2026 is turning space junk from a background worry into a loud, expensive signal. Satellite collision risk is rising. Regulators are tightening expectations. Insurers are reacting fast. This is a powerful shift for operators, investors, and anyone financing space assets.

The new reality at the end of 2025

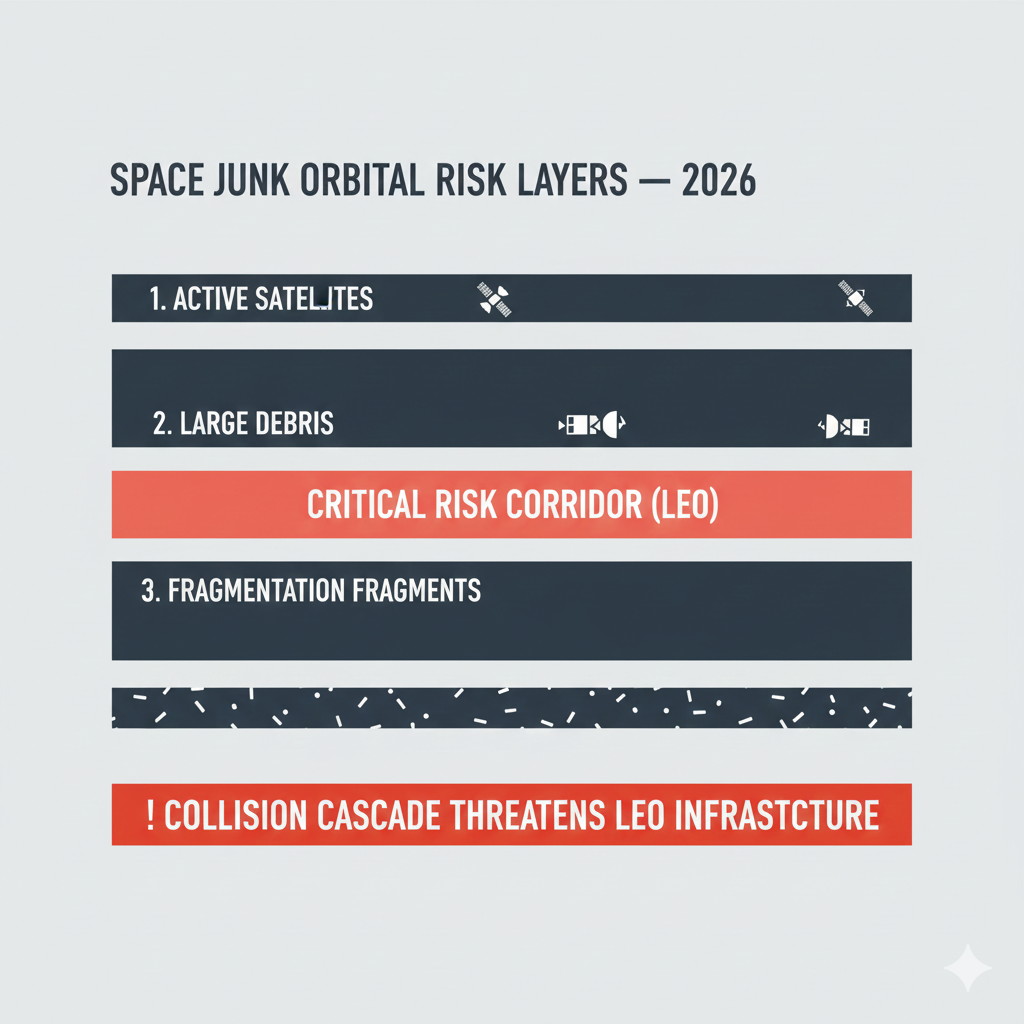

Low Earth orbit is no longer “open sky.” It is busy. It is fast. It is fragile. A single break up can flood a corridor with shards that stay dangerous for years. That is why 2026 is shaping up as the breakout year for “orbital risk pricing.”

Congestion is now a daily operating cost

Most people still picture space as empty. Operators do not. Collision avoidance is now routine work, not a rare emergency. Starlink’s own filings show a staggering number of avoidance maneuvers in a short window, which captures how dense the environment has become. (Aerospace America)

Additionally, debris is not just “tiny paint flecks.” It includes dead satellites, rocket bodies, and fragments from past events. NASA’s definition is blunt: orbital debris is any human made object in orbit that no longer serves a useful purpose. (NASA SMA)

Why this matters for insurance

Insurance loves patterns. Space is losing its old pattern. In the older world, risk clustered around launch. In the new world, risk stretches across a satellite’s full life, because traffic is thicker and the odds of a bad conjunction are higher.

Consequently, 2026 is likely to push a deeper split between “insurable” and “hard to insure” operators. That split will be driven by proof. Proof of tracking. Proof of maneuver ability. Proof of end of life disposal. Proof of cybersecurity. Proof of governance.

The “space junk” problem is also a policy problem

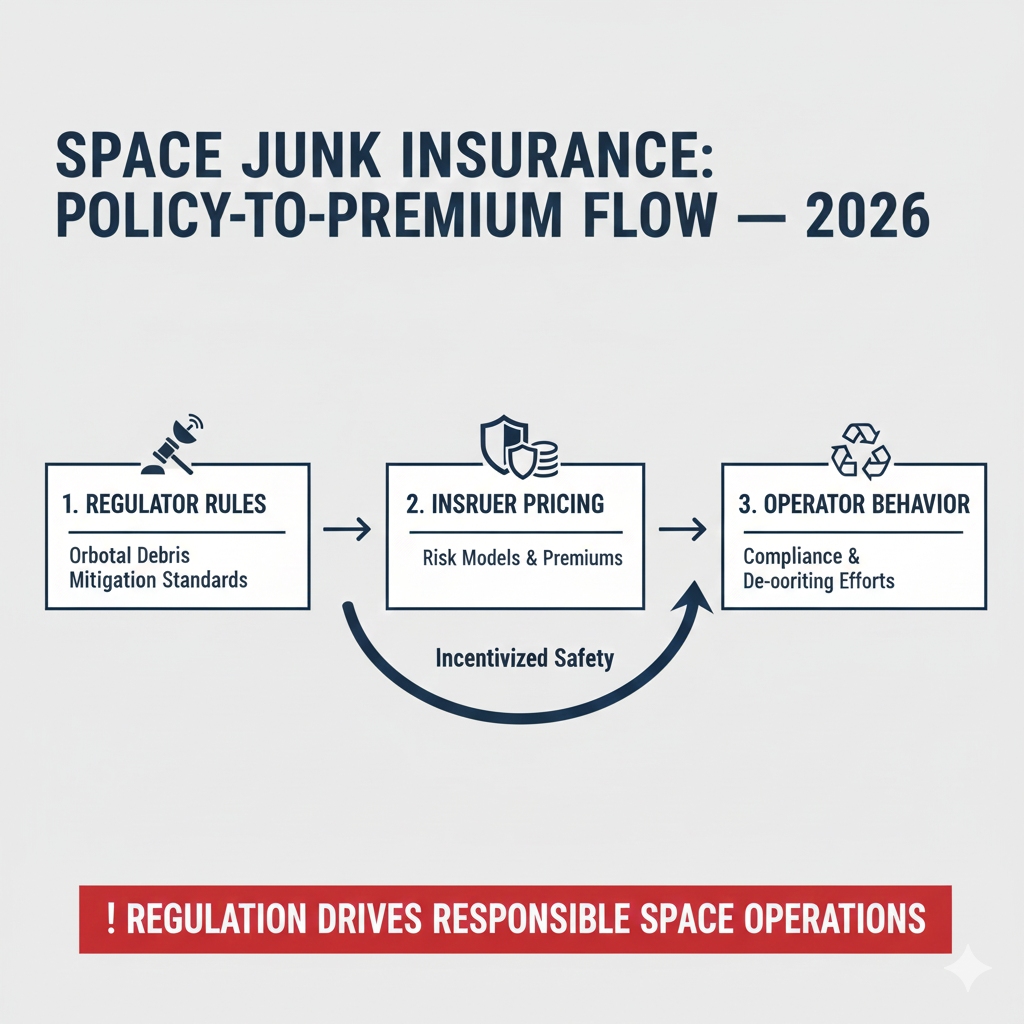

Insurance follows rules. Rules create incentives. Incentives shape behavior. 2026 will be a year where policy choices start to show up in premium quotes.

The short version of the policy shift

For years, many standards were guidelines. Now, major regulators are moving toward enforceable expectations. A clear example is the push to shorten how long satellites can remain in orbit after end of life, replacing the old “25 year” mindset with a stricter approach in key jurisdictions.

Meanwhile, Europe is advancing a major regulatory framework aimed at space safety, congestion, disposal, and resilience. The EU Space Act proposal is designed to harmonize rules and address debris and operational risk at scale. (Reuters)

Why insurers care about “rules that actually bite”

Insurance pricing is not just math. It is also enforceability. If a regulator can punish bad operators, then good operators look safer by comparison. If rules are weak, then everyone is dragged into the same risk pool.

Therefore, 2026 will likely reward operators who can show compliance fast, and punish those who cannot. That reward will show up as coverage availability, deductibles, exclusions, and price.

2026: the boom in specialized commercial space insurance

Space insurance has existed for decades. What is changing is the urgency and the specialization. In 2026, expect more tailored products that price orbital debris risk directly.

What “specialized” means in 2026

Traditional coverage often focuses on phases like pre launch, launch, and in orbit operation. Brokers and carriers describe coverage across those phases, including third party liability, revenue disruption, and other layers. (Aon)

However, the “space junk” era pushes demand for extra features, such as:

More granular in orbit risk modeling

Insurers will lean harder on conjunction data, orbital regimes, and operator behavior. Underwriters will ask sharper questions about tracking sources, maneuver planning, and autonomy.

Additionally, they will care about “fleet behavior,” not just one satellite. Constellations change the risk shape. A swarm can multiply conjunction events. It can also multiply operator discipline, if managed well.

More explicit exclusions and conditions

2026 policies may include conditions linked to disposal timing, passivation, and reporting. The logic is simple. If a satellite becomes a long lived derelict, it becomes a future hazard.

Demand for “proof of good citizenship”

Expect a rise in documentation demands. Insurers will want evidence of compliance processes and verification. In fact, international and agency level work is increasingly focused on compliance assessment and mitigation behavior. (UNOOSA)

The collision risk story is changing fast

A decade ago, many people talked about “Kessler syndrome” like a distant sci fi fear. Now it is discussed as a near term operational threat.

What is really driving risk in 2026

First, the number of active objects in key orbits has surged. Second, the rate of close approaches has exploded. Third, fragmentation events add thousands of new pieces quickly. ESA’s reporting highlights how fragmentation and poor end of life behavior raise collision risk and keep congested orbits dangerous. (Open Innovation Lombardia)

Additionally, high profile constellations are not the only issue. Smaller operators can create large problems if they fail to deorbit, lose control, or stop communicating. That is why insurers will become more selective.

The “reentry tempo” is a signal

It sounds odd, but reentry frequency matters. A high reentry tempo can mean more satellites are being disposed of. It can also mean more failures. ESA notes that intact objects are reentering frequently, and that congested orbits still are not clearing fast enough. (Open Innovation Lombardia)

Therefore, 2026 underwriting will treat reentry and disposal performance as a core variable, not a side note.

What regulations and policies are most likely to matter in 2026

No one can promise the exact legal timeline. But the direction is visible. 2026 will likely be defined by three policy themes: shorter disposal timeframes, stronger coordination, and stricter safety expectations for market access.

Shorter end of life disposal expectations

The “five year” disposal direction is one of the biggest practical shifts, because it changes fleet planning, propellant budgets, and failure tolerance.

Consequently, insurers will ask: can you still deorbit if one subsystem fails? Do you have enough propellant margin? Do you have a reliable passivation plan? Is your disposal strategy realistic for your orbit?

A stronger civil space traffic management push

The United States has been building systems and responsibilities around civil space traffic coordination, with efforts tied to data, standards, and a public facing service model.

However, funding and execution risk also matter. Reporting on budget and program pressure is part of the 2026 backdrop, because it affects how fast services mature.

The EU Space Act and market access leverage

Europe’s plan is big because it aims to apply rules not only to EU systems, but also to non EU companies providing services in the EU market. That creates leverage. It can turn “best practice” into “price of entry.” (Reuters)

Therefore, 2026 could be the year where compliance becomes a competitive weapon, not a paperwork chore.

The insurance market response in 2026

Insurance capacity is not infinite. Underwriters chase profits. Losses change appetites. In space, one major event can reshape pricing for years.

Why insurers are paying closer attention now

Space insurance is often described as low frequency and high severity. That is a fancy way of saying: long quiet periods, then one painful loss. (II London)

Additionally, the risk surface is widening. Reusable launch has changed launch risk. Mega constellations have changed in orbit risk. Cyber risk adds another layer. Interference and jamming create still another.

A key 2026 dynamic: “behavior based” pricing

This is the trend to watch. In 2026, two similar satellites may get very different quotes. The difference will be operational discipline.

Insurers and brokers already highlight risk management specialization for space clients. (Marsh)

Reinsurers also describe full lifecycle coverage, showing how broad the class has become. (Munich Re)

Consequently, the winners will be the operators who make themselves easy to trust. They will show strong processes. They will share data. They will prove they can maneuver. They will prove they can dispose.

Expect more coverage innovation

By 2026, expect more growth in niche products like:

Coverage that blends physical damage with revenue disruption for critical services.

Policies that better price partial failures in large fleets.

Risk sharing models tied to performance milestones.

I am not predicting that every carrier will offer these. But the competitive pressure is building.

The investor angle: orbital risk becomes a financial variable

Investors often model satellite businesses like “infrastructure.” That model breaks if collisions and debris risk are mispriced.

The hidden risk in financial models

Many forecasts assume steady uptime and predictable replacement cycles. Congestion pushes replacement sooner. Failure pushes it sooner still. If insurance becomes expensive or unavailable, cost of capital rises.

Therefore, 2026 may split the market into two narratives:

A “trusted operator” narrative that gets cheaper capital and better coverage.

A “high risk operator” narrative that gets higher premiums and harder financing.

A new theme: “compliance alpha”

In plain terms, compliance can create profit. It can reduce costs. It can unlock customers. It can unlock insurers.

This is why “space junk policy” is not just a government issue. It is an investing signal.

How 2026 policies may reshape contracts and underwriting

2026 will likely bring more contract clauses tied to safety behavior.

More demanding disclosure requirements

Operators may face more pressure to disclose maneuver statistics, failure rates, and disposal plans. The reason is simple. Without shared data, it is hard to coordinate. It is hard to price. It is hard to insure.

Aerospace reporting highlights how massive maneuver volumes have become for the largest fleets, which shows why transparency debates are intensifying. (Aerospace America)

A sharper focus on interference and cyber risk

Space insurance already spans broad risks. But 2026 will likely see tighter scrutiny around cyber, command and control, and interference resilience, because failures here can create debris and third party risk.

Meanwhile, the EU Space Act concept explicitly includes cybersecurity and interference mitigation expectations as part of safety and sustainability. (Reuters)

Liability and cross waiver pressure

Liability is complex in space. It crosses borders. It crosses legal regimes. Insurers dislike ambiguity. Therefore, they may push for cleaner cross waivers, clearer indemnities, and stronger operator responsibilities.

This will not be uniform. But the direction is consistent.

The “space junk policy” that may surprise people in 2026

Some policy tools are moving from theory toward real debate. These tools could reshape the market faster than new rockets ever could.

Orbital usage fees and congestion pricing

The idea is simple. If you occupy a crowded orbit, you pay. The goal is to discourage irresponsible behavior and fund debris management.

I cannot confirm which jurisdiction will implement this first. But debate is rising, and it is likely to intensify as congestion grows.

Mandatory “leave no trace” standards

The future may treat space like a protected environment, not a free dump. ESA and international groups already emphasize prevention and reduced orbit lifetime measures. (Open Innovation Lombardia)

Consequently, 2026 may be the year when “leave no trace” becomes a serious procurement requirement for commercial customers, not just a slogan.

Active debris removal economics

Active debris removal has struggled with the business case. But insurance pressure can change that. If insurers offer better terms when removal options exist, a market can form.

This is not guaranteed. Still, 2026 is the right year to watch pilots, partnerships, and bundled services.

Preparing for 2026: a practical playbook for operators

This is where the money is. This is where the pain is avoided. Preparation is not just technical. It is operational, legal, and financial.

Make your satellite “insurer friendly”

Start with maneuver credibility. If you cannot maneuver, you must have an exceptional disposal strategy and risk posture. If you can maneuver, prove it.

Additionally, build redundancy into disposal capability. A disposal plan that depends on one fragile component is a premium magnet.

Treat compliance like a product feature

In 2026, compliance will help you sell. It will help you finance. It will help you insure. Put it in your customer narrative.

However, do not oversell. Insurers and regulators will demand real evidence.

Create a clean data trail

Insurers will ask for documentation. Investors will ask for documentation. Regulators will ask for documentation.

Therefore, build a standard set of artifacts: disposal plan, passivation plan, conjunction handling process, anomaly response procedure, and cyber controls for command links.

Expect tighter underwriting questions

Brokers already outline major coverage types across the satellite lifecycle. (Aon)

In 2026, the key difference will be deeper questions about orbital behavior and disposal proof.

Preparing for 2026: a practical lens for buyers and investors

If you are investing in a satellite company, or buying satellite services, you will want to ask sharper questions.

Ask about maneuver workload and governance

High maneuver counts can mean heavy congestion. They can also mean good discipline. The difference is governance.

Therefore, ask: who approves maneuvers? How fast can they respond? Is collision avoidance automated? How do they handle false alarms?

Ask about end of life funding

Disposal is not free. It requires fuel, time, and attention. In 2026, a company that underfunds disposal is a company that invites insurance pain.

Ask about market access risk

If you sell services into Europe, EU rules could become a binding factor. (Reuters)

If you operate under US licensing, disposal expectations are tightening.

Consequently, market access becomes a risk line item, not a footnote.

The 2026 forecast: what to expect next year

Here is the most likely shape of 2026, based on the trends visible in late 2025.

A premium shock for weak operators

Expect higher prices, more exclusions, and stricter deductibles for operators with poor disposal credibility. Expect more reluctance to cover high risk constellations without strong evidence.

A “trusted operator” advantage

Operators who can show discipline may gain a real advantage. They may win customers. They may win financing. They may get better insurance terms.

More policy momentum, even if uneven

The EU is moving. (Reuters)

The US is building civil traffic capability.

International guidelines continue to evolve and compliance tracking is growing. (UNOOSA)

However, global coordination will still lag demand. That gap itself is a 2026 risk driver.

A larger debate about who pays for cleanup

This debate will become louder. It will influence insurers. It will influence regulators. It will influence procurement decisions by large buyers.

Conclusion: space junk is now an insurance story

For years, space junk felt like an engineering problem. In 2026, it becomes a pricing problem. It becomes a financing problem. It becomes a policy problem. It also becomes a competitive advantage for operators who prepare with discipline.

If you remember one idea, make it this: in 2026, “orbital behavior” will be underwritten like credit. The market will reward proof. The market will punish hope.

Sources and References

- NASA: Orbital Debris overview

- ESA Space Environment Report 2025 coverage and highlights

- FCC move toward a five-year deorbit standard (paper)

- EU Space Act overview (Reuters)

- IADC Space Debris Mitigation Guidelines Rev 4 (PDF)

- IADC Report on the Status of the Space Debris Environment (UNOOSA PDF)

- AIAA Aerospace America: “Heavy traffic ahead” (Starlink maneuver stats)

- Lloyd’s: Space class of business

- Aon International Space Brokers: coverage types

- Marsh: Space and Satellite Insurance