Master the art of selecting the perfect health insurance. Discover essential strategies to compare plans, save money, and secure elite coverage for your future.

Health insurance is the most critical financial product you will ever purchase. It is the barrier between your family and financial ruin. It is the key to accessing life-saving medical technology. Yet, for millions of people, the process of choosing a plan is a source of profound anxiety. The terminology is intentionally dense. The options are dizzying. The fear of making a mistake is paralyzing. This is not just about paperwork. It is about your survival.

As we navigate the complex landscape of December 2025, the stakes have never been higher. Medical inflation continues to outpace wage growth. New treatments offer miraculous cures but come with astronomical price tags. Consequently, selecting the right health insurance plan is no longer a simple administrative task. It is a strategic necessity. It requires a clear head, a sharp eye for detail, and a deep understanding of your personal risk profile.

This comprehensive, authoritative guide will dismantle the confusion. We will strip away the jargon to reveal the core mechanics of coverage. You will learn how to analyze plans like a professional underwriter. You will discover the hidden traps that insurers use to deny claims. Most importantly, you will gain the confidence to choose a plan that protects your health and your wealth. Do not leave your future to chance. Let us secure your peace of mind today.

The Financial Impact of Your Choice

Many consumers view health insurance premiums as a monthly nuisance. This is a dangerous misconception. Your health insurance is actually a massive portfolio protector. Medical debt remains the leading cause of personal bankruptcy in many developed nations. A single car accident, a sudden cancer diagnosis, or a complicated pregnancy can generate bills exceeding hundreds of thousands of dollars. Without the right coverage, those bills become your personal liability.

Imagine the devastating impact of draining your retirement savings to pay for a hospital stay. Picture the stress of choosing between your mortgage and your medication. These are not hypothetical scenarios. They are the daily reality for those who choose poorly. Conversely, the right plan acts as a financial fortress. It limits your liability. It ensures that a health crisis remains a medical issue, not a financial catastrophe.

Furthermore, comprehensive coverage unlocks access to preventive care. Regular screenings, vaccinations, and check-ups are the cornerstone of longevity. The best plans incentivize you to stay healthy. They pay for the maintenance of your body. This proactive approach is essential for a thriving life. When you compare plans, you are not just comparing costs. You are comparing potential futures.

Deconstructing the Core Terminology

You cannot win a game if you do not understand the rules. The insurance industry speaks a specific dialect designed to be precise but often confusing to the outsider. To compare plans effectively, you must master these four fundamental concepts. These are the levers that determine your financial exposure.

The Premium: Your Entry Fee

The premium is the fixed amount you pay every month to maintain your coverage. Think of it as a subscription service. Whether you visit the doctor zero times or fifty times, this cost remains constant. It is easy to be seduced by a low premium. However, a low premium often masks high costs elsewhere. It is the “sticker price,” but it is rarely the total cost of ownership.

The Deductible: Your Hurdle

The deductible is the amount you must pay out of pocket before your insurance company begins to share the cost. For example, if you have a $5,000 deductible, you are responsible for the first $5,000 of medical expenses in a year. Until you hit that number, you pay the full negotiated rate for visits and procedures.

- High Deductible: Usually equals a lower premium. Good for the healthy.

- Low Deductible: Usually equals a higher premium. Essential for the chronically ill.

Copayments and Coinsurance: Your Share

Once you meet your deductible, you enter the cost-sharing phase.

- Copayment (Copay): This is a flat fee for a specific service. You might pay $25 for a primary care visit or $50 for a specialist. Copays are predictable. They make budgeting easier.

- Coinsurance: This is a percentage of the cost. If your coinsurance is 20%, you pay 20% of the bill, and the insurer pays 80%. This is where costs can spiral. 20% of a $100,000 surgery is $20,000. This is a critical risk factor to analyze.

The Out-of-Pocket Maximum: Your Safety Net

This is the most important number in your contract. The Out-of-Pocket (OOP) Maximum is the absolute limit on what you will pay for covered services in a plan year. Once you reach this ceiling, the insurance company pays 100% of allowed costs. This prevents bankruptcy. A lower OOP maximum provides superior protection against catastrophic events. Never choose a plan without knowing this number.

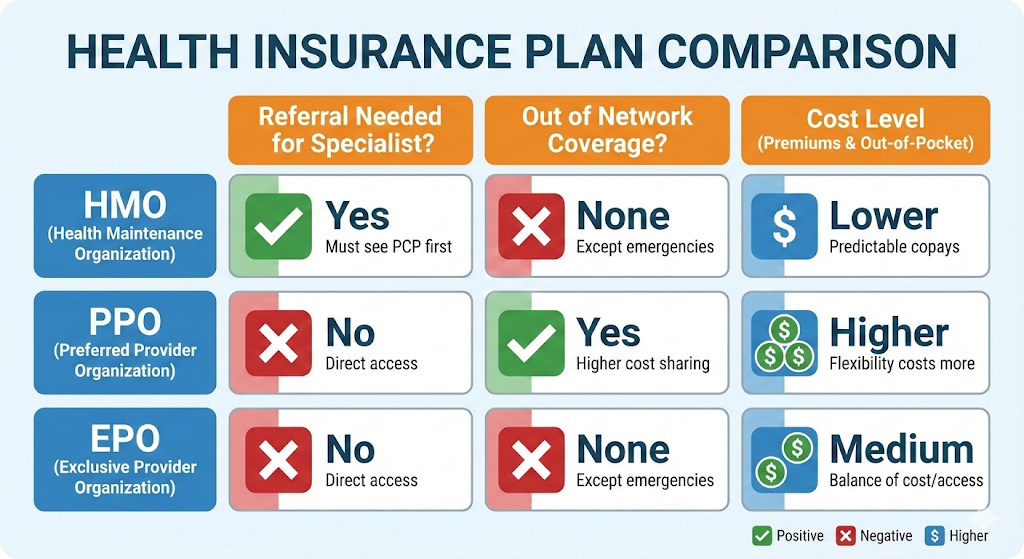

Analyzing the Alphabet Soup: HMO, PPO, EPO, POS

The structure of your plan dictates your freedom. It determines which doctors you can see and which hospitals you can visit. Choosing the wrong structure can lead to frustration and denied claims. We must examine the four main architectures of health coverage.

Health Maintenance Organization (HMO)

An HMO is a restrictive but affordable option. It focuses on integrated care.

- The Rules: You must select a Primary Care Physician (PCP). Your PCP is the gatekeeper. You usually cannot see a specialist (like a cardiologist or dermatologist) without a referral from your PCP.

- The Network: There is generally no coverage for care received outside the network, except for true emergencies.

- The Benefit: HMOs typically have the lowest premiums and low out-of-pocket costs. They are excellent for people who want affordable, coordinated care and do not mind navigating a system.

Preferred Provider Organization (PPO)

A PPO offers maximum flexibility and freedom. It is the premium choice for those who dislike gatekeepers.

- The Rules: You do not need a PCP. You do not need referrals. You can book an appointment with a specialist directly.

- The Network: You have access to a large network of providers. Crucially, you also have coverage for out-of-network doctors, though you will pay more to see them.

- The Trade-off: PPO premiums are significantly higher. You are paying for the privilege of choice.

Exclusive Provider Organization (EPO)

The EPO is a growing trend in 2025. It acts as a hybrid.

- The Rules: Like a PPO, you usually do not need a referral to see a specialist. This is a major convenience.

- The Network: Like an HMO, you have no coverage outside the network. If you go out of network, you pay 100%.

- The Verdict: This is a fantastic middle ground for healthy individuals who want specialist access without the high price of a PPO.

Point of Service (POS)

POS plans are less common today but still exist. They combine elements of HMO and PPO. You need a PCP and referrals (like an HMO), but you have some out-of-network coverage (like a PPO). The administrative burden often makes these less attractive than EPOs.

The Secret Weapon: Health Savings Accounts (HSA)

If you are considering a High-Deductible Health Plan (HDHP), you must understand the Health Savings Account (HSA). This is not just a savings account. It is a powerful investment vehicle. Financial advisors often call it the “Triple Tax Threat.”

- Tax-Free Contributions: The money you put in reduces your taxable income for the year. This saves you immediate cash on your tax bill.

- Tax-Free Growth: You can invest the funds in stocks or mutual funds. The growth on those investments is not taxed.

- Tax-Free Withdrawals: As long as you use the money for qualified medical expenses, you pay zero taxes when you take it out.

Furthermore, unlike a Flexible Spending Account (FSA), HSA funds never expire. They roll over year after year. You can build a massive medical nest egg for retirement. If you are young and healthy, choosing an HDHP with an HSA is often the smartest financial move you can make. It transforms your health insurance from an expense into an asset.

Assessing Your Personal Health Profile

Before comparing plans, you must audit your life. A plan that is perfect for your coworker might be a disaster for you. You need to perform a brutally honest assessment of your medical needs for the coming year.

The “Utilization” Question

How often do you actually interact with the healthcare system?

- Low Utilizers: You only go for your annual physical. You rarely get sick. You take no medications. Strategy: Lean towards a High Deductible Plan (EPO or PPO) to minimize monthly premiums. Bank the savings in an HSA.

- High Utilizers: You have a chronic condition (diabetes, hypertension). You see specialists quarterly. You have weekly therapy. Strategy: You need a higher premium plan with a lower deductible and flat copays. You want to reach your out-of-pocket maximum quickly.

The Prescription Factor

Medications are often the biggest hidden cost. You must check the “formulary” (drug list) of every plan you consider.

- Tier 1: Generics (Cheap).

- Tier 2: Preferred Brands (Moderate).

- Tier 3: Non-Preferred Brands (Expensive).

- Tier 4: Specialty Drugs (Very Expensive).If your vital daily medication is in Tier 3 on Plan A but Tier 2 on Plan B, Plan B might save you thousands, even if the premium is higher. Never sign up without checking the drug list.

Future Planning

Are you planning a major life event in 2025?

- Pregnancy: You need a plan with excellent maternity care and reasonable hospital stay costs.

- Surgery: If you need a knee replacement or hernia repair, look for low coinsurance for inpatient procedures.

- Travel: If you travel frequently for work, an HMO is risky. You need the nationwide coverage of a PPO.

The Total Cost of Ownership Calculation

Do not be fooled by the monthly rate. To choose the best plan, you must calculate the Total Cost of Ownership (TCO). This requires a bit of math, but it is the only accurate way to compare.

The Formula:

(Monthly Premium × 12) + Estimated Out-of-Pocket Costs = Total Annual Cost

Let us run a rigorous comparison scenario.

Scenario: You are generally healthy but want to be safe. You expect 4 doctor visits ($150 each) and 12 prescriptions ($20 each). Total expected medical cost: $840.

Plan A (Silver PPO):

- Premium: $400/month ($4,800/year).

- Deductible: $2,000.

- Copays: $30 doctor, $15 Rx.

- Analysis: You pay $4,800 in premiums. Your visits cost 4 x $30 = $120. Your Rx costs 12 x $15 = $180.

- Total Cost: $5,100.

Plan B (Bronze HDHP):

- Premium: $200/month ($2,400/year).

- Deductible: $6,000.

- Copays: 0% after deductible (You pay full price until then).

- Analysis: You pay $2,400 in premiums. You pay the full $840 for your medical care because you haven’t hit the deductible.

- Total Cost: $3,240.

The Verdict: In a healthy year, Plan B saves you nearly $2,000. However, you must also calculate the “Worst Case Scenario.” If you have a $50,000 heart attack, Plan B might cost you your full $6,000 deductible plus premiums. Can you afford that $6,000 shock? If not, Plan A is the safer bet despite the higher annual cost.

Network Adequacy: The Hidden Trap

In 2025, insurance networks are becoming narrower. Insurers are trying to control costs by limiting the number of doctors they contract with. This creates a significant risk for the consumer. You might buy a “Blue Cross” plan assuming your doctor accepts it, only to find out they accept “Blue Cross PPO” but not “Blue Cross Select Network.”

The “Surprise Bill” Danger

Although the “No Surprises Act” in the US has helped, network issues persist.

- Hospital Privileges: Your surgeon might be in-network, but the hospital they operate at might not be.

- Ancillary Providers: You go to an in-network ER. The ER doctor is in-network. But the radiologist who reads your X-ray is an outside contractor who is out-of-network.

Action Step: Before choosing a plan, call your essential providers. Do not ask, “Do you take UnitedHealthcare?” Ask, “Are you in the network for the UnitedHealthcare Choice Plus plan?” Be specific. Check the insurer’s online directory, but verify with the doctor’s office directly. Directories are often outdated.

Mental Health and Telehealth Benefits

The definition of “essential care” has expanded. In December 2025, a top-tier health plan must prioritize mental well-being and digital access.

Mental Health Parity

Verify that the plan covers therapy, counseling, and psychiatric medication at the same level as physical illness. Look for the number of in-network therapists. Many plans have “ghost networks” where listed therapists are not actually accepting new patients. Call a few to check availability before signing up.

Telehealth Revolution

Virtual care is a game-changer for convenience. The best plans offer $0 copays for 24/7 virtual visits. This means you can see a doctor for a sinus infection or a rash on a Sunday night without leaving your house and without paying a dime. This benefit alone can save you hundreds of dollars in urgent care fees.

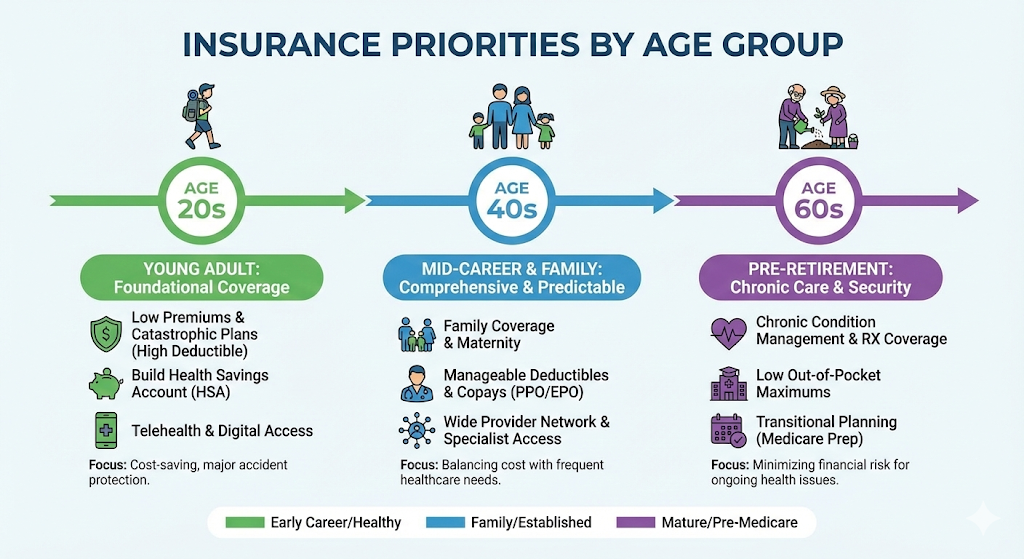

Strategies for Different Life Stages

Your health insurance needs evolve as you age. What worked in your 20s will be inadequate in your 40s.

The Young Professional (22-30)

You are likely healthy and budget-conscious.

- Focus: Low premiums.

- Strategy: Grab a catastrophic plan or a high-deductible plan. Maximize an HSA. You are building wealth. You just need protection against a major accident.

The Growing Family (30-50)

You have children who are germ magnets. You have sports injuries. You have stress.

- Focus: Predictability and convenience.

- Strategy: Avoid high deductibles if you can. You want copays. You want to know that a trip to the pediatrician costs $25, not $200. PPO or EPO plans are usually best here to ensure access to pediatric specialists.

The Pre-Retiree (55-64)

This is a critical window. You are not yet eligible for Medicare, but health issues are arising.

- Focus: Comprehensive coverage.

- Strategy: Prioritize a lower deductible. Your risk of needing a joint replacement or cardiac care increases statistically. Ensure your network includes top-tier hospitals for major procedures.

The Freelancer / Entrepreneur

You do not have an employer subsidy. You pay full price.

- Focus: Tax deduction and value.

- Strategy: You must shop on the Marketplace (ACA). Look for subsidies based on your income. If you earn too much for subsidies, look into professional association plans or Chamber of Commerce group plans to find better rates.

Navigating the Marketplace Application

If you are buying your own insurance (not through a job), you will likely use the Health Insurance Marketplace (Healthcare.gov in the US) or a state exchange.

- Gather Documents: You need social security numbers, employer information, and accurate income estimates for 2025. Income estimates are critical because they determine your subsidy (tax credit).

- Filter Properly: The website allows you to filter by “Silver,” “Gold,” and “Bronze.”

- Bronze: Pays ~60% of costs. Low premium, high deductible.

- Silver: Pays ~70% of costs. Moderate balance. Crucial Note: Only Silver plans offer “Cost Sharing Reductions” (extra savings) for lower-income applicants.

- Gold: Pays ~80% of costs. High premium, low deductible.

- Compare 3 Options: Never just pick the first one. Select three distinct plans and use the “Compare” feature to see them side-by-side.

Common Pitfalls and Red Flags

The insurance market is full of predatory products. You must be vigilant to avoid “junk insurance.”

- Short-Term Health Plans: These plans look incredibly cheap. However, they are not compliant with the Affordable Care Act (ACA). They can deny you coverage for pre-existing conditions. They often have caps on coverage (e.g., they will only pay up to $10,000). Avoid these unless you have absolutely no other choice for a gap of 1-2 months.

- Indemnity Plans: These pay a fixed cash amount for services (e.g., $50 per doctor visit). They do not pay the actual bill. If the visit costs $200, you are on the hook for $150. These are supplements, not replacements for real insurance.

- Health Care Sharing Ministries: These are not insurance. They are religious cooperatives. There is no legal guarantee they will pay your bills. They are unregulated. Proceed with extreme caution.

Managing Your Plan After Purchase

Choosing the plan is only step one. To get the best value, you must manage it actively.

- Create Your Portal Account: Immediately log in to the insurer’s website.

- Review Your EOBs: The “Explanation of Benefits” is the document you get after a visit. It is not a bill. It shows what the doctor charged, what the insurance paid, and what you owe. Errors are common. Verify every single one.

- Appeal Denials: If an insurance company refuses to pay for a covered service, do not accept it. You have the right to appeal. Statistics show that a significant percentage of denied claims are overturned upon appeal. Be persistent.

Conclusion

Comparing health insurance plans is a demanding intellectual exercise. It requires you to be a mathematician, a risk analyst, and a medical forecaster all at once. However, the effort is undeniably worth it. The right plan provides a foundation of security that allows you to live your life without fear.

As you finalize your decision for 2025, remember the golden rules: prioritize the Out-of-Pocket Maximum over the premium; match the network to your preferred doctors; and always check the drug formulary. You are now equipped with the expert knowledge to navigate this complex market. You have the power to protect your family and your finances.

Do not delay. Open enrollment periods are strictly limited. Take action today. Review your options, calculate your costs, and lock in a plan that ensures a thriving, protected future. Your health is your ultimate wealth; insure it accordingly.

Sources and References

- HealthCare.gov – Glossary of Health Coverage and Medical Terms

- KFF (Kaiser Family Foundation) – Health Insurance Coverage of the Total Population

- Consumer Reports – Health Insurance Buying Guide

- Mayo Clinic – Health Insurance: Understanding the Basics

- Centers for Medicare & Medicaid Services (CMS) – Marketplace Coverage

- Investopedia – How to Choose a Health Insurance Plan

- USA.gov – Health Insurance

- NCQA – Health Insurance Plan Ratings

- IRS.gov – Health Savings Accounts (HSAs)