A practical guide to secured vs unsecured loans, how collateral cuts rates, and how to avoid losing your car, cash, or home.

Borrowing can feel empowering. It can also turn into a brutal trap. The difference is often one word: collateral.

A secured loan can unlock lower rates and bigger limits. It can also put your most important asset on the line. Meanwhile, an unsecured loan can protect your property. Yet it can punish your budget with higher payments and stricter approval.

This guide helps you choose the safest structure for your situation. It stays real. It uses clear examples. It also looks forward, because lending is changing fast.

Understand the core difference fast

A lender wants one thing: confidence. They want proof you will repay.

With an unsecured loan, the proof is mostly you: income, credit history, debt level, and stability. With a secured loan, the proof is also an asset the lender can claim if you fail to pay.

That sounds cold. Still, it is the basic deal.

What “collateral” really means in real life

Collateral is an asset tied to the loan. If you default, the lender can take it, sell it, and use the proceeds to reduce the balance. The rules depend on the contract and local laws. However, the emotional reality is always the same: you can lose something you rely on.

Common collateral examples include:

A car, a home, cash in savings, investments, equipment, or even invoices in some business loans. Additionally, some lenders use a secured credit card style deposit, which is collateral in a simpler form.

Why lenders love collateral

Collateral lowers the lender’s risk. Consequently, lenders can offer better terms, such as:

Lower interest rates, longer repayment, and higher loan amounts. Approval can also become easier, especially for borrowers with limited credit history.

That sounds like a breakthrough win. Yet it only helps if the collateral risk is acceptable.

Why secured loans can be a powerful advantage

Secured debt can be a smart tool. It can even be life changing when used carefully. Still, it must match your cash flow and your risk tolerance.

Lower rate, higher limit, better odds

Secured loans often have lower rates than unsecured loans, because the lender has a fallback. Moreover, secured structures can raise the amount you qualify for.

This matters when you need a large purchase, or when you want predictable payments. It also matters when your credit profile is not strong.

When collateral fits your life plan

Collateral helps when the asset is not “critical to survival” and when the loan purpose is stable and valuable.

Here are strong situations where collateral can be a reliable fit, if numbers work:

A car loan for a car you need for work, but only if the payment is comfortably affordable. A secured personal loan using savings, but only if you keep an emergency buffer elsewhere. A home equity loan for a high-return home repair that protects property value, but only if you avoid stretching.

Additionally, business equipment financing can be a smart move if the equipment directly produces revenue and has resale value.

A simple rule that prevents painful mistakes

Never pledge “essential assets” for a “non-essential goal.”

If losing the collateral would create a crisis, treat that collateral as untouchable. That includes the family home in many cases. It also includes the only car that gets you to work.

This rule sounds strict. However, it prevents the most devastating outcomes.

When collateral becomes dangerous

Collateral risk is not theoretical. It is immediate. It is personal.

People often focus on the rate. They ignore the loss scenario. Then one job disruption or medical expense hits. Suddenly the loan is not “cheap” anymore. It becomes terrifying.

The fastest ways collateral destroys your finances

Collateral becomes dangerous when the asset is highly valuable, highly essential, or highly volatile.

A home can be essential. A car can be essential. Investments can be volatile. Meanwhile, a lender’s contract can contain triggers that feel unfair when life gets messy.

The biggest danger is not just repossession or foreclosure. The biggest danger is the chain reaction:

You lose the asset. You still may owe fees, interest, and a remaining balance. Your credit can get damaged for years. Your options shrink at the worst possible time.

Contract traps people miss

Many borrowers never read the sections that matter most. They read the rate. They skip the “events of default.”

Look for these hotspots:

Acceleration clauses, which can make the full balance due faster than expected after a serious default. Cross-default clauses, where default on one product triggers default on another. Insurance requirements, where the lender can add expensive coverage if you fail to maintain it. Late fee policies, which can snowball quickly. Collateral maintenance rules, which are common in business loans.

Moreover, some secured products can be structured in a way that gives the lender broad power over the collateral.

The emotional side you should respect

Secured debt can create constant anxiety. That stress is real. It can harm decision-making. It can push you into panic refinancing or desperate borrowing.

So, treat emotional cost as part of total cost. This is not weak. It is wise.

The unsecured loan reality check

Unsecured loans feel safer because your property is not directly pledged. That safety is valuable.

However, unsecured debt demands a different kind of discipline. Payments may be higher. Approval can be stricter. Consequences can still be severe if you default.

What you trade for convenience

When you borrow unsecured, you typically trade:

Higher interest rate, tighter underwriting, and sometimes smaller loan amounts. Additionally, lenders may price the loan based on credit tier, making cost differences dramatic.

Unsecured credit is also sensitive to your income stability. If your situation changes, refinancing may not be available later.

Who should prefer unsecured most of the time

Unsecured loans often make sense when:

You are borrowing for a short, clear purpose and can repay quickly. You cannot afford to risk any essential asset. You are protecting your home as a long-term foundation. You want flexibility without collateral rules.

However, unsecured debt is not automatically “safe.” The safe choice is the one you can repay with margin.

A practical warning that saves people

If you need an unsecured loan to cover regular living costs, that is a flashing red signal. It can work as a temporary bridge. Still, it often points to a budget gap that will get worse.

Consequently, fix the cash flow problem first if possible.

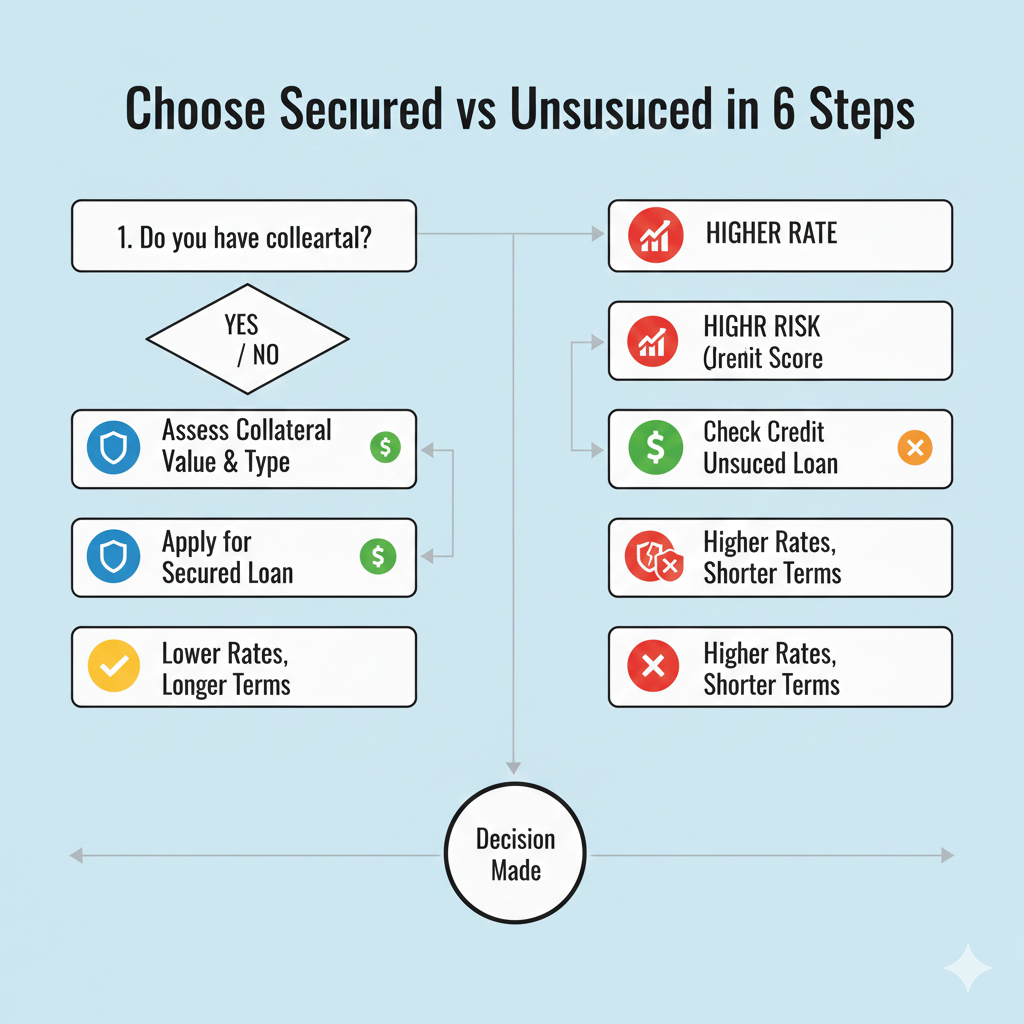

Step-by-step: choose the right loan structure

Now we get practical. This is where most guides fail. They talk concepts. They skip decisions.

Use this process to choose secured or unsecured with confidence.

Step 1: Define the purpose and time horizon

Ask one clean question: “What problem does this loan solve?”

Then ask: “Is that problem temporary, or ongoing?”

A secured loan fits better for stable, long-lived value, like a car you will keep or a home improvement with lasting benefit. An unsecured loan fits better for short, controlled needs, like consolidating a few high-interest balances with a clear payoff plan.

Additionally, match the loan term to the life of what you are funding. Do not finance a two-year need with a seven-year debt unless you have a strong reason.

Step 2: Stress test your payment like a professional

Do not ask “Can I pay it this month?” Ask “Can I pay it in a bad month?”

Stress test with three scenarios:

A normal month, a tight month, and a painful month. In the painful month, assume a surprise cost and reduced income.

If the payment still works, you have safety. If it breaks, the loan is too big, or the term is wrong.

Moreover, this stress test should be stricter for secured loans, because the downside is sharper.

Step 3: Classify your collateral as essential or non-essential

This step is critical. It protects your life.

Essential collateral means losing it would disrupt your work, your housing, or your family stability. Non-essential collateral means losing it would hurt, but not collapse your life.

If collateral is essential, be extremely cautious. You may still use it. However, only do it with a large repayment margin and a very clear plan.

Step 4: Compare total cost, not just APR

APR matters. Yet it is not the whole story.

Compare:

Origination fees, late fees, insurance costs, prepayment penalties, and required add-ons. Additionally, compare the “cost of risk.”

For secured loans, the cost of risk includes potential asset loss, plus recovery costs. For unsecured loans, the cost of risk includes credit damage and possible legal action.

Step 5: Read the contract like your future depends on it

Because it might.

Focus on:

Events of default, cure periods, how repossession or seizure is handled, how the asset is valued, and how the lender applies proceeds after a sale. Also check whether disputes go to arbitration.

If you do not understand a clause, ask the lender to explain it in writing. Moreover, do not accept vague answers.

Step 6: Build an exit plan before you sign

An exit plan is not optional. It is your protection.

Know how you will:

Pay extra principal, refinance if rates drop, or sell the asset if needed. Also plan what you do if income drops.

Consequently, the loan becomes a tool, not a trap.

Real examples that make the choice obvious

Examples make this guide practical. They also reveal hidden dangers.

Example 1: Car loan vs unsecured personal loan

You need a reliable car for work. The car costs more than your cash.

A secured auto loan is common. It can offer better rates than an unsecured personal loan. However, the collateral is also essential if you need the car for income.

The safe strategy is not “secured is better.” The safe strategy is:

Lower the loan size with a bigger down payment, keep the term reasonable, and keep a payment buffer. Additionally, maintain insurance and track your budget tightly.

If the only way the deal works is a long term and thin margin, an older car or smaller purchase may be safer.

Example 2: Home equity loan vs unsecured consolidation

You have credit card balances. You want to consolidate.

A home equity loan can reduce interest and simplify payments. Yet it moves unsecured debt into your home risk zone. That is a high-stakes trade.

An unsecured consolidation loan might cost more in interest. Still, it protects your home from direct collateral risk.

Consequently, many people choose unsecured consolidation unless their home equity plan is extremely conservative and their cash flow is stable.

Example 3: Business equipment loan with collateral

A small business needs equipment that directly produces revenue.

Secured equipment financing can be an excellent fit. The collateral is the equipment itself. Moreover, the loan aligns with business output.

However, risk rises if the collateral is also the core tool that makes money. If the lender can seize it quickly, your business can collapse overnight.

So, protect yourself with:

A strong cash buffer, maintenance plans, and a contract you understand. Additionally, avoid stacking multiple loans secured by the same asset.

Example 4: The dangerous side of collateral loans

Some products are famous for harsh outcomes, such as high-cost title loans. They are often short-term. They often carry extreme costs. They can also lead to rapid repossession risk.

Even when a product is “legal,” it can still be financially brutal.

If a lender seems aggressive, vague, or rushes you, treat that as a warning. Meanwhile, seek safer alternatives first.

Embedded video guidance to lock the basics in

Concepts click faster with a clear explanation. That is why short videos can be a powerful reinforcement.

[YouTube Video]: A clear explanation of secured vs unsecured loans, with simple examples you can map to your situation.

Additionally, if you watch it with your contract in hand, the details will feel more real.

How to document and compare offers like an analyst

Most people compare monthly payment only. That is a mistake.

Instead, build a one-page comparison. Keep it simple. Keep it brutal.

The five numbers that matter most

Start with:

Loan amount, APR, total fees, total repayment, and worst-case outcome.

Worst-case outcome means:

What you lose, what you still owe, and how long recovery might take.

Moreover, include whether the rate is fixed or variable. Variable rates can rise. That risk matters.

The three questions that reveal hidden costs

Ask each lender:

“What fees do I pay on day one?” “What fees can be added later?” “What triggers default besides missed payments?”

These questions create clarity. They also expose lenders who play games.

Consequently, you can avoid expensive surprises.

Negotiate with confidence without being aggressive

Negotiation in lending is real. It is not always dramatic. Still, it can save serious money.

What you can often negotiate

Depending on the lender and your credit, you may negotiate:

Rate, origination fee, term length, and prepayment penalties. Additionally, you can sometimes negotiate the collateral valuation approach, especially in business settings.

Even small improvements matter. A small rate change across years can be meaningful.

How to negotiate safely

Do not bluff. Do not threaten. Instead, be calm and precise.

Say: “I am comparing offers. If you can reduce the origination fee, I can proceed.”

That is firm. It is also respectful.

Moreover, always get the final terms in writing.

Watch for “good deal” pressure

Pressure is a red flag.

If a lender says “sign today or lose it,” slow down. If they refuse to provide documents in advance, walk away.

A reliable lender expects questions. A trustworthy lender welcomes clarity.

A second video that highlights unsecured pitfalls

Unsecured loans feel safe because there is no collateral. Yet they can still hurt if you borrow too much or ignore repayment planning.

[YouTube Video]: A practical breakdown of why unsecured personal loans can backfire, including payment stress and longer-term consequences.

Meanwhile, use it as a reminder: “No collateral” does not mean “no risk.”

Avoid denial and protect your approval odds

Approval is not just about income. It is about the lender’s view of risk.

What lenders usually focus on

Lenders often focus on:

Debt-to-income ratio, income stability, credit history, and recent inquiries. Additionally, they look for red flags like recent missed payments.

For secured loans, they also focus on collateral value and how easy it is to sell.

Clean moves that improve your position

If you are not in a rush, a few steps can help:

Lower revolving balances, correct credit report errors, avoid applying for many accounts at once, and keep stable employment.

Also, choose a realistic loan amount. Asking for too much can get you denied or overpriced.

Consequently, patience can be profitable in a very real way.

What’s changing next in loans and collateral

Lending is evolving quickly. The next wave can be exciting. It can also create new risks.

Faster underwriting through open banking and data

More lenders are using bank transaction data to assess affordability. This can help people with thin credit files. It can also make decisions faster.

However, it raises privacy questions. It can also lead to automated decisions that feel unfair.

So, watch for transparency and consumer protections. Additionally, understand what data you are sharing.

Smarter collateral valuation and monitoring

For cars, telematics can influence risk models. For equipment, sensors can track usage. For homes, automated valuations can update more often.

This can create better pricing for lower-risk borrowers. Yet it can also create new triggers in contracts, like covenant breaches based on updated values.

Moreover, in volatile markets, fast valuation changes can raise risk unexpectedly.

A new kind of collateral: digital assets and tokenization

Some markets are experimenting with tokenized collateral and faster lien recording. This could reduce friction and speed up secured lending.

Still, it may introduce legal complexity and operational risk. So, treat it cautiously until standards stabilize.

Regulation and enforcement will likely tighten

As AI underwriting expands, regulators are paying attention to fairness, transparency, and servicing practices. Servicing matters because many consumer disasters happen after the loan is already active.

Consequently, the future could bring more scrutiny on fees, repossession conduct, and data practices.

Build a personal “borrow safely” playbook

Here is a simple approach you can keep for life.

Protect essentials first

Your home stability, your ability to work, and your basic living costs come first.

Therefore, avoid pledging essential collateral unless the margin is strong.

Keep a buffer that makes you powerful

A buffer changes everything.

Even one to three months of payments set aside can stop panic. It can also prevent default after a short income disruption.

Moreover, a buffer gives you negotiation power if you need hardship options.

Choose boring, reliable structures

The safest loans often feel boring.

Fixed rate, clear term, transparent fees, no weird add-ons, and no pressure. Additionally, choose a lender with a solid reputation and clear documentation.

Document everything

Keep:

Contracts, payment history, lender emails, and insurance documents in one folder. That organization becomes crucial if disputes arise.

Conclusion: collateral is a tool, not a trophy

Secured vs unsecured is not about pride. It is about control.

Collateral can be a powerful advantage. It can also be a dangerous gamble. Unsecured debt can protect your assets. It can also strain your budget if you overborrow.

So, choose based on your worst month, not your best month. Build an exit plan early. Protect essential assets. Compare total cost and risk.

If you do that, loans become a practical tool for progress. They stop being a silent threat.

Sources and References

- UCC Article 9 overview (Cornell LII)

- Consumer Credit statistical release (Federal Reserve, G.19)

- Behind on your car payment, avoid repossession (CFPB)

- Behind on car payments and repossession guidance (FTC Consumer Advice)

- Quarterly Report on Household Debt and Credit (Federal Reserve Bank of New York)

- Secured loan definition and explanation (Investopedia)

- Unsecured loan definition and explanation (Investopedia)

- Secured vs unsecured loans basics (Bankrate)