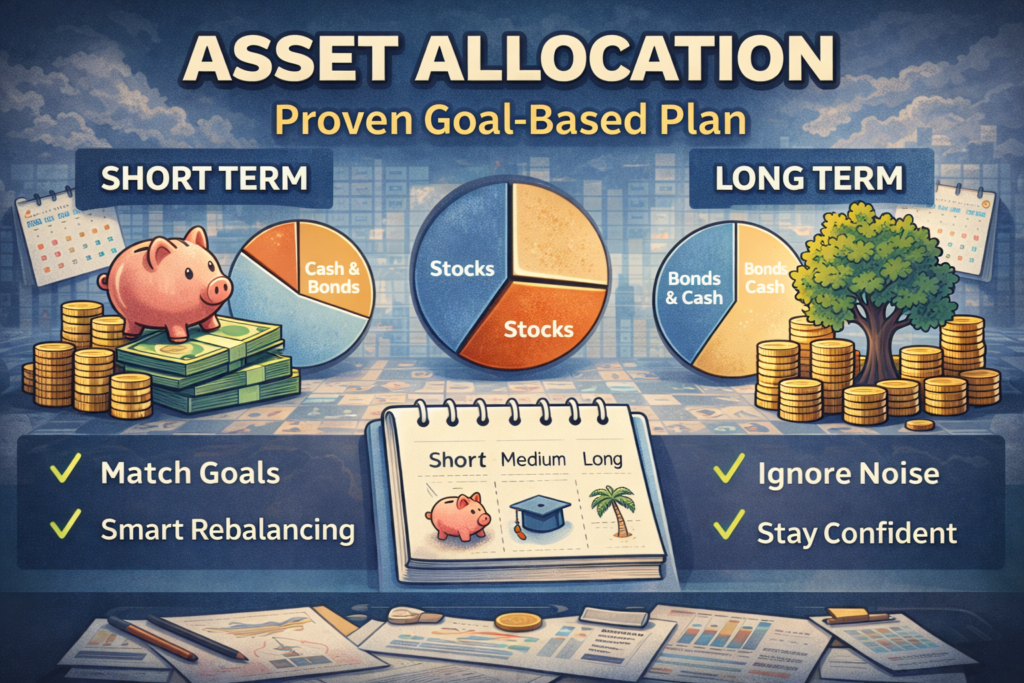

Build a powerful goal-based asset allocation plan. Learn short vs long horizons, smart rebalancing, and future tools to stay confident.

Why goal-based allocation beats “one perfect portfolio”

Asset allocation sounds technical. In practice, it is a simple promise you make to yourself. You match your money to your life. You stop forcing one portfolio to do every job. That change is powerful.

Most people lose confidence for one reason. They mix goals. Rent money sits in risky assets. Retirement money sits in cash. Then markets move. Emotions spike. A smart plan starts by separating goals, not by picking “the best” fund.

Goal-based allocation is also a proven way to reduce regret. When you know what each bucket is for, you panic less. You make fewer frantic decisions. You stay consistent. Consistency is a huge edge.

Additionally, goal-based thinking fits modern investing. You can automate contributions. You can rebalance with rules. You can use target-date funds for one goal and a simple index mix for another. You can keep it clean.

This guide is educational, not personal financial advice. If you are unsure, talk to a licensed professional. Still, the framework below is reliable and easy to apply.

The hidden win: clarity under stress

A bear market is scary. A sudden bill is stressful. A big life change can feel overwhelming. However, your plan can stay calm if your goals are clear. Clarity turns chaos into a manageable checklist.

Time horizon is the real risk switch

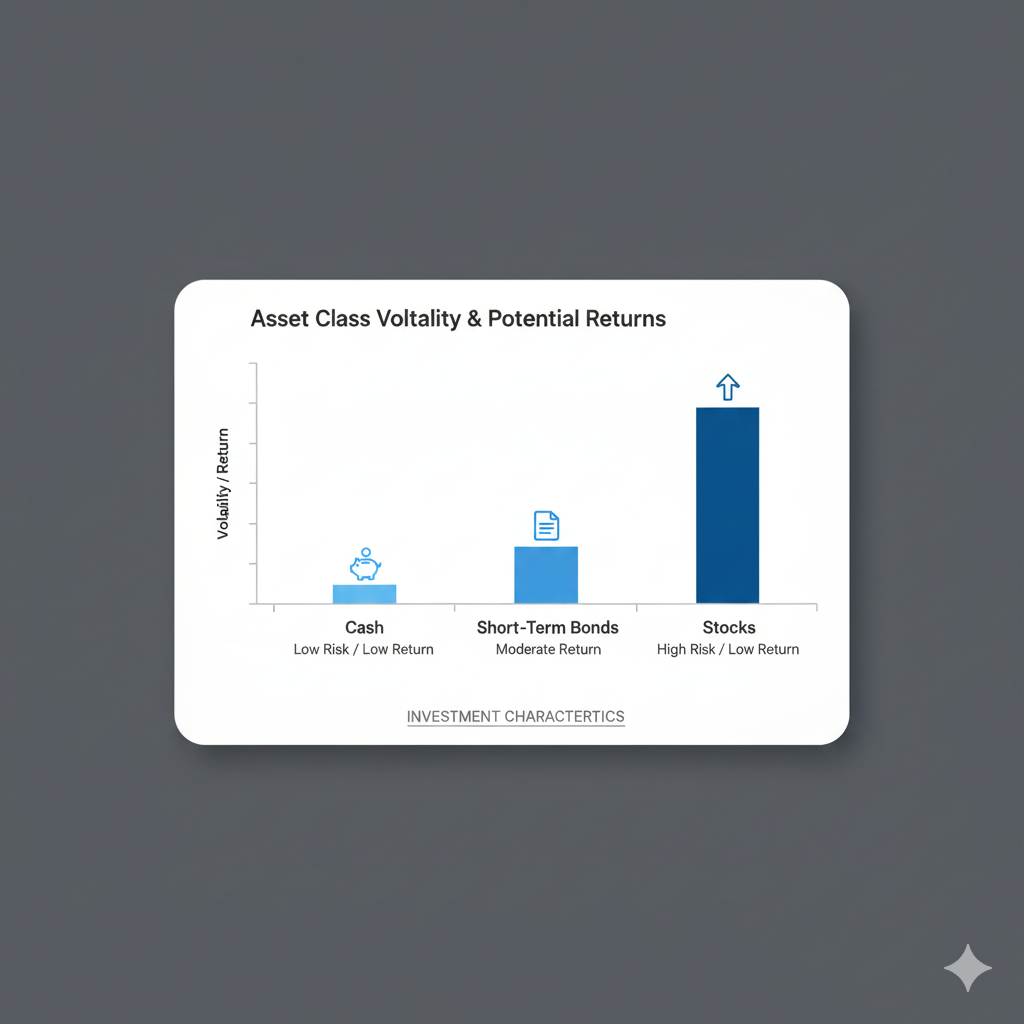

“Risk tolerance” is a popular phrase. Time horizon is often more useful. Time horizon means when you will need the money. It is the single most critical input.

Short horizon money cannot wait for a recovery. Long horizon money can. That is not opinion. It is math and time.

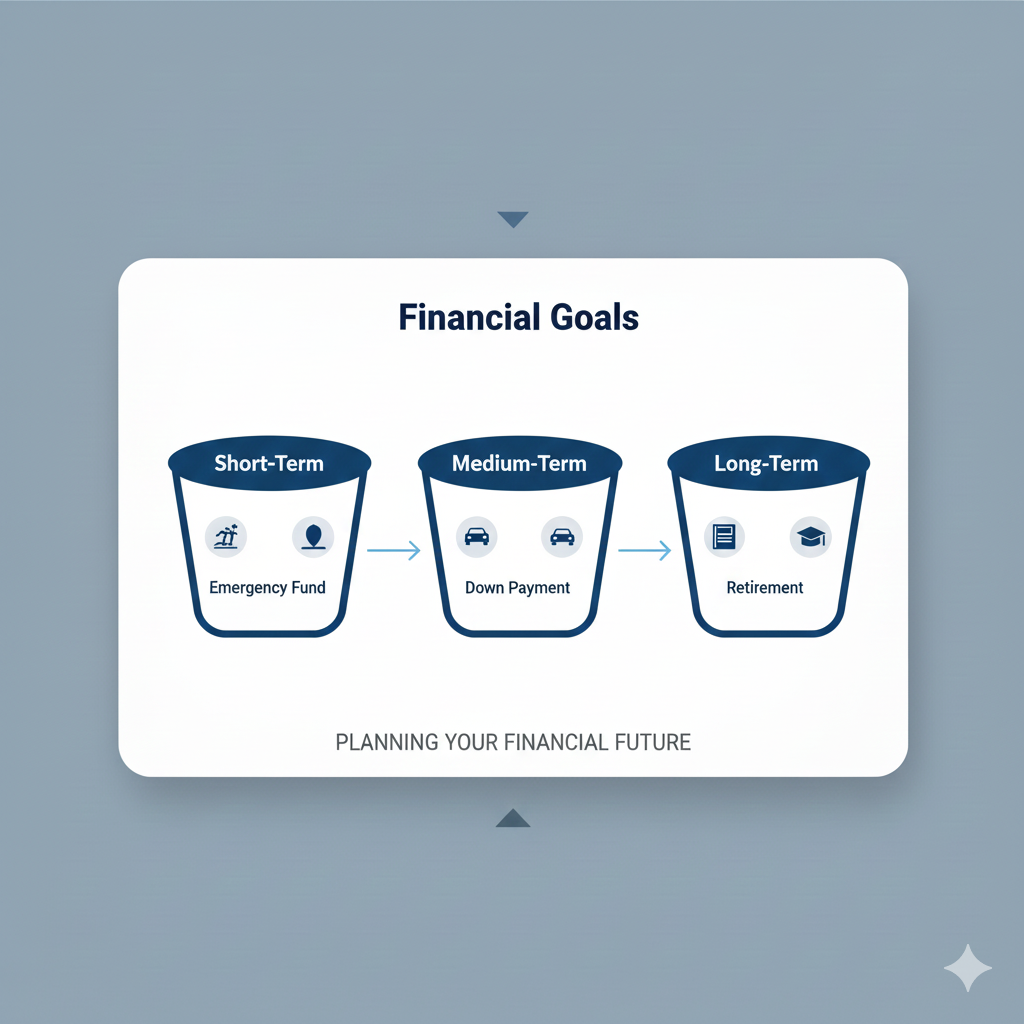

Consequently, you should think in three ranges:

Short-term goals, roughly 0 to 3 years. Medium-term goals, roughly 3 to 10 years. Long-term goals, roughly 10 years or more.

Additionally, the horizon is not your age. It is your goal’s deadline. A 40-year-old saving for a house in 18 months has a short horizon. A 20-year-old investing for retirement has a long horizon. This is essential.

The “need it soon” rule

If you will need the cash soon, your priority is stability. You want to avoid large drops. You accept lower expected return. That tradeoff is normal and responsible.

The “can wait” rule

If you can truly wait, your priority becomes growth. You accept volatility. You aim for long-run compounding. That patience can be rewarding.

[YouTube Video]: A clear walkthrough of asset allocation basics and why the mix matters more than stock picking.

Step 1: Write your goals in plain language

Before any portfolio mix, write your goals like a journalist. Simple words. Clear deadline. Real number.

For example: “Emergency fund, 6 months of expenses, always available.” Or: “Tuition, needed in 4 years.” Or: “Retirement, needed in 25+ years.” This is practical and powerful.

Moreover, include the currency and where you live. Inflation and local rates matter. Still, you do not need complex forecasting. You need a clear target and a deadline.

Turn goals into timelines

Give each goal a date range. If you do not know the exact date, use a conservative range. Earlier is safer.

Additionally, decide if the goal is flexible. Some goals can be delayed. Some cannot. A flexible goal can hold more risk than a fixed goal.

Step 2: Build a short-term portfolio that feels boring

Short-term money should feel boring. Boring is beautiful here. You want dependable value, not exciting charts.

A short-term portfolio is often built from cash-like tools. Think high-quality cash equivalents and very short duration fixed income. The exact product depends on your country, tax rules, and access.

However, the principle stays constant: avoid big drawdowns.

What “safe” really means

Safe does not mean “never moves.” It means it is unlikely to drop a lot right when you need it. That is a crucial difference.

Additionally, watch for hidden risks:

Currency risk if your goal is in local currency.

Credit risk in lower-quality products.

Duration risk in longer bonds.

A realistic short-term mix

Keep the structure simple. Many people use mostly cash equivalents, with a modest slice of very short bonds if appropriate. The goal is stability.

Consequently, a short-term plan is often about good habits:

Automate deposits.

Keep fees low.

Avoid chasing yields.

Stay liquid.

Step 3: Build a medium-term portfolio that balances growth and safety

Medium-term goals are tricky. They are long enough to want growth. They are short enough to fear a crash.

Therefore, you usually blend growth assets with stabilizers. Stocks can help. High-quality bonds can help. Cash can help. The mix depends on your deadline and flexibility.

Additionally, medium-term investing is where many people overthink. You do not need a perfect model. You need a resilient plan.

The “glide path” idea for one goal

As the goal date approaches, you can gradually reduce risk. This is a powerful concept. It lowers the chance of a bad surprise at the worst time.

For example, you might hold more growth early. Then you tilt toward stability later. This is similar to how many target-date funds operate, but you can apply it manually to a single goal.

Common medium-term mistake

A classic mistake is pretending medium-term money is long-term money. It feels optimistic. It can also be costly.

However, you can still aim for a rewarding outcome. Use a mix that you can stick with. Avoid panic-selling.

Step 4: Build a long-term portfolio designed for endurance

Long-term portfolios are built for decades. That is a serious advantage. Time can absorb volatility.

Moreover, long-term portfolios benefit from a clear philosophy:

Diversify widely.

Keep costs low.

Rebalance with rules.

Stay invested through cycles.

Long-term investing is not about being fearless. It is about being prepared.

What long-term risk actually is

Long-term risk is not day-to-day volatility. Long-term risk is failing to grow purchasing power. Inflation is relentless. That is why long-term portfolios often include meaningful growth exposure.

Additionally, concentration risk matters. Owning only a few stocks, or only one sector, can be fragile. Diversification is a protective, proven tool.

Long-term resilience mindset

Expect downturns. Expect scary headlines. Expect periods of poor performance. Consequently, you design the portfolio to survive those moments.

You survive by keeping the plan simple and repeatable.

Step 5: Choose your building blocks with ruthless simplicity

Your portfolio is a recipe. The ingredients matter more than fancy labels.

Common building blocks include broad stock exposure and high-quality fixed income exposure. Some investors add inflation-protection tools or real assets. Some add a small alternatives sleeve. However, complexity should earn its place.

The core questions to ask any fund

What does it own.

What does it cost.

How does it behave in stress.

How liquid is it.

Additionally, watch hidden fees and taxes. A “great” product can become disappointing after costs.

Indexing, active, or a mix

Index funds are often a reliable baseline. Active funds can help in some areas, but they add uncertainty. Consequently, many people keep the core passive and use small active slices only if they truly understand them.

Step 6: Rebalancing is your calm, mechanical edge

Rebalancing is a simple act with a powerful psychological benefit. You sell what has run up. You buy what has lagged. You return to your target mix.

It feels counterintuitive. That is why it works for many people. It forces discipline.

Additionally, rebalancing can reduce risk. If stocks rally and become too large in your portfolio, your risk quietly increases. Rebalancing pulls it back.

Two rebalancing styles that stay practical

Calendar method: rebalance on a schedule, like quarterly or yearly.

Band method: rebalance when an asset drifts too far from target.

Pick one method. Stick to it. Consistency is vital.

[YouTube Video]: A practical explanation of the “bucket” approach that ties assets to time horizons and withdrawals.

Rebalancing in the real world

Taxes and trading costs matter. Therefore, many people rebalance using new contributions. They buy more of what is underweight. This is gentle and efficient.

Moreover, some accounts allow more flexibility than others. Understand your account rules. Stay compliant.

Step 7: The traps that feel smart but hurt results

The most dangerous mistakes often sound intelligent. They feel “advanced.” They can still damage outcomes.

Trap: timing the market with confidence

Even smart investors struggle to time entries and exits. The cost is missing rebounds. Additionally, timing errors compound.

Trap: overreacting to headlines

Headlines are built to trigger emotion. Fear sells. However, your plan should not be run by news alerts.

Trap: confusing activity with progress

More trades do not mean better results. A calm plan is often more successful.

Trap: copying someone else’s horizon

Your friend’s portfolio is not your portfolio. Their goals differ. Their income differs. Their tolerance differs. Consequently, copying is risky.

Step 8: How technology is changing goal-based investing

The next few years are likely to make goal-based allocation easier and more personalized.

Robo-advisors already automate rebalancing and contributions in many markets. Direct indexing is expanding, especially for taxable accounts. Fractional shares make small, consistent investing more practical.

Moreover, AI tools are appearing inside broker platforms. Some will be helpful. Some will be noisy. You should treat them like calculators, not like prophets.

Personalization at scale

Platforms can now tailor portfolios by goal, tax status, and constraints. This is an emerging shift. It can be powerful if it stays transparent and low-cost.

Tokenization and access

Tokenized funds and digital assets may broaden access in some regions. However, the regulatory landscape is still evolving. Liquidity, custody, and transparency remain crucial.

Step 9: Regulations and policies that can reshape portfolios

Rules shape what products exist and how they are sold. Over time, policy changes can influence costs, disclosures, and what advice looks like.

Investor protection rules often push clearer disclosures and better suitability checks. Additionally, regulators in many places are paying more attention to digital advice, influencers, and platform design.

Consequently, you should build a plan that is not fragile. Avoid products you do not understand. Prefer transparency. Prefer reputable custody and reporting.

A practical way to stay prepared

Once a year, review:

Your goal timelines.

Your target mix.

Your fees.

Your account protections.

Your rebalancing rule.

That yearly review is simple and extremely valuable.

Step 10: A simple workflow you can repeat every year

You do not need constant tinkering. You need a repeatable workflow.

First, confirm goals and deadlines.

Next, confirm which bucket each goal belongs to.

Then, set a target mix for each bucket.

After that, automate contributions.

Finally, rebalance with your chosen rule.

Additionally, write down one sentence that protects you in stress: “I do not change my long-term plan during panic.” That sentence can be powerful.

The “without overthinking” test

If your system requires daily attention, it is too complex. If you cannot explain it in two minutes, it is probably too complex. A strong plan is clear and calm.

Conclusion: The goal is confidence, not perfection

Asset allocation is not a contest. It is a tool for a stable life.

A goal-based plan gives you clarity. It gives you a practical structure. It makes bear markets less personal. It makes good decisions more automatic.

Moreover, the best plan is the one you can follow. Keep it simple. Keep it consistent. Keep it aligned with your timelines. That is a proven, resilient path.

Sources and References

- Investor.gov: Asset Allocation (Investor)

- Schwab: Diversification and Asset Allocation (Schwab Brokerage)

- Fidelity: Guide to Asset Allocation (PDF) (Fidelity)

- Vanguard: Four Principles for Investing Success (Vanguard)

- FINRA: Investing Basics (FINRA)

- SEC Investor Bulletin: Year-End Investment Considerations (PDF) (SEC)

- CFA Institute: Rebalancing Your Portfolio (Schwab Brokerage)

- MFS: Investing for the Long Term (PDF)