Dynasty trusts and IDGTs are the 2026 legacy shield. See trends, tax risks, and practical steps advisors use to protect families.

The 2026 dynasty trust moment, and why it feels urgent

A dynasty trust sounds like a luxury move for billionaires. In 2026, it is turning into a mainstream defense play for many affluent families. The reason is not hype. The reason is math, timing, and fear.

For years, the U.S. transfer-tax world revolved around one massive question. Would the big federal estate and gift tax exemption stay high. Or would it snap back down. That question shaped every dinner conversation between business owners, physicians, founders, and their advisors.

By the end of 2025, the market had two competing, tense realities. First, the basic exclusion amount for 2025 was set near $13.99 million per person, which made large gifts feel urgent. Second, many planners were still gaming out 2026 scenarios because Congress can change the rules fast. Some reporting highlighted a 2025 law change that would lift the federal estate and gift exemption to about $15 million per person and index it, which would blunt a 2026 cliff.

That confusion is exactly why dynasty trusts and IDGTs are surging. When the rules feel unstable, families chase structures that feel stable. A well-built trust can feel like a private vault. It can feel certified. It can feel guaranteed. That emotional comfort is not irrational. It is strategic.

However, there is a catch. A trust is not magic. It is a contract with the future. It either works because the design is rigorous, or it fails because the design is sloppy.

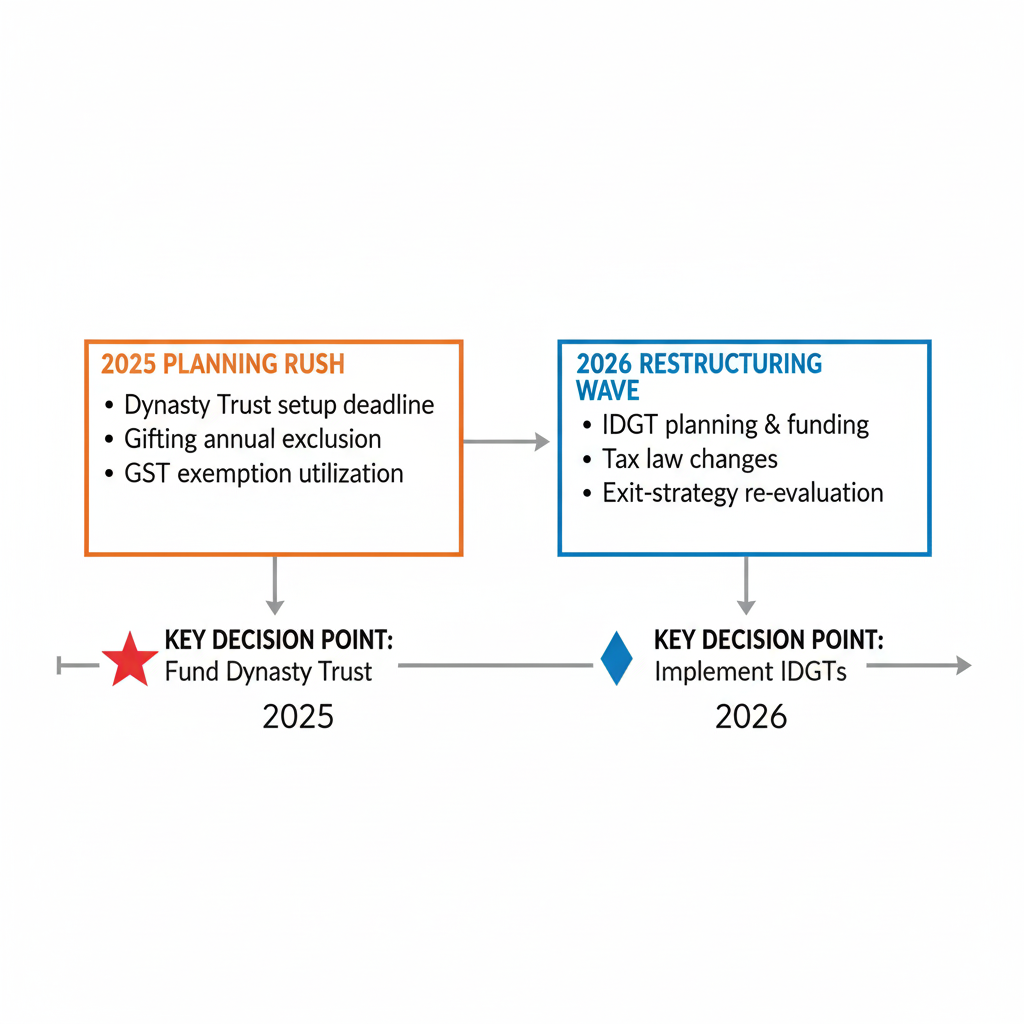

The “deadline hangover” that fuels 2026 planning

A lot of families tried to “do something” in 2025. Some did it well. Others froze. Many missed their window.

Now comes 2026. It is the year of professional cleanup. It is also the year of aggressive upgrades. Advisors are re-opening files. Clients are re-reading old memos. Adult children are suddenly paying attention. Meanwhile, the IRS and Congress remain unpredictable.

Consequently, planning energy moves toward two tools that do not depend on perfect prediction. Dynasty trusts offer long-term protection. IDGTs offer a controlled way to shift future growth.

The celebrity angle, and why it matters anyway

Jeff Bezos is not the point. He is a symbol. In every era, public wealth reminds private families that legacy is real. If a giant fortune can be vulnerable, then a smaller one is also vulnerable.

Furthermore, celebrity stories shape expectations. They make families ask sharper questions. They make founders wonder if their company stock will become a tax trap. They make parents worry about a child’s divorce. They make heirs worry about lawsuits.

That emotional pressure is a hidden driver of the dynasty trust boom.

Dynasty trusts, explained like a professional guide

A dynasty trust is not just a tax play. It is a powerful, proven tool to protect assets over generations. It aims to keep wealth inside a structure, not inside a person’s name.

When assets sit in an individual’s name, they are exposed. They are exposed to estate tax risk. They are exposed to lawsuits. They are exposed to divorce. They are exposed to bad decisions. A trust, if designed well, can reduce those exposures.

Additionally, dynasty trusts are often designed to last far longer than traditional trusts. In some states, that can mean extremely long durations. In other states, it may be shorter. Either way, the intention is bold: build a long runway.

Why dynasty trusts feel “bulletproof” in 2026

Families want a strategy that feels verified. They want something that feels durable. A dynasty trust can deliver that feeling because it creates separation.

The trust owns the asset. The beneficiary benefits from the asset. That difference sounds small. In practice, it can be revolutionary.

Moreover, in a world of rising litigation and social volatility, separation is a kind of quiet power.

The hidden engine: GST tax and allocation

The generation-skipping transfer tax exists because lawmakers do not want families to skip estate tax by jumping generations. If you fund a dynasty trust for grandchildren and beyond, GST issues can become critical.

This is where elite planning gets serious. The technical work is not optional. Allocation decisions matter. Timing matters. Documentation matters.

However, the emotional reality is simple: families hate the idea of losing a big slice of wealth to tax when it could have stayed inside the family story.

Where dynasty trusts can go wrong

Dynasty trusts fail in predictable ways. The trustee is weak. The rules are vague. The distribution standard is sloppy. The trust is underfunded. The state choice is mismatched.

Meanwhile, some families create a trust and then treat it like a checking account. That defeats the purpose. A dynasty trust must feel disciplined to remain powerful.

[YouTube Video]: A crisp, beginner-friendly explainer of dynasty trusts and how they can protect wealth over generations.

Why IDGTs became the 2026 power move

IDGT stands for “intentionally defective grantor trust.” The name sounds alarming. The strategy is intentionally brilliant.

The “defect” is not a mistake. It is a design feature. The goal is to have the trust treated one way for income tax, and another way for estate tax purposes.

In many meetings, that idea lands like a breakthrough. People realize they can move growth out of their estate while still paying income tax on the trust’s earnings. Paying that tax can function like an extra tax-free gift, because it preserves trust assets.

That point is not ego. It is leverage. The point is a secure future that feels authentic.

Why 2026 makes the IDGT feel urgent again

In 2026, the urgency is not only about exemption amounts. It is also about rate levels, valuation shifts, and business volatility. A sale to an IDGT can look especially rewarding when assets are temporarily depressed.

[YouTube Video]: A clear explainer of what an IDGT is and why the “defect” is intentional for tax planning.

Additionally, if the family expects a powerful rebound, shifting that rebound outside the estate can feel like a profitable, proven win.

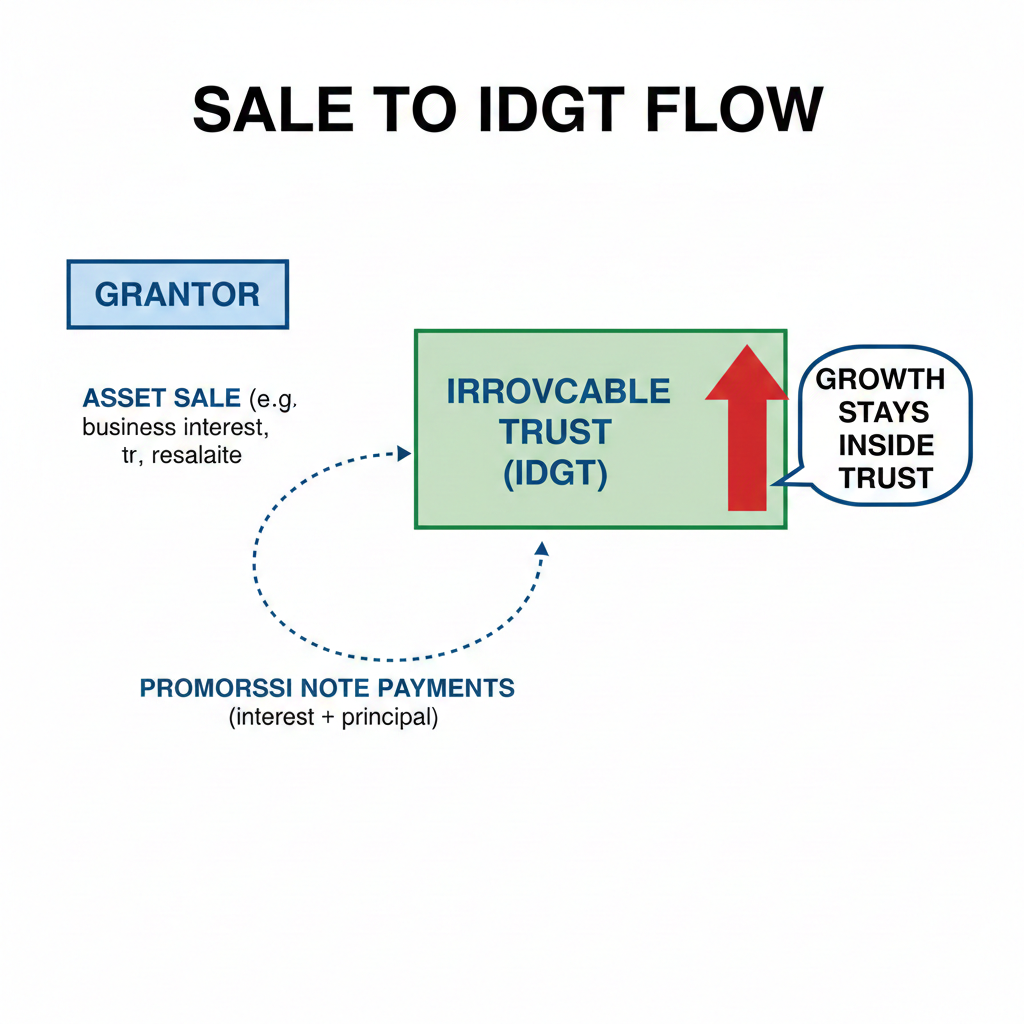

The classic structure: “sell” appreciating assets to the trust

A common IDGT strategy looks like this:

A grantor creates a trust. The trust is drafted so the grantor is treated as the owner for income tax purposes. Then the grantor sells assets to the trust in exchange for a promissory note.

If the assets grow faster than the interest rate on the note, the excess growth can accumulate in the trust. Over time, that can shift a shocking amount of wealth.

However, the note, the valuation, and the administration must be tight. In 2026, sloppy files will get punished.

The emotional appeal: control without chaos

Families love IDGTs because they can feel controlled. The grantor can often keep meaningful influence through trustee design and distribution standards, while still moving growth away from future estate tax.

This is not about “hiding money.” It is about controlling the narrative. A founder can protect a company’s future without handing a child unchecked cash.

Consequently, IDGTs are becoming the trusted bridge between “I want to protect wealth” and “I do not want to spoil anyone.”

The risk: IRS scrutiny and documentation fatigue

IDGTs attract scrutiny when the story looks fake. If the trust is undercapitalized, if the valuation is weak, if payments are not made, if records are messy, the whole structure can feel fragile.

In 2026, the winning plans will look boring. They will look methodical. They will look verified.

That is the paradox of elite planning. The most powerful moves often look quiet.

The 2026 reality check on “anti-clawback”

The fear behind 2025 planning was simple. “If I gift big when the exemption is high, will I get punished later if it falls.”

Anti-clawback was designed to reduce that fear. It created more confidence for large gifts.

Still, anti-clawback does not remove all risk. It does not fix poor valuations. It does not fix poor administration. It does not protect a family from state estate tax. It also does not guarantee future policy stability.

Therefore, dynasty trust and IDGT planning in 2026 remains essential, even if the exemption stays higher than feared.

What’s coming in 2026: the trends professionals are betting on

The smartest way to think about 2026 is not “one rule.” It is “several pressure points.”

Advisors are not just watching Congress. They are watching interest rates, valuations, state policies, enforcement energy, and family behavior.

Here is what is emerging as the next-generation planning map.

1) The “policy volatility premium” becomes real

Even when laws look stable, families now price volatility into decisions. They are willing to pay legal fees sooner because they fear later disruption.

That urgency is emotional. It is also rational.

Consequently, more clients will accept sophisticated trusts in 2026 than they would have accepted in 2018.

2) More trust work shifts to “audit-ready” engineering

In the past, some plans were drafted and then ignored. In 2026, advisors are designing plans as if they will be audited.

That means cleaner appraisals. It means consistent payments. It means meticulous minutes and trustee memos.

This trend is boring. It is also powerful. It turns a fragile plan into a resilient one.

3) Valuation strategy becomes a mainstream obsession

Volatility creates windows. If a business is temporarily down, a transfer can become more efficient. If the market is unstable, families become more open to “move now” decisions.

Meanwhile, appraisal firms are getting more sophisticated. So are IRS challenges.

Therefore, 2026 planning will put valuation at the center of the story, not as a footnote.

4) State-level estate and income tax planning intensifies

Federal rules are only part of the battlefield. States can create surprise costs. Residency decisions can reshape outcomes. Trust situs choices can change income tax results.

As a result, dynasty trust design in 2026 will increasingly look like a multi-jurisdiction strategy.

5) Annual exclusions become surprisingly important

When clients hear “estate tax,” they think “multi-million-dollar gifts.” They forget the small moves. However, small moves, repeated, become meaningful over time.

Inflation adjustments for 2026 shift multiple thresholds. That is not just trivia. It is a predictable, reliable planning lever.

In 2026, the annual exclusion is likely to matter more in family conversations than people expect.

6) “Family governance” becomes part of the trust package

Dynasty trusts fail when families fight. Advisors are responding by combining trust planning with governance.

That means family mission statements. It means distribution rules that feel fair. It means education plans. It means clear trustee selection logic.

In 2026, governance is no longer soft. It is a critical, protective feature.

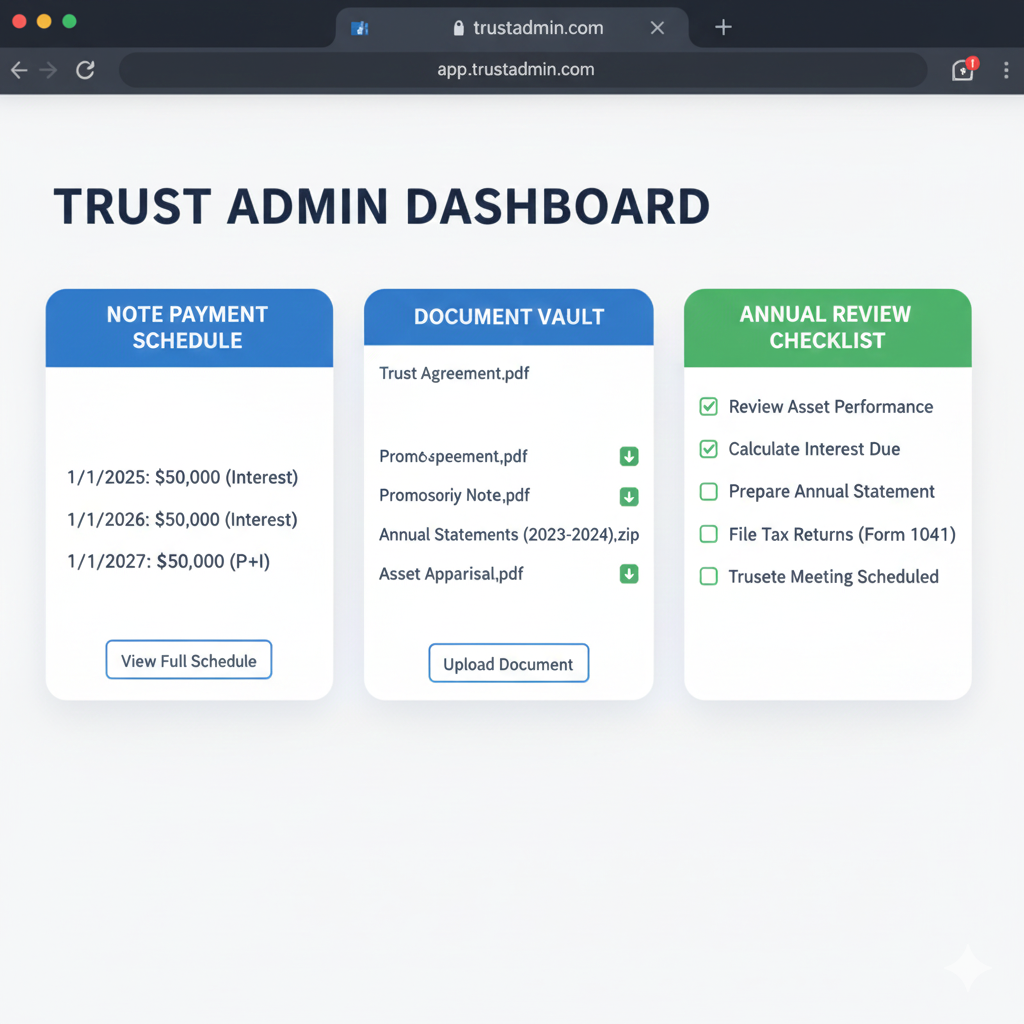

The technology layer arriving in 2026

Trust planning is often described as old-school. Yet 2026 is pushing it into a new era.

Technology does not replace lawyers. It changes execution quality.

Digital vaults become standard operating procedure

The modern trust plan includes documents, appraisals, payment logs, and trustee decisions. Losing any piece can weaken the story.

Therefore, advisors are building digital vault systems for clients. These vaults store signed PDFs, valuation reports, and payment schedules.

That is not headline innovation. Still, the impact is revolutionary in practice, because it reduces friction.

Better workflows for note payments and compliance

IDGT notes require discipline. Late payments can damage credibility. In 2026, families are adopting automated reminders and structured payment workflows.

This is not about convenience only. It is about audit defense.

Cleaner collaboration among professionals

Estate attorneys, CPAs, financial advisors, and trustees often work in silos. In 2026, collaborative platforms will reduce delays.

Faster collaboration increases the chance the plan stays accurate. It also increases the chance the plan stays credible.

How professionals are preparing clients for 2026 changes

The winning approach is not panic. It is preparation.

Advisors are framing 2026 as a year of structured optionality. They are designing plans that can adapt if laws change again.

Step one: stress-test the estate “as if the exemption shrinks”

Even if the exemption stays high, stress-testing is smart.

A stress test answers one question. “If the exemption were lower, what would break.” That answer guides how aggressive the trust planning should be.

Additionally, stress tests clarify what assets are the real problem. For many families, the biggest risk is concentrated stock or a fast-growing private business.

Step two: pick the right asset for the right tool

IDGTs are not ideal for every asset. Dynasty trusts are not ideal for every family.

Professionals in 2026 are pairing tools with asset behavior. High-growth assets fit transfer strategies. Stable assets may fit liquidity and governance needs.

Consequently, the plan becomes more precise, and less generic.

Step three: design trustee power like a security system

A trustee is a human firewall. A weak trustee makes a strong trust weak. A strong trustee makes the plan resilient.

In 2026, families are getting serious about trustee selection. They are building replacement rules. They are adding checks and balances.

This is essential. It is protective. It is often uncomfortable. That discomfort is a sign the plan is real.

Step four: create a “paper trail” that feels undeniable

Trust strategies do not fail because they are illegal. They fail because they are poorly executed.

Therefore, professionals are producing audit-ready files by default. Every payment gets logged. Every valuation gets stored. Every trustee decision gets summarized.

That file discipline is the difference between a proven structure and a fragile one.

Step five: build family buy-in before funding the trust

Dynasty trusts can create resentment if heirs feel trapped or controlled. Advisors now push family meetings earlier.

These meetings align expectations. They reduce future conflict. They make the trust feel authentic, not manipulative.

In 2026, buy-in is becoming a standard step, not a luxury step.

Expert projections: what 2026 could normalize

A few projections keep showing up across professional commentary and client behavior.

The “professionalization” of wealthy families accelerates

Families that used to feel informal are adopting systems. They are building advisory boards. They are documenting decisions. They are acting like institutions.

This shift is empowering. It is also protective.

IDGTs become less “fancy” and more “standard”

If interest rates stabilize and valuations remain volatile, sale-to-trust planning stays attractive.

That makes IDGT-style structures feel less exotic. It makes them feel like a predictable tool in the kit.

Dynasty trusts expand beyond tax, into lifestyle protection

Clients increasingly cite non-tax reasons. Divorce risk. Spendthrift risk. Lawsuit risk. Addiction risk. Social pressure.

This is emotional. It is also rational.

A dynasty trust becomes a “family safety architecture,” not a pure tax play.

Practical guidance: the 2026 dynasty trust and IDGT checklist

This is not legal advice. It is a professional lens. It is meant to help a reader understand what the best advisors are doing.

Get clear on goals before choosing structures

A family needs clarity. Do they want tax reduction. Do they want protection. Do they want governance. Do they want control.

If the goal is fuzzy, the trust becomes fuzzy. If the goal is sharp, the trust becomes sharp.

Avoid the “one trust fixes everything” fantasy

Some clients want one document to solve every risk. That desire is understandable. It is also dangerous.

Instead, professionals in 2026 build layered systems. They may use a dynasty trust for long-term protection. They may use an IDGT sale to shift growth. They may use insurance for liquidity.

This layered approach is more resilient.

Plan liquidity like a serious adult

Taxes and expenses still exist. Trustees need liquidity to manage distributions and costs. Estates need liquidity if a taxable event hits.

Therefore, 2026 planning increasingly includes liquidity engineering. Life insurance. Cash reserves. Credit lines. Smart asset selection.

Liquidity turns a strong plan into a livable plan.

Commit to annual maintenance

A trust is not “set it and forget it.” It is “set it and maintain it.”

Annual reviews confirm that beneficiaries, trustees, assets, and laws remain aligned. They confirm note payments were done correctly. They confirm the plan still matches the family reality.

In 2026, maintenance becomes the normal expectation, not an add-on.

The 2026 takeaway: the real “dynasty trust defense”

The dynasty trust defense is not a loophole. It is not a gimmick. It is a disciplined strategy built around clarity, separation, and documentation.

A dynasty trust can protect the long game. An IDGT can shift the growth game. Together, they can create a next-generation shield.

These are not headline innovations. Still, the impact is revolutionary in practice, because it reduces friction. Discipline will separate families. Verified records, essential liquidity, and a protective governance design will be their edge.

Meanwhile, the families who treat these tools casually will get fragile outcomes.

In 2026, the winners will not be the loudest families. They will be the most consistent ones. They will be the ones who treat legacy like a system.

Sources and References

- IRS Rev. Proc. 2024-40 (2025 inflation adjustments)

- IRS Rev. Proc. 2025-32 (2026 inflation adjustments)

- AICPA summary of 2026 inflation adjustments

- IRS Estate Tax overview

- IRS Gift Tax overview

- 26 U.S. Code § 2010 (Unified credit and basic exclusion)

- 26 U.S. Code § 671 (Grantor trust rules)

- 26 U.S. Code § 2601 (Generation-skipping transfer tax)

- Investopedia: Dynasty Trust

- YouTube: Dynasty Trusts Explained