulatory policy can shape payout choices. It can also change how investors evaluate them.

The SEC’s share repurchase disclosure changes have faced legal turbulence. Commentary around the Fifth Circuit decision and related developments underscores that the rule’s path has not been straightforward. (Digrin)

Consequently, long-term investors should watch how disclosure evolves. More transparency can change market reactions to buybacks. It can also affect how companies balance buybacks versus dividends.

Video Break: Spotting the High-Yield Trap

At this point, it helps to see a practical walkthrough of the “yield trap” problem and the warning signs.

[YouTube Video]: How high dividend yields can mislead you, and how to spot a yield trap before it becomes painful

Myth: “Dividend Stocks Are Always Defensive”

Dividend stocks often feel defensive. Many are mature businesses. Many have stable customers. Many sit in “boring” industries.

However, dividends do not guarantee protection.

A dividend stock can be extremely risky if the payout is unstable. It can also be risky if the business is a value trap. A declining business can still pay dividends for years, until it cannot.

Additionally, some high-yield sectors are cyclical. Energy payouts can swing with commodity prices. Financial payouts can swing with credit cycles. Even “defensive” names can cut dividends in a crisis.

Reality: Dividend Safety Is Cycle-Dependent

The true defense comes from resilience through cycles. That means revenue stability, cost control, and strong balance sheet design. It also means management that treats the dividend as a long-term promise, not a marketing slogan.

That is why “dividend aristocrats” and consistent dividend growers remain attractive to many investors. The concept is simple: a long history of maintaining and raising dividends can signal discipline. It is not a guarantee, but it is meaningful context.

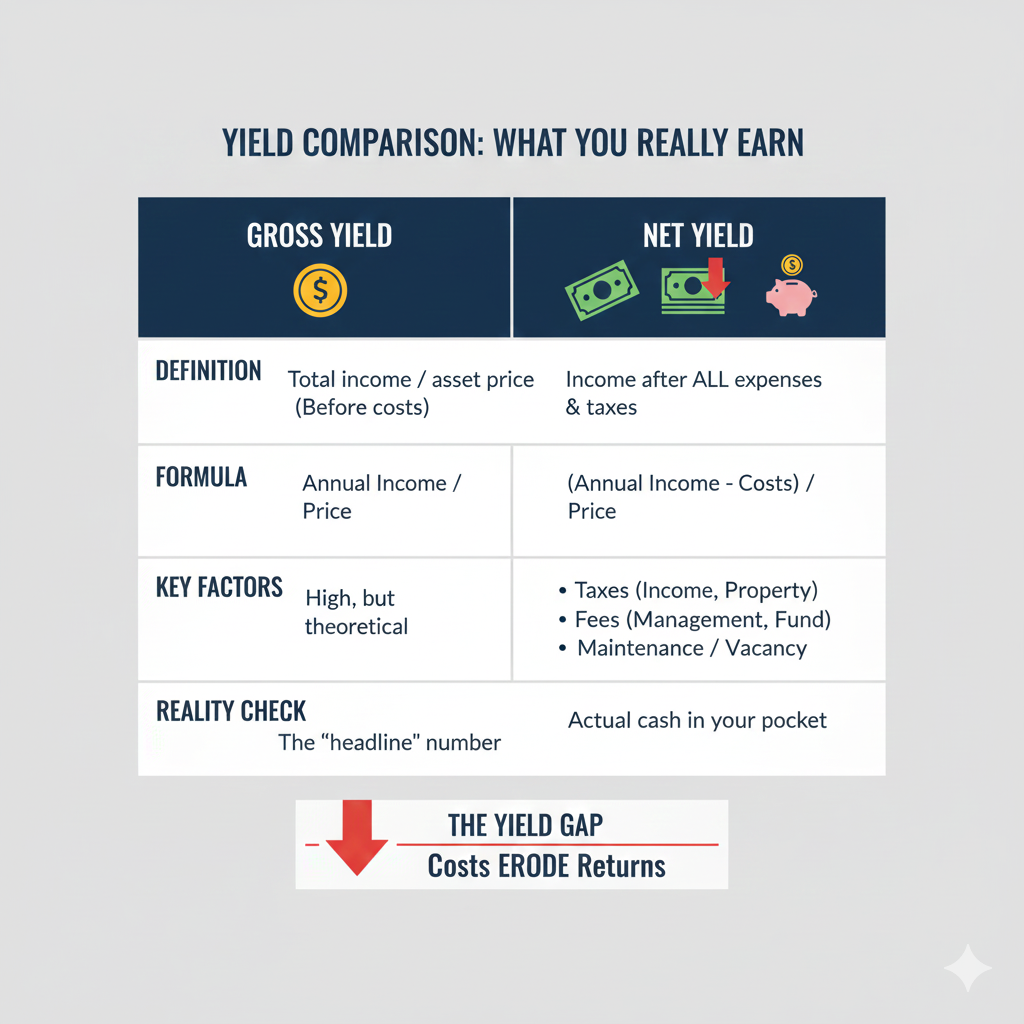

The Hidden Risk: Taxes, Withholding, and Income Illusions

Dividend investors often underestimate tax drag. Taxes can quietly erase the advantage of “income.”

Qualified dividends may have favorable tax treatment in some systems, but rules vary. The holding period rules, account type, and cross-border withholding can matter a lot. Investopedia summarizes the distinction and why dividend tax treatment differs. (Barron’s)

Additionally, international dividends can face withholding taxes. In many cases, you can reclaim some via credits. Yet the paperwork and timing can reduce real-world returns.

Consequently, “net yield” is the yield that matters. That net yield is after taxes, after fees, and after currency impact.

What’s Emerging: The Future of Dividend Investing Through 2026 and Beyond

Dividend investing is not dying. It is evolving. Several trends stand out.

1) The Rise of “Quality Income” Over “High Yield”

Investors have become more sensitive to payout durability. That pushes attention toward free cash flow, strong margins, and stable demand. It also pushes investors toward “dividend growth” rather than “maximum yield.”

Additionally, the popularity of factor-based ETFs and “quality dividend” screens keeps growing. Many portfolios now combine dividends with quality metrics, like return on equity and balance sheet strength.

2) Options Overlays and “Synthetic Yield”

Covered call ETFs and option-income strategies remain a major theme. They can deliver cash flow. Yet they often trade upside for income.

Moreover, these strategies can confuse investors. The “yield” may include option premium, not dividends. It can be powerful. It can also cap long-term compounding.

A smart investor separates true business payouts from strategy-generated distributions.

3) Direct Indexing and Personalized Dividend Policies

Direct indexing has grown as a way to own a custom basket. It can support tax management. It can also avoid concentrated sector risk.

Consequently, a dividend investor can build a “personal dividend index” that targets quality, avoids extreme yield, and improves diversification.

4) AI Screening: Helpful, Not Magical

AI tools can scan filings, detect cash flow patterns, and compare payout sustainability across peers. That is exciting. It feels next-generation.

However, models can miss regime shifts. They can also overfit past stability. That is why human judgment remains essential. Use AI as a filter, not an oracle.

Video Break: Myths vs Reality in Dividend Strategy

Now it helps to watch a broader myth-busting discussion. Look for how the speaker frames dividends versus total return, and how “yield chasing” often ends.

[YouTube Video]: Dividend investing myths, total return reality, and why “high yield” can backfire

Practical Implications: A Clear, Calm Dividend Playbook

This is where the article becomes actionable. The goal is not to ban high yield. The goal is to avoid fragile yield.

Step 1: Define the Job of Dividends in Your Life

Ask one question: “What problem does this dividend solve?”

If you need current income, you want reliability. If you are still building wealth, reinvestment and growth may matter more. If you want psychological comfort, you still need to avoid paying too much for it.

Additionally, match dividend strategy to time horizon. A long horizon can tolerate more volatility. A short horizon needs stability and liquidity.

Step 2: Build a “Safety First” Filter

Start with cash flow coverage and balance sheet strength. Then look at payout ratio. Then look at earnings quality.

Moreover, read dividend policy language in company filings and investor presentations. Watch how management talks about the dividend. Do they treat it as sacred? Do they treat it as flexible?

Step 3: Avoid Concentration Risk

Dividend portfolios often drift into a few sectors. That can create silent exposure to interest rates, regulation, or commodity cycles.

Consequently, diversify across sectors and business models. Diversify across geographies if it makes sense for your tax situation. Diversify across payout styles, including dividend growers and moderate yielders.

Step 4: Reinvest With Discipline, or Spend With Discipline

Reinvestment can be a powerful compounding engine. Spending can be a powerful lifestyle tool. Both can be successful.

However, the biggest mistake is “unplanned spending” from dividends while ignoring total return. That turns investing into slow erosion.

Step 5: Treat Dividend Cuts as Data, Not Drama

Dividend cuts are painful. They feel like betrayal. They trigger fear.

Yet a dividend cut is information. It often signals a stressed business model or an overleveraged balance sheet. Sometimes it can also be a strategic reset that saves the company.

So respond with process. Review free cash flow. Review debt. Review industry outlook. Then decide.

Expert Perspective: Why “Yield” Became a Marketing Weapon

High yield sells. It feels like certainty. It also feels like control.

Meanwhile, social media content often rewards simplicity. “This stock pays 12%” is a thrilling headline. “This portfolio has a balanced risk-adjusted return path” is not.

Consequently, the modern investor must build a defense against narrative seduction. That defense is a checklist. That defense is patience. That defense is accepting that boring can be profitable.

Additionally, remember that dividend investing is not the only route to income. Bonds, money market funds, and short-duration instruments can compete strongly in a higher-rate regime. That competition can pressure high-yield equities, especially if their dividends look less safe than a bond coupon.

The Biggest Myths, Reframed as Better Questions

Instead of myths, ask better questions.

When you feel tempted by a huge yield, ask: “Is this yield high because the price fell?” Then ask: “Why did the price fall?”

When you see a long dividend history, ask: “What is the business risk now?” Then ask: “What changes could break the pattern?”

When you want “income,” ask: “What is my after-tax income?” Then ask: “How does inflation change this?”

When you want safety, ask: “What happens to this company in a recession?” Then ask: “What happens if rates stay higher longer?”

These questions are not glamorous. They are critical. They are protective. They are proven.

Conclusion: Dividend Investing Can Be Powerful, If You Respect the Trap

Dividends can be an authentic wealth tool. They can create discipline. They can support income. They can also reduce behavioral mistakes.

However, yield is not a reward by itself. It is a signal. Sometimes it is a dangerous signal.

The future of dividend investing is likely to be more selective, more quality-driven, and more integrated with tax planning and technology. Meanwhile, buybacks, disclosure changes, and higher-rate competition will keep shaping the landscape. (Digrin)

So the winning move is not chasing the biggest yield. The winning move is building a resilient, diversified, cash-flow-backed dividend strategy that can survive stress and still feel calm.

Sources and References

- Recognizing the Red Flags: 5 Signs a Stock Is a Terrible Investment (Investopedia)

- 7 Quality Stocks That Don’t Pay a Dividend (Investopedia)

- Kiplinger: Dividends’ role in total returns (Kiplinger)

- Axios: Stock market’s wave of cash returns

- Reuters: S&P 500 buybacks outlook and scale

- Investor’s Business Daily: Buybacks topping $1T

- Harvard Law School Forum: Share Repurchase Disclosure Modernization (Candor Partners)

- Jenner & Block: Fifth Circuit and SEC buyback rule update (Digrin)