Learn how mortgage works, from interest rates to closing costs, so you can buy your first home with clarity, confidence and control.

Buying a home for the first time can feel thrilling and intimidating at the same time. The idea of taking on a large home loan may seem risky, yet it is also the main path to ownership for millions of households. In the United States alone, homeowners owed about 12.6 trillion dollars in mortgage debt by the end of 2024, and the average mortgage balance reached roughly 252,505 dollars in 2024. (KOAT) These numbers are huge, but they hide something hopeful. Behind those figures are millions of ordinary families who successfully navigated the mortgage process and now live in homes they own.

As of December 2025, mortgage rates are still higher than the historic lows of 2020 and 2021, but they have eased from the peaks of 2023. Data from Freddie Mac and other trackers shows the average 30 year fixed mortgage rate hovering around the low 6 percent range in December 2025. (Freddie Mac) That level is challenging for affordability, yet it is a significant improvement compared with periods when rates moved above 7 percent.

This beginner guide is designed to turn that complicated world into something understandable, practical and even empowering. You will not just learn definitions. You will learn how lenders think, how loans really work over time, and how to make decisions that support a stable, thriving financial life.

Why home loans still matter in 2025

Home prices are high in many countries, and interest rates are nowhere near the ultra low levels that once existed. Some people feel discouraged and wonder if buying a home is still realistic. Yet demand for ownership remains strong, and many households still view a home purchase as a vital piece of long term security.

Research from the Federal Reserve Bank of New York shows that mortgage originations picked up again in 2025 after slowing during the sharp rate increases of 2022 and 2023. (Federal Reserve Bank of New York) At the same time, guidance from consumer agencies such as the Consumer Financial Protection Bureau continues to emphasise that choosing the right home loan is just as important as choosing the home itself. (Consumer Financial Protection Bureau)

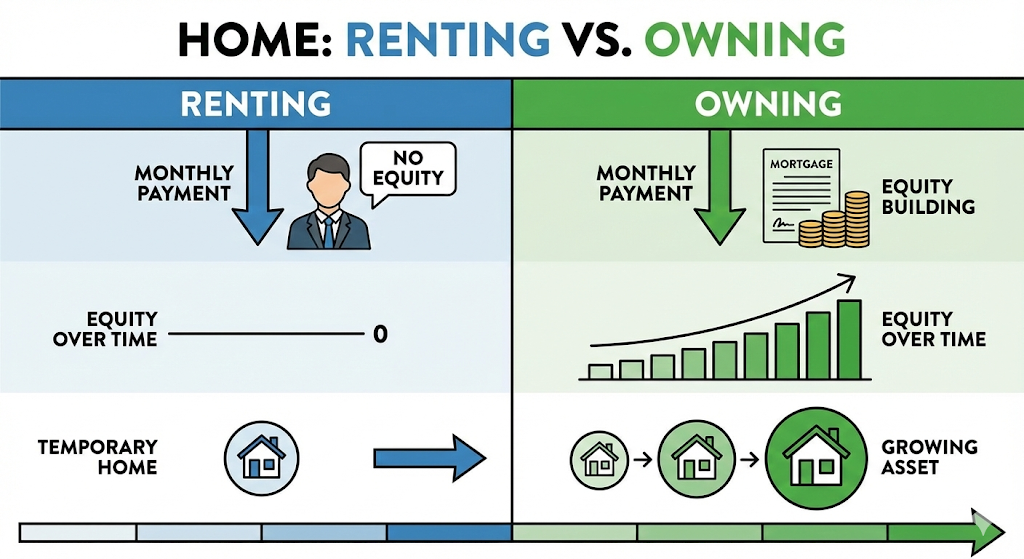

The reason is simple. A mortgage is not only a large debt. It is a long relationship. You may keep this loan for decades, refinance it when conditions change, or move and start again. Understanding the basics now gives you more emotional control, more negotiating power and a far better chance of building a stable, profitable future in your home.

Step 1: Learn the core mortgage language

Before talking about interest rates or loan types, it helps to decode the basic vocabulary. Once the words feel familiar, every other part of the process becomes less frightening and more manageable.

What a mortgage really is

At its core, a mortgage is a loan used to buy real estate, where the property itself serves as collateral. If the borrower fails to meet the payment obligations, the lender can eventually take the property through a legal process. Definitions from major financial education sites emphasise the same point. A mortgage is a secured loan tied to the property, with a contract that sets the interest rate, term and repayment schedule. (Investopedia)

The comforting side of this structure is predictability. The agreement clearly states what you must pay and for how long. The serious side is that missing payments can have consequences beyond a damaged credit score. Understanding that balance between opportunity and responsibility is essential.

Principal, interest, taxes and insurance

When people talk about their mortgage payment, they often use the shorthand “PITI” for principal, interest, taxes and insurance. Principal is the amount you borrowed. Interest is the cost of borrowing that money. Property taxes are local charges based on the value of your home. Homeowner’s insurance protects against damage and certain risks. Some buyers also pay mortgage insurance when the down payment is small. Guides on mortgage basics use this PITI framework to help buyers picture the full monthly cost, not just the loan portion. (Bond Street Mortgage)

In the early years, a larger share of each payment goes to interest. Over time, more of the payment goes to principal and your equity grows. This shift is known as amortization, and it explains why staying in a home for several years usually makes the numbers work better than frequent moves. (Investopedia)

Term, amortization and rate

Three concepts shape how heavy or light your loan feels.

The term is the length of the loan, often 30 years or 15 years in many markets. A longer term usually means lower monthly payments but more total interest over time. A shorter term increases the payment but can save you a large amount in interest and build equity faster. (Investopedia)

Amortization describes how the loan balance falls over the term, based on your payments. An amortization schedule shows how much of every payment goes to interest and how much goes to principal.

Finally, the rate is the percentage that determines the interest component. It can be fixed for the life of the loan or variable, adjusting over time according to market conditions. Understanding how those choices affect payment stability and total cost is one of the most important decisions a beginner will make. (Investopedia)

Step 2: Understand today’s mortgage rate environment

A mortgage does not live in a vacuum. It sits inside a larger economic story.

Throughout 2025, average 30 year mortgage rates in the United States have hovered around the mid 6 percent range, after swinging between roughly 6.26 and 7.19 percent earlier in the year. (bankrate.com) That is lower than the peaks seen in late 2023, yet still far above the sub 3 percent levels many borrowers enjoyed in 2021.

These rates are influenced by inflation expectations, bond markets and central bank policy. They do not simply mirror the headline policy rate, even though both move in response to economic conditions. News reports in late 2025 highlight how mortgage rates can stay high or even rise despite cuts in central bank rates, because investors demand compensation for inflation risks or uncertainty. (Investopedia)

For a beginner, the key lesson is practical. You cannot perfectly time the market. You can, however, decide whether the current rate, combined with the price of the home and your income, produces a monthly payment you can handle. When the numbers feel tight but manageable, you may still have a realistic path. When the numbers feel crushing, it may be wiser to continue renting, improve your position and wait.

Step 3: Explore the main home loan types

Once you understand the context and the vocabulary, you can explore the types of mortgages that lenders offer. Each type has strengths and trade offs.

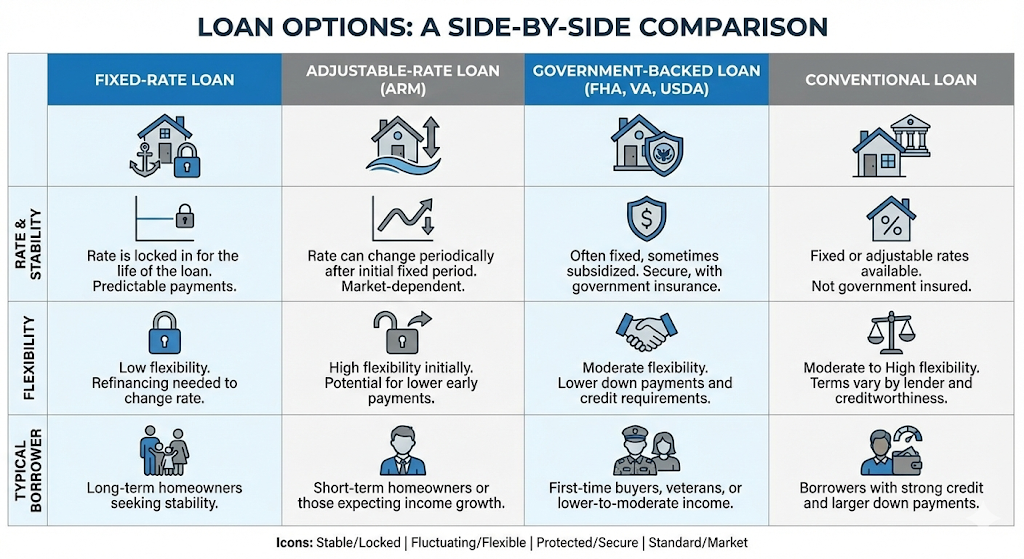

Fixed rate mortgages

A fixed rate mortgage keeps the same interest rate for the entire term. That means your principal and interest payment is stable, making long range budgeting much easier. Definitions from Investopedia and public agencies describe fixed rate loans as the preferred choice for borrowers who value certainty and expect to stay in their homes for many years. (Investopedia)

The main advantage is emotional and practical stability. You know what to expect. Even if market rates rise later, your payment does not change. The trade off is that the initial rate can be higher than the starting rate on some variable products.

In 2025, fixed rate mortgages are still the most common choice for many first time buyers. The predictability they offer is particularly comforting in an environment where inflation and interest rate paths remain uncertain. (Consumer Financial Protection Bureau)

Adjustable rate mortgages

Adjustable rate mortgages, often called ARMs or variable rate loans, have an interest rate that can change over time. Typically they start with a lower introductory rate for a fixed period, such as five or seven years, then adjust at set intervals based on a reference index plus a margin. (Investopedia)

The appeal is clear. If the starting rate is meaningfully lower than a fixed rate loan, your early payments are smaller. This can make a home more affordable in the short run. The risk is that payments can rise when the adjustment period begins, which may be stressful if your income has not grown or if rates in the market move higher.

Guides from both independent planners and banks suggest that ARMs may suit borrowers who expect to sell or refinance before the fixed period ends, and who have a strong buffer in their budget. (The Dana Company) For a cautious beginner, a fixed rate often feels safer unless there is a clear, realistic exit plan.

Government backed loans

In many markets, special mortgage programs exist to support first time buyers or particular groups. In the United States, these include FHA loans, VA loans for eligible veterans and USDA loans for some rural properties. These products are backed by government related agencies, which reduces the lender’s risk and can allow more flexible standards. (Consumer Financial Protection Bureau)

Such loans often permit smaller down payments and may have more tolerant credit score requirements. The trade off may include mortgage insurance premiums, funding fees or specific property rules. For buyers who qualify, these loans can be a powerful bridge into ownership.

In other regions, similar schemes exist through national or regional banks. For example, guidance from Kenyan and Australian lenders shows how local mortgages can be structured with targeted support for new buyers. (KCB Bank Kenya)

Conventional loans

Conventional loans are mortgages that are not part of government backed programs. They are offered by banks, credit unions, online lenders and mortgage companies. Many conventional loans follow standards set by large investors or agencies, which influence the required credit scores, down payments and debt ratios. (Investopedia)

For well qualified borrowers with solid credit histories and stable income, conventional loans can offer competitive rates and flexible options. For borrowers with weaker profiles, government backed products may be more forgiving.

The key for beginners is to realise that “conventional” does not mean “best” or “only serious option.” It is just one category among several. A strong decision comes from comparing how each type treats your situation, not from the label alone.

Step 4: How lenders decide what you qualify for

To a lender, a mortgage is a risk decision. To you, it is an emotional milestone. Understanding how the lender sees your application reduces the fear and makes the process feel more transparent.

Credit score and history

Your credit score summarises your past borrowing behaviour. It reflects payment history, debt levels, age of accounts, new inquiries and the mix of credit types. Mortgages often reserve the best rates for borrowers with higher scores, because past reliability signals lower risk. (First Bank)

Beginners sometimes feel ashamed of a less than perfect score. That reaction is understandable, but it is more useful to see the score as a dynamic number. Paying bills on time, reducing credit card balances and avoiding unnecessary new debt can improve it over months and years. Many lenders and public agencies now offer free score tools and education, which can be an encouraging starting point. (Consumer Financial Protection Bureau)

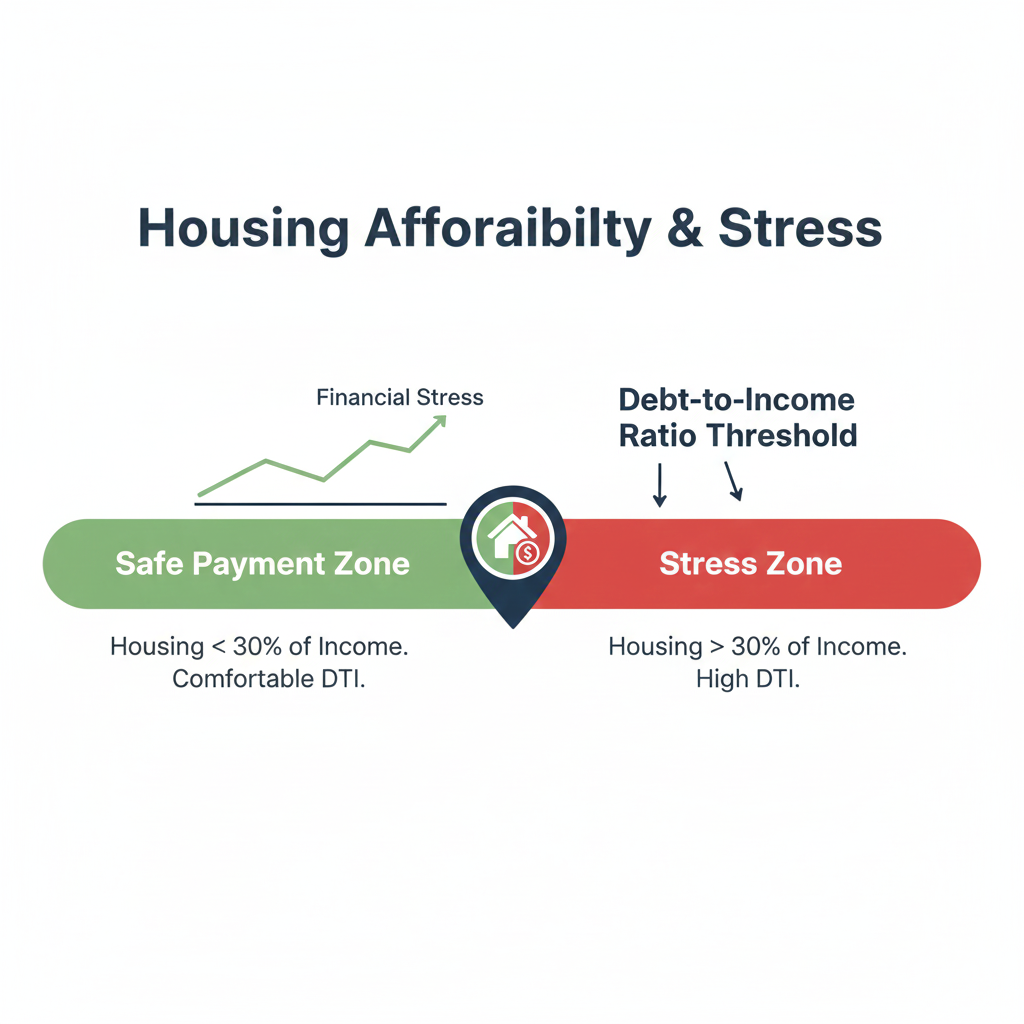

Debt to income ratio

The debt to income ratio, often called DTI, compares your monthly debt payments to your gross monthly income. Lenders use it to estimate whether you can safely manage a new mortgage on top of existing obligations.

Guides from banks and regulators often describe preferred DTI bands. Many lenders like to see total debts, including the new mortgage, at or below a certain percentage of income. (First Bank) Exact thresholds differ by country and loan type, but the principle is constant. The lower the ratio, the safer you look.

For a beginner, improving DTI may mean paying down car loans or credit cards, increasing income, or choosing a less expensive home. Each of these moves can feel difficult, yet they make your application stronger and your future budget safer.

Down payment and loan to value

The down payment is the amount you pay upfront toward the home. Loan to value, or LTV, compares the loan amount to the property’s price or appraised value. A higher down payment reduces LTV and lowers the lender’s risk.

Home buyer guides from banks and agencies often highlight the 20 percent down payment figure, because that level can help you avoid private mortgage insurance and may unlock better terms. (Associated Bank) However, many first time buyers use lower down payments through FHA or similar programs. The essential point is to understand how your chosen down payment affects monthly cost, fees and approval chances.

Employment and documentation

Lenders also verify your income and employment history. They typically ask for pay stubs, tax returns, bank statements and sometimes employer letters. Self employed borrowers may need to provide more detailed records. Guidance from the CFPB and mortgage advice sites stress the importance of organising these documents early, so the process feels smoother and less stressful. (Consumer Financial Protection Bureau)

Preparing this documentation in advance gives you a feeling of control. Instead of scrambling when the lender asks for proof, you already have a neat, verified file ready to share.

Step 5: From pre approval to closing

Once you understand your numbers and the loan options, you are ready to move from theory to action.

Pre qualification vs pre approval

Pre qualification is usually a quick, informal estimate based on information you provide about income, debts and savings. It can be useful early on, yet it does not carry strong weight. Pre approval is more serious. The lender reviews your documents and may run a hard credit check before issuing a letter that states a specific amount they are willing to lend, subject to conditions. (Consumer Financial Protection Bureau)

For sellers and real estate agents, a pre approval letter signals seriousness. For you, it gives a clear price range and a stronger sense of what is affordable. It is not a guarantee, but it is a powerful negotiation tool.

Shopping lenders and comparing offers

Many beginners make the mistake of accepting the first mortgage offer they receive. Research cited by the CFPB suggests that comparing offers from multiple lenders within a focused time window can save a typical buyer meaningful monthly amounts. (NerdWallet)

When comparing, look beyond the headline rate. Examine the annual percentage rate (APR), which includes certain fees, the structure of discount points, and the estimated closing costs. Ask each lender for a standardised loan estimate form so you can compare like for like.

Independent calculators and toolkits from agencies such as the CFPB and various banks can help you interpret these documents. (Consumer Financial Protection Bureau) Using them turns a confusing stack of numbers into an understandable set of choices.

Closing costs and the final signing

Closing costs are the fees and charges you pay when the loan is finalised. They can include appraisal fees, lender charges, title services, government fees and prepaid items such as initial taxes and insurance. Several guides for first time buyers estimate that closing costs may run from a few percent of the purchase price, depending on location and loan type. (Consumer Financial Protection Bureau)

Before the closing day, you should receive a closing disclosure that lays out the final terms and costs. Comparing this document with your earlier loan estimate helps you spot changes. Consumer agencies encourage borrowers to ask questions about any line they do not understand. (Consumer Financial Protection Bureau)

Signing the closing documents is both emotional and technical. It marks the moment when you become a homeowner, yet it is also the point where your long term obligations begin. Taking time to read, ask and understand protects you and reinforces your sense of control.

Step 6: Protect yourself from common beginner mistakes

Even smart, careful people can run into trouble with mortgages. Awareness of common traps reduces that risk.

One frequent mistake is focusing only on the lowest initial rate without considering the true cost over time. For example, a slightly lower rate with very high points, fees or risky adjustments can end up more expensive than a slightly higher but simpler loan. Educators often stress that you should look at total cost over the years you expect to keep the mortgage, not just the monthly payment today. (Investopedia)

Another mistake is stretching far beyond a comfortable budget because a lender is willing to approve that amount. A lender’s maximum is not the same as your personal comfort zone. Guides from first time buyer programs urge borrowers to choose a payment that still leaves room for savings, repairs and life events, rather than living at the edge each month. (WVHDF)

A third trap is ignoring the impact of other debts and financial goals. High student loans, car payments or credit card balances can make a large mortgage feel heavy. NerdWallet’s analysis of first time buyer mistakes emphasises the value of tackling expensive short term debts and building an emergency fund before stretching for a home. (NerdWallet)

Step 7: Your first mortgage roadmap in practice

To make this guide truly useful, it helps to translate everything into a simple sequence you can follow.

First, you check your credit, debts and savings. You use online calculators and public tools to estimate how much house you can realistically afford at current mortgage rates, which as of December 2025 sit near the low to mid 6 percent range on average for 30 year fixed loans in many markets. (Freddie Mac)

Second, you study the main loan types and decide whether a fixed rate, an adjustable rate or a government backed program best fits your situation. You ask whether you are more sensitive to monthly payment stability or to the possibility of paying less interest if you move quickly.

Third, you gather documentation and seek pre approval from one or more lenders. You compare loan estimates carefully, focusing on APR, fees, points and closing costs rather than just the headline rate.

Fourth, you work with a real estate agent or independent adviser to shop for homes within your realistic budget. You adjust your expectations if needed, keeping your long term stability more important than short term excitement.

Finally, when the right property appears and your offer is accepted, you move through underwriting and closing with calm confidence. You already understand terms like PITI, DTI, LTV and fixed vs adjustable rates. Closing day becomes not a confusing blur of signatures, but the final step in a plan you designed with care.

Conclusion: Turning a complex loan into a clear life decision

Mortgages can look complex from the outside. There are many loan types, shifting rates, long documents and technical words. Yet once you break the process into clear steps, the mystery fades. You see that a mortgage is a structured agreement that can either support your life or strain it, depending on how it is chosen and managed.

As of December 2025, the housing and mortgage environment remains challenging. Rates are higher than the very low years, and home prices are still elevated in many regions. (bankrate.com) At the same time, buyers who prepare carefully, compare offers and choose loan types that match their reality are still becoming owners every day.

The real power in “Mortgage 101” is not just information. It is confidence. When you understand the basics, you can ask sharper questions, negotiate with more courage and walk into the closing room knowing that you have chosen a loan that fits your family, your income and your dreams. That sense of control is priceless. It turns a huge financial obligation into a thoughtful investment in your future stability and freedom.

Sources and References

- Freddie Mac – Primary Mortgage Market Survey (Freddie Mac)

- FRED – 30 Year Fixed Rate Mortgage Average in the United States (FRED)

- Mortgage News Daily – 30 Year Fixed Mortgage Rates (Mortgage News Daily)

- Bankrate – Mortgage Rate History: 1970s To 2025 (bankrate.com)

- Fortune – Current Mortgage Rates Report, December 11, 2025 (Fortune)

- Experian – How Much Americans Owe on Their Mortgages in Every State (Experian)

- KOAT / Federal Reserve Bank of New York – Mortgage Debt Trends (KOAT)

- Federal Reserve Bank of New York – Household Debt Balances Grow Steadily; Mortgage Originations Tick Up (Federal Reserve Bank of New York)

- Consumer Financial Protection Bureau – Owning a Home: Buying a House Tools (Consumer Financial Protection Bureau)

- CFPB – Preparing to Shop for Your Mortgage (Consumer Financial Protection Bureau)

- CFPB – Understand the Different Kinds of Loans Available (Consumer Financial Protection Bureau)

- Investopedia – Mortgages: Types, How They Work, and Examples (Investopedia)

- Investopedia – Fixed Rate Mortgage (Investopedia)

- Investopedia – Understanding Mortgage Interest (Investopedia)

- Homebuyer.com – Mortgage 101: Complete Guide to Home Loans for First Time Buyers (Homebuyer)

- Consumer Finance – Your Home Loan Toolkit: A Step by Step Guide (Consumer Financial Protection Bureau)

- Navy Federal Credit Union – Mortgage Basics (Navy Federal Credit Union)

- First Bank – The Ultimate Guide for First Time Homebuyers (First Bank)

- NerdWallet – First Time Home Buyer Mistakes and How to Avoid Them (NerdWallet)

- Associated Bank – First Time Buyers Guide (Associated Bank)

- KCB Group – Mortgage 101: A Beginner’s Guide to Buying Your First Home in Kenya (KCB Bank Kenya)

- Deltos Finance – Mortgage 101: A Beginner’s Guide to Understanding Home Loans (Deltos Finance)

- Hunt Mortgage – Mortgage 101: The Basics and Common Mortgage Terms (HUNT Mortgage)

- Local First Bank – Mortgage Basics 101 (Local First Bank)