Protect your paycheck with disability insurance that actually works. Learn coverage types, costs, riders, traps, and future trends so you buy with confidence.

Disability insurance is the most ignored policy because it feels abstract. Yet it protects the most concrete thing in your life: your ability to earn. When income stops, everything else gets stressed fast. Rent feels heavier. Debt feels louder. Savings drains quicker than you expect. Meanwhile, modern work is changing. More freelancers. More burnout. More remote roles. More chronic health issues being openly discussed. This is exactly why disability coverage is becoming a crucial, next decade money move.

This guide is beginner-friendly on purpose. It stays practical. It avoids jargon where possible. When jargon matters, it gets explained in plain words.

Why disability insurance matters more than life insurance

Life insurance protects your family if you die. Disability insurance protects you if you stay alive, but cannot work. That reality is uncomfortable, so people skip it. However, “alive but unable” is financially brutal because bills keep coming.

Even strong savers get surprised. A serious illness or injury can turn a calm budget into a crisis budget. Furthermore, many disabilities are not dramatic accidents. They can be cancer treatment, back issues, long recovery, autoimmune flare-ups, pregnancy complications, severe anxiety, or depression. The risk is not rare in real life. It is just rarely discussed.

Another reason it matters: Social programs exist, but the rules are strict. In the United States, SSDI eligibility uses a specific definition of disability. It is not “I cannot do my job.” It is closer to “I cannot do substantial work.” (NAIC) That gap is where private disability insurance can be a lifesaver.

In Canada, CPP disability also exists, with its own criteria and benefit framework. (Legal Aid at Work) Public coverage can help, but it is rarely designed to replace a professional salary fully.

The two big buckets: short-term vs long-term disability

Short-term disability

Short-term disability typically covers a shorter window, often weeks to months. It can be employer-provided, state-provided in some places, or individually purchased. It is meant to bridge the immediate shock.

Some U.S. states run programs. For example, California SDI is administered by the Employment Development Department. New Jersey has Temporary Disability Insurance as well. These programs can be powerful, but they are location-specific.

Long-term disability

Long-term disability coverage is the heavyweight. It is designed for long claims. Think years, not weeks. Employer group long-term disability is common. Individual long-term disability is the premium, customizable version.

The core question is simple: if you could not work for a year, or five years, what would happen?

The words that decide whether a policy is “great” or “fake”

You can buy disability insurance that looks impressive and still fails you. The difference is often a few contract words. Consequently, you must understand the core levers.

Definition of disability

This is the most important clause.

“Own occupation” means you are considered disabled if you cannot do your own job duties, even if you could do another job. This is often crucial for high-skill careers like surgeons, pilots, dentists, specialized engineers, and traders whose income depends on performance.

“Any occupation” is stricter. It means you are disabled only if you cannot do any job you are reasonably suited for by education or experience. That is a much tougher standard.

Some policies use hybrid language that sounds like “own occupation” but behaves like “any occupation” after a period. So you must read carefully.

[YouTube Video]: A clear explanation of disability income insurance basics and why definitions matter.

Elimination period

This is your waiting time before benefits start. Common elimination periods are 30, 60, 90, or 180 days. A longer waiting period often lowers premiums. However, it raises the amount of emergency cash you must carry.

Think of the elimination period as “how long can my savings carry me without income.”

Benefit period

This is how long benefits can last once you qualify. It might be 2 years, 5 years, 10 years, or to age 65 or 67. Longer benefit periods cost more. Yet for a young professional, “to age 65” can be a vital shield.

Benefit amount and replacement ratio

Most plans cover a percentage of income. Group plans often target around 50 to 60 percent. Individual plans vary, with underwriting limits.

This is where taxes matter. Benefits can be tax-free or taxable depending on who paid premiums and how. IRS guidance on disability benefits and taxes can change outcomes in a big way. (NAIC)

Group disability vs individual disability

Group disability is usually cheaper and easier to get. It is often offered at work. Still, group coverage has common weaknesses. It may cap monthly benefits. It may not fully replace bonuses. It may have stricter definitions. It may be less portable. It can be tied to your job.

Individual disability is more expensive, but it is often more precise and more protective. It is built around you. It can follow you across jobs. It can offer stronger “own occupation” language.

This is why many professionals use a layered strategy: take employer coverage, then add an individual policy to close the gap.

[YouTube Video]: A discussion of group vs individual disability policies and where surprises happen.

The “high yield trap” version of disability insurance

In investing, “high yield” can hide risk. In disability insurance, “cheap premium” can hide traps. The policy can be real, but the coverage can be weak.

Here are the classic traps, explained without drama.

Trap 1: The definition quietly flips

Some plans start as “own occupation” and later switch to “any occupation.” That switch can turn a confident buyer into a disappointed claimant.

Trap 2: Mental health and subjective conditions get limited

Many group plans limit benefits for mental health claims, substance use, and sometimes “subjective” issues like chronic pain. This is a sensitive area and it is evolving. Meanwhile, mental health claims are rising across many workplaces. So limitations matter more than ever.

Trap 3: Income caps hit high earners hard

A plan might replace 60 percent of income but cap at a number like $10,000 per month. If your real income is $25,000 per month, your true replacement rate becomes painfully low.

Trap 4: No inflation protection

A long claim without inflation adjustments can become financially crushing over time. This is why some policies offer COLA riders.

Trap 5: Non-portable coverage in a mobile world

If you change jobs, move countries, or go from employed to self-employed, group coverage may end. Modern careers are fluid. Coverage needs to match that reality.

Step-by-step: how to choose disability insurance without overthinking

This is the practical core. It is designed to be fast, focused, and effective.

Step 1: Define your “income survival number”

Start with a simple number: the monthly amount you must have to avoid financial panic.

Include housing, food, utilities, minimum debt payments, insurance, and basic transport. Add a small buffer. Keep it realistic.

This number guides everything else. It decides your elimination period comfort. It shapes your benefit target.

Step 2: Build the emergency runway first

Before you optimize coverage, build cash. Even great policies have waiting periods. Claims take time. Paperwork exists.

A solid runway makes you stronger and calmer. It also lets you choose better contract terms instead of choosing the cheapest option.

Step 3: Check what you already have

If employed, ask HR for:

The summary plan description. The definition of disability. The percentage covered. The cap. The benefit period. Any mental health limitations.

If in the U.S., also confirm if the plan is governed by ERISA, which affects appeals and claims processes. The U.S. Department of Labor’s EBSA materials help explain ERISA plan rights and processes. (IRS)

Step 4: Decide whether “own occupation” matters for you

If your income depends on a specialized role, “own occupation” can be a powerful must-have. If you could switch roles easily without losing most income, you may prioritize cost and simplicity.

This is not about fear. It is about matching coverage to your income engine.

Step 5: Choose elimination period and benefit period

Pick an elimination period that matches your runway. Pick a benefit period that matches your life stage.

A 25-year-old professional with dependents has a different risk profile than a 55-year-old near retirement.

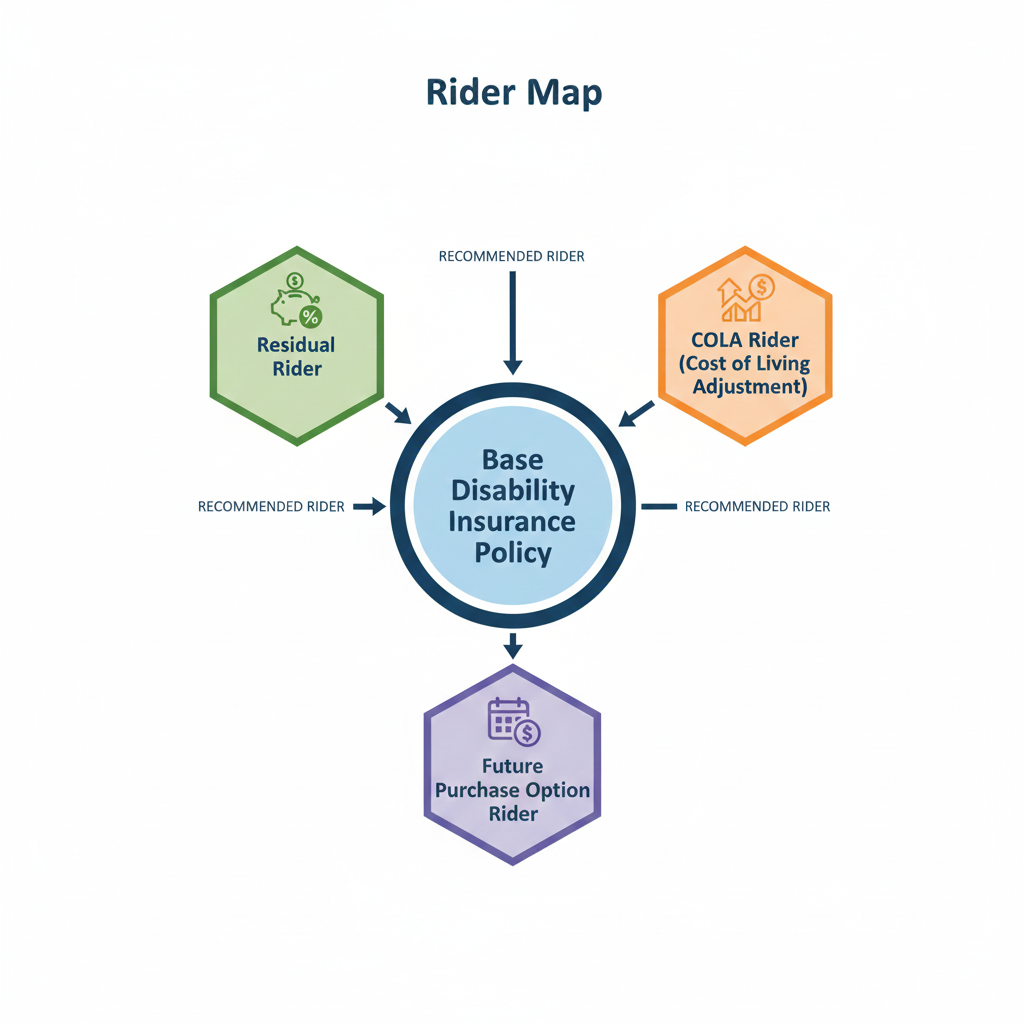

Step 6: Add only the riders that truly matter

Riders are add-ons. Some are worth it. Some are marketing.

The most valuable riders often include:

Residual or partial disability benefits, so you get paid if you can work, but earn less.

COLA, so benefits can rise during long claims.

Future purchase options, so you can increase coverage as income rises.

However, riders must fit your budget. A policy that forces you to cancel later is not a win.

Real-world claim scenarios you should imagine

People choose better coverage when they picture the claim. So let’s do it.

Scenario A: You can work, but not like before

You can still work 20 hours per week. Your income drops 40 percent. Without residual benefits, you might get nothing. With residual coverage, you can get partial benefits that stabilize your life.

This is a common reality. Disability is often partial, not total.

Scenario B: A long recovery that drains savings

A serious illness takes a year. You eventually return to work. If you had a 180-day elimination period and weak savings, the stress is intense. If you had a 90-day elimination period and a runway, you survive with dignity.

Scenario C: A specialized career where switching jobs is not simple

If you are trained for a narrow role, the difference between “own occupation” and “any occupation” can decide whether you get paid. The contract words become the whole story.

How costs are changing, and what insurers are watching now

Disability insurance pricing is not random. Underwriting is evolving.

Insurers watch age, occupation, income stability, health history, and sometimes lifestyle. Meanwhile, the world is shifting in ways that will likely reshape disability insurance through 2026 and beyond.

Trend 1: Mental health becomes a central underwriting and claims frontier

Mental health is no longer a side topic. It is a workforce reality. Expect more attention on mental health benefit limits, treatment compliance, and the way policies define conditions.

This will trigger pressure from employers, regulators, and consumers. Some group benefits may expand. Some underwriting may tighten. The direction may differ by insurer and market.

Trend 2: Remote work changes disability patterns

Remote work can reduce commuting injuries. Yet it can raise ergonomic issues and social isolation risks. It can also change how “ability to work” is evaluated.

Expect more digital claims management and more functional capacity assessment methods. That can be both helpful and frustrating, depending on implementation.

Trend 3: The gig economy pushes portable coverage

More people work without traditional benefits. Portable benefits are becoming a bigger policy conversation. Consequently, individual disability insurance and association-based coverage may grow.

Trend 4: AI-driven underwriting expands, with new fairness questions

Automation can speed quotes and underwriting. It can also raise concerns about bias, transparency, and explainability. Regulations may respond over the next few years, especially as AI governance expands in financial services.

Disability insurance and public benefits: how they interact

Public benefits can be part of your safety net. They are not usually a full replacement.

United States: SSDI

SSDI uses a strict disability definition and process. It is not built for “I cannot do my exact job.” It is built around the ability to engage in substantial work. (NAIC)

Private disability insurance can fill the gap between your real income needs and what SSDI can provide.

Canada: CPP Disability

CPP disability provides benefits under its own rules and amounts. The Government of Canada publishes details and maximum monthly amounts, which can change year to year. (Legal Aid at Work)

If you are a Canadian worker or have Canadian coverage ties, CPP disability may be relevant. Still, many professionals need extra private coverage to protect lifestyle-level income.

State programs: temporary disability insurance

Some U.S. states provide short-term disability style coverage. California SDI and New Jersey TDI are examples. These programs can reduce short-term shock. However, they are not substitutes for long-term income protection.

The smartest mistakes to avoid

This section is short on purpose. These mistakes are common and expensive.

Buying only what feels “cheap”

Cheap can be a trap. A weak definition, low cap, or harsh limitation can create false confidence.

Ignoring taxes

Tax treatment can decide whether your benefit is powerful or disappointing. IRS guidance is worth checking when evaluating employer-paid versus employee-paid premiums. (NAIC)

Skipping residual coverage when your income is performance-based

If your income is commission-based, bonus-heavy, or relies on a high-performance role, residual benefits are often crucial.

Forgetting portability

Careers move. Countries change. Companies collapse. Your coverage strategy should survive job changes.

Quick guide to reading a policy like a pro

You do not need to become an insurance lawyer. You just need a simple reading order.

First, read the definition of disability. Then read benefit amount and cap. Next, read elimination period and benefit period. After that, scan limitations and exclusions. Finally, check riders and portability.

If any section feels slippery, ask for clarification in writing. The goal is reliable clarity, not vague reassurance.

Tools and resources that make this easier

You can keep this simple and still be thorough.

If you have employer coverage, ask for the plan documents and a claims summary process. If buying individual coverage, consider working with a specialist broker who understands your occupation class and contract language.

Consumer-oriented insurance education resources can also help you avoid confusion. The Insurance Information Institute has plain-language explainers on disability income insurance. (Ramsey Solutions) NAIC also publishes consumer guidance that breaks down disability insurance complications. (DevelopmentEducation.ie)

A forward-looking checklist for 2026 and beyond

Disability insurance is not static. So you should plan for change.

Expect more digital-first claims experiences. Expect more scrutiny around mental health limitations. Expect more debate around portable benefits for non-traditional workers. Expect AI underwriting to expand, with more regulation and more consumer education.

The winning strategy is stable: buy a strong definition, protect against partial disability, match elimination period to runway, and keep portability in mind.

If you do that, you are not just buying insurance. You are buying breathing room. You are buying calm. You are buying a powerful income shield that lets you keep building, even when life hits hard.

Sources and References

- Social Security Disability Benefits Overview

- SSA: Disability Definition and Eligibility

- U.S. Department of Labor EBSA: ERISA Guidance

- IRS: Disability Benefits and Taxability

- NAIC: Simplifying Disability Insurance

- Insurance Information Institute: Disability Income Insurance

- California EDD: State Disability Insurance

- New Jersey: Temporary Disability Insurance

- Government of Canada: CPP Disability Benefits

- ACLI Fact Book