A bear market can feel brutal, personal, and unfair. Prices fall, headlines get darker, and even smart investors start doubting themselves. This article explains what a bear market really is, why it hijacks your brain, what long-term investors should do, and what they must avoid, especially as markets evolve with faster trading, more passive flows, and new tech.

The Bear Market Problem Nobody Admits

Bear markets do not only damage portfolios. They attack confidence. They can make a careful plan feel naive. They can make patience feel like weakness. That emotional pressure is the hidden cost.

In calm years, investing sounds simple. Buy quality assets. Diversify. Rebalance. Stay invested. In a bear market, those words collide with fear. Furthermore, fear is not abstract. It shows up as checking prices too often, doom scrolling, and imagining worst-case outcomes.

The twist is that the market drop is visible, while the opportunity cost of panic is invisible. Consequently, many investors “do something” to feel safe, then discover later that action was the expensive mistake.

What Counts as a Bear Market

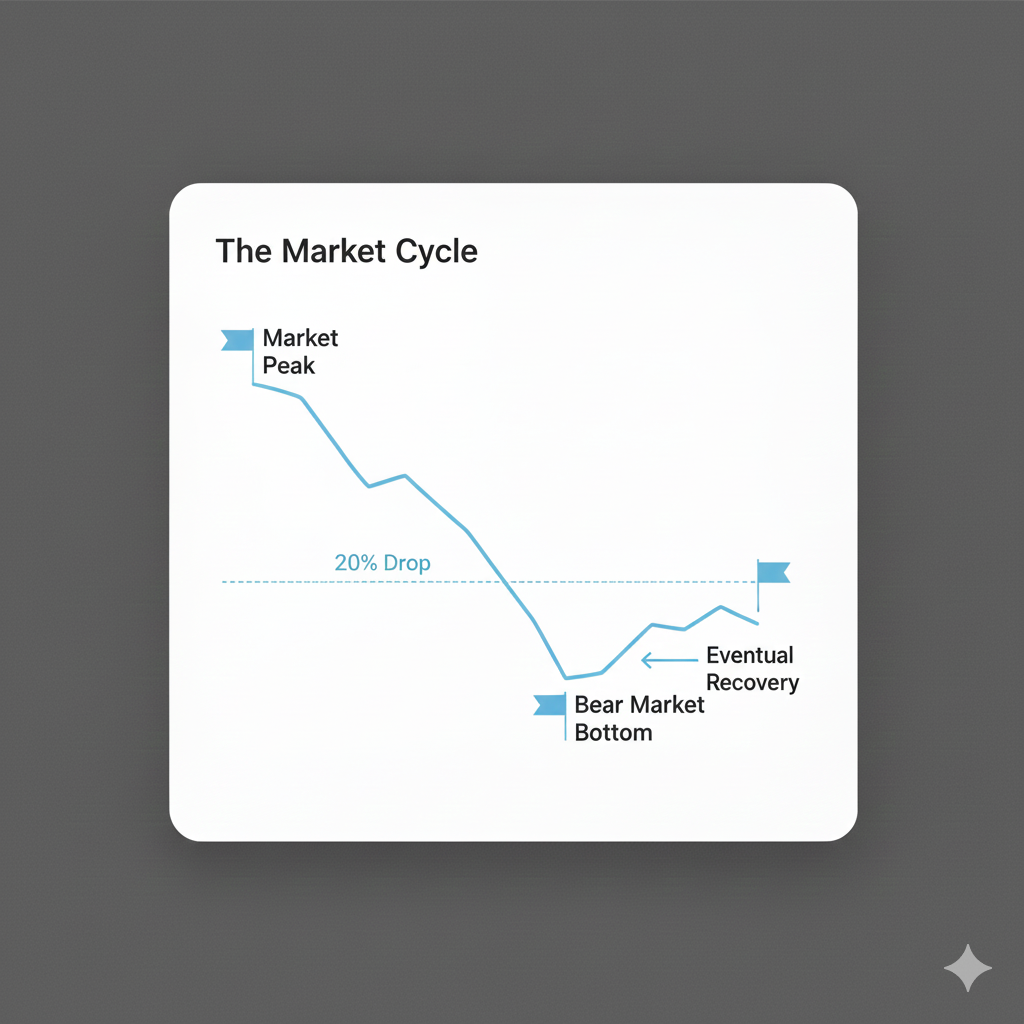

A bear market is commonly defined as a decline of 20% or more from a recent peak in a broad market index. (Investopedia) That definition is simple, but the experience is messy.

Why the 20% line matters, and why it misleads

The 20% threshold is a useful signal. It tells you the market has shifted from normal volatility into a deeper drawdown. However, it does not tell you when the bottom is in, or how long the pain will last.

Some bear markets are fast and violent. Others are slow and grinding. Additionally, many bear markets include powerful rallies that look like a recovery, then fade again. Those rallies can trick long-term investors into emotional decisions.

The most dangerous moment is not the first drop

Early declines often feel “fixable.” People think, “It will bounce back next week.” Later, after months of stress, exhaustion sets in. Meanwhile, that is when capitulation risk rises, meaning investors sell simply to stop feeling bad.

That is why the correct goal is not predicting the bottom. The goal is staying rational long enough to let compounding do its job.

The Psychology Trap: Why Smart People Panic

Bear markets reveal a cruel truth. Investing is less about IQ and more about emotional control under pressure.

Loss feels bigger than gain

Classic behavioral finance research shows that people tend to feel losses more intensely than equivalent gains. This is a core insight of prospect theory. (Haas School of Business) When your portfolio drops, your brain treats it like a threat, not a math problem.

That reaction is not weakness. It is human wiring. However, the market does not reward your wiring. It rewards discipline.

The disposition effect: selling winners, holding losers

Another well-studied pattern is the disposition effect. Investors often sell assets that went up to “lock profits,” and hold assets that went down to avoid admitting a loss. (Wikipedia) In a bear market, this can become disastrous, because you can end up cutting future winners and clinging to damaged positions.

Social proof turns fear into a stampede

When everyone around you is anxious, anxiety feels smart. That is social proof. It is why bearish headlines are so contagious. Furthermore, algorithms feed the mood. The more you click fear, the more fear you see.

The real enemy is time compression

A long-term plan assumes time. A bear market steals that feeling. It makes the future feel like it shrank. Consequently, people act as if they must fix everything today.

To fight that pressure, you need a process that slows decisions down.

[YouTube Video]: A clear, practical explanation of what a bear market is and how investors typically react.

The Bear Market Reality Most Investors Miss

Bear markets are normal in equities. They are not a rare glitch. They are part of the price you pay for long-run returns.

This is not motivational talk. It is a structural feature of markets. Risk assets move in cycles. Recessions happen. Earnings fall. Liquidity tightens. Additionally, geopolitics and policy shocks appear without warning.

That is why long-term investing is not about avoiding bear markets. It is about being prepared for them.

What Long-Term Investors Should Do

A bear market is not the time to invent a brand-new identity as an investor. It is the time to execute your plan with calm intensity.

Reconfirm your real time horizon

Start with one critical question: “When do I actually need this money?” Not “when do I want to feel better.” If your horizon is 10 to 20 years, daily price moves are noise. However, if you need the funds soon, risk must be reduced thoughtfully, not in a panic.

A long-term investor is not someone who says they are long-term. It is someone whose money does not need to be touched for years.

Recheck your asset allocation, then rebalance

Rebalancing is not exciting. It is also one of the most reliable, disciplined behaviors during drawdowns.

When stocks fall, their weight in your portfolio drops. Rebalancing means you buy what became cheaper and sell what held up better. That feels emotionally backwards. Meanwhile, that is exactly why it can work.

Vanguard’s guidance on handling down markets emphasizes staying the course and keeping a plan aligned with goals. (S&P Global)

Keep investing if you have earned income

If you are still getting paid, you have a powerful advantage. You are buying more shares at lower prices. This is the quiet logic behind dollar-cost averaging. It is not magic. It is persistence.

The market does not need your feelings. It needs your consistency.

Upgrade your “liquidity shield”

Bear markets often become expensive because people are forced to sell at bad prices to cover life costs. That is a liquidity problem, not an investing problem.

A practical move is building a cash buffer that fits your situation. It reduces the chance you sell long-term assets at the worst moment. Additionally, it improves sleep, which is underrated alpha.

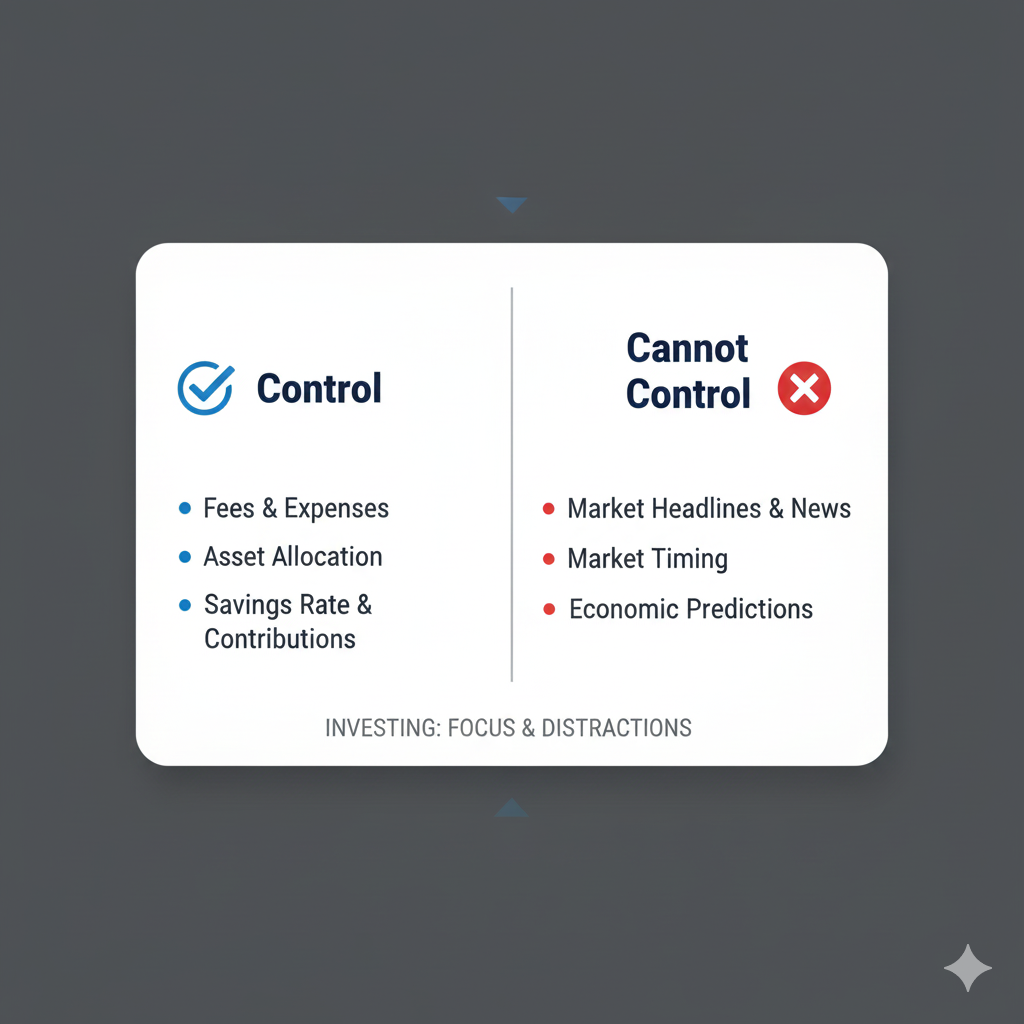

Focus on behavior, not predictions

Forecasts feel comforting. They also fail often. Instead, long-term investors win by controlling what can be controlled: fees, diversification, taxes, and emotions.

Moreover, investors who chase confident narratives often end up buying high and selling low, because narratives peak at extremes.

What Long-Term Investors Should Not Do

Bear markets punish a specific set of mistakes. These mistakes are common because they feel logical in the moment.

Do not sell just to stop the discomfort

Selling can feel like relief. It removes anxiety instantly. However, it also locks in losses and creates a second problem: when to buy back.

Many investors sell after large declines, then wait for “clarity.” Clarity arrives after prices rise. Consequently, they re-enter late, if they re-enter at all.

Do not confuse a plan with a hunch

Changing allocation because your life changed is valid. Changing allocation because you saw a scary chart is not. A bear market produces convincing stories every day. Additionally, those stories often conflict with each other, which should be a warning.

Do not concentrate more than you can emotionally hold

A portfolio that is “mathematically” fine can still be behaviorally impossible. If a concentrated bet drops 60%, you may not hold through it, even if you promised yourself you would. Therefore, diversification is not only a finance concept. It is a psychology tool.

Do not reach for leverage to “make it back”

Leverage is seductive after losses. It can also be lethal. Margin calls force selling at the worst time. Options can decay faster than emotions can recover. Meanwhile, the rise of ultra-short-dated options has increased the market’s speed and noise, which can pull investors into impulsive moves.

Do not let your information diet poison your decisions

If your media feed is 90% panic, your brain will act like the world is ending. Curate inputs. Pick fewer, higher-quality sources. Additionally, set boundaries on how often you check prices.

This is not avoidance. It is risk management for your attention.

The “Reset Plan” for Bear Market Discipline

Long-term investing needs a simple reset button. Not a heroic one. A practical one.

Step one: slow the decision clock

Make one rule: no major portfolio changes on the same day you feel intense fear. Wait 24 to 72 hours. Talk it through. Write down the reason. Consequently, you filter out impulsive moves.

Step two: translate headlines into numbers

Headlines are designed to trigger emotion. Numbers reveal reality.

Instead of “markets are collapsing,” ask:

What is my portfolio down, in percentage terms?

How long is my horizon?

What is my next contribution?

Do I have an emergency buffer?

This turns drama into math.

Step three: run a “bad year” simulation

Imagine your portfolio drops another 20% from here. How would you respond? If the answer is “I would panic,” then your risk level is too high. Adjust gradually, not violently.

Step four: write your bear market rules

Rules are powerful because they act when you cannot.

Keep it short. Examples include:

“I rebalance quarterly, not daily.”

“I stay invested unless my goal changes.”

“I do not sell based on headlines.”

“I increase savings rate if possible during drawdowns.”

Small rules can create a huge protective wall.

The Bear Market Playbook Is Evolving

The next bear market will not look exactly like the last one. Market structure and investor behavior are changing.

Faster settlement, faster feedback loops

The U.S. moved toward a shorter settlement cycle, known as T+1. The practical effect is a faster post-trade process and tighter timelines around funding and operations. (SEC) This does not “cause” bear markets. However, it contributes to a world where markets feel faster, and where operational discipline matters more.

Passive flows are a bigger force

ETF growth has been explosive. In 2024, U.S. ETFs saw record inflows, reflecting how investors increasingly use low-cost, index-based vehicles. (Financial Times) In a bear market, this can change how selling pressure shows up, and how quickly flows move across sectors.

Additionally, active ETFs are growing too. That creates a market where rules-based strategies and systematic trading can amplify moves in both directions.

Tokenization is creeping into mainstream finance

Large institutions are experimenting with tokenized money market funds and tokenized Treasury products, which could reshape liquidity management over time. (Investopedia) In future stress periods, the “plumbing” of markets could matter more than most retail investors realize.

This is a big deal, but it is not a reason to gamble. It is a reason to stay educated and avoid fragile assumptions.

AI increases speed, not certainty

AI tools can summarize filings, scan earnings calls, and spot patterns. That is powerful. It is also risky. Faster analysis can lead to faster overconfidence. Consequently, long-term investors will need a new skill: using AI for clarity without outsourcing judgment.

How to Prepare for the Next Bear Market Before It Hits

Preparation is the most underrated form of confidence.

Build a portfolio you can hold in public

If your portfolio is so aggressive that you would be embarrassed during a drawdown, it is too aggressive. This matters because bear markets are social. Friends talk. Social media screams. Meanwhile, your plan should remain boring.

Stress-test your income and expenses

Bear markets can overlap with job risk. That is why your personal balance sheet matters. Reduce high-interest debt. Create flexibility. Additionally, avoid lifestyle commitments that force selling investments.

Decide your rebalancing trigger now

Do not wait until fear is high. Pick a schedule or threshold. Quarterly is simple. Some investors use percentage bands. The key is committing ahead of time.

Prepare a “watch list” of what you will not do

This is surprisingly effective. Write down the actions you are most tempted by in panic, then forbid them unless your life circumstances truly changed.

For example, “I will not liquidate my retirement account because a commentator said the market is doomed.”

A Clear Truth: Bear Markets Reward the Patient, Not the Brave

Bravery is noisy. Patience is quiet. The market rewards quiet.

Long-term investors do best when they accept that discomfort is part of the deal. They do not romanticize it. They simply price it in.

Furthermore, discipline is not one choice. It is a series of small choices repeated while you feel uncertain.

[YouTube Video]: A disciplined, research-driven discussion on surviving bear markets without panic decisions.

The Bottom Line

A bear market is not a test of your intelligence. It is a test of your process.

If you have a long horizon, diversified exposure, a liquidity buffer, and a rebalancing habit, you already have a strong advantage. Moreover, if you protect your attention and slow your decisions, you reduce the risk of the most painful error: selling low and buying back higher.

The future will bring faster market cycles, more systematic flows, and more tech-driven narratives. However, the core discipline will stay timeless: stay diversified, stay invested, and stay emotionally honest.

Sources and References

- What Is a Bear Market? (Investopedia)

- How Long Do Bear Markets Last? (Investopedia)

- Vanguard: How to Handle Market Downturns (S&P Global)

- Fidelity: What Is a Bear Market? (fidelity.ca)

- SEC: Shortening the Settlement Cycle (SEC)

- Prospect Theory (Kahneman & Tversky, 1979) PDF (Haas School of Business)

- Disposition Effect Review PDF (Wikipedia)

- Financial Times: 0DTE Options and Market Impact

- Financial Times: Record 2024 ETF Inflows (Financial Times)

- Tokenized Money Market Funds Trend (Investopedia)