Power outage in San Francisco? Learn when homeowners insurance pays for spoiled food, typical limits, and smart claim steps to protect your budget in 2025.

San Francisco is a city of surprises. Fog can roll in fast. A storm can hit hard. And sometimes the lights go out at the worst moment. When that happens, the first painful thought is simple: your fridge and freezer are full.

In December 2025, this feels immediate and personal. Groceries are costly in SF. A sudden outage can feel shocking. This is why a clear, proven plan matters.

If you are a homeowner in San Francisco, you might assume your homeowners insurance will “obviously” pay for ruined groceries. Sometimes it does. Sometimes it pays nothing. The difference can feel frustrating and unfair.

This guide delivers an essential, proven explanation of what usually happens in December 2025, how to read the key words in a policy, and how to make a smart decision about claiming. It is written for real life: busy schedules, expensive groceries, and the unique outage and insurance landscape in California.

The quick answer for SF residents in 2025

This is essential, critical, and proven. Keep notes that are verified and authentic.

In many cases, homeowners insurance can help with spoiled food, but only under specific triggers. This detail is critical. A common trigger is a power outage caused by a covered event, such as a windstorm or lightning. Many policies then include a small “food spoilage” or “refrigerated property” limit, often around a few hundred dollars.

However, a plain citywide outage that is not tied to a covered peril, or an outage caused by off-premises utility failure, may be excluded unless you have extra coverage. Additionally, your deductible often applies. That one word, deductible, can turn a hopeful claim into a zero dollar payout.

In San Francisco, that math matters. Grocery prices in the San Francisco area have been rising, and the food at home index increased over the year in 2025, adding more stress when a fridge fails. At the same time, homeowners insurance costs in California have been under serious strain, with premium pressure and availability issues in many areas. This means you want a careful, strategic approach, not a rushed claim. That choice is essential. It can be profitable. It supports a thriving budget.

Why spoiled food coverage is confusing

Most importantly, stay calm. The steps are vital, verified, and often rewarding.

Insurance is built around causes, not just consequences. This is a critical concept. It is also proven in real claims. “My food spoiled” is a consequence. The policy usually asks: what caused the loss, and is that cause covered?

Additionally, homeowners insurance is not one single universal contract. Most policies are based on standard forms, but insurers vary. California rules also shape what is common. That variation creates a confusing, stressful gray zone. It can also feel unfair and exhausting.

Covered peril vs. simple loss of power

A covered peril is an event the policy lists as covered. Classic examples include fire, lightning, and windstorm. If that peril causes the power loss, your odds improve.

A simple loss of power is different. It can be caused by utility equipment failure, planned shutoffs, or broader grid issues. Many policies treat that as off-premises power failure. That is often excluded, unless you have a special endorsement.

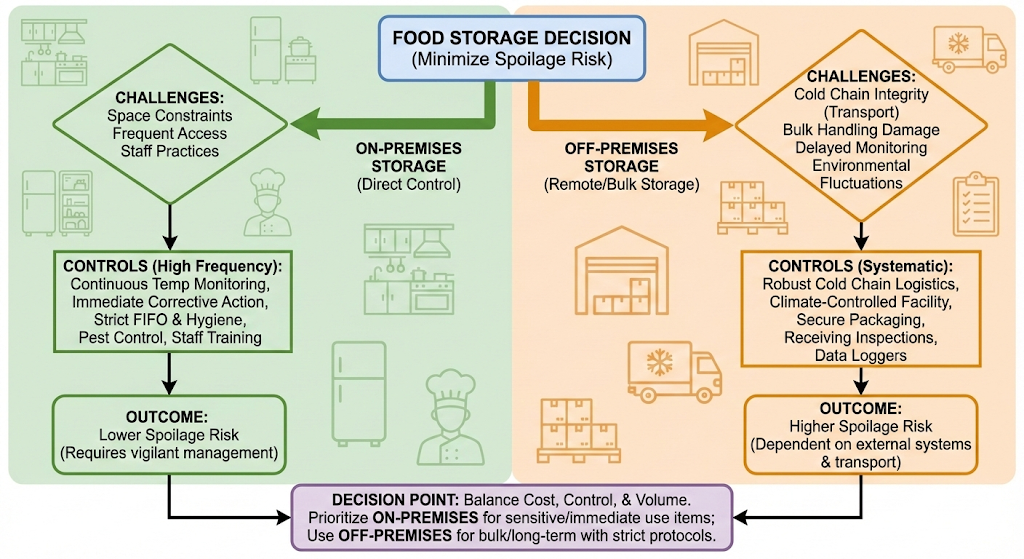

On-premises vs. off-premises power failure

This is one of the most decisive details. If the power failure starts on your property, like a lightning strike that damages your electrical panel, your policy may treat it as direct physical loss at the home.

If the failure starts off your property, like a substation problem, the policy may treat it as utility interruption. Coverage for food loss can be limited or excluded unless you added an endorsement.

San Francisco has had major outages tied to utility issues, including high impact events reported in December 2025. That is why SF residents should learn this distinction, even if it feels annoying.

Essential terms SF homeowners should know

This is essential, critical, and proven. Keep notes that are verified and authentic.

Insurance language can feel cold. However, learning a few terms is essential. It is also critical for a successful claim. These short definitions are proven to cut confusion.

Deductible

A deductible is the amount you pay first. It is an essential number. It is also a critical decision when you buy the policy. A higher deductible can lower your bill, but it makes small claims less profitable. Nothing about a payout is guaranteed, so you want a deductible you can truly afford.

Endorsement

An endorsement is an add-on that changes your policy. It can add coverage, raise limits, or fill a gap. In this topic, a food spoilage endorsement can feel like a breakthrough. It can also feel revolutionary during an outage. Endorsements are not exclusive to big homes. Many condos can add them too.

Covered peril

A covered peril is a cause your policy covers, like fire or lightning. This is a critical idea, because the cause drives payment. If the peril is covered, your chance of reimbursement is higher. Still, no outcome is guaranteed. It depends on your contract and your proof.

Off-premises power failure

Off-premises means the failure started away from your home, like a utility substation issue. Many policies treat this as excluded unless you have an endorsement. That is why it is vital to ask. It is also essential to get the answer in writing if you can.

Verified proof and authentic documentation

Verified proof means clear photos, clear timing, and a clear list of items. Authentic documentation means you do not inflate prices or quantities. This is proven to speed up decisions. It also helps your claim feel certified and trustworthy, even though a payout is never guaranteed.

Where spoiled food fits inside a homeowners policy

Most importantly, stay calm. The steps are vital, verified, and often rewarding.

To understand your odds, it helps to know where “food” lives in the policy structure. Food is usually personal property. That sounds promising. Yet the cause still controls coverage.

Personal property coverage is broad, but not endless

Most homeowners policies include personal property coverage. It covers your stuff, including food, when a covered peril causes direct physical loss. The tricky part is that spoiled food is not always treated as “direct physical loss.” Some insurers see it as a special kind of loss tied to refrigeration, and they handle it under an extra coverage bucket with a lower limit.

That is why you may see language like “refrigerated property” or “food spoilage.” It might be included automatically, or it might require an add-on.

Food spoilage or refrigerated property endorsements

Many insurers offer an endorsement that covers refrigerated products when there is a power failure. Limits vary. Some versions cover a set amount, like $500. Others allow higher limits for an added premium.

In practical terms, this endorsement is one of the most valuable small upgrades for city homeowners who keep a stocked freezer. It is a vital add-on for many families. It is also one of the easiest to miss, because many people never ask for it.

San Francisco scenarios that decide whether you get paid

This is essential, critical, and proven. Keep notes that are verified and authentic.

These examples are essential. They are proven patterns. The details are critical.

Let’s make this concrete. Below are common SF patterns, and what typically happens.

Scenario 1: A big PG&E outage impacts your neighborhood

This is the classic SF problem. A major outage hits many customers. In December 2025, news reports described very large impacts in San Francisco during an outage event, with a huge share of the city affected at the peak.

In this situation, your policy may not automatically pay for food, because the cause can be classified as off-premises power failure. That outcome feels harsh, but it is common. You might still get coverage if:

- the outage was caused by a covered peril, such as storm damage, or

- your policy includes an endorsement for food spoilage during off-premises outages.

If neither applies, your insurer may deny the claim, even if the loss feels brutal.

Scenario 2: A covered peril causes the outage

Imagine a windstorm knocks down lines and causes outages. Or lightning hits nearby equipment. If your insurer treats the event as a covered peril, you have a stronger claim story.

In this case, many policies that include food spoilage coverage may respond. Even then, limits can be low. You might see a cap that feels painfully small compared to SF grocery bills.

Additionally, you still face your deductible. This is where “covered” does not always mean “paid.”

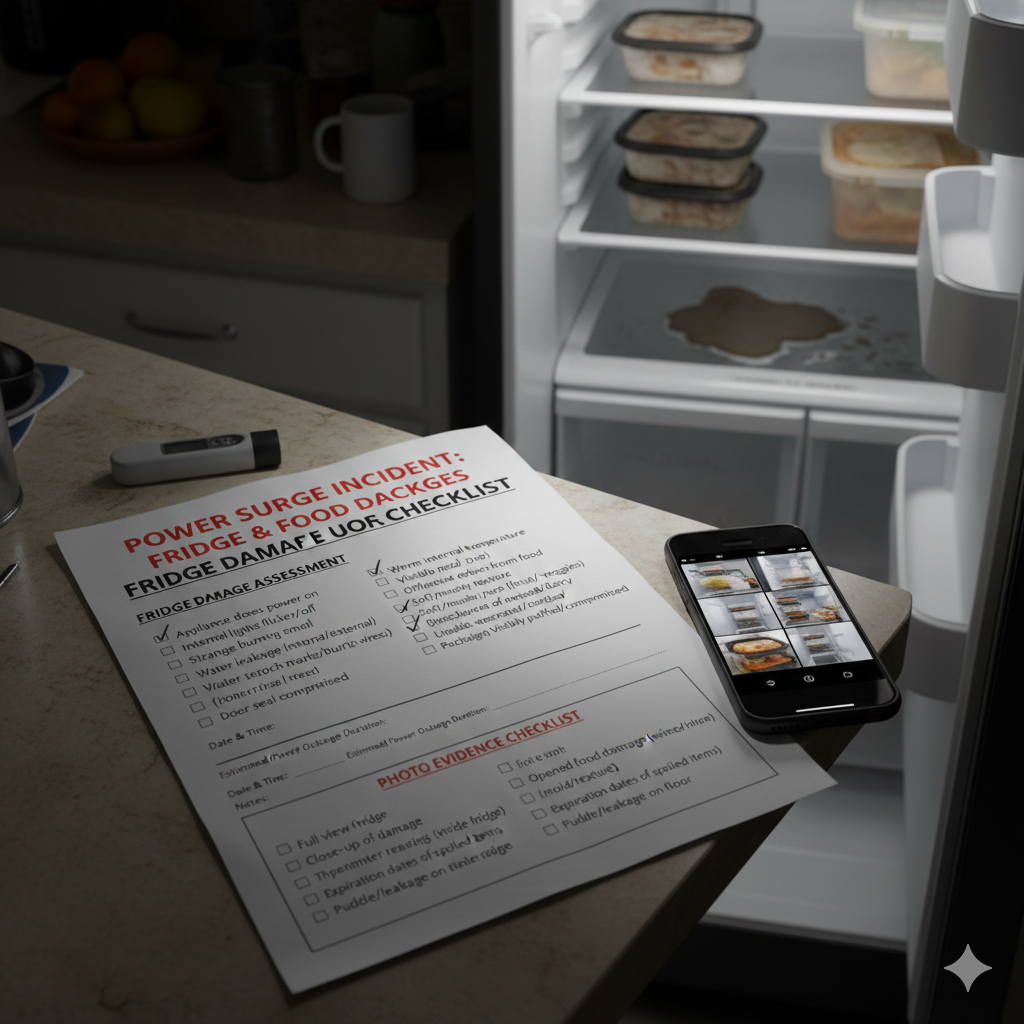

Scenario 3: A power surge or electrical event damages your fridge

This is different from a long outage. A surge can break appliances. If the fridge fails because of a sudden electrical event, some policies may cover the appliance damage, depending on the cause and your endorsements.

Food loss may then be covered as part of that same claim. However, insurers can still question whether the appliance failed from wear and tear, which is usually excluded. Clear evidence matters.

Scenario 4: Your fridge fails on its own

This is the harsh one. If the fridge dies due to age, wear, or maintenance issues, homeowners insurance usually will not pay. It is treated like a normal home maintenance cost, not an insured accident.

If you have a special equipment breakdown endorsement, you might get help. Without it, the claim is usually a dead end.

Scenario 5: Earthquake related outages

San Francisco always has earthquake risk in the background. Earthquake insurance is typically separate from standard homeowners coverage. A quake could cause power interruption and spoilage. In that case, your coverage depends on whether you have earthquake coverage and whether it includes this type of loss.

The key idea is simple: a dramatic event does not guarantee coverage, because policies carve the world into categories.

Food safety timing matters more than you think

Most importantly, stay calm. The steps are vital, verified, and often rewarding.

Even if insurance pays, you still need to make safe choices. Food safety guidance is strict, and it can protect your health.

A helpful rule is the four hour fridge rule. If your refrigerator has been without power for about four hours and you kept the door closed, many foods may still be safe. After that, risk rises fast. A full freezer can hold a safe temperature much longer if it stays closed, often around two days, and about one day if it is half full.

This matters for insurance too. Do not exaggerate a loss. Aim for an accurate list. Also, keep everyone in your home safe from risky food.

Additionally, having a cheap fridge thermometer can make your decisions calmer and more confident.

The money math that protects you from a bad claim

This is essential, critical, and proven. Keep notes that are verified and authentic.

This math is vital. It is proven to prevent regret. It also keeps your budget thriving.

A food spoilage loss is emotional. It feels like money melting. Yet the smart move is to slow down and do the math.

Deductibles can erase small claims

Your deductible is the amount you pay before insurance pays. Many homeowners in California carry deductibles in the range of $1,000 or more.

Now picture a realistic SF loss. You lose $300 in groceries. That feels painful and immediate. But if your deductible is $1,000, your payout is typically $0. Even if your policy has a $500 food spoilage limit, the deductible can still apply.

This is why many people find out the hard way that the claim was “covered” in theory, but not paid in practice.

Claim history can matter, even for small losses

Some insurers view repeated small claims as a risk signal. In a tight insurance market, you want to be thoughtful. If you can handle a small loss without claiming, that can be a calm, strategic choice.

However, a large loss is different. If you had a packed freezer, expensive specialty foods, and maybe medicine that spoiled, the claim can be worth it. The key is to decide with clear eyes.

When a food claim is more likely to be worth it

A claim is more likely to make sense when:

- your food loss is clearly above your deductible, or

- your policy has a separate low deductible for food spoilage, or

- the outage is tied to a larger covered loss that you are already claiming.

Additionally, if your policy limit for food spoilage is higher, the value can be real.

A step by step claim playbook for SF homeowners

Most importantly, stay calm. The steps are vital, verified, and often rewarding.

This playbook is essential. It is also proven to reduce stress. Your documentation should be verified and authentic.

When the power goes out, it is easy to panic. A calm plan protects you.

Step 1: Confirm the outage window and save proof

Take a screenshot of any outage alerts. Save a utility message. Record the time the power went out and returned. This can help you show the duration.

If the outage is widely reported, that helps too. Yet you still want your own proof.

Step 2: Keep doors closed and check temperatures

Do not open the fridge repeatedly. Every open door speeds up warming.

If you have a thermometer, check it once. Write the temperature down. If you do not have one, you can still follow the basic time rules and use common sense.

Step 3: Take clear photos before you throw things away

This step is essential and proven. Take wide photos of the fridge and freezer. Then take closer photos of key shelves.

Next, photograph the spoiled items as you remove them. Keep it clean and simple. You are building a verified record.

Step 4: Build an itemized list with reasonable prices

Most insurers and utilities want an itemized list. That means each item, quantity, and price. You can use receipts, online order history, or typical prices.

Be honest. Accuracy makes you credible. Authentic details build trust. It also reduces stressful back and forth.

Step 5: Call your insurer and ask one critical question

Ask this exact question: “Does my policy cover food spoilage from an off-premises power outage, and does my deductible apply?”

If they say yes, ask the limit. Ask if there is a separate deductible. Ask what documentation they want.

If they say no, do not waste time. Move to alternatives.

Step 6: File fast, but do it cleanly

Food spoilage claims are time sensitive. Many companies expect prompt notice. File the claim in the channel they prefer, and keep a record of your submission.

Be organized. A clean claim feels professional and often moves faster.

Alternatives when insurance will not pay

This is essential, critical, and proven. Keep notes that are verified and authentic.

These backup options can feel like a breakthrough. They can also be rewarding when cash is tight.

A powerful plan has backups. In San Francisco, you have more options than many people realize.

Utility claims and credits can be a real path

PG&E has a claims process for losses you believe the utility caused. Their claim form specifically mentions food spoilage and asks for an itemized list and proof of cost.

Separately, PG&E has outage compensation programs. In certain cases, customers may qualify for bill credits after extended outages tied to major weather events.

These options can be slower than insurance. However, they can be meaningful, especially when your insurance deductible blocks you.

Credit card benefits and purchase protection

If you bought groceries with a credit card, check your card benefits. Some cards offer purchase protection. Some offer extended warranty coverage for certain appliances when purchased with the card.

It is not a guaranteed fix. Still, it is a smart, low effort check.

Community and public support after declared disasters

After extreme events, disaster support sometimes exists. Food loss is not always covered directly, yet programs can appear through local relief groups. In a declared emergency, agencies may also point residents to help.

The key is to look early and act fast. Waiting often reduces options.

How SF’s insurance market changes the best strategy

Most importantly, stay calm. The steps are vital, verified, and often rewarding.

San Francisco homeowners live in California’s unique insurance moment. Your policy terms are exclusive to your contract. Premiums and insurer appetite have shifted fast in recent years. Availability concerns, wildfire risk pricing, and policy non-renewals have changed how people think about claims.

Additionally, more homeowners are thinking about the California FAIR Plan as a backstop. That is a critical signal. The market feels tighter. You want to keep your record clean when possible, without being reckless.

This does not mean you should avoid claims that matter. It means you should treat small food spoilage losses like a financial decision, not just an emotional reaction.

Smart prevention that feels worth it in San Francisco

This is essential, critical, and proven. Keep notes that are verified and authentic.

Prevention is essential. The right add-ons can be critical. The benefit can feel revolutionary.

Prevention is not glamorous. However, it can feel rewarding and even profitable when the next outage hits, because you avoid chaos.

Ask your insurer for two specific endorsements

Ask about:

- Food spoilage or refrigerated property coverage, including off-premises power failure.

- Equipment breakdown coverage for major appliances.

These are often low cost add-ons. They can create a breakthrough difference in payout.

Build a simple outage kit for your kitchen

Keep:

- a fridge and freezer thermometer

- a few frozen water bottles to hold cold

- a small cooler bag

- shelf stable snacks and water

This kit is simple. It is also calming.

Consider backup power with realistic expectations

Not everyone needs a whole home generator. In a city home, a small backup battery can keep a router running and help charge devices. It will not run a full fridge for days, but it can reduce stress.

Some homeowners also consider a small inverter solution. If you go that route, follow safety rules. The goal is peace of mind, not risk.

Shop and store with outages in mind

This sounds small, but it helps. Freeze items in flatter shapes. Keep a list of what is in your freezer. Use labels. A clean system makes your future claim list faster and more accurate.

A proven, verified 15-minute checklist to keep handy

Most importantly, stay calm. The steps are vital, verified, and often rewarding.

This is a simple routine. It is also powerful. It keeps you calm when the moment is urgent.

First, treat this checklist as authentic protection for your budget. Next, keep it somewhere visible. Finally, update it when your policy renews, because coverage details can change.

The exclusive three questions that unlock the truth

Ask your insurer these three questions. They are essential. They are also surprisingly fast.

- Is food spoilage covered for off-premises power failure at my address?

- What is the exact limit, and is there a separate deductible?

- Is the coverage automatic, or does it require an endorsement?

These questions feel small. However, the answers can be revolutionary for peace of mind.

The verified documentation set

Keep a folder on your phone. Make it simple. When an outage hits, capture:

- A screenshot of outage alerts and restoration time

- Wide and close photos of the fridge and freezer

- An itemized list with prices

- Receipts or order history when you have them

This is proven to reduce friction. It also makes your claim feel certified and trustworthy, even though no payout is ever guaranteed.

Frequently asked questions SF homeowners ask

This is essential, critical, and proven. Keep notes that are verified and authentic.

Does homeowners insurance always cover spoiled food?

No. Coverage depends on the cause of the outage, your endorsements, and how the policy treats off-premises power failure. The deductible can also erase the payout.

How much will homeowners insurance pay for spoiled food?

Many policies that cover food spoilage have a modest limit, often a few hundred dollars. Your exact limit is in your declarations page or endorsements.

Should I file a claim for $200 to $400 of groceries?

Often, no, because your deductible is likely higher than the loss. However, if your policy has a separate food spoilage deductible or you have a bigger related claim, it can make sense.

What if I live in a condo in San Francisco?

Condo insurance works similarly for personal property. Yet the building’s master policy is separate. Your claim still depends on your HO-6 policy details and endorsements.

Can PG&E reimburse me for spoiled food?

Sometimes. PG&E has a claims process where customers can submit a claim for losses they believe PG&E caused. They also have certain outage compensation programs and bill credits in qualifying situations.

Do I need receipts for a food claim?

Receipts help, but they are not always required for every item. Insurers and utilities often accept an itemized list with reasonable pricing, especially if you can show some proof, like a grocery order history.

How fast should I act?

Move quickly. Save outage proof, take photos, and build your list the same day if possible. Fast action feels vital when you want a smooth outcome.

A critical recap for busy SF homeowners

Most importantly, stay calm. The steps are vital, verified, and often rewarding.

If you only remember a few points, make them these. This recap is essential. It is also proven to save money and stress.

- Ask the three questions about off-premises coverage. It is critical, vital, and often the breakthrough moment.

- Do the deductible math first. This keeps your decision profitable and your budget thriving.

- Document with verified photos and an authentic itemized list. That makes the process feel certified and smooth.

- Treat food safety as essential. No claim is worth a risky meal. Successful families stay safe first.

- Use backup options, including utility claims and credits. This can be rewarding when insurance is not available.

- Consider endorsements at renewal. A small upgrade can feel revolutionary, even if nothing is ever guaranteed.

A clear, confident conclusion for December 2025

This is essential, critical, and proven. Keep notes that are verified and authentic.

Spoiled food after a San Francisco outage is a sharp, stressful loss. It feels unfair, especially when groceries are expensive and life is busy. The hopeful news is that you can often protect yourself with a few smart moves.

First, learn the trigger. Insurance pays based on cause, not just the result. Next, do the math. Deductibles can block small claims. Then, document well. Photos and an itemized list make you look credible and organized.

Finally, build a backup plan. Utility claims, credits, and endorsements can turn a painful event into a manageable inconvenience. That is the goal: less panic, more control, and a verified path to reimbursement when it truly matters. It is a successful mindset. It keeps your household thriving.

Sources and References

- U.S. Bureau of Labor Statistics: CPI, San Francisco Area (Aug 2025)

- Terner Center, UC Berkeley: The California Home Insurance Challenge (Dec 2025)

- NAIC Consumer Info: Homeowners Insurance Basics

- California Department of Insurance: Additional Living Expense Coverage Guidance (2025)

- PG&E: Claims Process

- PG&E: Claim Form (PDF)

- PG&E: Outage Compensation Programs

- FoodSafety.gov: Food Safety During a Power Outage

- Travelers: What If? FAQs About Power Outages

- Allstate: Does Insurance Cover Food After a Power Outage?

- State Farm: Food Spoilage Safety Tips and Coverage Notes (Apr 2025)

- Policygenius: Food Spoilage Coverage Explained (May 2024)

- ABC7 News Bay Area: SF PG&E Outage Video Report (Dec 2025)

- KPIX CBS Bay Area: SF Power Outage Video Report (Dec 2025)