Defense boom 2026: American Dynamism drives drones, border tech, and new policies. Learn winners, risks, and how investors can prepare.

The loudest story in investing used to be virtue plus growth. ESG screens, climate narratives, and carefully curated portfolios dominated boardrooms and pitch decks. As 2025 ends, a different story is rising. It is sharper, harder, and more urgent.

Hard power is back.

Investors are watching defense technology, drone manufacturing, secure AI, and border security tech with renewed intensity. This shift is not just mood. It is anchored in real spending, real procurement change, and real geopolitical pressure.

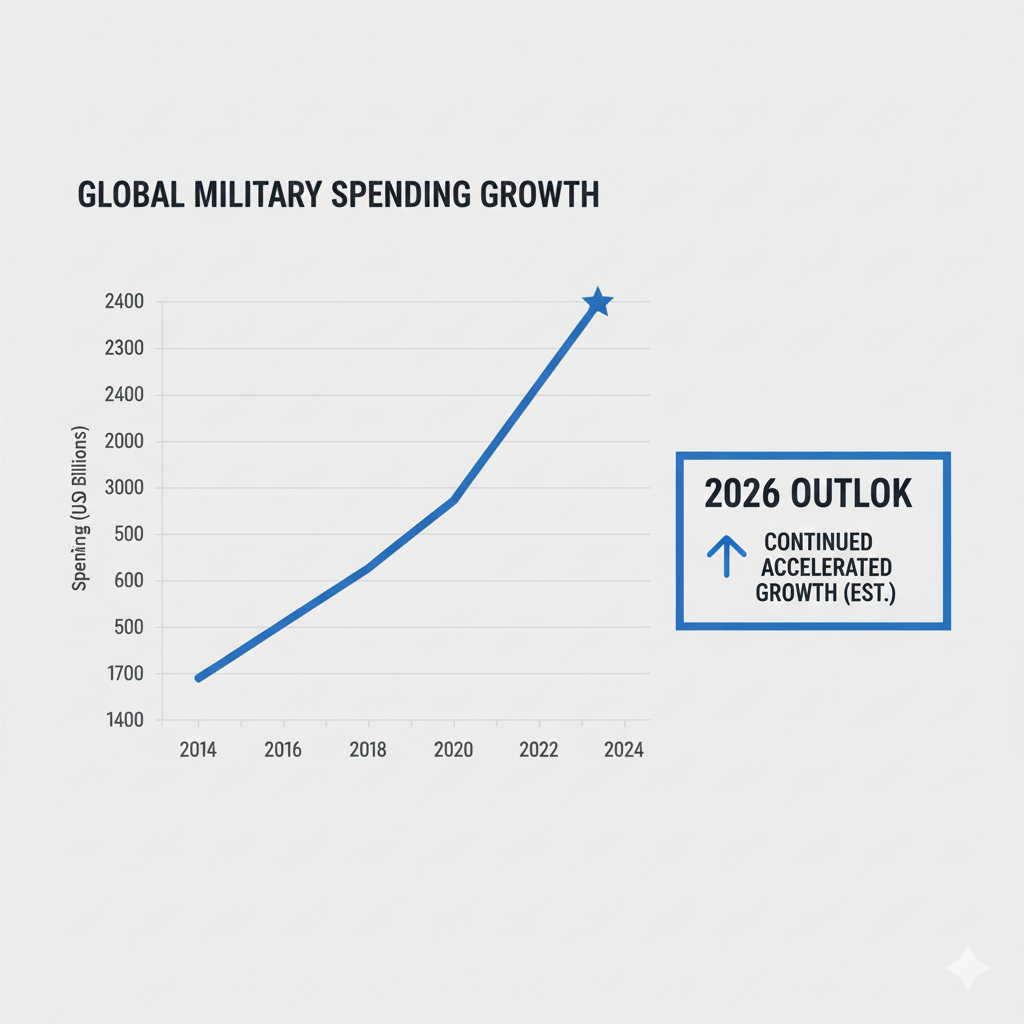

Global military expenditure hit a fresh high in 2024, rising to about $2.7 trillion, with a steep year-on-year increase. (SIPRI) That rising tide pulls capital toward the companies that build sensors, autonomy, software, and production capacity. Meanwhile, venture funding and private capital have been pushing deeper into defense tech, with major trackers highlighting surges in investment activity in 2025. (PitchBook)

The personalities tied to this moment matter, too. Palmer Luckey represents the new defense startup archetype: fast iteration, modern manufacturing, and AI-first systems. Alex Karp represents the “software as strategic power” thesis: data platforms and AI-enabled decision support as a core defense asset. The cultural label that often frames this capital rotation is “American Dynamism,” popularized in venture circles as a pro-building, pro-industry worldview. (Andreessen Horowitz)

Now comes the critical question for December 2025 investors: what changes in 2026?

The answer is not simply “more defense spending.” The more meaningful shift is structural. 2026 is likely to bring faster drone procurement, deeper export and AI controls, tighter supply-chain rules, and more investor attention to dual-use companies that can sell to government and commercial markets at once. (Reuters)

Why the “Hard Power” trade is accelerating now

The defense boom is not just a reaction to headlines. It is driven by three forces that reinforce each other: budgets, battlefield lessons, and industrial strategy.

First, spending momentum is real. SIPRI’s 2024 figures show a decade-long climb in global military spending, with a sharp jump in the latest year. (SIPRI) Even if 2026 growth moderates, the baseline level is already massive.

Second, drones changed the perceived economics of conflict. Cheap, expendable systems can deliver outsized impact. This idea is now moving from war reporting into procurement plans and legislative language. A major Reuters report in late 2025 described the U.S. Army’s plan to scale up to at least one million drones over the next two to three years. (Reuters) That is a staggering signal. It implies scale manufacturing, component supply chains, and faster acquisition pathways.

Third, industrial policy is tightening. Governments want domestic production, especially for sensitive components. That trend supports U.S.-based manufacturing and “trusted supply chain” businesses, while raising friction for firms that rely on foreign inputs for motors, sensors, batteries, and electronics. (Reuters)

Furthermore, the venture narrative is shifting. “American Dynamism” frames defense, advanced manufacturing, and national resilience as investable growth themes, not taboo sectors. (Andreessen Horowitz) When a narrative turns emotionally positive, capital follows faster.

Palmer Luckey and the speed doctrine

Luckey’s appeal to investors is not just celebrity. It is speed. Modern defense startups pitch rapid iteration, software-driven upgrades, and manufacturing that can ramp.

That story resonates because traditional procurement has a reputation for being slow and bureaucratic. In contrast, 2026 is shaping up as a year where policymakers openly demand faster drone procurement, faster testing, and faster scaling. (Reuters)

[YouTube Video]: A high-profile interview that captures the new defense tech mindset, including autonomy, production speed, and why “scale” is the core battlefield advantage.

Additionally, this “speed doctrine” has investment consequences. It favors firms that look more like modern industrial companies than classic defense primes. It also favors software platforms that can update capabilities quickly.

ESG vs “American Dynamism”: what is really changing

The popular framing says ESG is being replaced by “American Dynamism.” That is partly true, but the deeper reality is more nuanced.

ESG did not disappear. It weakened as a dominant organizing story. Higher rates, geopolitics, and disappointing returns in certain categories pushed many allocators to re-rank priorities.

Meanwhile, defense became easier to justify. Investors can describe it as resilience, deterrence, and protection. They can also describe it as a jobs-and-manufacturing engine. That makes the shift feel rational, not ideological.

“American Dynamism,” as described by a16z’s Katherine Boyle, is explicitly pro-building and pro-industry, emphasizing momentum and the defense of core values. (Andreessen Horowitz) That message lands in a world where security risks feel immediate.

However, the ethical debate does not vanish. It becomes sharper. In 2026, many institutions will still face internal constraints around weapons, surveillance, and border technologies. That creates an investing split: some pools of capital lean in aggressively, while others stay cautious.

Consequently, valuations can swing fast. If one big allocator changes policy, or one scandal hits the sector, momentum can flip.

The “quiet” factor: dual-use is the bridge

A major reason this trend can expand in 2026 is dual-use positioning.

Dual-use companies sell technology that can serve defense needs and civilian needs. Think secure communications, robotics, logistics software, cyber defense, resilient manufacturing, and certain sensor platforms. Dual-use makes the narrative more comfortable. It also expands the total addressable market.

Additionally, dual-use firms can sometimes smooth revenue cycles. A pure defense contractor may be hostage to procurement timing. A dual-use company can offset delays with commercial demand.

That said, dual-use also creates policy risk. Export controls and foreign customer restrictions can hit dual-use firms hard. 2026 is likely to intensify that pressure.

The drone manufacturing supercycle heading into 2026

If one theme dominates the next year, it is drones at scale.

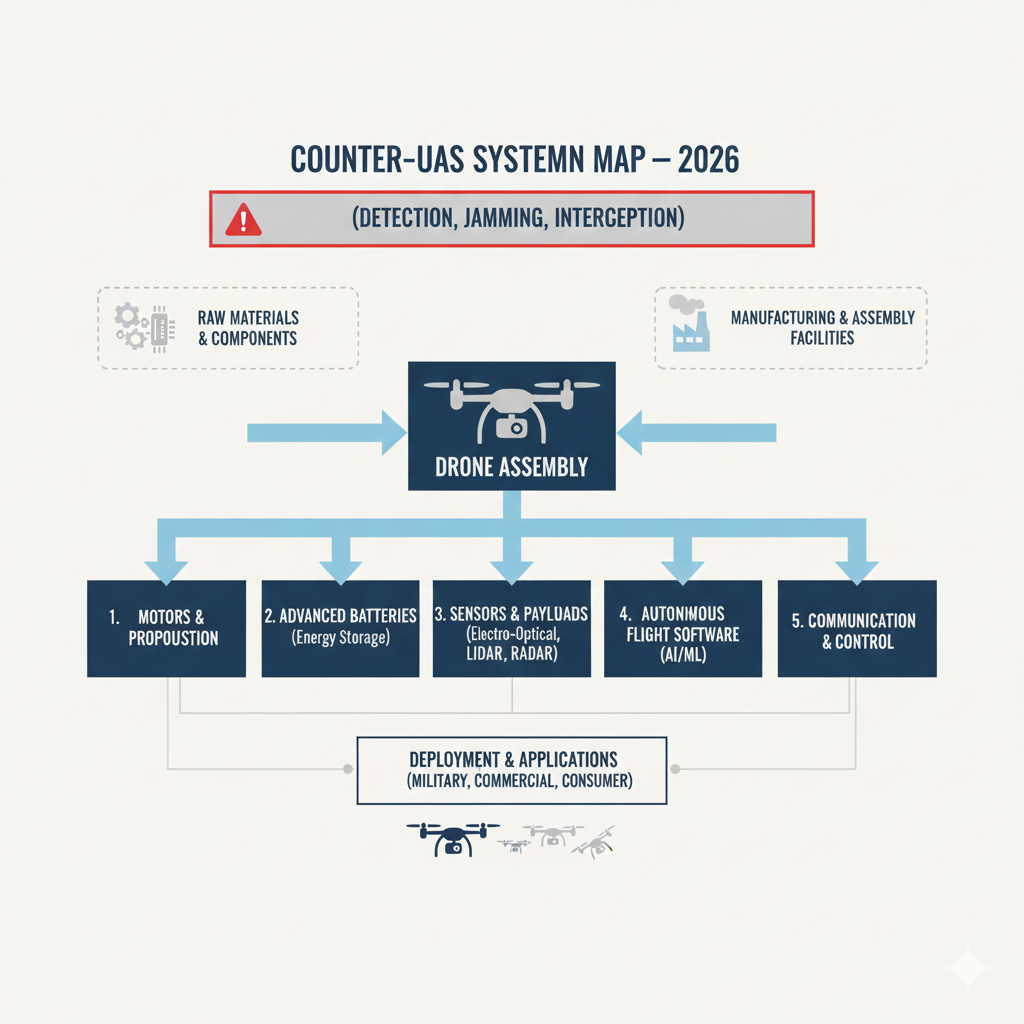

The late-2025 reporting on the U.S. Army’s drone ramp suggests a new procurement mindset: drones as expendable, closer to ammunition than to high-value aircraft. (Reuters) That shift supports a “volume-first” industrial strategy. It also supports a broader ecosystem: components, testing, training, counter-drone systems, and software.

Meanwhile, the DoD’s Replicator initiative has been central to the push for mass fielding of uncrewed systems. A Congressional Research Service brief describes Replicator as aiming to deploy uncrewed systems “en masse,” emphasizing the value of relatively inexpensive platforms distributed across many units. (Congress.gov) The DIU also outlines Replicator’s focus and its evolution. (Defense Intelligence University)

Still, Replicator has faced questions about secrecy, progress, and transition to scaled production. (DefenseScoop) That uncertainty is itself investable information. It suggests the government wants the outcome, but the path is still being fought over.

The 2026 prediction: procurement reforms get louder

Expect 2026 to bring more visible pressure to reform drone procurement.

Reuters reported in late 2025 that a Pentagon “DOGE” unit was tasked with overhauling the drone program, with an aim to streamline procurement and increase domestic production, including tens of thousands of cost-effective drones. (Reuters) Even if the specifics evolve, the signal is clear: speed and volume are now policy goals.

Therefore, 2026 is likely to reward companies that can do three things at once: manufacture at scale, prove reliability, and navigate compliance.

The supply chain reality: components are the bottleneck

A million drones is not just airframes. It is motors, batteries, sensors, boards, and secure links.

The Reuters reporting highlighted concerns about dependence on China for key components, and the push to expand domestic production. (Reuters) This is crucial for investors. When supply chains become strategic, winners often include the “boring” suppliers.

However, this area is also crowded with hype. In 2026, the companies that win serious contracts will need evidence, not slogans. They will need test results, production yield, and credible security claims.

Software-defined defense: why Alex Karp’s thesis matters in 2026

Drones capture attention because they are visual. Software is less visible, but it can be more decisive.

Alex Karp and Palantir represent a worldview where data integration, intelligence processing, and AI-enabled operations become a strategic advantage. In this framing, the “weapon” is not only hardware. The weapon is the system that sees, decides, and coordinates faster.

In 2026, software-defined defense is likely to expand in three directions.

First, data fusion becomes more urgent. As uncrewed systems proliferate, sensor data explodes. Processing, filtering, and turning it into action becomes essential.

Second, AI governance becomes a competitive factor. Governments want AI, but they also want control, explainability, and security. Export controls on advanced AI and computing also add pressure to keep sensitive capabilities inside trusted networks. (federalregister.gov)

Third, procurement is shifting toward platforms that can update quickly. A system that improves every month has an advantage over a system that upgrades every five years.

[YouTube Video]: A mainstream interview that highlights how defense, AI, and geopolitical pressure are reshaping strategy, and why software platforms are becoming central.

Meanwhile, investors should separate emotion from business fundamentals. Software margins can be attractive, but government contracting can be complex. Revenue timing can be uneven. Political scrutiny can be intense. In 2026, those realities will not soften.

The 2026 prediction: AI controls tighten, but demand rises

Here is the paradox investors need to hold at once.

Demand for AI-enabled defense tools is rising. Governments want better autonomy, better intelligence processing, and better resilience. At the same time, controls on AI diffusion are tightening.

The U.S. Federal Register published an “AI diffusion” framework under the Export Administration Regulations, aimed at controlling the global spread of the most advanced AI models and computing clusters. (federalregister.gov) This kind of rule pushes companies to treat AI capability as strategic, regulated infrastructure.

Consequently, 2026 could see a premium placed on firms that can comply cleanly while still shipping products fast.

Border security tech: the hottest and most controversial pillar

Border security technology sits at the intersection of security policy, civil liberties, and industrial capability. It is also a major driver of procurement.

Investors are paying attention because border agencies buy sensors, cameras, analytics software, secure networks, drones, and automated monitoring tools. These purchases can scale. They can also become politically explosive.

In 2026, expect border tech to grow in two directions.

One direction is “detection and interdiction.” That includes counter-drone systems, surveillance towers, sensor networks, and data analytics. The other direction is “identity and processing.” That includes secure systems for managing large flows of data and decisions.

However, the headline risk is real. A single story about misuse can trigger backlash. Regulatory and legal pressure can rise quickly.

Therefore, border tech investing in 2026 will be as much about governance as about growth. Investors will likely demand clearer guardrails, stronger audit trails, and tighter oversight.

The 2026 policy angle: export and drone rules evolve

Export policy is not just about jets and missiles. It increasingly touches drones and autonomy.

In September 2025, the U.S. State Department announced a policy update on the export of unmanned aerial systems, emphasizing that export controls must keep pace with technological change. (State Department) That kind of policy language suggests more updates could follow.

Additionally, export controls on advanced computing and AI can affect border tech firms that rely on sensitive chips or models. (federalregister.gov)

So, 2026 may bring more compliance burdens for companies that operate globally. It may also limit some growth pathways.

What to expect in 2026: the key trends investors should watch

The core 2026 story is not a single company. It is a system shift in how governments buy, scale, and regulate security technology.

Trend 1: Drones become a mass-market defense category

The Army’s one-million-drone plan is the clearest signal of scale ambition. (Reuters) It suggests 2026 will emphasize manufacturing, component availability, and training pipelines.

Furthermore, counter-drone capabilities will likely grow in parallel. Replicator’s second iteration focuses on countering enemy drones, which supports demand for detection and defeat systems. (Defense Intelligence University)

Trend 2: Acquisition reform becomes a competitive moat

In 2026, procurement speed will be a strategic battleground.

If policymakers demand faster fielding, then contractors that can navigate contracting pathways quickly may win share. That includes firms that understand compliance, testing requirements, and production quality assurance.

However, this can also reward insiders and punish newcomers. The tension between innovation and bureaucracy will stay intense.

Trend 3: Domestic production becomes a national priority

The push to reduce reliance on China for components is becoming explicit. (Reuters)

Consequently, companies with U.S.-based manufacturing, verified supply chains, and secure component sourcing may gain an advantage. This theme fits “American Dynamism” perfectly because it merges patriotism, industrial growth, and security.

Trend 4: AI and export controls reshape global growth plans

The “AI diffusion” export control framework signals that advanced AI is being treated as a national security asset. (federalregister.gov)

Therefore, in 2026, global expansion strategies may change. Some firms will avoid certain markets. Some will build “compliance-by-design.” Some will split product lines to manage restrictions.

New regulations and policies expected in 2026

Investors often miss how much policy shapes returns in defense and security tech. In 2026, policy looks especially important.

The FY2026 NDAA and the legislative pipeline

The National Defense Authorization Act is a central policy engine. The FY2026 NDAA process includes bills and reports that shape funding priorities, program direction, and procurement mandates. (Congress.gov)

Additionally, legal and policy firms have already published analyses of FY2026 NDAA themes and funding priorities. (Holland & Knight)

For 2026 investing, the key is not reading every page. The key is watching what is emphasized: uncrewed systems, supply chain, software modernization, and acquisition reform.

Replicator oversight and accountability

CRS analysis highlights Replicator’s goal and raises “background and issues” for Congress. (Congress.gov) That signals continued oversight.

In 2026, this matters because oversight can change program design. It can change vendor selection. It can also create sudden pauses.

Export policy tightening around drones and autonomy

The State Department’s UAS export policy update suggests a continuing effort to adapt controls to fast-evolving drone technology. (State Department)

Meanwhile, broader AI and advanced computing export rules can affect the hardware and software stack behind modern defense tech. (federalregister.gov)

Consequently, 2026 could feature more compliance costs, more licensing friction, and more emphasis on “trusted” ecosystems.

The investing opportunity, without the hype

This is a powerful, emotional trend. It is also full of traps.

Defense and security investing can feel like a guaranteed boom. It is not. It is cyclical. It is politically sensitive. It is exposed to policy shocks.

So, how should investors think about it in 2026?

Start with business models, not slogans.

Companies that rely on one program, one agency, or one contract can be fragile. Companies with diversified customers and repeatable production tend to be more resilient.

Next, focus on time. Many defense deals take longer than investors expect. Cash flow timing matters. In 2026, a firm can look like a star in headlines and still struggle in execution.

Also, watch unit economics. Scale manufacturing rewards disciplined operations. If a company cannot produce reliably, “million-drone” headlines will not matter.

Furthermore, evaluate supply chain exposure. If core components are constrained, growth can stall.

Finally, treat ethics and governance as risk management, not as moral theater. Border security and surveillance tech can trigger backlash. That backlash can hit valuations fast.

This is not investment advice. It is a framework for thinking clearly in a noisy market.

The 2026 red flags investors should respect

Aggressive claims without evidence are dangerous. So are vague contracts, unclear margins, and “black box” procurement stories.

Additionally, pay attention to export exposure. A firm can lose access to markets due to policy changes.

Also, watch for geopolitical retaliation. Recent reporting described China sanctioning U.S. defense companies and executives, including references to Anduril and Palmer Luckey, amid rising tensions. (Investors) Sanctions may be symbolic in some cases, but they illustrate how politics can spill into business.

Consequently, 2026 portfolios may need wider diversification within the theme, not a single concentrated bet.

How to prepare for 2026 changes

Preparation in this sector means tracking policy, understanding procurement logic, and staying honest about risk.

First, follow the procurement signals. The Army’s drone ramp, Replicator oversight, and reform pushes are not background noise. They are the market. (Reuters)

Second, follow the regulatory signals. AI export controls and UAS export policy changes can reshape growth plans quickly. (federalregister.gov)

Third, follow the funding signals. Defense tech VC reports suggest strong momentum in 2025, which can carry into 2026, but also create valuation risk if optimism outruns execution. (PitchBook)

Finally, stay emotionally balanced. This theme is designed to feel dramatic. That drama can help returns, but it can also provoke expensive mistakes.

Conclusion: 2026 is the year “Hard Power” becomes mainstream capital

In December 2025, the defense boom is already visible. Spending trends are strong. Procurement urgency is rising. Drones are moving toward mass scale. Export rules are tightening around AI and autonomy. (SIPRI)

So 2026 is likely to be a decisive year. It will test whether “American Dynamism” can produce consistent execution, not just powerful storytelling. (Andreessen Horowitz) It will test whether the drone supercycle can be built on reliable supply chains and smart procurement. It will also test whether border security tech can grow while meeting public demands for oversight.

For investors, the opportunity is real. The risk is real, too. The winners in 2026 will likely be companies that combine speed with discipline, innovation with compliance, and ambition with credible proof.

Sources and References

- Trends in World Military Expenditure, 2024 (SIPRI)

- 2025 Vertical Snapshot: Defense Tech (PitchBook)

- Q3 2025 Defense Tech VC Trends (PitchBook)

- DOD Replicator Initiative page (DIU)

- CRS: DOD Replicator Initiative, Background and Issues (IF12611)

- Reuters: U.S. Army plans to buy 1 million drones (Nov 7, 2025)

- Reuters: Pentagon unit to revamp military drone program (Oct 30, 2025)

- Framework for Artificial Intelligence Diffusion (Federal Register, Jan 15, 2025)

- U.S. policy update on export of unmanned aerial systems (State Dept, Sept 15, 2025)

- Building American Dynamism (a16z)

- FY2026 NDAA Senate bill text (Congress.gov)

- H.R. 3838 FY26 NDAA as reported to the House (PDF)