Secure your future with our ultimate guide to insurance policies. Discover essential coverage options for 2025 and protect what matters most today.

The world in December 2025 is complex. Risks are everywhere. Protecting your assets and your loved ones is not just a choice. It is a vital necessity. Life throws unexpected curveballs. A sudden illness, a car accident, or a natural disaster can wipe out years of hard work. This is where insurance comes in. It acts as a powerful shield. It stands between you and financial ruin.

Understanding the vast landscape of insurance policies can feel overwhelming. There are so many options. The terminology is often confusing. However, knowledge is power. When you understand the different types of insurance available, you gain control. You can make certified decisions that secure your future. This guide is your essential roadmap. We will navigate through the critical types of insurance policies you need to know.

We will explore personal protections that keep your family safe. We will dive into commercial policies that ensure your business keeps thriving. We will even look at specialty coverage for unique risks. This is about more than just paperwork. It is about peace of mind. It is about building a legacy that lasts. Let us begin this journey toward total financial security.

The Foundation of Personal Protection

Personal insurance is the bedrock of a secure financial plan. It protects you and your family from life’s most severe shocks. Without it, you are vulnerable. One single event could derail your dreams. Therefore, securing the right personal coverage is an immediate priority.

Life Insurance: Securing Your Legacy

Life insurance is perhaps the most emotional purchase you will make. It is a promise to your loved ones. You are telling them they will be okay, even if you are not there. It provides a financial safety net when it is needed most. There are several distinct types of life insurance to consider.

Term Life Insurance is the most straightforward option. You purchase coverage for a specific period, such as 10, 20, or 30 years. It offers a pure death benefit. If you pass away during the term, your beneficiaries receive a tax-free payout. This is often the most affordable way to get a substantial amount of coverage. It is perfect for young families. It covers the years when financial obligations are highest.

Whole Life Insurance offers permanent protection. It covers you for your entire life, as long as premiums are paid. Additionally, it includes a cash value component. This cash value grows over time. You can borrow against it or use it to pay premiums later in life. It acts as both protection and a savings vehicle.

Universal Life Insurance provides flexibility. You can adjust your premium payments and death benefits within certain limits. This is ideal for those with fluctuating incomes. It also has a cash value component that earns interest.

Health Insurance: Your Vital Lifeline

Health is wealth. However, medical care is expensive. In 2025, healthcare costs continue to rise. A serious illness or injury can lead to bankruptcy without proper coverage. Health insurance is not a luxury. It is a critical requirement for survival.

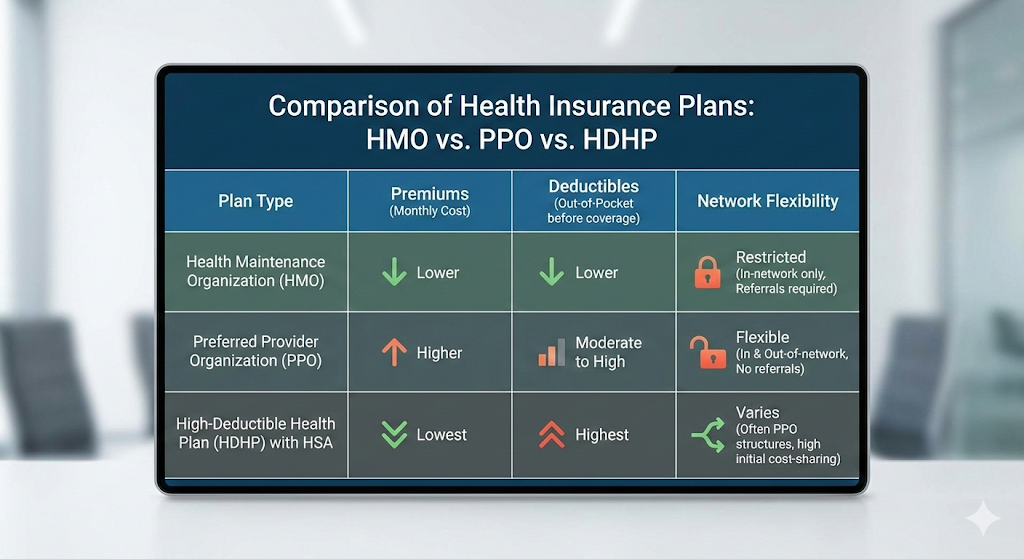

HMO (Health Maintenance Organization) plans are often more affordable. They require you to use a network of doctors and hospitals. You usually need a referral to see a specialist. This structure keeps costs lower for everyone.

PPO (Preferred Provider Organization) plans offer more freedom. You can see any doctor you want. You do not need referrals. However, staying in-network saves you money. These plans usually have higher premiums but offer greater flexibility.

High-Deductible Health Plans (HDHP) are becoming popular. They have lower monthly premiums. However, you pay more out-of-pocket before insurance kicks in. These are often paired with a Health Savings Account (HSA). An HSA allows you to save pre-tax money for medical expenses. It is a powerful tool for managing healthcare costs.

Auto Insurance: Essential Road Protection

Driving is a daily activity for millions. It is also one of the most dangerous things we do. Auto insurance is mandatory in most places. Yet, minimum coverage is rarely enough. You need a policy that truly protects you from liability and loss.

Liability Coverage pays for bodily injury and property damage you cause to others. It is the legal minimum. However, if you cause a major accident, minimum limits may not cover the full cost. You could be sued for the difference.

Collision Coverage pays to repair your own car if you hit something. It does not matter who is at fault. If you have a newer car, this is essential. It ensures you can get back on the road quickly.

Comprehensive Coverage protects against non-collision events. This includes theft, vandalism, fire, and weather damage. It offers peace of mind against events you cannot control.

Uninsured/Underinsured Motorist Coverage is vital. Not everyone follows the law. If an uninsured driver hits you, this coverage pays for your medical bills and repairs. It is a critical layer of self-protection.

Commercial Insurance: Safeguarding Your Enterprise

Business owners face unique risks. One lawsuit or disaster can destroy a thriving company. Commercial insurance is the armor that protects your hard work. It ensures your business can survive and prosper, no matter what happens.

General Liability Insurance

This is the foundation of business protection. It covers claims of bodily injury or property damage caused by your business operations. If a customer slips in your store, this policy kicks in. If you accidentally damage a client’s property, you are covered.

Furthermore, it covers legal fees. Lawsuits are expensive, even if you win. General liability insurance pays for your defense. It prevents a legal battle from draining your working capital. For any serious entrepreneur, this coverage is non-negotiable.

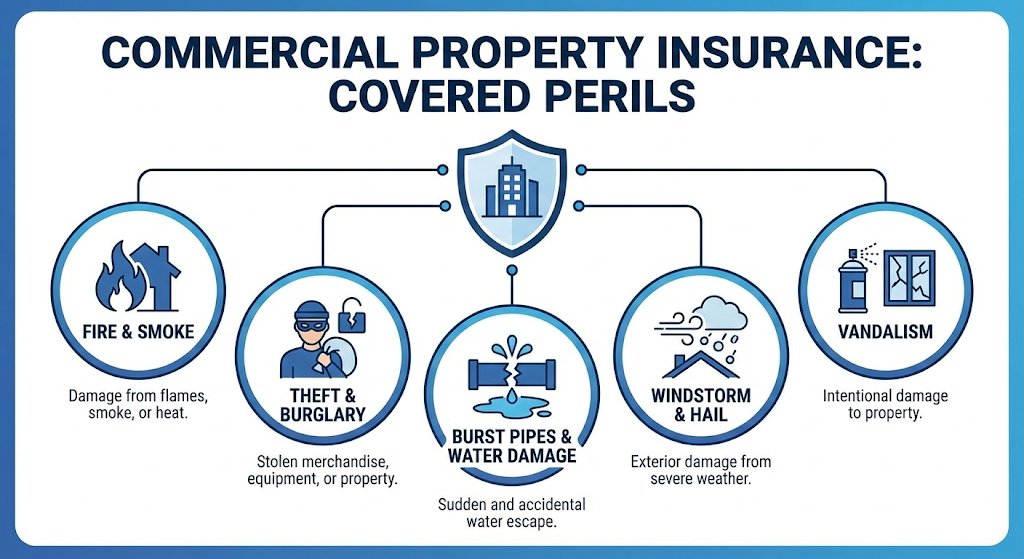

Property Insurance

Your physical assets are valuable. Your building, equipment, inventory, and furniture represent a significant investment. Commercial property insurance protects these assets from fire, theft, and natural disasters.

Business Interruption Insurance is often part of this. Imagine a fire forces you to close for months. You still have rent, salaries, and bills to pay. This coverage replaces your lost income during the restoration period. It can be the difference between reopening and closing forever.

Workers’ Compensation

If you have employees, you likely need workers’ compensation. It covers medical expenses and lost wages for employees injured on the job. It is a crucial safety net for your workforce.

Additionally, it protects you from lawsuits. In most cases, employees cannot sue you for workplace injuries if they receive workers’ compensation benefits. It creates a stable environment for both employer and employee. It fosters trust and security in the workplace.

Professional Liability Insurance

Also known as Errors and Omissions (E&O) insurance. This is vital for service providers. If you give advice or provide a service, you can be sued for negligence. Even if you did nothing wrong, a dissatisfied client can file a claim.

Doctors, lawyers, consultants, and architects need this coverage. It covers legal defense costs and settlements. It protects your professional reputation and your personal assets. In a litigious society, it is an essential safeguard.

Specialty Insurance: Covering Unique Risks

Standard policies do not cover everything. Sometimes, you need specialized protection. These policies address specific risks that standard insurance might exclude. They offer tailored solutions for unique situations.

Cyber Liability Insurance

In the digital age, data is currency. Cyberattacks are a constant threat. Hackers target businesses of all sizes. A data breach can cost millions in fines, legal fees, and reputational damage.

Cyber liability insurance covers the costs associated with a data breach. This includes notifying customers, credit monitoring, and legal defense. It also covers ransomware payments in some cases. As we move deeper into 2025, this coverage is becoming as important as general liability.

Travel Insurance

Travel is exciting, but it carries risks. Flights get cancelled. Luggage gets lost. Medical emergencies happen abroad. Travel insurance protects your investment in your trip.

Trip Cancellation reimburses you if you cannot travel due to illness or other covered reasons. Medical Emergency coverage is crucial when traveling internationally. Your domestic health insurance may not work overseas. This coverage ensures you get the care you need without a massive bill.

Pet Insurance

Our pets are family. Veterinary care is becoming increasingly sophisticated and expensive. A serious illness for a pet can cost thousands of dollars. Pet insurance helps cover these costs.

It usually works on a reimbursement basis. You pay the vet, and the insurance pays you back. It covers accidents, illnesses, and sometimes routine care. It ensures you never have to make a heartbreaking decision based on money.

Umbrella Insurance

Sometimes, standard limits are not enough. A catastrophic lawsuit could exceed your auto or homeowners liability limits. Umbrella insurance provides an extra layer of liability protection.

It kicks in when your underlying policies are exhausted. It is relatively inexpensive for the amount of coverage it provides. It offers a massive shield for your net worth. It is highly recommended for anyone with significant assets to protect.

Navigating the Claims Process

Having insurance is the first step. Knowing how to use it is the second. Filing a claim can be stressful, especially after a traumatic event. However, understanding the process makes it smoother.

Immediate Action Required

When a loss occurs, act fast. Contact your insurance provider immediately. Most companies have 24/7 hotlines or mobile apps. Delaying a claim can sometimes lead to denial.

Document everything. Take photos of the damage. Keep receipts for emergency repairs. Write down names and contact information of witnesses. The more evidence you have, the stronger your claim will be. This documentation is your proof. It is essential for a fair settlement.

working with Adjusters

An insurance adjuster will investigate your claim. They determine the extent of the loss and the amount the company will pay. Be honest and cooperative. However, remember they work for the insurance company.

Review their findings carefully. If you disagree with their assessment, do not be afraid to challenge it. You can hire a public adjuster to advocate for you. They work on your behalf to ensure you get the maximum payout you are entitled to.

Understanding Deductibles

Your deductible is the amount you pay out of pocket before insurance kicks in. A higher deductible usually means a lower premium. However, you must be able to afford the deductible in an emergency.

Choose a deductible that balances your monthly budget with your savings. If you have a solid emergency fund, a higher deductible might be a smart financial move. It lowers your fixed costs while keeping your catastrophic protection intact.

The Future of Insurance: Trends in 2025

The insurance industry is evolving rapidly. Technology is changing how we buy and use insurance. New risks are emerging, and new solutions are being created. Staying ahead of these trends ensures you have the most up-to-date protection.

Artificial Intelligence and Automation

AI is revolutionizing claims processing. Simple claims are now settled in seconds. Chatbots handle customer service inquiries instantly. This speed is a massive benefit for consumers. It means you get paid faster when disaster strikes.

Furthermore, AI helps insurers assess risk more accurately. This leads to more personalized pricing. Safe drivers and healthy individuals can see significant savings. It rewards responsible behavior.

Usage-Based Insurance

Telematics is changing auto insurance. Devices in your car track your driving habits. If you drive safely, you pay less. This “pay-as-you-drive” model is fair and transparent.

Similarly, wearable devices are impacting life and health insurance. Steps, heart rate, and activity levels can influence your premiums. It encourages a healthy lifestyle while lowering costs. It is a win-win for insurers and policyholders.

Climate Change Adaptation

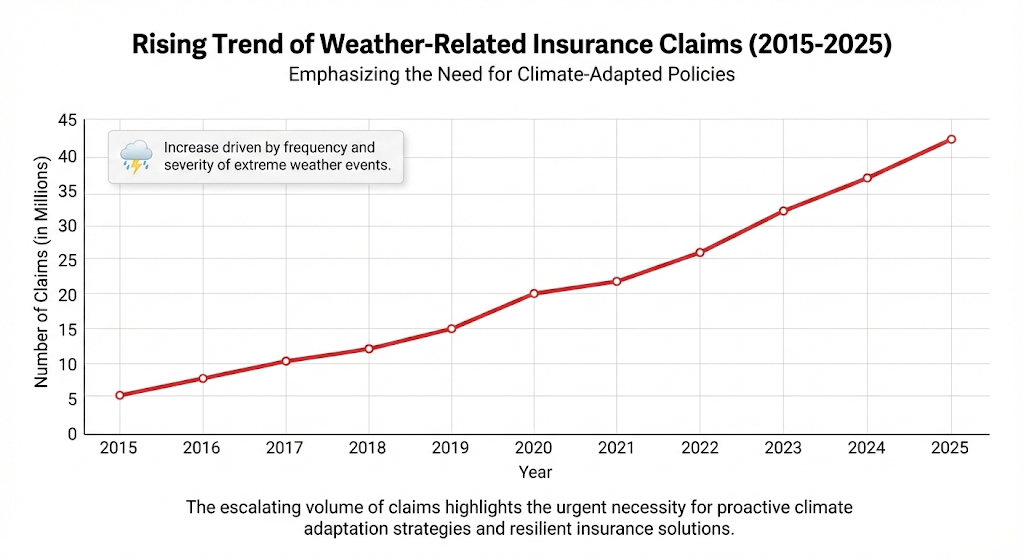

Extreme weather events are more frequent. Insurers are adjusting their models to account for climate change. Some areas are becoming harder to insure.

New products are emerging to address these risks. Parametric insurance pays out automatically based on weather data, like wind speed or rainfall. It eliminates the need for a lengthy claims process. It provides immediate funds for recovery.

How to Choose the Right Policy

With so many options, how do you choose? The right policy depends on your unique needs. There is no one-size-fits-all solution. You must assess your risks and your budget.

Assess Your Risks

Look at your life and your assets. Do you have dependents? You need life insurance. Do you own a home? You need strong property coverage. Do you run a business? You need commercial liability.

Identify your biggest vulnerabilities. What would cause the most financial pain? Prioritize coverage for those risks. Do not ignore the potential for catastrophic loss.

Compare Quotes

Never settle for the first quote you receive. Prices vary significantly between companies. Shop around. Use online comparison tools. Contact independent agents who represent multiple carriers.

Look at the value, not just the price. A cheap policy with gaping holes in coverage is worthless. Compare limits, deductibles, and exclusions. Ensure you are comparing apples to apples.

Read the Fine Print

This is tedious but critical. The policy document is a legal contract. It defines exactly what is covered and what is not. Pay attention to the “Exclusions” section.

If you do not understand something, ask questions. Ask your agent to explain scenarios. “If this happens, am I covered?” Clarity is essential. Do not wait until a claim to discover you are not protected.

Conclusion: Empower Your Future

Insurance is more than a monthly bill. It is the foundation of your financial freedom. It allows you to take risks, build businesses, and raise families without the constant fear of disaster. It transforms uncertainty into security.

By understanding the different types of insurance policies, you take control of your destiny. You protect the wealth you have built. You ensure your loved ones are cared for. You guarantee that your business can weather any storm.

Do not leave your future to chance. Take action today. Review your current policies. Identify any gaps in your coverage. Consult with a trusted professional. Secure the protection you need. Your peace of mind is worth it. Your legacy depends on it.