Discover five proven ways to lower your home insurance premium while keeping protection solid, from smart upgrades to deductibles and key discounts.

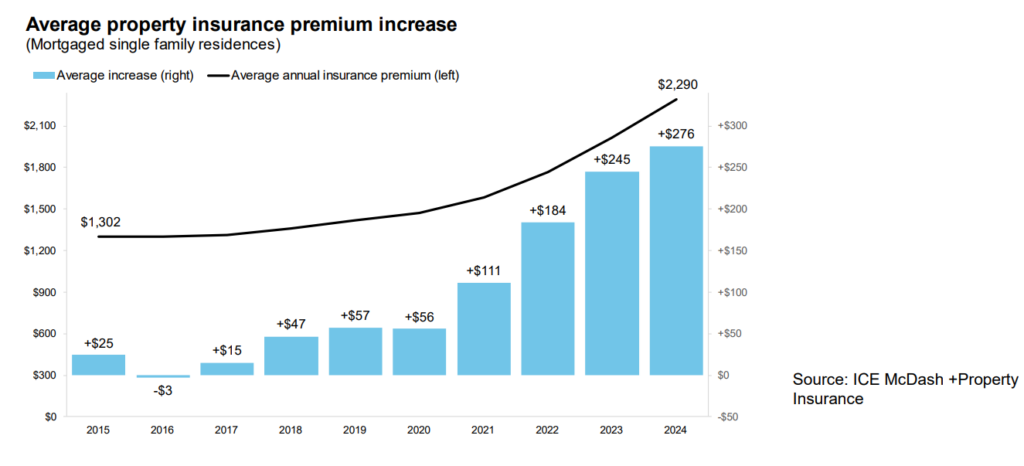

As of December 2025, home insurance inflation feels brutal and unfair for many families. Studies show that between 2021 and 2024, typical homeowners in the United States saw average premiums rise about 24 percent, with costs up in roughly 95 percent of postal codes. (Consumer Federation of America) By 2024, a typical policy was around 3,300 dollars per year, and the trend has not stopped. At the same time, a separate analysis found that average homeowners premiums increased more than 11 percent in a single year, reflecting strong pressure on budgets. (III)

Meanwhile, insurers continue to push through double digit rate increases in many states, driven by extreme weather, higher construction costs, and reinsurance expenses. (S&P Global) For many households, this situation creates real anxiety. It feels like you are paying more for shrinking coverage and that your safety net is under attack.

However, you are not powerless. You can take strategic, confident steps that reduce your premium while protecting the structure of your home, your belongings, and your peace of mind. The goal is not to gamble with your coverage. The goal is to act like a proactive risk manager for your own property.

In this guide, you will learn five powerful and practical ways to cut your home insurance premium without losing the essential protection that keeps your family safe. Each strategy is designed to be realistic, emotionally reassuring, and financially smart.

Why Home Insurance Premiums Are Rising

Before you dive into savings strategies, it helps to understand why your premiums are rising so aggressively. This knowledge gives you more confidence when you negotiate or adjust coverage.

The perfect storm of risk and cost

First, climate risk has intensified. More frequent wildfires, hurricanes, floods, and severe storms have generated massive claim payouts. In some markets, insurers have even left high risk regions or reduced new policies. That exodus creates less competition and pushes prices higher for those who remain. (San Francisco Chronicle)

Second, construction and labor costs climbed sharply after the pandemic. When it costs more to rebuild a kitchen, replace a roof, or reconstruct an entire house, insurers need higher premiums to keep their books balanced. This directly affects your dwelling coverage and your premium.

Third, financial and regulatory pressure has pushed insurers to recalculate risk more precisely. New models, updated catastrophe maps, and refined data sets can suddenly reclassify your neighborhood from moderate risk to high risk. That shift can feel shocking when your renewal arrives.

Why understanding the trend matters

If you see your premium jump again, it is easy to feel helpless or angry. However, when you understand the drivers behind these increases, you can respond more calmly and strategically. You can decide where to accept some risk, where to invest in protection, and where to push back during negotiations.

Additionally, this context will help you judge whether a particular discount is really attractive or just a small gesture. In a world where premiums in many regions have climbed 30 to 40 percent over only a few years, a five percent discount alone will not transform your finances. (Kiplinger) You need a combination of several tactics.

Strategy 1: Raise Your Deductible Without Risking Disaster

Increasing your deductible is one of the most direct ways to reach a lower premium. Yet many homeowners fear that a higher deductible will leave them dangerously exposed. You can avoid that fear with a clear, disciplined approach.

How deductibles influence your premium

Your deductible is the amount you agree to pay out of pocket when you file a covered claim. The higher your deductible, the more risk you carry, and the less risk the insurer carries. Because of this shift, insurers usually offer a meaningful discount when you move from, for example, 500 dollars to 1,000 dollars or from 1,000 dollars to 2,500 dollars.

Insurance regulators and consumer agencies often highlight deductible increases as one of the most effective levers for reducing premiums while preserving solid coverage. (Texas Department of Insurance) This adjustment does not reduce your dwelling limit, your personal property protection, or your liability coverage. It simply changes who pays first when a claim occurs.

Building a safety buffer around a higher deductible

To make this move feel safe instead of frightening, treat the higher deductible as a planned, protected expense.

- Choose a deductible that you could realistically cover from savings without emotional panic.

- If your current savings are too low, gradually build an emergency fund that covers at least your new deductible plus an extra cushion.

- Keep that money in a separate, high liquidity account so that it is easy to access but not tempting to spend.

For example, imagine you raise your deductible from 500 dollars to 1,500 dollars, and your premium drops by 250 dollars per year. Within four years, you have saved 1,000 dollars in premiums, and you still have your emergency fund completely intact. If you never file a claim, the savings become a secure, rewarding buffer for other projects.

Additionally, many homeowners go years without filing any claim at all. Frequent small claims can even hurt your claim history and trigger higher premiums. So absorbing minor issues yourself can be emotionally empowering and financially smart.

When a higher deductible is a bad idea

However, raising your deductible is not always wise. If your finances are very tight, or if you live in a region with extremely high claim frequency, a large deductible can create stressful financial shocks. In that case, start with a modest increase or focus first on other strategies that do not raise your risk.

Strategy 2: Strengthen Your Home With Safety Upgrades

Next, you can lower your premium by turning your home into a more resilient, secure fortress. This approach protects your family physically and emotionally while making you more attractive to insurers.

Classic security improvements that pay off

Many insurers offer discounts when you install monitored security systems, burglar alarms, or certain types of deadbolts. Independent guides note that some companies may offer up to 20 percent reductions for homes with strong alarm systems, especially when the system is professionally monitored. (Roombanker)

Consider the following upgrades:

- Central station alarm that alerts a monitoring center

- Motion sensing exterior lights

- High grade deadbolts on all exterior doors

- Reinforced strike plates and longer screws

- Security cameras or a video doorbell

These improvements reduce the risk of burglary and vandalism. They also create a strong psychological benefit. You feel calmer leaving the house, and you sleep more easily knowing that your property is less vulnerable.

Fire protection and water damage control

Furthermore, insurers care deeply about fire and water damage because these claims are often huge. Simple changes can be surprisingly powerful:

- Add smoke detectors in every bedroom and hallway.

- Install fire extinguishers on each level of your home.

- Upgrade old wiring if a licensed electrician identifies serious risks.

- Replace aging flexible hoses on washing machines or dishwashers.

Some insurers even recognize modern leak detection systems and automatic water shutoff valves as a protective upgrade and reward you with a discount. (Risk & Insurance)

These improvements not only protect your premium. They also protect your memories, your furniture, and your sense of safety during storms or emergencies.

Strategy 3: Use Smart Home Technology for Powerful Discounts

Additionally, smart home technology has evolved from “fun gadget” to “serious risk reduction tool.” Many insurers now offer specific smart home discounts because connected devices can detect and prevent damage early.

Which smart devices can trigger savings

Several types of devices are especially attractive to insurers:

- Smart leak detectors near water heaters, washing machines, and sinks

- Automatic water shutoff valves controlled by sensors or apps

- Smart smoke and carbon monoxide detectors with remote alerts

- Smart security cameras and doorbells

- Smart thermostats that prevent freezing pipes

Industry reports and insurer blogs highlight that some companies provide special discounts for homes equipped with qualified smart devices, especially connected leak detection systems and advanced security packages. (AAA)

How to choose devices that insurers recognize

To maximize your financial benefit, do not shop blindly for gadgets. Instead, take these steps:

- Call or email your insurer and ask which brands or device categories qualify for discounts.

- Confirm whether you need professional installation or if self installation is acceptable.

- Ask how large the discount is and how it will appear on your renewal documents.

- Keep receipts and installation records in a safe digital folder.

Some insurers offer their own connected home programs, complete with device bundles or preferred vendors. (USAA) Joining these programs can feel reassuring because you know the equipment is already accepted for discounts.

YouTube example: smart ways to cut your bill

Smart home and safety upgrades are easier to understand visually. A short, trustworthy video can show exactly how these devices work.

This type of resource brings the concepts in this section to life and offers a confident, verified overview of common discounts.

Strategy 4: Clean Up Your Coverage and Remove Hidden Waste

Another essential way to lower your premium is to examine your coverage line by line. The goal is not to strip away important protection. The goal is to remove waste, duplication, and outdated details.

Make sure you are not over insuring

First, confirm that your dwelling coverage reflects the cost to rebuild your home, not its market value. In some areas, home prices have exploded faster than construction costs. In other regions, especially where premiums spiked, market values may have stagnated even as replacement costs rose. Regulators and consumer advocates stress the importance of accurate replacement cost estimates, especially now that coverage growth sometimes lags premium growth. (Matic Insurance)

Have your agent run a fresh replacement cost estimator. If your coverage is far higher than a realistic rebuild cost, you may be paying for an unnecessary cushion.

However, never drop dwelling coverage to a level that would leave you unable to rebuild after a total loss. Being underinsured is emotionally devastating. The small savings are rarely worth that risk.

Review personal property and special limits

Next, review the personal property section. Over years, people often sell furniture, electronics, or luxury items but never update their policy. Meanwhile, they may buy new items that sit outside special limits.

Consider these steps:

- Create an updated home inventory with photos and approximate values.

- Remove endorsements that no longer match your life, such as coverage for a boat you no longer own.

- Add targeted endorsements for items that matter deeply to you, such as jewelry, art, or musical instruments.

By aligning your coverage with your actual belongings, you protect the things that are emotionally important while avoiding payments for items you do not own.

Liability and additional structures

Liability coverage is often surprisingly cheap relative to its value. Increasing it from 100,000 dollars to 300,000 dollars or more usually costs far less than people expect. This protection can be emotionally comforting and financially critical if someone is seriously injured on your property.

For additional structures, such as detached garages or sheds, check whether your current limit is realistic. If you demolished an old shed and never rebuilt it, you might be paying for coverage you do not need.

Strategy 5: Become Your Own Risk Manager and Reduce Claims

Consequently, one of the most powerful long term strategies for lower premiums is to simply reduce the likelihood that you will need to file a claim at all. A cleaner claim history often leads to discounts and avoids claim related surcharges.

Prevent small claims that become large losses

Many experts encourage homeowners to think like professional risk managers. That means aggressively tackling small maintenance issues before they turn into expensive disasters.

For example:

- Fix minor roof leaks promptly instead of waiting for a major storm.

- Clean gutters regularly to prevent ice dams or water penetration.

- Trim trees away from the house to reduce wind damage risk.

- Replace old supply lines on toilets and appliances.

Consumer and industry publications repeatedly highlight that preventive maintenance, especially related to water and fire, can significantly reduce both claim frequency and severity. (Blue Rock Insurance Services)

By investing a little time and money in maintenance, you not only protect your premium. You protect your comfort, your sleep, and your sense of control.

When to pay small losses out of pocket

Additionally, consider paying for very small losses yourself instead of filing a claim, especially when the cost is close to your deductible. Too many small claims in a short period can brand you as a higher risk customer and trigger premium increases that last for years. (Kiplinger)

This does not mean you should never use your policy. For large, painful events, filing a claim is exactly what insurance is designed for. The key is to reserve claims for events that would seriously damage your financial stability.

Bonus Strategy: Shop Proactively and Negotiate With Confidence

Even if you love your current insurer, it is dangerous to auto renew every year without comparison shopping. In a market where premiums are rising aggressively, staying passive can be very expensive.

Why annual shopping matters more since 2023

Reports show that many homeowners who remained with the same insurer through recent years experienced larger effective premium increases than those who shopped around or switched carriers. (National Mortgage Professional) Increases of 60 percent or more over just a few years are now common for long term customers in some regions.

Therefore, set a firm reminder for yourself about 45 to 60 days before your renewal date. In that period:

- Request fresh quotes from at least three or four reputable insurers.

- Ask each one to match your desired coverage levels exactly so comparisons are fair.

- Request a separate quote with a higher deductible and one with specific safety upgrades included.

With these quotes in hand, you can return to your current insurer and negotiate more effectively. Even if they cannot match the lowest competitor, they may still offer a loyalty discount or a retention incentive.

YouTube example: visual guide to rate shopping

Sometimes a simple, direct explanation helps you feel motivated and ready to shop around.

Watching this type of content can provide emotional reassurance that you are not alone and that proactive shopping is normal and healthy.

How to Build a Powerful 30 Day Action Plan

At this point, you may feel both informed and slightly overwhelmed. That reaction is normal. To protect your energy, convert everything into a simple timeline.

Week 1: Understand and organize

During the first week:

- Gather your current policy, renewal notice, and any recent claim letters.

- Create a one page summary of your coverage limits and deductibles.

- Write down your biggest worries. For example, you may fear fire, theft, or flooding.

Additionally, make a quick list of upgrades you already have, such as smoke alarms, security cameras, or leak detectors. This list will be useful when you talk to agents.

Week 2: Upgrade and protect

In the second week:

- Install or update at least one meaningful safety improvement, such as a monitored alarm, upgraded locks, or additional smoke detectors.

- Schedule a roof or electrical inspection if your home is older.

- Photograph your belongings for a new home inventory.

These steps are emotionally satisfying and practically valuable. You are no longer waiting for bad news. Instead, you are actively strengthening your world.

Week 3: Plan your financing and deductible

Now move to the financial side:

- Review your emergency fund and decide how much risk you can carry.

- Run scenarios with different deductibles and estimated premium savings.

- Choose a target deductible that feels challenging but not terrifying.

Furthermore, consider opening a separate savings account named something like “Home Protection Reserve.” Each time you save on premiums or skip a small claim, transfer money into that account. Over time, it becomes a powerful safety cushion.

Week 4: Shop, negotiate, and finalize

In the final week of your plan:

- Request multiple quotes with identical coverage.

- Ask about specific discounts related to alarms, smart devices, renovations, and claim free history. (Texas Department of Insurance)

- Negotiate calmly with your current insurer using competitive quotes as leverage.

- Decide whether to switch carriers or stay with your existing one at an improved rate.

By the end of this month, you should have a cleaner policy, a stronger home, and a more confident sense of control over your financial protection.

Conclusion: Protecting Your Home and Your Peace of Mind

Rising home insurance premiums can feel like an unstoppable force. Yet by raising your deductible carefully, investing in security and smart devices, cleaning up coverage, reducing claims, and shopping proactively, you can create a more affordable, resilient arrangement.

These strategies do not just save money. They create emotional stability, because you know you are acting thoughtfully, not passively. You are protecting the roof over your head, the memories inside your walls, and the long term health of your finances.

With a clear 30 day plan and a willingness to negotiate, you can transform a stressful premium increase into a powerful opportunity to redesign your protection on your terms.

Sources and References

- Facts and Statistics: Homeowners and Renters Insurance – Insurance Information Institute (III)

- New Report Finds American Homeowners Faced 24 Percent Increase in Homeowners Insurance Premiums Over the Past Three Years – Consumer Federation of America (Consumer Federation of America)

- Home Insurance Statistics 2025 – Guardian Service (Guardian Service)

- US Homeowners Rates Rise by Double Digits for Second Straight Year in 2024 – S and P Global Market Intelligence (S&P Global)

- Homeowners Insurance Costs Are Growing Fast but Coverage Is Shrinking – Federal Reserve Bank of Minneapolis (Federal Reserve Bank of Minneapolis)

- Home Insurance Costs, Coverage Worsening in 2024 – National Mortgage Professional (National Mortgage Professional)

- Lower Your Home Insurance Costs: Tips for Saving Money – Texas Department of Insurance (Texas Department of Insurance)

- Save on Home Insurance – Intact Insurance Canada (Intact)

- Smart Home Technology and Insurance – AAA (AAA)

- Smart Devices Can Result in Homeowners Insurance Savings – Risk and Insurance (Risk & Insurance)

- How Insurers Are Using Smart Home Technology – ANZIIF Journal (ANZIIF)

- Smart Wireless Alarm Systems for House – Roombanker (Roombanker)

- Homeowners Insurance Discounts 2025: 20 Ways to Save – ServiceMaster Restoration by Simons (ServiceMaster by Simons)