In 2026, “Key Person 2.0” insurance will evolve fast. It will blend burnout prevention, reputation defense, and rapid crisis support for CEOs and founders.

A new CEO risk hits the balance sheet

In December 2025, boards are saying the quiet part out loud. A founder is not just a leader. A founder is a critical operating system. When that system crashes, the company can stall in days.

This is why a new tier of corporate insurance is emerging. It is not only about death or disability. It is about burnout, brand shock, and leadership volatility. It is also about speed. Companies want help before the damage spreads.

However, the reason this is happening is bigger than any one executive. Work itself changed. The news cycle changed. Social media changed. Investors changed. Even regulators are moving. The result is a pressure cooker that can turn one human moment into a corporate event.

Burnout is now a board-level exposure

Burnout used to be a private struggle. Now it is a reportable risk. The World Health Organization describes burnout as an occupational phenomenon linked to chronic workplace stress that is not successfully managed. (World Health Organization)

That definition matters. It frames burnout as a work-linked condition. It is not simply “weakness.” It is also not “drama.” It is a predictable breakdown pattern. That makes it interesting to insurers.

Additionally, surveys and leadership research keep flashing red. Even when numbers vary, the direction is consistent: leadership stress is rising, and leadership churn is rising. A single exit can trigger missed product deadlines, stalled fundraising, and a credibility wobble that feels immediate.

The “cancellation” risk is not just celebrities anymore

The old model was simple. Reputation damage was “PR.” It lived outside finance.

That separation is fading. A controversy can now create direct costs in hours: legal fees, crisis communications, security, hiring an interim leader, and negotiating with investors. A Financial Times report described new insurance offerings aimed at “cancel culture” fallout, including crisis management support. (Financial Times)

Meanwhile, misinformation and disinformation have become a high-profile global risk theme, which keeps raising the baseline for brand volatility. (World Economic Forum)

Why 2026 is the turning point for “Key Person 2.0”

The classic “key person” policy was built for one big, simple loss. Someone dies. Someone becomes disabled. A payout helps the company survive the gap.

The 2026 version is more ambitious. It is being shaped by three pressures at once.

First, executive health risk is being priced like a continuity risk. Second, reputation events are being treated like operational shocks. Third, companies are demanding service, not just checks.

Consequently, insurers and brokers are experimenting with packages that look more like a “shield” than a policy. The shield idea is the real shift. It mixes coverage, prevention, and fast response.

The new promise: pay less later by acting earlier

The logic is brutally practical. If an insurer can reduce the chance of a catastrophic leadership event, everyone wins. The company avoids a painful spiral. The insurer avoids a huge claim. Investors avoid value destruction.

So the product design is moving toward three layers:

A prevention layer, focused on early warning and support.

A response layer, focused on rapid crisis services.

A coverage layer, focused on cash if the event still happens.

This is why 2026 feels different. The industry is testing where insurance ends and “risk operations” begins.

What “Executive Burnout Shields” actually cover

The phrase “Key Person 2.0” can sound vague. Under the hood, the structure usually pulls from multiple insurance lines, plus contracted services.

Still, the big idea stays consistent: protect the company from losing its key leader, or from the leader becoming a liability event.

The human continuity layer

This is the part closest to old key person insurance. It often includes life coverage and disability-related coverage. In 2026, disability is getting more attention, because it maps to real business interruption, not just personal hardship.

Some programs also expand into executive medical travel, concierge support, and access to fast specialist care. The pitch is “reduce downtime.” The practical outcome is “reduce risk.”

The performance collapse layer

This is where burnout enters. Burnout is messy to define as an “insured event,” so insurers are careful. Most are unlikely to pay a claim just because someone feels exhausted.

Instead, the policies tend to route burnout through measurable events: medical disability, mandated leave, or inability to perform essential duties. That framing is more insurable. It is also less subjective.

Moreover, the market is adding services here. Think high-touch care navigation, executive coaching partnerships, and structured return-to-work planning. These offerings borrow ideas from workplace mental health strategies that employers are expanding across the workforce. (Business Group on Health)

The scandal and reputation defense layer

This is the controversial part. It is also the fastest-growing story.

Some new products position themselves as “reputation insurance.” They emphasize crisis PR, legal support, and social media monitoring. Reports about “cancel culture” insurance highlight packages that combine underwriting with crisis PR capability. (LS:N Global)

This is not a magic erase button. It is more like disaster response. It aims to contain harm and stabilize operations.

The Arianna Huffington factor: burnout becomes insurable when it becomes measurable

Arianna Huffington’s public work on sleep, boundaries, and “microsteps” helped make burnout a business conversation, not just a personal confession.

That cultural change matters. Insurers need language that boards will use. They also need behavior changes that are trackable.

So in 2026, the most successful “burnout shield” designs will not start with claims. They will start with habits, support systems, and earlier intervention.

Additionally, prevention becomes more credible when it is packaged as performance. Executives do not want to be treated like fragile glass. They want to be treated like high-value assets that deserve elite maintenance.

Micro-interventions are becoming the new normal

Preventing burnout rarely needs a dramatic retreat. It often needs consistent, small shifts. Research groups like Stanford have popularized “tiny habits” style thinking, including “microsteps,” as a realistic path to healthier routines. (RegEd.com)

In 2026, insurers and employers will try to operationalize that idea. Expect more “small steps” programs that are easy to adopt, easy to measure, and hard to argue with.

That creates a powerful alignment. A small change can be sold as performance optimization. It can also be justified as risk reduction.

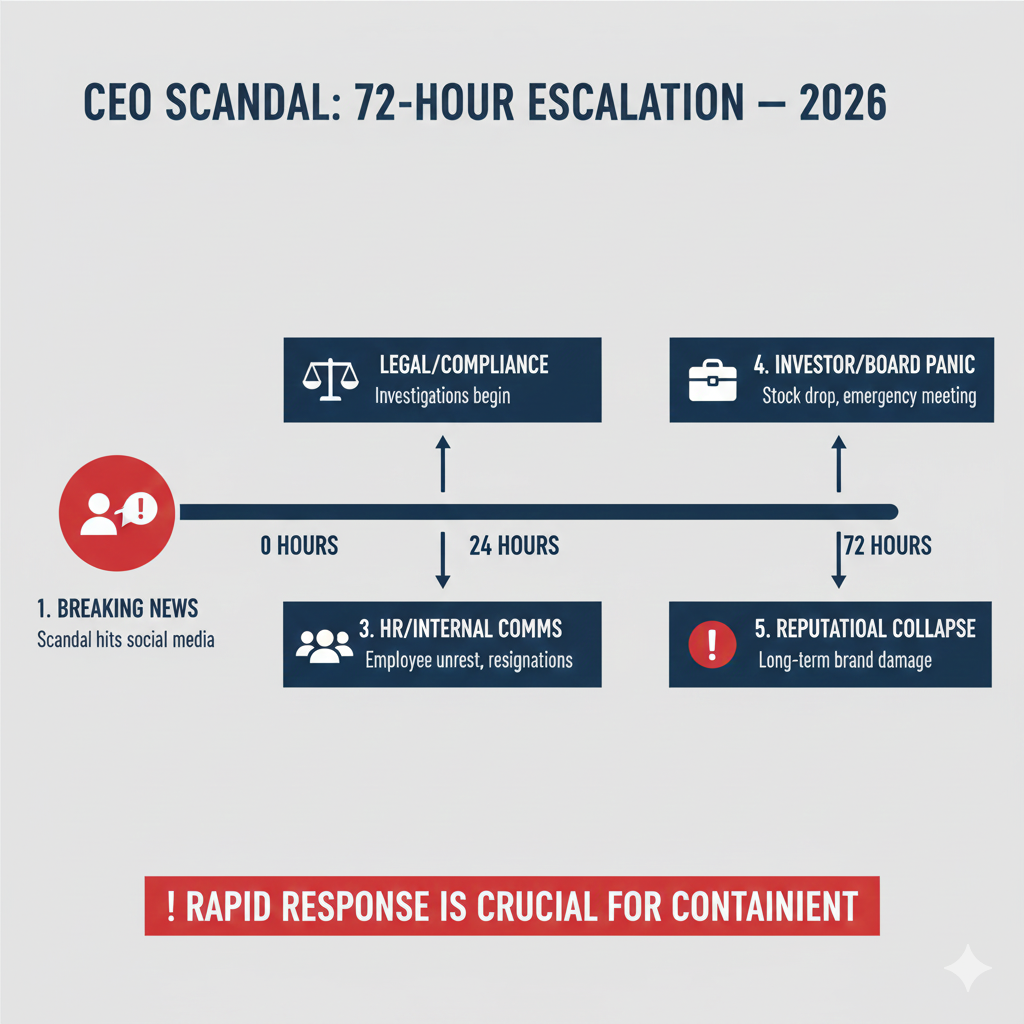

The reputation storm problem is getting sharper in 2026

A brand crisis used to unfold on TV, then in newspapers, then in a slow corporate statement. Today, it can unfold inside one app, across millions of screens, with no pause.

So the “cancellation” angle is not really about culture wars. It is about speed and amplification.

Meanwhile, AI-generated content is making fake screenshots, fake audio, and fake narratives cheaper to produce. This raises the risk of sudden credibility shocks, even when the underlying story is wrong.

Why insurers are even willing to touch this

Historically, insurers hated “reputation” because it is hard to price. It is also hard to prove.

Now, a few changes are making it more tractable:

Crisis PR has become more standardized.

Security and legal response can be scoped.

Digital monitoring tools can detect early escalation.

Boards are demanding formal plans.

Some new policies explicitly bundle crisis management services, rather than promising to “restore reputation.” That narrower promise is more believable.

A Financial Times report in 2025 described offerings that cover the fallout of being “cancelled,” signaling that this idea is moving from rumor to market behavior. (Financial Times)

The real corporate value is continuity

The biggest hidden cost in a scandal is not the headlines. It is operational paralysis.

Teams freeze. Partners hesitate. Customers delay. Employees leak. Investors pressure. One incident can become a chain.

So “burnout shield” products increasingly sell a continuity outcome: keep the company functioning even if the leader is offstage for a while.

That is why, in 2026, more programs will include interim leadership planning, pre-approved communications workflows, and rapid access to specialist advisors.

The 2026 policy environment will push mental health into compliance

Insurance trends do not happen in isolation. Regulation and compliance shape what companies measure and what they must prove.

In the US, mental health parity enforcement has been intensifying. The US Department of Labor has highlighted final rules under the Mental Health Parity and Addiction Equity Act, including stronger requirements and timelines, with some provisions applying in later plan years. (mindsharepartners)

Even if Key Person 2.0 is not the same as employee health coverage, the broader message matters. Mental health support is increasingly being treated as a governance issue, not a perk.

Additionally, investors and boards are treating “culture and conduct” as risk. That pulls burnout and scandal risk closer to formal enterprise risk management.

Governance is underwriting now

In 2026, many underwriters will look for evidence of real governance controls:

A clear chain of command.

A crisis plan that is practiced.

A documented succession path.

A mental health support structure that is credible.

This is not softness. It is underwriting logic. The better the governance, the lower the probability of catastrophic loss.

Consequently, Key Person 2.0 becomes a forcing function. It can push founders to build mature structures earlier than they want.

Technology innovations that will shape these products in 2026

The most dramatic shift is the rise of continuous signals. Not constant surveillance, but continuous risk indicators.

That opens both exciting and uneasy possibilities.

AI-driven early warning, but with strict privacy limits

By 2026, many companies will use AI tools to detect workplace stress patterns across the organization. Executive-level tools will likely be even more sensitive, because the individual stakes are higher.

Expect “opt-in” models to dominate. Executives will prefer privacy. Boards will prefer assurance. The compromise will be anonymized analytics, third-party data handling, and strong consent frameworks.

However, there is still a tension. A burnout shield works best with early signals. Early signals often require data.

So the 2026 innovation battle will be about trust. The winning platforms will be the ones that feel safe, discreet, and premium.

Crisis simulation becomes a standard add-on

Crisis response is a skill. It can be trained.

In 2026, more insurers and brokers will sell scenario training as part of the policy. Think “fire drills” for reputation events. The goal is calm execution under pressure.

This approach also reduces claims. It is a smart business loop.

D&O and management liability will stay central

Even if a burnout shield is the headline, governance coverage remains the foundation. Scandals often trigger shareholder claims, employment disputes, and regulatory scrutiny.

So Key Person 2.0 frequently sits beside D&O. That is where the legal defense and governance exposure live.

What insurers learned in 2024 and 2025 that will reshape 2026

The last two years pushed insurers to map executive risk in a more realistic way.

Workplace mental health data has been getting more detailed. Organizations like Mind Share Partners emphasize that workplaces that support mental health see less burnout and better retention outcomes. (mindsharepartners)

That creates a measurable business case. It also creates underwriting confidence.

Meanwhile, boardroom risk conversations increasingly include leadership behavior, culture, and reputation. Beazley’s Boardroom Risk reporting has highlighted how executives are navigating a complex risk environment with growing scrutiny. (Beazley)

Additionally, the global risk backdrop is not calming. The World Economic Forum’s Global Risks Report continues to frame misinformation, polarization, and instability as persistent pressures. (World Economic Forum)

Together, these inputs support a single conclusion: leadership volatility is rising, and companies want formal protection.

Predictions for 2026: how “burnout shields” will evolve

The industry is still experimenting. Yet a few outcomes look highly likely.

Prevention will be priced as a premium advantage

In 2026, policies that include credible prevention programs will often have better terms. Underwriters will reward structure.

Executives will accept this, because prevention can feel empowering. It can also feel exclusive. That emotional framing matters. “Elite support” sells.

“Reputation response” will be standardized, not improvised

Crisis PR will become a routine add-on. Legal and security partners will be pre-selected. Social monitoring will be integrated.

This changes the corporate experience. Instead of panic buying help during a crisis, companies will have help on call.

Coverage language will get narrower, but more usable

Insurers will avoid vague promises like “reputation restoration.” They will write specific service triggers: credible threats, viral escalation, media surge, doxxing risk, or required leave.

That makes policies more defensible. It also makes them more practical.

Boards will demand succession plans as a condition

Succession planning can feel political. In 2026, it will feel mandatory.

Key Person 2.0 will reward companies that can show a real interim plan. That includes operational authority, communications authority, and investor relations authority.

The next frontier is parametric triggers, cautiously

Parametric insurance pays when a defined trigger happens. In 2026, some players will explore parametric style triggers for reputation events, like a verified spike in negative media volume.

This will be controversial. It will also be tempting, because it reduces disputes. Still, adoption will be careful and limited.

How to prepare now, before 2026 hits

This topic can feel intimidating. The best response is calm preparation.

First, define what would actually break your company. Is it the CEO being out for 60 days? Is it a scandal that freezes sales? Is it an investor trust crash?

Next, build a continuity plan that is real, not theater. Practice it. Run a tabletop scenario. Include finance, HR, legal, and communications.

Additionally, take mental health support seriously, because it is now both humane and strategic. That does not mean forcing executives into public vulnerability. It means creating private, trusted pathways for help.

Meanwhile, review your insurance stack with a modern lens. Key person coverage, D&O, employment practices, cyber, kidnap and ransom in some profiles, and crisis management services can overlap. The goal is not more paper. The goal is fewer gaps.

Finally, treat reputation as an operational risk. Monitor signals. Train spokespeople. Create clear escalation rules. The best crisis response is the one you rehearsed before you needed it.

The ethical and practical risks of this trend

A burnout shield can be powerful. It can also be misused.

Privacy is the first risk. If executives feel watched, they will resist. Insurers must keep consent clear, and data handling strict.

Stigma is another risk. If burnout becomes an underwriting label, leaders may hide problems. That would be tragic and counterproductive.

Moral hazard is also real. If a leader believes insurance will clean up any mess, standards can slip. Policies must be designed to encourage responsibility, not reward recklessness.

However, the upside remains compelling. A well-designed Key Person 2.0 product can protect jobs, stabilize companies, and support humans at the top when pressure peaks.

Conclusion: 2026 will reward leaders who treat resilience as infrastructure

Executive burnout is not a gossip topic anymore. It is a continuity risk with real costs.

In 2026, the most successful companies will treat leadership resilience like infrastructure. They will insure it. They will support it. They will plan for it.

That shift is not only strategic. It is also deeply human. A thriving leader is a competitive advantage. A protected company is a confident company. In the coming year, that confidence will be priceless.

Sources and References

- WHO: Burn-out in ICD-11

- US DOL: Final Rules on Mental Health Parity

- Mind Share Partners: 2025 Mental Health at Work Report

- Beazley: Boardroom Risk Report 2024

- WTW: UK D&O Insurance Market Update 2024

- Financial Times: ‘Cancel culture’ insurance coverage

- World Economic Forum: Global Risks Report 2025

- WEF Global Risks Report 2025 PDF

- Stanford: Tiny habits and “microsteps” overview