Stocks vs bonds feels confusing at first. Yet the core idea is simple. Stocks are ownership. Bonds are loans. Once you see that difference clearly, your choices feel calmer, smarter, and more rewarding.

As of December 2025, many new investors feel real pressure. Prices have been volatile. Interest rates have mattered again. Headlines can sound urgent and scary. However, you can build a confident plan without guessing the future. You just need to match the tool to the goal.

The clearest definitions you will ever need

Many guides bury you in jargon. This section stays clean and practical.

What stocks really are

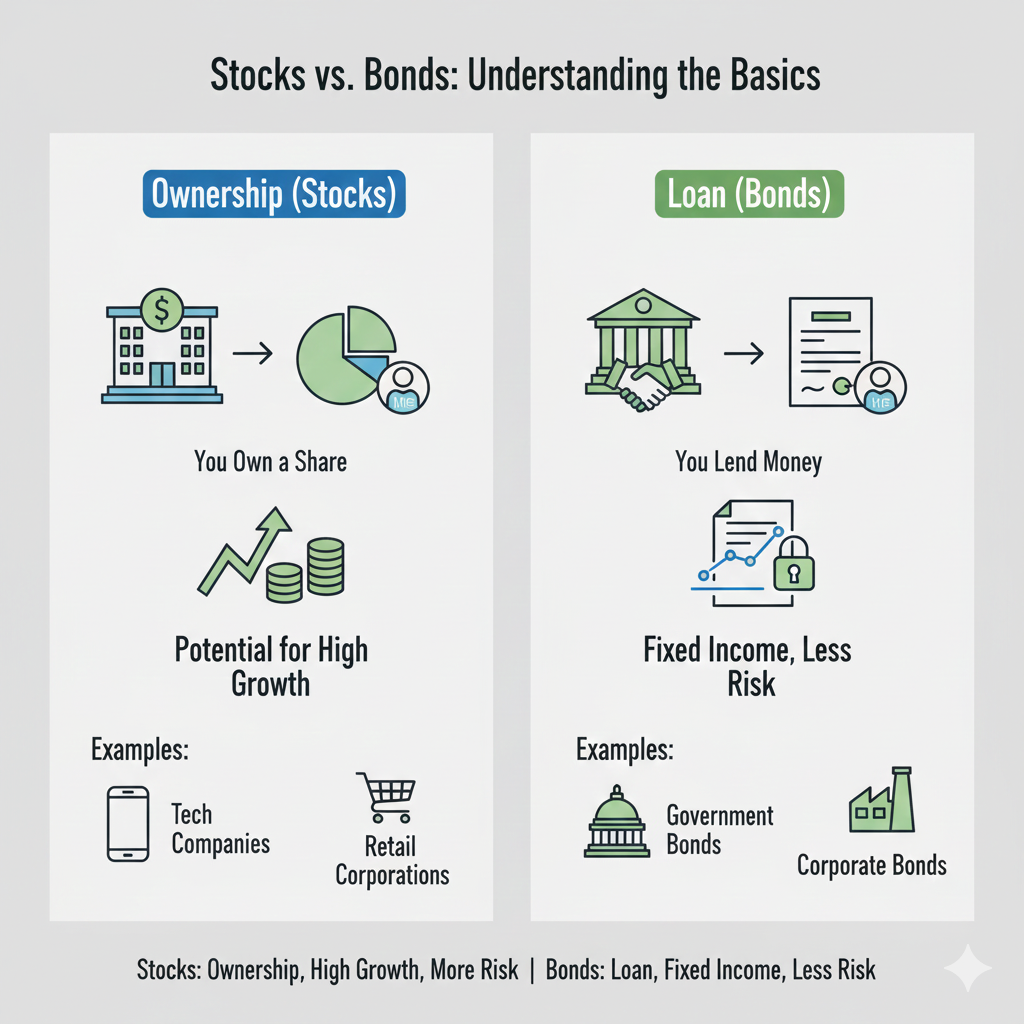

A stock is a share of ownership in a company. You are not lending money. You are buying a small slice of the business. If the business grows, your slice can become more valuable. If the business struggles, your slice can shrink. That is the deal. (investor.gov)

Stocks trade all day in public markets. Prices move fast. Some days feel thrilling. Other days feel brutal. Consequently, stocks reward patience more than prediction.

What bonds really are

A bond is a loan you make to a government, a company, or another issuer. In return, the issuer promises interest and a return of principal at maturity. Bonds can feel steadier than stocks. Still, they have real risks too. (investor.gov)

Bond prices can rise or fall before maturity. If you sell early, you can gain or lose money. That surprise is a common pain point for beginners. (youtube.com)

How stocks can pay you

Stocks can create wealth in two main ways. Understanding both is essential. It also keeps you from chasing hype.

Price growth and compounding

A stock can rise in price as the company grows sales, profit, and cash flow. Over long periods, this growth can be powerful. It can feel revolutionary when you finally see compounding in action.

However, growth is not smooth. Markets reprice risk fast. Bad news can hit like a storm. Additionally, even good companies can have ugly years.

Dividends and shareholder returns

Some companies share profits through dividends. Dividends can feel rewarding because you see cash flow. They can also help you stay calm during drops.

Still, dividends are not guaranteed. Companies can cut them. In a crisis, they often do. So treat dividends as helpful, not sacred.

How bonds can pay you

Bonds look simple on the surface. Yet the mechanics matter. If you understand the mechanics, you avoid costly mistakes.

Coupon payments and principal

Many bonds pay periodic interest. This interest is often called the coupon. At maturity, you typically get your principal back. That structure feels stable. It can feel comforting, even protective.

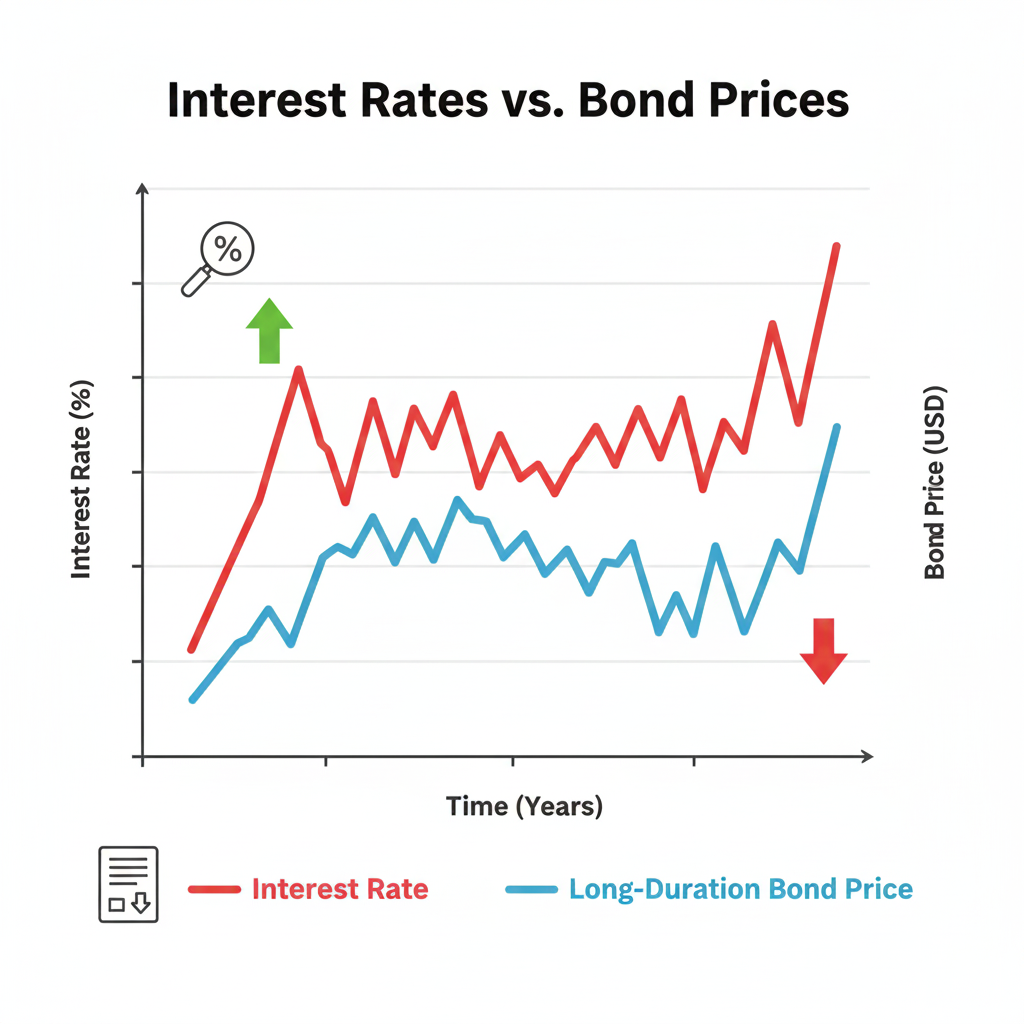

But there is a critical detail. The market price of the bond can move. If rates rise, older bonds become less attractive. Their prices can fall. If rates fall, prices often rise. (FINRA)

Yield, yield to maturity, and the real return

Beginners often fixate on the coupon rate. That is a trap. The return you earn depends on the price you pay and the cash flows you receive.

Yield to maturity is a common way to estimate return if you hold to maturity. It helps you compare bonds with different prices, coupons, and maturities. (Fidelity)

Interest rate risk and duration

Interest rate risk is not a small detail. It is vital. When rates change, bond prices react. Duration is a measure of sensitivity. Longer duration often means bigger price swings when rates move. (FINRA)

Consequently, a bond can be “safe” in one way and risky in another. A U.S. Treasury has very low default risk. Yet a long Treasury can still swing hard with rate moves.

The risks that actually matter for your decision

Risk is not just “will I lose money.” Risk is also “will I panic and quit.” That emotional risk is real. It can destroy an otherwise proven plan.

Stock risk: volatility and uncertainty

Stock prices can drop fast. A deep decline can feel shocking. It can trigger fear, regret, and self-blame.

However, volatility is the price of long-term growth. If you sell in panic, you lock in damage. If you stay invested with a solid plan, volatility becomes survivable.

Bond risk: rates, inflation, and credit

Bonds face three big risks.

Rates can rise, pushing prices down. (FINRA)

Inflation can erode purchasing power. A “safe” bond can still leave you poorer in real terms.

Credit risk exists for corporate and high-yield bonds. The issuer might weaken or default. (FINRA)

Additionally, liquidity matters. Some bonds are harder to sell at a fair price in stress.

The hidden risk: mismatch between time horizon and asset

This is the silent killer. If you need money soon, stocks can be a terrible fit. If you need growth for decades, ultra-safe short-term bonds can be too slow.

So the best choice is not moral. It is mechanical. Match the tool to the timeline.

Stocks vs bonds: the differences that decide everything

At this point, you can reduce the decision to a few practical contrasts. These contrasts are proven and easy to remember.

Stocks are ownership and growth-focused. Bonds are lending and stability-focused. (investor.gov)

Stocks usually have higher long-term upside, with painful drawdowns. Bonds usually have lower upside, with steadier income. However, bonds can still drop, especially when rates move quickly. (FINRA)

Stocks do not promise anything. Bonds usually promise cash flows, but the market price can move. (youtube.com)

Consequently, “which is better” is the wrong question. The right question is “which fits my goal, my timeline, and my sleep.”

What changed in 2024 and 2025, and why it matters

Many people built their beliefs during the low-rate era. That era shaped habits. December 2025 is different. Rates and bond yields became meaningful again. That shift is essential for your decision.

Bond markets got huge, and issuance stayed intense

In 2024, long-term fixed income issuance rose sharply. SIFMA reported 2024 long-term fixed income issuance around $10.4 trillion, with U.S. Treasury issuance about $4.7 trillion. (SIFMA)

Meanwhile, governments outside the U.S. also faced heavy borrowing needs. A Reuters analysis in late 2024 discussed expectations of record euro zone net government bond supply around €660 to €670 billion in 2025, with gross issuance projected around €1.26 trillion. (Reuters) Another Reuters poll in March 2025 pointed to UK gilt issuance expectations around £304 billion for 2025/26. (Reuters)

This matters because supply can influence yields, investor demand, and term premiums. It also keeps bonds in the headline risk zone.

Cash became “tempting” again

When yields rise, many investors park money in cash-like funds. In December 2025, Reuters reported a very large weekly inflow into U.S. money market funds, about $104.75 billion in the week before December 3. (Reuters)

Cash can feel safe. It can feel guaranteed. However, long-term goals often need growth that cash may not deliver.

Debt levels stayed a global theme

In early December 2025, Reuters reported the Institute of International Finance estimate that global debt reached nearly $346 trillion as of Q3 2025, about 310% of global GDP. (Reuters)

That does not tell you what markets will do next week. Still, it explains why rates, bond supply, and fiscal headlines keep showing up. Consequently, understanding bonds is no longer optional.

Which should you choose: start with your goal, not opinions

Your goal is your compass. Without it, every headline can hijack you.

If your goal is survival and stability

If you need an emergency fund, that money has one job. It must be there when life hits. Stocks are usually a poor match for that job. Bonds can be better, but short-term focus is key.

Additionally, understand that even bond funds can dip. So keep truly near-term money in safer vehicles than long-duration bond funds.

If your goal is a purchase in 1 to 5 years

This is the danger zone for stocks. A bad market year can wreck your timing. Short-term bonds, high-quality bond funds with low duration, or a bond ladder can be more reliable.

However, “reliable” does not mean “no fluctuation.” It means “lower chance of catastrophic timing.” (FINRA)

If your goal is wealth building over 10+ years

This is where stocks often shine. Over long horizons, ownership in productive companies can be a breakthrough path to growth.

Still, bonds can play a vital role. They can reduce portfolio swings. They can also give you a rebalancing tool during crashes. That ballast can keep you from quitting at the worst time.

If your goal is retirement income

As retirement gets closer, stability becomes more critical. Many people shift toward a higher bond allocation over time. This reduces the risk of selling stocks after a crash to pay bills. That sequence risk is brutal.

Consequently, bonds often become more important as the spending date approaches.

A simple way to choose your stock-bond mix

You do not need a perfect formula. You need a clear rule you can follow. Simple rules can be powerful and authentic.

The “time horizon first” rule

Ask one question. “When do I need this money?”

If the answer is soon, prioritize stability.

If the answer is far, prioritize growth.

If the answer is mixed, build buckets.

Additionally, separate accounts mentally by purpose. That reduces panic.

The “sleep test” rule

Ask another question. “Will I stay invested during a scary drop?”

If the honest answer is no, a 100% stock plan is not brave. It is fragile. A slightly lower stock allocation can be more successful because it is sustainable.

The “behavior beats brilliance” rule

A modest plan you follow can outperform an aggressive plan you abandon. That is not motivational fluff. It is practical reality.

The smartest way to buy stocks and bonds with small money

You do not need a big account. You need low costs, broad diversification, and discipline.

Index funds and ETFs: the modern default

Index funds and ETFs let you buy broad baskets of stocks or bonds in one trade. This can reduce single-company risk. It also makes investing more accessible.

Furthermore, ETFs can be a practical way to hold bonds without buying individual issues. Vanguard, for example, describes bond ETFs as diversified pools that trade like stocks. (Vanguard)

Bond funds vs individual bonds

Individual bonds have a maturity date. If held to maturity, the path can feel clearer. Bond funds do not mature. Their price moves daily.

However, bond funds can offer instant diversification. They can be easier for beginners. The key is matching duration and credit quality to your goal. (FINRA)

Target-date and balanced funds

If you want simplicity, a balanced fund or target-date fund can be a verified shortcut. It bundles stocks and bonds and adjusts risk over time.

Still, you must understand the allocation inside. Some funds are more aggressive than you expect.

Core strategies that make the decision easier

Once you pick a mix, you need a system. Systems beat moods.

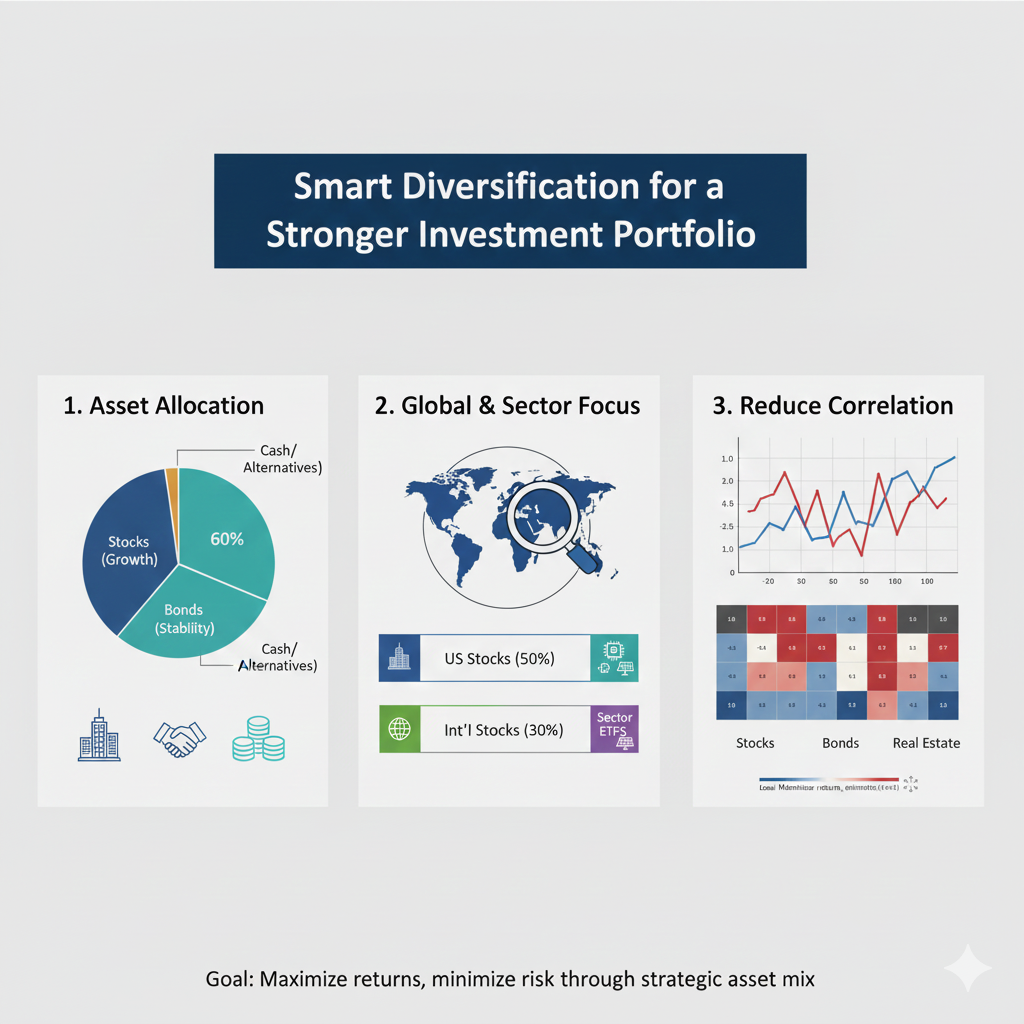

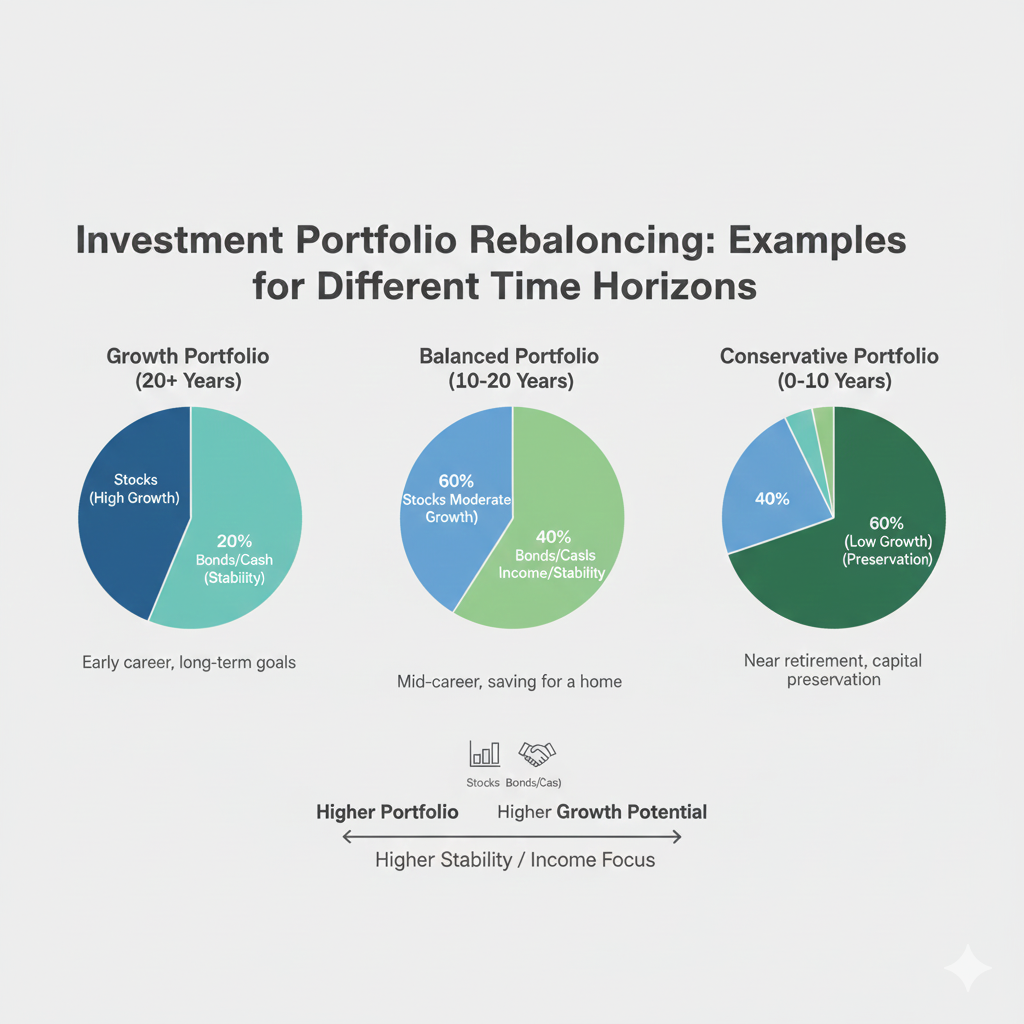

Asset allocation is the engine

Asset allocation is simply your split between stocks and bonds. Vanguard publishes model allocations to help investors match risk level to goals. (Vanguard)

The exact percentages matter less than consistency. Additionally, picking an allocation you can hold through stress is critical.

Rebalancing turns volatility into a tool

Rebalancing means you trim what grew and add to what fell. It sounds boring. It is also proven and powerful.

When stocks surge, rebalancing forces you to take some gains. When stocks crash, rebalancing forces you to buy when fear is high. That can feel uncomfortable. It can also be deeply rewarding.

Dollar-cost averaging reduces regret

Invest a set amount regularly. That smooths your entry points. It also reduces the emotional weight of “buying at the top.”

However, do not confuse dollar-cost averaging with safety. Stocks can still drop. The difference is that your process stays steady.

Common mistakes that sabotage beginners

Avoiding mistakes is often more profitable than finding a “perfect” pick.

Mistake 1: Chasing yield without understanding risk

High yields can be seductive. They can feel like a guaranteed win. Often they are a warning sign.

High-yield bonds carry more credit risk. Long-duration bonds carry more rate risk. (FINRA)

Consequently, a “safe” income plan can break under stress if the risks are hidden.

Mistake 2: Treating bonds as cash

Bonds are not cash. Long bonds can swing hard. Even intermediate bond funds can drop during rapid rate moves. (FINRA)

So be honest about the timeline. If you need the money in a year, a long bond fund can be a painful mismatch.

Mistake 3: Panic selling after a scary headline

This is the classic tragedy. You buy stocks for growth. Then volatility arrives. Fear takes over. You sell low. Later, you buy back higher, feeling regret.

Additionally, panic selling can turn a temporary drop into a permanent loss.

Mistake 4: Overconcentrating in one story

In 2024 and 2025, many investors chased a few hot themes, especially AI-related stocks and mega-cap tech narratives. Some did well. Many took concentrated risk without realizing it.

Diversification is not exciting. It is protective. It is also a proven path to long-term survival.

A practical decision framework you can use today

You can decide in minutes. You just need honesty.

Step 1: Name the purpose of the money

Write one sentence. “This money is for ___ in ___ years.” Keep it specific. Vague goals create fragile portfolios.

Step 2: Pick a simple mix that matches the purpose

If the goal is 10+ years away, lean stock-heavy.

If the goal is 1 to 5 years away, lean bond-heavy or short-term focused.

If the goal is mixed, use a bucket approach.

Keep it simple. Complexity can feel sophisticated. It often becomes unmanageable.

Step 3: Choose the vehicle

For stocks, broad equity index funds and global ETFs can be a strong base.

For bonds, consider high-quality bond funds, shorter duration, and simple ladders.

FINRA’s investor materials are especially useful for understanding interest rate risk and duration in plain terms. (FINRA)

Step 4: Automate and review calmly

Automate contributions if you can. Review quarterly or twice a year. Avoid daily checking. Daily checking feeds stress.

Consequently, your plan becomes calmer and more durable.

Conclusion: the winning choice is the one you can hold

Stocks vs bonds is not a battle. It is a toolbox.

Stocks can be thrilling, profitable, and powerful for long horizons. Bonds can be stabilizing, essential, and deeply useful when timelines matter. In December 2025, understanding both is more valuable than ever. Rates, bond supply, and cash yields changed the landscape. (SIFMA)

If you want a simple rule that works, do this. Put growth money in diversified stocks. Put near-term money in high-quality, short-term focused bonds or cash-like tools. Then rebalance with discipline. That is not glamorous. It is authentic, proven, and effective.

Sources and References

- Investor.gov: Stocks

- Investor.gov: Bonds

- Investor.gov: Bonds, Selling Before Maturity

- FINRA: Bonds

- FINRA: Interest Rate Changes and Duration

- Fidelity: Bond prices, rates, and yields

- SIFMA: Capital Markets Fact Book

- Reuters: Record 2025 bond sales risk higher euro zone borrowing costs (Nov 22, 2024)

- Reuters: UK issuance around £304bn for 2025/26 expected (Mar 25, 2025)

- Reuters: Global debt near $346 trillion in Q3 2025 (Dec 9, 2025)

- Reuters: U.S. money market funds inflows ahead of Fed decision (Dec 9, 2025)