Learn a practical, step by step plan to crush credit card balances, cut interest costs, and become debt free faster without losing protections.

Why paying off credit card debt fast matters in 2025

Credit card debt can feel like a quiet emergency. The balance looks manageable, yet the interest rate is brutal and relentlessly compounds in the background. In late 2025, many cards still charge annual percentage rates around or above 21 percent for accounts that carry a balance, which makes this one of the most expensive forms of everyday borrowing. (LendingTree)

At the same time, total credit card balances in the United States are sitting around 1.23 trillion dollars. (LendingTree) That figure is huge, but behind it are individual stories of stress, fear and sometimes shame. Those emotions are powerful, yet they can also be turned into fuel. When you see the situation clearly and follow a structured plan, you can move from feeling trapped to feeling decisive and confident.

Furthermore, this topic matters globally, not only in the United States. High interest revolving credit affects families in Canada, the United Kingdom, the European Union and many emerging markets. Even if the exact numbers differ, the pattern is the same: easy spending, painful interest, and a sense that escape will take forever. This guide is designed to cut through that confusion and give you a focused, emotionally motivating roadmap.

Finally, it is important to remember that you are not strange or reckless for having a balance. In 2024, about 81 percent of American adults had at least one credit card, and a large share of them carry balances from month to month. (Federal Reserve) What matters now is not past decisions but the powerful, courageous steps you take next.

Step 1: Take control of your numbers

Before you can pay off credit card debt fast, you need a clean picture of the problem. Many people avoid looking at their statements because the situation feels scary. That avoidance gives interest charges more power. A calm, analytical approach instantly gives you more control and more emotional strength.

List every card and balance

Start by collecting every card you have. Include store cards, gas cards and any line of credit that works like a card. Write down for each one:

- Current balance

- Minimum payment

- Interest rate (APR)

- Due date

You can do this in a notebook, but a simple spreadsheet or note app is often clearer. What matters is one consolidated view. Once everything is in front of you, the situation shifts from vague anxiety to specific information. That clarity is deeply empowering and surprisingly calming.

Additionally, make a note of any cards that are already in trouble. If a card is over the limit, behind on payments or with a collection agency, mark it clearly. Those accounts may need special handling later.

Understand the real cost of your APR

Next, look closely at the interest rate on each card. A card with a rate above 20 percent is not just expensive, it is aggressively expensive. In the third quarter of 2025, the average APR across all credit card accounts in the United States was around 21.39 percent, which shows how common these high rates have become. (LendingTree)

To feel the impact, imagine a 5,000 dollar balance at 21 percent with only minimum payments. You might pay thousands in interest over several years and stay stuck. When people say they feel like they are running on a treadmill, this is why. Recognizing this harsh cost is not meant to scare you. Instead, it gives you a strong, urgent reason to attack the balance with a powerful plan.

Estimate your payoff timeline at current speed

Now, use an online credit card payoff calculator from a respected bank or financial education site. Input each balance, the interest rate and your current monthly payment. Many tools will show how long payoff would take if you stick to minimums, and how much interest you would pay along the way. (indus-ind)

However, do not get discouraged if the timeline looks depressing. Treat it as a baseline. You are about to choose a more aggressive strategy. This contrast will make your progress feel even more dramatic and rewarding.

Step 2: Stop the bleeding and protect essentials

Once you understand your numbers, the next move is to stop things from getting worse. That means reducing new charges and protecting your basic needs at the same time.

Freeze new spending where you can

If possible, stop using your credit cards for everyday spending. You do not have to cut them up today, but consider moving them out of easy reach. Delete stored card details from online shops and delivery apps. This simple barrier gives you a moment to pause before every new charge, which is incredibly powerful.

In the short term, switch as much daily spending as possible to a debit card or cash. This keeps your credit card balances from growing while you work to shrink them. It also reconnects your mind to the real size of each purchase, which can feel surprisingly liberating.

Build a realistic survival budget

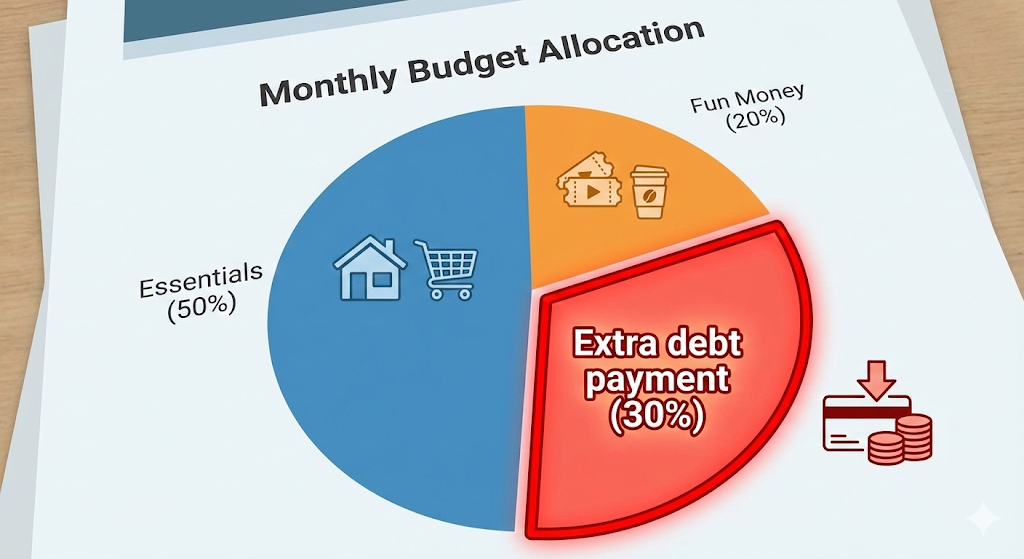

Next, create a clear monthly budget. List your essential expenses: housing, utilities, basic food, transport, insurance and any non negotiable commitments. Then list flexible spending like entertainment, subscriptions and optional shopping.

The goal is not a perfect or punishing budget. The goal is a realistic plan that frees up as much cash as possible for debt payments without destroying your life. A sustainable plan is far more powerful than an extreme one you abandon in three weeks.

Furthermore, give yourself a small, guilt free pocket of fun money if you can. When you know you have a tiny, planned amount for pleasure, it is easier to keep everything else tight. That balance makes your plan emotionally stronger and more resilient.

Create a tiny emergency buffer

Paying off debt fast is easier when a small surprise does not push you straight back to the card. If you do not have any emergency savings, aim to build a short term buffer of perhaps 300 to 1,000 dollars, depending on your income and location.

You can do this in parallel with your payoff plan. For a couple of months, send part of your extra money to savings and part to debt. Once the buffer is in place, switch more aggressively to debt payments. This backup fund is emotionally soothing and reduces the risk of panic spending later.

Step 3: Choose the payoff strategy that fits you

There is no single magical method. Two proven strategies dominate the conversation: the debt avalanche and the debt snowball. Both can be highly effective if you commit to them.

Debt avalanche: Mathematically efficient

With the avalanche method, you pay minimums on all cards, then put every extra dollar on the card with the highest interest rate first. Once that card is paid off, you move all that payment power to the card with the next highest rate, and so on.

Because you attack the most expensive debt first, you save the most interest over time. Many analyses that compare these methods show that the avalanche usually leads to slightly lower total interest and sometimes a shorter payoff timeline, assuming you stay fully committed. (Hoyes, Michalos & Associates Inc.)

Emotionally, the avalanche can feel a bit slow at the start if your highest rate card also has a large balance. However, for people who love efficiency and logical optimization, it can be very satisfying and motivating.

Debt snowball: Psychologically powerful

With the snowball method, you pay minimums on all cards, then focus every extra dollar on the card with the smallest balance, regardless of interest rate. When that card disappears, you roll the payment onto the next smallest balance.

The snowball gives quick wins. You see accounts disappear, which can feel thrilling and deeply reassuring. Studies and real world case studies show that many people stick with their plan better when they see these early victories, even if the math is slightly less efficient. (Navy Federal Credit Union)

For someone who feels exhausted or ashamed, the snowball can be emotionally life changing. Each eliminated card is proof that your actions are working. That proof builds confidence and courage for the next step.

Hybrid: Tailor the strategy to your reality

In practice, you can blend both methods. One common hybrid approach is to start with the smallest balances until you free up a couple of cards, then switch to avalanche on the remaining high rate accounts. This gives early wins and long term efficiency.

Alternatively, you might follow avalanche but allow one exception for a very small card that you clear early just for momentum. The key idea is intentional design rather than random payments. A deliberate plan feels professional, strategic and powerful.

Step 4: Squeeze more cash flow for faster progress

Once your strategy is chosen, speed comes from cash flow. Every extra dollar you can send to your targeted card shortens the journey and cuts interest.

Cut high impact expenses first

Start with expenses that carry a big monthly price but limited emotional value. Empty subscriptions, unused gym memberships, overpowered phone plans and forgotten services are common examples. Redirecting even 50 or 100 dollars a month toward your debt makes a real difference over a year.

Next, look at flexible categories like food and entertainment. Cooking at home more often, choosing cheaper brands for a season and saying no to a few nights out are powerful, temporary sacrifices. Remind yourself that they are not forever. They are a focused, courageous campaign to buy your freedom from interest.

Increase income in realistic ways

For many people, cutting is not enough. Additional income can accelerate your progress in a dramatic way. Overtime, weekend shifts, freelance jobs, tutoring, rideshare driving or selling unused items can all boost cash flow.

However, protect your health and your primary job. The aim is a balanced, intentional push, not burnout. Even an extra 200 dollars per month can slash months off your payoff schedule when combined with a strong avalanche or snowball plan.

Direct every extra dollar with intention

Once you free up extra money, always send it to your chosen target card, not scattered across all debts. That concentration of effort feels aggressive and decisive. It also makes progress visible.

You could even name the payment in your banking app notes as “Freedom payment” or “Avalanche strike”. These emotional labels may seem small, yet they reinforce your identity as someone who takes bold, purposeful financial action.

Step 5: Use financial tools safely, not desperately

Certain financial products can accelerate payoff when used wisely. They can also backfire if used without a plan.

0 percent intro APR balance transfer cards

A balance transfer card with a 0 percent introductory APR can be a powerful tool. You move a higher interest balance to the new card, pay a transfer fee and then have a period, often 12 to 21 months, during which interest is temporarily paused on that balance. (bankrate.com)

During that window, every payment goes directly to principal. This can feel exciting and highly motivating. However, there are important conditions:

- You must understand the fee and calculate whether the saving is worth it.

- You need a clear plan to pay the balance down before the promotional rate expires.

- You must avoid new purchases on the card if they accrue interest immediately.

If you treat the transfer as an emergency brake and then continue overspending, you risk ending up with two large balances instead of one. Used carefully, this tool is strategic and efficient. Used carelessly, it becomes dangerous.

Personal loans and consolidation

A personal loan for debt consolidation can replace multiple high rate cards with one fixed loan at a lower rate. In some markets, this can cut interest costs and simplify your payments. Many lenders actively promote these consolidation loans when rates fall. (Reuters)

The psychological effect is strong. One payment, one end date, one clear plan. That clarity can feel deeply relieving. Yet the same risk appears: if you keep using the old cards after consolidating, your situation can worsen.

Therefore, if you consolidate, consider closing some cards or at least lowering their limits, while carefully preserving enough available credit to protect your score. The safest approach is to treat consolidation as part of a strict, long term strategy, not as a quick fix.

When to talk to your lender or a counselor

If payments are already late, or if you are choosing between food and minimums, you may need structured help. Reputable nonprofit credit counseling agencies can negotiate reduced interest rates or structured payment plans with creditors. They also offer education and support. (NFCC)

Calling for help is not failure. It is a mature, courageous move, especially when stress feels overwhelming. A verified counselor can help you avoid more extreme options and plan a sustainable path.

Step 6: Automate, track, and stay motivated

A powerful plan still fails if it depends on perfect memory and constant willpower. Automation and simple tracking systems protect you from busy days and low energy moments.

Set up automatic payments

Where possible, set up automatic payments at least for the minimum on every card. Then, schedule an extra automatic payment for your targeted card, timed just after you receive your salary. This habit makes your aggressive payment the default, not the exception.

Additionally, consider adjusting due dates so they cluster just after your main income hits your account. Many card issuers allow date changes. This reduces the chance of late payments and the stress that comes with them.

Create a one page progress dashboard

You do not need complex software to track your progress. A single sheet with all your balances updated each month is enough. Record:

- Starting balance for each card

- Current balance

- Total debt

- Change since last month

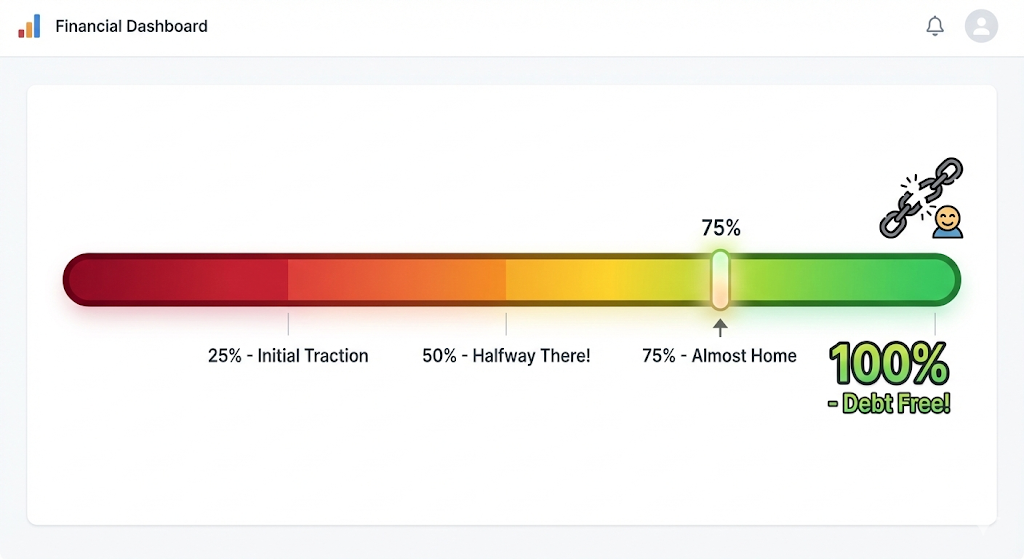

Watching the total fall month after month is incredibly rewarding. That visual confirmation keeps your energy high when motivation dips. It also lets you celebrate real milestones, such as your first 1,000 dollars paid off or your first card closed.

Protect your mindset

Debt payoff is partly a numbers game and partly a psychological marathon. Surround yourself with positive, practical information. Listen to podcasts, watch educational videos like the ones linked above, and follow people who share real, honest payoff stories.

Meanwhile, try to reduce constant exposure to impulsive shopping triggers. Unsubscribe from marketing emails, mute some store accounts on social media and avoid browsing shopping apps out of boredom. These small barriers keep your emotional focus on freedom rather than consumption.

Step 7: A real world style example

Examples make strategies feel concrete. Imagine a household in late 2025 with three credit cards:

- Card A: 6,000 dollars at 24 percent APR, 180 dollar minimum

- Card B: 3,000 dollars at 21 percent APR, 90 dollar minimum

- Card C: 1,200 dollars at 18 percent APR, 40 dollar minimum

Their combined minimums are 310 dollars. After building a basic budget and trimming some expenses, they free up an extra 340 dollars per month. That gives them 650 dollars total for credit card payments.

Choosing a strategy

If this household chooses the avalanche method, they will pay minimums on Cards B and C, then send all remaining money to Card A, the highest rate. The monthly payment on that card might jump from 180 to over 400 dollars. The balance will start shrinking at a satisfying speed.

If they choose the snowball method, they will hit Card C first, because it has the smallest balance. With 310 dollars in minimums plus 340 extra, they can clear Card C in just a few months. Then they roll that momentum onto Card B, and finally onto Card A.

Analyses of similar examples show that avalanche usually wins by a small margin on interest, while snowball sometimes creates more emotional strength and better long term commitment. (Hoyes, Michalos & Associates Inc.) In real life, the best choice is the one they will actually maintain.

Timelines and emotional impact

With either method and a consistent 650 dollars per month, this family could become credit card debt free in roughly two to three years, depending on exact details and any extra income they add. During that time, their total interest cost would still be significant, yet far lower than if they had kept paying only minimums across all three cards.

The emotional shift is even more impressive. Instead of drifting and hoping, they would see consistent, measurable progress. Each month, more principal disappears and their future feels safer. That strong sense of progress is vital for staying focused and avoiding relapse.

Step 8: Protecting your credit score while you attack debt

Fast payoff and healthy credit can work together. You do not have to choose one or the other.

Watch your credit utilization

Credit scores often respond strongly to utilization, which is the proportion of your available credit that you are using. As you pay balances down, your utilization falls and your score tends to improve over time, as long as you keep accounts in good standing. (NerdWallet)

If a card is very close to its limit, focus on reducing that balance quickly. High utilization on a single card can hurt even when total utilization looks moderate. Moving a card from 95 percent utilization down to 70 percent, then to 49 percent and below, often has a positive effect.

Avoid unnecessary new applications

While you are in aggressive payoff mode, avoid opening many new credit accounts unless a specific tool, such as a balance transfer card, is part of your deliberate plan. Each application triggers a hard inquiry, and new credit lines may tempt additional spending.

However, you do not necessarily need to close every card after payoff. Keeping older accounts open with zero or very low balances can help your utilization and your length of credit history. Carefully decide which cards to keep based on fees, features and your ability to resist unnecessary spending.

Rebuilding after payoff

Once your cards are paid off, your financial power increases sharply. You have freed up monthly cash flow and reduced one of the most stressful risks in your financial life. Now you can redirect that same payment amount to savings, retirement contributions or other goals.

Maintaining a small, controlled card that you pay in full each month can keep your credit history active and strong. The difference is that now you are using credit as a precise, disciplined tool instead of a survival mechanism.

Step 9: Your step by step roadmap in summary

To finish, bring all the elements together in one clear, emotionally charged picture.

You begin by facing your numbers with courage, listing every card, every balance and every rate. That single act turns confusion into clarity and restores a sense of control. You then create a focused budget that protects essentials while freeing cash for your plan.

Next, you choose a powerful strategy: avalanche for maximum interest savings, snowball for psychological momentum or a smart hybrid of both. With that decision made, you squeeze extra cash from spending cuts and reasonable extra income, directing every dollar to your chosen target.

Then, you use tools like 0 percent intro APR balance transfers or consolidation loans carefully, as strategic instruments instead of desperate moves. You add automation, simple tracking and emotional support so that your plan survives busy weeks and tired evenings.

As the months pass, your balances fall. Your credit utilization improves. Your stress eases. The transformation is not just financial, it is emotional and even physical. Sleep improves, arguments about money decrease and your confidence in your future becomes stronger and more authentic.

Most importantly, you prove something vital to yourself. You demonstrate that disciplined, compassionate action can defeat even aggressive interest rates. That belief will support every future decision you make about loans, credit and long term goals.

Sources and References

- LendingTree – 2025 Credit Card Debt Statistics

- LendingTree – Average Credit Card Interest Rate in America

- Federal Reserve – Consumer Credit G.19 Release

- Federal Reserve Bank of New York – Household Debt and Credit Report

- Federal Reserve – Economic Well Being of U.S. Households: Banking and Credit

- FRED – Commercial Bank Interest Rate on Credit Card Plans

- NerdWallet – What Is the Average Credit Card Interest Rate?

- Bankrate – Current Credit Card Interest Rates

- Cadence Bank – Debt Avalanche and Debt Snowball Methods

- National Foundation for Credit Counseling – Best Way to Pay Off Debt

- IndusInd Bank – Strategies to Pay Off Credit Card Debts Faster

- KSAT – U.S. Credit Card Debt Rising Slower Before Christmas 2025

This guide reflects data and trends available as of December 2025 and is intended for educational and informational purposes, not as individualized financial advice.