Checkout credit is exploding in 2025. Learn the thrilling benefits, hidden risks, and 2026 rules for BNPL and point-of-sale loans.

The checkout has become a quiet credit desk

Point-of-sale lending used to feel optional. It felt like a perk. It was a small button under the “Pay” line.

In 2025, it often feels like the default.

You see “Pay in 4.” You see “Pay monthly.” You see “Instant approval.” You see it on your phone. You see it in-store. You see it inside apps that do not look like banks.

Consequently, the checkout is no longer just a payment moment. It is a borrowing moment.

That shift is powerful. It is also emotionally loaded. The offer arrives when desire is high. The product photo looks perfect. The price feels manageable. The commitment feels distant.

However, the bill is still real. The debt is still debt. The new era is not only about convenience. It is about behavior.

Why “buy now” feels irresistible in 2025

Modern retail is built for speed.

One click. One tap. One face scan. One receipt. That speed is thrilling. It also lowers friction that used to protect people.

Point-of-sale lending fits this rhythm. It turns a big price into smaller slices. It reduces sticker shock. It creates a comforting illusion of control.

Additionally, life has become more expensive. People feel squeezed. Many shoppers want flexibility, not luxury. BNPL and checkout loans promise relief.

Still, relief can turn into stress when repayments stack.

The phrase that should worry you: “It’s only a small payment”

Small payments are not always small commitments.

A $40 payment looks harmless. Four of them look fine. Three different plans at once can feel manageable.

Then reality hits. A rent payment lands. A car issue appears. A medical bill shows up. Suddenly, the calendar is crowded.

Therefore, the new POS lending era demands a new mindset. It demands clarity. It demands discipline. It demands respect for timing.

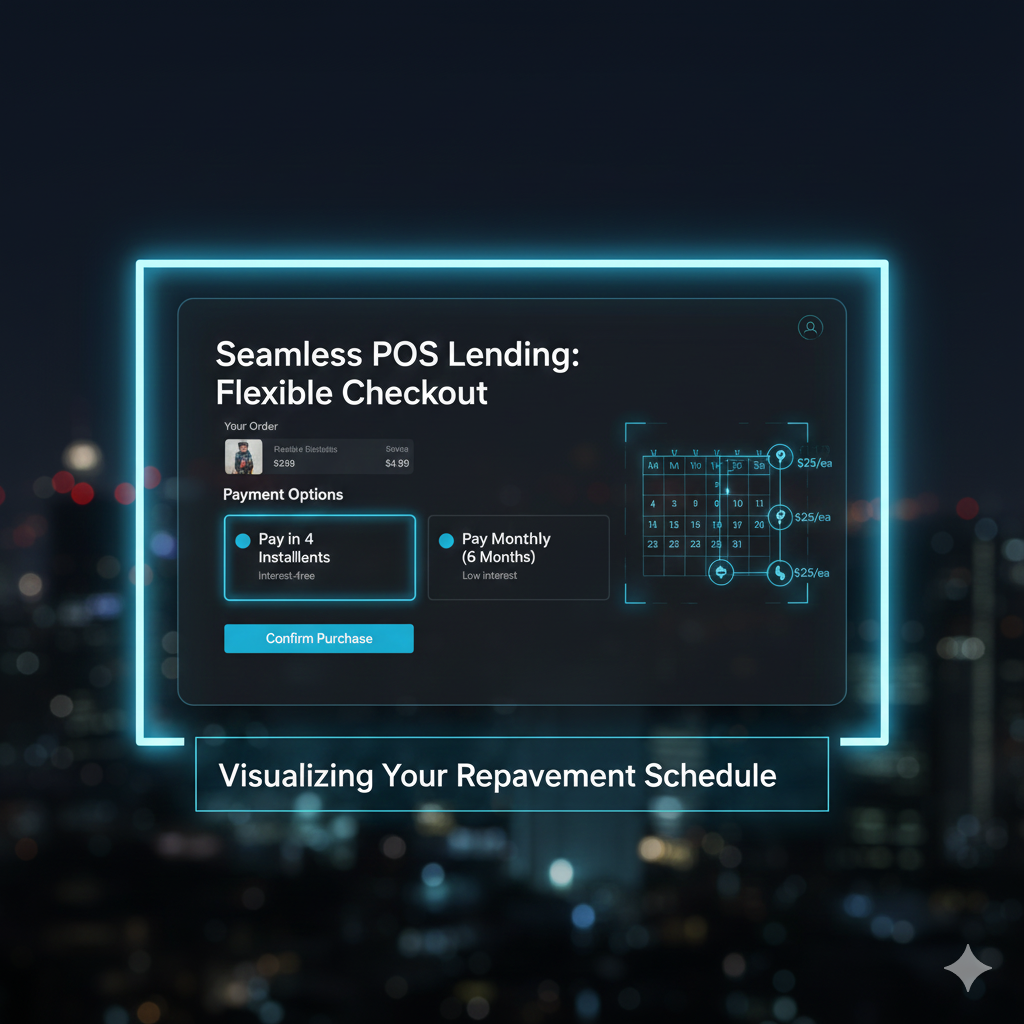

What point-of-sale lending includes in 2025

Point-of-sale lending is bigger than one product.

It is a family of credit options offered at checkout. Some are short. Some are longer. Some are “interest-free” on the surface. Some are priced like traditional loans.

Meanwhile, the same purchase can be financed in multiple ways. That is the key change.

Pay-in-4 BNPL: the flagship product

Pay-in-4 is the familiar format.

You pay a portion upfront. You pay the rest in three more payments. The timeline is short. The marketing is cheerful.

However, “no interest” does not mean “no cost.” Fees, late charges, and missed-payment impacts can still exist. Policies vary by provider and market.

Additionally, disputes can be tricky. Returns can be messy. A refund may take time. The repayment schedule may not pause automatically.

So, pay-in-4 is simple in theory. In practice, it demands attention.

Longer installment loans: the quiet expansion

Many checkouts now offer monthly installments.

These plans can run 6, 12, 24, or even more months. They can look like classic loans. They can also be embedded inside a shopping experience.

Consequently, shoppers can finance bigger items with less immediate pain.

Yet longer terms create a different risk. You may forget the loan. You may keep buying while still repaying. You may accept a price that feels small monthly but large in total.

Therefore, term length matters. Total cost matters. Early payoff rules matter.

Revolving lines and co-branded cards: the comeback

Retail credit never died. It evolved.

Some merchants push store cards. Some offer a revolving line at checkout. Some partner with platforms to offer a reusable limit.

This can be useful. It can also be sticky. Revolving credit invites repeated use. It can become a constant background burden.

Additionally, these products can be paired with rewards. Rewards feel exciting. They can also distract from interest cost.

So, the smartest move is simple. Treat rewards as a bonus. Treat the rate as the core.

What the data in 2024 and 2025 tells us

The BNPL boom is not a rumor. It is measurable.

Regulators, payment companies, and news outlets have published fresh numbers that show scale and momentum.

BNPL is mainstream in the United States

A CFPB study released in January 2025 found that 21.2% of consumers with a credit record used BNPL at least once in 2022, up from 17.6% in 2021. The report also found the average transaction amount around $142 in 2022, with a median around $108.

Those numbers matter for two reasons.

First, adoption is broad. Second, average ticket size is small enough to encourage casual use.

Consequently, BNPL becomes a habit product, not a rare tool.

2023 usage scaled up, and frequency rose

A CFPB BNPL market report published in December 2025 examined trends for calendar years 2022 and 2023 using data from large BNPL companies. It described expansion in the market and detailed key metrics across those years.

This matters because the “pay-in-4” product matured. The industry moved from novelty to infrastructure.

Additionally, more loans per user can signal deeper reliance. It can also signal risk.

So, the key question becomes: is BNPL replacing credit cards, or adding a new layer of debt?

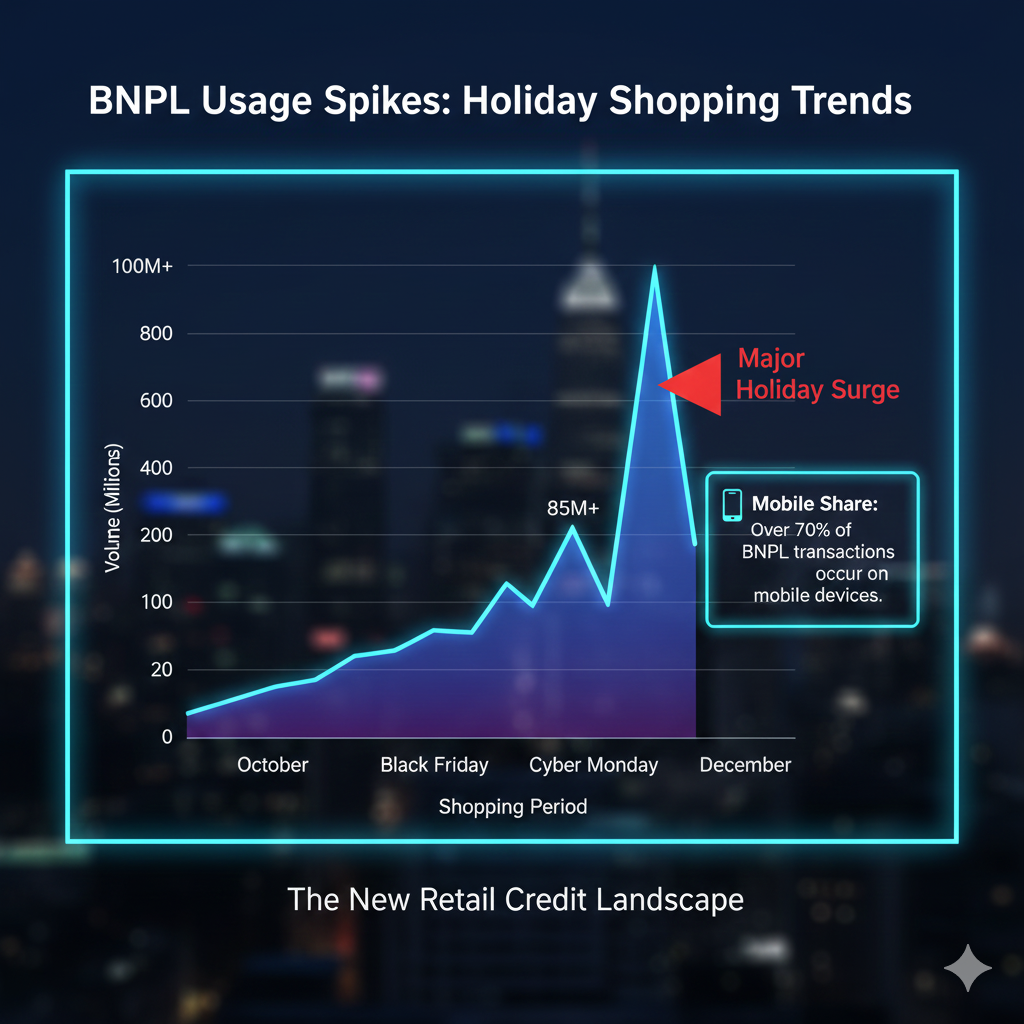

Holiday shopping shows how “strategic” BNPL became

Late 2025 shopping coverage highlighted that BNPL spending crossed huge thresholds during major retail events.

Adobe reported Cyber Monday 2025 hit a record for online spending, and other reporting highlighted BNPL-driven spending around $1.03 billion on that day.

That is a vivid signal.

BNPL is no longer niche. It is part of seasonal budgeting for many shoppers.

However, strategy can turn into strain if plans overlap.

Why merchants love point-of-sale lending

Merchants do not offer POS loans out of charity.

They offer them because conversion matters. Average order value matters. Cart abandonment matters. Loyalty matters.

Furthermore, POS lending can move risk away from the merchant. The lender funds the purchase. The merchant gets paid. The lender collects later.

This structure can feel clean. It can also hide incentives.

The conversion boost is a proven obsession

Retail is brutal.

A shopper hesitates. A cart sits. A sale dies. POS lending reduces hesitation. It splits the pain. It makes “yes” easier.

Additionally, it can increase basket size. A shopper adds accessories. A shopper upgrades. A shopper clicks the premium model.

That is thrilling for revenue. It can also be dangerous for consumers who buy beyond their comfort.

So, the system is built to encourage more buying. That is the point.

Merchant subsidies change the economics

Many POS programs are funded partly by merchants.

A merchant may pay a fee so that the consumer sees “0% interest” or a lower rate. It looks generous. It is also a pricing strategy.

Consequently, POS loans can become a marketing channel.

This is why you should treat every checkout offer like a product sale. The loan is being sold to you. The merchant wants the sale now.

Therefore, your job is to slow down. Read the terms. Compare options.

Why lenders and investors are pushing hard in 2025

POS lending is not only a retail story. It is a capital story.

Loan portfolios get financed. Loans get sold. Loans get securitized. Investors chase yield.

Meanwhile, as banks tighten in some segments, alternative capital steps in.

Private credit is entering consumer lending aggressively

Recent reporting described private credit firms piling into consumer debt in 2025, including credit card and BNPL exposure, with a major jump versus 2024.

This matters because it can change underwriting incentives.

When capital wants growth, lenders want originations. When lenders want originations, offers spread everywhere.

However, rising originations can stress credit quality if controls slip.

So, the 2025 story is mixed. There is exciting expansion. There is also a real risk of risk-taking.

BNPL firms manage funding and risk like banks, but faster

Many BNPL players partner with banks. Many also fund loans through capital markets.

This creates a complex ecosystem.

If delinquencies rise, funding can tighten. If funding tightens, pricing changes. If pricing changes, merchants and shoppers feel it.

Therefore, POS lending is sensitive to macro conditions. Rates matter. Consumer strain matters. Regulation matters.

The hidden costs that most shoppers miss

Point-of-sale lending is not evil. It is not magic either.

The risk is not only the interest rate. The risk is the behavior pattern.

Additionally, the risk is confusion. Many users do not track repayment calendars well.

Debt stacking is the core danger

Debt stacking is simple.

You take one BNPL plan. Then another. Then another. Each plan looks small.

Soon, you have four payment dates in one week. Two plans hit the same day. A third hits right before rent.

Consequently, “no interest” becomes irrelevant. The problem becomes cash timing.

Late fees can appear. Overdraft fees can appear. Stress can spike. Credit issues can follow, depending on the product and reporting.

So, stacking is the real enemy.

Returns and disputes can become painful

Retail has returns. People change their mind. Items arrive damaged.

With POS lending, the refund path can be less clean.

A refund may post after a payment is due. A merchant may process a return slowly. A lender may still expect payment on schedule.

Additionally, partial returns can be confusing. The loan may adjust. The schedule may not adjust. Terms vary.

Therefore, if you are buying something with a high chance of return, be extra careful. Clothes and shoes are common examples.

The phrase “pay always” is not a joke

A short plan ends fast. A longer plan lingers.

When plans linger, they become background noise. Background debt is dangerous. It makes future borrowing harder. It reduces flexibility.

Consequently, the responsible move is to keep your open plans minimal. Keep them visible. Keep them short when possible.

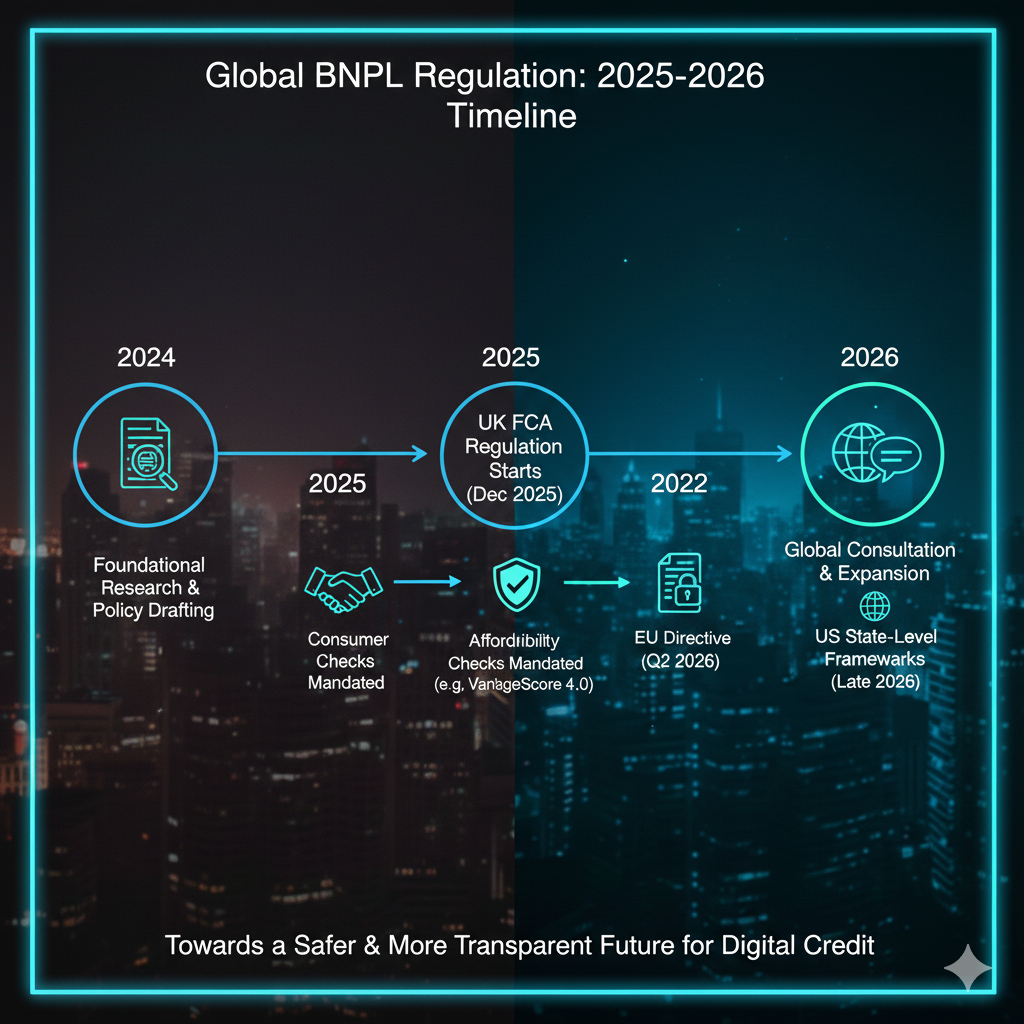

Regulation is tightening, and 2026 is a deadline year

POS lending grew fast. Regulators are reacting.

Different markets are moving at different speeds. The direction is clear. More oversight is coming.

The UK: FCA regulation starts in July 2026

The UK Financial Conduct Authority has stated it will start regulating Deferred Payment Credit, often called BNPL, in 2026. FCA consultation materials also point to July 15, 2026 as the start date for certain lenders offering this credit.

This is a major shift.

Regulation often brings affordability checks. It can bring clearer disclosures. It can bring complaint routes. It can bring stricter handling of customers in difficulty.

Consequently, “instant approval with zero friction” may become harder in that market.

Europe: consumer credit rules are evolving

European regulators have also been watching BNPL and payment problems.

A 2025 BNPL market update from the Netherlands’ AFM discussed growth and highlighted that payment problems remain meaningful in absolute numbers, while also connecting the landscape to evolving consumer credit rules.

This matters because many BNPL products grew in a lighter regulatory zone.

As that zone shrinks, providers will need stronger processes. Merchants may need clearer flows. Consumers may see more checks.

The US: regulators are asking more questions

In the United States, the CFPB has published detailed research on BNPL usage. The Federal Register also includes a 2025 Request for Information that references BNPL and unsecured debt concerns.

This signals active attention.

Therefore, 2026 may bring more formal expectations around reporting, disclosures, and consumer protections.

How to use point-of-sale lending safely

You do not need to fear POS lending. You need a simple playbook.

Additionally, you need a strict rule for yourself. Borrowing must be intentional, not automatic.

The 7-second pause rule

Before you click “confirm,” pause.

Count seven seconds. Ask one question: “Would I buy this without financing?”

If the answer is no, stop.

That pause is small. It is powerful. It breaks impulse.

Always calculate the total, not the monthly

Monthly pricing is seductive.

Your brain loves small numbers. Your future budget may hate them.

So, look for total repayment. Add fees. Note penalties. Check whether missed payments trigger extra costs.

Additionally, compare with other options. A credit card with a grace period might be cheaper. A debit purchase might be safest. A savings buffer might be best.

Track open plans like bills

Treat each plan like a bill.

Write the due dates. Use calendar reminders. Keep a simple list.

If you cannot name your next three due dates, you are in danger of stacking.

Consequently, clarity is a form of protection.

Watch your bank balance timing

Many BNPL payments pull automatically.

If your pay day is Friday and your BNPL pulls Monday, be careful. If rent pulls on the same day, be careful.

Timing creates overdrafts. Overdrafts create fees. Fees create anger and stress.

So, align your payment dates when possible. If you cannot, avoid new plans.

What retailers and product teams should do in 2025 and 2026

This era rewards trust. It punishes manipulation.

Merchants and platforms can build a responsible POS lending experience that still converts.

Use transparent design, not dark design

A dark design hides the real cost. A transparent design shows it.

Show total repayment clearly. Show fees clearly. Show what happens if a payment fails. Show a link to support.

Additionally, avoid pushing the loan as the default. Offer it, but do not trap the user into it.

Trust is profitable. Panic churn is not.

Build “good friction” into risky moments

Friction is not always bad.

A short summary screen is good. A warning about stacking is good. A reminder of other open plans is good.

Meanwhile, a simple affordability check can be respectful. It protects the customer. It protects the portfolio.

Therefore, the best POS lending experience has guardrails. It feels verified. It feels authentic.

Prepare for regulation now, not later

If your market will regulate in 2026, do not wait.

Update disclosures. Improve collections practices. Add complaint flows. Train support.

Additionally, audit marketing language. “Free” claims can backfire. “Guaranteed approval” claims can become legal risk.

So, preparation is essential.

The 2026 outlook: buy now will stay, but rules will harden

POS lending is not going away.

Instead, it will evolve. It will spread into new categories. It will also face tougher scrutiny.

Expect smarter underwriting and more data use

Lenders want fewer losses. Regulators want fewer harms.

So, more affordability checks are likely. More data-driven decisions are likely. More friction for risky borrowers is likely.

This can be good. It can reduce reckless approvals. It can also reduce access for some users.

Consequently, the fairness debate will grow.

Expect AI-driven “offer timing” to get more intense

Embedded credit is becoming predictive.

Offers appear at the right moment. Limits adapt. Pricing shifts. That is effective. It can also be manipulative.

Therefore, the next trust battle is timing.

A responsible lender will use timing to prevent hardship. A reckless lender will use timing to exploit vulnerability.

Consumers should assume offers are optimized. That assumption keeps you alert.

Expect POS lending to expand beyond retail

BNPL is moving into travel. It is moving into services. It is moving into subscriptions.

As it spreads, it will touch more essential spending.

That is critical. It raises the stakes. It also raises the need for consumer protections.

So, the 2026 era will be louder, more regulated, and more competitive.

Conclusion

Point-of-sale lending has turned the checkout into a credit moment.

In 2025, “pay later” is not a niche option. It is a mainstream tool that shapes how people shop and budget. The benefits can be real. The speed can be rewarding. The flexibility can be comforting.

However, the risks are also real. Stacking is dangerous. Timing traps are common. Returns and disputes can be frustrating. Capital pressures can push aggressive offers.

Consequently, the smartest approach is simple.

Pause before you accept. Calculate total cost. Track repayments like bills. Avoid stacking. Protect your cash timing.

Meanwhile, merchants and lenders who build transparent, verified, consumer-first experiences will win in 2026. Regulation will make the market more disciplined. Trust will become the true gold standard.

Sources and References

- CFPB: BNPL Market Report (Dec 2025 PDF)

- CFPB: Consumer Use of BNPL and Other Unsecured Debt (Jan 2025 PDF)

- FCA: Regulating Buy Now Pay Later (BNPL) in 2026

- FCA Consultation Paper CP25/23 on Deferred Payment Credit

- AFM: Buy Now, Pay Later Market Update 2025 (PDF)

- Worldpay: Global Payments Report 2025 landing page

- Adobe: Cyber Monday 2025 hits record online spend (Dec 2025)

- Payments Dive: BNPL drove $1.03B in spend on Cyber Monday (Dec 2025)

- Financial Times: Private credit firms pile into consumer debt (Dec 2025)

- Federal Register: RFI on BNPL and unsecured debt (Jun 2025)

- YouTube: CNBC Payments trends for 2024, BNPL boom

- YouTube: CNBC, BNPL threatening banks