Unpack the real costs, risks, and scams behind debt settlement and bankruptcy, with practical steps to protect your money and credit.

The decision that can change your decade

Debt problems rarely arrive all at once. They build. A late fee becomes two. A minimum payment becomes a treadmill. Then a creditor call lands on a workday, and suddenly the pressure feels personal, urgent, and exhausting.

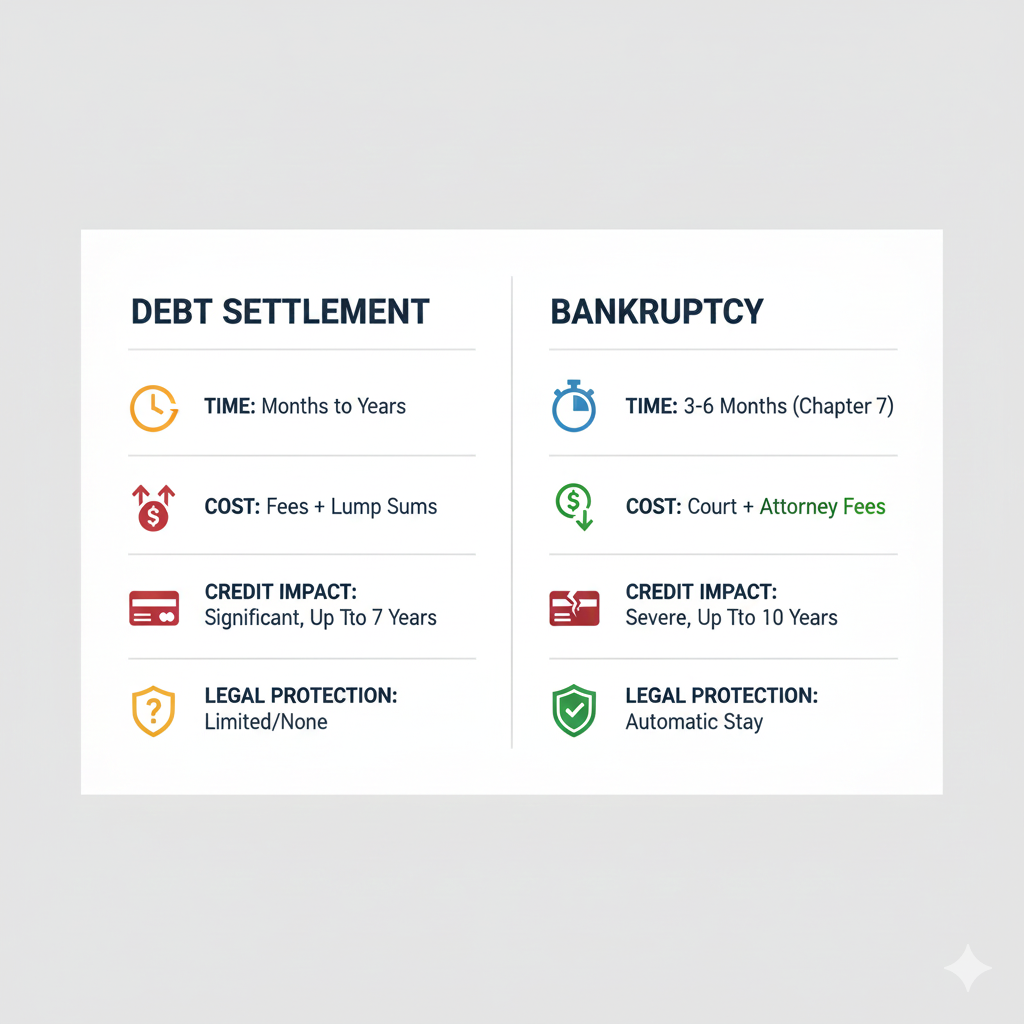

That is why “debt settlement vs bankruptcy” is not just a finance question. It is a life question. It affects your credit score, your savings, your stress level, and often your family. It can also shape your ability to rent an apartment, finance a car, or qualify for a mortgage later.

However, the loudest voices online often sell simple stories. Settlement is pitched as a clean “discount.” Bankruptcy is painted as “the end.” Both frames are misleading. In reality, each path has real benefits and real damage. Each has scam risks. Each has moments where it becomes the safest choice you can make.

Why this choice feels even more intense now

Across 2024 and 2025, more consumers have faced a harsh mix: higher interest costs, tighter lending, and aggressive collections. Meanwhile, regulators have pushed harder on certain consumer harms, including medical debt reporting. That shifting landscape changes how lenders judge risk and how borrowers should protect themselves. (YouTube)

Additionally, scams have evolved. The marketing is slicker. The promises are bolder. The fine print is more punishing. That makes clarity a powerful advantage.

[YouTube Video]: A clear explanation of the core differences between debt settlement and bankruptcy, plus common traps people miss.

What debt settlement really is

Debt settlement usually means this: you or a company tries to persuade creditors to accept less than the full amount you owe. The pitch sounds thrilling. “Pay pennies on the dollar.” “Get out fast.” “Avoid bankruptcy.”

Yet the typical reality is messier.

The standard settlement path

Most settlement programs tell you to stop paying your creditors and instead pay monthly into a dedicated account. Then, once enough money accumulates, the company negotiates lump-sum settlements with each creditor.

Consequently, two things often happen at the same time:

First, your accounts fall behind. Late fees add up. Interest keeps compounding. Collections calls intensify.

Second, your credit report typically shows severe delinquency. That can crater your score. It can also trigger lawsuits, depending on the creditor and the balance.

The hidden math people do not see

Settlement can be powerful when it works. A reduced payoff can feel like a breakthrough. Still, the numbers can turn dangerous if you ignore the total cost.

A typical settlement outcome has three big cost buckets:

You pay the settlement amount to the creditor.

You may pay fees to the settlement company.

You may face taxes on forgiven debt in some situations.

Moreover, time is not neutral. While you are waiting for “negotiation,” balances can grow. If a creditor sues, you may need an attorney anyway. And if you settle one debt, others may remain in collection, keeping the pressure alive.

What bankruptcy really is

Bankruptcy is a legal process. That is the key difference. It is not a negotiation game. It is a court-supervised system that can provide powerful protection, including an automatic stay that typically stops most collection actions once a case is filed.

However, bankruptcy is not one thing. In consumer cases, the two most common chapters are Chapter 7 and Chapter 13.

Chapter 7 vs Chapter 13 in plain language

Chapter 7 is often described as “liquidation.” In many cases, it wipes out eligible unsecured debts. It is usually faster than Chapter 13. (California Northern District Court)

Chapter 13 is often described as a “repayment plan.” It lets some people keep assets and catch up on certain debts over time, under court protection. (Nevada Bankruptcy Court)

Additionally, bankruptcy has boundaries. Some debts are harder to discharge. Some assets may be protected by exemptions, but rules vary by jurisdiction. That is why generic advice online can be risky.

What bankruptcy can and cannot wipe out

Bankruptcy can be a vital reset for many unsecured debts, like many credit cards and medical bills, depending on the facts.

Yet bankruptcy often does not erase certain obligations, such as child support and alimony. Student loans can be complex, though policies and practices around student loan discharge have received renewed attention, including government guidance aimed at making the process more consistent in appropriate cases. (Almb Uscourts)

Moreover, bankruptcy is not only about discharge. The legal protection itself can be lifesaving if you face lawsuits, wage garnishment, or nonstop collection pressure.

How credit reporting and lending signals are shifting

Credit reporting is not frozen in time. Rules, scoring models, and reporting practices evolve. That matters because both settlement and bankruptcy impact your credit profile, but they do so differently over time.

Medical debt and reporting changes

Medical debt has been a major focus. The CFPB has pushed to limit the role of medical debt in credit reporting, arguing it can distort risk signals and harm consumers. (YouTube)

Consequently, lenders may lean more on other factors. That can include payment history on revolving credit, utilization patterns, and income verification. It can also include newer “alternative data” in some contexts.

The rise of tougher underwriting and AI-driven screening

Even when a person’s story is reasonable, automated underwriting can be unforgiving. A string of missed payments during a settlement program can look like a clear red flag to a scoring model. A bankruptcy filing is also negative, but it can sometimes be followed by a cleaner payment history sooner, depending on the person’s budget discipline and access to secured credit.

Additionally, collections technology is sharper now. Data-driven targeting helps collectors decide which accounts to sue first, and which accounts to sell to debt buyers. This is one reason “waiting it out” can feel more dangerous than it did a decade ago.

Cost, timeline, and emotional weight

People often ask, “Which is cheaper?” That is the wrong first question. The better question is: which option reduces total damage, with the least risk of a catastrophic surprise?

Fees and true out-of-pocket cost

Debt settlement companies often charge fees for their services, and the structure matters. The CFPB has warned consumers about debt settlement companies and common red flags, including fee issues. (Consumer Advice)

Bankruptcy has costs too, including attorney fees and court costs. Yet it can also stop the bleeding faster in many cases, which can protect income and reduce chaos.

Timeline differences

Settlement timelines vary widely. Some people settle quickly. Others drag on for years, especially if they are trying to settle multiple accounts while avoiding lawsuits.

Chapter 7 is often faster. Chapter 13 is longer by design, since it involves a plan period.

However, speed is not automatically “better.” A rushed decision can create regret. A slow process can create burnout. You want the timeline that you can sustain.

The emotional reality

Debt is not only financial. It is emotional. It can trigger shame, fear, and exhaustion. A settlement program that requires you to ignore calls for months can feel brutal. A bankruptcy filing can feel scary, yet it can also bring relief because there is structure and legal protection.

Moreover, stress can lead to bad choices, like taking on new high-interest loans just to quiet the panic. That is why clarity and planning are essential.

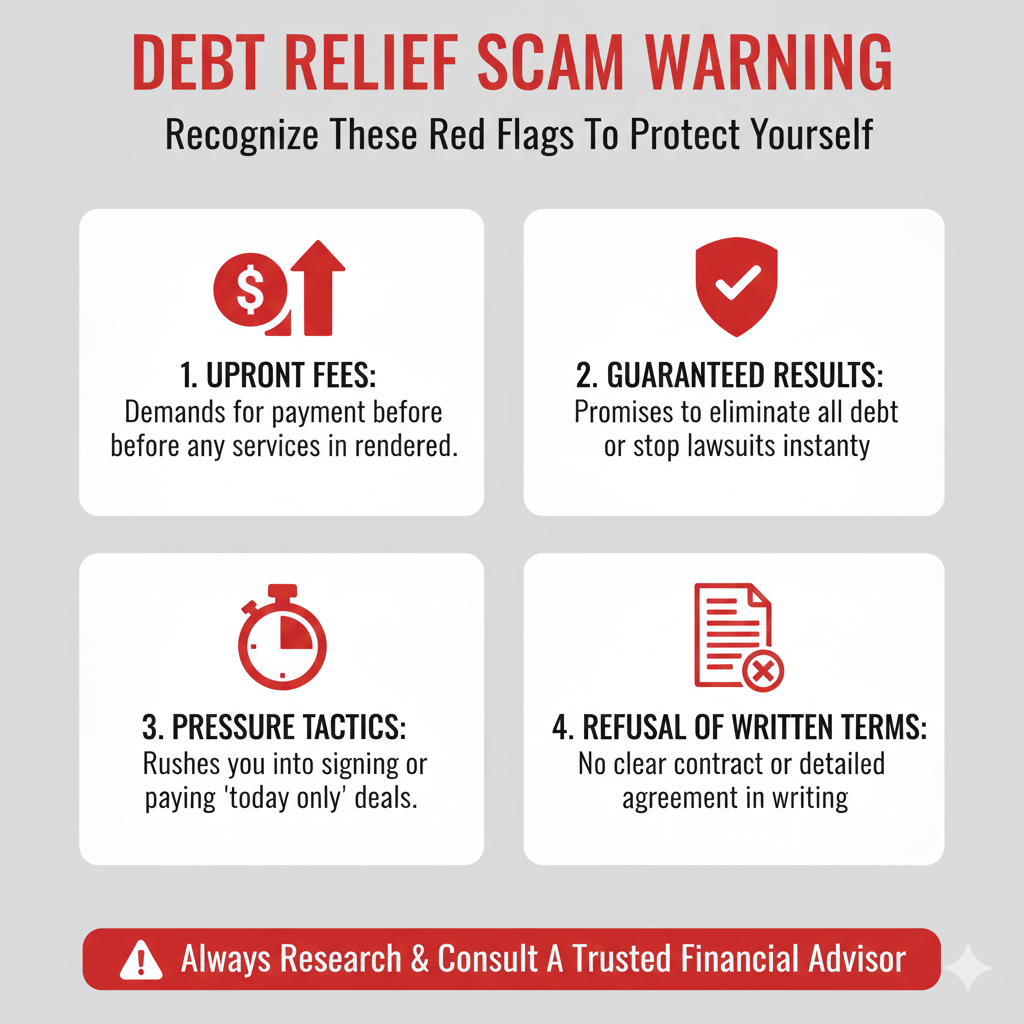

The scam map: how people get trapped

Debt distress attracts predators. When someone is desperate, they want a guaranteed lifeline. Scammers know that. They design marketing to feel urgent and comforting at the same time.

The advance-fee red flag

A classic danger sign in debt relief is being asked to pay significant fees upfront for promised results. Regulators have highlighted problems in debt relief markets and rules aimed at preventing abusive practices, including fee-related issues in telemarketing contexts. (Federal Trade Commission)

Additionally, many deceptive operators use confusing language. They may call themselves “mediation.” They may imply legal authority they do not have. They may promise to “erase debt” using secret programs.

Fake law firms, lead generators, and the “transfer” trap

A modern pattern is the “intake funnel.” You see an ad. You fill a form. You get a call from a “case manager.” Then your file is transferred again and again.

Consequently, you may not know who actually holds your money. You may not know who negotiates. You may not know what happens if a creditor sues.

That confusion is not accidental. It is profitable.

New scam patterns to watch in 2025 and 2026

Expect scams to keep evolving. Some operators will use AI-generated testimonials. Others will use fake “government program” branding. Many will promise instant results with minimal paperwork.

Meanwhile, the safest move is boring but powerful: slow down, verify identities, read contracts, and confirm how fees work before you give anyone control of your money.

What creditors actually do during settlement

Debt settlement advice often skips the creditor side. That is dangerous. Creditors do not behave like one unified group. They behave like businesses with different policies and different thresholds.

Collections pressure and lawsuits

Some creditors are more likely to sue than others. Debt buyers may also sue, depending on documentation and state law. If you are in a settlement plan and a lawsuit hits, you may have to respond fast. That can add legal cost and serious stress.

Additionally, if a creditor gets a judgment, consequences can include wage garnishment or bank levies, depending on local rules. That is why legal risk is a central factor in the settlement vs bankruptcy decision.

Why settlement succeeds for some people

Settlement can be a strong option when three conditions are true.

First, the person has access to lump sums, or can save quickly.

Second, creditors are willing to negotiate and not sue first.

Third, the person can tolerate short-term credit damage without needing major new credit soon.

Consequently, settlement often works best for people with stable income and realistic cash flow, who can build negotiating leverage without triggering lawsuits.

Why settlement collapses for others

Settlement fails when savings are too slow, balances are too high, or creditors escalate. It also fails when fees and delays consume the money that should have gone to settlements.

Moreover, some people settle a few accounts and then run out of cash. That leaves them with half-settled damage and continued collection pressure.

When bankruptcy can be the safer move

Bankruptcy is not “easy.” Still, it is often the safer option when risk is high and time is short.

If you face lawsuits or wage garnishment

Legal pressure changes everything. Once lawsuits start, the cost of delay rises fast. A settlement plan that requires months of delinquency can become dangerous in a lawsuit-heavy environment.

However, bankruptcy’s automatic stay can provide immediate, structured relief in many cases. That protection is one of bankruptcy’s most powerful features.

If your budget cannot support settlement savings

Settlement requires you to save while you are under attack from interest, fees, and collectors. That is hard. If your budget is already tight, settlement can become a slow-motion crisis.

Additionally, bankruptcy can sometimes give you a clean slate that makes budgeting realistic again. That can be a crucial turning point.

If you have multiple types of debt

A person with credit cards, medical debt, personal loans, and collection accounts may find settlement negotiations overwhelming. Bankruptcy can consolidate the process into one legal pathway.

Moreover, bankruptcy may be paired with credit rebuilding steps that can restore stability faster than people expect, especially if spending habits change.

The special-debt problem: taxes, student loans, and support

Not all debts behave the same. This is where many online comparisons fail. They treat “debt” as one pile. In reality, each category has different rules and different consequences.

Student loans: a shifting area with real movement

Student loans have long been seen as hard to discharge. Yet there has been notable policy focus on making the bankruptcy discharge process clearer and more consistent in appropriate cases, including Department of Justice guidance and coordination. (Almb Uscourts)

Consequently, anyone with major student loan balances should not rely on old assumptions. The practical path can depend on facts, documentation, and the current enforcement posture.

[YouTube Video]: A practical breakdown of how debt settlement works, common risks, and how to evaluate whether it is a safe fit.

Taxes and government debts

Tax debts and other government obligations can have their own rules. Settlement with private creditors does not remove government collection powers. Bankruptcy may help with some tax debts in limited situations, but details matter.

Additionally, if you owe child support or alimony, neither settlement nor bankruptcy can simply wish that away. Those obligations usually require a separate plan.

Co-signers and family impact

If someone co-signed a debt, settlement and bankruptcy can affect them differently. A settlement negotiation might not release a co-signer unless the creditor agrees. Bankruptcy might discharge your obligation, but the co-signer may still face collection, depending on the debt and the chapter.

Moreover, family dynamics can complicate decisions. Some people choose settlement to avoid stigma, even when bankruptcy would be safer. Others choose bankruptcy to protect peace at home. Both motivations are human. The key is to understand the true cost.

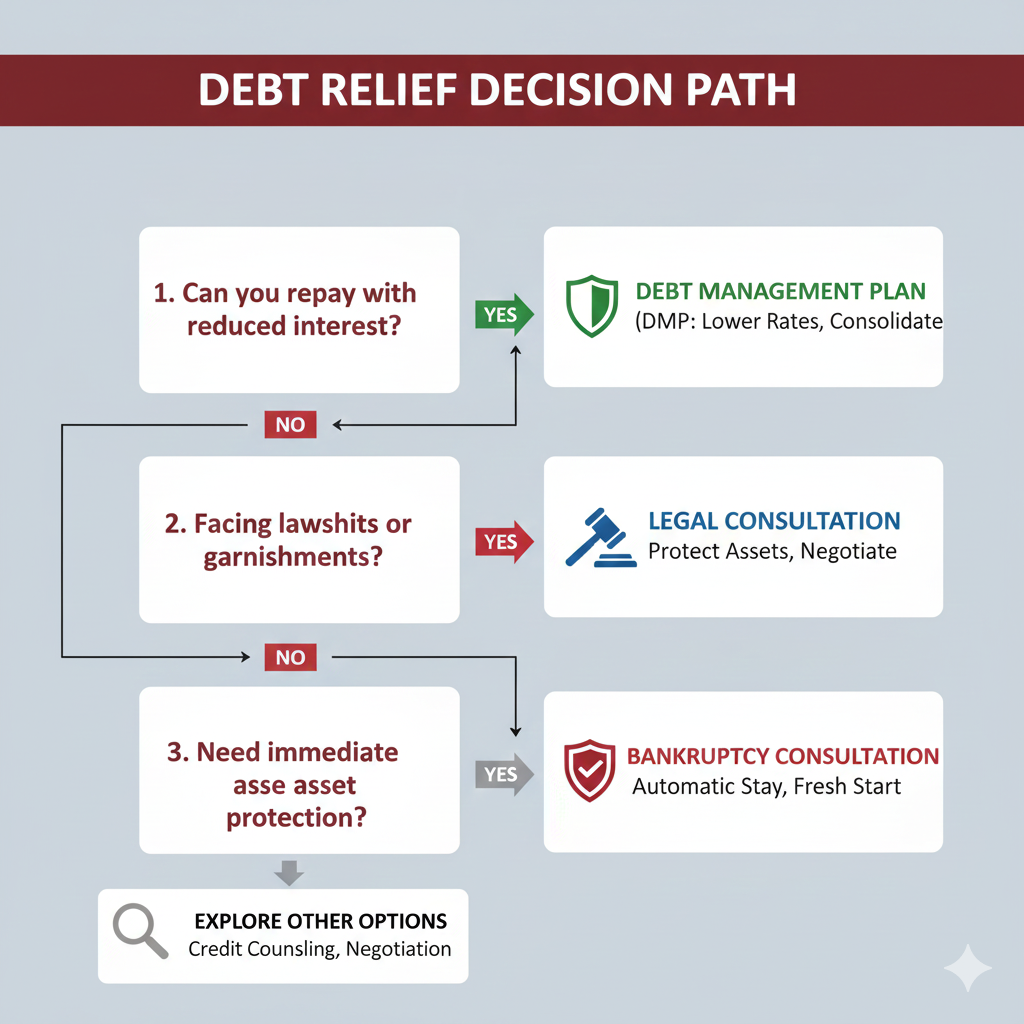

Alternatives that can beat both options

Many people jump straight to settlement or bankruptcy because they feel trapped. Yet there are alternatives that can be more stable, more predictable, and less risky.

Credit counseling and a debt management plan

A debt management plan, often through reputable nonprofit credit counseling, may reduce interest rates and structure payments. This is not the same as debt settlement. It is not about paying less principal. It is about making repayment realistic.

The National Foundation for Credit Counseling explains how a debt management plan can work and what to expect. (GovInfo)

Additionally, a structured plan can reduce stress because you are not intentionally defaulting. That can protect your credit trajectory compared to a settlement strategy that requires long delinquency.

Hardship programs and direct creditor negotiations

Sometimes the most powerful move is direct contact with creditors. Many issuers have hardship options, especially during genuine income disruption. That can include temporary rate reductions, modified payment plans, or fee waivers.

However, you need discipline. You need documentation. You need to record names, dates, and terms. A messy phone call can become a forgotten promise.

Targeted refinancing, consolidation, and budgeting fixes

Consolidation loans can help, but only if the interest rate is lower and spending behavior changes. Otherwise, consolidation becomes a trap: you pay off cards, then run them back up.

Meanwhile, budgeting changes can feel boring. Yet they are often the difference between recovery and relapse.

A practical decision framework that reduces regret

You do not need to guess. You need a process.

Step 1: Identify your risk level

If lawsuits are likely, time matters. If income is unstable, predictability matters. If you need to rent soon, credit matters. If you own assets, legal advice matters.

Additionally, if you are being pressured by a company promising guaranteed results, that pressure itself is a warning sign.

Step 2: Gather the documents that change the outcome

Collect your credit reports, recent statements, collection letters, and any court notices. Know your monthly income and essential expenses. Know your assets and any co-signed obligations.

Consequently, you can have a real conversation with a qualified professional instead of a sales call.

Step 3: Interview help the same way you would hire a contractor

Ask how fees work. Ask what happens if a creditor sues you mid-program. Ask who holds your funds. Ask if they will provide all terms in writing. Ask what they expect your credit profile to look like in six months.

Moreover, if they dodge direct answers, that is data. Take it seriously.

Step 4: Make your decision based on protection, not pride

Pride is expensive. Shame is expensive. The goal is stability and safety.

Sometimes settlement is a powerful, rewarding choice. Sometimes bankruptcy is the proven, reliable choice. Your best option is the one that reduces total harm and restores control.

What to expect next: 2026 trends worth watching

The debt relief world is changing in ways that will affect both settlement and bankruptcy decisions.

Regulation and enforcement will keep evolving

Regulators have shown increased interest in reducing harmful credit reporting practices, including medical debt impacts. (YouTube)

Additionally, consumer protection focus on debt relief marketing and fee practices is not going away. The rules and enforcement posture can shift, but the direction is clear: less tolerance for deception.

Collections and underwriting will keep getting more automated

Automation makes outcomes faster. That can be good when you are protected. It can be brutal when you are exposed.

Consequently, early action may matter more than ever. Waiting for “things to calm down” can be risky in an automated collections environment.

How to prepare now

Build a realistic cash flow plan. Verify every debt relief offer. Get legal advice if lawsuits are on the table. Choose a strategy you can sustain.

Moreover, once you choose, commit fully. Half-measures are where people get hurt.

Conclusion: choose the path that gives you control

Debt settlement can be a bold tool. Bankruptcy can be a powerful shield. Both can be smart. Both can also be dangerous if you rely on marketing instead of facts.

However, you are not powerless. With verification, documentation, and a clear framework, you can avoid scams, reduce risk, and pick the option that protects your future.

Sources and References

- CFPB: Proposed rule to remove medical debt from credit reports (YouTube)

- CFPB Ask: “Should I use a debt settlement company?” (Consumer Advice)

- CFPB: Beware of student loan debt relief scams (United States Courts)

- FTC: Debt Relief Services and the Telemarketing Sales Rule (PDF) (Federal Trade Commission)

- FTC: Money Matters – Debt Relief Scams (PPT) (Consumer Advice)

- U.S. Courts: Difference between Chapter 7, 11, 12, 13 (FAQ) (California Northern District Court)

- NFCC: Debt Management Plan overview (GovInfo)

- U.S. Department of Justice: Student loan bankruptcy discharge process update (Almb Uscourts)