In 2026, “pocket family office” tools bring powerful, secure tax and trust workflows to more investors, with AI-driven coordination, clearer compliance, and faster decisions.

A quiet revolution hiding in plain sight

A real family office is not just “wealth management.” It is logistics for money, taxes, entities, documents, and decisions. It is the constant, careful work that keeps a complex life from turning into expensive chaos. For decades, that work stayed behind closed doors. It lived in binders, private emails, and small teams of specialists. It also carried a brutal price tag. That is why the label “family office” often starts at eight figures of net worth and quickly climbs.

However, something meaningful changed in 2024 and 2025. Complexity went mainstream. More people held multiple income streams. Side businesses became common. Remote work blurred borders. Digital assets, private markets, and global bank accounts became easier to access. Meanwhile, interest rates and volatility made mistakes feel more painful. In that environment, the old “one advisor and a spreadsheet” model began to crack.

As we look into 2026, a new idea is gaining confident momentum. You do not hire a full family office first. You download one. Or you subscribe. Or you plug it into your existing bank and advisor stack. The result is not a perfect replacement for a human team. It is something more practical. It is a “family office operating system” that handles the repetitive work and highlights the risky gaps.

This is where the phrase “pocket family office” becomes more than hype. It describes software that can coordinate tasks across taxes, entities, trusts, insurance, reporting, cybersecurity, and investment administration. It also hints at a deeper shift in pricing. The trend is usage-based. You pay for what you use. You pay for what you activate. You pay for what changes. That model is emotionally attractive in a world that feels financially unpredictable.

Additionally, the name “Ray Dalio” belongs in this conversation, even if the products are not “his.” Dalio is famous for turning messy decisions into a system. That mindset fits the moment. A pocket family office is essentially an attempt to encode rules, checks, and priorities into software. It is a disciplined approach to financial life. It promises control, clarity, and calm.

[YouTube Video]: Ray Dalio’s “Principles for Success” is a sharp primer on building decision systems, which is exactly what the best pocket family office tools try to automate.

Why 2026 is the tipping year

The demand side: more wealth, more complexity, more anxiety

In 2026, more households will feel like mini-companies. Income can come from salary, consulting, content, dividends, rentals, and small businesses. Assets can sit in retirement accounts, brokerage accounts, crypto wallets, employee stock plans, and private deals. Taxes can touch multiple jurisdictions. Estate planning can involve blended families and fast-changing life goals.

Consequently, the “hidden workload” grows. You must track documents. You must know which entity owns what. You must update beneficiaries. You must prove funds are clean. You must monitor cyber risk. You must reconcile statements. You must stay ready for audits. In the old world, this was handled by a staff. In the new world, it is handled by systems.

The supply side: AI turns advice into software

Generative AI did not simply create chatbots. It created a new interface for complex workflows. In 2026, the strongest products will not just answer questions. They will complete tasks. They will draft letters, collect forms, categorize transactions, and prepare review packs for professionals. They will also monitor deadlines and alert you before mistakes become costly.

Meanwhile, the “agentic” trend will mature. You will see tools that can plan a workflow, execute it across apps, and request human approval at key points. This is the missing link. A pocket family office is not a single app. It is orchestration across many tools.

The trust factor: regulation pushes better governance

Ironically, regulation may accelerate adoption. New rules often feel annoying. Yet they can force stronger identity checks, better record keeping, and safer data handling. That creates a more trustworthy ecosystem. In 2026, financial software will be pressured to prove compliance, especially around AI governance and cross-border data.

For example, the EU AI Act sets a structured framework for AI risk and compliance, with obligations that phase in over time. Firms offering AI-driven services in the EU will have to pay closer attention to controls, documentation, and prohibited practices.

What a “pocket family office” actually includes

The data spine: one view of everything that matters

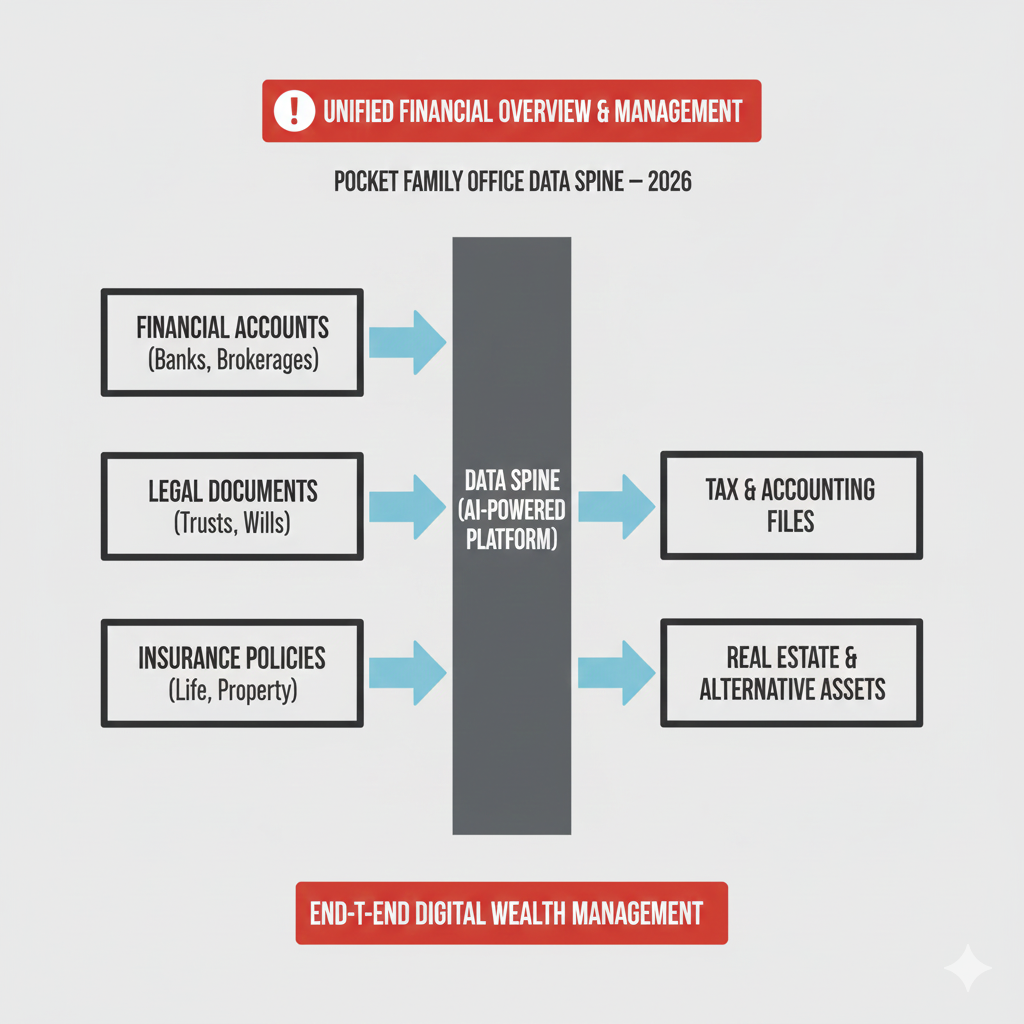

At the center is a clean, unified data layer. It pulls from banks, brokerages, credit cards, payroll systems, tax records, and document vaults. It also maps entities. That includes LLCs, holding companies, trusts, and foundations. The mapping is not cosmetic. It is essential. Without it, you cannot know who owns what, or why a transaction happened.

Moreover, the best systems build a “life ledger.” That ledger is not only money. It is beneficiaries, insurance policies, wills, trust deeds, property titles, cap tables, and key contracts. In 2026, that document intelligence becomes a competitive advantage. AI can read, tag, summarize, and surface risks. Humans still sign and decide. Software handles the tedious scanning.

The workflow engine: turning complexity into checklists that run

A real family office runs on workflows. A pocket version does the same. It schedules tasks and pushes them to the right person. It requests signatures. It logs evidence. It stores audit trails. It generates a monthly reporting pack. It also handles “events,” like selling a business, buying a home, having a child, or moving countries.

Additionally, the system becomes a bridge between you and professionals. In 2026, accountants and attorneys will increasingly expect structured data, not messy emails. The pocket family office can generate “review-ready” exports that are easier to validate. This reduces friction and can reduce fees.

The decision layer: financial intelligence that feels personal

This is where “AI” becomes real value. The software models scenarios. It can forecast taxes under different choices. It can show how a trust distribution affects future liabilities. It can stress-test liquidity. It can flag concentration risk. It can also prompt you with uncomfortable truths, like “you are underinsured,” or “your beneficiaries are outdated,” or “this entity has missing filings.”

However, in 2026, the smartest tools will be humble. They will not promise magic. They will explain assumptions. They will show you what changed. They will ask for confirmation. That transparency is critical. A false sense of confidence is dangerous.

The tax-and-trust stack is the real battleground

“Loopholes” versus legal planning: why words matter

The phrase “tax loophole” sounds thrilling. It also sounds risky. Most serious planners avoid that language. They talk about deductions, credits, timing, entity selection, and compliance strategies. The core idea is not to hide income. The goal is to structure life in a legal, documented way that matches the rules.

In 2026, software will automate more of that structure. It will also raise new questions. If AI suggests a strategy, who is responsible? If the strategy is wrong, who pays? The answer will be human accountability. The tool can guide. You still own the outcome. That is why trusted products will build clear disclaimers, audit trails, and professional handoffs.

Trust structures become a mainstream coordination tool

Trusts are not only for billionaires. They are used for minors, special needs planning, asset protection in certain contexts, charitable goals, and orderly inheritance. In 2026, the trend is not “more tricks.” The trend is “more coordination.” People want smoother transitions. They want fewer family disputes. They want less probate stress. They want privacy and control.

Consequently, tools that simplify trust administration, beneficiary updates, and document control will grow. Some of this work is surprisingly repetitive. It is notices, distributions, records, valuations, and compliance steps. AI can help draft and organize. It cannot replace legal judgment. Yet it can shrink the operational burden.

Continuous tax awareness replaces annual panic

Many people still treat taxes as a once-a-year emergency. That is expensive. It also invites mistakes. In 2026, the best pocket family office tools push a different habit. They keep a rolling estimate of tax exposure. They flag unusual transactions. They suggest document collection early. They also integrate with spending and investing decisions.

Meanwhile, regulators are increasing reporting expectations for digital assets and cross-border flows. In Europe, DAC8 sets new reporting rules for crypto-asset service providers, with the directive entering into force in 2026 and applying from 2026 onward. (AI Act Service Desk) That matters because your “family office stack” must understand crypto, even if you do not consider yourself a crypto person.

[YouTube Video]: This longer conversation with Ray Dalio is useful for understanding macro risk, cycles, and why structured decision-making matters when managing complex wealth.

2026 predictions: what changes in the product experience

The family office becomes an “always-on” monitor

Today, many tools are reactive. You open them when you need them. In 2026, the model shifts to monitoring. The software watches for triggers: a large transfer, a new account, a policy renewal, a suspicious login, a change in tax law that hits your profile, or a deadline that is approaching.

Additionally, expect more “explainable alerts.” Instead of vague warnings, you will see clear reasons. “Your cash buffer fell below your target.” “Your entity’s annual filing window is closing.” “A new data-sharing fee policy may affect your account aggregation.” That clarity feels empowering.

Agentic workflows, but with tighter controls

The scary version of AI is a bot moving money without you. The credible version is different. In 2026, the winning design is “human-in-the-loop by default.” The tool drafts. The tool prepares. The tool proposes. Then it waits for approval.

However, you will still see competitive pressure to automate more. Banks and fintechs want stickiness. They also want lower support costs. That creates a tension. The products that earn trust will use staged permissions. Read-only first. Then limited actions. Then broader actions, only after strong authentication and clear logs.

Usage-based pricing becomes normal for premium complexity

The term “usage-based everything” fits well here. In 2026, many platforms will stop selling a single expensive subscription. They will sell modules. You might pay a base fee for aggregation and reporting. Then you pay per additional entity. You pay for trust administration workflows. You pay for advanced tax modeling. You pay for private asset reporting. You pay for cyber protection monitoring.

Consequently, the software can reach smaller clients while still serving ultra-wealthy families. That is the commercial unlock. It is also emotionally appealing. People like paying for value they can see.

Tokenized assets and 24/7 settlement reshape reporting

Even if you do not trade tokens, tokenization is pushing a broader shift. Money market funds, treasuries, and other instruments are being tokenized for faster settlement and tighter collateral workflows. In 2026, reporting tools will have to ingest these assets and explain them in plain language. As mainstream finance experiments with tokenization, wealthy investors will see new custody and record-keeping patterns. (Investopedia)

Moreover, this amplifies the need for a unified ledger. If assets move across chains, banks, and brokers, your reporting must keep up. A pocket family office is positioned as the “system of record.”

Regulation and policy: the 2026 guardrails that matter

AI governance moves from “nice to have” to required

In 2026, AI compliance is no longer optional, especially for firms operating in Europe. The EU AI Act creates categories of risk and expectations around transparency, controls, and prohibited uses. Firms offering AI-driven financial services will need to align product design and documentation accordingly.

Additionally, expect more internal governance in banks and insurers. Model risk management will expand beyond credit models. It will cover generative systems, data lineage, and human oversight. This makes AI products slower to ship, but more dependable.

Crypto reporting becomes harder to ignore

DAC8 is not a niche policy. It is a signal. Governments want better visibility into crypto-asset transactions. In 2026, reporting obligations in Europe expand through DAC8, and many jurisdictions follow similar directions through OECD frameworks. (AI Act Service Desk)

Consequently, pocket family office products will compete on crypto tax and reporting clarity. The “winner” is the product that reduces stress. It shows what you hold. It shows cost basis logic. It shows likely tax impact. It also stores proof.

Open banking stays powerful, but politics and fees create noise

Account aggregation is the heart of these tools. Yet open banking policy remains contested. In the United States, the CFPB’s Personal Financial Data Rights rule under Section 1033 has faced legal and political turbulence, with reconsideration activity documented in the Federal Register. (Federal Register) A Reuters report in December 2025 also highlighted the agency’s plan for an interim final rule and broader revisions amid funding pressure. (Reuters)

Meanwhile, Europe continues to evolve payment and data frameworks through PSD3 and the PSR discussions. (European Commission) For a pocket family office, this matters because data access is oxygen. If data becomes expensive or restricted, product pricing and reliability shift.

Beneficial ownership and AML: the compliance story changes quickly

Many people expected beneficial ownership reporting to become a major ongoing burden. Yet reality can shift. In the U.S., FinCEN’s own notice states that domestic reporting companies and U.S. persons are exempt from BOI reporting requirements as of March 2025.

However, AML expectations still rise in practice. Banks ask more questions. Payment platforms tighten onboarding. Cross-border transfers receive more scrutiny. The pocket family office that wins in 2026 will not fight this. It will help you document sources of funds, store evidence, and respond quickly.

Cybersecurity becomes personal, not technical

The new threat model: your financial life is a target

As these platforms centralize more data, they become a tempting target. That sounds scary, and it is. Yet centralization also allows stronger security investment. A single platform can deploy professional-grade defenses that most individuals cannot build.

Additionally, identity is shifting fast. Passkeys, device-based authentication, and biometrics reduce password risk. In 2026, premium products will expect hardware-backed authentication. They will also log every sensitive action. Auditability becomes a selling point, not a boring feature.

Model risk is the silent cybersecurity issue

AI introduces a special risk. It can leak sensitive data through prompts, logs, or integrations. It can also hallucinate. In a pocket family office, hallucination is not funny. It is dangerous. That is why the best tools in 2026 will isolate client data, minimize retention, and provide clear boundaries on what the AI can access.

Consequently, procurement becomes more serious. Even individual clients will ask questions that used to be enterprise-only. Where is the data stored? How long is it retained? Who can access it? Is it used to train models? How does the vendor handle incident response?

“Trust” becomes the product, not a marketing slogan

In 2026, slick UI will not be enough. The winning platforms will feel boring in the best way. They will feel stable. They will feel predictable. They will feel verified. Clients will pay for that calm. They will also pay for clear guarantees, clear controls, and clear accountability.

Who benefits, and who gets disrupted

Banks: threatened, but also perfectly positioned

Banks already hold much of the data. They also hold the customer relationship. That gives them an advantage. Yet banks move slowly. Fintechs move fast. In 2026, expect more partnerships. Banks will embed third-party modules. Fintechs will rely on banks for custody. The pocket family office becomes a layer above both.

Accountants and lawyers: less grunt work, more judgment

Some professionals fear automation. The healthier view is leverage. In 2026, software will reduce the low-value tasks. It will generate drafts. It will organize evidence. That frees professionals to focus on strategy, interpretation, and risk. It also pushes them to justify fees with real expertise.

However, there is a hard truth. Some work will vanish. Simple filings and basic document prep become cheaper. The professionals who thrive will specialize and integrate into these platforms.

Consumers: more power, but also more responsibility

A pocket family office can feel liberating. It can also create overconfidence. Software can suggest. It can model. It can flag. Yet life is messy. The human must still decide. In 2026, financial literacy matters more, not less. The good news is that the best tools teach while they help.

How to prepare now for 2026’s pocket family office era

Start with your “financial inventory,” not a new app

Before you pick software, get your basics in order. Gather your accounts. Gather your key documents. List your entities. Write down your goals. If you cannot describe your structure, software will not magically fix it. It will only mirror confusion.

Additionally, decide what you want to automate. Do you want reporting and organization only? Do you want planning support? Do you want workflow coordination with professionals? The answer guides the product choice.

Treat the first 30 days as a data cleanup sprint

In the first month, focus on accuracy. Link accounts. Fix duplicates. Tag transactions. Upload documents. Confirm entity ownership. Set beneficiaries. Create a consistent naming system. This part feels tedious, but it is the foundation of everything else.

Meanwhile, test alerts. If the platform sends too many, tune them. If it sends too few, tighten thresholds. The goal is signal, not noise.

Add modules only after trust is earned

The smart move is gradual adoption. Start with read-only aggregation. Then enable document workflows. Then add tax forecasting. Then connect professionals. Finally, consider any action features, like approvals and execution flows.

[YouTube Video]: A practical overview of online estate planning and trust basics. It is useful context for why trust workflows are moving into mainstream software.

Build a “governance habit” that keeps you safe

In 2026, governance is not only for corporations. Individuals need it too. Set a monthly review meeting with yourself. Check beneficiaries. Review account access. Rotate keys if needed. Confirm your document vault is complete. Export a quarterly report pack for your accountant. This habit feels small. It is quietly powerful.

Consequently, you reduce the chance of surprise. Surprise is what destroys wealth. Calm preparation is what preserves it.

The bottom line for 2026

The pocket family office is not a fantasy. It is an emerging category. It is driven by real pain and real innovation. In 2026, you will see sharper products, clearer regulation, stronger security expectations, and more modular pricing. Some people will call it a luxury. Others will call it essential.

However you label it, the direction is clear. The logic of the ultra-wealthy is becoming software. Not perfectly. Not instantly. Yet undeniably.

The winners will be the platforms that deliver verified clarity without reckless automation. The losers will be the ones that oversell, under-secure, or ignore regulation. For users, the opportunity is thrilling. You can gain structure and confidence without hiring a small staff. At the same time, you must stay alert. Convenience always carries risk.

In 2026, the most valuable feeling in finance may be simple. It is not greed. It is not hype. It is control.

Sources and References

- EU AI Act text and timeline (EUR-Lex)

- EU Council: DAC8 adopted and key dates

- FinCEN: BOI reporting exemption notice (March 2025)

- Federal Register: Personal Financial Data Rights reconsideration

- Reuters: CFPB open banking interim rule plans (Dec 2025)

- European Commission Q&A: revised rules on payment services (PSD3/PSR context)

- Investopedia: tokenized money market funds and major institutions

- Thomson Reuters Institute: GenAI and the future of tax and accounting

- OECD: Crypto-Asset Reporting Framework (CARF) overview

- NIST AI Risk Management Framework (AI RMF)