2026 brings AI-driven debt plans that cut interest fast. Learn the tools, rules, and smart moves to stay protected and win next year.

The debt game is being rewritten for 2026

Crucially, 2026 looks like an essential, critical, upcoming, next-generation, transformative moment for personal debt strategy.

Debt is not new. The feeling around it is new. As 2025 closes, interest feels louder. Minimum payments feel smaller. Offers feel more aggressive. At the same time, AI feels suddenly practical. It is showing up inside banking apps, budgeting tools, and credit platforms. That combination is explosive. It can be empowering. It can also be risky.

However, the big shift is not “AI will pay your debt.” The shift is that algorithms can now do what most people never had time to do. They can track every account, model dozens of payoff paths, and adjust daily. They can scan rates, predict cash flow gaps, and suggest exact payment moves. Used well, that reduces total interest. Used blindly, it can backfire.

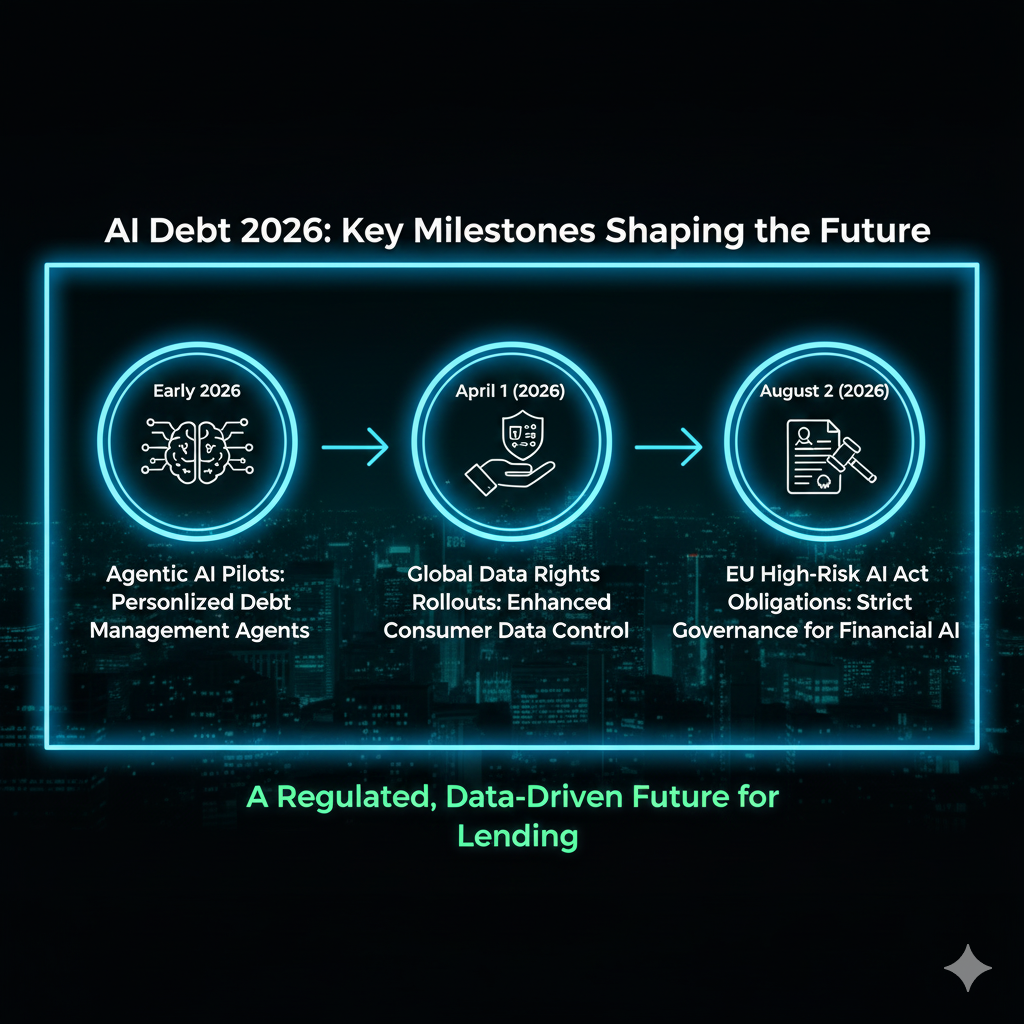

Additionally, 2026 is a pivotal year for data access. In the United States, the CFPB’s “personal financial data rights” rule under Section 1033 has phased compliance dates that begin in April 2026 for the largest data providers. (Consumer Financial Protection Bureau) In plain terms, more consumers can authorize safer, standardized data sharing. That helps algorithms see the full picture. It also raises new privacy stakes.

Meanwhile, Europe’s AI Act is moving from headlines into hard deadlines. The European Commission’s implementation timeline and the Act’s own schedule point to August 2026 as a major compliance moment for many high-risk AI obligations. (AI Act Service Desk) Even if you do not live in the EU, the compliance mindset will spread. Big fintechs rarely build two versions of trust. They usually build one global standard.

Consequently, the real 2026 question is simple: how do you turn AI into a loyal ally that attacks interest, without letting it attack your privacy or your choices?

Why interest feels harsher in late 2025

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

Rates have been unusually sticky. Credit card APRs can be punishing. Many borrowers carry multiple balances. When you combine high APR with slow repayment, interest compounds in a brutal way. That makes “small” optimization meaningful. Shaving one or two months off a payoff plan can feel thrilling. Saving hundreds in interest can feel liberating.

Still, the market context matters. Deloitte’s 2026 banking outlook highlights a period of changing credit conditions, with banks tightening standards in 2025 and expecting stabilization in 2026. (Deloitte) When lenders become selective, refinancing is harder. When refinancing is harder, better payoff strategy is vital.

The new promise of algorithmic payoff

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

The strongest promise is not magic. It is precision. A good algorithm is relentless. Fatigue is not a factor. Due dates do not slip. It can run the “what if” math across every debt account, every payday, and every fee rule. It can also react fast when life changes. That responsiveness is where interest savings often hide.

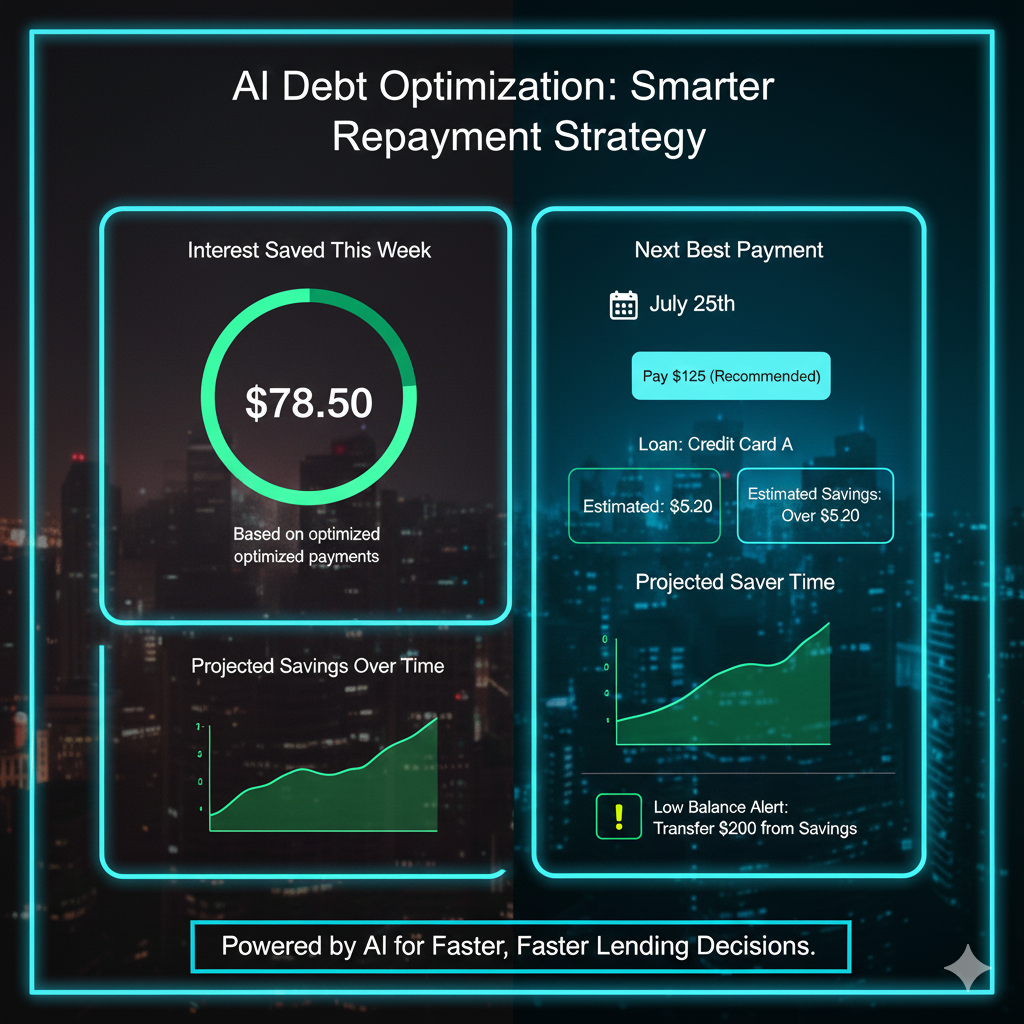

Moreover, AI makes the experience feel personal. Instead of a spreadsheet, you get a coach. You get a reminder at the exact moment you are tempted to spend. You get a message that says, “If you pay $37 more this week, your payoff date moves up by 18 days.” That is motivating. It is also psychologically powerful.

How algorithms actually cut interest, not just stress

Consequently, this section focuses on proven, rewarding, successful levers that can feel truly liberating when applied with discipline.

The fastest way to reduce interest is to reduce the average daily balance on the highest-rate debt. That sounds obvious. The hard part is execution. Algorithms help because they can optimize three things at once: prioritization, timing, and stability.

The math that most people never run

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

Many people know “debt snowball” and “debt avalanche.” Snowball prioritizes the smallest balance for emotional momentum. Avalanche prioritizes the highest APR for maximum interest savings. The avalanche is often the most financially efficient method, yet people struggle to stick with it. AI tools can blend both. They can keep one small “quick win” while still attacking the highest rate.

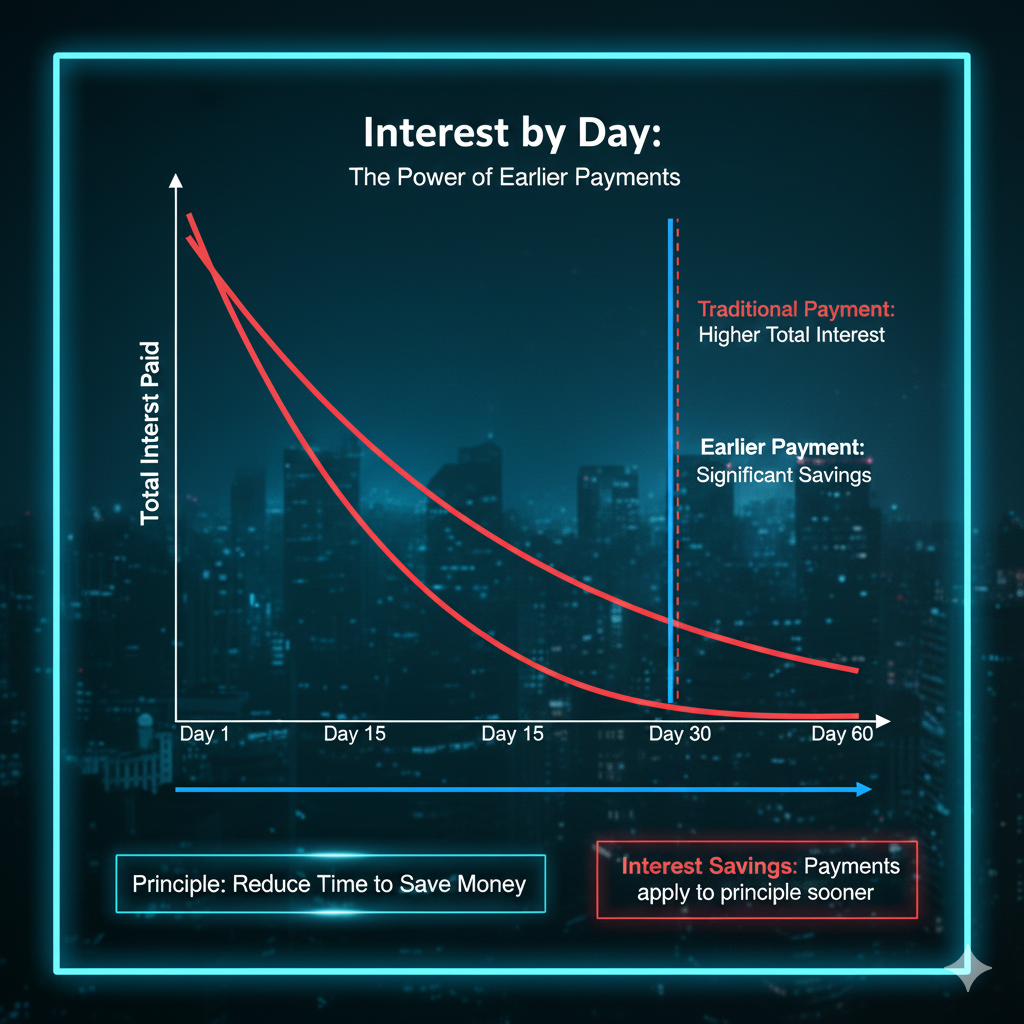

Additionally, algorithms can model interest by day, not by month. That matters because credit card interest accrues daily. If you get paid on the 15th, paying on the 16th instead of the 30th can reduce interest. The difference is subtle. Over 18 months, it becomes real money.

Furthermore, a strong algorithm watches fees. A late fee can erase a week of progress. A balance transfer fee can ruin a “deal” if you do not keep the promo terms. AI can flag the tripwires. It can warn you before the damage.

From a static plan to a living plan

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

A spreadsheet plan is static. Life is not. AI becomes powerful when it is adaptive. If your income is irregular, your best payoff move changes weekly. If you have seasonal expenses, your best plan changes monthly. A living plan reacts. It keeps you safe while still pressing the attack.

Meanwhile, “agentic” AI is entering banking. Reuters reported that British banks have been working with the FCA on customer-facing trials of agentic AI, with launches expected in early 2026. (Reuters) Agentic AI is not just a chatbot. It can plan, decide, and execute within rules. In debt payoff terms, it could move money, schedule payments, and negotiate within limits. That is exciting. It is also a governance test.

However, speed is a double-edged blade. If an AI executes a wrong move, it can create chaos faster. That is why 2026 will bring a louder debate about “human-in-the-loop” controls. The best tools will show their work. They will explain why. They will ask for confirmation on high-stakes actions.

The 2026 data fuel: open banking goes mainstream

Meanwhile, data access is the vital fuel, and 2026 makes that fuel more authentic, more verified, and far more powerful in the right hands.

Algorithms need data. In 2026, more people will have the option to share data with trusted apps in a standardized way. That is the “open banking” story, but the details matter.

The U.S. Section 1033 effect in 2026

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

The CFPB finalized a personal financial data rights rule in October 2024, aiming to give consumers and authorized third parties access to account data in a standardized format. (Consumer Financial Protection Bureau) The rule’s phased compliance dates, reflected in the federal eCFR, start with April 1, 2026 for the largest covered data providers, followed by later tiers. (eCFR)

Consequently, debt tools can become sharper. Instead of manual entry, an app can ingest your real balances, transactions, and payment history. Waste becomes visible. Subscription creep stands out. Then it can forecast how much “extra” you truly have. It can also recommend payoff moves that match your reality, not your guess.

Still, this is not frictionless. A U.S. Congressional Research Service brief has noted litigation and reconsideration activity around the rule. (Congress.gov) That means 2026 could bring tweaks. Yet even with uncertainty, the direction is clear. Data portability is gaining momentum.

Why portability changes debt optimization

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

When data stays trapped in one bank, optimization is blind. When data is portable, optimization becomes holistic. A tool can see your checking account, your credit cards, your loan, and your bills. It can route your next dollar to where it saves the most interest, without risking overdraft.

Additionally, portability encourages competition. If you can move easily, lenders have to earn your loyalty. That pressure can translate into better refinancing offers. It can also translate into more creative debt relief programs. In 2026, algorithms will not only plan payments. They will shop options.

The AI innovations that will feel normal in 2026

Additionally, the innovations ahead are pioneering, emerging, and sometimes revolutionary, but only if they stay secure and trusted.

In late 2025, some debt apps already offer payoff calculators and reminders. In 2026, the best products will feel more like autopilots. Several innovations are converging at once.

Real-time payoff “routing” and micro-optimizations

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

Expect more real-time routing. Instead of “pay extra $200 per month,” the instruction becomes “pay $37 today, $61 next Tuesday, and $102 after rent clears.” That pattern lowers average daily balance while keeping you stable. It feels precise. It also feels achievable.

Furthermore, budgeting tools will use generative AI to translate numbers into plain language. The best ones will feel like a conversation, but backed by math. They will detect patterns, like “your food spending spikes on weekends,” then propose a targeted limit. That targeted limit becomes extra payoff money. This is not glamorous. It is effective.

[YouTube Video]: NerdWallet breaks down debt consolidation choices and payoff strategy, which is crucial when algorithms recommend refinancing or balance transfers.

Automated negotiation becomes less rare

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

Debt payoff is not only about payments. It is also about terms. In 2026, more tools will attempt to negotiate. Some will help you ask for lower APRs. Others will guide hardship requests. A few will coordinate settlement workflows, but those carry serious credit consequences.

Meanwhile, banks are experimenting with AI to predict distress early and intervene sooner. PwC’s 2025 banking survey discussion of GenAI highlights the idea of predicting borrowers at risk of default and enabling timely interventions. (PwC) If that mindset spreads, 2026 could bring more proactive “save plans” that reduce delinquencies. The upside is relief. The risk is intrusive surveillance.

AI coaching that is emotional, not just logical

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

Debt is emotional. Shame is common. Avoidance is common. Algorithms can help by reducing the mental load. Small steps become clearer. Milestones feel worth celebrating. They also keep you moving.

However, emotional design can also become manipulation. In 2026, watch for tools that push you into products that benefit them. A trustworthy tool is transparent. It separates coaching from selling. It also makes it easy to leave.

The 2026 regulatory pressure that will shape debt AI

However, regulation is becoming critical and immediate, pushing a more certified, verified, and accountable AI experience.

The AI debt era is not only a tech story. It is a policy story. Rules will shape what tools can do, what they must disclose, and what data they can touch.

EU AI Act: August 2026 is a trust milestone

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

The European Commission’s AI Act timeline shows progressive application, with major waves through 2025, 2026, and beyond. (AI Act Service Desk) For many high-risk obligations, August 2026 is a key point. (Artificial Intelligence Act) In consumer finance, AI used for credit decisions and related high-stakes assessments can fall into higher-risk categories. That pressure will push for documentation, risk management, and stronger oversight.

Additionally, “model explainability” will matter more. Not every AI can explain itself perfectly. Still, regulators and consumers will demand clarity. If an AI says “do not refinance,” you will want to know why. If it says “pay this card first,” you will want the math.

Consequently, product teams will build more “receipts.” Expect more in-app explanations, more audit logs, and more options to contest automated recommendations. That will feel reassuring. It may also slow down some features.

UK: agentic AI trials and consumer duty

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

The UK is becoming a visible testbed. Reuters described British banks collaborating with the FCA on early 2026 customer-facing trials of agentic AI for budgeting and money management. (Reuters) Those pilots will shape expectations. If a bank can offer an AI that helps customers avoid overdrafts and pay debt faster, competitors will copy.

However, the FCA’s focus on consumer duty and accountability means the AI cannot be a “black box excuse.” If harm happens, someone is responsible. That accountability theme will likely influence other markets in 2026.

U.S.: data rights plus privacy anxiety

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

In the U.S., data portability is rising, but privacy fear is rising too. The CFPB’s data rights rule is framed around choice, competition, and privacy protections. (Consumer Financial Protection Bureau) Yet consumers will still worry about who sees their spending. They will worry about scams. They will worry about leaks.

Meanwhile, AI-driven fraud detection is expanding. Banks are shifting AI attention toward scam detection and risk scoring, according to reporting on AI deployment trends. (The Australian) That is relevant for debt tools because scams often target stressed borrowers. In 2026, safety features will become a selling point.

The business reality behind your debt in 2026

Still, the market forces behind debt are dramatic and volatile, so the most resilient plans anticipate shocks and stay confident.

Debt optimization does not happen in a vacuum. The ownership of consumer debt is shifting. That affects offers, collections, and refinancing terms.

Private credit is moving into consumer debt

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

In 2025, private credit firms have increased their exposure to consumer debt, including credit card portfolios and BNPL loans, raising concerns about risk and underwriting standards. (Financial Times) When new capital chases yield, you often see more aggressive marketing and more complex structures.

Consequently, borrowers can face a confusing landscape. You might owe money to one brand, but your loan is owned by another entity. You might see new “refinance” offers that are really securitization pipelines. This matters because algorithms must understand the true terms. They must know where fees hide. They must know who services the account.

What this means for your payoff plan

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

When lenders and investors tighten, relief programs may become stricter. When competition increases, balance transfer deals may become more generous. Both can happen at once, in different segments. That is why a 2026-ready algorithm must be dynamic. It must watch for offers. It must also stress-test your plan for setbacks.

Additionally, delinquency trends can change how lenders treat customers. If delinquencies rise, some lenders clamp down. If delinquencies stabilize, some lenders compete again. Deloitte expects stabilization dynamics in 2026 in parts of consumer credit. (Deloitte) That environment can create windows of opportunity.

When AI debt advice becomes dangerous

Furthermore, the risks are real, yet a trusted, secure, proven approach can keep the payoff journey calm and rewarding.

AI can be brilliant. It can also be confidently wrong. In 2026, the biggest harms will come from over-trust and under-skepticism.

The “optimization trap” that breaks real life

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

Some tools will push for maximum payoff speed. That can be inspiring. It can also be reckless. If you drain your emergency cash, one shock can push you back into debt. A strong tool balances aggression and resilience. It should treat stability as a goal, not an obstacle.

However, many algorithms are trained on averages. Your life is not average. If you have irregular income, health expenses, or family obligations, your risk is higher. The right tool lets you tune the plan. It asks about your “floor,” the minimum cash you refuse to touch.

Dark patterns and conflicts of interest

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

In 2026, watch for “free” apps that secretly make money from steering. One app might nudge you toward a loan partner. Another could suggest a balance transfer that pays them. A third may push a subscription you do not need.

Meanwhile, emotionally charged notifications can become coercive. A tool that shames you is not helpful. A tool that pressures you to take a product is not neutral. Trustworthy tools disclose incentives in clear language.

Privacy and security are not optional

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

If an app connects to your bank data, it becomes a high-value target. Data rights rules are meant to support safer sharing, yet criminals adapt. In 2026, assume phishing gets smarter. Assume fake “debt help” apps spread faster.

Additionally, AI can hallucinate. A chatbot can make up a rule. A planning model can misread a term. The safest tools separate chat from execution. They also validate recommendations against hard data. If a tool cannot show the source of a rule, treat it as unverified.

How to prepare now, so 2026 works in your favor

Therefore, preparation is not optional. It is essential, vital, and deeply empowering if you want a thriving 2026.

You do not need to become a programmer. You need a disciplined, simple system. Think of it as an “AI-assisted routine,” not an “AI takeover.”

Build a clean debt map before you add AI

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

Start with clarity. List every debt, APR, minimum payment, and due date. Add any promo expiration dates. That is your baseline. Then, when an AI tool imports data, you can confirm it matches reality. This prevents silent errors.

Additionally, decide your personal rules. Choose a minimum emergency buffer. Choose a maximum monthly payment you can sustain. Decide which accounts you refuse to link, if any. Those choices make the AI safer.

Choose tools using trust signals, not hype

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

Look for a tool that explains recommendations. Prefer apps that let you export data. Value products with strong security practices. Pay attention to permissions. If an app asks for more access than it needs, be skeptical.

Meanwhile, expect the best tools to talk about regulation in 2026. They may mention EU AI Act compliance, stronger audit logs, or data rights alignment. That is not marketing fluff. It is a signal they are building for the next era. (AI Act Service Desk)

Adopt a weekly “interest attack” check-in

Notably, this is a proven, essential, critical checkpoint for a secure 2026.

Importantly, the next steps can be empowering, rewarding, and resilient when you keep control.

In practice, treat this as an upcoming, next-generation, breakthrough moment, not a quick trick.

A weekly ritual is powerful. Once a week, review three things: balances, upcoming bills, and the next best extra payment. Keep it short. Keep it consistent. Let the algorithm suggest moves, but keep your final approval.

Furthermore, track one motivating metric: “interest avoided.” Seeing that number rise is rewarding. It turns discipline into a visible win.

What the next year will reward most

Meanwhile, the next year will favor bold, disciplined, successful borrowers who chase breakthrough savings without losing safety.

2026 will reward borrowers who blend technology with skepticism. Those who use data portability will see the full picture. Early negotiators will improve terms before stress hits. Careful planners will keep a safety buffer and avoid panic borrowing.

Meanwhile, institutions will compete on “trusted AI.” Global development reports are already pushing the conversation toward responsible adoption and capability building. (World Bank) That means the tools you use will likely become more regulated, more transparent, and more standardized. The winners will be products that feel calm and reliable, not flashy.

Consequently, your advantage is choice. You can adopt AI on your terms. Using it to reduce interest with precision is the goal. Clear boundaries can also protect your privacy and your autonomy. That mix is powerful.

Conclusion: make algorithms serve you, not the other way around

Finally, the goal is a verified, authentic, secure system that delivers a breakthrough reduction in interest and stress.

Debt in the age of AI can feel intimidating. Yet it can also feel hopeful. The same technology that lenders use to price risk can help borrowers cut cost. The same data rails that power fintech growth can power personal relief. In 2026, the best payoff journey will be disciplined, data-informed, and emotionally supportive.

However, the core truth remains human. A tool cannot care about your future. You can. Use AI as a proven assistant. Demand transparency. Keep a safety buffer. Then apply steady pressure to the highest-interest balances. If you do that, next year can feel like a breakthrough, not a burden.

Sources and References

- CFPB: Finalizes Personal Financial Data Rights Rule (Oct 22, 2024)

- eCFR: 12 CFR Part 1033 Compliance Dates

- Congressional Research Service: Open Banking and Section 1033 (Sept 30, 2025)

- European Commission: EU AI Act Implementation Timeline

- EU AI Act Article 16: High-Risk Provider Obligations (effective Aug 2, 2026)

- Reuters: Agentic AI race by British banks, trials early 2026 (Dec 17, 2025)

- Deloitte: 2026 Banking and Capital Markets Outlook (Oct 30, 2025)

- Financial Times: Private credit firms pile into consumer debt (Dec 2025)

- PwC: Ghana Banking Survey 2025 (GenAI in banking)

- World Bank: Digital Progress and Trends Report 2025 (AI adoption)