In 2026, cyber-physical insurance gets personal and real-time. AI, sensors, and new rules reshape protection for your identity, devices, home, and daily life.

The cyber-physical moment is no longer abstract

A decade ago, “cyber” mostly meant your laptop and your email. Today, the digital world is glued to your physical world. Your phone unlocks your bank. Your car runs on software. Your doorbell is an internet device. Even your utilities depend on connected systems.

That fusion has a name: cyber-physical risk. It is a powerful concept because it matches how attacks work now. Criminals do not always stop at stealing data. They can turn stolen data into real-world harm.

However, most people still buy protection in separate boxes. Cyber insurance sits apart from home insurance. Identity protection feels like a subscription. Device coverage feels like a warranty. Physical security feels like cameras and alarms.

In 2026, that separation starts to look outdated. The market is moving toward one shield that covers both worlds. It will be smarter. It will be more personalized. It will also be more controversial.

Additionally, “usage-based everything” is the fuel. Insurers are learning to price risk in moments. If your risk is higher tonight, pricing and protection can shift tonight. If your risk drops next week, the plan can reward you next week. That is the alluring promise.

Consequently, the cyber-physical shield becomes a new insurance story for 2026. It blends prevention, monitoring, response, and coverage into one experience. For some customers, that will feel reassuring and empowering. For others, it will feel invasive.

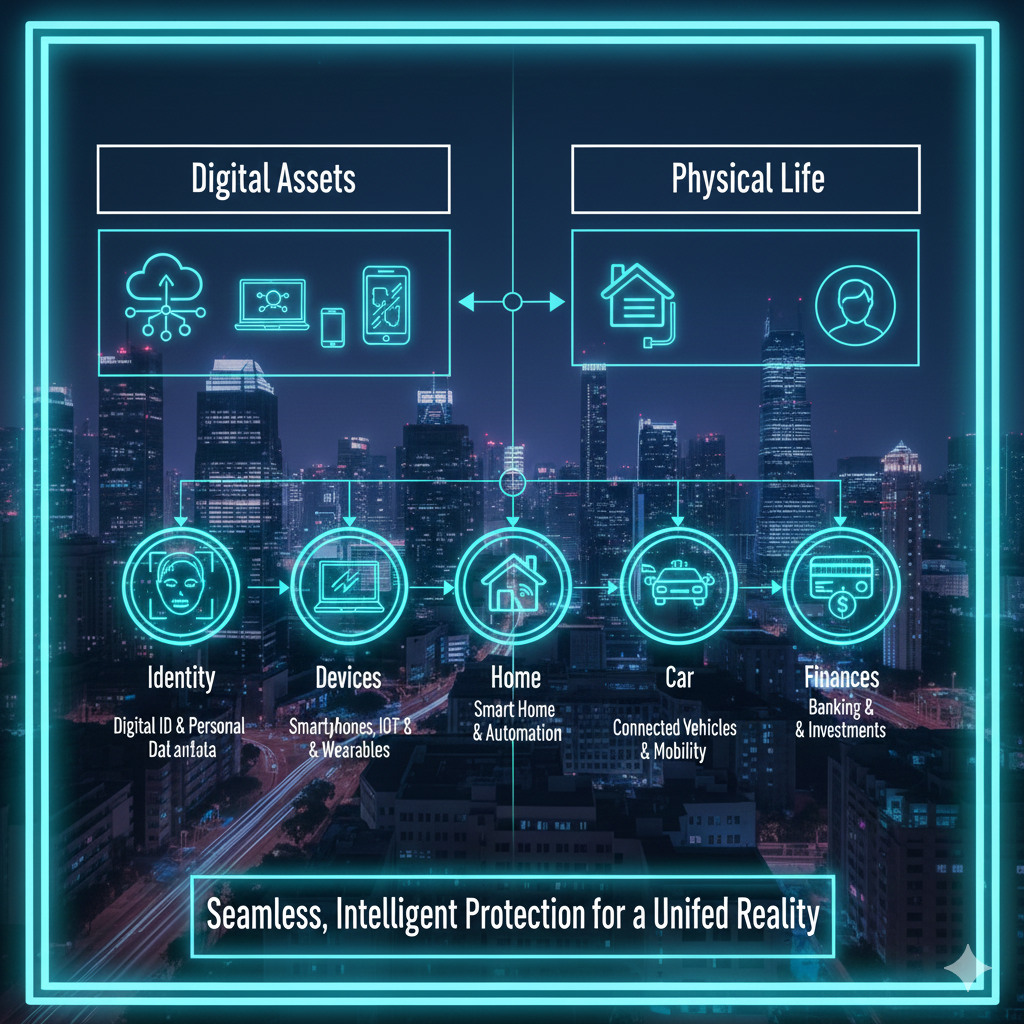

What a “cyber-physical shield” really covers

A practical definition matters. A cyber-physical shield is not a single product label. It is a bundle of protections built around one idea. Digital threats can spill into physical life.

That bundle typically includes identity theft response, cyber extortion support, fraud monitoring, device recovery, and liability coverage. It can also include physical protection signals such as smart locks, cameras, alarm events, water leak alerts, and location-based risk warnings.

Furthermore, the best designs treat coverage as only one layer. They treat prevention as the headline. They treat response speed as the brand promise. They treat pricing personalization as the loyalty engine.

That is why 2026 will be a breakthrough year. The pieces now exist at scale. The business models are getting tighter. The regulations are also getting sharper.

Why 2024 and 2025 pushed this into the spotlight

The cyber-physical shift did not happen overnight. Still, the last two years made the trend feel urgent.

First, attacks became more “life-aware.” Scams became more convincing. Deepfake fraud grew. Social engineering became frighteningly personal. Many incidents started with a simple data leak and ended with real financial loss.

Second, connected devices kept spreading. Smart homes moved from luxury to normal. Cars became rolling computers. Work moved between home, office, and public Wi-Fi without friction. The attack surface expanded quietly.

However, the most important change was emotional. People started to feel that cyber risk is not just a business problem. It is a personal safety problem. Losing access to money is scary. Being stalked through leaked data is terrifying. Getting locked out of your own accounts is maddening.

Additionally, insurers started reacting with stricter underwriting in cyber lines, especially for businesses. That stricter stance signals a market that is maturing and getting serious. It also signals that prevention and proof matter more than promises.

Consequently, 2026 is set up as a convergence year. Security companies are offering integrated platforms. Insurers are looking for differentiated products. Consumers are looking for protection that feels real, not theoretical.

[YouTube Video]: A clear 2025 explainer on how cyber insurance has tightened, and why “proof of security” now matters. It helps frame why 2026 cyber-physical coverage will bundle prevention with insurance.

The 2026 shift: from “policies” to “protective systems”

Insurance has historically been paperwork plus a promise. You pay, then you hope. The cyber-physical shield flips that logic.

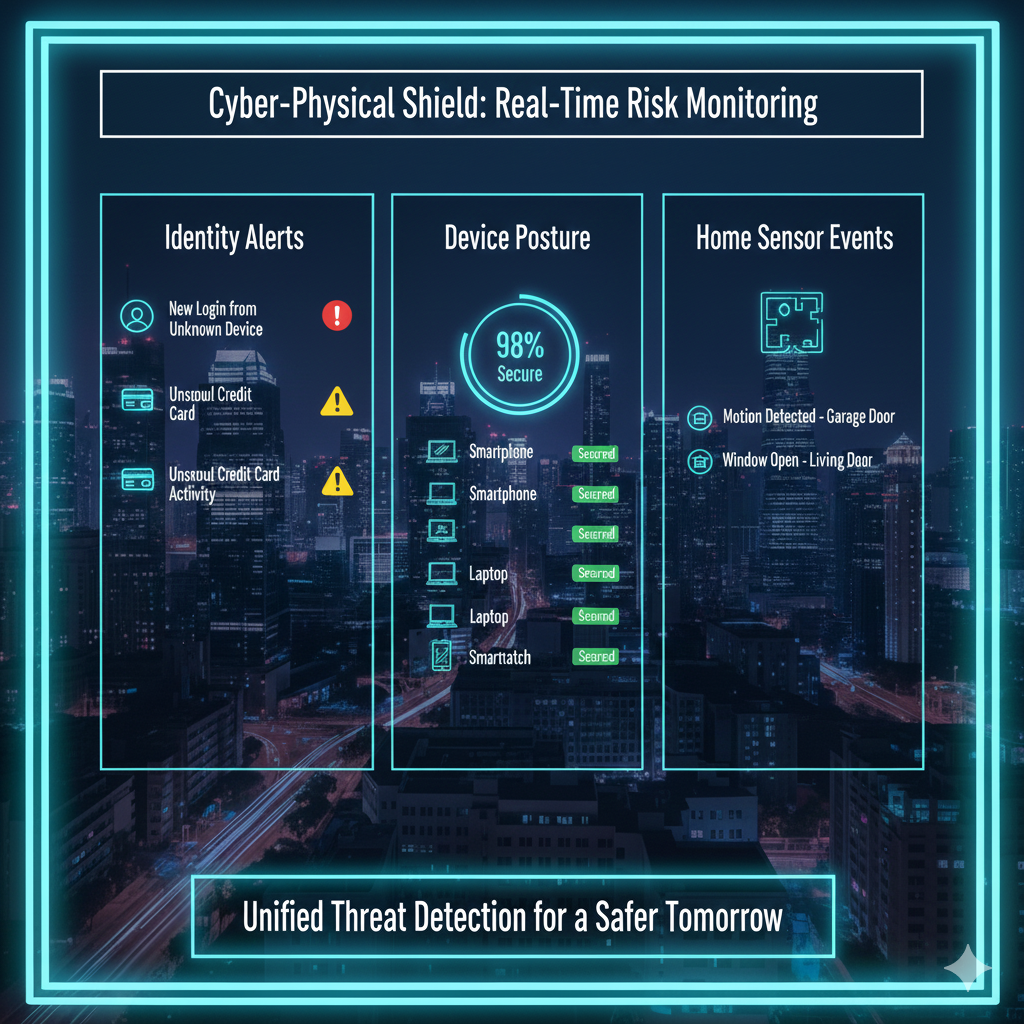

In 2026, more insurers will sell a system, not only a policy. That system will watch risk signals. It will nudge safer behavior. It will respond when trouble starts. Coverage becomes the financial backstop, not the only value.

However, selling a “system” changes expectations. Customers will demand fast help. They will demand transparent rules. They will demand control over their data. They will also demand that the system works during the worst moment.

Additionally, this is where usage-based thinking becomes central. If insurers can see risk change, they will try to price risk change. If they can price it, they can reward it. If they can reward it, they can influence behavior.

Consequently, 2026 becomes the year insurers experiment with dynamic cyber-physical pricing. You might see discounts tied to strong password hygiene. You might see rewards tied to enabling multi-factor authentication. You might see lower rates tied to smart-home leak sensors. You might see improved terms tied to verified device security.

Meanwhile, prevention vendors will align with this. Security companies want recurring revenue. Insurers want reduced claims. Partnerships become an obvious move.

What makes this feel “next-generation”

The next-generation part is not only AI. It is the full loop.

Signals come in from devices and accounts. AI interprets the signals. The system triggers actions. Actions reduce losses. Reduced losses allow better pricing. Better pricing increases adoption. Adoption creates more signals. The loop gets stronger.

Furthermore, this loop is emotionally compelling. People do not want to feel helpless. They want to feel in control. A cyber-physical shield sells control.

Yet control can be an illusion. Data can be wrong. Models can be biased. Alerts can be noisy. A “shield” that panics you every day is not a shield. It is stress.

So the 2026 winner will be the shield that feels calm, not chaotic.

The technology innovations that will define 2026

The cyber-physical shield is built on a stack. When the stack improves, the product improves.

Continuous identity protection becomes the core

Identity is now the key that opens everything. If an attacker gets your identity signals, they can pivot. They can reset passwords. They can open credit. They can drain accounts. They can impersonate you.

In 2026, expect more insurers to treat identity as the starting point. They will bundle identity restoration, fraud support, and monitoring into cyber-physical packages. They will pitch it as vital. They will be right.

Additionally, expect more “continuous authentication” ideas to enter consumer products. Instead of one login check, systems will quietly verify your behavior patterns. This can reduce account takeovers. It can also trigger privacy concerns.

Consequently, insurers will position identity controls as a discount lever. Stronger identity posture can become “lower risk.” Lower risk can mean better pricing or better limits.

Device security becomes an insurance variable

Phones and laptops are no longer optional. They are life devices. If they are compromised, the damage is real.

In 2026, more offerings will link device security to coverage terms. Not in a harsh way at first. More in a rewarding way. “Enable these settings, get a better deal.” “Install this protection, get faster response.”

However, this creates a question. Who verifies device security? Is it the insurer? Is it the vendor? Is it a third party? Trust depends on how clean that verification is.

Additionally, insurance-linked device security will push vendors to make “security posture” easy to prove. That is a technical and product challenge. It is also a powerful moat for companies that solve it.

Smart-home signals move from novelty to evidence

A leak sensor can prevent expensive damage. A smoke sensor can save a home. A smart lock can track entry events. Cameras can deter theft.

In 2026, expect more insurers to treat these signals as evidence of lower risk. This is already happening in fragments. The difference is scale and integration. The shield bundles the sensor, the monitoring, the response, and the coverage.

Consequently, home insurance starts to feel like a protective service. That can be comforting. It can also create surveillance anxiety if boundaries are weak.

So the strongest programs will build strict data minimization. They will prove they do not need video footage to price risk. They will focus on events, not voyeurism.

Emerging trends for 2026: where the market is heading

Trends are often vague. This one is concrete. Cyber and physical security are merging operationally.

The rise of unified security operations for everyday life

Businesses have Security Operations Centers. Consumers do not. Yet consumer life now has the same complexity. Multiple devices, accounts, and connected environments.

In 2026, some cyber-physical shield offerings will look like a mini SOC for individuals and families. It will be automated. It will be guided. It will be available 24/7. The pitch will feel exclusive and premium.

Additionally, support will become more proactive. Instead of waiting for a claim, the shield will send an alert. It will help you lock accounts. It will coach you through steps. It will coordinate with banks and platforms.

Consequently, the line between “insurance” and “assistance” will blur. That will redefine value. People will buy peace of mind, not paperwork.

Embedded distribution accelerates the shield

The fastest growth in 2026 will likely come from embedded channels. Banks can offer cyber-physical coverage with accounts. Telecom companies can bundle it with plans. Smart-home brands can add it with device subscriptions.

However, embedded distribution has a trust problem. It can hide complexity. It can push opt-ins too fast. It can make consent feel vague.

So regulators will watch. Consumer advocates will watch. Brands will need to be careful.

Agentic AI changes both attack and defense

AI is now used by attackers and defenders. That is a frightening symmetry. It also creates a breakthrough defense chance.

In 2026, expect more automated response tools for consumers. AI assistants can help write dispute letters. They can guide identity restoration. They can detect scam patterns. They can explain what to do next.

However, AI can also be used to create convincing fraud. Voice cloning scams and fake customer support are already real risks. That means the shield must include scam resilience as a feature, not an afterthought.

Consequently, “anti-scam coaching” becomes a product differentiator in 2026. The emotional value is huge. The practical value is even bigger.

[YouTube Video]: A focused look at OT and cyber-physical risks, and why cyber incidents can become real-world disruptions. It helps explain why “cyber-physical” is not a buzzword in 2026.

New regulations and policies that will shape 2026

Technology is racing. Regulation is catching up. 2026 matters because several AI governance rules hit meaningful dates.

Colorado’s AI law becomes a real 2026 compliance deadline

Colorado’s SB24-205 creates consumer protections for AI systems. It becomes effective on February 1, 2026. It requires reasonable care to protect consumers from known or foreseeable risks of algorithmic discrimination in high-risk AI systems.

Why does this matter for cyber-physical insurance? Because personalization often uses AI. Pricing can be AI-assisted. Claims triage can be AI-assisted. Fraud detection can be AI-assisted. Marketing eligibility can be AI-assisted.

Consequently, insurers and insurtech partners will be pushed to document safeguards. They will need governance. They will need a way to explain decisions. They will need monitoring to catch unfair outcomes.

Additionally, this pressure can spread beyond one state. Big insurers dislike fragmented standards. They often adopt the strictest standard as a baseline.

The EU AI Act’s 2026 milestone changes global expectations

The EU AI Act has an official implementation timeline. Many rules become applicable and enforcement begins around August 2, 2026, including high-risk system obligations and transparency rules.

Even if you are not in Europe, this matters. Global vendors build to global standards. Insurance groups operate across borders. Compliance teams build common frameworks. That raises the governance baseline.

However, there has been public debate about timing and potential delays. The direction still remains clear. More AI accountability is coming. Less “black box pricing” will be tolerated.

Consequently, 2026 cyber-physical shields will need clear explainability stories. They will need clear consumer disclosures. They will also need strong data protection.

Cyber rules keep expanding, especially for connected products

Cyber policy is also tightening around connected devices and critical infrastructure. Governments want safer IoT. They want clearer responsibilities. They want fewer silent vulnerabilities.

For insurers, this creates opportunity. If devices become more secure by default, claims can drop. If devices remain weak, insurers will push requirements and exclusions.

Therefore, expect more cyber-physical coverage in 2026 that ties eligibility to basic security controls. The best versions will feel helpful, not punitive.

Industry predictions and forecasts for 2026

Predictions should be useful, not flashy. Here are the most likely shifts.

Cyber insurance becomes more competitive, but more segmented

Market outlook commentary in late 2025 points to tougher competition and pockets of growth in cyber insurance, alongside changes in claims patterns. That suggests a maturing market.

In 2026, the cyber-physical shield will intensify segmentation. Low-risk customers will be aggressively targeted with premium experiences and rewards. Higher-risk customers may face tighter terms.

Consequently, personalization becomes both a benefit and a gate. Some people will feel thrilled by rewards. Others will feel shut out.

This is where regulators and fairness debates get louder.

Physical security brands start speaking the language of cyber risk

Physical security companies are increasingly talking about cyber-physical risk. They are pushing cloud-managed access control, intelligent automation, and unified operations platforms.

In 2026, that narrative will become more mainstream. The reason is simple. Cameras and locks are now computers. Computers get hacked. Hacked systems become physical threats.

Consequently, insurers will treat physical security devices as cyber endpoints. This will change underwriting logic. It will also change what “home security discount” means.

National threat assessments push cyber-physical realism

Government threat assessments are increasingly explicit about real-world impacts. They cover ransomware, state-backed threats, and risks to critical services.

This matters because insurers price based on reality. When public agencies describe a threat climate as persistent, insurers respond with controls, exclusions, and pricing discipline.

In 2026, the consumer-facing story becomes sharper. “This can happen to you” is not a scare tactic. It is a reflection of daily risk.

How personalization and usage-based pricing will work in the cyber-physical shield

This is the controversial center. It is also the most commercially important piece.

The new premium logic: risk posture, not only demographics

Traditional insurance relies on static proxies. Age. Location. Property type. Prior claims.

Cyber-physical personalization adds dynamic posture signals. Do you use multi-factor authentication? Do you patch devices quickly? Do you reuse passwords? Does your home have leak detection? Do you travel frequently? Do you use public Wi-Fi daily?

However, a shield must avoid turning life into a constant judgment. The best programs will design posture scoring as supportive. They will focus on a few high-impact behaviors. They will avoid intrusive surveillance.

Consequently, 2026 will likely bring two tiers. A light posture program with basic signals and modest rewards. A deep posture program with more signals and bigger rewards.

Claims shift from “submit paperwork” to “trigger support”

When identity theft happens, speed matters. When a device is compromised, speed matters. When a smart lock is hacked, speed matters.

In 2026, the cyber-physical shield will compete on response time. Some products will promise immediate phone support. Others will use chat plus escalation. The best versions will coordinate with banks, credit bureaus, and platforms.

Additionally, expect more “guided claims.” The system will ask a few questions. It will collect logs. It will open cases automatically. It will keep a timeline.

Consequently, the claims experience becomes the brand. Coverage limits still matter. Yet the emotional memory is the response.

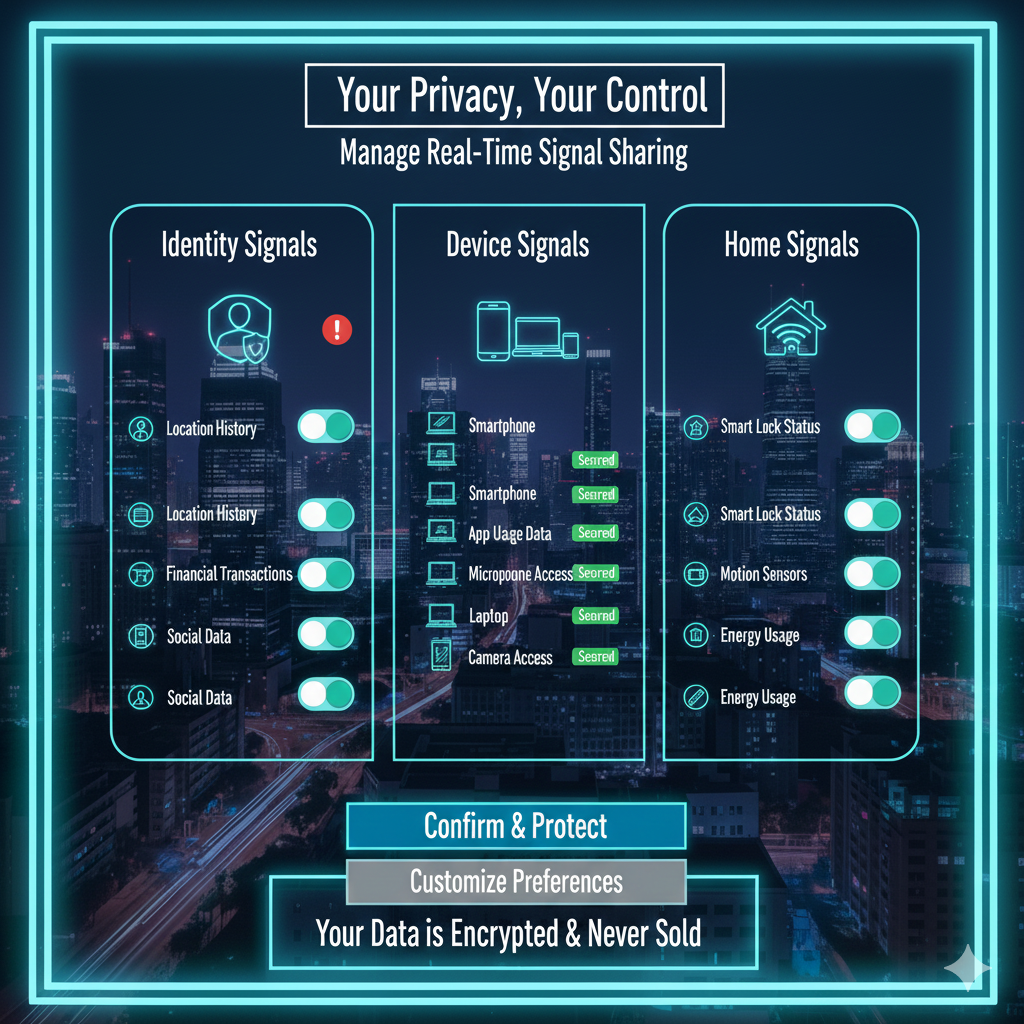

The trust challenge: data, consent, and control

Personalization needs data. Data creates fear.

In 2026, trust will be a product feature. Customers will demand clear controls. They will demand easy opt-out. They will demand deletion rights. They will demand proof that data is not sold.

Therefore, the winners will publish transparent data maps. They will show what is collected. They will show why it is collected. They will show how long it is kept.

If a shield cannot explain itself, it will struggle.

The cyber-physical risk scenarios that matter most in 2026

Cyber-physical talk becomes real when you picture daily life.

Scenario one: identity theft becomes physical vulnerability

A criminal gains access to your email. They reset passwords. They find your address in old receipts. They learn your routine from social posts. Now the threat is not only money. It is safety.

A cyber-physical shield responds by locking accounts, monitoring credit, and coordinating identity restoration. It also advises on home security steps. It might recommend changing smart lock codes. It might recommend camera audit checks.

The powerful point is integration. One incident triggers both digital and physical guidance.

Scenario two: smart-home compromise becomes home risk

A weak password on a router. An old firmware version. A compromised camera feed. These can expose your home environment.

In 2026, the shield’s prevention layer should detect weak posture early. It should nudge updates. It should guide safe configuration.

If compromise happens, the response layer should help you isolate devices. It should guide a reset process. It should document the incident for claims.

Scenario three: car software and accounts collide

Cars are software systems. They also connect to apps. That creates account-based risk.

In 2026, cyber-physical insurance could expand to include account takeover response for vehicle apps, and assistance after digital break-ins that lead to theft risk.

This is not science fiction. It is the logical future of connected mobility.

How to prepare for 2026 changes

Preparation should feel practical, not overwhelming.

Start with five high-impact moves

You do not need 50 settings. You need the vital few.

Use multi-factor authentication on your primary email. Use a password manager. Keep devices updated. Secure your router. Turn on account alerts for banking and payments.

Additionally, treat your phone number as a security asset. SIM swap fraud is still dangerous. Ask your carrier about extra protection options. Keep your recovery methods strong.

These steps are empowering. They also make you a lower-risk profile. That matters in usage-based insurance.

Choose a shield that respects boundaries

If a product demands constant location access, be cautious. If it refuses to explain what data it uses, be skeptical. If it cannot describe dispute processes, avoid it.

Consequently, look for three trust signals. Clear data controls. Clear incident response promises. Clear governance language about AI decisions.

Expect more transparency in 2026, and use it

Regulatory pressure is pushing companies to explain AI. That is a gift to consumers.

In 2026, read the program disclosures. Compare them. Use them as a filter. A credible shield will welcome questions.

The 2026 outlook: the shield becomes a competitive necessity

The cyber-physical shield is moving from a niche to a category. It is being pulled by real fear and real demand. It is also being pushed by industry economics.

Insurers need lower losses. Security vendors need differentiation. Consumers need reassurance.

However, the future is not guaranteed. If products overreach on surveillance, backlash will slow adoption. If models create unfair outcomes, regulators will react. If a major breach exposes behavioral data, trust will collapse fast.

Consequently, 2026 will reward restraint and clarity. The most successful shields will be protective, not controlling. They will be proven, not hype-driven. They will be transparent, not mysterious.

That is the real promise. Not only to pay after harm. It is to prevent harm. It is to keep your digital assets safe, and your physical life calm.

Sources and References

- Cyber Insurance Market Outlook 2026 (S&P Global Ratings) (S&P Global)

- Colorado SB24-205: Consumer Protections for AI (official) (Colorado General Assembly)

- SB24-205 signed bill PDF (Colorado General Assembly)

- EU AI Act implementation timeline (European Commission) (AI Act Service Desk)

- EU AI Act overview and application timeline (EU) (Digital Strategy)

- Trends in Cybersecurity 2025/2026 (Capgemini, PDF) (Capgemini)

- National Cyber Threat Assessment 2025-2026 (Canada) (Canadian Centre for Cyber Security)

- Cyber security trends 2025 (Allianz Commercial, PDF) (Allianz Commercial)

- What is cyber-physical system security (Darktrace glossary) (Darktrace)

- Genetec physical security trends for 2026 (industry view) (tahawultech.com)