Secure your financial future with a robust emergency fund. Discover essential strategies to save money fast and protect against life’s unexpected crises today.

The path to financial freedom begins with a single, decisive step. That step is not investing in the stock market. It is not buying real estate. It is building a rock-solid emergency fund. In the unpredictable economic landscape of December 2025, having a financial safety net is no longer optional. It is absolutely critical for your survival. Without it, you are walking a tightrope without a net. One slip could lead to a devastating fall. This comprehensive guide will empower you to build that net. We will explore the vital strategies you need to protect your family, your assets, and your peace of mind.

The Critical Necessity of Financial Protection

Life has a habit of striking when you least expect it. A sudden job loss can shatter your routine. A medical emergency can drain your bank account in seconds. A natural disaster can upend your entire world. These are not just possibilities; they are eventualities. Everyone faces financial shocks at some point. The difference between those who crumble and those who thrive is preparation.

An emergency fund serves as your primary defense against these catastrophes. It is a dedicated pool of cash reserved strictly for unplanned expenses. It prevents you from relying on high-interest credit cards or predatory loans. Furthermore, it protects your long-term investments. When you have cash on hand, you do not need to liquidate stocks during a market downturn. This simple account acts as a powerful shield for your future wealth.

The Psychological Benefit of Cash Reserves

Beyond the math, there is a profound emotional benefit to holding cash. Financial stress is a leading cause of anxiety and relationship breakdown. Living paycheck to paycheck creates a constant, low-level panic. You worry about every noise your car makes. You dread opening the mailbox. An emergency fund eliminates this fear. It transforms you from a victim of circumstance into a master of your destiny.

When you have three to six months of expenses in the bank, you walk taller. You breathe easier. This sense of security is priceless. It allows you to make career decisions based on passion rather than desperation. It gives you the freedom to leave a toxic work environment. Consequently, the mental clarity you gain is often worth more than the money itself.

Why 2025 Demands Greater Security

The economic climate of late 2025 presents unique challenges. We have seen fluctuations in the job market due to rapid AI integration. Traditional career paths are shifting. The gig economy has expanded, bringing both freedom and instability. Inflationary pressures in previous years have increased the baseline cost of living. Therefore, the “standard” advice of the past may be insufficient.

In this modern era, reliance on credit is dangerous. Interest rates remain a significant factor. Carrying debt is costlier than ever before. Thus, self-reliance is the only guaranteed strategy. You must be your own bank. You must be your own insurance policy against minor disasters. This proactive approach is essential for navigating the complexities of the modern financial world.

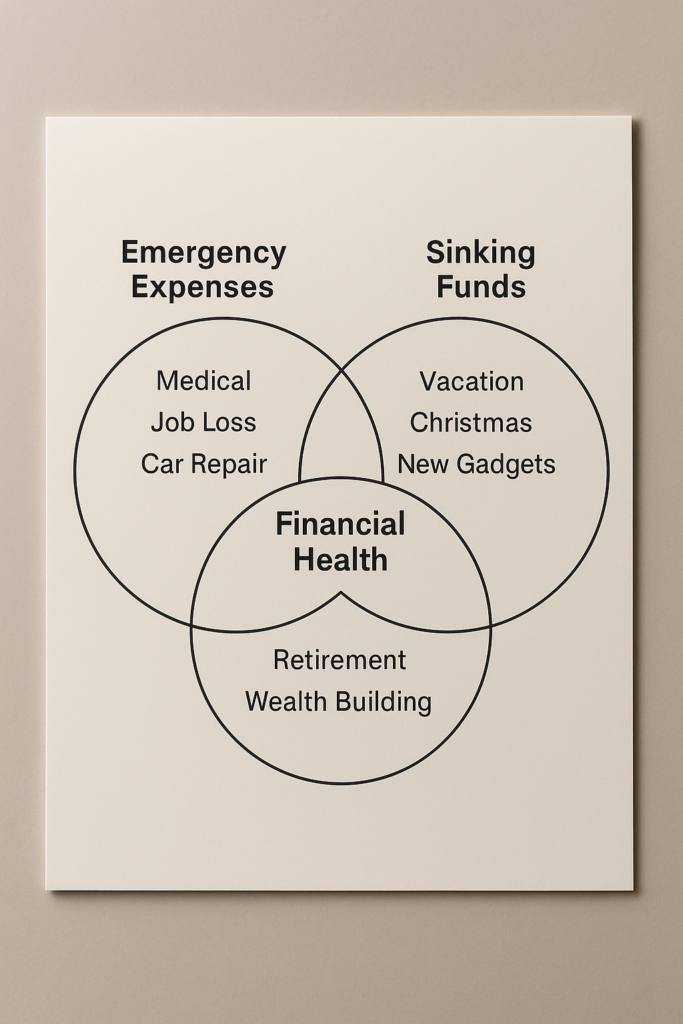

Defining Your Safety Net: What It Is and Is Not

Clarity is vital when building your fund. Many people confuse an emergency fund with a “slush fund” or general savings. This mistake can be costly. An emergency fund has a specific, singular purpose. It is for true emergencies only. It is not for a vacation. It is not for a new television. It is not for holiday gifts.

The Three Pillars of an Emergency Fund

To function effectively, your fund must meet three strict criteria. If it fails one of these, it is not a true emergency fund.

- Liquidity: You must be able to access the money immediately. If your car breaks down on a Sunday, you cannot wait three days for a stock trade to settle. You need cash now.

- Safety: The principal must be guaranteed. This money cannot be exposed to market risk. You cannot afford for your safety net to shrink by 10% because the stock market had a bad week.

- Separation: The money must be in a separate account from your daily checking. If it sits in your checking account, you will accidentally spend it. It needs to be “out of sight, out of mind” until disaster strikes.

Common Misconceptions to Avoid

Some financial gurus might suggest using a credit card as an emergency fund. This is terrible advice. Credit lines can be cut by banks without warning. During economic downturns, banks often reduce limits to minimize their risk. If you rely on a card, you might find it useless exactly when you need it most.

Additionally, do not count your Home Equity Line of Credit (HELOC) as an emergency fund. Like credit cards, these can be frozen. Furthermore, accessing equity takes time and involves paperwork. In a true crisis, speed is essential. Cash is the only asset that provides immediate, unquestioned purchasing power.

Calculating Your Magic Number

How much is enough? This is the most common question. The standard answer is “three to six months of expenses.” However, a generic answer is dangerous. Your specific number depends on your unique life situation. A single 22-year-old renter needs less security than a 45-year-old homeowner with three children and a mortgage.

The Essential Expense Audit

To calculate your target, you must know your “bare bones” budget. This is not your current spending. This is the minimum amount required to survive.

- Housing: Rent or mortgage, property taxes, insurance.

- Utilities: Electricity, water, heat, basic internet (essential for job hunting).

- Food: Groceries only. No dining out.

- Transportation: Gas, insurance, essential public transit.

- Debt Minimums: Minimum payments on loans to avoid default.

- Healthcare: Insurance premiums and essential medications.

Add these numbers up. This is your monthly survival number. If your survival number is $4,000, then a three-month fund is $12,000. A six-month fund is $24,000. Seeing these numbers can be intimidating. However, do not let the size of the goal paralyze you. Every great achievement starts with a small beginning.

Adjusting for Risk Factors

You should lean toward a six-month or even twelve-month fund if you face higher risks. Consider these factors carefully.

- Income Stability: Are you a freelancer or commission-based worker? If your income fluctuates, you need a larger buffer.

- Dependents: Do you have children or elderly parents relying on you? More people means more potential emergencies.

- Health Status: Do you have a chronic condition? Medical surprises are expensive.

- Industry Volatility: Is your job sector stable? If layoffs are common in your field, aim for a larger fund.

Conversely, a two-income household with stable government jobs might be safe with a three-month fund. Assess your vulnerability honestly. It is always better to have too much savings than too little.

Where to Keep Your Emergency Cash

We established that this money must be safe and liquid. However, it should not sit under your mattress losing value to inflation. You need a vehicle that offers easy access while earning a respectable interest rate. In 2025, digital banking offers excellent options that balance growth and liquidity.

High-Yield Savings Accounts (HYSA)

For most people, a High-Yield Savings Account is the gold standard. These accounts are offered primarily by online banks. Because these banks do not have expensive brick-and-mortar branches, they pass the savings to you in the form of higher interest rates.

As of December 2025, interest rates remain competitive. A good HYSA will pay significantly more interest than a traditional bank savings account. This interest helps your emergency fund keep pace with inflation. Furthermore, these accounts are FDIC insured up to $250,000. Your money is safe, accessible, and growing.

Money Market Accounts (MMA)

A Money Market Account is another strong contender. MMAs are hybrids between checking and savings accounts. They often come with debit cards or check-writing privileges. This feature offers superior liquidity. If you have a medical emergency, you can pay the hospital directly from the account.

However, MMAs sometimes require higher minimum balances to waive fees. Read the fine print carefully. Ensure the interest rate is comparable to a HYSA. If the rate is significantly lower, the extra convenience may not be justified.

Roth IRA: The Controversial Backup

Some advanced financial planners suggest using a Roth IRA as a backup emergency fund. You can withdraw your contributions (not earnings) from a Roth IRA at any time without penalty. This strategy allows your money to potentially grow in the market.

However, this is risky. If the market crashes when you need the money, you lose capital. Additionally, once you pull money out of a retirement account, you can never put that tax-advantaged space back. Generally, keep your emergency fund separate from your retirement. Do not rob your future self to pay for a present crisis unless absolutely necessary.

Strategic Steps to Build Your Fund Fast

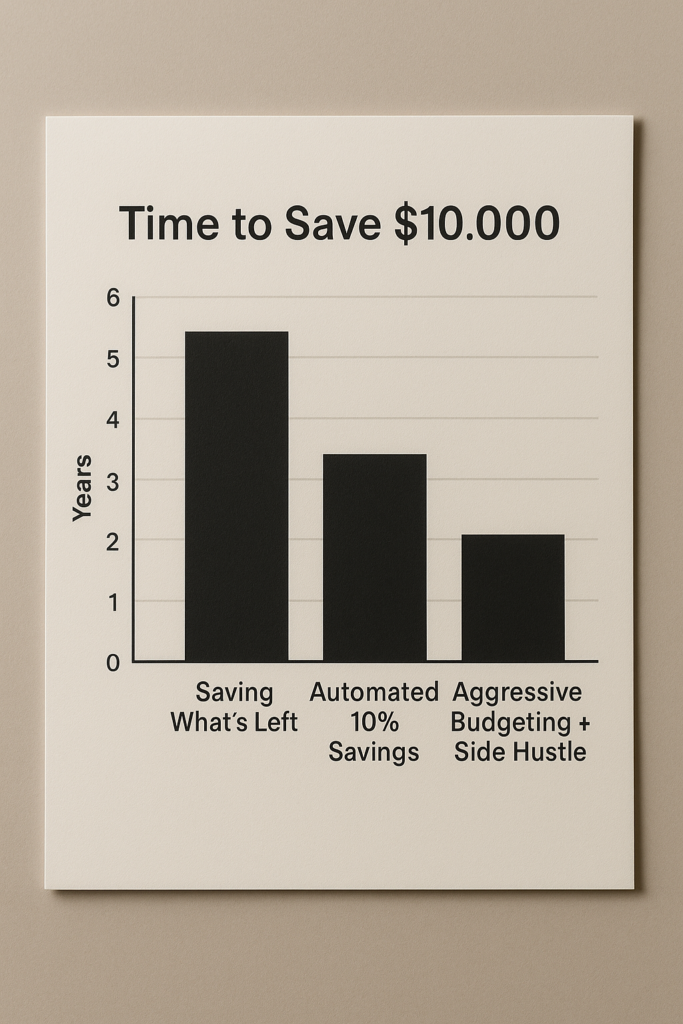

Now we move to execution. Saving $10,000 or $20,000 feels like climbing a mountain. You need a strategy. You need a map. Relying on willpower alone will fail. You must build systems that make saving inevitable.

Step 1: The Mini-Emergency Fund

Do not aim for six months immediately. That goal is too distant. First, aim for a “starter” emergency fund. Set a target of $1,000 or one month of expenses. This small amount covers minor incidents like a blown tire or a broken appliance. Achieving this quick win provides a massive psychological boost. It proves you can do it. It breaks the cycle of using credit cards for minor hiccups.

Step 2: Automate Everything

Automation is the secret weapon of the wealthy. You cannot spend money you do not see. Set up an automatic transfer from your checking account to your HYSA on payday. Treat this transfer like a bill. You pay your rent. You pay your electricity. Now, you pay your future self.

Start with a manageable amount. Even $50 per paycheck makes a difference. Over time, increase this amount. When you get a raise, increase the transfer. When you pay off a debt, redirect that payment to your savings. This is known as the “snowball effect” applied to savings.

Step 3: Slash and Burn Expenses

To supercharge your savings, you must temporarily reduce your outflow. Conduct a ruthless audit of your spending.

- Subscriptions: Cancel streaming services you rarely use.

- Dining Out: Commit to cooking at home for 30 days.

- Insurance: Shop around for better rates on car and home insurance.

- Groceries: Buy generic brands and meal plan.

This austerity is not permanent. It is a sprint to reach your safety goal. Once your fund is fully funded, you can reintroduce these luxuries. The temporary sacrifice leads to permanent security.

Step 4: Increase Your Income

There is a limit to how much you can cut, but there is no limit to how much you can earn. In the gig economy of 2025, opportunities abound. Consider a temporary side hustle to fund your account.

- Freelancing: Use your professional skills on consulting platforms.

- Selling Items: Declutter your home and sell unused electronics or clothes.

- Gig Work: Delivery driving or rideshare on weekends.

Direct 100% of this extra income to your emergency fund. This accelerates the process dramatically. You might reach your six-month goal in half the time.

Overcoming Psychological Barriers

Building an emergency fund is 20% math and 80% psychology. The biggest enemy is not low income; it is human nature. We are wired for instant gratification. We want the reward now. Saving is delaying gratification. This feels painful to our primal brains.

Dealing with FOMO (Fear Of Missing Out)

Social media exacerbates spending. You see friends on expensive trips. You see neighbors buying new cars. You feel pressure to keep up. Remember, social media is a highlight reel. You do not see their credit card bills. You do not see their stress.

Focus on your own race. The peace of mind you are building is invisible but powerful. When your friend panics about a layoff, you will be calm. That tranquility is the ultimate luxury.

The “It Won’t Happen to Me” Fallacy

Optimism bias is dangerous. We all believe we are above average. We believe bad things happen to other people. This is a delusion. Statistics are stubborn. Illness, accidents, and economic shifts are blind to your confidence. Acknowledge your vulnerability. It is not pessimism; it is realism. Accepting risk is the first step to mitigating it.

When to Use the Money (and When Not To)

Once you have the money, you must protect it. The temptation to dip into the fund for non-emergencies will be strong. You must establish strict rules of engagement.

The Litmus Test

Before withdrawing a single cent, ask yourself these three questions:

- Is it unexpected? Christmas is not unexpected. Annual car registration is not unexpected. These should be budget items.

- Is it necessary? Is this essential for survival, health, or income? A broken laptop is an emergency if you work from home. It is not an emergency if you only use it for gaming.

- Is it urgent? Can this wait? If you can save up for it over three months, it is not an emergency.

If you answer “Yes” to all three, use the fund. That is what it is there for. Do not feel guilty. Feel proud that you were prepared.

Examples of Valid Emergencies

- Medical Deductibles: An emergency room visit or urgent surgery.

- Job Loss: Covering rent and food while you interview for new roles.

- Major Car Repair: Transmission failure or engine trouble (maintenance like oil changes are not emergencies).

- Home Repair: A leaking roof or a broken furnace in winter.

- Family Emergency: Urgent travel for a funeral or critical illness of a loved one.

Replenishing the Fund

Using your emergency fund can be traumatic. Watching that balance drop feels like a setback. However, remember that the fund did its job. It saved you from debt. It saved you from ruin.

Once the crisis passes, your immediate priority shifts. You must refill the bucket. Pause your other financial goals. Pause extra investing. Redirect all available cash flow back into the emergency fund.

The Rebuilding Strategy

- Assess the Damage: How much did you spend? What is the new balance?

- Adjust the Budget: Go back to your “slash and burn” budget mode.

- Pause Contributions: Stop extra payments to debt (pay minimums only) until the fund is restored to a safe level (at least one month of expenses).

- Resume Normalcy: Once the fund is back to 3-6 months, resume your normal investment and debt payoff strategy.

This cycle is normal. You fill the bucket, you empty the bucket, you refill the bucket. This is the rhythm of a healthy financial life.

Advanced Strategies for 2025

For those who have mastered the basics, there are advanced ways to structure your reserves. These strategies optimize for yield while maintaining safety.

The Tiered Approach

You do not need to keep all six months of expenses in a single account. You can tier your funds based on accessibility.

- Tier 1 (Immediate Cash): Keep one month of expenses in your primary bank’s savings account. This is for instant transfer to checking.

- Tier 2 (High Yield): Keep three months in a High-Yield Savings Account. It takes 1-3 days to transfer, but earns better interest.

- Tier 3 (Growth/Safety): Keep the remaining two to three months in slightly less liquid vehicles like CD ladders (Certificates of Deposit) or T-Bills (Treasury Bills). These lock your money for short periods (e.g., 30 days to 6 months) but often pay higher rates.

CD Ladders

A CD ladder involves buying multiple Certificates of Deposit with different maturity dates. For example, you buy a 3-month, 6-month, 9-month, and 12-month CD. As each one matures, you have access to cash if needed. If you do not need it, you reinvest it. This strategy ensures a portion of your money becomes liquid regularly while capturing higher interest rates.

Conclusion: Your Foundation for Freedom

Building an emergency fund is the most profound act of self-care you can perform. It is a declaration of independence. It says that you refuse to be a victim of circumstance. It transforms the unknown from a source of terror into a manageable inconvenience.

The journey to saving three to six months of expenses is not easy. It requires discipline. It requires sacrifice. It requires saying “no” to temporary pleasures so you can say “yes” to permanent security. But the reward is worth every penny.

Imagine a life where a car breakdown is just an annoyance, not a financial crisis. Imagine losing a job and viewing it as a sabbatical rather than a catastrophe. This reality is possible. It starts with your next paycheck. It starts with your next decision. Open that High-Yield Savings Account. Transfer that first $100. Build your fortress. Your future self is begging you to start today. You have the power to change your financial destiny. Seize it.

Sources and References

- Consumer Financial Protection Bureau: An Essential Guide to Building an Emergency Fund

- Vanguard: Emergency Fund Basics and Strategies

- Investopedia: Why You Need an Emergency Fund

- Fidelity: How Much to Save for Emergencies

- Bankrate: Best High-Yield Savings Accounts for 2025

- NerdWallet: Emergency Fund Calculator and Guide

- Ramsey Solutions: A Quick Guide to Your Emergency Fund

- Federal Reserve: Report on the Economic Well-Being of U.S. Households