Unlock the secrets to skyrocketing your credit score in 2025. Discover proven, high-impact strategies to secure better loan rates and financial freedom now.

The financial landscape of December 2025 is unforgiving. Your credit score has evolved from a simple metric into the absolute gatekeeper of your economic survival. Whether you are desperate to secure a mortgage for your dream home, needing a vital business loan to launch your startup, or simply wanting to escape the crushing weight of high-interest debt, your credit score dictates your reality. A low score is a prison; a high score is your passport to exclusive opportunities and massive wealth generation.

You may feel paralyzed by the opaque, complex algorithms used by major banks. This is a common feeling, but it is unnecessary. Improving your standing is not only possible; it is a predictable, mechanical process. It requires a strategic, almost military approach to your personal finances. This comprehensive guide delivers verified, aggressive methods to elevate your credit profile rapidly. We will bypass the common myths and focus exclusively on actionable, profitable steps. You are about to learn the insider secrets that lenders usually keep hidden. Prepare to revolutionize your financial identity.

Understanding the Algorithm: Your Financial DNA

To win this high-stakes game, you must first master the rules. Credit scoring models like FICO and VantageScore use specific, rigid formulas to judge you. They analyze your past behavior to predict your future risk. Understanding these factors is the essential foundation for your success. Without this knowledge, you are flying blind.

The breakdown generally follows this hierarchy:

- Payment History (35%): This is the single most critical factor. It tracks whether you pay your obligations on time.

- Amounts Owed (30%): This measures your credit utilization and total debt load.

- Length of Credit History (15%): Older accounts anchor your score and prove stability.

- New Credit (10%): Recent applications can signal distress and hurt you slightly.

- Credit Mix (10%): A variety of account types shows you can handle different responsibilities.

Knowing this hierarchy allows you to prioritize your limited energy. You should focus your efforts where they yield the highest return on investment.

The FICO vs. VantageScore Dilemma

You might notice different scores on different websites, which can be confusing. This happens because there are competing models. FICO is used by 90% of top lenders. It is the gold standard for mortgages and auto loans. VantageScore is often seen on free credit monitoring sites.

In late 2025, newer versions like FICO 10 T are gaining massive traction. These advanced models look at “trended data.” They see if you are aggressively paying down debt or letting it balloon. Therefore, your trajectory matters as much as your current balance. You must demonstrate a consistent pattern of reducing debt to impress these sophisticated algorithms.

Strategy 1: The Tactical Dispute Method

Errors on credit reports are shockingly common and devastating. A landmark study by the FTC showed that one in five people have a material error on at least one of their credit reports. These mistakes can drag your score down by dozens of points, acting as an anchor on your progress. Correcting them is the fastest, most effective way to see a jump. This is an immediate, powerful fix.

You must audit your reports from Equifax, Experian, and TransUnion with forensic detail. Look for late payments that you actually paid on time. Look for accounts that do not belong to you. Also check for old debts that should have aged off but are still lingering like ghosts.

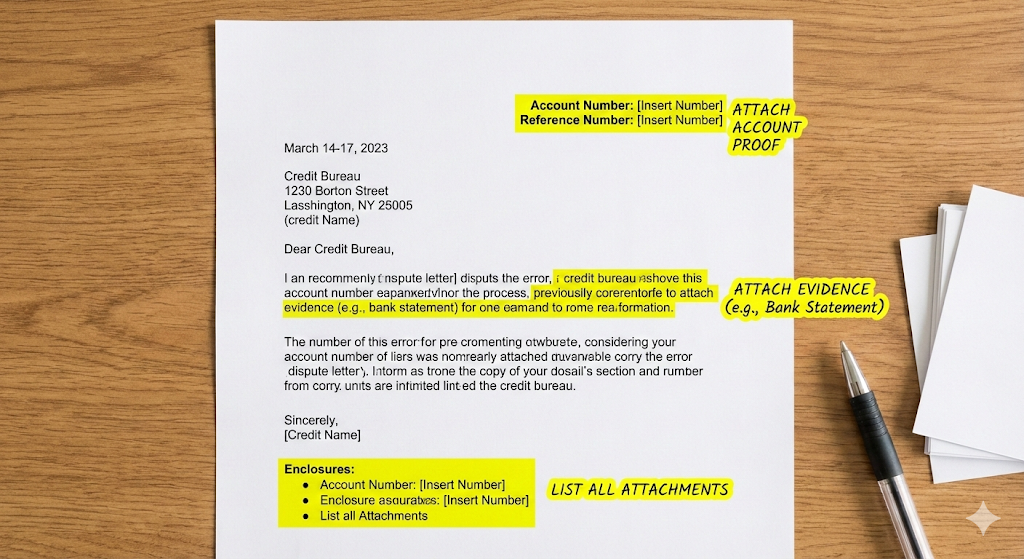

How to File a Dispute Successfully

Do not just click “dispute” on a website. For the best results, you need a paper trail. Send a certified letter. This forces the bureaus to take your claim seriously and adhere to strict legal timelines.

- Identify the Error: Be surgically specific about what is wrong.

- Gather Evidence: Include bank statements, cashed checks, or payment confirmations.

- Write the Letter: State clearly that the item is inaccurate and demand its removal.

- Send via Certified Mail: Request a return receipt to prove delivery.

The bureau has 30 to 45 days to investigate. If they cannot verify the information with the creditor, they must delete it by law. This removal can lead to an instant, massive score increase. It is a victorious moment for your financial health.

Strategy 2: Mastering Credit Utilization

Credit utilization is the ratio of your credit card balance to your credit limit. This factor accounts for 30% of your total score. It is highly volatile, meaning it changes monthly. This means you can manipulate it quickly to your advantage.

If you have a limit of $10,000 and a balance of $5,000, your utilization is 50%. This is dangerously high. Lenders view this as risky behavior. They worry you are overextended and living beyond your means. To maximize your score, you need to lower this ratio immediately.

The 30% Myth vs. The 10% Reality

Many “experts” suggest keeping utilization below 30%. While this keeps you safe from severe penalties, it is not optimal for explosive growth. For a revolutionary score boost, you must aim for below 10%.

Better yet, master the AZEO method. This stands for “All Zero Except One.” You pay off every single card to $0 before the statement date. You leave a tiny balance (like $10 or $20) on just one card. This proves you use credit but carry almost no risk. The algorithm loves this specific behavior and rewards it with peak scores.

Strategic Payment Timing

You must understand the critical difference between the “due date” and the “statement date.” The statement date is when the card issuer reports your balance to the bureaus. The due date is when you must pay to avoid interest.

To trick the system legally, pay your bill before the statement date. If you do this, the statement will show a $0 balance. The bureaus will see $0 utilization, even if you spent thousands that month. Your score will react positively almost immediately. This is a vital technique for rapid improvement.

Strategy 3: The Authorized User Hack

This strategy is often called “piggybacking.” It is one of the most effective ways to build credit without doing any actual work. It involves asking a trusted family member or friend to add you to their credit card account as an authorized user.

The ideal account must have a perfect payment history. It should also have a low utilization rate and a long, established history. Once you are added, the account’s entire history appears on your credit report. It looks as if you have been managing that account for years.

Choosing the Right Partner

Trust is essential here. You do not need to actually use their card or spend their money. You only need the data to appear on your file.

- Ensure the issuer reports authorized users: Not all banks do this. Verify this first.

- Verify the account is in good standing: A bad account with missed payments will hurt you.

- Confirm no late payments exist: Check the history thoroughly.

This method is entirely legal and highly effective. It helps millions of people jumpstart their credit profiles. However, if the primary user misses a payment, your score will suffer alongside theirs. Choose your partner wisely.

Strategy 4: Rapid Rescoring for Immediate Results

Sometimes you cannot wait 30 days for a score update. You might be applying for a massive home mortgage next week. In this urgent scenario, you need a tool called “rapid rescore.”

This is a professional service. You cannot do it yourself. A mortgage lender or loan officer must initiate it on your behalf. It is designed for crunch time.

How It Works

- Pay Down a Balance: You pay off a large debt today.

- Provide Proof: You give the receipt or updated statement to your lender.

- Lender Files Request: They ask the bureau to update your file immediately.

- Score Updates in Days: Instead of weeks, the change happens in 48 to 72 hours.

This service usually costs a fee per bureau, which the lender might pass on to you. However, the investment is incredible. A higher score can save you thousands in interest on a large loan. It is a critical tool for homebuyers in a time crunch.

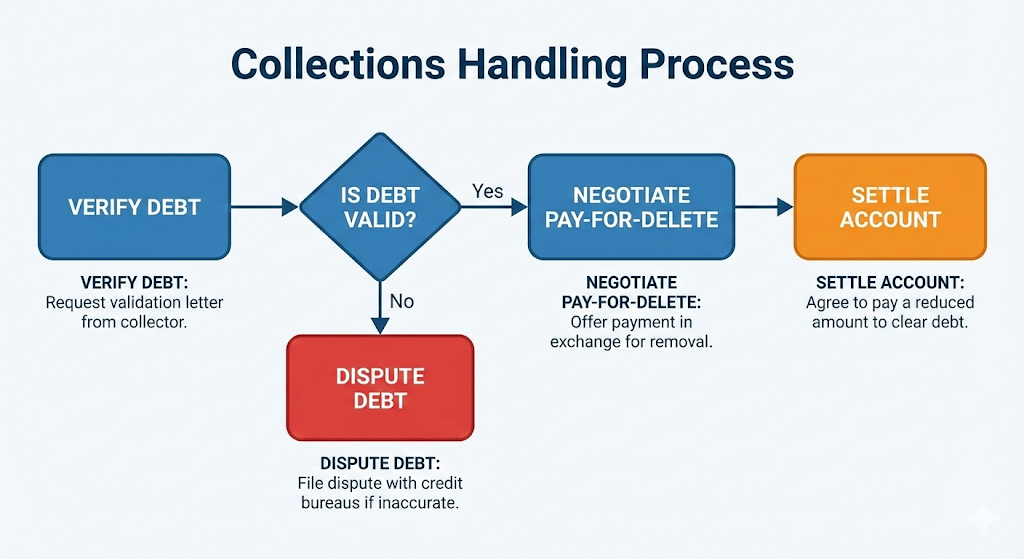

Strategy 5: Dealing with Collection Accounts

Collection accounts are a nightmare for your credit score. They signal a major default and failure to pay. However, simply paying them off does not always remove them. The damage is often already done.

In 2025, newer scoring models ignore paid collections that are zeroed out. However, older models used for mortgages still see them. You need a strategic, negotiated approach to handle these toxic items.

Pay-for-Delete Negotiations

This is an aggressive negotiation tactic. You contact the collection agency directly. You offer to pay the full amount or a settled amount. In exchange, they must agree to delete the account from your report entirely.

Get this agreement in writing before you pay a single cent. If they delete the account, it is as if the collection never happened. Your score will rebound significantly. Without the deletion, the “paid collection” status remains on your report for seven years, still dragging you down.

Strategy 6: Increasing Your Credit Limits

Another way to lower your utilization is to increase your total limit. This involves asking your current credit card issuers for a credit limit increase.

If you owe $2,000 on a $4,000 limit, you are at 50%. If your limit is raised to $8,000, that same debt is now only 25%. Your score improves without you paying a dollar. This is pure leverage.

The Request Process

Most banks allow you to request this online. It is often an instant decision.

- Update your income: If your salary increased, tell them immediately.

- Ask for a soft pull: Ask if the increase requires a hard inquiry. Try to avoid hard inquiries if possible.

- Be reasonable: Ask for a 20% to 50% increase.

This is a powerful lever to pull. It instantly creates more “breathing room” in your credit profile. It signals to other lenders that you are trusted with higher limits by major institutions.

Strategy 7: Diversifying Your Credit Mix

Lenders like to see that you can handle different types of debt. There are two main categories: revolving credit (cards) and installment loans (mortgages, auto loans). If you only have credit cards, your profile looks “thin” and one-dimensional.

Adding an Installment Loan

You do not need to buy a car to do this. You can use a “credit builder loan.” These are small loans designed specifically to build credit.

The bank holds the money in a savings account. You make monthly payments. Once the loan is paid, you get the money back. It acts like a forced savings plan that boosts your score. This adds the “installment” variety to your report. It is a safe, guaranteed way to diversify your profile.

Strategy 8: Using Tech Tools for an Instant Boost

Technology has revolutionized credit repair. Several tools now allow you to add non-traditional data to your credit file. This is essential for people with thin files or those who are new to the country.

Experian Boost and Similar Tools

Services like Experian Boost connect to your bank account. They scan for payments to streaming services, utilities, and phone bills. Historically, these payments did not count. Now, they can positively impact your FICO score.

The average user sees an instant increase. If you have a history of paying Netflix or your electric bill on time, use this. It is verified, safe, and immediate.

Rent Reporting Services

Rent is likely your biggest monthly expense. Yet, it usually does not help your score. Services like Rental Kharma or RentReporters can change this dynamic. They verify your rent payments with your landlord. They then report this positive history to the bureaus.

This can add years of positive payment history to your file overnight. It is a vital strategy for renters who want to become homeowners.

Strategy 9: Handling Hard Inquiries

Every time you apply for credit, a “hard inquiry” hits your report. This can drop your score by a few points. Too many inquiries make you look desperate for cash.

Inquiries stay on your report for two years. However, they only impact your score for one year. You should be strategic about when you apply.

The Shopping Window Safeguard

If you are shopping for a mortgage or auto loan, you have a safeguard. All inquiries made within a 14 to 45-day window count as one single inquiry. The algorithms understand you are rate shopping.

Do not spread your applications over months. Bunch them together within two weeks. This protects your score from cumulative damage. It is a smart way to find the best deal without penalties.

Strategy 10: Goodwill Letters for Late Payments

A single late payment can haunt you for seven years. If you have an otherwise perfect history, you can ask for forgiveness. This is done through a “goodwill letter.”

You write to the creditor explaining why you were late. Perhaps it was a medical emergency or a technical error. You highlight your long history of loyalty. You politely, emotionally ask them to remove the late mark as a gesture of goodwill.

This is not guaranteed. However, it works surprisingly often. Creditors value long-term customers. If they remove the late mark, your payment history becomes pristine again. This restoration is invaluable.

Strategy 11: The Dangers of Closing Old Accounts

When you pay off a credit card, you might feel the urge to close it. You might want to simplify your wallet. Do not do this. Closing an old account is often a massive strategic mistake.

The Impact on History and Utilization

Closing a card hurts you in two distinct ways. First, it reduces your total available credit. This spikes your utilization rate instantly. Second, eventually, the history of that account will fall off. This shortens your “average age of accounts.”

Keep the account open. Put a small recurring charge on it, like a subscription. Set it to autopay. This keeps the account active and the history alive. It is a passive way to maintain a strong score.

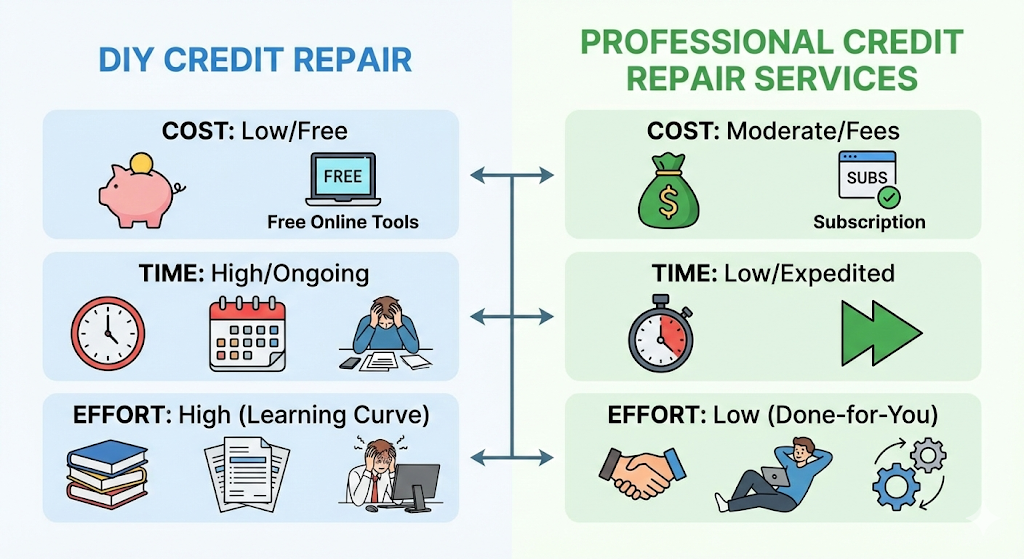

Strategy 12: Professional Credit Repair Agencies

Sometimes the mess is too big to handle alone. Identity theft or complex legal issues may require professionals. Credit repair agencies specialize in disputing negative items.

Vet Your Agency Carefully

The industry is full of scams. A legitimate agency will never promise a specific score. They will never ask for payment upfront before work is done. Look for certified experts.

They can handle the tedious work of mailing letters and tracking disputes. They know the specific legal language that forces bureaus to comply. For busy professionals, this outsourcing can be a lifesaver.

Strategy 13: The Hidden Dangers of “Buy Now, Pay Later” (BNPL)

In the past few years, “Buy Now, Pay Later” services like Affirm, Klarna, and Afterpay have exploded in popularity. For a long time, these loans were invisible to the credit bureaus. You could stack up debt on these platforms, and it would not affect your credit score. That “phantom debt” era is officially over as of late 2025.

FICO has introduced new scoring models, specifically FICO Score 10 BNPL and FICO Score 10 T BNPL. These models are designed to capture this specific type of installment data. Major bureaus like Experian and TransUnion are now actively ingesting data from these providers. This shift fundamentally changes how you should approach these convenient payment plans.

The Double-Edged Sword

Previously, the risk with BNPL was just late fees. Now, the risk is reputational damage.

- The Positive: If you pay on time, these accounts can act like mini-installment loans, adding positive data to your file. For someone with a thin file, this can be a benefit.

- The Negative: A missed payment is now reported as a delinquency. Because these loans are often for small amounts, consumers tend to take out several at once. If you miss payments on three different BNPL plans in one month, that is three separate delinquencies hitting your report simultaneously. That can devastate a score faster than a single missed credit card payment.

The Utilization Trap

Furthermore, some lenders treat these BNPL accounts as “consumer finance accounts,” which can be viewed negatively even if paid on time. They may signal to a mortgage underwriter that you do not have the cash flow to buy everyday items like clothes or electronics.

The smartest strategy in 2025 is to treat BNPL with the same caution as a high-interest credit card. Do not use it for consumption. Only use it if you are leveraging the 0% interest to keep cash in a high-yield savings account, and only if you have the cash to pay it off in full immediately.

Strategy 14: Recession-Proofing Your Credit Strategy

With economic volatility characterizing late 2025, “recession-proofing” your credit is no longer optional; it is a survival skill. During economic downturns, banks and lenders change their behavior drastically. They enter a mode of risk mitigation, which often directly impacts consumers with “good” but not “excellent” credit.

The Threat of Limit Cuts

In a booming economy, banks hand out credit limit increases freely. In a recession, they do the opposite. They actively scan their portfolios for “high-risk” behavior. If you are carrying a high balance, even if you are paying on time, a bank might suddenly cut your credit limit to match your balance.

Example: You have a $10,000 limit and owe $4,000 (40% utilization). The bank gets nervous about the economy and cuts your limit to $4,500. Suddenly, your utilization spikes to nearly 90%. Your score plummets overnight, through no fault of your own.

Defensive Measures

To protect yourself, you must be proactive:

- Reduce Utilization Aggressively: Aim for 0-5% utilization rather than the standard 30%. You need a buffer zone in case your limits are slashed.

- Keep “Sock Drawer” Cards Active: Lenders are more likely to close inactive accounts during a recession to reduce their exposure. Rotate a small purchase onto every single card you own at least once every three months.

- Build a Cash Fortress: Relying on credit cards as an emergency fund is dangerous during a recession because those lines of credit can be revoked. You need liquid cash (3-6 months of expenses) so you are never forced to run up balances when rates are high and limits are low.

By anticipating these lender behaviors, you effectively immunize your score against the broader economic chaos. You remain creditworthy even when the market tightens, ensuring you have access to capital when you need it most.

Consistency is the Ultimate Key

Credit repair is not a one-time event. It is a lifestyle. You must monitor your score monthly. Apps from banks and credit card issuers make this free and easy.

Set up alerts for any changes. If a new account appears, investigate immediately. Fraud protection is critical in the digital age. Your vigilance ensures that your hard work is not undone by criminals.

Furthermore, automate everything. Set all your bills to autopay for the minimum amount. This guarantees you never miss a due date. You can always pay more later, but you can never erase a missed deadline.

Conclusion

Improving your credit score quickly is a tangible, achievable goal. It requires a blend of aggressive error correction, strategic payments, and smart leverage of financial tools. You now possess the blueprint to navigate this system.

Do not wait for the perfect moment. The best time to start was yesterday. The second best time is right now. Every point you gain brings you closer to lower rates, better approvals, and true financial independence. Take control of your narrative. Demand the creditworthiness you deserve. Your future self will thank you for the actions you take today.

Sources and References

- myFICO – How FICO Scores Are Calculated

- Experian – How to Improve Your Credit Score

- Equifax – What is a Good Credit Score?

- Consumer Financial Protection Bureau – Disputing Errors on Credit Reports

- TransUnion – Credit Score Basics

- VantageScore – The Difference Between FICO and VantageScore

- Federal Trade Commission – Credit Repair Scams

- AnnualCreditReport.com – Official Free Credit Reports