Stop lending without guilt. Learn money boundaries that protect your peace, cut drama, and keep friendships strong in a high-pressure fintech world.

Money can ruin friendships in a quiet, painful way. It rarely starts with greed. It starts with a story. Someone is stressed. Someone is behind. Someone needs help “just this once.” Then your phone buzzes. It is a payment request. It is a message. It is a call that feels urgent.

You want to be loyal. You want to be kind. You also want to be safe. That tension creates guilt. It can feel immediate and crushing. Consequently, many people lend even when they know it is a bad idea.

This is not only a personal problem. It is a cultural shift. In late 2025, instant payments, social money apps, and “tap to request” features made asking easier than ever. Meanwhile, inflation pressure, job instability, and rising everyday costs have kept more households tight. The result is predictable. More people ask. More people feel trapped.

This article explains why “lending without guilt” is becoming an essential life skill. It also shows what is changing next, and how to protect your relationships without burning bridges. Additionally, it offers practical language you can use, without turning the article into a long checklist.

The quiet crisis behind “Can you lend me?”

Why the ask hits harder than you expect

A money request is not only about cash. It often feels like a test of love. That is why guilt spikes. Many people fear that saying no will label them as cold, selfish, or disloyal.

Guilt is powerful because it pretends to be morality. It whispers, “If you were a good friend, you would help.” However, that is not always true. A healthy friendship can survive a no. An unhealthy friendship punishes you for it.

Money requests also create fear. Fear of conflict. Fear of gossip. Fear of being excluded. Consequently, people pay to avoid discomfort. That trade is expensive.

The friendship loan myth

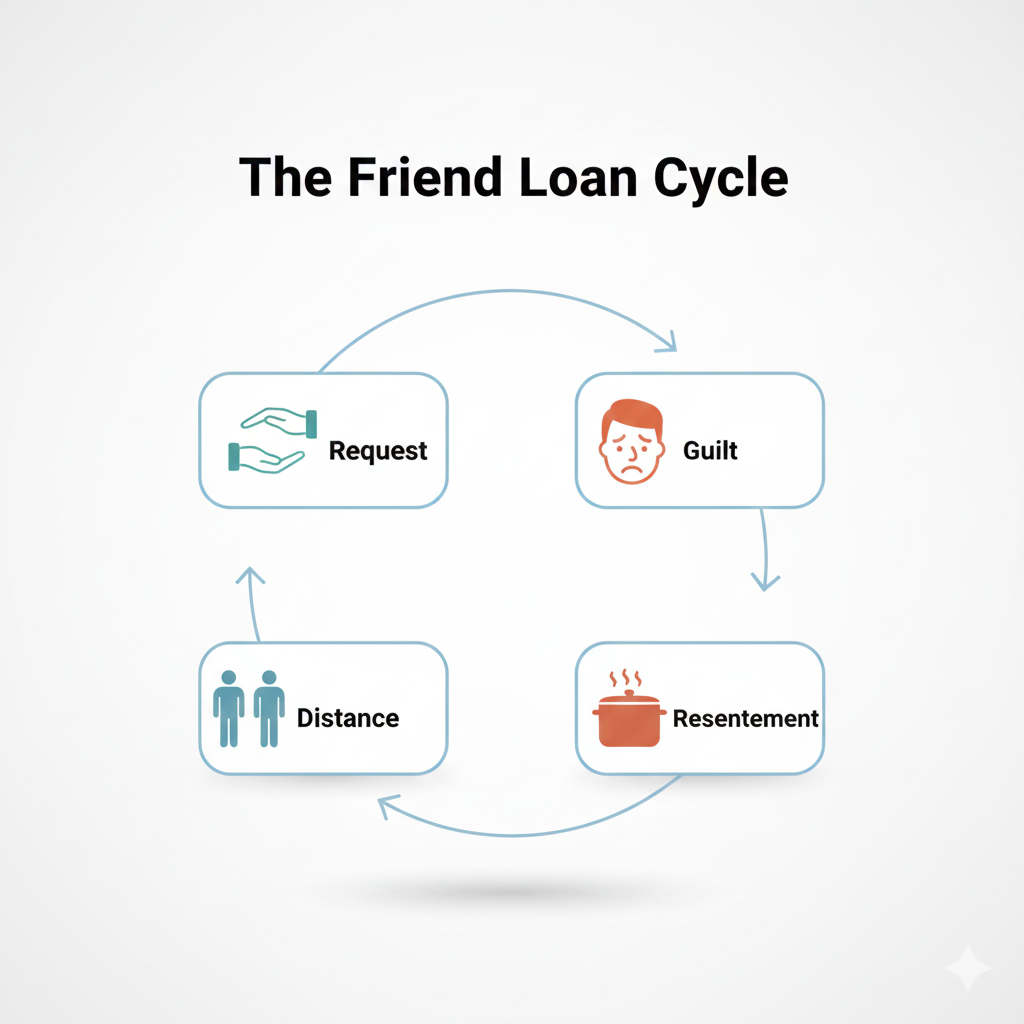

There is a popular myth: “If I lend, they will respect me.” In real life, the opposite often happens. Lending can change the power balance. It can create shame for the borrower. It can create resentment for the lender. Moreover, it can turn warmth into a scoreboard.

Many “friend loans” do not fail because of bad people. They fail because the terms are unclear. The timeline is vague. The expectation is emotional. That mix is fragile.

Money boundaries are becoming a survival skill

Instant payments create instant pressure

A decade ago, asking to borrow money took effort. You had to call. You had to explain. You had to face a reaction. Now a request can arrive with a single tap.

Peer-to-peer payment apps are widely used. Pew Research reports broad adoption of payment apps among U.S. adults. (Pew Research Center) This matters even if you are not in the U.S. The behavior is global. Convenience spreads fast.

When asking becomes frictionless, people ask more often. Additionally, the ask can feel less serious. It becomes casual. Yet your money is not casual.

Payment requests also arrive in public or semi-public ways. Notes. Emojis. Social comments. That creates pressure. Consequently, boundaries feel harder, even when they are crucial.

[YouTube Video]: Real-world advice on saying no to money requests without damaging relationships. Useful for hearing calm tone and clean wording.

The new etiquette gap

Etiquette used to be taught in families. Now money etiquette is a moving target. Many people never agreed on “what is normal.” LendingTree’s study on peer-to-peer payment etiquette highlights how rarely users discuss expectations before requests happen. (LendingTree)

This gap creates confusion. Confusion creates conflict. Moreover, conflict damages trust.

A friend might believe a request is harmless. You might experience it as manipulative. Both feelings can be real. That is why money boundaries must become explicit, not implied.

What is changing next and why it matters

Social features will keep blending money and identity

Payment apps increasingly look like social platforms. They use feeds, reactions, reminders, and “split” tools. Meanwhile, messaging apps keep adding payment rails. That blending makes money feel like social participation.

This trend is emotionally dangerous. Social belonging is a deep human need. When money gets tied to belonging, guilt grows sharper.

In 2026, expect more “default asking.” Expect more group payment workflows. Expect more frictionless “request again” nudges. Consequently, the person with boundaries can look “difficult,” even when they are simply responsible.

BNPL culture normalizes tiny debts

Buy Now, Pay Later products made small debt feel ordinary. Regulators have paid more attention to that space. The CFPB issued an interpretive rule in 2024 addressing BNPL lenders and certain consumer protections tied to credit card-style rules. (Consumer Financial Protection Bureau)

That matters socially. When debt feels normal, borrowing from friends can feel normal too. The borrower may even believe they are being practical. Yet interpersonal debt is different. It is emotional. It is messy. It is rarely “just numbers.”

Scams are rising, and “helping” can turn risky

Money requests are not always real. Scams exploit trust. Investopedia describes common P2P request scams, including impersonation and refund tricks. (Investopedia)

This changes the meaning of boundaries. A boundary is not only about fairness. It is also about safety. In 2026, basic verification will become normal. That is not paranoia. It is smart.

The psychology of guilt and why it works

Reciprocity can be healthy, but it can also trap you

Human relationships rely on reciprocity. That is normal. However, reciprocity becomes toxic when it becomes a weapon.

A borrower might say, “I helped you before.” Or, “You have more than me.” Or, “I would do it for you.” Those lines create emotional debt. Emotional debt is hard to repay. Consequently, the lender keeps paying with silence, stress, and regret.

The “good person tax”

Many generous people pay what feels like a moral tax. They lend to prove they are loyal. They lend to avoid looking proud. They lend to keep the peace.

This is common in close family systems too. Roles get assigned. One person becomes the “rescuer.” Another becomes the “emergency.” Over time, the rescuer’s life gets smaller.

Stress research shows money strain is strongly linked to anxiety and health pressure. The American Psychological Association has discussed how money stress affects people’s well-being. (APA)

That link is a wake-up call. If lending creates ongoing stress, the “kind” act becomes self-harm in a financial sense. It can also harm the relationship.

Why “no” can protect a friendship

Boundaries create predictability

Friendships need predictability. They need trust. A boundary creates a clear rule. That rule reduces future conflict.

A vague relationship creates repeated negotiation. Repeated negotiation creates resentment. Moreover, resentment leaks into tone, delays, and passive comments.

When you set a calm boundary, you replace chaos with clarity. Clarity feels mature. It also feels safe.

A boundary reveals the real relationship

This is uncomfortable, but it is liberating. Some people only stay close when you provide money. When you stop, they disappear.

That outcome hurts. Yet it also gives truth. A relationship that needs your cash to survive is not a stable friendship. Additionally, a person who respects you will respect your limits.

The boundary framework that keeps relationships intact

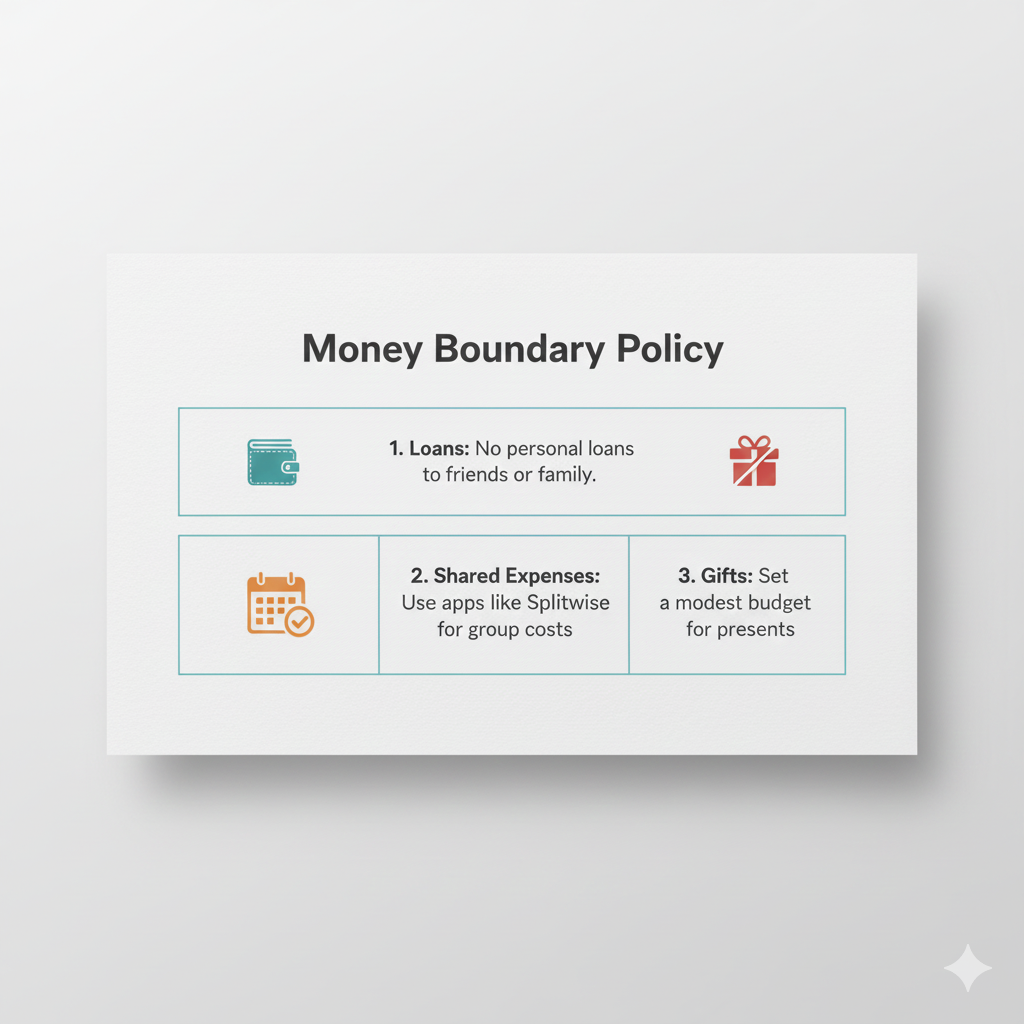

Decide your personal “lending policy” in advance

The biggest mistake is deciding in the moment. The moment is emotional. The moment is pressured. The moment is loud.

A policy is quiet. It is stable. It is protective.

Your policy can be simple. For example, you might choose: “I do not lend money to friends. I only give a small gift when I truly can.” Or you might choose: “I lend only small amounts, only once, only with a written date.” The exact rule is yours. The power is in deciding before the ask.

This is not cold. It is disciplined. Additionally, it removes favoritism, which prevents jealousy in friend groups.

Replace loans with alternatives that still show care

Many people want to help, but they want safety too. Alternatives can be a breakthrough.

You can offer help without lending. You can share resources. You can help someone plan. You can connect them to support. You can buy a specific item instead of giving cash. You can offer time, not money.

These alternatives can feel supportive. They can also reduce the chance you become a long-term wallet.

Beware the “yes, but” trap

A soft yes often turns into a slow yes. It sounds like, “Not now, but soon,” or “Maybe next week.” This creates hope. Hope creates pressure. Pressure creates repeated asks.

A clean boundary is kinder than a confusing boundary. Consequently, clarity is a gift to both sides.

Language that stops lending without creating drama

The clean no, with respect

A clean no is short. It avoids debate. It respects both people.

You can say: “I can’t lend money, but I hope things improve soon.”

Notice the structure. It is firm. It is not insulting. It does not invite negotiation.

The supportive no, with an option

Support can be emotional and practical. It does not need to be financial.

You can say: “I can’t lend, but I can help you map a plan for the month.”

This protects your money. It also protects the bond, if the bond is real.

The “policy” no, which removes personal judgment

Policies reduce arguments. They also reduce shame.

You can say: “I have a rule now. I don’t lend money to friends. It protects relationships.”

This makes the no feel fair. It also feels mature and consistent.

The “verify first” response for suspicious requests

With scams and impersonation, verification is vital. Investopedia notes how scammers can mimic contacts to send urgent requests. (Investopedia)

You can say: “I got your request. I’m calling you to confirm first.”

If they are real, they will understand. If they are fake, you are protected.

[YouTube Video]: A tough but practical message about helping without going broke. Useful when guilt is tied to family roles and emotional obligation.

Red flags that predict a painful outcome

The repeat borrower who never “graduates”

Some people always have a crisis. The crisis changes, but the pattern stays. You lend. They delay. They promise. They vanish.

This pattern is not only about money. It is about responsibility. Additionally, it is about respect.

A boundary here is not selfish. It is essential.

Urgency without details

Urgency is a classic pressure tactic. It can be real. It can also be manipulative.

If someone cannot explain what they need, how they will repay, and when, the request is risky. Consequently, your safest answer is no, or a non-cash alternative.

Anger when you ask questions

A healthy borrower understands questions. Questions protect both sides. Anger can signal entitlement.

If someone gets hostile when you set a boundary, the boundary is doing its job. Moreover, it shows you the future.

Requests through public shame

Some people apply pressure in groups. They ask in front of others. They hint that you are “stingy.” They joke about your success.

Public shame is a powerful red flag. It predicts future manipulation. It also predicts gossip if you stop paying.

When lending can be healthy, and how to keep it clean

Small amounts with clear expectations

Some friendships handle money well. They are rare, but real. If you choose to lend, keep it small. Keep it written. Keep it dated.

A written agreement does not have to be legal language. It can be a simple message: amount, repayment date, and method.

This reduces memory fights. It also reduces “I thought you said…” stress.

Gifts can be safer than loans

If you know repayment is unlikely, a “loan” can become a silent wound. A small gift can be emotionally cleaner.

A gift also gives you control. You decide the amount. You decide once. You avoid a long emotional chase.

The key is honesty with yourself. If you will resent them, do not give. If you can give with peace, give with clarity.

The tech layer: money boundaries in a fintech world

Payment apps can turn boundaries into settings

This is a practical shift. Boundaries are no longer only words. They can be features.

Many payment apps allow privacy controls, request controls, and notification settings. Even if you keep using P2P payments, you can reduce “random pressure” by tightening how people can reach you.

This matters because digital pressure is constant. Consequently, reducing triggers reduces guilt.

Scams will keep exploiting kindness

As P2P systems grow, scams evolve. Investopedia’s coverage of suspicious requests shows how easy it is for scammers to mimic trusted identities. (Investopedia)

In 2026, “verify by voice” will become more common. So will “confirm on a second channel.” This is not rude. It is modern safety.

Social money research is catching up

Researchers have studied how P2P payment apps affect interpersonal exchanges and offline relationships. A Clemson University paper explores how requesting and sending money through apps can shape social dynamics. (Guo Freeman)

That research points to a deeper truth. The medium changes the message. A payment request on a screen can feel colder, bolder, or more demanding than a face-to-face talk. Additionally, it can reduce empathy, which increases conflict.

The cultural layer: why some communities feel more pressure

Family systems and role expectations

In many cultures, success comes with duties. The most “stable” person becomes the support system. That role can feel honorable. It can also become exhausting.

In late 2025, economic pressure has made these expectations more intense. When costs rise, families lean harder on the same person. Consequently, boundaries become vital for survival.

A strong boundary does not reject your people. It protects your future so you can help in smarter ways later.

Friendship groups, status, and silent competition

Money can trigger shame. Shame can trigger competition. In friend groups, borrowing can be tied to pride. That is why some people avoid clear talks and instead rely on hints, jokes, or pressure.

A boundary can feel “too direct.” However, directness often saves the friendship. It replaces mind games with truth.

How to prepare for 2026 without becoming cold

Normalize the boundary before the emergency

If you wait for a crisis, your no feels personal. If you set the boundary earlier, it feels normal.

You can mention it casually: “I’m tightening my budget this year, so I’m not lending money anymore.” This is simple. It is also protective.

Build a generosity budget on purpose

This is a powerful trick that reduces guilt. You choose a small amount you can give each month. It is planned. It is limited. It is peaceful.

Then, when someone asks, you already know what is possible. Additionally, you do not feel like you are deciding their worth. You are simply following your plan.

Use “help that builds” instead of “help that leaks”

The most rewarding help improves someone’s future. It supports stability. It reduces repeat crises.

That can mean helping them find services, training, work leads, or budget tools. It can mean teaching them to negotiate bills. It can mean reviewing their plan for rent. Consequently, you shift from emergency funding to lasting support.

Practical implications you can expect next

More requests will arrive through apps, not conversations

That shift reduces social friction for the asker. It increases pressure for the receiver. Therefore, your boundary will need to be faster and more automatic.

Financial therapy language will spread

Terms like “money boundaries,” “financial self-care,” and “financial shame” are becoming mainstream. This is a hopeful trend. It gives people better tools. It also makes boundary-setting more socially acceptable.

Regulation will keep watching consumer credit products

BNPL has already drawn regulatory attention in the U.S., including the CFPB’s interpretive rule and related communications in 2024. (Consumer Financial Protection Bureau) Even when the rules differ by country, the direction is clear: more scrutiny, more disclosures, and more consumer protection debates.

This matters because credit products shape culture. When credit becomes smoother, borrowing becomes more normal. Consequently, your personal boundary becomes your strongest protection.

Conclusion: the calm power of a clean boundary

Money boundaries are not about being harsh. They are about being honest. They protect your peace. They protect your future. They also protect your relationships from turning into quiet resentments.

A guilt-free “no” is a skill. Like any skill, it becomes easier with practice. Moreover, it becomes more respected over time.

In 2026, the world will keep making it easier to ask for money. It will also keep making money stress heavier for many people. Your boundary is not a wall. It is a stable bridge. It lets you stay connected without drowning.

Sources and References

- Payment apps bring convenience and concerns (Pew)

- Money stress weighs on Americans’ health (APA)

- Financial stress podcast episode (APA)

- P2P payment etiquette study (LendingTree)

- P2P payment apps and interpersonal exchanges (Clemson PDF)

- Common Venmo request scams (Investopedia)

- CFPB BNPL interpretive rule page (CFPB)

- BNPL interpretive rule in the Federal Register

- Coping with financial stress (HelpGuide)