Career staking is heating up. Learn how Income Share Agreements could fund coding bootcamps or pilot training in 2026, plus risks and rules.

As 2025 closes, one idea feels suddenly electric: funding a career pivot the way markets fund a startup. Not with a classic loan, not with a scholarship, but with a contract that acts like a “Human IPO”. You get upfront money for training. In return, you share a slice of future income for a set time.

This is the logic behind Income Share Agreements, often shortened to ISAs. For years, ISAs lived on the edges of bootcamps, alternative colleges, and niche lenders. Now they are re-entering the spotlight, with louder debate, sharper rules, and better technology.

In 2026, the big shift is not just “more ISAs.” The real change is structural. ISAs are becoming a regulated credit product in more places, with stricter disclosure, stronger consumer protection, and more scrutiny around fairness. (Jobs for the Future (JFF))

At the same time, the demand for rapid reskilling is rising fast. Global employers are planning for heavy skill change between 2025 and 2030, driven by AI, digitization, and industry transition. (World Economic Forum) That pressure creates a powerful market story: if your skills can change your earnings quickly, then your future income starts to look like an “asset” someone might finance.

This article looks forward from a December 2025 perspective. It focuses on what is likely to expand in 2026, what rules are coming, what tech will unlock, and how to prepare without getting trapped by a flashy promise.

Why “Human IPO” financing is back in 2026

The comeback is not random. It is built on three forces that reinforce each other.

First, mid-career pivots are no longer rare. People switch fields because of layoffs, AI disruption, burnout, or a desire for better pay. That creates a constant stream of motivated learners. The demand is intense, urgent, and emotional. It also fits the ISA pitch perfectly: “Pay when you earn.”

Second, the old financing model is losing trust. Classic loans are rigid. They feel punishing when outcomes are uncertain. ISAs sell the opposite story. They feel flexible, modern, and humane. That is the seductive part.

Third, the market is starting to treat skills like a measurable signal. Hiring is drifting toward skills-based evaluation, not only degrees. LinkedIn’s research points to the growing use of skills-based hiring as a way to widen talent pools and reduce barriers. (Economic Graph) When the labor market rewards skills more directly, “fund training, share income” becomes easier to justify.

However, there is a serious catch. When a product becomes popular, regulators show up. In the ISA world, that moment is already happening, and 2026 is set to be a pivotal year.

The Alexis Ohanian angle: legitimacy and narrative power

Part of the “Human IPO” buzz is cultural. High-profile tech voices helped sell the idea that education can be funded like venture capital. Alexis Ohanian has been tied to this story for years, including backing models that used income share concepts in tech education. (LinkedIn)

That matters because narratives move markets. When respected founders treat ISAs as a bold, next-generation alternative, the model gains mainstream attention. At the same time, that attention attracts tougher questions about consumer harm, misleading marketing, and the thin line between “outcome-based” and “debt with a cooler name.” (Consumer Financial Protection Bureau)

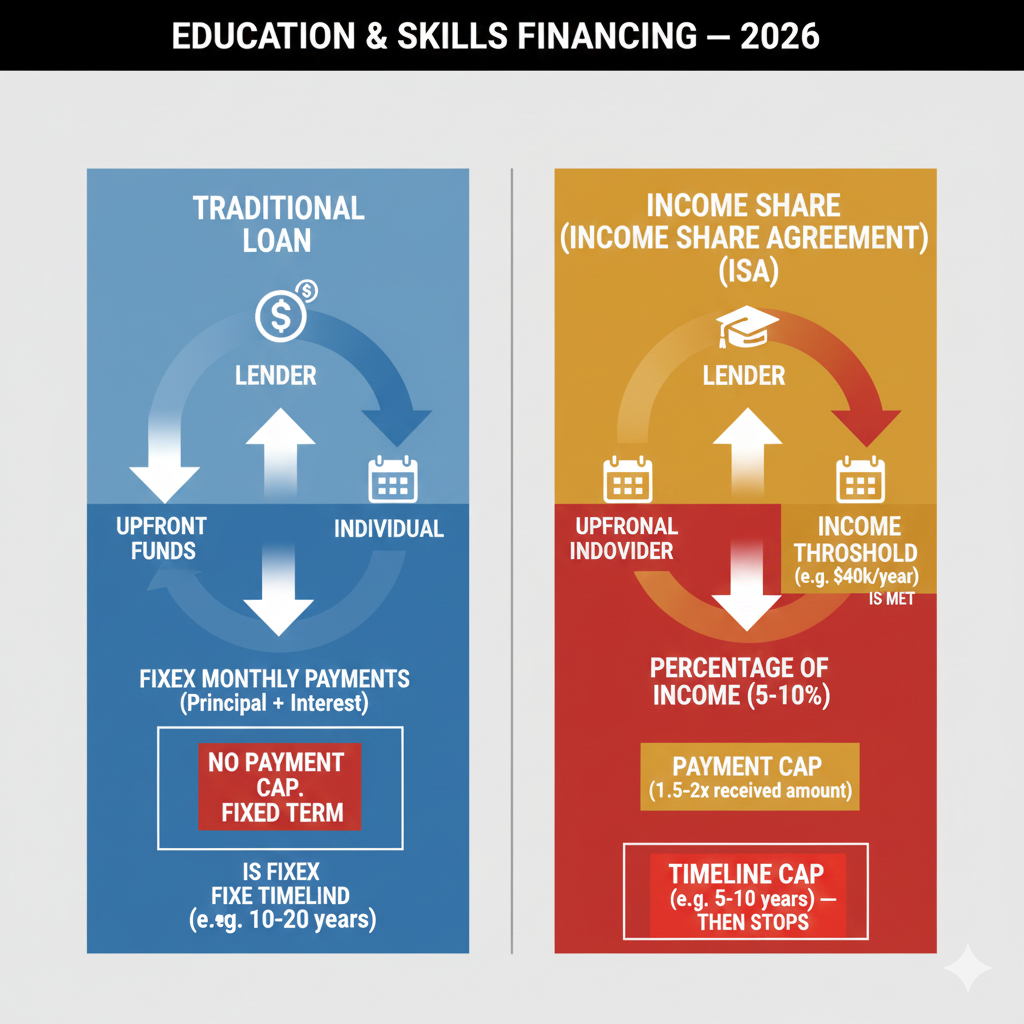

How ISAs actually work, in plain English

At their core, ISAs are simple.

You receive money for tuition or training costs today. Later, if you earn above a threshold, you pay a fixed percentage of income for a set period. Many ISA contracts also use caps. That cap limits the maximum total you can pay.

The emotional appeal is obvious. In the best version, you get breathing room. You also get a sense of shared risk. If your income stays low, payments may pause or fall to zero.

Still, the details can be brutal.

The terms that decide whether an ISA is empowering or predatory

The difference between a thrilling deal and a painful trap often sits in a few contract lines:

Income threshold: If it is low, you pay sooner. If it is high, you get more protection.

Income percentage: A few percent can be manageable. A double-digit share can feel crushing.

Term length: Three years can be tolerable. Longer terms can become draining.

Payment cap: Caps can protect you. Weak caps can turn the contract into a silent profit machine.

Early payoff rules: Some ISAs allow an early buyout. Others penalize it.

Additionally, enforcement and collection practices matter. A “friendly” ISA can turn dark if collections become aggressive or misleading.

This is not theory. U.S. regulators have already taken action against ISA providers for misleading claims and for failures around required disclosures. (Consumer Financial Protection Bureau)

[YouTube Video]: A clear walkthrough of what an Income Share Agreement is, how payments are calculated, and the key fine print to watch.

Consequently, the smartest way to read an ISA is to treat it like a high-stakes credit contract. The branding may feel modern. The obligation is still real.

The regulation story that will shape 2026

If 2024 and 2025 were years of debate, 2026 looks like a year of rule impact.

The most important signal is state-level law. Illinois moved first with a clear regulatory framework for educational income share agreements, signed in August 2025. (The State of Illinois Newsroom) Illinois’ framework explicitly treats an income share agreement as a loan and a debt under the Act’s definitions, which is a major statement about how the product should be viewed. (Illinois General Assembly)

That is bigger than one state. It creates a template. It also creates pressure on other states to respond, either by copying protections or by choosing lighter rules.

Meanwhile, federal enforcement history already set a tone. The CFPB’s action against Better Future Forward highlighted problems like claiming ISAs are not loans, failing to provide required disclosures, and using unlawful prepayment penalties. (Consumer Financial Protection Bureau)

Also, the Prehired case remains a warning sign. The CFPB’s case page describes “income share loans” with high income percentages and long terms, tied to job promises, followed by enforcement and consumer redress. (Consumer Financial Protection Bureau)

The 2026 policy prediction: more “ISA as credit” clarity, and more fights

In 2026, expect more clarity, but also more conflict.

On one side, consumer protection groups will keep pushing for strict disclosure, APR-style comparisons, limits on payment share, limits on term length, and strong rules against deceptive marketing. (Protect Borrowers)

On the other side, some providers will push for special ISA treatment, arguing that ISAs are not classic loans and should have flexible rules to support innovation.

However, a fresh late-2025 signal matters here. Reuters reported that the CFPB said most earned wage advances are not considered consumer loans under federal law, reversing a prior 2024 interpretation. (Reuters) Earned wage access is not the same as an ISA, yet the theme is familiar: what counts as a loan, what needs disclosures, and how strict the regulator will be.

So, the 2026 regulatory landscape may look uneven. State rules could tighten even if some federal interpretations shift. That divergence would be messy, and it could create compliance chaos for ISA providers operating across states.

Why 2026 is a perfect storm for mid-career “pivot finance”

The ISA pitch works best when three things are true.

The training is short and outcome-linked. The job market has high demand. The income jump is meaningful.

In 2026, several career tracks fit that pattern, especially tech roles tied to AI, security, cloud, and data. The World Economic Forum’s Future of Jobs work emphasizes that employers expect major skill disruption and workforce transformation through 2030. (World Economic Forum Reports) That creates urgent reskilling pressure.

Pilot training is another interesting case. It is expensive. It is also attached to a strong long-term demand narrative. Boeing’s Pilot and Technician Outlook projects very large global needs for new aviation personnel over 20 years, including hundreds of thousands of new pilots. (Boeing) Airbus also describes large future needs tied to fleet growth. (Airbus)

Therefore, it is not crazy to imagine a 2026 wave of “career staking” products aimed at aviation training as well as coding bootcamps.

Yet the danger is obvious too. When training is tied to aggressive job promises, the product can turn toxic. The Prehired story shows how powerful marketing plus ISA-like obligations can harm consumers when outcomes do not match the pitch. (Consumer Financial Protection Bureau)

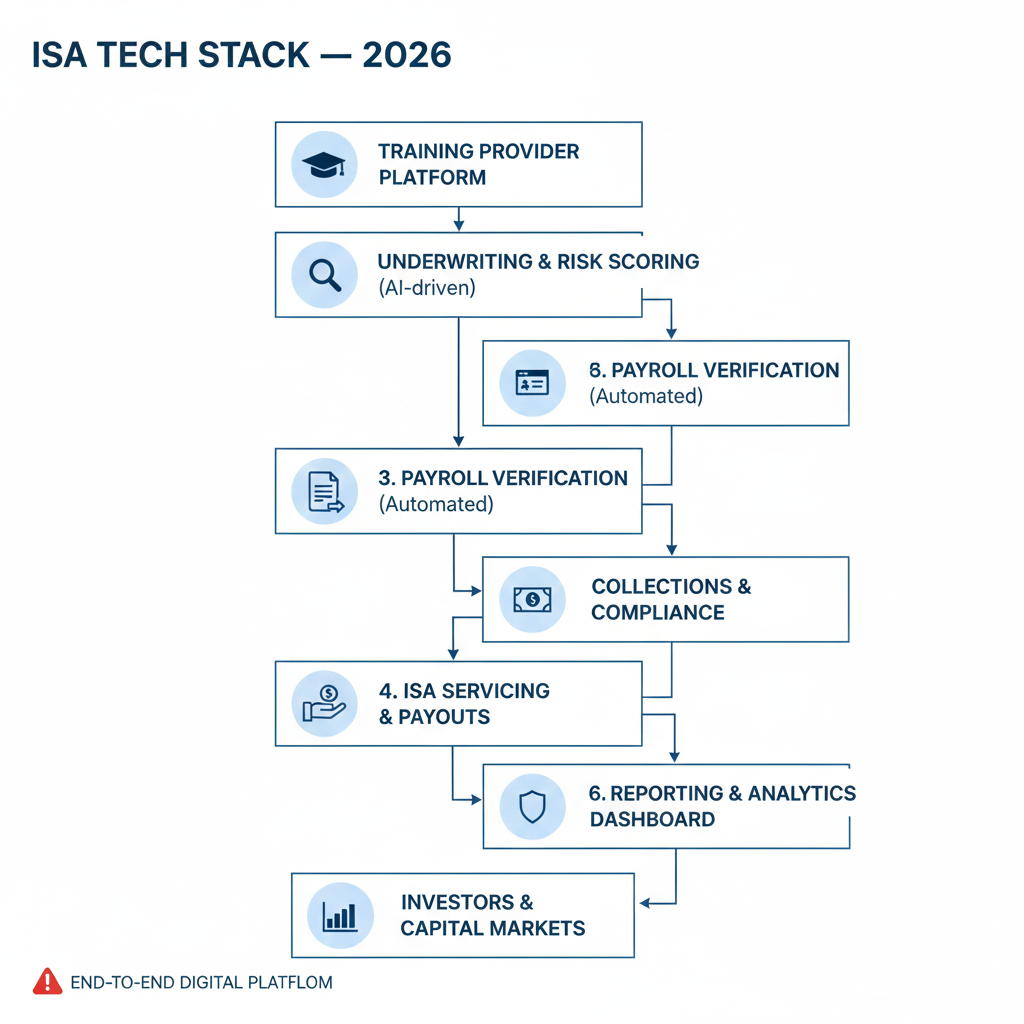

The technology innovations that could explode ISA use in 2026

Old ISAs were clunky. They relied on self-reported income, manual verification, and slow billing. That friction held the market back.

Now, the infrastructure is improving quickly. In 2026, expect ISA products to feel more seamless and more “embedded” inside education and training platforms.

Payroll connectivity and real-time verification

A huge unlock is payroll and income verification APIs. Instead of asking for documents, providers can verify employment and income faster through consumer-permissioned data connections.

Argyle, for example, markets an API for employment and income verification that can be embedded into financial workflows. (Argyle)

This matters because it makes repayment tracking easier. It also makes underwriting sharper. That can reduce defaults and increase investor confidence.

However, it also raises privacy and control concerns. When a lender can track income more easily, the “soft” feeling of an ISA can disappear. It can start to feel like a relentless system.

AI underwriting and pricing in 2026

In 2026, AI will likely become a bigger part of ISA pricing. Providers will claim they can predict outcomes better. They will price the income percentage and cap based on risk. That could make some deals cheaper for high-confidence profiles.

Still, it can also worsen inequality. If models penalize certain backgrounds or geographies, the most vulnerable learners could face the harshest terms.

Consequently, algorithmic fairness becomes a policy topic, not just a technical issue. Expect advocates and regulators to ask for transparency on how ISA terms are set.

Verifiable credentials and “proof of skill”

Another 2026 innovation theme is verified credentials. Skills-based hiring is rising, and employers want better signals of real ability. (Economic Graph)

If credential systems improve, ISA providers can link funding to measurable progress, not just enrollment. That could support fairer structures, like staged funding releases or better alignment between training and job placement.

Additionally, it could push the market toward “performance-based” deals where the provider takes more risk if placements fail.

The emotional promise vs the real risk

ISAs succeed because they sell hope. Hope is powerful. Hope is also easy to exploit.

In the most inspiring story, an ISA is a bridge. It helps someone escape a dead-end job and move into a thriving, rewarding career. The learner feels protected. The investor feels aligned. The training provider feels accountable.

In the darker story, an ISA is a trap wearing a friendly mask. The learner signs under pressure, driven by urgency. The fine print is complex. The job outcome is shaky. Then the collection process becomes stressful and relentless.

Regulators have already pointed to misleading marketing and missing disclosures in ISA offerings. (Consumer Financial Protection Bureau) That history will shape 2026 decisions.

The fairness debate will intensify in 2026

Fairness is the issue that can make or break the “Human IPO” model.

Critics argue that ISAs can operate like a private tax on future success. They also worry about steering, where certain groups are offered worse terms. Supporters argue that ISAs can reduce downside risk compared with fixed payments.

In 2026, the debate will become more data-driven. Policymakers and researchers will demand clarity on outcomes: job placement rates, typical total paid, and how terms vary across demographics and programs.

The UNESCO and UBS Optimus Foundation work on financing models like ISAs highlights both potential and risks, especially around student protection and program design. (UNESCO)

Meanwhile, consumer advocates have warned that ISAs can be risky, especially when companies frame them as “not debt” while still enforcing repayment aggressively. (Protect Borrowers)

Therefore, 2026 will likely bring more standardized disclosure and more limits on the most aggressive deal structures.

[YouTube Video]: A practical discussion of ISA bootcamp deals, including why the “too good to be true” feeling can be a warning sign and what questions to ask.

What the Illinois model signals for 2026 and beyond

Illinois is the clearest “watch this” case for 2026.

The state created a defined regulatory framework for educational ISAs, and it positions the Attorney General to enforce violations as unlawful practices. (Jobs for the Future (JFF))

It also frames ISAs as loans and debt, which pushes providers toward loan-like compliance, including disclosures and guardrails. (Illinois General Assembly)

For 2026, expect two major ripple effects.

First, more states will feel pressure to act. Some will pass similar rules. Others might issue guidance. A few might try to attract “innovative” programs with looser regulation, but that creates a risk of becoming a magnet for bad actors.

Second, providers will adapt their contracts to match Illinois-style expectations, even outside Illinois, because it is costly to run multiple rulebooks. That can raise the floor for consumer protection nationwide.

However, there is also a strategic risk. If rules become too fragmented, the market could split into compliant providers and shadow operators. The Prehired story, and reports of copycat behavior, show why enforcement consistency matters. (The Verge)

The 2026 business model shift: from niche ISAs to “embedded career finance”

The most likely 2026 evolution is not a single “ISA company” selling a product directly.

Instead, expect embedded models.

Training platforms will partner with finance providers. Employers may offer ISA-style support for retraining, especially for roles with high need. Recruiters may connect candidates to “pay after placement” models.

This is where the “Human IPO” idea becomes scalable. It becomes an ecosystem, not a product.

Investors will demand better proof

In 2026, capital will not flow to vibes alone. Investors will want verified outcomes.

That means stronger reporting, clearer job placement metrics, and more standard comparisons across programs. Payroll verification tech supports that. (Argyle)

Additionally, skills-based hiring trends support the thesis that non-degree paths can lead to real income gains, which makes the “share income” approach more plausible. (Economic Graph)

Still, the pressure to show results can create perverse incentives. Programs might “game” placement definitions. They might overpromise. They might push learners into any job just to trigger repayment.

Therefore, 2026 will be a year where trust systems matter: audits, clearer definitions, and penalties for deceptive claims.

The pilot training ISA: the most compelling, and most dangerous, new frontier

Pilot training is a fascinating test case for “career staking.”

The cost is high. The payoff can be strong. The demand story is persuasive.

Boeing’s outlook projects major needs for new pilots and aviation personnel over two decades. (Boeing) Airbus also expects major workforce needs tied to fleet growth. (Airbus)

This creates a tempting pitch: “Fund your flight training now, pay from your airline salary later.”

However, aviation careers also have volatility. Medical requirements matter. Training timelines slip. Hiring cycles change. A contract that assumes smooth income growth can become stressful if life happens.

So, in 2026, the ethical ISA pilot program would need strong protections: realistic income thresholds, hardship clauses, clear caps, and honest placement claims.

Anything less becomes risky.

How to prepare for 2026 changes without getting burned

If ISAs grow in 2026, learners will face more offers. Some will be excellent. Some will be dangerous. The goal is not to fear the model. The goal is to read it like a pro.

Start by treating the ISA as a serious credit decision. Even regulators and laws are moving toward that framing. (Illinois General Assembly)

Next, compare the ISA to alternatives. Scholarships, employer support, savings plans, and traditional loans each have tradeoffs.

Then focus on the contract mechanics that control outcomes. The income percentage, threshold, term, and cap are the “engine.” If the engine is aggressive, the deal is aggressive.

Also, demand transparent placement data. Ask what “placement” means. Ask what happens if you do not find work. Ask what collections look like.

Finally, watch where regulation is heading. Illinois is a headline case, but it is also a signal that “ISA rules” are becoming real policy. (Jobs for the Future (JFF))

Consequently, a deal that is legal but exploitative today may become illegal tomorrow. That can matter for enforcement, disputes, and consumer rights.

2026 forecasts: what is most likely, and what would be a surprise

The most likely 2026 reality is a bigger ISA market with sharper constraints.

Expect more state frameworks inspired by Illinois, especially if consumer complaints rise. (Jobs for the Future (JFF))

Expect more marketing battles around the word “loan.” The CFPB has already challenged claims that ISAs are “not loans” in enforcement. (Consumer Financial Protection Bureau)

Expect more tech-driven servicing, using payroll verification and automated workflows. (Argyle)

Expect more ISA-like offers in high-demand pivot tracks, including certain aviation pathways, because the demand narrative is strong. (Boeing)

A surprise would be a single national U.S. ISA law in 2026. That is possible, but state action is currently the clearer path.

Another surprise would be a major collapse in public trust caused by a new scandal. Prehired shows how reputational shocks can happen. (Consumer Financial Protection Bureau) If a new, high-profile ISA program fails loudly, it could freeze capital and accelerate regulation.

The bottom line: 2026 is the make-or-break year for “Human IPO” finance

The “Human IPO” idea is thrilling because it speaks to ambition. It feels daring. It feels liberating. It feels like the future.

Yet 2026 will test whether the model can be both innovative and safe.

Regulators are already treating ISAs as serious credit products in key cases. (Consumer Financial Protection Bureau) Illinois has created a strong framework that signals where policy may go next. (Jobs for the Future (JFF))

Meanwhile, labor markets are shifting fast, and skills-based hiring is rising, creating fertile ground for pivot finance. (World Economic Forum Reports)

So the honest prediction is this: in 2026, ISAs will grow, but they will grow under pressure. The winners will be programs that prove outcomes, disclose terms clearly, and build trust through real protection. The losers will be those who sell hype, hide risk, and rely on aggressive collection.

If you are evaluating an ISA in 2026, think like an analyst. Respect the promise, but interrogate the structure. The future is exciting, but the contract is still a contract.

Sources and References

- CFPB: Action against Better Future Forward ISAs

- CFPB: Prehired case page and consumer payments

- Illinois Governor’s newsroom: SB1537 signed

- Illinois statute: Educational Income Share Agreement definitions

- JFF: Illinois passes landmark ISA regulation

- FSA guidance: ISAs treated as private education loans

- WEF: Future of Jobs Report 2025 (PDF)

- LinkedIn: Skills-Based Hiring (March 2025 PDF)

- Boeing: Pilot and Technician Outlook 2025-2044 (PDF)

- Argyle: Employment and income verification API overview

- Reuters: CFPB advisory on earned wage advances (Dec 22, 2025)

- PR Newswire: Make School funding round mentioning Ohanian