Explore how faith shapes budgeting, debt, giving, investing, and insurance. Build a calm, ethical plan that fits your beliefs in 2025.

Introduction: why money feels spiritual

Money is practical. Money is emotional too. This is a vital conversation. For many people, it is also spiritual. Your paycheck can feel like provision. The next bill can feel like fear. That donation can feel like worship. Debt can feel like shame. Those feelings are powerful, and they shape decisions. That mix can feel overwhelming. Calm planning can be surprisingly freeing.

Religion matters here because it gives people a moral map. Religion teaches what is worthy. Many traditions warn about harm. It sets priorities for family, community, and the future. In December 2025, personal finance is also louder than ever. Apps make spending fast. Credit is one tap away. Scams look polished. Meanwhile, prices still feel high in many places. All of that can pull you away from your values.

This guide is an essential bridge between belief and behavior. It offers a proven framework you can trust. The goal is peaceful progress. It does not try to convert you. It tries to equip you. You will learn how to turn sacred values into simple money rules. You will also see where faith can protect you, and where it can accidentally pressure you.

Additionally, you will learn how to talk about money without conflict. You will learn how to plan with hope and discipline. Most of all, you will build a verified, practical system that matches your conscience.

How religion influences financial behavior

Religion affects finance in quiet ways. It shows up in habits, choices, and even stress levels. However, the impact is not magical. It is social and psychological. It is also deeply personal.

Your beliefs create a money story

Every person has a money story. Some stories say, “Money is dangerous.” Other stories say, “Money proves success.” Many faith traditions push a third story: “Money is a tool.” That tool can serve love, justice, family, or ego.

A money story shapes daily actions. If you fear money, you may avoid planning. When you worship money, you may chase status. If you see money as a trust, you may plan with steady care. That mindset can be liberating. It can also be demanding. The key is to keep it humane.

Consequently, your first task is to name your story. Ask yourself one honest question: “What do I think money says about me?” The answer may feel uncomfortable. That discomfort is useful. It points to the beliefs that drive your spending, your saving, and your risk taking.

Community norms can lift you or trap you

Faith is often lived in community. That community can be a lifesaving support. It can also create pressure. Some groups celebrate simplicity. Others celebrate visible blessing. Some communities have strong giving expectations. Others keep money private.

Meanwhile, social media adds fuel. People now display charity, luxury, and lifestyle online. A religious person can feel torn. They want to be generous. They also want to look successful. That tension can push bad choices, like overspending on weddings, funerals, or status gifts.

The strongest communities do two things well. First, they normalize wise planning. Second, they protect people from shame. When your community respects privacy and welcomes honest struggle, you are more likely to build a successful budget and follow it.

Turning values into a budget you can live with

A budget is not a punishment. It is a plan for peace. A clear plan feels calming. It also feels empowering. Still, many people hate budgets. They feel restricted. They feel judged. However, a values based budget can feel surprisingly freeing.

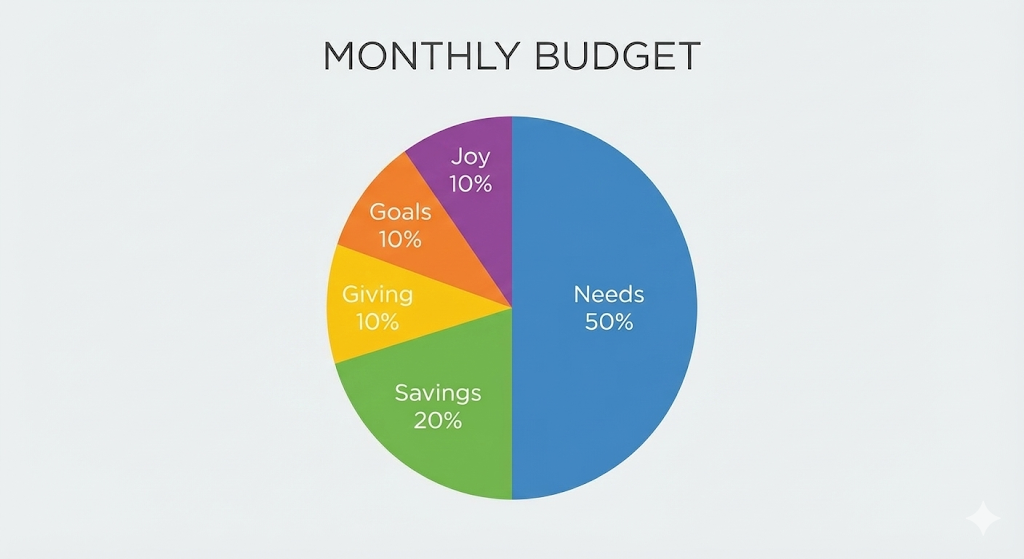

The “purpose budget” method

Start by giving every dollar a purpose. Not a perfect purpose. Just a clear one. This is proven to reduce impulse spending. It also reduces anxiety because you know what is covered.

First, name your sacred priorities. For one person, it is family security. Another person may prioritize charity. Education may come first for others. Then, build your spending around those priorities. In practice, this means you decide in advance what “enough” looks like in each area.

Additionally, add a “compassion line.” This is money for real life surprises. That line can cover a relative in need. It can also cover travel for a funeral. Sometimes it covers a medical gap. The goal is to avoid panic borrowing when life hits hard.

Spending with intention, not guilt

Many faith communities talk about self control. That can be inspiring. Yet it can turn toxic when it becomes guilt. A healthier approach is intention. Intention is the skill of choosing. It is not the drama of self punishment.

For example, it is wise to decide a “joy budget.” Joy can be a coffee, a dinner, or a small hobby. Without planned joy, many people binge spend later. That binge creates shame. Shame then creates secrecy. Secrecy destroys trust in families.

Furthermore, use modern tools with wisdom. Budgeting apps, bank alerts, and category limits can be extremely helpful. AI powered budgeting assistants are also more common in 2025. They can spot patterns fast. Still, a tool cannot replace honesty. You must decide what you want your money to represent.

Debt, interest, and conscience

Debt is not only financial. It is emotional. It can become spiritual too. However, the topic is complex because religions view debt in different ways.

When debt becomes a heavy burden

Debt is useful when it builds long term value. A student loan may create skills. A mortgage may create stability. Yet consumer debt often buys short term comfort at long term cost. That trade can feel brutal.

Additionally, high interest debt can create a sense of bondage. You work hard. You pay. The balance barely moves. That is discouraging. It can also breed resentment. In families, debt is a common source of conflict and secrecy.

A faith centered approach starts with truth. This is a critical moment. Honest numbers are protective. List every debt. Write the balance, rate, and minimum payment. Then choose a payoff strategy you can sustain. Many people prefer the “snowball” method because it creates quick wins. Others prefer the “avalanche” method because it minimizes interest costs. Both can work. The best plan is the one you follow.

Faith compatible borrowing options

Some religious traditions restrict interest, or at least warn strongly about it. Even if you do not follow a strict rule, you may want ethical options. Fortunately, more options exist in 2025.

In Islamic finance, Sharia compliant products aim to avoid riba and focus on shared risk, asset backing, or profit sharing. Outside that, ethical credit unions and community lenders can offer fairer terms. In many Christian and Jewish contexts, there are also faith aligned counseling programs that focus on stewardship and wise repayment.

Meanwhile, family loans are common in many cultures. They can be beautiful. They can also explode relationships. If you borrow from family, treat it like a real contract. Put dates in writing. Agree on what happens if you cannot pay. Clarity is protective, not cold.

Saving, emergency funds, and trust

Saving can sound unspiritual to some people. They worry it shows a lack of faith. However, most traditions also value wisdom and preparation. The key is to save without fear.

Building a safety net that reduces panic

An emergency fund is a practical shield. This cushion is vital for peace. In a true crisis, it can be lifesaving. It protects you from sudden medical costs, job gaps, and family emergencies. It also protects your relationships, because money stress often creates harsh behavior.

Start small. A first goal can be one month of basic expenses. Then build toward three months. Some people aim for six months. The “right” size depends on your income stability, family size, and health risk.

Additionally, separate your emergency savings from daily spending. Use a different bank account if possible. If you see the money every day, you may spend it. Distance helps discipline.

Saving in a high inflation world

Inflation and interest rates have been a major story in 2024 and 2025. Even when inflation cools, prices often feel sticky. Consequently, many people now care about high yield savings accounts, money market funds, and short term Treasury options.

Your faith values can guide your choices here too. You can choose safe and transparent products. You can also avoid hype. In 2025, many scams promise “guaranteed” high returns. Avoid them. Real safety is usually boring.

Furthermore, remember the emotional goal of saving. The point is not to hoard. The point is to create calm. Calm makes you more generous and more rational. It also makes it easier to say no to bad deals.

Giving, generosity, and the psychology of “enough”

Giving is where religion and money meet most visibly. It is also where people feel the most pressure. However, generosity can be deeply rewarding when it is wise. Joyful giving often strengthens trust.

Different traditions, similar goals

Many Christians practice tithing or planned giving. Muslims practice zakat and often sadaqah. Jews practice tzedakah and structured charity. Many Buddhists practice dana. Hindus may practice daan. The names differ, but the heart is often similar: support community, reduce suffering, and loosen the grip of greed.

Additionally, generosity is not only money. It can be time, skills, and mentorship. Still, money is unique because it is measurable. That makes it easy to compare, and comparison can create pride or shame.

A healthy giving plan is clear and private. Decide a range that fits your situation. Then automate it if you can. Automation removes mood swings. It also reduces “giving theater,” where you donate for approval.

Giving without sacrificing your future

Some people give until they are in danger. That can feel heroic. It can also be reckless. A more sustainable approach balances charity with self care. In many traditions, caring for family obligations is also a moral duty.

Consequently, you can set a giving “floor” and a giving “ceiling.” The floor keeps you consistent. The ceiling keeps you safe. If your income rises, you can raise the range. If your income falls, you can lower it without guilt.

Furthermore, beware of manipulative appeals. Any leader who uses fear, shame, or threats to extract money is creating harm. True spiritual leadership protects people. It does not exploit them.

Investing with integrity in 2025

Investing is about the future. Religion is often about the future too, in a moral sense. That creates a natural connection. However, investing can also feel intimidating.

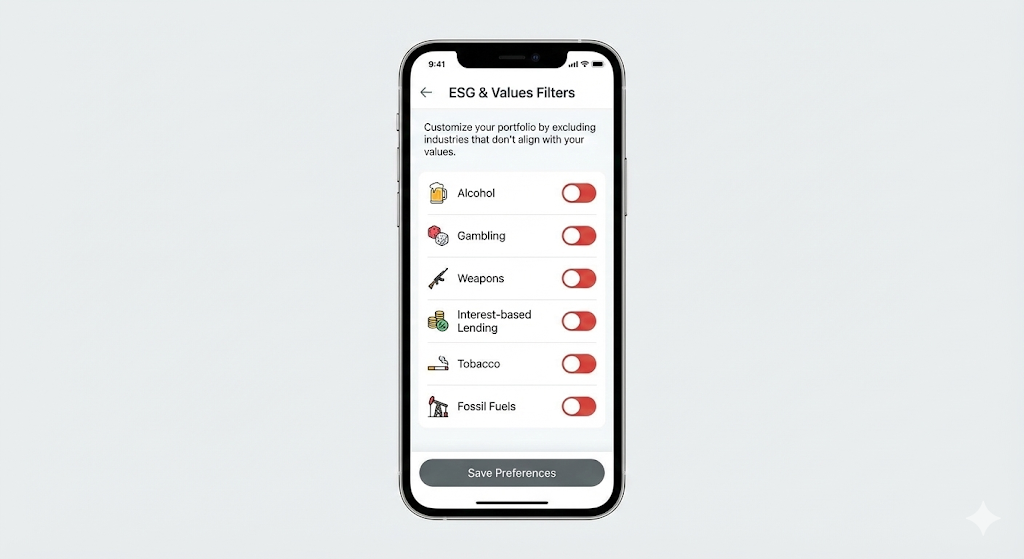

Ethical investing, ESG, and faith based screens

Ethical investing has grown fast. You may hear terms like ESG, sustainable investing, or values aligned portfolios. Faith based investing is part of this movement, but it has its own screens.

For example, some faith aligned investors avoid companies tied to alcohol, gambling, pornography, or weapons. Others avoid predatory lending. Some focus on positive impact, like clean water, healthcare, or education.

Additionally, be careful with slogans. A fund can claim ethics and still be messy. Always read the holdings and the methodology. Look for verified disclosures and transparent screens. Authentic alignment matters. In 2025, many platforms now offer “values filters.” Those filters can be helpful. Yet they are not perfect.

Faith specific products and smart questions to ask

Islamic finance includes concepts like sukuk, profit sharing, and asset backed structures. Christian and Jewish investors may focus on stewardship and social impact. Many investors of all traditions now ask about labor standards and supply chains.

Meanwhile, robo advisors can build diversified portfolios cheaply. That is good for small investors. Still, you must ask the right questions. How much are the fees? What is the risk level? In a market crash, what happens? Is the portfolio diversified across regions and sectors?

A critical reminder helps here: there is no risk free return. Trusted basics still win over time. A “guaranteed” market profit is usually a trap. Diversification, long time horizons, and disciplined contributions are the trusted path for most people.

Insurance and risk through a faith lens

Insurance is often ignored in religious conversations. That is a mistake. Insurance is not only a product. It is a form of protection and responsibility.

Why insurance can fit stewardship

Faith traditions often teach care for family and community. Insurance supports that care. It reduces the chance that one crisis destroys a household. It can also prevent relatives from carrying the full burden during tragedy. That protection is meaningful. It is also deeply caring.

Consider the main categories: health, life, disability, property, and liability. Secure coverage supports stable families. Each serves a different risk. In many cases, the most vital coverage is health and disability, because income loss can be devastating.

Additionally, insurance is about probability, not prophecy. You are not betting on disaster. You are acknowledging reality. That is a mature and humble stance. It also supports peace.

Mutual aid, takaful, and community support

Some people prefer community based risk sharing. Mutual aid groups exist in many faith communities. Islamic takaful is also structured as cooperative risk sharing in many markets.

However, mutual aid has limits. Some groups may not cover large losses. Regulation may be limited. Group health can also matter. Consequently, it can be wise to combine mutual aid with formal insurance.

Furthermore, read policies carefully. Many people buy insurance and then discover exclusions later. Clarity is essential. If you feel confused, ask a licensed professional. A trusted advisor should explain terms in plain language.

Family, marriage, inheritance, and legacy

Religion often shapes family life. It also shapes how families handle money. In December 2025, family finances face new pressures, like remote work moves, blended families, and cross border assets.

Building money unity in a relationship

A couple does not need identical beliefs. They do need shared rules. Money conflict often comes from hidden expectations. One partner thinks generosity is the priority. The other thinks security is the priority. Both are valid. The fight comes from silence.

Additionally, schedule a monthly “money meeting.” Keep it short. Make it kind. Review bills, goals, and upcoming obligations. Then end with a simple question: “What do we want our money to say about us this month?”

Meanwhile, protect the relationship from secrecy. If you hide purchases, you create distrust. If you hide debt, you create a crisis later. Honesty is a powerful form of love.

Inheritance, wills, and moral clarity

Many traditions have strong teachings on inheritance. Some have legal structures too. Even if you follow a strict system, you still need documents. A will, beneficiary forms, and clear records can prevent painful conflict.

Estate planning is not only for the rich. It is for anyone who loves people. It is also for anyone who has children, property, or dependents. In 2025, digital assets also matter. That includes online accounts, crypto wallets, and business logins.

Consequently, make a simple legacy file. List accounts, contacts, and key instructions. Store it safely. Then tell one trusted person where it is. This is a calm, responsible act.

Modern money traps: pressure, BNPL, and scams

The modern financial world moves fast. That speed creates opportunity. It also creates danger. Religion can help here, because it trains patience. However, patience must become a habit.

Buy now pay later and the illusion of “easy”

BNPL products feel friendly. They look like budgeting. Yet they are still credit. Late fees and missed payments can cause real stress. Additionally, BNPL can encourage impulse buying because the pain feels delayed.

If your faith teaches contentment, BNPL is a clear test. Ask one question before using it: “Would I buy this if I had to pay all today?” If the answer is no, pause. Delay is a powerful tool.

Furthermore, if you do use BNPL, treat it like a loan. Track it. Pay on time. Avoid stacking multiple plans across apps. Stacking creates a fog. That fog creates accidents.

Fraud, deepfakes, and “blessed” scams

Scams now use AI. Deepfake voices can mimic relatives. Fake investment platforms look real. Some scams even use religious language. They promise “breakthrough blessing” if you invest now. That is predatory.

Consequently, slow down. Verify. Stay calm and steady. That calm is a powerful advantage. Call a known number. Do not trust a message that creates immediate urgency. Legitimate institutions do not demand secrecy. They also do not threaten you with shame.

Additionally, protect your community. If you see a scam, warn others. Older members are often targeted. Helping them is a meaningful act of service.

A 30 day faith forward finance reset

You do not need a perfect system. You need a consistent one. Consistency is proven to beat intensity. Small steps feel rewarding. This is a simple, practical reset you can start today.

Days 1 to 7: clarity and courage

Begin with a full money inventory. Track income. List expenses. List debt. Include giving commitments. Do it with honesty and kindness.

Next, write a one sentence “money mission.” Keep it short. For example: “We use money to protect our family and serve others.” This mission is a powerful anchor.

Additionally, choose one small habit. It can be checking your bank balance daily. It can be packing lunch twice a week. Small wins build confidence fast.

Days 8 to 15: protection and stability

Build or rebuild your emergency fund. Even a small amount is meaningful. Then review insurance basics. Ask what would break your life if it happened.

Meanwhile, set automatic bill pay for fixed costs. Automation prevents late fees. Late fees are a silent drain. Avoid them whenever possible.

Furthermore, create one barrier against impulse. Remove saved cards from shopping apps. Turn on spending alerts. Pause one subscription. These actions feel small. They create real freedom.

Days 16 to 23: debt momentum and clean habits

Choose your debt strategy. Then pay extra on one target. Celebrate the progress. Celebration matters because it keeps you moving.

Additionally, replace one “status” expense with one “value” expense. For example, reduce luxury spending and fund a skill course. That shift builds dignity and long term income power.

Consequently, talk about money with someone safe. A spouse, a mentor, or a counselor can help you stay accountable. Shame thrives in silence.

Days 24 to 30: generosity, growth, and a long view

Revisit your giving plan. Make it sustainable. If you are giving from debt, consider a smaller consistent gift and a future plan to increase.

Meanwhile, start investing if you are ready. Keep it simple. Use diversified funds. Align choices with your ethics. Avoid hype.

Finally, write a one page legacy note. Name your key accounts, beneficiaries, and wishes. This is a loving act. It is also calming.

December 2025 snapshot: trends that shape faith and finance

This section connects recent 2024 to 2025 trends to daily decisions. These facts matter because they change the emotional climate around money.

Giving trends and faith communities

In the United States, total charitable giving in 2024 rose 6.3%, or 3.3% after inflation adjustment, according to the Giving USA 2025 findings. Religious organizations still received the largest share in dollars, even as growth in that category was modest. (Lake Institute)

Additionally, surveys of donors show that personal finances and inflation can push people to give less in certain years. That tension is real for households. It is also real for religious institutions that depend on donations. (Candid)

Household debt and financial stress signals

In the third quarter of 2025, the New York Fed reported total U.S. household debt reaching about $18.59 trillion. Delinquency rates also moved slightly higher. These signals matter because debt stress often hits families and communities at the same time. (Federal Reserve Bank of New York)

Meanwhile, high debt makes people vulnerable to shame based financial messaging. It can also make them chase “miracle” solutions. A calm payoff plan is still the most reliable path.

BNPL growth and the new credit culture

In December 2025, the CFPB released a report on the buy now, pay later market, covering trends from 2019 to 2023 and noting strong growth and increasing usage. In practical terms, BNPL is now a mainstream spending habit for many consumers. (Consumer Financial Protection Bureau)

Consequently, values and guardrails matter more than ever. A small rule, like “BNPL only for planned essentials,” can prevent regret.

Insurance growth and protection thinking

Insurance is also changing. Swiss Re projected strong real growth in life insurance in 2024, with continued growth expected in 2025 and 2026, supported in part by higher interest rates. OECD reporting on global insurance market trends also shows premiums rising in real terms in 2024 in many jurisdictions. (Swiss Re)

Additionally, these trends matter for households because pricing, coverage options, and risk awareness are shifting. Protection is becoming a central part of financial wellness.

Inflation outlook and the mood of money

The IMF’s World Economic Outlook updates in 2025 note that global inflation is expected to keep declining, though it may remain above target in some countries. (IMF) Even when inflation slows, people still feel cautious because past price increases linger.

Consequently, the emotional work of money remains vital. Faith can help you stay steady. It can also help you avoid panic.

Conclusion: a peaceful and powerful alignment

Religion and personal finance meet at one deep question: “What is my life for?” Money then becomes a mirror. It reflects priorities. It also reveals pressure points.

However, you are not trapped by your past. A thriving system can be simple and kind. Paying down debt is possible without despair. Saving can happen without fear. Generosity can grow without guilt. Investing can stay aligned with your conscience. Insurance can protect your family without shame.

Additionally, the world in December 2025 is noisy. Credit is easy. Scams are slick. Prices still sting. In that environment, faith can be a breakthrough advantage. Faith can slow you down. It can keep you grounded. This grounding can make your choices more intentional, more disciplined, and more rewarding.

Most of all, values give you a definition of “enough.” Stay hopeful as you build it. That definition is priceless. It is also emotionally reassuring.

Sources and References

- Giving USA 2025: Trends in Religious Giving (Lake Institute)

- 5 takeaways on individual donors’ 2025 charitable giving plans (Candid)

- Bank of America Study of Philanthropy: 2024 trends (Bank of America Private Bank)

- IMF World Economic Outlook, October 2025 (IMF)

- IMF World Economic Outlook Update, July 2025 (IMF)

- New York Fed: Household Debt and Credit (Federal Reserve Bank of New York)

- New York Fed Household Debt and Credit Report 2025Q3 PDF (Federal Reserve Bank of New York)

- CFPB: The Buy Now, Pay Later Market (Consumer Financial Protection Bureau)

- Swiss Re sigma 5/2024: Global insurance outlook (Swiss Re)

- OECD Global Insurance Market Trends 2025 (OECD)