Umbrella insurance adds powerful extra liability protection. Learn when you truly need it, real examples, costs, exclusions, and how to buy the right limit.

Umbrella insurance is one of the most misunderstood policies in personal finance. That is exactly why it is so valuable. It is simple, but it is not obvious.

This is a guide, not an opinion piece. You will get clear steps, plain language, and real-world examples. You will also learn what umbrella insurance does not do, because false confidence is a costly trap.

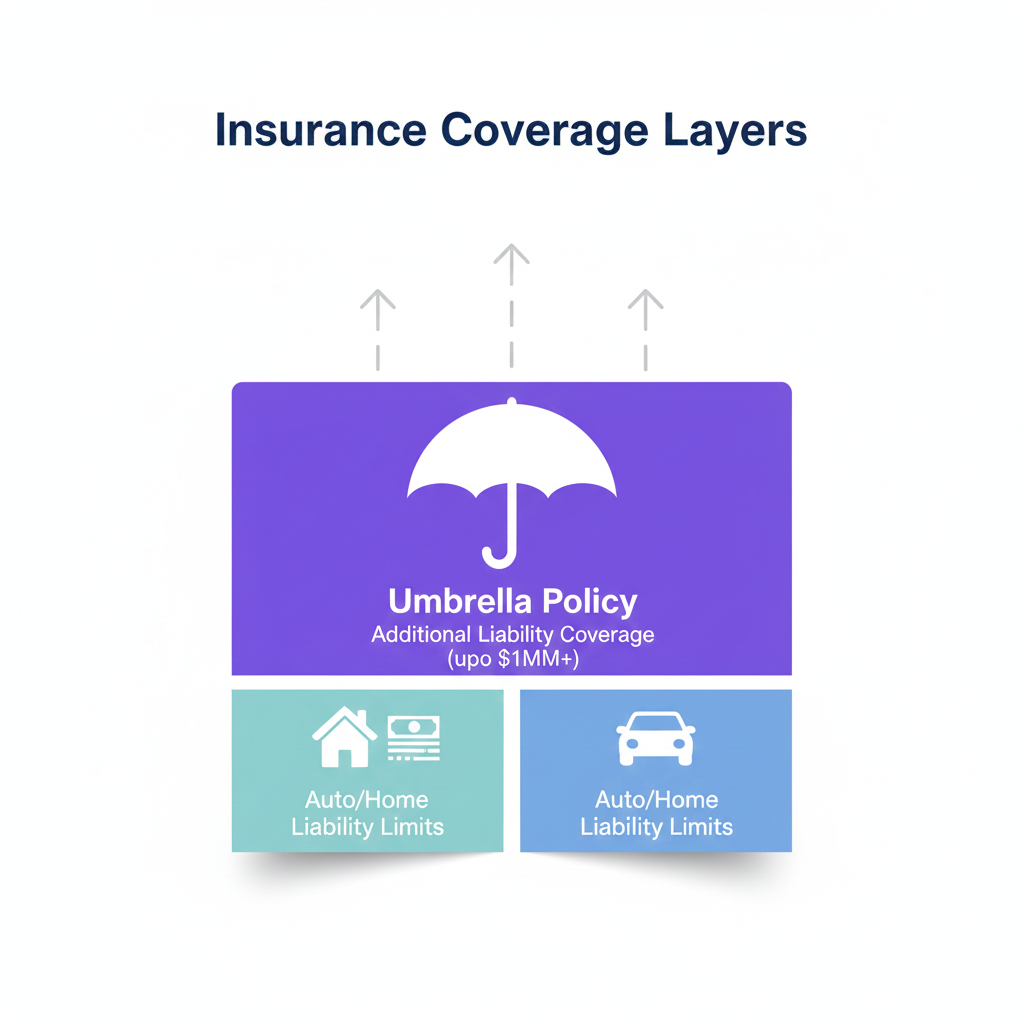

At its core, umbrella insurance is extra liability coverage. It is designed for moments when your normal auto or homeowners liability limit is not enough. Those moments are rare. However, when they happen, they can be financially brutal.

The modern world is also raising the stakes. Medical costs are high. Legal costs are high. Settlements can be extreme. Insurers and researchers often point to “social inflation” and “nuclear verdicts” as forces that push liability losses higher than many people expect. (Verisk Core)

Consequently, umbrella insurance has shifted from “nice to have” to “smart protection” for a wider group of people.

What umbrella insurance is, in plain language

Umbrella insurance is a policy that gives you extra liability limits on top of your other policies.

Your “base” policies are usually:

Auto insurance

Homeowners insurance or renters insurance

If a covered liability claim exceeds the limit on your base policy, the umbrella policy can pay the next layer, up to its own limit.

Most personal umbrella policies are sold in big blocks, often starting at $1 million and rising in million-dollar increments. (NAIC)

What it typically covers

Umbrella insurance is about your responsibility to others. It can help pay for:

Injuries you cause to other people

Property damage you cause to other people

Legal defense costs, depending on the policy wording

Some “personal injury” claims like defamation, libel, or slander, depending on the insurer and contract language

That last point surprises people. So read carefully. Some policies include personal injury coverage. Some do not. (Jencap, Inc.)

What it is not

Umbrella insurance is not a health policy. It does not pay your own medical bills.

It is not a property policy. It usually does not fix your home. It usually does not fix your car.

It is not a magic shield for business activities. Many personal umbrellas exclude business-related liability. (TrustedChoice.com)

Moreover, it is not useful if your underlying coverage is weak or missing. Umbrella coverage is built to sit above solid base limits.

Why umbrella insurance matters more now

A decade ago, many people saw umbrella insurance as something for the wealthy. That view is outdated.

Today, the risk is not only about net worth. It is also about modern exposure.

Big claims are more common than people assume

A serious car crash can involve multiple injuries. Costs can stack fast. Even a single ambulance ride, surgery, and recovery can be expensive.

Additionally, legal disputes can be intense. Researchers track a rise in extreme jury awards, sometimes called “nuclear verdicts,” which can reshape how insurers price liability risk. (ILR)

Daily life creates new liability “surfaces”

More people host guests. More people rent out property. More people post online. More people do side work. More people drive long distances.

Each of these is normal. Yet each one can create a real liability moment.

Therefore, umbrella insurance is increasingly a practical tool for “regular” households with real responsibilities.

Step 1: Decide if you are a true umbrella candidate

This step is essential. It saves you money and confusion.

You are a strong umbrella candidate if you have either meaningful assets or meaningful future income and you have common risk multipliers.

The asset and income reality check

Ask two calm questions:

If I lost a lawsuit, what could I lose?

If I got a judgment against me, could my future income be targeted?

Even if you do not feel rich, savings and investments can be exposed. In many places, wages can also be affected after a judgment.

So umbrella insurance is not only “wealth protection.” It can be “life stability protection.”

The lifestyle risk check

Now ask: do you have any of these high-exposure patterns?

A lot of driving, long commutes, or frequent highways

A teen driver or a new driver in the home

Hosting guests often, parties, or gatherings

A dog, especially with bite history

A pool, trampoline, or similar high-injury features

Rental property, hosting, or frequent short-term rentals

A public social media presence where defamation claims are plausible

Volunteer leadership roles that may create decision risk

You do not need all of them. One or two can be enough.

A fast “umbrella trigger” test

Imagine this single scenario:

You cause a serious accident. Two people are injured.

Your auto liability limit is $300,000.

The claim and legal costs land at $900,000.

What happens to the extra $600,000?

That gap is where umbrella insurance can be a powerful, reassuring tool.

Step 2: Understand the “attachment” rules

This is where people get burned. Umbrella insurance usually has conditions.

Most insurers require you to carry minimum underlying liability limits on auto and home before the umbrella applies. (Jencap, Inc.)

If you fail to maintain those limits, you can create a dangerous coverage gap.

Common underlying limit requirements

Insurers often want auto liability limits like $250,000 per person and $500,000 per accident, plus property damage limits, and a homeowners liability limit like $300,000. Exact requirements vary. (Jencap, Inc.)

Some insurers will force you to increase your base limits before they sell you the umbrella.

That is not them being annoying. It is them controlling risk.

What “retained limit” means

Some umbrella policies have a concept similar to a deductible for claims not covered by your base policy but covered by the umbrella. This is sometimes called a self-insured retention.

In plain terms, it means you might pay the first chunk yourself in certain situations.

So do not assume “umbrella always pays immediately.” It depends on the path of the claim.

Defense costs can be the hidden superpower

Even when you are not “at fault,” legal defense can be expensive. Many liability policies provide defense.

Still, the details matter. Some policies treat defense costs as part of limits. Some do not. You must read the contract.

Consequently, two umbrellas with the same $1M limit can feel very different in a real dispute.

A quick video to lock the basics in your mind

Umbrella insurance becomes crystal-clear once you see how the layers work.

[YouTube Video]: A straightforward explanation of umbrella insurance, when it applies, and why base limits matter.

Now let’s move from theory to real life.

Step 3: Real examples of when umbrella insurance helps

These examples are simplified. They are not promises. They show the pattern that umbrellas are built for.

Example 1: The serious auto accident

You cause a crash on a busy road. Three cars are involved. Two people are injured.

Your auto policy pays up to its liability limit. If the claim exceeds that limit, an umbrella policy can cover the next layer, up to the umbrella limit, if the claim is covered.

This is the classic umbrella scenario. It can be life-saving.

Example 2: The guest injury at your home

A guest falls on stairs. They suffer a severe injury. They sue for medical costs, lost income, and pain and suffering.

Your homeowners liability coverage pays first, up to its limit. After that, the umbrella can step in.

Even if the claim settles, legal defense can still be expensive. That is why liability structure matters.

Example 3: The dog bite claim

A dog bite can generate emergency care, follow-up care, and a lawsuit. If your base policy covers it, the umbrella can add extra limits.

However, dog-related risks are sensitive in underwriting. Disclose the dog. Disclose prior incidents. Honesty keeps the policy reliable.

Example 4: The social media defamation dispute

You post a claim about a person or business. They say it harmed their reputation. A lawsuit follows.

Some umbrella policies include “personal injury” coverage that can address defamation-type allegations. Others exclude it. Investopedia notes that umbrellas can cover certain personal injury claims, depending on the policy. (Jencap, Inc.)

So this is a critical reading section if you are active online.

Example 5: The rental property liability

A tenant or guest claims unsafe conditions and sues. Your landlord policy might respond. If the claim exceeds the landlord liability limit, umbrella coverage may help, but only if the umbrella is set up correctly and the property is included.

This is where many people make a mistake. They buy an umbrella and forget to disclose rental properties.

That is risky.

Step 4: Real examples of when umbrella insurance fails

This section is crucial. It protects you from false confidence.

Example 1: The side hustle that turns you into a business

You start doing paid delivery driving or rideshare driving. You do not update your insurer.

A crash happens during work. Your personal auto policy may deny coverage. Your personal umbrella may also deny coverage.

That is a brutal gap.

So if you do paid driving, you need correct endorsements or commercial coverage.

Example 2: The home business with client traffic

A client comes to your home office. They trip and get injured. Your homeowners policy may treat it as business activity and deny it.

Many personal umbrellas also exclude business activities. (TrustedChoice.com)

So you may need a small business policy, even if the business feels “tiny.”

Example 3: You drop your underlying limits later

Some people raise auto liability limits to qualify for an umbrella. Later, they drop those limits to save money.

That can violate umbrella conditions. Then a claim happens.

Depending on the contract, the umbrella may treat you as if you still had the required underlying limits, leaving you responsible for the gap. Or it may deny.

Either result is painful. So keep the required base limits.

Example 4: Intentional acts

If you intentionally harm someone or intentionally damage property, insurance usually will not cover it. That is standard across the industry.

Umbrella insurance is designed for accidents and negligence. It is not designed for deliberate harm.

Step 5: Choose the right umbrella limit

This is where you turn the policy into a powerful, calming shield instead of a random purchase.

Most people start at $1 million. Some go to $2 million or more.

The right number depends on your exposure.

A reliable way to think about limits

Start with your net worth.

Then add a buffer for future earnings and stability.

Then compare that total to your base liability limits.

If your auto liability is $300,000 and homeowners liability is $300,000, you are not truly protected above those amounts without an umbrella.

Kiplinger notes that umbrellas are often sold in $1M increments and are aimed at protecting assets when base limits are not enough. (Jencap, Inc.)

When $1M can be a smart baseline

A $1M umbrella is often a reasonable starting point for households with:

Moderate assets

Regular driving risk

Occasional hosting

No unusual high-risk activities

It can be a rewarding “sleep at night” decision.

When $2M to $5M becomes realistic

Higher limits can make sense if you have:

High net worth

High income

Teen drivers

Rental properties

Frequent public exposure

Higher lawsuit risk professions, even off the job

Multiple homes, boats, or other complex assets

This is not about fear. It is about math and protection.

A practical warning about “overbuying”

More coverage is not always better if it comes with exclusions, confusion, or bad setup.

A clean $1M umbrella that actually attaches properly is better than a messy $5M umbrella that fails when you need it.

So set the policy up correctly first. Then raise the limit if needed.

Step 6: Understand the cost, and what drives pricing

Umbrella insurance is often described as “cheap for what it gives.” That is sometimes true.

Still, prices vary.

Kiplinger cites typical pricing that can range widely depending on risk profile, drivers, and assets. (Jencap, Inc.)

Meanwhile, broader insurance market pressures have been pushing rates in many lines, including liability-related products. (San Francisco Chronicle)

What usually increases umbrella premiums

Insurers price umbrella policies by looking at risk factors such as:

Number of drivers and their history

Teen drivers

Prior claims

Multiple properties

Pools or high-injury features

Rental properties

Boats and recreational vehicles

In short, they price exposure.

Why pricing has been pressured recently

Liability costs have been affected by trends that include higher claim severity and larger jury awards.

Research on “nuclear verdicts” highlights how extreme awards can influence the civil justice landscape. (ILR)

Additionally, “social inflation” research describes legal and social forces that can increase claim costs beyond normal economic inflation. (Verisk Core)

Consequently, umbrella insurance can become more expensive over time, even for careful buyers.

A second video that clarifies a common confusion

Many people confuse “umbrella” with “excess liability.” The distinction matters when you compare offers.

[YouTube Video]: Explains umbrella insurance vs excess liability, with practical examples of how they differ.

Now let’s move into the buying process.

Step 7: How to buy umbrella insurance, step by step

Buying umbrella insurance is not complicated. The smart part is asking the right questions.

Step 7.1: Strengthen your underlying limits first

If your auto liability limits are low, raise them first. If your home liability limits are low, raise them first.

Many umbrellas require it. (Jencap, Inc.)

This step is often surprisingly affordable and very protective.

Step 7.2: Decide if you want to bundle

Many insurers prefer to sell umbrellas when they also insure your auto and home.

Bundling can be convenient. It can also reduce friction during claims.

However, do not let bundling hide weak exclusions. Always read the umbrella form.

Step 7.3: Disclose every relevant risk factor

Tell the insurer about:

All drivers and ages

All properties you own or rent out

Dogs and bite history

Pools or trampolines

Boats and recreational vehicles

Any side work that could be seen as business activity

This honesty is not optional. It is the foundation of reliable coverage.

Step 7.4: Ask these essential questions

You do not need a long list. You need a few sharp questions.

Ask:

What underlying limits do you require for auto and home? (Jencap, Inc.)

Does this umbrella include personal injury coverage like defamation? (Jencap, Inc.)

Are defense costs inside or outside the umbrella limit?

Does this cover worldwide incidents, and what are the restrictions? (Jencap, Inc.)

How are rental properties handled?

What business activities are excluded? (TrustedChoice.com)

If the agent cannot answer clearly, that is a warning sign.

Step 7.5: Keep the policy valid over time

Umbrella insurance is not “set and forget.”

Review it yearly. Update it when life changes.

A new teen driver can change everything. A new property can change everything. A new side hustle can change everything.

Therefore, treat it like a living shield, not a dusty document.

Step 8: Umbrella insurance vs excess liability

This is a critical distinction when you compare quotes.

Investopedia explains that umbrella insurance and excess liability both add extra limits, but umbrella can sometimes provide broader coverage depending on how it is written. (Jencap, Inc.)

Here is the simple way to think about it:

Excess liability is often “more of the same” above a specific policy.

Umbrella can be “more plus broader,” but only if the policy form actually grants broader coverage.

So do not buy based on the name. Buy based on the contract language.

Step 9: The future of personal liability protection

Umbrella insurance is not stuck in the past. Several trends are shaping how it is priced and how it is sold.

Trend 1: More advanced risk scoring

Auto insurers use telematics and behavior data in some markets. That can influence risk perception over time.

Meanwhile, underwriting is becoming more data-driven across the industry.

Consequently, households with risky driving profiles may face higher umbrella pricing or tighter conditions.

Trend 2: Higher severity claims and legal pressure

Research on social inflation and extreme verdicts suggests that liability costs can remain pressured. (Verisk Core)

That trend can push insurers to:

Raise required underlying limits

Raise umbrella premiums

Add exclusions or tighten underwriting

Limit how much umbrella they will sell to certain households

Trend 3: Regulatory attention on insurance pricing

Insurance pricing changes often involve regulator review. News coverage shows how rate pressure has been a major story in some states. (San Francisco Chronicle)

This matters because umbrella insurance is not priced in a vacuum. It is connected to auto and homeowners markets.

Trend 4: More complex “life stacks”

People blend personal life and business life more than ever. That creates gray zones.

If you work from home, consult, host guests, and post online, your liability footprint is larger.

Therefore, the future “smart move” may be a more intentional mix of personal umbrella, business liability, and specialized coverage.

Step 10: A simple setup plan you can follow today

Let’s turn the guide into action.

First, grab your auto declarations page and your home or renters declarations page.

Then follow this plan.

Step 10.1: Raise base limits to strong levels

If your auto liability is low, raise it. If your home liability is low, raise it.

This step often costs less than people fear. It can be a powerful upgrade.

Step 10.2: Pick a clear umbrella number

Choose $1M, $2M, or more based on:

Assets

Income

Drivers

Properties

Hosting habits

Online presence

Keep it simple. Make it credible.

Step 10.3: Buy from an insurer that can clearly explain the contract

Look for clarity. Look for strong claim support. Look for stable underwriting.

Allstate explains the general structure of umbrella coverage and the idea of million-dollar increments. (NAIC) That is a good baseline concept to keep in mind, even if you buy elsewhere.

Step 10.4: Do a yearly review with one question

Ask:

Has my life added new liability exposure this year?

If yes, update the insurer. If no, confirm your underlying limits still meet umbrella requirements.

This is a simple ritual. It keeps your protection reliable.

Common mistakes that smart people still make

Mistakes happen when people buy umbrella insurance like a gadget.

Here are the most common traps to avoid.

Mistake 1: Buying umbrella without improving base limits

If you do not carry the required underlying limits, the umbrella may not protect you the way you expect. (Jencap, Inc.)

Mistake 2: Forgetting rentals and side work

Rental property and business activity can change everything. Personal umbrellas often exclude business liability. (TrustedChoice.com)

Mistake 3: Not reading the personal injury section

If you want protection for defamation-type claims, you must confirm it is included. (Jencap, Inc.)

Mistake 4: Underestimating how fast claims can grow

Serious injuries and legal disputes can become expensive fast.

Research into extreme verdicts shows why insurers take liability severity seriously. (ILR)

So do not assume your base limits are “fine” just because you have not had a claim.

Conclusion: The calm power of extra liability coverage

Umbrella insurance is not exciting. That is its strength.

It is a quiet, reliable shield against rare but devastating liability outcomes.

If you drive often, host people, own assets, or have meaningful future income, umbrella insurance can be a smart upgrade. It can turn financial chaos into a controlled outcome.

However, the policy must be set up correctly. Underlying limits must be strong. Risks must be disclosed. Exclusions must be understood.

Do that, and you get something priceless: confident protection that matches the real world.

Sources and References

- Kiplinger: What Is Umbrella Insurance and Do You Need It? (Jencap, Inc.)

- Investopedia: Umbrella Insurance (and related liability concepts) (Jencap, Inc.)

- Allstate: Umbrella Insurance Coverage Basics (NAIC)

- Insurance Information Institute: Commercial Umbrella and Excess Liability Overview (TrustedChoice.com)

- Maine Bureau of Insurance: Personal Umbrella Liability Insurance (PDF) (III)

- North Dakota Insurance Department: Umbrella Liability Insurance (PDF) (TrustedChoice.com)

- Verisk: Understanding the Surge in Social Inflation (Verisk Core)

- U.S. Chamber Institute for Legal Reform: Nuclear Verdicts Study (PDF) (ILR)

- SF Chronicle: Why auto insurance rates are soaring in California (San Francisco Chronicle)

- Ramsey Solutions: Umbrella Insurance Overview (State Farm)