Compare personal loans and credit cards for major purchases and discover which option is safer, cheaper and more empowering for your long term money goals.

Updated December 2025

Choosing how to fund a big purchase can feel like a high pressure moment. You might be excited about a powerful new laptop, a life changing course, a medical procedure or a critical home repair. At the same time, you may feel anxious about taking on debt, afraid of making an expensive mistake and unsure which tool is actually smarter: a personal loan or a credit card.

This guide gives you a clear, emotionally reassuring and data driven way to decide. You will see when a personal loan shines, when a credit card is surprisingly effective and where both can become dangerous if used without a careful plan. Throughout, we use current numbers from 2024 and 2025 so that your decision feels grounded, not theoretical.

Understanding what “big purchase” really means

Before you compare personal loan vs credit card, you need a realistic picture of the purchase itself. A “big purchase” is not the same for everyone. For one person it might be a 1,000 dollar laptop. For another it might be a 15,000 dollar wedding or 8,000 dollars of medical bills.

A helpful way to define a big purchase is emotional and mathematical at the same time:

- It is large enough that you cannot comfortably repay it in one month from your normal income.

- It is important enough to your life that delaying it would create real stress or lost opportunities.

- It carries financial consequences if you choose the wrong kind of borrowing.

In late 2025, many households are already stretched. Central bank data in the United States shows revolving consumer credit, which includes credit cards, growing at an annual rate of about 4.9 percent in October 2025. Non revolving credit, which includes many personal loans, is growing more slowly at about 1.2 percent. (Federal Reserve) This gap hints at a painful reality. People are still relying heavily on credit cards for everyday pressure and big ticket spending.

Because of that, deciding calmly between a personal loan and a credit card for the next big purchase is not just a technical choice. It is a protective move for your future self.

How personal loans work for big purchases

Fixed sum, fixed term, fixed payment

A personal loan is a lump sum that you borrow once and repay over a fixed period, usually between two and seven years. The loan is often unsecured, which means you do not pledge a house or a car as collateral.

In most cases the interest rate is fixed. Your monthly payment stays the same for the whole term. That predictability can feel extremely reassuring when you are already juggling rent, food, transport and other essentials. Guides from NerdWallet and other major finance platforms describe personal loans as installment debt with regular payments and a clear end date. (NerdWallet)

As of late 2025, average personal loan interest rates vary widely. Data from Credible shows that average rates for three year personal loans were about 13.83 percent APR in early December 2025, down from 13.11 percent the week before but still firmly in double digit territory. (Credible) Bankrate’s analysis of credit union lending suggests more attractive averages around 10.72 percent for a three year personal loan at credit unions in the third quarter of 2025. (Bankrate) In some markets such as India, large lenders advertise starting rates near 10 percent per year for strong applicants. (https://www.bajajfinserv.in)

So, while there is no single “normal” personal loan rate, a skilled borrower with good credit can often secure a rate that is significantly lower than a typical credit card APR.

Emotional strengths of a personal loan

For a big, planned purchase, a personal loan feels powerful because it gives you:

- A defined finish line. You know exactly when the debt will be gone if you pay on time.

- A predictable monthly cost that fits into your budget.

- A sense of disciplined structure that can be very motivating if you want to break out of chaotic spending habits.

That structure helps many people feel more in control, more confident and more safe. It reduces the emotional drag of “will my minimum payment explode next month?” which is common with large credit card balances.

Emotional risks and hidden pressure

However, a personal loan also carries risks.

Once the loan is funded, the money lands in your account. That can create a dangerous feeling of sudden abundance. Without a clear, written plan, it is easy to spend part of the funds on something different from the original goal. When that happens, you lock yourself into years of payments for a purchase that is no longer aligned with your priorities.

There is also a psychological trap in the fixed payment itself. Because the monthly amount never changes, you might feel less urgency to accelerate payoff even when your income rises. A personal loan can become comfortable background noise instead of a temporary tool.

How credit cards work for big purchases

Revolving credit and variable cost

A credit card offers a revolving line of credit. You can borrow, repay and borrow again up to a limit. There is no fixed payoff date. Instead, you must make a minimum payment each month, typically between two and four percent of the balance. (NerdWallet)

For everyday spending that you can pay off in full each month, a credit card is flexible and convenient. For big purchases, though, the story changes quickly because of high interest rates.

Recent data from LendingTree shows that the average APR across all credit card accounts in America reached about 21.39 percent in the third quarter of 2025. (LendingTree) Average rates tracked by FRED, the Federal Reserve’s data platform, show a similar level around 21.39 percent for August 2025. (FRED) In the United Kingdom, NimbleFins reports average credit card APRs above 24 percent as of early 2025. (NimbleFins)

Those are punishing numbers. Over time, they turn a big purchase into a heavy financial burden if you only make minimum payments.

Emotional strengths of using a credit card

Even with high rates, a credit card still has powerful benefits when used wisely for big purchases.

First, if you can pay the full balance by the due date each month, you typically pay no interest at all. Some cards also offer 0 percent introductory APR for new purchases for 12 to 21 months, which can be a life changing opportunity if you are very disciplined. (NerdWallet)

Second, many people find that the ability to spread a purchase over two or three months, interest free, gives them emotional relief. They can keep cash in savings for emergencies while still handling an important purchase.

Finally, credit cards offer consumer protection benefits such as dispute rights, fraud protection and sometimes extended warranties. For expensive electronics, travel and online purchases, that protection is invaluable.

Emotional risks and mental traps

The emotional dangers of using a credit card for big purchases are intense.

Minimum payments make the debt feel smaller than it really is. For example, a 3,000 dollar purchase at 21 percent APR with a three percent minimum payment could take more than 15 years to clear if you never pay extra. During that time, you pay more in interest than the original purchase price.

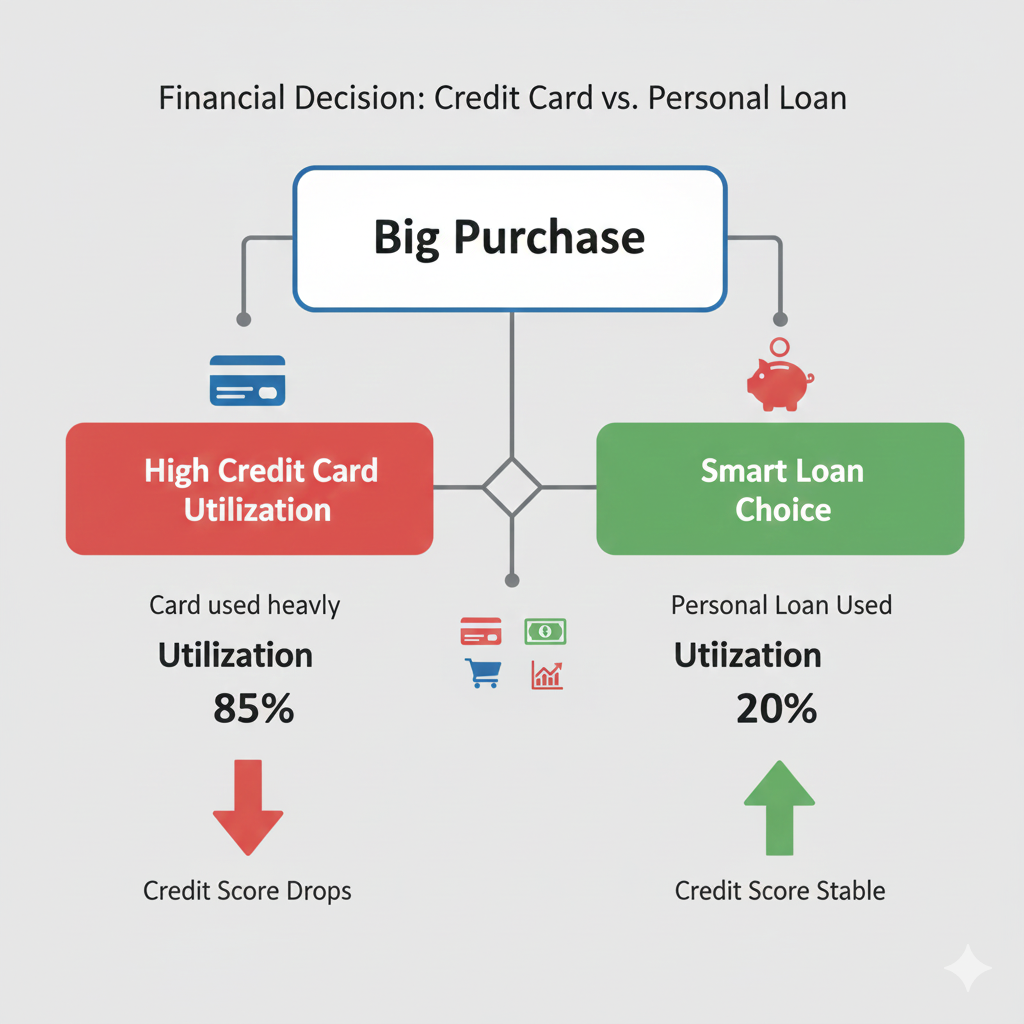

Another risk is credit utilization. If you use a large part of your limit for a big purchase, your utilization ratio spikes. High utilization can hurt your credit score and create a sense of constant pressure each time you open your banking app. NerdWallet and other experts highlight that keeping utilization below 30 percent is a healthy target, with lower being even better. (NerdWallet)

Interest rates in 2025: cost comparison in real numbers

To feel the difference between personal loan vs credit card for big purchases, compare the cost using late 2025 interest levels.

As of December 2025:

- Average credit card APR in the United States sits around 21 percent. (LendingTree)

- Average three year personal loan rates fall around 11 to 14 percent for many borrowers, with some credit unions under 11 percent and online platforms closer to the mid teens. (Bankrate)

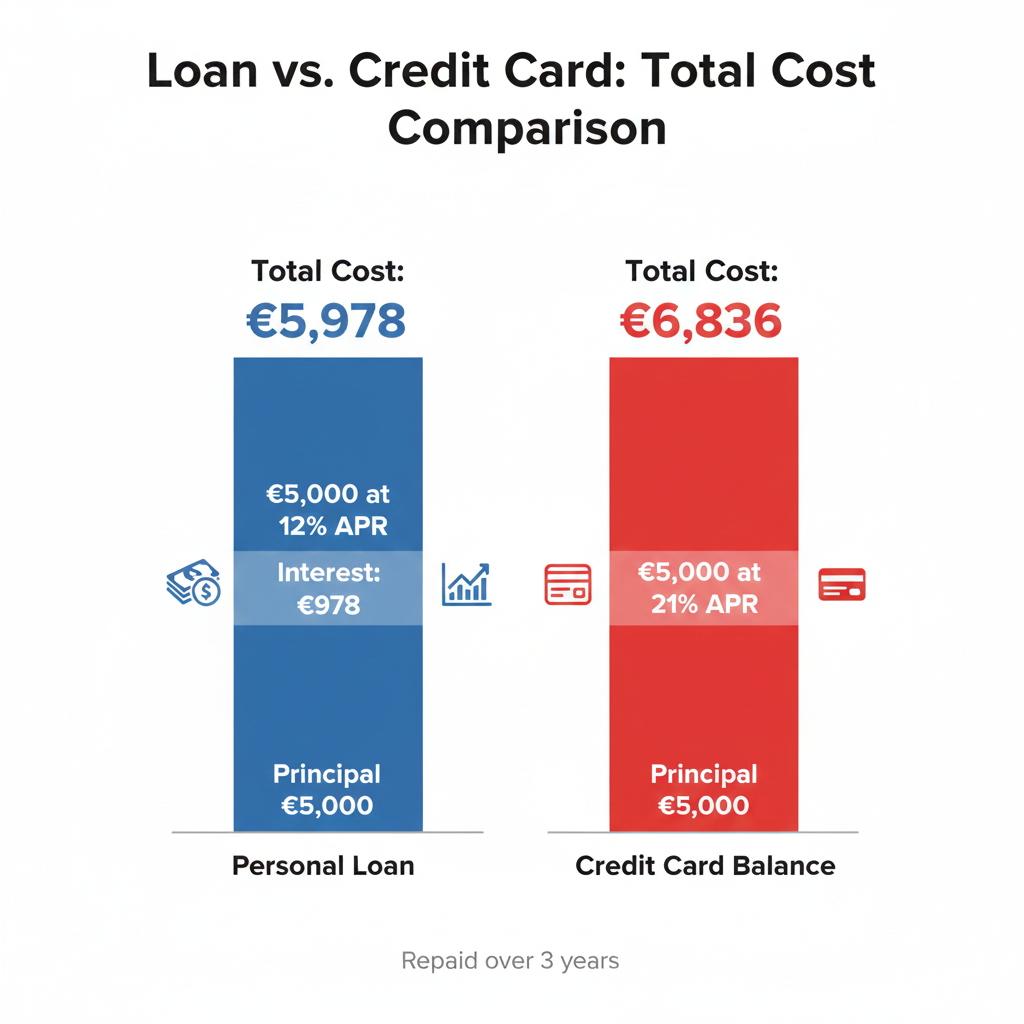

Imagine a 5,000 dollar big purchase that you want to repay in three years.

If you use a personal loan at 12 percent APR, your monthly payment will be roughly 166 dollars and your total interest paid will be around 980 dollars.

If you put that same 5,000 dollars on a credit card at 21 percent APR and commit to paying it off in three years (not just the minimum), your monthly payment will be close to 190 dollars and your total interest will be about 1,840 dollars.

The personal loan saves you around 860 dollars in interest in this simple scenario. The exact numbers vary with fees and exact APR, but the pattern is consistent.

This gap explains why many professional advisors say that for big, planned expenses where you cannot clear the balance quickly, a personal loan is often a more affordable and less stressful choice. (Bankrate)

Video explainer: seeing the comparison in action

Sometimes a visual explanation makes the difference feel more real. The following videos walk through personal loan vs credit card comparisons, focusing on interest rates, tenure and total cost.

These videos are especially useful if you like to pause, replay and absorb concepts visually alongside this written guide.

When a personal loan is usually better for big purchases

One time, clearly defined expense

If your big purchase is a single, clearly defined cost that will not repeat, a personal loan often offers a more stable path. Typical examples include:

- Major home repairs that protect the value of your property.

- Medical procedures that are non negotiable for your health.

- Consolidated tuition payments for a certified program that raises your earning potential.

- A necessary vehicle for work or business when you do not have access to cheaper financing.

In these cases, a personal loan behaves like a focused project. You borrow once, use the funds for the exact purpose, and repay over a time frame that matches the life of the benefit.

Longer payoff horizon and need for discipline

If you already know that it will take more than a year to repay the amount safely, a fixed installment plan is often kinder to your future self. Surveys of personal loan products show that many borrowers choose terms between three and five years because that timeline feels realistic and emotionally manageable. (Fortune)

Instead of juggling a huge credit card balance with a variable minimum payment, you commit to one predictable amount. That structure reduces decision fatigue each month, which is crucial if you often feel overwhelmed by money choices.

Maintaining healthy credit utilization

Using a personal loan instead of a card for a big purchase can keep your credit card utilization ratio low.

Experts frequently highlight that high utilization above 50 or 60 percent can push your credit score down, while keeping utilization under 30 percent supports healthier scores. (NerdWallet) If you load a big purchase onto a card near its limit, your utilization may jump into the danger zone.

By using a personal loan instead, you leave your cards more open for emergencies and small expenses, which keeps your profile more stable in the eyes of future lenders.

When a credit card can be the smarter choice

You can genuinely repay quickly

If your income is stable and you can realistically repay the entire purchase within a few months, a credit card can be extremely efficient.

The key word is genuine. If your internal voice is already saying “maybe I can manage it somehow,” be careful. A smart credit card strategy is built on precise numbers, not hope.

For example, say you want to buy a 1,500 dollar laptop that will significantly improve your productivity. You already know that you can pay 500 dollars per month for the next three months without touching your emergency fund. In this case, putting the purchase on a card and paying in full over three months can be safe, especially if your card has a grace period and you avoid interest.

You qualify for a strong 0 percent intro APR offer

In 2025 many cards still offer 0 percent intro APR on purchases for 12 to 21 months for borrowers with strong credit. (NerdWallet) If you can combine such an offer with a strict payoff plan, a large purchase can become almost free financing.

The emotional danger lies in treating the intro period as permission to relax. The promotional rate ends. If you do not pay the balance before that date, you fall back into double digit APRs, often above 20 percent. At that point, the card becomes more expensive than a personal loan.

You value purchase protections and rewards

Credit cards often provide extra layers of protection that personal loans do not. These may include:

- Chargeback rights if the product is defective or never arrives.

- Extended warranty on electronics or appliances.

- Built in travel protections like trip cancellation or rental car coverage.

For very expensive electronics, flights or hotel packages, these protections may justify using a card if you also have a clear payoff plan. Some people also feel emotionally calmer knowing they have a powerful dispute mechanism behind the transaction.

How personal loans and credit cards affect your credit profile

Hard inquiries and new accounts

Both personal loans and credit cards usually involve a hard inquiry on your credit report when you apply. That may temporarily lower your score by a few points.

Opening either type of account also affects the average age of your credit history. A brand new loan or card will lower the average age, which can have a small negative effect.

However, the long term impact depends more on how you manage the debt than on the application itself.

Payment history and reliability

Payment history is the largest factor in most credit scoring models. Making on time payments on a personal loan or credit card builds a powerful record of reliability.

NerdWallet highlights that using a personal loan to consolidate high interest card debt can help overall credit health, especially when the borrower protects the new structure with consistent payments. (NerdWallet)

Missed payments in either case are damaging. Late payments more than 30 days can stay on your report for years and create emotional and financial stress.

Utilization and emotional breathing room

The most important difference is utilization. Personal loans do not count as revolving credit, so their balances do not affect your utilization ratio. Credit cards do.

If you use personal loans for big purchases and keep card balances relatively low, you can maintain a strong utilization ratio. That gives you more breathing room in case you need new credit in the future.

Global borrowing trends in 2024 and 2025

Looking at the global picture gives additional context.

In the United States, recent releases from the Federal Reserve show consumer credit still rising, but with revolving credit growing faster than non revolving. (Federal Reserve) This hints that many households lean on cards for both daily expenses and big purchases.

In India and parts of Asia, detailed comparisons in financial media suggest that personal loans often carry lower fixed interest rates than credit card loans, which can justify using them for larger needs when eligibility criteria are met. (Moneycontrol)

Meanwhile, lenders and comparison sites around the world have published updated guides in 2024 and 2025 explaining the trade off between personal loans, credit cards and other tools such as lines of credit and buy now pay later products. They consistently stress three things:

- Personal loans provide structure and sometimes lower cost for big, one time expenses. (Bankrate)

- Credit cards offer speed, flexibility and rewards but can be brutally expensive if you carry large balances for long periods. (Bankrate)

- The “best” option depends on the size of the purchase, your repayment horizon, your discipline and your current credit profile. (The Week)

This global perspective can be emotionally grounding. You are not alone in facing these decisions. Millions of borrowers are asking the same question and slowly learning the same lesson: choose the tool that matches the job, not the one that feels easiest today.

A simple decision framework for your next big purchase

To make a calm, confident choice between personal loan vs credit card for your next big purchase, work through these questions in order.

1. How big is the purchase relative to your monthly income?

If the cost is less than half of your monthly take home pay and you can clear it in two or three months without touching your emergency fund, a credit card with full payoff might be fine.

If the cost is equal to one or several months of your income, a personal loan or a longer payoff plan is usually more realistic and safer.

2. How fast can you repay without fear or sacrifice?

Write down an exact month by month plan, not a vague idea. If you choose a card, calculate the monthly payment required to clear the balance within a strict time frame, not just the minimum payment shown on your statement.

If the card plan looks too aggressive, a personal loan with a lower payment may protect your mental health and your daily life.

3. What is the real APR you qualify for?

Do not guess. Check prequalified rates for personal loans and confirm the actual APR on your credit card. Studies in 2025 show that the difference between a 12 percent loan and a 22 percent card can add thousands of dollars in cost over time for larger balances like 10,000 dollars. (Finance Centers at the Wharton School)

If your personal loan offer is not significantly cheaper than your credit card APR, the emotional advantage of a loan still exists, but the pure financial advantage is smaller.

4. How important is credit utilization for you in the next two years?

If you are planning a mortgage, a car loan or another major credit application soon, protecting your score becomes even more critical. In that case, using a personal loan to keep card utilization low can be a strategic move. (NerdWallet)

If you have no large credit plans and your utilization would remain below 30 percent even after a big purchase, a card may be acceptable if you also have a strong payoff plan.

5. Where does your self discipline feel strongest?

This step is emotional but crucial.

Some people feel more responsible when they see a fixed loan payment and a clear end date. Others become more careful when they see a card balance because they hate variable interest.

Be honest about your habits. Choose the structure that will keep you consistent without constant willpower.

Final thoughts: choose the tool, not the temptation

By December 2025, borrowing environments around the world are still challenging. Average credit card APRs above 20 percent create intense pressure on households that lean on cards for large purchases. Personal loans are not perfect, but they often offer a lower, fixed rate and a structured path to freedom when used thoughtfully. (LendingTree)

For big purchases that are clearly defined, important and too large to clear in a few months, a well chosen personal loan is usually the safer, calmer and more sustainable choice. For smaller big purchases that you can repay quickly, or when you have access to a strong 0 percent intro APR card and a serious payoff plan, a credit card can still be a strategic ally.

The most powerful decision is not “loan vs card” in the abstract. It is “which combination of cost, time and structure will protect my future self while still letting me move forward today?”

When you answer that question honestly, you turn a stressful choice into a confident step toward a more stable, thriving financial life.

Sources and References

- LendingTree – Average credit card interest rate in America, Q3 2025 (LendingTree)

- FRED – Commercial bank interest rate on credit card plans, August 2025 (FRED)

- Credible – Average personal loan interest rates in December 2025 (Credible)

- Bankrate – Average personal loan interest rates and credit union data (Bankrate)

- NerdWallet – Personal loan vs credit card: what is the difference? (NerdWallet)

- Bankrate – Personal loan vs credit card: which should you use? (Bankrate)

- Moneycontrol – Personal loan vs credit card: eligibility and interest rate differences (Moneycontrol)

- Moneycontrol – Personal loan vs credit card loan: interest rates and hidden charges (Moneycontrol)

- Federal Reserve – Consumer Credit G.19, October 2025 release (Federal Reserve)

- NerdWallet – How a personal loan can affect your credit score (NerdWallet)

- SoFi – Personal loan vs credit card overview (SoFi)

- Fortune – Best personal loans in 2025 and rate context (Fortune)