In 2026, home equity “un-loans” promise cash with no monthly payments. See the exciting upside, the brutal trade-offs, and the new rules likely next.

In late 2025, American homeowners are living in a new reality. The era of ultra-cheap money is gone. Mortgage rates are no longer anchored near the 2020 lows, and every decision around borrowing feels heavier. A cash-out refinance can look painful. A HELOC can look risky. Even a plain home equity loan can feel like signing up for years of expensive payments.

Meanwhile, a different pitch is spreading fast, and it sounds almost too smooth. You can get a large lump of cash today without taking on a traditional loan. You make no monthly payments. You do not refinance your first mortgage. Instead, you sell a slice of your home’s future price growth to an investor. When you sell the home, or when you buy the investor out later, that investor receives their share.

That product is usually called a Home Equity Investment, sometimes a Home Equity Agreement, and sometimes a Home Equity Contract. In this piece, I’ll call it HEI, the “un-loan,” because that framing explains why people are curious. It is not debt in the normal sense. It is not free money either. It is a bold trade between present comfort and future upside.

This matters for 2026 because the market pressure behind it is not fading. If rates stay higher than the last cycle, demand for alternatives will keep climbing. Regulators will respond. Investors will get smarter. Product design will evolve quickly. Consumers will face sharper choices, and more traps if they do not read the fine print.

However, the real story is not only about a clever new contract. The deeper story is about how Americans now treat their homes. For decades, home equity was a quiet safety net. Now it is becoming a liquid asset class, sliced, priced, and sold in pieces. That shift could feel empowering. It could also feel predatory if the rules are weak.

The Rate Shock That Made “Un-Loans” Feel Inevitable

In the 2020 world, the home equity playbook was simple. Rates fell, refinancing was easy, and homeowners could roll multiple goals into one cheap mortgage. A family could refinance, renovate, and consolidate debt. The monthly payment often stayed tolerable. That era trained people to think of their home as a friendly ATM.

In the 2024-2025 world, the math is colder. Many homeowners have a low first mortgage rate locked in. They do not want to touch it. They also face higher borrowing costs if they take a second lien. HELOC rates move with the broader rate environment, and the payment can jump. That volatility is emotionally exhausting.

Additionally, there is a psychological issue. A HELOC is debt. Even if it is useful, it feels like another weight. A homeowner who watched prices, insurance premiums, and everyday costs climb can feel squeezed. The last thing they want is a new bill every month.

Therefore, a product that offers cash now with no monthly payments lands like a relief. It feels like breathing room. It feels modern. It feels like software finally found a loophole in the old system.

Yet the biggest driver is still simple. Homeowners are equity-rich and cash-poor. They may have wealth trapped in the walls. They may also have urgent needs. Medical bills, family support, renovations, tuition, business capital, and debt stress all create pressure. If a traditional loan is unattractive, the “sell a fraction of tomorrow” deal becomes tempting.

Why This Is a 2026 Story, Not Just a 2025 Story

In 2026, more households will face this same squeeze. Many borrowers will still be sitting on low first-mortgage rates and will refuse to refinance into a higher rate. At the same time, life expenses will not politely wait for rates to fall.

Meanwhile, investors will keep chasing new ways to earn returns. Home equity is a giant pool of value. If finance can repackage it, someone will. That is the backdrop. That is the energy pushing HEIs forward.

What the Home Equity “Un-Loan” Really Is

A Home Equity Investment is a contract where an investor gives you cash today in exchange for a share of your home’s future value. You do not pay interest each month like a loan. You do not usually pay principal each month either. Instead, the investor gets paid later, typically when you sell the home or when you choose to buy them out.

That sounds clean. However, the details decide whether it becomes a breakthrough tool or a brutal mistake.

In most models, the investor’s return is linked to the home’s appreciation. If the home rises in value, the investor receives more. If the home falls, the investor may receive less, depending on the contract. Some contracts include minimum returns. Some include floors. Some include fees that still hit even if the home does not grow.

Additionally, the contract usually has a term. Common terms range around 10 to 30 years, depending on the product. If you do not sell by the end, you might be required to settle then. That settlement can be a big event.

The HEI Life Cycle in Plain Language

First, you apply. The provider checks your home value, your equity, and your ability to maintain the property. They price the deal based on risk.

Next, you receive a cash amount. You sign an agreement that defines the investor’s share. The share is not always the same as the cash percentage. It is often larger because the investor wants compensation for risk and time.

Later, you either sell the home, refinance, or buy out the investor. The investor gets their share of the new value, plus any fees defined in the contract.

Consequently, the deal is not about interest rates. It is about how much future upside you are willing to give away.

[YouTube Video]: A clear walkthrough of how a Home Equity Investment works, including the “cash now, share later” trade and common contract terms.

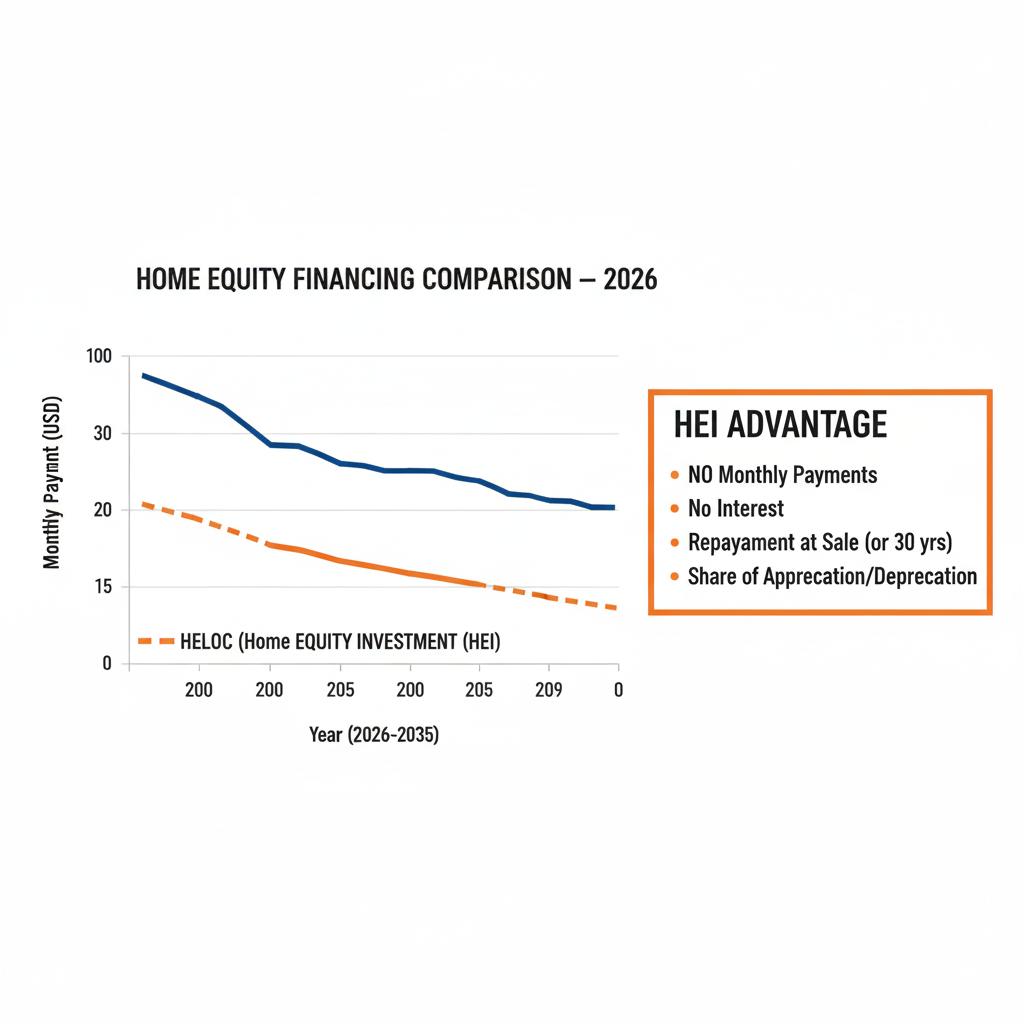

HEI vs HELOC: The Emotional Difference Is Real

A HELOC can be a smart tool. Still, it creates monthly obligations. It can also create payment shocks because rates can change. That uncertainty can feel scary.

An HEI removes the monthly payment, which feels liberating. Yet it replaces that stress with a future cost that is harder to feel today. Humans discount the future. That bias is powerful. It is also dangerous.

Moreover, HEIs can be harder to compare. A loan has an APR. An HEI often does not. That makes shopping tricky. It can feel like a mysterious box.

Why Investors Love This Model

From the investor’s view, HEIs offer a rare promise. They give exposure to residential real estate appreciation without owning the property directly. The investor does not manage tenants. They do not fix roofs. They do not handle property taxes. They simply wait for the value change.

That is a seductive concept. It feels scalable. It feels like a next-generation asset class.

Additionally, data makes it easier. Property value models, neighborhood analytics, climate risk scoring, and transaction databases help investors price risk. As underwriting becomes more automated, the deal becomes faster.

Meanwhile, large pools of capital are always hunting for assets that can be packaged and sold. If HEI portfolios can be standardized, they can be securitized. That means more investor demand. That means more consumer offers. That means more market heat.

However, securitization also creates pressure. When money floods into a product, sales tactics can get aggressive. Fees can hide. Disclosures can weaken. That is why 2026 is likely to become a regulatory turning point.

The Silicon Valley Angle Without the Hype

The “software will eat finance” storyline is not new. It is also not wrong. Automating contracts, risk scoring, and funding pipelines can reduce friction. It can expand access. It can cut costs.

Yet real life is messy. Homes are emotional. Families are unpredictable. Job losses happen. Divorces happen. Health crises happen. A contract that looks elegant in a deck can become painful in a kitchen.

Therefore, the optimistic story needs guardrails. If those guardrails do not arrive, the backlash will arrive instead.

The Hidden Costs That Decide Whether This Is Genius or Grief

HEIs are often marketed with bright language. “No monthly payments” is the headline. The true price hides in three places: the share percentage, the settlement timing, and the fee structure.

First, the share percentage can be shocking. A homeowner might take cash equal to 10 percent of the home’s value but owe 20 percent of the appreciation, or even a share of the total value change. Each provider structures it differently.

Second, settlement timing matters. If you sell during a hot market, the investor gets paid handsomely. If you hold for decades, the investor can still get a strong return. That can be fine. It can also feel like regret if home prices soar.

Third, fees can be brutal. Some models include origination fees, appraisal fees, and transaction fees. Some also include minimum return features that act like hidden interest.

Additionally, the contract may require you to maintain the home. That sounds reasonable. Yet “maintain” can become a vague standard. If a dispute happens, a homeowner can feel trapped in legal fog.

The Regret Scenario People Underestimate

A homeowner takes $80,000 today. They feel relieved. They pay off credit cards. They renovate. They sleep better.

Then the neighborhood explodes in value. Five years later, the home is worth far more. The homeowner sells, and the investor’s share is far larger than the homeowner emotionally expected.

At that moment, the HEI can feel like giving away a winning lottery ticket. The homeowner may still have benefited. Yet the emotional sting can be intense.

However, the opposite scenario exists too. If the home value falls, an HEI might be less painful than a loan, depending on the structure. That uncertainty is the core gamble.

The “No Monthly Payments” Line Can Be Misread

No monthly payments does not mean no cost. It means the cost is deferred. It means the cost is linked to the future home value. That is a different kind of risk.

Consequently, HEIs can be attractive for cash flow. They can also be punishing for long-term wealth.

The Consumer Protection Storm Building for 2026

In 2026, the biggest shift may not be product adoption. The biggest shift may be standardized disclosure.

Regulators tend to act when three things happen at once. A product grows fast. Complaints rise. Confusion is widespread. HEIs are moving toward that zone.

Additionally, consumer advocates have already raised alarms about complexity and fairness. That pressure is likely to increase as more households use these contracts.

A key issue is classification. Is an HEI a credit product? Is it an investment contract? Is it something else? The answer shapes which rules apply, what disclosures are required, and who supervises marketing claims.

Meanwhile, state regulators may step in faster than federal regulators. States often act first when consumer harm appears locally.

Therefore, 2026 could bring several changes that reshape the market.

What New Rules Might Look Like Next Year

One likely development is a standardized “APR-like” metric. Even if HEIs are not loans, consumers need a simple way to compare offers. A single, mandatory “effective cost range” could appear.

Another likely development is stronger cooling-off protections. A homeowner might be given a longer period to cancel after signing. That is common in products with high regret risk.

Additionally, regulators may demand clearer language about worst-case outcomes. Marketing may be forced to show scenarios. If home prices rise 30 percent, what do you pay? If they rise 60 percent, what happens? That kind of scenario disclosure could become mandatory.

Moreover, data use will be scrutinized. Underwriting is increasingly driven by property data and personal data. Privacy rules are tightening globally. The more intimate the data, the stronger the backlash when it is misused.

[YouTube Video]: A caution-focused discussion of HEIs and HEAs, including why disclosures and “effective cost” comparisons matter for real families.

The 2026 Product Evolution: Where HEIs Are Headed Next

The 2025 version of the HEI market is still fragmented. Terms vary widely. Pricing is inconsistent. Consumer understanding is low.

In 2026, expect consolidation and refinement. Big capital prefers standardization. Regulators prefer standardization too. That combination can be powerful.

Faster Underwriting and “Instant Equity Offers”

In the next wave, HEI offers will become faster. Automated valuation models are improving. Property data is richer. Identity verification is smoother. That reduces friction. It also makes impulse decisions easier, which is not always good.

Additionally, HEIs could become embedded in other platforms. Mortgage servicers may offer them as an option to struggling homeowners. Real estate apps may present them as a “smart liquidity” choice. Home improvement platforms may bundle them at checkout.

That is thrilling and dangerous. Convenience sells. Confusion also sells.

Dynamic Pricing That Feels Like Insurance Underwriting

Pricing may become more personalized. Climate risk scores, local liquidity, employment trends, and even renovation permit history can affect terms. That means two neighbors might get radically different deals.

Moreover, AI systems will get better at predicting who will sell soon. That matters because investor returns depend heavily on timing. If the model thinks you will sell in five years, it will price the deal differently than if it thinks you will stay for twenty.

Consequently, the market could quietly become more unequal. People with stable profiles may get better terms. People under pressure may get harsher terms. That is where consumer protection becomes vital.

Securitization and the “Wall Street Amplifier”

If HEI contracts are pooled and sold to investors, funding can scale quickly. That can lower costs. It can also create volume pressure.

When volume pressure rises, sales teams chase targets. When targets become aggressive, bad deals spread. That cycle is familiar in finance history. It is also avoidable if rules and transparency keep up.

Who Uses HEIs and Why the Demand Will Rise in 2026

HEIs are not only for desperate borrowers. They are also used by homeowners who want flexibility. Some want renovation cash without a new payment. Some want to start a business. Some want to diversify wealth away from a single property.

However, the highest-risk group is the group that feels cornered. If someone is using an HEI to patch chronic budget problems, the future cost can worsen long-term stability.

Additionally, homeowners in fast-growing markets face a sharper trade-off. If you believe your home will appreciate strongly, giving away appreciation is expensive. If you believe your market is flat, the trade can look fairer.

Meanwhile, older homeowners may consider HEIs as an alternative to other equity-tapping tools. That comparison can be complex, and it depends on contract structure.

Therefore, the right question is not “Is an HEI good?” The right question is “What problem am I solving, and what future upside am I trading away?”

The Emotional Trap: Relief Now, Regret Later

Relief is powerful. It can feel lifesaving. It can also make people sign fast.

A strong 2026 trend will be “liquidity at the speed of need.” That is a broader consumer finance trend. It shows up in paycheck advances, embedded lending, and instant approvals. HEIs will ride that wave.

Consequently, education becomes essential. The market will not slow down to protect consumers. Consumers must slow themselves down.

How to Evaluate an HEI Like a Calm Professional

This is not financial advice. It is a practical framework for thinking clearly.

Start with your timeline. If you might sell in a few years, the investor return could be large. If you plan to stay long, the cost might still be large if the market rises over time. Timing matters.

Next, model scenarios. Imagine three futures: flat prices, moderate growth, and strong growth. Ask what you pay in each. If the provider does not give clear numbers, treat that as a red flag.

Additionally, examine fees. Fees are real money. Fees are guaranteed for the provider. Appreciation is uncertain. When fees are heavy, the homeowner is taking more risk.

Moreover, read settlement triggers. What happens if you refinance? What happens if a divorce forces a sale? What happens if you die and your heirs want to keep the home? Those moments are when fine print becomes brutal.

Finally, check dispute processes. How is the home value determined at settlement? Can you challenge it? Who pays for appraisal disputes? Clarity matters.

The 2026 Forecast: Where This Market Goes Next

So what is likely in 2026?

First, volume grows. High mortgage rates make alternatives attractive. Forecasts suggest rates may ease, but not necessarily return to 2020 extremes. That keeps the “do not refinance” behavior alive.

Second, regulators tighten. If consumer complaints rise, disclosures will improve. Some providers will adapt and become more trusted. Others may fade.

Third, product design matures. Expect more standardized terms, clearer buyout paths, and better scenario tools. Expect more marketing too, and more aggressive competition.

Fourth, reputational battles intensify. Critics will highlight worst-case stories. Supporters will highlight success stories. The truth will remain nuanced.

Meanwhile, the biggest long-term question is cultural. Will Americans accept selling future home appreciation as normal? If yes, the home becomes even more financialized. If no, the backlash could limit growth.

Therefore, 2026 may be the year the “un-loan” either becomes a mainstream tool with strong rules, or becomes a cautionary tale that triggers a reset.

Preparing for 2026: Smart Moves Before You Sign Anything

If you are considering an HEI in 2026, preparation is not complicated. It is disciplined.

Take time. Speed is the enemy of good contracts. Ask for full documents. Ask for clear example scenarios. Compare at least two offers if possible.

Additionally, treat the contract like a partnership you cannot easily escape. Because in a sense, it is. You are inviting an investor into your home’s future. That is intimate.

Moreover, keep your own goals clear. If the cash will fund something productive, that can change the emotional equation. If the cash only delays a budget crisis, the future cost may deepen stress.

Finally, watch for regulatory updates. If 2026 brings stronger disclosures, waiting could improve clarity. That might be worth it.

Conclusion: A Powerful Tool That Needs Honest Light

The Home Equity “Un-Loan” is a striking idea. It speaks to a real need. It also exploits a real bias, the tendency to undervalue future costs.

In a high-rate world, the desire for cash without payments is understandable. The promise feels liberating. The mechanism can be legitimate. Still, legitimacy is not the same as fairness.

However, the best version of this market in 2026 is not a hype machine. It is a transparent market. It is a market where consumers can compare offers easily. It is a market where fees are clear, outcomes are modeled, and worst-case scenarios are not hidden.

If that happens, HEIs could become a useful option in the household finance toolbox. If it does not, the “un-loan” could become the next financial product that burns trust.

Either way, 2026 will be a defining year. The money is flowing. The contracts are spreading. The rules are coming.

Sources and References

- Fannie Mae: Shared Equity Transactions Guide

- Kiplinger: How a HELOC Works

- Kiplinger: HELOC Cost Example and Risks

- Point: Home Equity Investment Overview

- Hometap: Home Equity Investment How It Works

- Unison: HomeOwner Shared Appreciation Model

- National Consumer Law Center: Home Equity Investment Model Clauses

- Forbes Advisor: Mortgage Rate Forecast (context for 2026)

- Fast Company: Zillow 2026 Home Price Forecast (secondary context)