Discover the proven power of compound interest in 2025. See simple examples, smart habits, and vital mistakes to avoid so your money can thrive for decades.

December 2025 reality check

Compound interest is not a cute slogan. It is a relentless engine. Done right, it builds a rewarding future in the background. On the flip side, it can drain you with brutal speed when it works against you.

In December 2025, this topic feels immediate. Savings yields have been attractive in recent years. At the same time, borrowing costs have been painfully high. Consequently, many people are finally seeing compounding in real numbers, not theory.

This guide stays practical. It keeps the math simple. It also stays honest about risk.

What compounding really means

Compound interest is interest earned on both your starting money and the interest already added. That second part is the breakthrough. It turns time into a multiplier.

Simple interest is different. With simple interest, you earn interest only on the original principal. With compounding, the base grows. Therefore, the interest earned each period grows too.

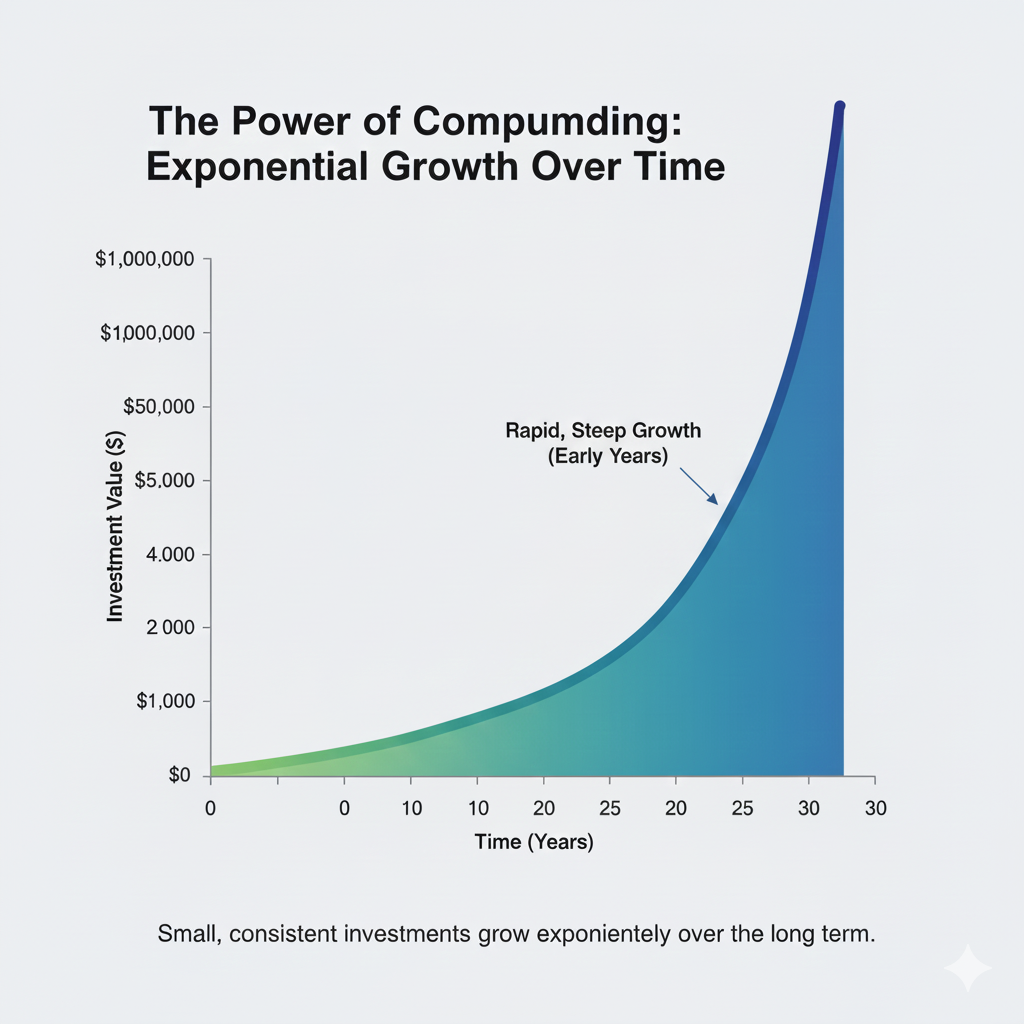

Why it feels like “money magic”

Compounding starts slow. Early results look boring. Then the curve bends. The last years often do most of the heavy lifting. That delayed payoff is why it feels mysterious.

However, the mechanism is plain. Growth depends on four levers: rate, time, contributions, and frequency. You control three of those levers more than you think.

The simple math that changes everything

Most people do not need complex formulas. You need a clean mental model. Still, seeing the structure builds confidence.

The core formula in plain language

A common compound interest formula looks like this:

Future value = Principal × (1 + rate/periods)^(periods × years)

That line can look intimidating. Yet each part is concrete.

Principal is your starting amount. Rate is the annual interest rate. Periods is how often interest is added. Years is time.

Additionally, deposits matter. If you add money each month, you are not just compounding. You are stacking compounding layers. Each deposit becomes a tiny engine of its own.

The Rule of 72 for fast decisions

The Rule of 72 is a quick shortcut. Divide 72 by an annual rate. The result is the approximate years to double.

At 6%, 72/6 is about 12 years. At 9%, it is about 8 years. This is not perfect math. Still, it is a powerful mental tool for comparing options.

Compound interest vs compound returns

People say “compound interest” when they really mean “compounding.” The distinction matters. It keeps your expectations realistic.

Interest is promised, returns are not

In a savings account or a CD, interest is stated upfront. You can estimate the path. It may still change. Yet it is usually stable in the short term.

In stocks and bonds, you often earn returns. Returns are not guaranteed. Prices move. Dividends can change. Bond yields shift. Therefore, investing compounding is less predictable.

Still, returns can compound in the same way. Gains remain invested. Future gains build on a larger base. That is compounding, even without an interest rate printed on a statement.

Why this distinction protects your emotions

When you expect a smooth curve, volatility feels like failure. That feeling can trigger panic selling. Panic selling breaks compounding.

When you expect a bumpy ride, you can plan. Holding some cash can prevent forced selling during emergencies. Diversification can soften shocks. Rebalancing can keep risk in check. Consequently, you protect the compounding engine when it matters most.

Time is the most valuable ingredient

People obsess over picking the perfect investment. They ignore the calendar. That is a costly mistake.

A vivid beginner example

Imagine two investors. Both are disciplined. Both earn the same average return.

Investor A starts at 20. They invest a small amount each month. Investor B starts at 30. They invest the same amount each month.

A has ten extra years. That decade is not “just” ten years. It is ten years of growth on growth. As a result, A can end up far ahead, even if both behave well.

The intermediate investor twist

Now add an intermediate reality. Income rises over time. Many people contribute more later.

Even then, starting earlier is usually a decisive advantage. Early contributions sit in the market longer. They compound for more cycles. Consequently, the early deposits can beat larger later deposits.

This is why retirement planners repeat one phrase: start now. It is not hype. It is math.

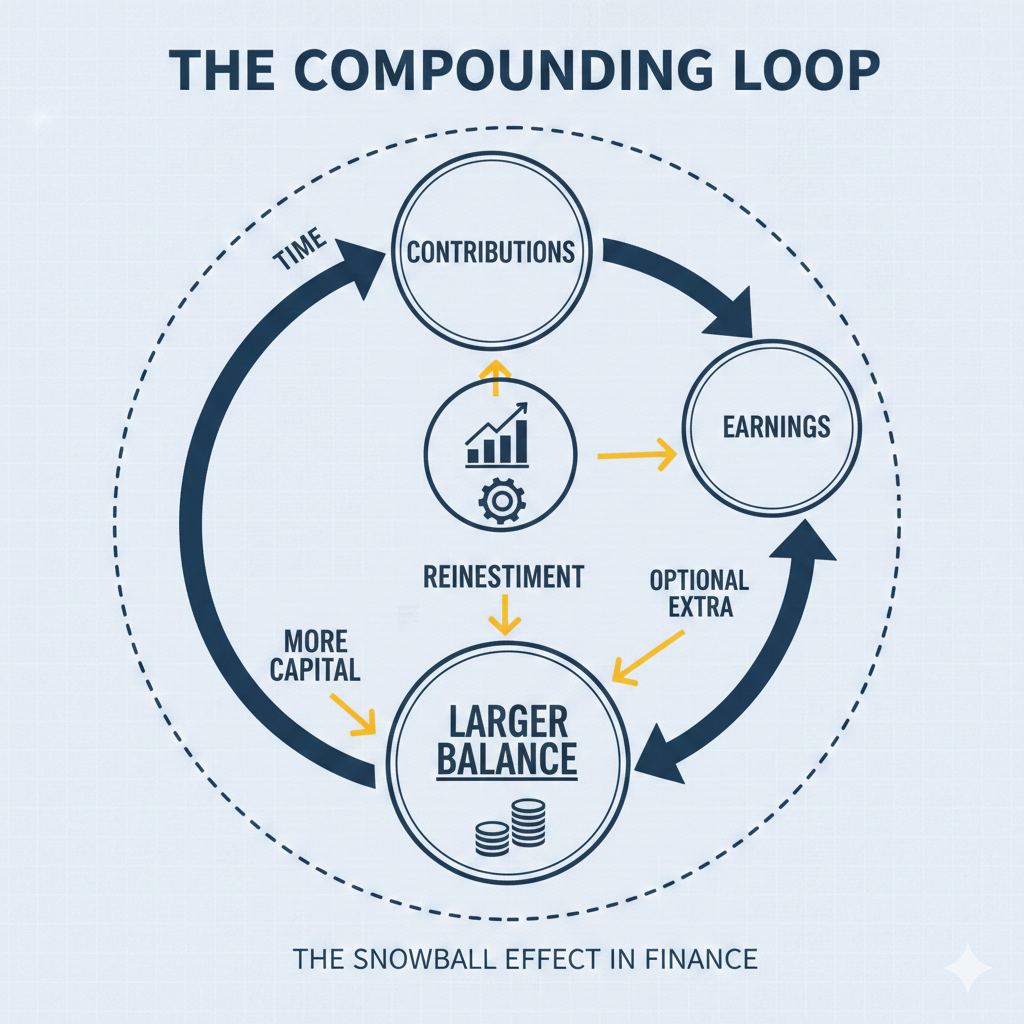

Frequency matters, but habits matter more

Compounding frequency can help. Monthly compounding beats annual compounding at the same stated rate. The difference is often modest. The habit difference is massive.

Monthly contributions are emotional insurance

A monthly contribution turns investing into a routine. Routine reduces fear. Routine also reduces decision fatigue.

Furthermore, it makes volatility less scary. When markets dip, your automatic buy can purchase more shares. When markets rise, you still participate. This is the calm logic behind dollar cost averaging.

Automatic reinvestment is the quiet hero

Dividends and interest can be paid out as cash. Or they can be reinvested. Reinvestment is how you keep the compounding loop closed.

Many brokers let you automatically reinvest dividends in stocks or ETFs. Many bond funds and money market funds reinvest by default. That default can be a vital advantage.

Where compound interest shows up in real investing

Compound interest is often discussed as a savings account concept. That is incomplete. Investing has compounding too. It just shows up as compound returns.

Additionally, different assets compound in different ways. Understanding the differences is empowering.

Savings accounts, CDs, and cash tools

Bank accounts can compound daily, monthly, or quarterly. Certificates of deposit can compound too. Money market funds often distribute yield, then reinvest.

In late 2024 and 2025, many people rediscovered cash returns. That can be rewarding for emergency funds and short goals. However, long term goals usually need growth that can outpace inflation.

Still, cash has a crucial role. It keeps you from selling investments in panic. It also protects you from surprise bills.

Bonds and bond funds

Bonds pay interest, often called coupons. When you reinvest those coupons, compounding begins. Bond funds can also compound through reinvested distributions.

However, bond prices move. Rates rise and prices tend to fall. Rates fall and prices tend to rise. Therefore, bond compounding is not as smooth as a savings account.

Yet bonds can be a stabilizing force. They can reduce portfolio swings. They also create predictable income streams for many goals.

Stocks, dividends, and reinvested growth

Stocks do not pay “interest.” They can still compound. Price growth compounds when gains remain invested. Dividends can also be reinvested, creating more shares, which can produce more dividends.

Moreover, many companies reinvest profits inside the business. That internal reinvestment can drive long-term earnings growth. Earnings growth can support long-term price growth.

This is why patience is a certified advantage. Short-term market noise is loud. Long-term compounding is stronger.

Compounding needs protection from volatility

Compounding is powerful. Yet it is fragile when you quit early. The main threat is not bad math. The threat is bad timing plus bad behavior.

Sequence of returns risk in plain English

Two investors can earn the same average return. One ends with more money. The other ends with less. How is that possible?

The order of returns matters. A big drop early can hurt more. A big drop right before you withdraw can also hurt. Consequently, investors who are close to a goal need a different approach than investors who are far away.

This is not fearmongering. That is reality. Still, planning can reduce the damage.

Diversification as a shock absorber

Diversification spreads risk across assets. It cannot prevent losses. Still, it can reduce the odds that one event ruins you.

A mix of stocks and bonds can feel calmer than stocks alone. A global mix can also help. Furthermore, holding some cash can prevent forced selling during emergencies.

The emotional win is vital. A calmer portfolio is easier to hold. Holding is how compounding survives market storms.

Rebalancing keeps the engine honest

Rebalancing means bringing your portfolio back to your target mix. It often means trimming what went up and adding to what went down.

That feels counterintuitive. Yet it can be a disciplined way to “buy low and sell high” without predictions. Additionally, it can control risk as your portfolio grows.

Rebalancing does not guarantee better returns. It can improve consistency. Consistency is a powerful ally of compounding.

The hidden enemies of compounding

Compounding is strong. Still, it is not unstoppable. Friction can quietly destroy it.

Fees: the silent leak in your bucket

Investment fees look small. A 1% fee feels harmless. Over decades, it can be devastating.

Fees reduce your return every year. Then the lost return also stops compounding. Consequently, the damage can be double: less growth now, and less growth later.

This is why low-cost index funds and low-cost ETFs became so popular. They offer a simple, verified way to reduce friction. (YouTube)

Inflation: the invisible thief

Inflation is not a headline only. It is a daily reality. It reduces what your money can buy.

If your savings earns 4% and inflation runs 3%, your real growth is about 1% before taxes. That is still positive. Yet it can feel disappointing.

Therefore, your plan should match your timeline. Short goals may favor stability. Long goals often need growth assets that can outpace inflation, even if they fluctuate.

Taxes: the rules that shape your outcome

Taxes differ by account and by country. Yet one idea is universal. Sheltering compounding helps.

In the United States, retirement accounts can offer tax advantages. Traditional accounts can defer taxes. Roth accounts can offer tax-free qualified withdrawals.

In December 2025, retirement contribution limits remain a critical detail for planners. Those limits change over time. The exact numbers matter. Still, the bigger idea matters more: tax-advantaged space can protect compounding.

2024 and 2025 compounding snapshots

Numbers make the lesson real. They also show why compounding is both thrilling and dangerous.

Retirement limits that can accelerate compounding

In 2025, many savers can contribute $7,000 to an IRA, or $8,000 if they are age 50 and older. Many workplace plans also allow up to $23,500 in employee deferrals for 2025. For 2026, the IRS announced increases to $7,500 for IRAs and $24,500 for 401(k) deferrals. (AP News)

These limits are not trivia. They are capacity. Capacity lets you compound more of your money, not less. Additionally, higher limits can encourage a simple habit: raise contributions when the rules allow it.

Inflation data that changes the “real return” story

Inflation cooled from the extremes of 2022. Yet it has not vanished. In 2025, inflation readings still matter for planning. (YouTube)

This matters because compounding is about purchasing power, not just dollars. Consequently, a plan that ignores inflation can feel successful on paper, yet disappointing in life.

Borrowing costs that amplify negative compounding

Credit card rates can be painfully high. In 2024 and 2025, the broad average rate tracked by the Federal Reserve stayed above 20% for long stretches. When rates are high, compounding works against borrowers with ruthless speed. (FRED)

That is why debt payoff can be an immediate, vital “return.” You avoid interest today. You also avoid future interest on interest. The relief is real.

The most powerful compounding move: regular contributions

A single deposit can grow. Regular deposits can transform.

Why consistency wins against perfection

Many investors wait for a perfect entry. They wait for a “safe” moment. That moment often never comes.

Meanwhile, consistent investing captures many market environments. It reduces regret. It also turns you into a system builder, not a fortune teller.

This is a proven mindset shift. You stop asking, “Is today the perfect day?” You start asking, “Did my plan execute today?”

How intermediates can level up without complexity

Beginners need momentum. Intermediates need refinement.

If you already invest, focus on three upgrades. First, reduce costs where possible. Second, increase contribution rate when income rises. Third, keep your asset mix aligned with your timeline.

Additionally, consider tax location. Some assets are more tax-efficient in taxable accounts. Some can fit better in retirement accounts. This is an advanced lever, yet it can be very rewarding.

When compounding works against you

Compound interest has a dark mirror. Debt can compound too. This part is essential.

Credit cards and revolving debt

Credit cards often compound interest daily. High rates can turn small balances into punishing burdens. Late fees can add fuel too.

Consequently, paying only the minimum can feel like running in place. The math is designed to be slow.

If you carry revolving debt, the most profitable investment may be paying it down. That can be a verified “return” equal to your interest rate, after tax, with no market risk.

A practical way to stop negative compounding

Start with clarity. List balances, rates, and minimums. Then choose a payoff method you can stick with.

The avalanche method targets the highest rate first. The snowball method targets the smallest balance first. One is mathematically stronger. The other can be emotionally stronger.

However, the best method is the one you will follow. Consistency is the winning factor again.

Real-world compounding scenarios that feel personal

Abstract examples can feel distant. Let’s make it real.

Scenario 1: A new saver with a short goal

You want a down payment in three years. Safety matters. Liquidity matters.

A high-yield savings account or short-term instruments can be a vital fit. You will see compounding in small, steady steps. That steadiness can protect your goal date.

However, you should not expect explosive growth. The mission here is reliability, not hero returns.

Scenario 2: A long-term investor building retirement wealth

Your timeline is 20 to 40 years. Volatility is normal. Growth matters.

A diversified portfolio can help you stay invested. Diversification reduces the chance that one failure ruins you. Rebalancing can also force disciplined behavior.

Additionally, reinvesting dividends and staying cost-aware can dramatically increase the compounding effect over decades.

Scenario 3: A parent investing for education

Education costs can rise fast. A dedicated account can create focus.

A 529 plan in the US may offer tax advantages for qualified education expenses. Compounding inside a tax-advantaged wrapper can be extremely rewarding.

Still, rules matter. Investments can lose value. Therefore, the portfolio often becomes more conservative as the target date approaches.

A practical 30-day compounding plan

This plan is simple by design. It is meant for beginners and intermediates. It is also built to be sustainable.

Week 1: build a stable base

First, track your cash flow for seven days. Keep it honest. Then set a small emergency buffer goal.

Additionally, remove obvious friction. Turn off unused subscriptions. Reduce fees where you can. Small savings can fund your first automatic contribution.

Finally, decide on one primary goal. Clarity reduces stress. It also increases follow-through.

Week 2: automate contributions and reinvestment

Next, open or review your investing accounts. Set automatic transfers on payday. Choose a number that will not break your budget.

Then enable automatic reinvestment for dividends, if available. This keeps your compounding loop intact.

Meanwhile, choose a default behavior for raises. For example, allocate a set percentage of any raise to investing. That rule can be a breakthrough for long-term growth.

Week 3: build a simple diversified core

Now pick a core approach you understand. Many people use broad index funds or broad ETFs. They offer instant diversification.

Keep the number of holdings small at first. Complexity can create paralysis. A simple, transparent plan is often more successful.

Furthermore, decide how you will split between cash, bonds, and stocks. Your risk tolerance matters. Your timeline matters too.

Week 4: create a review rhythm that prevents panic

Finally, set a calendar habit. Do a monthly review for cash flow. Add a quarterly check for progress. Finish with an annual review for allocation and rebalancing.

Avoid daily checking. Daily checking invites emotional mistakes. It also magnifies noise.

Consequently, your system becomes your protector. You follow rules, not feelings.

The most dangerous myths about compound interest

Myths are expensive. They create false confidence or false fear.

Myth: “Compounding means guaranteed profits”

Compounding is not a promise of positive returns. Markets can fall. Bonds can lose value. Inflation can spike.

What compounding does guarantee is this: if returns are positive and reinvested, growth accelerates. That is a verified mechanism, not a forecast.

Myth: “I missed my chance”

Starting later is not ideal. Yet it is still powerful.

Many people increase contributions. Others reduce fees. Some optimize taxes within legal limits. Another lever is staying invested longer than expected.

Additionally, you can avoid catastrophic mistakes. Avoiding mistakes is a thrilling advantage.

Myth: “The rate is everything”

Rate matters. Yet behavior often matters more.

Time, contributions, and staying invested can beat a slightly higher rate. Fees and taxes can also erase a higher rate. Therefore, focus on controllable levers first.

Closing: turn compounding into your default setting

Compound interest is not for “finance people.” It is for anyone who wants a calmer future.

Start with one automatic transfer. Reinvest what you earn. Keep fees low. Stay diversified. Be patient.

Additionally, protect yourself from negative compounding in debt. That step can feel like immediate relief.

If you do these things, your money gets a job. It works while you sleep. Meanwhile, it can work while you learn. Over years, it works while you build a life.

That is the authentic power of compounding.

Sources and References

- Investor.gov: Compound Interest Calculator

- Investor.gov: What Is Compound Interest? (Teachers Resource)

- Consumer Financial Protection Bureau: How Does Compound Interest Work?

- Fidelity: What Is Compound Interest?

- Fidelity: Continuous Contributions and Compounding

- IRS: Retirement Topics, IRA Contribution Limits

- IRS Newsroom: 401(k) and IRA Limits for 2026

- Investor.gov: Mutual Fund and ETF Fees and Expenses (Investor Bulletin, 2025)

- SEC: How Fees and Expenses Affect Your Investment Portfolio (PDF)

- Vanguard: What Is an Expense Ratio?

- BLS: CPI 12-Month Percent Change Chart

- Federal Reserve: Consumer Credit (G.19) Current Release

- FRED: Commercial Bank Interest Rate on Credit Card Plans

- Investopedia: Compound Interest Definition and Examples